Professional Documents

Culture Documents

PDFContent PDF

PDFContent PDF

Uploaded by

ER Gautam GauravOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

PDFContent PDF

PDFContent PDF

Uploaded by

ER Gautam GauravCopyright:

Available Formats

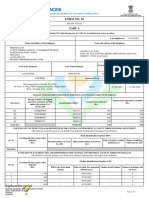

Incometax Calculation Worksheet (Old Regime)

THERMAX LTD Ascent Payroll

PAN : AAACT3910D/ TAN : PNET00017D F.Y. : 2020-21 / A.Y. : 2021-22

Employee: T9605 Gaurav Gautam Calculation Month: October-2020

Date of Joining: 14/06/2019 PAN: BJTPG1624F Tax Category: MEN

1. Gross Salary Actual(Rs.) Projection(Rs.) Total(Rs.)

Basic 90,484 75,000 165,484

House Rent Allowance 33,177 27,500 60,677

Special Allowance 77,843 66,250 144,093

Ex-Gratia 750 0 750

Bonus 23,040 0 23,040

Totals: 225,295 168,750 394,045

WORKSHEET :

1. Gross Salary 394,045

2. Less: Allowances Exempt Under Section 10

3. Balance (1-2) 394,045

4. Deductions:

Standard Deduction 50,000

5. Aggregate of 4 50,000

6. Income chargeable under the head 'Salaries' (3-5) 344,045

7. Add: Any other income reported by the employee

8. Gross total income (6+7) 344,045

9. Deductions under Chapter VI-A Qualifying Deductible

Gross Amount

(A) Section 80C, 80CCC and 80CCD Amount Amount

(a) Section 80 C

a. Provident Fund 19,858 19,858

Total of Section 80C, 80CCC and 80CCD 19,858 19,858 19,858

(B) Other Sections under Chapter VI-A

a. Sec 80D (Mediclaim Family) 1,200 1,200

Total of Other Sections under Chapter VI-A 1,200 1,200 1200

10. Aggregate of deductible amount under Chapter VIA 21,058

11. Total Income (8-10) 322,990

12. Tax on total income based on Old Regime 3,650

13. Less: rebate u/s 87A 3,650

*

14. Tax payable and surcharge thereon 0 + 0 0

15. Add: Education CESS 4.00% on (14) 0

16. Less: Rebate Under Section 89 0

17. Total Tax Liability (14+15-16) 0

18. Less Tax deducted at source till September-2020 0

19. Tax payable/refundable (17-18) 0

20. Tax payable/refundable this month 0

Income tax calculated as follows: ( Based on Old Regime)

From To Tax Percent % Tax

0 250,000 0 0

250,000 322,990 5 3,650

3,650

Total Tax on income 322,990 (excluding surcharge, CESS and Rebate) *

Printed On 02/11/2020 11:47:46 AM Calculation based on Estimated Declaration (Standard) Page 1 of 1

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5820)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (845)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (898)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Pay Slip For October 2020: Empno Gaurav Gautam T9605 NameDocument1 pagePay Slip For October 2020: Empno Gaurav Gautam T9605 NameER Gautam GauravNo ratings yet

- Pay Slip For September 2020: Thermax LTDDocument1 pagePay Slip For September 2020: Thermax LTDER Gautam GauravNo ratings yet

- PDFContent PDFDocument1 pagePDFContent PDFER Gautam GauravNo ratings yet

- PDF IntentDocument9 pagesPDF IntentER Gautam GauravNo ratings yet