Professional Documents

Culture Documents

Faheem Gul - South West Airlines Internal Analysis

Faheem Gul - South West Airlines Internal Analysis

Uploaded by

Faheem Gul0 ratings0% found this document useful (0 votes)

12 views2 pagesFaheem Gul - South West Airlines Internal Analysis

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentFaheem Gul - South West Airlines Internal Analysis

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

12 views2 pagesFaheem Gul - South West Airlines Internal Analysis

Faheem Gul - South West Airlines Internal Analysis

Uploaded by

Faheem GulFaheem Gul - South West Airlines Internal Analysis

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 2

South West Airlines employee productivity is by the ratio of

employees to passengers carried.

Southwest Airlines has long been one of According to figures from company 10-K

the standout performers in the U.S. statements, in 2008 Southwest had an

airline industry. It is famous for its low employee-to-passenger ratio of 1 to

fares, which are often some 30% lower 2,400, the best in the industry. By

than those of its major rivals. These are comparison, the ratio at United Airlines

balanced by an even lower cost structure, was 1 to 1,175 and, at Continental, it was

enabling it to record superior 1 to 1,125.

profitability even in bad years such as

2002, when the industry faced slumping Southwest devotes enormous attention to

demand in the wake of the September 11 the people it hires. On average, the

terrorist attacks. Indeed, from 2001 to company hires only 3% of those

2005, quite possibly the worst four years interviewed in a year. When hiring, it

in the history of the airline industry, emphasizes teamwork and a positive

while every other major airline lost attitude. Southwest rationalizes that

money, Southwest made money every skills can be taught, but a positive

year and earned an ROIC of 5.8%. Even attitude and a willingness to pitch in

in 2008, an awful year for most airlines, cannot. Southwest also creates incentives

Southwest made a profit and earned an for its employees to work hard. All

ROIC of 4%. employees are covered by a profit-

sharing plan, and at least 25% of an

Southwest operates somewhat employee’s share of the profit-sharing

differently from many of its competitors. plan has to be invested in Southwest

While operators like American Airlines Airlines stock. This gives rise to a simple

and United Airlines route passengers formula: the harder employees work, the

through hubs, Southwest Airlines flies more profitable Southwest becomes, and

point-to point, often through smaller the richer the employees get. The results

airports. By competing in a way that are clear. At other airlines, one would

other airlines do not, Southwest has never see a pilot helping to check

found that it can capture enough demand passengers onto the plane. At Southwest,

to keep its planes full. Moreover, because pilots and flight attendants have been

it avoids many hubs, Southwest has known to help clean the aircraft and

experienced fewer delays. In the first check in passengers at the gate. They do

eight months of 2008, Southwest planes this to turn around an aircraft as quickly

arrived on schedule 80% of the time, as possible and get it into the air again

compared to 76% at United and 74% at because an aircraft does not make money

Continental. while it is on the ground. This flexible

and motivated workforce leads to higher

Southwest flies only one type of plane, productivity and reduces the company’s

the Boeing 737. This reduces training need for more employees.

costs, maintenance costs, and inventory

costs while increasing efficiency in crew Because Southwest flies point-to-point

and flight scheduling. The operation is rather than through congested airport

nearly ticketless, with no seat hubs, there is no need for dozens of gates

assignments, which reduces cost and and thousands of employees to handle

back-office accounting functions. There banks of flights that come in and then

are no meals or movies in flight, and the disperse within a two-hour window,

airline will not transfer baggage to other leaving the hub empty until the next

airlines, reducing the need for baggage flights a few hours later. The result:

handlers. Southwest can operate with far fewer

employees than airlines that fly through

Southwest also has high employee hubs

productivity. One-way airlines measure

Case Discussion Questions

1. How would you characterize the

business model of Southwest

Airlines? How does this differ

from the business model used at

many other airlines, such as

United and American Airlines?

2. Identify the resources,

capabilities, and distinctive

competencies of Southwest

Airlines.

3. How do Southwest’s resources,

capabilities, and distinctive

competencies translate into

superior financial performance?

4. How secure is Southwest’s

competitive advantage? What are

the barriers to imitation here?

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5835)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (350)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (824)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (405)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- MCQ On PPP ModelDocument10 pagesMCQ On PPP Modelsarita100% (2)

- Money MarketsDocument41 pagesMoney MarketsFaheem GulNo ratings yet

- ManageDocument8 pagesManageFaheem GulNo ratings yet

- A Study of Theories On Consumer BehaviorDocument29 pagesA Study of Theories On Consumer BehaviorFaheem GulNo ratings yet

- Fixed Versus Flexible Exchange Rate SystemsDocument14 pagesFixed Versus Flexible Exchange Rate SystemsFaheem GulNo ratings yet

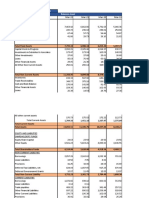

- Canon Marketing Japan Group Three-Year Management Plan 2015 - 2017Document43 pagesCanon Marketing Japan Group Three-Year Management Plan 2015 - 2017Faheem GulNo ratings yet

- 2008 Bookmatter FinancialRiskManagementForIsla PDFDocument29 pages2008 Bookmatter FinancialRiskManagementForIsla PDFFaheem GulNo ratings yet

- Banning BarbieDocument5 pagesBanning Barbieapi-267623773No ratings yet

- Name of School Where Service S Render ED Surplu S Under Rationa Lization Name of THE School Where Service S Are To Be UtilizedDocument5 pagesName of School Where Service S Render ED Surplu S Under Rationa Lization Name of THE School Where Service S Are To Be UtilizedFaheem GulNo ratings yet

- Banning Barbie.: International Marketing-II: MBA-3 Sem (2020) M. Marks: 50 Time: 24 Hrs Case Study-IDocument2 pagesBanning Barbie.: International Marketing-II: MBA-3 Sem (2020) M. Marks: 50 Time: 24 Hrs Case Study-IFaheem GulNo ratings yet

- RMC No. 13-2022Document1 pageRMC No. 13-2022Shiela Marie MaraonNo ratings yet

- Unit 2 InsuranceDocument9 pagesUnit 2 Insurancepreeti aggarwalNo ratings yet

- Flare Fragrance CaseDocument6 pagesFlare Fragrance CaseHualu Zhao100% (1)

- New Economic Policy 1991Document12 pagesNew Economic Policy 1991AtinNo ratings yet

- CA Certificate For Loan PurposeDocument5 pagesCA Certificate For Loan PurposeAgrovision GreenhouseNo ratings yet

- Kojeve - Colonialism From A European PerspectiveDocument18 pagesKojeve - Colonialism From A European PerspectiveTetsuya MaruyamaNo ratings yet

- Ramco Cements StandaloneDocument13 pagesRamco Cements StandaloneTao LoheNo ratings yet

- Link Building ProposalDocument7 pagesLink Building ProposalJhune VeloriaNo ratings yet

- Business, Trade and Commerce: Art Integrated ProjectDocument11 pagesBusiness, Trade and Commerce: Art Integrated ProjectRekha MarlechaNo ratings yet

- Loyalty Programs in Coffee ChainsDocument16 pagesLoyalty Programs in Coffee ChainsAdib MustafaNo ratings yet

- Sample Franchise Agreement Word FormatDocument7 pagesSample Franchise Agreement Word FormatKeshav KalyaniNo ratings yet

- Convexity CalculationDocument3 pagesConvexity Calculationsatu tanvirNo ratings yet

- EBOOK - Getting Started With ForexDocument27 pagesEBOOK - Getting Started With ForexAnother HumanNo ratings yet

- GE 3 ReviewerDocument5 pagesGE 3 Reviewervincent boralNo ratings yet

- Financial Ratio Analyses and Their Implications To ManagementDocument31 pagesFinancial Ratio Analyses and Their Implications To ManagementKeisha Kaye SaleraNo ratings yet

- Capital Budgeting and Decision MakingDocument71 pagesCapital Budgeting and Decision MakingNEERAJ GUPTANo ratings yet

- Marketing Management: Prof. Rubina D'MelloDocument34 pagesMarketing Management: Prof. Rubina D'MelloVidhi VarmaNo ratings yet

- 4Q21 Investor PresentationDocument17 pages4Q21 Investor Presentationhaitex48No ratings yet

- Purchase Order-ImportDocument3 pagesPurchase Order-ImportHarshavardhanan SNo ratings yet

- Pitch Deck PT Hakim Ekspress Berkah (Eng) - r2Document29 pagesPitch Deck PT Hakim Ekspress Berkah (Eng) - r2YugiIbnuNurmawanNo ratings yet

- DefaultDocument5 pagesDefaultBrandon DietzNo ratings yet

- 2023 JCI Century 4th IAB Souvenir MagazineDocument86 pages2023 JCI Century 4th IAB Souvenir MagazineJCI Century SecretaryNo ratings yet

- Act. 3-9Document4 pagesAct. 3-9Fernando III PerezNo ratings yet

- 9 Years English - CompressedDocument154 pages9 Years English - CompressedExpress WebNo ratings yet

- Act East Policy 2014Document5 pagesAct East Policy 2014justinsunny974No ratings yet

- IA Portfoliob enDocument18 pagesIA Portfoliob enOscar E. SánchezNo ratings yet

- Time Value of MoneyDocument14 pagesTime Value of MoneyKavya VermaNo ratings yet

- Globalization and Internalization of BusinessDocument35 pagesGlobalization and Internalization of BusinessMary Rose ArguellesNo ratings yet

- Account Statement 20230530 20230629 110547Document3 pagesAccount Statement 20230530 20230629 110547DARANo ratings yet