Professional Documents

Culture Documents

Multiple Choice Questions & Answers: Banking Law

Multiple Choice Questions & Answers: Banking Law

Uploaded by

Arun Kumar Tripathy0 ratings0% found this document useful (0 votes)

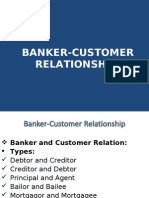

414 views2 pagesThis document contains 12 multiple choice questions and answers about banking law. It addresses topics like the primary relationship between a banker and customer, which begins when a customer opens an account. The most important relationship is that of debtor and creditor. The Reserve Bank of India has given instructions to commercial banks regarding immediate credit for outstation checks. Dishonor of a check by a banker without justification is called wrongful dishonor. The Negotiable Instruments Act of 1881 regulates negotiable instruments in India.

Original Description:

Banking law and practice

Original Title

banking-law

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document contains 12 multiple choice questions and answers about banking law. It addresses topics like the primary relationship between a banker and customer, which begins when a customer opens an account. The most important relationship is that of debtor and creditor. The Reserve Bank of India has given instructions to commercial banks regarding immediate credit for outstation checks. Dishonor of a check by a banker without justification is called wrongful dishonor. The Negotiable Instruments Act of 1881 regulates negotiable instruments in India.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

414 views2 pagesMultiple Choice Questions & Answers: Banking Law

Multiple Choice Questions & Answers: Banking Law

Uploaded by

Arun Kumar TripathyThis document contains 12 multiple choice questions and answers about banking law. It addresses topics like the primary relationship between a banker and customer, which begins when a customer opens an account. The most important relationship is that of debtor and creditor. The Reserve Bank of India has given instructions to commercial banks regarding immediate credit for outstation checks. Dishonor of a check by a banker without justification is called wrongful dishonor. The Negotiable Instruments Act of 1881 regulates negotiable instruments in India.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 2

BANKING LAW

Multiple Choice Questions & Answers

1. The primary relationship between a banker and customer starts from the time

A. when customer visits that bank

B. when customer opens account

C. when customer visits that bank to made queries

D. All of the above

ANSWER: B

2. The primary relationship between banker and customer is a ------------------ relationship

A. Mutual

B. Contractual

C. Personal

D. None of the above

ANSWER: B

3. Which one of the following is the most important relationship between banker and

customer

A. Debtor and Creditor

B. Bailee and Bailor

C. Agency and Principal

D. Trustee and Beneficiary

ANSWER: A

4. Which bank have given the instructions to the commercial banks regarding the immediate

credit of outstation cheques?

A. Reserve Bank of India

B. Central Bank

C. World Bank

D. All of the above

ANSWER: A

5. Dishonour of cheque by a banker without any justifiable reason is called

A. Valid dishonour of cheques

B. Unmindful dishonour of cheques

C. Negligence dishonour of cheques

D. Wrongful dishonour of cheques

ANSWER: D

6. Special damages refers to damages payable by a banker to his customer for the actual --------

----- loss suffered by customer

A. Financial

B. Special

C. Unpecuniary

D. Unfinancial

ANSWER: A

7. MICR technology used for clearance of cheques by banks refers to

A. Magnetic Ink Character Recognition

B. Magnetic Ink Company Recognition

C. Magnetic Ink Cross Recognition

D. Magnetic Ink Community Recognition

ANSWER: A

8. In India, the law regulating the Negotiable instruments are

A. Banking Regulation Act 1949

B. Reserve Bank of India Act 1934

C. Negotiable Instruments Act 1881

D. Companies Act 1956

Read more question on Banking Law

BANKING LAW

Multiple Choice Questions & Answers

ANSWER: C

9. Which banks which accept deposits from the public and lend them mainly to commerce for

short periods?

A. Commercial Bank

B. . Industrial Bank

C. Agricultural Bank

D. Central Bank

ANSWER: A

10. Fixed Deposits is otherwise called as

A. Accrued Deposits

B. Time deposits

C. . Recurring Deposits

D. Demand Deposits

ANSWER: B

11. In which type of deposit, the high rate of interest is provided by the Bank?

A. Current Account

B. Recurring Deposit Account

C. Fixed Deposit Account

D. Savings Account

ANSWER: C

12. The rate of interest charged for the loan by the banker compared to overdraft and cash

credit is generally

A. High

B. Low

C. Same

D. Based on the amount

ANSWER: B

Read more question on Banking Law

You might also like

- E Statement Download HandlerDocument2 pagesE Statement Download Handleranastasiya DubininaNo ratings yet

- Sample Statement For Insurance CarDocument2 pagesSample Statement For Insurance CarRajesh Mukkavilli57% (14)

- Auditing Problems PDFDocument106 pagesAuditing Problems PDFCharla Suan100% (1)

- Loan SyndicationDocument11 pagesLoan SyndicationArun DasNo ratings yet

- CASE STUDY Trends in International BankingDocument9 pagesCASE STUDY Trends in International BankingbilalbalushiNo ratings yet

- Chapter 3 Investment Information and Securities Transactions - 1Document42 pagesChapter 3 Investment Information and Securities Transactions - 1Mya EmberNo ratings yet

- List of Mutual Fund AdministratorsDocument3 pagesList of Mutual Fund AdministratorsJohn MiklaNo ratings yet

- Your Dual Fuel Account - Actual Reading: MR R Salimath 24B Norway Street Aro Valley Wellington 6012Document3 pagesYour Dual Fuel Account - Actual Reading: MR R Salimath 24B Norway Street Aro Valley Wellington 6012Ravi SalimathNo ratings yet

- Banker and Customer Relationship PDFDocument25 pagesBanker and Customer Relationship PDFaaditya01No ratings yet

- EBT Market: Bonds-Types and CharacteristicsDocument25 pagesEBT Market: Bonds-Types and CharacteristicsKristen HicksNo ratings yet

- Origin of BankingDocument6 pagesOrigin of BankingamaznsNo ratings yet

- Principles of Sound LendingDocument2 pagesPrinciples of Sound LendingRajat Das100% (1)

- CHAPTER 3 Investment Information and Security TransactionDocument22 pagesCHAPTER 3 Investment Information and Security TransactionTika TimilsinaNo ratings yet

- Insider TradingDocument24 pagesInsider TradingharshitNo ratings yet

- Chapter 3 - Money and Banking PDFDocument5 pagesChapter 3 - Money and Banking PDFPankaj SharmaNo ratings yet

- Unit 05 - Principles of Bank LendingDocument18 pagesUnit 05 - Principles of Bank LendingSayak GhoshNo ratings yet

- Money MarketDocument7 pagesMoney MarketNiraj Arun ThakkarNo ratings yet

- 15 International Working Capital Management: Chapter ObjectivesDocument16 pages15 International Working Capital Management: Chapter ObjectivesNancy DsouzaNo ratings yet

- Bond ValuationDocument50 pagesBond Valuationrenu3rdjanNo ratings yet

- 2023 Understanding Financial Markets and Financial InstitutionsDocument55 pages2023 Understanding Financial Markets and Financial Institutionsdemo040804No ratings yet

- Financial Markets and Institutions 1Document29 pagesFinancial Markets and Institutions 1Hamza Iqbal100% (1)

- Functions of Central BanksDocument3 pagesFunctions of Central BanksSenelwa Anaya100% (1)

- Long Term Finance Sources 2020Document50 pagesLong Term Finance Sources 2020Rudraksh PareyNo ratings yet

- Central Bank RegulationDocument2 pagesCentral Bank RegulationGwenn PosoNo ratings yet

- 53177137-Securitization-Ppt 1Document23 pages53177137-Securitization-Ppt 1kimmiahujaNo ratings yet

- Brief History of RBI: Hilton Young CommissionDocument24 pagesBrief History of RBI: Hilton Young CommissionharishNo ratings yet

- Debt MarketDocument11 pagesDebt MarketPsychopheticNo ratings yet

- Designing A Global Financing StrategyDocument23 pagesDesigning A Global Financing StrategyShankar ReddyNo ratings yet

- Assignment On Money Market in BangladeshDocument14 pagesAssignment On Money Market in BangladeshOmar Faruk OviNo ratings yet

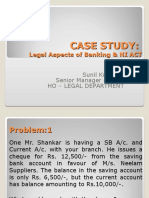

- Case Study Legal Aspects & NI ActDocument23 pagesCase Study Legal Aspects & NI Actvarun_bathula100% (1)

- 7 Major Functions of The Reserve Bank of IndiaDocument2 pages7 Major Functions of The Reserve Bank of IndiaAkshay GodeNo ratings yet

- Monetary Policy: Aira Mae Nueva Jhessanie PinedaDocument43 pagesMonetary Policy: Aira Mae Nueva Jhessanie PinedaMAWIIINo ratings yet

- Banking Law and Practice Units-2Document52 pagesBanking Law and Practice Units-2പേരില്ലോക്കെ എന്തിരിക്കുന്നുNo ratings yet

- Techniques For Managing ExposureDocument26 pagesTechniques For Managing Exposureprasanthgeni22100% (1)

- On Financial InstitutionsDocument8 pagesOn Financial InstitutionsAnkit PoddarNo ratings yet

- Financial System and Financial MarketDocument10 pagesFinancial System and Financial MarketPulkit PareekNo ratings yet

- Banking & Financial Markets: Bülent ŞenverDocument73 pagesBanking & Financial Markets: Bülent ŞenverjamesburdenNo ratings yet

- FE101: Chapter 1: Corporate Finance and The Financial ManagerDocument43 pagesFE101: Chapter 1: Corporate Finance and The Financial ManagerlizNo ratings yet

- Commercial Banks in IndiaDocument29 pagesCommercial Banks in IndiaVarsha SinghNo ratings yet

- Banker and CustomerDocument23 pagesBanker and CustomerAnkan Pattanayak100% (1)

- Resident Status For IndividualDocument24 pagesResident Status For IndividualMalabaris Malaya Umar SiddiqNo ratings yet

- Bank Finance For Working CapitalDocument12 pagesBank Finance For Working CapitalAjilal KadakkalNo ratings yet

- Welcome To Our Presentation On Investment Corporation of BangladeshDocument15 pagesWelcome To Our Presentation On Investment Corporation of BangladeshYasin ArAthNo ratings yet

- Differences Between A Central Bank and Commercial BankDocument4 pagesDifferences Between A Central Bank and Commercial BankMuhammadZariyan AsifNo ratings yet

- Money Market in BangladeshDocument34 pagesMoney Market in Bangladeshjubaida khanamNo ratings yet

- Deposit Insurance and Credit Guarantee Corporation Act 1961Document10 pagesDeposit Insurance and Credit Guarantee Corporation Act 1961Debayan GhoshNo ratings yet

- Money & Banking (ECON 310) : Final Exam Review QuestionsDocument5 pagesMoney & Banking (ECON 310) : Final Exam Review Questionskrizzzna100% (1)

- Insolvency and Bankruptcy CodeDocument13 pagesInsolvency and Bankruptcy CodeMishika PanditaNo ratings yet

- Cheque Bill of Exchange Promissary NoteDocument2 pagesCheque Bill of Exchange Promissary NoteNeel NaikNo ratings yet

- Ch. 3 (Interest Rates) FMI (Mishkin Et Al) (8th Ed.) PDFDocument43 pagesCh. 3 (Interest Rates) FMI (Mishkin Et Al) (8th Ed.) PDFRahul NagrajNo ratings yet

- The International Financial Environment: Multinational Corporation (MNC)Document30 pagesThe International Financial Environment: Multinational Corporation (MNC)FarhanAwaisiNo ratings yet

- Borrowing Powers of A Company - PDFDocument23 pagesBorrowing Powers of A Company - PDFDrRupali GuptaNo ratings yet

- Part 1. Questions For Review: Tutorial 1Document25 pagesPart 1. Questions For Review: Tutorial 1TACN-4TC-19ACN Nguyen Thu HienNo ratings yet

- Security Market Operations BookDocument282 pagesSecurity Market Operations BookAbhishek AnandNo ratings yet

- Euro BondsDocument21 pagesEuro BondsKhan ZiaNo ratings yet

- Narasimham CommitteeDocument17 pagesNarasimham CommitteeTorsha SahaNo ratings yet

- Mixed Banking:: System Refers To That Banking System Under Which TheDocument7 pagesMixed Banking:: System Refers To That Banking System Under Which TheLOKESH RAMNo ratings yet

- Customers and Account HoldersDocument23 pagesCustomers and Account HoldersMAHESH VNo ratings yet

- Banker Customer RelationshipDocument101 pagesBanker Customer Relationshipmasudranabd100% (1)

- Development Banks in IndiaDocument17 pagesDevelopment Banks in IndianutantiwariNo ratings yet

- Chapter 01-The Role and Environment of Managerial FinanceDocument24 pagesChapter 01-The Role and Environment of Managerial FinancemmtusharNo ratings yet

- 1 Meaning and Function of Foreign Exchange Market 2 Types of Foreign Exchange MarketsDocument14 pages1 Meaning and Function of Foreign Exchange Market 2 Types of Foreign Exchange MarketsAnonymous GueU02hBdNo ratings yet

- Principles of LendingDocument29 pagesPrinciples of LendingAsadul HoqueNo ratings yet

- 202d - Skill Based Subject - Banking Law and PracticeDocument21 pages202d - Skill Based Subject - Banking Law and PracticeŠ Òű VïķNo ratings yet

- PPB2Document30 pagesPPB2chappidi chandra sekharNo ratings yet

- Chapter 01: An Overview of Bank and Their ServicesDocument15 pagesChapter 01: An Overview of Bank and Their ServicesTahmid Sadat100% (1)

- 2010 StatementsDocument22 pages2010 StatementsHonolulu Star-AdvertiserNo ratings yet

- Final Report On Guidelines On ICAAP ILAAP (EBA-GL-2016-10)Document70 pagesFinal Report On Guidelines On ICAAP ILAAP (EBA-GL-2016-10)Herbert BurgstallerNo ratings yet

- All ISADocument30 pagesAll ISANTurin1435No ratings yet

- Sa 402Document26 pagesSa 402johnsondevasia80No ratings yet

- BankDocument153 pagesBankdumchi100% (1)

- ListDocument8 pagesListJames O. LeGrosNo ratings yet

- BNI Mobile Banking: Histori TransaksiDocument7 pagesBNI Mobile Banking: Histori TransaksiIrvan KurniawanNo ratings yet

- Press ReleaseDocument3 pagesPress ReleaseFuaad DodooNo ratings yet

- Disaster Response, Rehabilitation and RebuildingDocument3 pagesDisaster Response, Rehabilitation and RebuildingSittie Nadzmah GuilingNo ratings yet

- Unison Affordability-Report 2019Document35 pagesUnison Affordability-Report 2019HNN0% (1)

- Top 10 Private Sector Banks by AssetsDocument129 pagesTop 10 Private Sector Banks by AssetsrohitcshettyNo ratings yet

- Veronis Inc.: Prospect Lease Offer SheetDocument1 pageVeronis Inc.: Prospect Lease Offer Sheetspur iousNo ratings yet

- Tutorial 6 - Cost of Short Term Credit PDFDocument1 pageTutorial 6 - Cost of Short Term Credit PDFChamNo ratings yet

- CMA 19 II-Section-DDocument22 pagesCMA 19 II-Section-DAkash GuptaNo ratings yet

- BB 2016Document37 pagesBB 2016Maisie Rose VilladolidNo ratings yet

- What Harshad Mehta DidDocument5 pagesWhat Harshad Mehta Didyatheesh07No ratings yet

- Crisis ManagementDocument19 pagesCrisis Managementletter2lalNo ratings yet

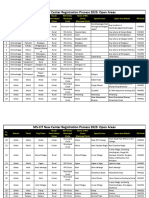

- Ms Cit NCR 2023 Open Area ListDocument67 pagesMs Cit NCR 2023 Open Area ListSD filmsNo ratings yet

- Zurich - Report PDFDocument304 pagesZurich - Report PDFMiguel PintoNo ratings yet

- 9 Role of Customs in Regulating International TradeDocument36 pages9 Role of Customs in Regulating International Tradesukriti bajpaiNo ratings yet

- Behavioral FinanceDocument14 pagesBehavioral FinanceNichols Amy TarunNo ratings yet

- Plant Assets: Created by Ina IndrianaDocument23 pagesPlant Assets: Created by Ina IndrianadewiestiNo ratings yet

- Volume 6Document2 pagesVolume 6Suresh VenkatNo ratings yet

- PO - Period Close ProcessDocument6 pagesPO - Period Close Processanishokm2992No ratings yet