Professional Documents

Culture Documents

Certif Ir Is

Certif Ir Is

Uploaded by

Ben Tahar AbdeljabarOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Certif Ir Is

Certif Ir Is

Uploaded by

Ben Tahar AbdeljabarCopyright:

Available Formats

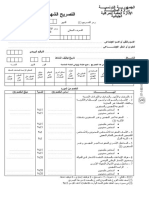

اﻟﺠﻤﻬﻮرﻳﺔ اﻟﺘﻮﻧﺴﻴﺔ

وزارة اﻟﻤﺎﻟﻴﺔ

ﺷﮭﺎدة ﻓﻲ اﻟﺨﺼﻢ ﻣﻦ اﻟﻤﻮرد ﻋﻠﻰ اﻟﺼﻔﻘﺎت

اﻟﻤﺒﺮﻣﺔ

ﻣﻊ اﻟﺪوﻟﺔ واﻟﺠﻤﺎﻋﺎت اﻟﻤﺤﻠﯿّﺔ واﻟﻤﺆﺳﺴﺎت

واﻟﻤﻨﺸﺂت

اﻟﻌﻤﻮﻣﯿﺔ ﺑﻌﻨﻮان اﻷداء ﻋﻠﻰ اﻟﻘﯿﻤﺔ اﻟﻤﻀﺎﻓﺔ

واﻟﻀﺮﯾﺒﺔ

ﻋﻠﻰ اﻟﺪﺧﻞ واﻟﻀﺮﯾﺒﺔ ﻋﻠﻰ اﻟﺸﺮﻛﺎت

ﺃ ـ ﺍﻟﻬﻴﻜل ﺍﻟﻤﺩﻴﻥ :

ﺍﻻﺴﻡ ﻭﺍﻟﻠﻘﺏ ﺃﻭ ﺍﻻﺴﻡ ﺍﻻﺠﺘﻤﺎﻋﻲ .................................................................... :

ﺍﻟﻨﺸﺎﻁ ............................................................................................... :

ﺍﻟﻌﻨﻭﺍﻥ ............................................................................................... :

ﺭﻗﻡ ﺍﻟﻤﺅﺴﺴﺔ ﺍﻟﺜﺎﻨﻭﻴﺔ ﺭﻤﺯ ﺍﻟﺼﻨﻑ ﺭﻤﺯ ﺍﻷﺩﺍﺀ ﻋﻠﻰ ﺍﻟﻘﻴﻤﺔ ﺍﻟﻤﻀﺎﻓﺔ ﺍﻟﻤﻌﺭﻑ ﺍﻟﺠﺒﺎﺌﻲ

ﺏ ـ ﺍﻟﻤﺴﺘﻔﻴﺩ :

ﺍﻻﺴﻡ ﻭﺍﻟﻠﻘﺏ ﺃﻭ ﺍﻻﺴﻡ ﺍﻻﺠﺘﻤﺎﻋﻲ..................................................................... :

07-5.019-02

ﺍﻟﻨﺸﺎﻁ ............................................................................................... :

ﺍﻟﻌﻨﻭﺍﻥ ............................................................................................... :

ﺭﻗﻡ ﺍﻟﻤﺅﺴﺴﺔ ﺍﻟﺜﺎﻨﻭﻴﺔ ﺭﻤﺯ ﺍﻟﺼﻨﻑ ﺭﻤﺯ ﺍﻷﺩﺍﺀ ﻋﻠﻰ ﺍﻟﻘﻴﻤﺔ ﺍﻟﻤﻀﺎﻓﺔ ﺍﻟﻤﻌﺭﻑ ﺍﻟﺠﺒﺎﺌﻲ

ﺝ ـ ﻤﻌﻠﻭﻤﺎﺕ ﻤﺘﻌﻠﻘﺔ ﺒﺎﻟﺼﻔﻘﺔ :

ﻤﻭﻀﻭﻉ ﺍﻟﺼﻔﻘﺔ ..................................................................................... :

ﻤﺒﻠﻎ ﺍﻟﺼﻔﻘﺔ .......................................................................................... :

ﺘﺎﺭﻴﺦ ﺇﺒﺭﺍﻡ ﺍﻟﺼﻔﻘﺔ ................................................................................... :

ﺩ ـ ﺍﻟﻤﺒﺎﻟﻎ ﺍﻟﻤﺩﻓﻭﻋﺔ ﺒﺎﻟﺩﻴﻨﺎﺭ:

ﺍﻟﺨﺼﻡ ﻤﻥ ﺍﻟﻤﻭﺭﺩ : ﺍﻷﺩﺍﺀ ﻋﻠﻰ ﺍﻟﻘﻴﻤﺔ ﺍﻟﻤﺒﻠﻎ ﺍﻟﺠﻤﻠﻲ ﻤﻊ ﺍﻷﺩﺍﺀ ﻋﻠﻰ ﺍﻟﻘﻴﻤﺔ ﻨﺴﺒﺔ ﺍﻷﺩﺍﺀ ﻋﻠﻰ ﺍﻟﻤﺒﻠﻎ ﺨﺎل ﻤﻥ

ﺍﻟﻀﺭﻴﺒﺔ ﻋﻠﻰ ﺍﻟﺩﺨل ﺃﻭ ﻋﻠﻰ ﺍﻟﺸﺭﻜﺎﺕ ﺍﻟﻤﻀﺎﻓﺔ ﺍﻟﻤﺨﺼﻭﻡ ﺍﺤﺘﺴﺎﺏ ﺍﻷﺩﺍﺀ ﻋﻠﻰ ﺍﻟﻤﻀﺎﻓﺔ ﺍﻟﻘﻴﻤﺔ ﺍﻟﻤﻀﺎﻓﺔ ﺍﻷﺩﺍﺀ ﻋﻠﻰ

ﻤﻥ ﺍﻟﻤﻭﺭﺩ % 50 ﺍﻟﻘﻴﻤﺔ ﺍﻟﻤﻀﺎﻓﺔ ﺍﻟﻤﺴﺘﻭﺠﺏ ﺍﻟﻘﻴﻤﺔ ﺍﻟﻤﻀﺎﻓﺔ

ﻤﺒﺎﻟﻎ ﺍﻟﺨﺼﻡ ﻨﺴﺒﺔ ﺍﻟﺨﺼﻡ

)(4) × (3 )* (4 )2 / (2) × (1 )(3 )(2) × (1 )(2 )(1

---------------------------------------

ﺇﻨﻲ ﺍﻟﻤﻤﻀﻲ ﺃﺴﻔﻠﻪ ،ﺃﺸﻬﺩ ﺒﺼﺤﺔ ﺍﻟﺒﻴﺎﻨﺎﺕ ﺍﻟﻭﺍﺭﺩﺓ ﺒﻬﺫﻩ ﺍﻟﺸﻬﺎﺩﺓ. )*( ﻨﺴﺒﺔ ﺍﻟﺨﺼﻡ ﺘﺴﺎﻭﻱ :

ـ % 5ﺒﺎﻟﻨﺴـﺒﺔ ﻟﻸﺘﻌﺎﺏ ﺍﻟﻤﺩﻓﻭﻋﺔ ﻟﻸﺸﺨﺎﺹ ﺍﻟﻤﻌﻨﻭﻴﻴﻥ ﻭﺍﻷﺸﺨﺎﺹ ﺍﻟﻁﺒﻴﻌﻴﻴﻥ ﺍﻟﺨﺎﻀﻌﻴﻥ

ﺒـ…………… ﻓﻲ ……………….. ﻟﻠﻀﺭﻴﺒﺔ ﻋﻠﻰ ﺍﻟﺩﺨل ﺤﺴﺏ ﺍﻟﻨﻅﺎﻡ ﺍﻟﺤﻘﻴﻘﻲ .

ـ % 15ﺒﺎﻟﻨﺴـﺒﺔ ﻟﻸﺘﻌـﺎﺏ ﺍﻟﻤﺩﻓﻭﻋﺔ ﻟﻸﺸﺨﺎﺹ ﻏﻴﺭ ﺍﻟﺨﺎﻀﻌﻴﻥ ﻟﻠﻀﺭﻴﺒﺔ ﻋﻠﻰ ﺍﻟﺩﺨل

ﺍﻹﻤﻀﺎﺀ ﻭﺍﻟﺨﺘﻡ ﺤﺴﺏ ﺍﻟﻨﻅﺎﻡ ﺍﻟﺤﻘﻴﻘﻲ .

ـ % 15ﺒﺎﻟﻨﺴـﺒﺔ ﻟﻸﺘﻌﺎﺏ ﺍﻟﻤﺩﻓﻭﻋﺔ ﻟﻐﻴﺭ ﺍﻟﻤﻘﻴﻤﻴﻥ ﻭﻓﻲ ﺼﻭﺭﺓ ﻭﺠﻭﺩ ﺍﺘﻔﺎﻗﻴﺔ ﺘﻁﺒﻕ ﺍﻟﻨﺴﺒﺔ

ﺍﻟﻭﺍﺭﺩﺓ ﺒﻬﺎ ﺇﺫﺍ ﻜﺎﻨﺕ ﺃﻗل .

ـ % 1,5ﻓﻲ ﺠﻤﻴﻊ ﺍﻟﺤﺎﻻﺕ ﺍﻵﺨﺭﻯ .

You might also like

- Imprime Declarationd Employeur 2013Document22 pagesImprime Declarationd Employeur 2013sarra ezzeddineNo ratings yet

- Dec Mens Forf ArDocument12 pagesDec Mens Forf ArChaaBani NiZar0% (1)

- التصريح الشهري بالآداءDocument12 pagesالتصريح الشهري بالآداءhsan essNo ratings yet

- Déclaration Mensuelle Des Impôts Mise À Jour Selon Les Dispositions de La Loi Des Finances Complémentaire Pour L'année 2014 - 724281-IdaratyDocument12 pagesDéclaration Mensuelle Des Impôts Mise À Jour Selon Les Dispositions de La Loi Des Finances Complémentaire Pour L'année 2014 - 724281-IdaratyKhadija BoukhrisNo ratings yet

- تقرير صرف الشطر الاولDocument15 pagesتقرير صرف الشطر الاولHoussam MouzharNo ratings yet

- Demande de Mise À Jour de L'adhésion À La Télé Liquidation - 455406-IdaratyDocument1 pageDemande de Mise À Jour de L'adhésion À La Télé Liquidation - 455406-IdaratyIkram MejNo ratings yet

- Certif Rentes ViageresDocument1 pageCertif Rentes ViageresGalai AbdelbassetNo ratings yet

- العرض التقني المطاعم 2024Document20 pagesالعرض التقني المطاعم 2024hamidbachi1986100% (1)

- Imprimé de La Déclaration Mensuelle 2018 PDFDocument11 pagesImprimé de La Déclaration Mensuelle 2018 PDFAmé Ni100% (1)

- Déclaration Employeur 2018Document26 pagesDéclaration Employeur 2018Foulen FoulenNo ratings yet

- For MulaireDocument4 pagesFor MulaireMarouane BenthamiNo ratings yet

- For MulaireDocument4 pagesFor MulaireKhalid Banana50% (2)

- م11Document1 pageم11mohamad hajj100% (1)

- G 30 PDFDocument1 pageG 30 PDFعادل عمرانيNo ratings yet

- Sup Mag SadecDocument2 pagesSup Mag SadecAbaza Mohamed AliNo ratings yet

- Declaration Previsionnelle PDFDocument2 pagesDeclaration Previsionnelle PDFHayet KhedherNo ratings yet

- Déclaration de L'acompte Provisionnel-cg4-IdaratyDocument2 pagesDéclaration de L'acompte Provisionnel-cg4-Idaratykarim jebaliNo ratings yet

- Declaration PrevisionnelleDocument2 pagesDeclaration PrevisionnelleSaber MkadmiNo ratings yet

- G4 ArDocument4 pagesG4 ArHicham Ben AbdallahNo ratings yet

- التصريح بالضريبة على ارباح الشركات -الرسم على النشاط المهني GN°4Document4 pagesالتصريح بالضريبة على ارباح الشركات -الرسم على النشاط المهني GN°4abdouamine872No ratings yet

- Honneur Physique Arts 2022Document1 pageHonneur Physique Arts 2022Nexuslord1kNo ratings yet

- Déclaration Mensuelle D'impôts 1v IdaratyDocument10 pagesDéclaration Mensuelle D'impôts 1v IdaratyAmeni LahwawiNo ratings yet

- التصريح - الشهري - 2022 - 2Document12 pagesالتصريح - الشهري - 2022 - 2BrockLesnarNo ratings yet

- التصريح الشهري 2022Document12 pagesالتصريح الشهري 2022Jbeli SiwarNo ratings yet

- CH6 20210901ouv0177771Document1 pageCH6 20210901ouv0177771hanane liliaNo ratings yet

- امتحان محلي تربية اسلامية 2022Document2 pagesامتحان محلي تربية اسلامية 2022aya aabidNo ratings yet

- سليماني الفضيلDocument310 pagesسليماني الفضيلmary mous100% (1)

- Déclaration Mensuelle. (HM) PDF PDFDocument10 pagesDéclaration Mensuelle. (HM) PDF PDFthamer mahjoubiNo ratings yet

- Declaration MensuelleDocument10 pagesDeclaration Mensuelletunisia tunisiaNo ratings yet

- مشروع كباب بلديDocument2 pagesمشروع كباب بلديvodka_taste2882No ratings yet

- طلب ترخيص دار اشخاص طبيعيون3 PDFDocument2 pagesطلب ترخيص دار اشخاص طبيعيون3 PDFvodka_taste2882No ratings yet

- CDCDocument4 pagesCDCmouhcine haimoudNo ratings yet

- ملف الترشح مطاعم مدرسية2024Document7 pagesملف الترشح مطاعم مدرسية2024KHM INFONo ratings yet

- عقد الإعداد للحياة المهنية1)Document14 pagesعقد الإعداد للحياة المهنية1)clicclimNo ratings yet

- عقد الإعداد للحياة المهنية1)Document14 pagesعقد الإعداد للحياة المهنية1)Fatma ArfawiNo ratings yet

- دراسة فنية في مجال البناءDocument33 pagesدراسة فنية في مجال البناءbouchouicha100% (2)

- تحميل الامتحان المحلي في مادة التربية الإسلامية بمجموعة مدارس مولاي رشيد دورة يناير 2018Document2 pagesتحميل الامتحان المحلي في مادة التربية الإسلامية بمجموعة مدارس مولاي رشيد دورة يناير 2018MOHAMED AKRAM-SMPC-B4 BOUCHOUIKANo ratings yet

- المحاسبة و طبيعة العمل المالي و المحاسبي في شركات التأمين يحياوي سفيانDocument96 pagesالمحاسبة و طبيعة العمل المالي و المحاسبي في شركات التأمين يحياوي سفيانatc titaNo ratings yet

- ملف الترشحDocument10 pagesملف الترشحhcen166No ratings yet

- ملف الترشحDocument8 pagesملف الترشحبكاي جلولNo ratings yet

- ملف الترشحDocument8 pagesملف الترشحبكاي جلولNo ratings yet

- فرض منزليDocument2 pagesفرض منزليWalidNo ratings yet

- التصريح الثلاثي بالأداءات الخاص بالأشخاص الخاضعين للنظام التقديري و الملحقين بالنظام الحقيقي نهائيDocument7 pagesالتصريح الثلاثي بالأداءات الخاص بالأشخاص الخاضعين للنظام التقديري و الملحقين بالنظام الحقيقي نهائيgicoraNo ratings yet

- UntitledDocument3 pagesUntitledmurtada gubaNo ratings yet

- 551535de-3a63-45af-861d-dd3d46372bdfDocument7 pages551535de-3a63-45af-861d-dd3d46372bdflaajimi olfaNo ratings yet

- Formulaire Adhesion TeledeclarationDocument2 pagesFormulaire Adhesion TeledeclarationImen ImenNo ratings yet

- نماذج الوثائق الملحقة بدليل المساطر الخاص بتحسين ظروف تمدرس الأطفال في وضعية إعاقةDocument16 pagesنماذج الوثائق الملحقة بدليل المساطر الخاص بتحسين ظروف تمدرس الأطفال في وضعية إعاقةASQIRIBANo ratings yet

- Prolongation CIVPDocument1 pageProlongation CIVPMaryem ChakchoukNo ratings yet

- طلب الانخراط في المؤسسة لأرامل والأيتامDocument4 pagesطلب الانخراط في المؤسسة لأرامل والأيتامMarouane BenthamiNo ratings yet

- تحميل الامتحان المحلي في مادة الاجتماعياتDocument2 pagesتحميل الامتحان المحلي في مادة الاجتماعياتIman OussalehNo ratings yet

- Tab - Fact 4Document1 pageTab - Fact 4Naim AyariNo ratings yet

- Imprimé Déclaration Mensuelle Impôts 2020Document12 pagesImprimé Déclaration Mensuelle Impôts 2020Sami JaballahNo ratings yet

- مطلب جراية A144 PDFDocument4 pagesمطلب جراية A144 PDFbaati zied100% (3)

- مطلب جراية A144 PDFDocument4 pagesمطلب جراية A144 PDFbaati zied100% (6)

- Fiche 6etab105Document38 pagesFiche 6etab105chaabani hamidNo ratings yet

- نموذج لتقرير حول سلوك تلميذDocument2 pagesنموذج لتقرير حول سلوك تلميذMohammed Sobhi Sultan25% (4)

- Alfrdh 1 Nmothj 1 Altrbia Alislamia Raba Ibtdaii Aldora AlthaniaDocument2 pagesAlfrdh 1 Nmothj 1 Altrbia Alislamia Raba Ibtdaii Aldora AlthaniaWarda KerroumiNo ratings yet

- MPH2122Document2 pagesMPH2122Ziad HawwaNo ratings yet

- العرض المالي2024Document6 pagesالعرض المالي2024hamidbachi1986No ratings yet