Professional Documents

Culture Documents

Solution Pricing Decision

Solution Pricing Decision

Uploaded by

Ann SalazarOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Solution Pricing Decision

Solution Pricing Decision

Uploaded by

Ann SalazarCopyright:

Available Formats

B.

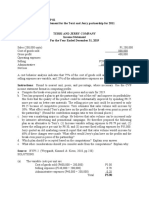

FVR Company

USP = ( 40 +10 + 15 + 14.50) + 15% ( 400,000 )

150,000

1- (.15 x .35 )

= P 84.33

C. ADM Company

Computation of variable and Fixed cost Components :

FACTORY OVERHEAD

Variable ( 80% x 250,000 ) 200,000

Fixed 50,000

Selling and administrative

Variable ( 90% x 50,000 ) 45,000

Fixed 5,000

Computation of total costs :

Materials ( 85,000/200,000) .425

Labor ( 100,000/200,000 .50

Variable overhead 200,000/200,000 1.00

Variable selling 45,000/200,000 .225

Total variable cost 2.15

X Expected sales in units s 180,000

Total variable costs 387,000

Add : Fixed costs 55,000

Total costs 442,000

USP = 442,000 + (.15 x 60,000)

180,000 units

= P2.96

2. P 3.12

E. Sey Company

250,000 + ( 30%) x 500,000

20,000

= P20.00 20/.94 22.22

2. 250,000 + (.3 x x 500,000

20,000 u

1- ( .3 x .2 )

= P21.28 21.28/.94 23.64

Practice

Direct materials 1.00

Direct labor 1.20

Variable overhead . 80

Fixed overhead .50

Variable selling 1.50

Fixed selling .90

Required :

Determine the selling price if

1. Mark up is 50% of CC. 7.15

2. 40% based on full production costs7.30

3. 45% based on variable cost7. 25

4. 30% based on full costs 7.67

5. 35% based on variable costs 7.475

6. 60 % based on prime costs 7.22

7. The company desires to enter a foreign market. An order of 10,000 units is sought. It is

expected that selling cost for this order amounts to P.75 per unit but the fixed costs of

obtaining the contract will be P4,000. Determine the break even price. 4.15

B. Variable raw materials cost 75.00

Direct labor cost 45.00

Fixed annual overhead 450,000

Mark up is 10% on full cost.

1. If the company’s selling potential is 200,000 units, What is the unit selling price?

(75 + 45 +2.25) x1.1 = 134.48

2. . If the company’s pricing policy is changed to 20% based on full cost and its selling potential is

increased by 300,000 units with a corresponding increase in fixed annual expenses to P600,000,

what is the unit selling price to be set up ?

( 75 + 45 + 1.2 ) X 1.2 = 145.44

You might also like

- Fixed IncomeDocument112 pagesFixed IncomeNGOC NHINo ratings yet

- CVP Solution (Quiz)Document9 pagesCVP Solution (Quiz)Angela Miles DizonNo ratings yet

- Advanced MacroeconomicsDocument420 pagesAdvanced MacroeconomicsJuan Sanchez90% (10)

- Ma Bep01Document4 pagesMa Bep01Grace SimonNo ratings yet

- DocxDocument8 pagesDocxMburu J. Irungu100% (1)

- External Environment AnalysisDocument7 pagesExternal Environment AnalysisAmutha RamasamyNo ratings yet

- Marginal Costing Problems&Solutions 2Document51 pagesMarginal Costing Problems&Solutions 2Dr.Ashok Kumar Panigrahi100% (4)

- Sargent Wallace ModelDocument4 pagesSargent Wallace ModelsaskenziborNo ratings yet

- Ke Toan Quan Tri FinalDocument13 pagesKe Toan Quan Tri Finalkhanhlinh.vuha02No ratings yet

- See Zhao Wei U2003083Document5 pagesSee Zhao Wei U2003083zhaoweiNo ratings yet

- Maf551 PricingDocument4 pagesMaf551 Pricinghanisfarhanah17No ratings yet

- Assignment On BudgetingDocument5 pagesAssignment On BudgetingRameshNo ratings yet

- Basic Cost Accounting DefinitionsDocument8 pagesBasic Cost Accounting Definitionsbritonkariuki97No ratings yet

- Problems in Relevant CostingDocument20 pagesProblems in Relevant CostingJem ValmonteNo ratings yet

- Relevant CostingDocument23 pagesRelevant CostingEy GuanlaoNo ratings yet

- COSMAN2 Final ExamDocument18 pagesCOSMAN2 Final ExamRIZLE SOGRADIELNo ratings yet

- Application of CVPDocument17 pagesApplication of CVPTWINKLE MEHTANo ratings yet

- Flexible Budget: ProblemsDocument3 pagesFlexible Budget: ProblemsRenu PoddarNo ratings yet

- Chapter 22Document14 pagesChapter 22Nguyên BảoNo ratings yet

- Marginal Costing-Problems&Solutions-2Document45 pagesMarginal Costing-Problems&Solutions-2nahi batanaNo ratings yet

- Madrigal Company Case StudyDocument4 pagesMadrigal Company Case StudyChleo EsperaNo ratings yet

- Cost Accounting Answer Chapter 2 PDFDocument5 pagesCost Accounting Answer Chapter 2 PDFangel cruz0% (1)

- Chapters 1 3Document112 pagesChapters 1 3julygg0710No ratings yet

- Relevant Costing - SolutionsDocument3 pagesRelevant Costing - SolutionsSwiss HanNo ratings yet

- Answer To PTP - Intermediate - Syllabus 2012 - Jun2014 - Set 3: Section A-Cost AccountingDocument17 pagesAnswer To PTP - Intermediate - Syllabus 2012 - Jun2014 - Set 3: Section A-Cost AccountingIshaan guptaNo ratings yet

- Prelim ReviewerDocument19 pagesPrelim ReviewerMah2SetNo ratings yet

- Cost Management Anudeep Velagapudi PGDM6 1967Document9 pagesCost Management Anudeep Velagapudi PGDM6 1967Harsh Vardhan SinghNo ratings yet

- 2m00154 S.y.b.com - Bms Sem Ivchoice Based 78512 Group A Finance Strategic Cost Management Q.p.code53273Document5 pages2m00154 S.y.b.com - Bms Sem Ivchoice Based 78512 Group A Finance Strategic Cost Management Q.p.code53273Navira MirajkarNo ratings yet

- Chapter 6 Activity Based CostingDocument20 pagesChapter 6 Activity Based CostingSVPSNo ratings yet

- Studocu 12137811-1Document31 pagesStudocu 12137811-1kristinejoy pacalNo ratings yet

- Ma Mba07083 Mhatre Bhushan GhanshyamDocument11 pagesMa Mba07083 Mhatre Bhushan GhanshyamsidNo ratings yet

- Costing CaseDocument6 pagesCosting CasenguyenthingocmaimkNo ratings yet

- Profit Rate and Return On Capital Employed: Moh. Ihya' UlumuddinDocument11 pagesProfit Rate and Return On Capital Employed: Moh. Ihya' UlumuddinKKM 37 2023No ratings yet

- Lesson 8 Management Science Short Term DecisionsDocument3 pagesLesson 8 Management Science Short Term DecisionsMila Casandra CastañedaNo ratings yet

- Business AccountingDocument5 pagesBusiness Accountingerielle mejicoNo ratings yet

- MAE RevisionDocument57 pagesMAE RevisionsaloniNo ratings yet

- Solution For Chapter 22 - Part2Document4 pagesSolution For Chapter 22 - Part2Dương Xuân ĐạtNo ratings yet

- BEP SolutionsDocument4 pagesBEP SolutionsMahediNo ratings yet

- SOLUTION For Break Even Analysis Example ProblemDocument11 pagesSOLUTION For Break Even Analysis Example ProblemArly Kurt TorresNo ratings yet

- Cost Volume Profit Analysis Cost Accounting 2022 P1Document6 pagesCost Volume Profit Analysis Cost Accounting 2022 P1jay-an DahunogNo ratings yet

- DR Rachna Mahalwla - B.Com III Year Management Accounting Flexible BudgetingDocument6 pagesDR Rachna Mahalwla - B.Com III Year Management Accounting Flexible BudgetingSaumya JainNo ratings yet

- Name: I.L.Edirisingha Student No: HDIB/2019/014 Cost & Management Accounting University of KelaniyaDocument10 pagesName: I.L.Edirisingha Student No: HDIB/2019/014 Cost & Management Accounting University of KelaniyaIrushi EdirisinghaNo ratings yet

- Ma - Bep01 - LucioDocument4 pagesMa - Bep01 - LucioGrace SimonNo ratings yet

- Mas TestbanksDocument25 pagesMas TestbanksKristine Esplana ToraldeNo ratings yet

- CMA Garrison SuggestedSolutions Chap2Document12 pagesCMA Garrison SuggestedSolutions Chap2PIYUSH SINGHNo ratings yet

- 03122020055228-Job Costing Problems & Solutions NotesDocument4 pages03122020055228-Job Costing Problems & Solutions NotesRohit RanaNo ratings yet

- Solution AccountDocument12 pagesSolution Accountbikaspatra89No ratings yet

- 84 1.05 54 B. Direct Labour 14 0.175 28 Add: Factory O/h 42 0.525 84 Units Produced 80 120Document6 pages84 1.05 54 B. Direct Labour 14 0.175 28 Add: Factory O/h 42 0.525 84 Units Produced 80 120Ashutosh PatidarNo ratings yet

- Day 2 Cost Template (My)Document36 pagesDay 2 Cost Template (My)Jhilmil JeswaniNo ratings yet

- Pricing Decision 2022Document5 pagesPricing Decision 2022ChrysNo ratings yet

- Cristine Dominico - Exercises On The Topics Discussed On May 29, 2021Document17 pagesCristine Dominico - Exercises On The Topics Discussed On May 29, 2021Tin Bernadette DominicoNo ratings yet

- 5 6181699682708750974Document123 pages5 6181699682708750974Kay SanNo ratings yet

- Toaz - Info Midterm PRDocument9 pagesToaz - Info Midterm PRXyrene Keith MedranoNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Management Accounting: Decision-Making by Numbers: Business Strategy & Competitive AdvantageFrom EverandManagement Accounting: Decision-Making by Numbers: Business Strategy & Competitive AdvantageRating: 5 out of 5 stars5/5 (1)

- Advanced Analysis and Appraisal of PerformanceDocument7 pagesAdvanced Analysis and Appraisal of PerformanceAnn SalazarNo ratings yet

- Advanced Analysis and Appraisal of PerformanceDocument7 pagesAdvanced Analysis and Appraisal of PerformanceAnn SalazarNo ratings yet

- Segment Reporting PDFDocument4 pagesSegment Reporting PDFAnn Salazar100% (1)

- Solution Relevant CostingDocument3 pagesSolution Relevant CostingAnn Salazar0% (1)

- Final ExamDocument30 pagesFinal ExamAnn Salazar100% (2)

- The Classical Model: Gardner AckleyDocument39 pagesThe Classical Model: Gardner AckleyMahesh KumarNo ratings yet

- Economics of The Welfare StateDocument6 pagesEconomics of The Welfare StateIgnacio PHNo ratings yet

- Technip India LimitedDocument1 pageTechnip India LimitedUdit KheraNo ratings yet

- Bodie Investments 12e IM CH06Document2 pagesBodie Investments 12e IM CH06lexon_kbNo ratings yet

- Evolution of Entrepreneurship Time ContentDocument2 pagesEvolution of Entrepreneurship Time ContentMay Grethel Joy PeranteNo ratings yet

- 4 CVP MCQsDocument34 pages4 CVP MCQsBhup EshNo ratings yet

- Test 3 FALL 2011 AcctDocument15 pagesTest 3 FALL 2011 AcctAndy LauNo ratings yet

- Ch-8 Investing Decision Capital BudgetingDocument58 pagesCh-8 Investing Decision Capital BudgetingAbdela AyalewNo ratings yet

- PR - Order in The Matter of M/s Bharat Krishi Samridhi Industries LimitedDocument1 pagePR - Order in The Matter of M/s Bharat Krishi Samridhi Industries LimitedShyam SunderNo ratings yet

- Solution Manual For Microeconomics Principles Applications and Tools 10th Edition Arthur Osullivan Steven Sheffrin Stephen Perez 10 013Document12 pagesSolution Manual For Microeconomics Principles Applications and Tools 10th Edition Arthur Osullivan Steven Sheffrin Stephen Perez 10 013louisdienek3100% (23)

- Evaluating Theories 1997Document6 pagesEvaluating Theories 1997pedronuno20No ratings yet

- Operation ManagementDocument3 pagesOperation ManagementKaushal ShresthaNo ratings yet

- Sita VenkateswarDocument272 pagesSita VenkateswarMariusz KairskiNo ratings yet

- Blanco and Raurich - 2022 - Agricultural Composition and Labor ProductivityDocument40 pagesBlanco and Raurich - 2022 - Agricultural Composition and Labor ProductivityIndra RosadiNo ratings yet

- CH 13 Macroeconomics KrugmanDocument6 pagesCH 13 Macroeconomics KrugmanMary Petrova100% (2)

- Paper On Manitoba Basic Annual Income Experiment - Ikponmwosa OlotuDocument8 pagesPaper On Manitoba Basic Annual Income Experiment - Ikponmwosa Olotuikponmwosa olotuNo ratings yet

- Law of Variable ProportionsDocument14 pagesLaw of Variable Proportionsgoyal0705No ratings yet

- Economics NotesDocument4 pagesEconomics Noteskulbirsg100% (1)

- Unit 7 Interactive NotebookDocument18 pagesUnit 7 Interactive NotebookSankalp YeletiNo ratings yet

- Money Growth and InflationDocument48 pagesMoney Growth and InflationNhược NhượcNo ratings yet

- 26 Urban PlanningDocument16 pages26 Urban PlanningNeha JayaramanNo ratings yet

- Valuation+in+the+Context+of+a+Restructuring+ (3 23 10)Document53 pagesValuation+in+the+Context+of+a+Restructuring+ (3 23 10)aniketparikh3100% (1)

- Cur 65 M I XB07 ENGDocument17 pagesCur 65 M I XB07 ENGJohn AgborNo ratings yet

- Womens Fashion IndonesiaDocument209 pagesWomens Fashion IndonesiaNatasha Martin100% (1)

- Class 11 Economics Sample Paper With Solutions Set 1 2020 2021Document19 pagesClass 11 Economics Sample Paper With Solutions Set 1 2020 2021Zeeshan AkhtarNo ratings yet

- Economy Mind Map IndexDocument10 pagesEconomy Mind Map IndexShashvatKaushalNo ratings yet