Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

58 viewsActivity For Chapter 3 (Financial Statements, Cash Flow and Taxes)

Activity For Chapter 3 (Financial Statements, Cash Flow and Taxes)

Uploaded by

pamela dequillamorte1. This document contains an activity for Chapter 3 of a course involving financial statements, cash flow, and taxes. It includes 4 problems:

2. Problem 1 computes Economic Value Added (EVA) for a company with an ROIC of 21% and WACC of 15%. The EVA is R6 million.

3. Problem 2 analyzes a company's net working capital of R430,000, indicating it has enough current assets to cover current liabilities.

4. Problem 3 calculates the company's free cash flow at R15 million based on its EBIT, depreciation, capital expenditures, and change in net working capital.

5. Problem 4 presents the statement of cash flows for

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You might also like

- Name It To Win ItDocument32 pagesName It To Win Itpamela dequillamorte76% (17)

- Cash Flow Statement Problems PDFDocument32 pagesCash Flow Statement Problems PDFnsrivastav181% (31)

- Assign 5 Chapter 7 Cash Flow Analysis Answer Cabrera 2019-2020Document6 pagesAssign 5 Chapter 7 Cash Flow Analysis Answer Cabrera 2019-2020mhikeedelantar50% (2)

- Cavite Mutiny: Spanish Gov. Izquierdo Filipino V E R S I O NDocument10 pagesCavite Mutiny: Spanish Gov. Izquierdo Filipino V E R S I O Npamela dequillamorte100% (1)

- CLA2 A Case Study On Alphabet Inc.Document9 pagesCLA2 A Case Study On Alphabet Inc.Shrestha PressNo ratings yet

- Principles of Accounts: Sample P AgesDocument28 pagesPrinciples of Accounts: Sample P AgesDanita100% (1)

- TK4 AkuntasniDocument7 pagesTK4 AkuntasniSarah NurfadilahNo ratings yet

- Ultimate Book of Accountancy: Brilliant ProblemsDocument9 pagesUltimate Book of Accountancy: Brilliant ProblemsPramod VasudevNo ratings yet

- CashFlowStatement AssignmentDocument15 pagesCashFlowStatement AssignmentAnanta Vishain0% (1)

- CF Statement Solutions 1Document4 pagesCF Statement Solutions 1Joy MukhiNo ratings yet

- Ma AssigmentDocument32 pagesMa AssigmentAashayNo ratings yet

- Statement of Accounting Cash FlowsDocument1 pageStatement of Accounting Cash FlowsUtkarsh GurjarNo ratings yet

- Chegg SolutionsDocument4 pagesChegg SolutionsZenika PetersNo ratings yet

- Accounting Sample Question Along With A SolutionDocument9 pagesAccounting Sample Question Along With A SolutionNoor Mohammad Abu RaihanNo ratings yet

- PA Biweekly5 G1Document3 pagesPA Biweekly5 G1Quang NguyenNo ratings yet

- The Hong Kong Polytechnic University Hong Kong Community CollegeDocument6 pagesThe Hong Kong Polytechnic University Hong Kong Community CollegeFung Yat Kit KeithNo ratings yet

- ACC12 - Statement of Cash FlowsDocument1 pageACC12 - Statement of Cash FlowsVimal KvNo ratings yet

- AS Book 1Document12 pagesAS Book 1Vashu ShrivastavNo ratings yet

- AFA IIP.L III SolutionJune 2016Document4 pagesAFA IIP.L III SolutionJune 2016HossainNo ratings yet

- 1712 Acct6174 Tmba TK4-W10-S15-R2 Team2Document7 pages1712 Acct6174 Tmba TK4-W10-S15-R2 Team2Adzinta Syamsa100% (1)

- Assignment - CASH FLOWDocument6 pagesAssignment - CASH FLOWFariha tamannaNo ratings yet

- FINANCIAL MANAGEMENT AssignmentDocument2 pagesFINANCIAL MANAGEMENT Assignmentfinn mertensNo ratings yet

- CH 5 Answers 09Document5 pagesCH 5 Answers 09ExequielCamisaCrusperoNo ratings yet

- Perfect Practice SolutionDocument41 pagesPerfect Practice Solutionnarutevarsha5No ratings yet

- Excess Cash or Need To Borrow 111,300 297,600 (155,100) (22,800) 118,500 187,800Document3 pagesExcess Cash or Need To Borrow 111,300 297,600 (155,100) (22,800) 118,500 187,800Marjon0% (1)

- Tutorial 17.5Document4 pagesTutorial 17.5نور عفيفهNo ratings yet

- FINA 3330 - Notes CH 9Document2 pagesFINA 3330 - Notes CH 9fische100% (1)

- Problem 1: Ritchelle G. Reyes Mr. Marvin Dente 2.1 Bsa-Cy1 Financial ManagementDocument4 pagesProblem 1: Ritchelle G. Reyes Mr. Marvin Dente 2.1 Bsa-Cy1 Financial ManagementRavena ReyesNo ratings yet

- Financial Accounting Class Activity Fall 6 2021 Statement of Cash FlowsDocument4 pagesFinancial Accounting Class Activity Fall 6 2021 Statement of Cash FlowsRajay BramwellNo ratings yet

- UntitledDocument13 pagesUntitledTejasree SaiNo ratings yet

- Intermediate Accounting 3 - SolutionsDocument3 pagesIntermediate Accounting 3 - Solutionssammie helsonNo ratings yet

- BUSINESS COMBI (Activity On Goodwill Computation) - PALLERDocument5 pagesBUSINESS COMBI (Activity On Goodwill Computation) - PALLERGlayca PallerNo ratings yet

- 16 B 3 Supplemental - Problems - and - Solutions - CH - 1Document6 pages16 B 3 Supplemental - Problems - and - Solutions - CH - 1minajovanovicNo ratings yet

- CHATTO - Finals - Summer 2022 - Cash Flows & Cap. BudgDocument6 pagesCHATTO - Finals - Summer 2022 - Cash Flows & Cap. BudgJULLIE CARMELLE H. CHATTONo ratings yet

- PROBLEM 9 (Net Present Value)Document8 pagesPROBLEM 9 (Net Present Value)Kathlyn TajadaNo ratings yet

- Far210 - July2020 SS Q5Document2 pagesFar210 - July2020 SS Q5imn njwaaaNo ratings yet

- AS Book 1Document4 pagesAS Book 1Vashu ShrivastavNo ratings yet

- The Statement of Cash Flows Problems 5-1. (Currency Company)Document7 pagesThe Statement of Cash Flows Problems 5-1. (Currency Company)Marcos DmitriNo ratings yet

- ACT320 Assignment ProjectDocument11 pagesACT320 Assignment ProjectMd. Shakil Ahmed 1620890630No ratings yet

- Ultimate Book of Accountancy: Class - XII Accountancy Chapter - 05 (Part - B) : Cash Flow Statement Part-4Document11 pagesUltimate Book of Accountancy: Class - XII Accountancy Chapter - 05 (Part - B) : Cash Flow Statement Part-4Pramod VasudevNo ratings yet

- Question 2: Ias 7 Statements of Cash Flows: The Following Information Is RelevantDocument3 pagesQuestion 2: Ias 7 Statements of Cash Flows: The Following Information Is RelevantamitsinghslideshareNo ratings yet

- Cash Flow Statement ProblemsDocument11 pagesCash Flow Statement ProblemsRaman SachdevaNo ratings yet

- Manatad - Accounting 14NDocument5 pagesManatad - Accounting 14NJullie Carmelle ChattoNo ratings yet

- FAR Final Preboard SolutionsDocument6 pagesFAR Final Preboard SolutionsVillanueva, Mariella De VeraNo ratings yet

- BT Tổng Hợp Topic 7 8 2Document12 pagesBT Tổng Hợp Topic 7 8 2Man Tran Y NhiNo ratings yet

- BE Chap 17Document3 pagesBE Chap 17TIÊN NGUYỄN LÊ MỸNo ratings yet

- Fernandez Acctg 14N Finals ExamDocument5 pagesFernandez Acctg 14N Finals ExamJULLIE CARMELLE H. CHATTONo ratings yet

- CA Inter FM Super 50 Q by Sanjay Saraf SirDocument129 pagesCA Inter FM Super 50 Q by Sanjay Saraf SirSaroj AdhikariNo ratings yet

- Solution Test 1Document3 pagesSolution Test 1anis izzatiNo ratings yet

- Ultimate Book of Accountancy: Class - XII Accountancy Chapter - 05 (Part - B) : Cash Flow Statement Part-5Document7 pagesUltimate Book of Accountancy: Class - XII Accountancy Chapter - 05 (Part - B) : Cash Flow Statement Part-5Pramod VasudevNo ratings yet

- Cash Flow Master Question With SolutionDocument6 pagesCash Flow Master Question With Solutionft2vny7nytNo ratings yet

- Accounts Project (Solution 1)Document3 pagesAccounts Project (Solution 1)sejanahmad48No ratings yet

- Test Series: November, 2021 Mock Test Paper - 2 Intermediate (New) : Group - I Paper - 1: AccountingDocument12 pagesTest Series: November, 2021 Mock Test Paper - 2 Intermediate (New) : Group - I Paper - 1: Accountingsunil1287No ratings yet

- TK 2 Accounting Nomer 3Document6 pagesTK 2 Accounting Nomer 3Dwi PutriNo ratings yet

- Financial Reporting, Statement and Analysis Assignment For 2 Semester Name: Dishant Tibrewal SUBMISSION DATE - 16/07/21Document3 pagesFinancial Reporting, Statement and Analysis Assignment For 2 Semester Name: Dishant Tibrewal SUBMISSION DATE - 16/07/21Dishant TibrewalNo ratings yet

- Cash Flow QuestionDocument3 pagesCash Flow QuestionChia Zen ChenNo ratings yet

- Examination Question and Answers, Set D (Problem Solving), Chapter 15 - Statement of Cash FlowDocument2 pagesExamination Question and Answers, Set D (Problem Solving), Chapter 15 - Statement of Cash Flowjohn carlos doringoNo ratings yet

- Assign 2 Chapter 5 Understanding The Financial Statements Prob 8 Answer Cabrera 2019-2020Document5 pagesAssign 2 Chapter 5 Understanding The Financial Statements Prob 8 Answer Cabrera 2019-2020mhikeedelantar100% (1)

- Chapter 16Document72 pagesChapter 16Sour CandyNo ratings yet

- Worksheet-4 On CFSDocument6 pagesWorksheet-4 On CFSNavya KhemkaNo ratings yet

- Cash Flow Statement and Financial Ratio AssignDocument4 pagesCash Flow Statement and Financial Ratio AssignChristian TanNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Understanding IFRS Fundamentals: International Financial Reporting StandardsFrom EverandUnderstanding IFRS Fundamentals: International Financial Reporting StandardsNo ratings yet

- Equity Valuation: Models from Leading Investment BanksFrom EverandEquity Valuation: Models from Leading Investment BanksJan ViebigNo ratings yet

- Florenz C. T Florenz C. T Florenz C. T Florenz C. T Florenz C. Tugas Ugas Ugas Ugas Ugas Accountancy Department, de La Salle University-ManilaDocument12 pagesFlorenz C. T Florenz C. T Florenz C. T Florenz C. T Florenz C. Tugas Ugas Ugas Ugas Ugas Accountancy Department, de La Salle University-Manilapamela dequillamorteNo ratings yet

- AEC 126 Chapter 1Document19 pagesAEC 126 Chapter 1pamela dequillamorteNo ratings yet

- Management Accounting Practices of The Philippines Small and Medium-Sized EnterprisesDocument21 pagesManagement Accounting Practices of The Philippines Small and Medium-Sized Enterprisespamela dequillamorteNo ratings yet

- Punzalan-Holy Order AssessmentDocument5 pagesPunzalan-Holy Order Assessmentpamela dequillamorteNo ratings yet

- General Guidelines: Junior Philippine Association of Management Accountants A.Y. 2020-2021Document16 pagesGeneral Guidelines: Junior Philippine Association of Management Accountants A.Y. 2020-2021pamela dequillamorteNo ratings yet

- Summary For Number 4: BDO Unibank, IncDocument1 pageSummary For Number 4: BDO Unibank, Incpamela dequillamorteNo ratings yet

- Club Calendar of ActivitiesDocument1 pageClub Calendar of Activitiespamela dequillamorteNo ratings yet

- Net Worth: Total Assets Value of BDO Unibank Inc. in The Philippines From December 2014 To December 2019Document4 pagesNet Worth: Total Assets Value of BDO Unibank Inc. in The Philippines From December 2014 To December 2019pamela dequillamorteNo ratings yet

- Chapter 1 Cost-Volume-Profit RelationshipsDocument51 pagesChapter 1 Cost-Volume-Profit Relationshipspamela dequillamorteNo ratings yet

- Democratic Philippine IndependenceDocument2 pagesDemocratic Philippine Independencepamela dequillamorteNo ratings yet

- Organization and Management Plan: JMJ Marist Brothers Integrated Basic Education Department Senior High SchoolDocument3 pagesOrganization and Management Plan: JMJ Marist Brothers Integrated Basic Education Department Senior High Schoolpamela dequillamorteNo ratings yet

- Henlo Welcome To Our Tutorial Week Idk HihiDocument19 pagesHenlo Welcome To Our Tutorial Week Idk Hihipamela dequillamorteNo ratings yet

- Calendar 01Document1 pageCalendar 01pamela dequillamorteNo ratings yet

- AnnounDocument4 pagesAnnounpamela dequillamorteNo ratings yet

- Ayala Corporation Background and PortfolioDocument1 pageAyala Corporation Background and Portfoliopamela dequillamorteNo ratings yet

- Account Description Debit CreditDocument2 pagesAccount Description Debit Creditpamela dequillamorte100% (1)

- Activity On The Sacrament of Holy Eucharist PDFDocument2 pagesActivity On The Sacrament of Holy Eucharist PDFpamela dequillamorteNo ratings yet

- Quiz Cash and ReceivablesDocument4 pagesQuiz Cash and Receivableserica insiongNo ratings yet

- V2s2a19 PDFDocument21 pagesV2s2a19 PDFElshafeiNo ratings yet

- AM2 - Tutorial 3Document13 pagesAM2 - Tutorial 3hqfNo ratings yet

- APQC Catman PublishedDocument26 pagesAPQC Catman PublishedVikas GuliaNo ratings yet

- Test Bank For Intermediate Accounting 7 Edition David Spiceland James F Sepe Mark W NelsonDocument38 pagesTest Bank For Intermediate Accounting 7 Edition David Spiceland James F Sepe Mark W Nelsonfirelockversantka88zn100% (13)

- Dean Robert Blair GibsonDocument2 pagesDean Robert Blair GibsonKabanNo ratings yet

- Bad Debts RecoveryDocument6 pagesBad Debts RecoveryThilaga Senthilmurugan100% (1)

- Master Thesis Examples FinanceDocument4 pagesMaster Thesis Examples Financenikkismithmilwaukee100% (2)

- Purchase Order 159442926387958500Document4 pagesPurchase Order 159442926387958500Toka Barisovi BarisoviNo ratings yet

- Developing Project Cash Flow Statement: Lecture No. 23 Fundamentals of Engineering EconomicsDocument24 pagesDeveloping Project Cash Flow Statement: Lecture No. 23 Fundamentals of Engineering EconomicsAyman SobhyNo ratings yet

- ch7 (1) Becker CPA Chapter 7Document9 pagesch7 (1) Becker CPA Chapter 7VaeNo ratings yet

- Financial Performance of Sonali Bank LimitedDocument55 pagesFinancial Performance of Sonali Bank LimitedSharifMahmud67% (3)

- Equitas Small Finance Bank: Internet Banking Terms & ConditionsDocument10 pagesEquitas Small Finance Bank: Internet Banking Terms & ConditionsHappy SingerhNo ratings yet

- Wells Fargo Everyday Checking: Important Account InformationDocument6 pagesWells Fargo Everyday Checking: Important Account InformationMiguel A RevecoNo ratings yet

- Company Law ProjectDocument8 pagesCompany Law ProjectDouble A CreationNo ratings yet

- Corporate GovernanceDocument15 pagesCorporate GovernanceChristopher AiyapiNo ratings yet

- Canara BankDocument52 pagesCanara BankSandipto BanerjeeNo ratings yet

- 10) Impact of Financial Literacy On Investment DecisionsDocument11 pages10) Impact of Financial Literacy On Investment DecisionsYuri SouzaNo ratings yet

- PDF 17256553 1586590267466Document7 pagesPDF 17256553 1586590267466Lucky TraderNo ratings yet

- Coaching and MentoringDocument24 pagesCoaching and MentoringDuraiD Khan100% (1)

- b3 Economics and FinanceDocument35 pagesb3 Economics and FinanceAnonymous YkMptv9jNo ratings yet

- Demand For Payment Letter PDFDocument2 pagesDemand For Payment Letter PDFgaleNo ratings yet

- Dividend DecisionDocument6 pagesDividend DecisionYasin Misvari T MNo ratings yet

- FAR Pre-Week Part 1Document24 pagesFAR Pre-Week Part 1John DoeNo ratings yet

- Sales Manager Business Development in Phoenix AZ Resume John LadnerDocument3 pagesSales Manager Business Development in Phoenix AZ Resume John LadnerJohnLadnerNo ratings yet

- Replacement Studies NotesDocument4 pagesReplacement Studies NotesVHIMBER GALLUTANNo ratings yet

- GENEROSO PCDocument5 pagesGENEROSO PCJar Jorquia100% (1)

- Colegio de Sta. Rita Business TaxationDocument1 pageColegio de Sta. Rita Business TaxationJunivenReyUmadhayNo ratings yet

Activity For Chapter 3 (Financial Statements, Cash Flow and Taxes)

Activity For Chapter 3 (Financial Statements, Cash Flow and Taxes)

Uploaded by

pamela dequillamorte0 ratings0% found this document useful (0 votes)

58 views2 pages1. This document contains an activity for Chapter 3 of a course involving financial statements, cash flow, and taxes. It includes 4 problems:

2. Problem 1 computes Economic Value Added (EVA) for a company with an ROIC of 21% and WACC of 15%. The EVA is R6 million.

3. Problem 2 analyzes a company's net working capital of R430,000, indicating it has enough current assets to cover current liabilities.

4. Problem 3 calculates the company's free cash flow at R15 million based on its EBIT, depreciation, capital expenditures, and change in net working capital.

5. Problem 4 presents the statement of cash flows for

Original Description:

Original Title

ACTIVITY - CHAPTER 3

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Document1. This document contains an activity for Chapter 3 of a course involving financial statements, cash flow, and taxes. It includes 4 problems:

2. Problem 1 computes Economic Value Added (EVA) for a company with an ROIC of 21% and WACC of 15%. The EVA is R6 million.

3. Problem 2 analyzes a company's net working capital of R430,000, indicating it has enough current assets to cover current liabilities.

4. Problem 3 calculates the company's free cash flow at R15 million based on its EBIT, depreciation, capital expenditures, and change in net working capital.

5. Problem 4 presents the statement of cash flows for

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

58 views2 pagesActivity For Chapter 3 (Financial Statements, Cash Flow and Taxes)

Activity For Chapter 3 (Financial Statements, Cash Flow and Taxes)

Uploaded by

pamela dequillamorte1. This document contains an activity for Chapter 3 of a course involving financial statements, cash flow, and taxes. It includes 4 problems:

2. Problem 1 computes Economic Value Added (EVA) for a company with an ROIC of 21% and WACC of 15%. The EVA is R6 million.

3. Problem 2 analyzes a company's net working capital of R430,000, indicating it has enough current assets to cover current liabilities.

4. Problem 3 calculates the company's free cash flow at R15 million based on its EBIT, depreciation, capital expenditures, and change in net working capital.

5. Problem 4 presents the statement of cash flows for

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 2

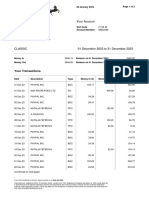

Name: Pamela D.

Morte Subject: AEC 127 – MA3

Course and Year: BSMA – 3 Schedule: MWF (1:30pm – 2:30pm)

ACTIVITY FOR CHAPTER 3

(Financial Statements, Cash Flow and Taxes)

Problem 1. EVA COMPUTATION

ROIC is R30 million / R100 million x (1 – tax rate of 30%) = 21%.

EVA = (ROIC – WACC) x IC

EVA = (21% - 15%) x R100 million

EVA = 6% x R100 million

EVA = R6 million

Problem 2. Working Capital

a.) compute for the net working capital

Net working capital = Current assets – Current liabilities

Net working capital = $950,000 – $520,000

Net working capital = $430,000

b.) what is the indication of the computed net working capital?

The computed net working capital shows that all current liabilities are to be

settled, the company would still have $430,000 left to continue its operations. Thus, this

indicates that the company has enough current assets to meet its current liabilities.

Problem 3. Free Cash Flow

FCF = EBIT (1 – tax rate) +Depreciation and Amortization + Capital Expenditure and Change in

NOWC)

Free Cash Flow = 45,000,000 ( 1 – 0.40) 27,000,000

Depreciation 12,000,000

Less:

CAPEX (18,000,000)

Change in Net Operating Working Capital (6,000,000) (24,000,000)

FCF = 15,000,000

Problem 4. Statement of Cash Flow

Class Exercise Pty Ltd

Statement of Cash Flows for Year ended June 30, 2006

Cash Flows from Operating Activities

Receipts from customers 388,000

Payments to Suppliers (304,200)

Interest Paid (9,200)

Income Tax Paid (15,000)

Net Cash Provided from Operating Activities 59,600

Cash Flows from Investing Activities

Disposal of old equipment 16,000

Purchase of new equipment (66,700)

Net Cash Provided from Investing Activities (50,700)

Cash Flows Provided from Financing Activities

Proceeds from Share Issuance 20,000

Repayment of Loan (25,000)

Dividend Paid (22,500)

Net Cash Provided from Financing Activities (27,500)

NET DECREASE IN CASH (18,600)

Beginning Cash balance 73,800

Ending Cash balance 55,200

You might also like

- Name It To Win ItDocument32 pagesName It To Win Itpamela dequillamorte76% (17)

- Cash Flow Statement Problems PDFDocument32 pagesCash Flow Statement Problems PDFnsrivastav181% (31)

- Assign 5 Chapter 7 Cash Flow Analysis Answer Cabrera 2019-2020Document6 pagesAssign 5 Chapter 7 Cash Flow Analysis Answer Cabrera 2019-2020mhikeedelantar50% (2)

- Cavite Mutiny: Spanish Gov. Izquierdo Filipino V E R S I O NDocument10 pagesCavite Mutiny: Spanish Gov. Izquierdo Filipino V E R S I O Npamela dequillamorte100% (1)

- CLA2 A Case Study On Alphabet Inc.Document9 pagesCLA2 A Case Study On Alphabet Inc.Shrestha PressNo ratings yet

- Principles of Accounts: Sample P AgesDocument28 pagesPrinciples of Accounts: Sample P AgesDanita100% (1)

- TK4 AkuntasniDocument7 pagesTK4 AkuntasniSarah NurfadilahNo ratings yet

- Ultimate Book of Accountancy: Brilliant ProblemsDocument9 pagesUltimate Book of Accountancy: Brilliant ProblemsPramod VasudevNo ratings yet

- CashFlowStatement AssignmentDocument15 pagesCashFlowStatement AssignmentAnanta Vishain0% (1)

- CF Statement Solutions 1Document4 pagesCF Statement Solutions 1Joy MukhiNo ratings yet

- Ma AssigmentDocument32 pagesMa AssigmentAashayNo ratings yet

- Statement of Accounting Cash FlowsDocument1 pageStatement of Accounting Cash FlowsUtkarsh GurjarNo ratings yet

- Chegg SolutionsDocument4 pagesChegg SolutionsZenika PetersNo ratings yet

- Accounting Sample Question Along With A SolutionDocument9 pagesAccounting Sample Question Along With A SolutionNoor Mohammad Abu RaihanNo ratings yet

- PA Biweekly5 G1Document3 pagesPA Biweekly5 G1Quang NguyenNo ratings yet

- The Hong Kong Polytechnic University Hong Kong Community CollegeDocument6 pagesThe Hong Kong Polytechnic University Hong Kong Community CollegeFung Yat Kit KeithNo ratings yet

- ACC12 - Statement of Cash FlowsDocument1 pageACC12 - Statement of Cash FlowsVimal KvNo ratings yet

- AS Book 1Document12 pagesAS Book 1Vashu ShrivastavNo ratings yet

- AFA IIP.L III SolutionJune 2016Document4 pagesAFA IIP.L III SolutionJune 2016HossainNo ratings yet

- 1712 Acct6174 Tmba TK4-W10-S15-R2 Team2Document7 pages1712 Acct6174 Tmba TK4-W10-S15-R2 Team2Adzinta Syamsa100% (1)

- Assignment - CASH FLOWDocument6 pagesAssignment - CASH FLOWFariha tamannaNo ratings yet

- FINANCIAL MANAGEMENT AssignmentDocument2 pagesFINANCIAL MANAGEMENT Assignmentfinn mertensNo ratings yet

- CH 5 Answers 09Document5 pagesCH 5 Answers 09ExequielCamisaCrusperoNo ratings yet

- Perfect Practice SolutionDocument41 pagesPerfect Practice Solutionnarutevarsha5No ratings yet

- Excess Cash or Need To Borrow 111,300 297,600 (155,100) (22,800) 118,500 187,800Document3 pagesExcess Cash or Need To Borrow 111,300 297,600 (155,100) (22,800) 118,500 187,800Marjon0% (1)

- Tutorial 17.5Document4 pagesTutorial 17.5نور عفيفهNo ratings yet

- FINA 3330 - Notes CH 9Document2 pagesFINA 3330 - Notes CH 9fische100% (1)

- Problem 1: Ritchelle G. Reyes Mr. Marvin Dente 2.1 Bsa-Cy1 Financial ManagementDocument4 pagesProblem 1: Ritchelle G. Reyes Mr. Marvin Dente 2.1 Bsa-Cy1 Financial ManagementRavena ReyesNo ratings yet

- Financial Accounting Class Activity Fall 6 2021 Statement of Cash FlowsDocument4 pagesFinancial Accounting Class Activity Fall 6 2021 Statement of Cash FlowsRajay BramwellNo ratings yet

- UntitledDocument13 pagesUntitledTejasree SaiNo ratings yet

- Intermediate Accounting 3 - SolutionsDocument3 pagesIntermediate Accounting 3 - Solutionssammie helsonNo ratings yet

- BUSINESS COMBI (Activity On Goodwill Computation) - PALLERDocument5 pagesBUSINESS COMBI (Activity On Goodwill Computation) - PALLERGlayca PallerNo ratings yet

- 16 B 3 Supplemental - Problems - and - Solutions - CH - 1Document6 pages16 B 3 Supplemental - Problems - and - Solutions - CH - 1minajovanovicNo ratings yet

- CHATTO - Finals - Summer 2022 - Cash Flows & Cap. BudgDocument6 pagesCHATTO - Finals - Summer 2022 - Cash Flows & Cap. BudgJULLIE CARMELLE H. CHATTONo ratings yet

- PROBLEM 9 (Net Present Value)Document8 pagesPROBLEM 9 (Net Present Value)Kathlyn TajadaNo ratings yet

- Far210 - July2020 SS Q5Document2 pagesFar210 - July2020 SS Q5imn njwaaaNo ratings yet

- AS Book 1Document4 pagesAS Book 1Vashu ShrivastavNo ratings yet

- The Statement of Cash Flows Problems 5-1. (Currency Company)Document7 pagesThe Statement of Cash Flows Problems 5-1. (Currency Company)Marcos DmitriNo ratings yet

- ACT320 Assignment ProjectDocument11 pagesACT320 Assignment ProjectMd. Shakil Ahmed 1620890630No ratings yet

- Ultimate Book of Accountancy: Class - XII Accountancy Chapter - 05 (Part - B) : Cash Flow Statement Part-4Document11 pagesUltimate Book of Accountancy: Class - XII Accountancy Chapter - 05 (Part - B) : Cash Flow Statement Part-4Pramod VasudevNo ratings yet

- Question 2: Ias 7 Statements of Cash Flows: The Following Information Is RelevantDocument3 pagesQuestion 2: Ias 7 Statements of Cash Flows: The Following Information Is RelevantamitsinghslideshareNo ratings yet

- Cash Flow Statement ProblemsDocument11 pagesCash Flow Statement ProblemsRaman SachdevaNo ratings yet

- Manatad - Accounting 14NDocument5 pagesManatad - Accounting 14NJullie Carmelle ChattoNo ratings yet

- FAR Final Preboard SolutionsDocument6 pagesFAR Final Preboard SolutionsVillanueva, Mariella De VeraNo ratings yet

- BT Tổng Hợp Topic 7 8 2Document12 pagesBT Tổng Hợp Topic 7 8 2Man Tran Y NhiNo ratings yet

- BE Chap 17Document3 pagesBE Chap 17TIÊN NGUYỄN LÊ MỸNo ratings yet

- Fernandez Acctg 14N Finals ExamDocument5 pagesFernandez Acctg 14N Finals ExamJULLIE CARMELLE H. CHATTONo ratings yet

- CA Inter FM Super 50 Q by Sanjay Saraf SirDocument129 pagesCA Inter FM Super 50 Q by Sanjay Saraf SirSaroj AdhikariNo ratings yet

- Solution Test 1Document3 pagesSolution Test 1anis izzatiNo ratings yet

- Ultimate Book of Accountancy: Class - XII Accountancy Chapter - 05 (Part - B) : Cash Flow Statement Part-5Document7 pagesUltimate Book of Accountancy: Class - XII Accountancy Chapter - 05 (Part - B) : Cash Flow Statement Part-5Pramod VasudevNo ratings yet

- Cash Flow Master Question With SolutionDocument6 pagesCash Flow Master Question With Solutionft2vny7nytNo ratings yet

- Accounts Project (Solution 1)Document3 pagesAccounts Project (Solution 1)sejanahmad48No ratings yet

- Test Series: November, 2021 Mock Test Paper - 2 Intermediate (New) : Group - I Paper - 1: AccountingDocument12 pagesTest Series: November, 2021 Mock Test Paper - 2 Intermediate (New) : Group - I Paper - 1: Accountingsunil1287No ratings yet

- TK 2 Accounting Nomer 3Document6 pagesTK 2 Accounting Nomer 3Dwi PutriNo ratings yet

- Financial Reporting, Statement and Analysis Assignment For 2 Semester Name: Dishant Tibrewal SUBMISSION DATE - 16/07/21Document3 pagesFinancial Reporting, Statement and Analysis Assignment For 2 Semester Name: Dishant Tibrewal SUBMISSION DATE - 16/07/21Dishant TibrewalNo ratings yet

- Cash Flow QuestionDocument3 pagesCash Flow QuestionChia Zen ChenNo ratings yet

- Examination Question and Answers, Set D (Problem Solving), Chapter 15 - Statement of Cash FlowDocument2 pagesExamination Question and Answers, Set D (Problem Solving), Chapter 15 - Statement of Cash Flowjohn carlos doringoNo ratings yet

- Assign 2 Chapter 5 Understanding The Financial Statements Prob 8 Answer Cabrera 2019-2020Document5 pagesAssign 2 Chapter 5 Understanding The Financial Statements Prob 8 Answer Cabrera 2019-2020mhikeedelantar100% (1)

- Chapter 16Document72 pagesChapter 16Sour CandyNo ratings yet

- Worksheet-4 On CFSDocument6 pagesWorksheet-4 On CFSNavya KhemkaNo ratings yet

- Cash Flow Statement and Financial Ratio AssignDocument4 pagesCash Flow Statement and Financial Ratio AssignChristian TanNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Understanding IFRS Fundamentals: International Financial Reporting StandardsFrom EverandUnderstanding IFRS Fundamentals: International Financial Reporting StandardsNo ratings yet

- Equity Valuation: Models from Leading Investment BanksFrom EverandEquity Valuation: Models from Leading Investment BanksJan ViebigNo ratings yet

- Florenz C. T Florenz C. T Florenz C. T Florenz C. T Florenz C. Tugas Ugas Ugas Ugas Ugas Accountancy Department, de La Salle University-ManilaDocument12 pagesFlorenz C. T Florenz C. T Florenz C. T Florenz C. T Florenz C. Tugas Ugas Ugas Ugas Ugas Accountancy Department, de La Salle University-Manilapamela dequillamorteNo ratings yet

- AEC 126 Chapter 1Document19 pagesAEC 126 Chapter 1pamela dequillamorteNo ratings yet

- Management Accounting Practices of The Philippines Small and Medium-Sized EnterprisesDocument21 pagesManagement Accounting Practices of The Philippines Small and Medium-Sized Enterprisespamela dequillamorteNo ratings yet

- Punzalan-Holy Order AssessmentDocument5 pagesPunzalan-Holy Order Assessmentpamela dequillamorteNo ratings yet

- General Guidelines: Junior Philippine Association of Management Accountants A.Y. 2020-2021Document16 pagesGeneral Guidelines: Junior Philippine Association of Management Accountants A.Y. 2020-2021pamela dequillamorteNo ratings yet

- Summary For Number 4: BDO Unibank, IncDocument1 pageSummary For Number 4: BDO Unibank, Incpamela dequillamorteNo ratings yet

- Club Calendar of ActivitiesDocument1 pageClub Calendar of Activitiespamela dequillamorteNo ratings yet

- Net Worth: Total Assets Value of BDO Unibank Inc. in The Philippines From December 2014 To December 2019Document4 pagesNet Worth: Total Assets Value of BDO Unibank Inc. in The Philippines From December 2014 To December 2019pamela dequillamorteNo ratings yet

- Chapter 1 Cost-Volume-Profit RelationshipsDocument51 pagesChapter 1 Cost-Volume-Profit Relationshipspamela dequillamorteNo ratings yet

- Democratic Philippine IndependenceDocument2 pagesDemocratic Philippine Independencepamela dequillamorteNo ratings yet

- Organization and Management Plan: JMJ Marist Brothers Integrated Basic Education Department Senior High SchoolDocument3 pagesOrganization and Management Plan: JMJ Marist Brothers Integrated Basic Education Department Senior High Schoolpamela dequillamorteNo ratings yet

- Henlo Welcome To Our Tutorial Week Idk HihiDocument19 pagesHenlo Welcome To Our Tutorial Week Idk Hihipamela dequillamorteNo ratings yet

- Calendar 01Document1 pageCalendar 01pamela dequillamorteNo ratings yet

- AnnounDocument4 pagesAnnounpamela dequillamorteNo ratings yet

- Ayala Corporation Background and PortfolioDocument1 pageAyala Corporation Background and Portfoliopamela dequillamorteNo ratings yet

- Account Description Debit CreditDocument2 pagesAccount Description Debit Creditpamela dequillamorte100% (1)

- Activity On The Sacrament of Holy Eucharist PDFDocument2 pagesActivity On The Sacrament of Holy Eucharist PDFpamela dequillamorteNo ratings yet

- Quiz Cash and ReceivablesDocument4 pagesQuiz Cash and Receivableserica insiongNo ratings yet

- V2s2a19 PDFDocument21 pagesV2s2a19 PDFElshafeiNo ratings yet

- AM2 - Tutorial 3Document13 pagesAM2 - Tutorial 3hqfNo ratings yet

- APQC Catman PublishedDocument26 pagesAPQC Catman PublishedVikas GuliaNo ratings yet

- Test Bank For Intermediate Accounting 7 Edition David Spiceland James F Sepe Mark W NelsonDocument38 pagesTest Bank For Intermediate Accounting 7 Edition David Spiceland James F Sepe Mark W Nelsonfirelockversantka88zn100% (13)

- Dean Robert Blair GibsonDocument2 pagesDean Robert Blair GibsonKabanNo ratings yet

- Bad Debts RecoveryDocument6 pagesBad Debts RecoveryThilaga Senthilmurugan100% (1)

- Master Thesis Examples FinanceDocument4 pagesMaster Thesis Examples Financenikkismithmilwaukee100% (2)

- Purchase Order 159442926387958500Document4 pagesPurchase Order 159442926387958500Toka Barisovi BarisoviNo ratings yet

- Developing Project Cash Flow Statement: Lecture No. 23 Fundamentals of Engineering EconomicsDocument24 pagesDeveloping Project Cash Flow Statement: Lecture No. 23 Fundamentals of Engineering EconomicsAyman SobhyNo ratings yet

- ch7 (1) Becker CPA Chapter 7Document9 pagesch7 (1) Becker CPA Chapter 7VaeNo ratings yet

- Financial Performance of Sonali Bank LimitedDocument55 pagesFinancial Performance of Sonali Bank LimitedSharifMahmud67% (3)

- Equitas Small Finance Bank: Internet Banking Terms & ConditionsDocument10 pagesEquitas Small Finance Bank: Internet Banking Terms & ConditionsHappy SingerhNo ratings yet

- Wells Fargo Everyday Checking: Important Account InformationDocument6 pagesWells Fargo Everyday Checking: Important Account InformationMiguel A RevecoNo ratings yet

- Company Law ProjectDocument8 pagesCompany Law ProjectDouble A CreationNo ratings yet

- Corporate GovernanceDocument15 pagesCorporate GovernanceChristopher AiyapiNo ratings yet

- Canara BankDocument52 pagesCanara BankSandipto BanerjeeNo ratings yet

- 10) Impact of Financial Literacy On Investment DecisionsDocument11 pages10) Impact of Financial Literacy On Investment DecisionsYuri SouzaNo ratings yet

- PDF 17256553 1586590267466Document7 pagesPDF 17256553 1586590267466Lucky TraderNo ratings yet

- Coaching and MentoringDocument24 pagesCoaching and MentoringDuraiD Khan100% (1)

- b3 Economics and FinanceDocument35 pagesb3 Economics and FinanceAnonymous YkMptv9jNo ratings yet

- Demand For Payment Letter PDFDocument2 pagesDemand For Payment Letter PDFgaleNo ratings yet

- Dividend DecisionDocument6 pagesDividend DecisionYasin Misvari T MNo ratings yet

- FAR Pre-Week Part 1Document24 pagesFAR Pre-Week Part 1John DoeNo ratings yet

- Sales Manager Business Development in Phoenix AZ Resume John LadnerDocument3 pagesSales Manager Business Development in Phoenix AZ Resume John LadnerJohnLadnerNo ratings yet

- Replacement Studies NotesDocument4 pagesReplacement Studies NotesVHIMBER GALLUTANNo ratings yet

- GENEROSO PCDocument5 pagesGENEROSO PCJar Jorquia100% (1)

- Colegio de Sta. Rita Business TaxationDocument1 pageColegio de Sta. Rita Business TaxationJunivenReyUmadhayNo ratings yet