Professional Documents

Culture Documents

ESIC IP Interface

ESIC IP Interface

Uploaded by

Mithlesh YadavCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

ESIC IP Interface

ESIC IP Interface

Uploaded by

Mithlesh YadavCopyright:

Available Formats

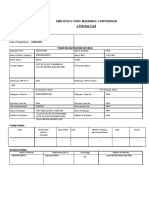

Insured Person Details

Login

1322997849

User:

Entitlement to Benefits

Period: Current Period Report Generated on Dated: 24/10/2020 08:58:12 Hrs

Benefit Period Eligiblity

Contribution Contribution

Benefit Start Date Benefit End Date Total Wages Total Working Days Paid / Payable

Period From Period To

01 Jan 2020 30 Jun 2020 42362.00 127 01 Apr 2019 30 Sep 2019

01 Jul 2020 31 Dec 2020 60678.00 178 01 Oct 2019 31 Mar 2020

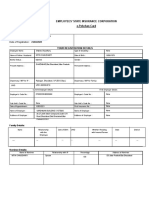

Eligiblity to ESIC Benefits

Benefit Type Entitlement Status Probable Reasons for Non-Entitlement to Benefits

IP/IW not in insurable employment and contributory

Medical Benefit Yes conditions are not met in the corresponding

Contribution Period.

* Not an IW.

* Less than 9 months of insurable employment on EDD

Maternity Benefit No / Date of delivery.

* Less than 70 days contribution in 2 preceding

Contribution Period.

* Less than 9 months of Insurable employment from

the date of first appointment

* Contributed less than 78 days in the corresponding

Sickness Benefit Yes contribution penod.

* If entered in insurable employment for the first time in

any Contribution period and contributed for less than

half no. of days of such shorter Contribution period.

* Not suffering from any of the listed 34 diseases.

* Less than two years continuous insurable

employment.

Extended Sickness Benefit Yes * Contributed for less than 156 days in proceeding four

Contribution periods (Two years).

* Not entitled for SB in any one of the four preceding

Contribution Periods.

Enhanced Sickness Benefit Yes Not Entitled for Sickness Benefit.

* Not completed six months of service from Date of

registration.

Super Specialty For IP Yes

* Contributed less than 78 days in a contribution

period.

* Not completed one year of service from date of

registration.

Super Specialty For Family Yes

* Contributed less than 78 days in each of the two

contribution period.

Disablement not due to Employment Injury or

Temporary Disablement Benefit Yes

Occupational Disease as per the ESI Act.

Disablement not due to Employment Injury or

Permanent Disablment Benefit Yes

Occupational Disease as per the ESI Act.

Death of the Insured person is not due to Employment

Dependent Benefit Yes

Injury or Occupational Disease as per the ESI Act.

R.G.S.K.Y No * Not an IP/ IW on the date of loss of Insurable

Employment on account of retrenchment under ID act,

closure of the factory / establishment under ID act or

permanent invalidity of not less than 40% arising out of

non-employment injury.

* Less than three years (One year = 156 days)

contribution paid/payable prior to loss of employment.

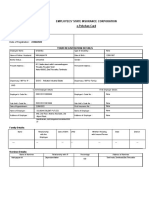

'Ward of IP' certificate as on 31-10-2018 - ***

*** This eligibility status is based only on the date Online Registration in the System. However, this shall be subject to change based upon

further verification of other relevant documents/ records.

* The list is not exhaustive. For further details please visit nearest Branch Office or www.esic.nic.in. Eligibility status shown here is as on

today's date and is further subject to Medical Certificates and/or other conditions.

Cancel

DISCLAIMER: Content owned, maintained and updated by Employee's State Insurance Corporation. Copyright © 2009, ESIC, India. All Rights Reserved. Best

viewed in 1024 x 768 pixels, Maintained by CMS. IP : 81

You might also like

- Social Justice. History, Theory, Research. Jost2010Document44 pagesSocial Justice. History, Theory, Research. Jost2010kostzaf0% (1)

- ESIC IP InterfaceDocument1 pageESIC IP InterfaceAnonymous Lq463icf100% (2)

- Peeda ActDocument42 pagesPeeda ActMuhammad Ehetisham Ul Haq100% (2)

- Online EPF, ESIC & HRIS TrainingDocument8 pagesOnline EPF, ESIC & HRIS TrainingMount Saipal International AcademyNo ratings yet

- Entitlement To Benefits Current PeriodDocument2 pagesEntitlement To Benefits Current PeriodMARUTI MISAL0% (1)

- ESIC IP InterfaceDocument1 pageESIC IP Interfaceअभिजीत कुमारNo ratings yet

- Entitlement to Benefits Language/ भाषाDocument2 pagesEntitlement to Benefits Language/ भाषाinfoprincemachinesNo ratings yet

- I - ESIC IP Interface ROOPADocument1 pageI - ESIC IP Interface ROOPAYogesh DevkareNo ratings yet

- Employees' State Insurance Corporation E-Pehchan Card: Insured Person: Insurance No.: Date of RegistrationDocument3 pagesEmployees' State Insurance Corporation E-Pehchan Card: Insured Person: Insurance No.: Date of RegistrationsagarNo ratings yet

- Features of ICICI Pru Guaranteed Income For Tomorrow: What Are Benefits of This Policy?Document3 pagesFeatures of ICICI Pru Guaranteed Income For Tomorrow: What Are Benefits of This Policy?Meenu SinghNo ratings yet

- ICICI Guaranteed BenifitsDocument3 pagesICICI Guaranteed BenifitsNaveen SettyNo ratings yet

- ESICDocument30 pagesESICLucKy PanditNo ratings yet

- INDUCTION - Accenture ATCIDocument1 pageINDUCTION - Accenture ATCIAparnaNo ratings yet

- FormsDocument16 pagesFormsSujeet kumarNo ratings yet

- Features of ICICI Pru Guaranteed Income For Tomorrow (Long-Term)Document3 pagesFeatures of ICICI Pru Guaranteed Income For Tomorrow (Long-Term)ShreyaNo ratings yet

- Legato Health Insurance - AdityaDocument54 pagesLegato Health Insurance - Adityaamruta UNo ratings yet

- Ipru Pension 10 Year X 2 LacDocument5 pagesIpru Pension 10 Year X 2 LacHK Option LearnNo ratings yet

- Features of ICICI Pru Guaranteed Income For Tomorrow: What Are Benefits of This Policy?Document3 pagesFeatures of ICICI Pru Guaranteed Income For Tomorrow: What Are Benefits of This Policy?ShreyaNo ratings yet

- Salary and Leave Policy in IndiaDocument6 pagesSalary and Leave Policy in IndiaAditya SrivastawaNo ratings yet

- Employees' State Insurance Corporation E-Pehchan Card: Insured Person: Insurance No.: Date of RegistrationDocument3 pagesEmployees' State Insurance Corporation E-Pehchan Card: Insured Person: Insurance No.: Date of Registrationnitin chaudharyNo ratings yet

- Unemployment InsuranceDocument8 pagesUnemployment InsuranceBhumani TyagiNo ratings yet

- Major Changes in Labour ActDocument1 pageMajor Changes in Labour ActMenuka SiwaNo ratings yet

- ESI ACT (Sickness Benefit)Document5 pagesESI ACT (Sickness Benefit)priyanka pinkyNo ratings yet

- FormsDocument18 pagesFormsvishan techNo ratings yet

- Balram PatelDocument3 pagesBalram PatelManoj SahuNo ratings yet

- PNBMetlife Gauranteed Future PlanDocument4 pagesPNBMetlife Gauranteed Future PlanManager Pnb LucknowNo ratings yet

- E Pehchan-7011258676Document3 pagesE Pehchan-7011258676gurpreetsingh777000777No ratings yet

- Draft Proposal 229013441Document19 pagesDraft Proposal 229013441NAND KISHOR GUPTANo ratings yet

- WireWheel Short Term DisabilityDocument7 pagesWireWheel Short Term DisabilitySteve MooreNo ratings yet

- Employee Benefits Manual 23-24 (V1)Document58 pagesEmployee Benefits Manual 23-24 (V1)Srijita JoarderNo ratings yet

- Permanent Disability BenefitsDocument2 pagesPermanent Disability BenefitsClarNo ratings yet

- Workright ChecklistDocument1 pageWorkright ChecklistSAIFUL ADIL (Art)No ratings yet

- Religare - 80D - Policy - Sukhadeo VibhuteDocument5 pagesReligare - 80D - Policy - Sukhadeo VibhuteArvind kumarNo ratings yet

- Draft Proposal 587694358Document22 pagesDraft Proposal 587694358UJJWAL EKKANo ratings yet

- Sumbitted By: Sumedha Pandey (16IN662)Document11 pagesSumbitted By: Sumedha Pandey (16IN662)MasthanNo ratings yet

- Non Floater QuoteDocument3 pagesNon Floater Quotegaurav.20230rbNo ratings yet

- ESIC - Benifits PresentationDocument30 pagesESIC - Benifits PresentationRanjan KumarNo ratings yet

- 1821 - Nishchit Aayush GG 15 - Income Variant Increasing Income Lumpsum BenefitDocument1 page1821 - Nishchit Aayush GG 15 - Income Variant Increasing Income Lumpsum BenefitVardhiniNo ratings yet

- HDFC Life Smart Income Plan-Mon Oct 17 20 - 02 - 31 IST 2022Document3 pagesHDFC Life Smart Income Plan-Mon Oct 17 20 - 02 - 31 IST 2022Teja Reddy Telugu YuvathaNo ratings yet

- Employees' State Insurance Corporation E-Pehchan Card: Insured Person: Insurance No.: Date of RegistrationDocument3 pagesEmployees' State Insurance Corporation E-Pehchan Card: Insured Person: Insurance No.: Date of RegistrationAravind reddyNo ratings yet

- icccdddDocument3 pagesicccdddJayant KelkarNo ratings yet

- Benefits and Services-HrmDocument27 pagesBenefits and Services-Hrmrizalleneangiela44No ratings yet

- STAR - Employee Benefits Insurance Manual 2019-2020-1Document36 pagesSTAR - Employee Benefits Insurance Manual 2019-2020-1utkarsh kumarNo ratings yet

- What Are Benefits of This Policy?: 1. Guaranteed IncomeDocument3 pagesWhat Are Benefits of This Policy?: 1. Guaranteed IncomeAmreen KubraNo ratings yet

- Magma HdiDocument3 pagesMagma HdiSunny AhujaNo ratings yet

- E Pehchan-8500093239Document3 pagesE Pehchan-8500093239Shivam MishraNo ratings yet

- E Pehchan-4216545494Document3 pagesE Pehchan-4216545494Technology Of Computer BELTRONNo ratings yet

- ESIC Benefit DetailsDocument15 pagesESIC Benefit DetailsPranav PasteNo ratings yet

- Reports Webdocs T1049 Terex India - Benefits Manual-2021Document38 pagesReports Webdocs T1049 Terex India - Benefits Manual-2021mzaidpervezNo ratings yet

- EPF-PPT - BenifitsDocument12 pagesEPF-PPT - BenifitsRanjan KumarNo ratings yet

- Policy Certificate 38892205Document6 pagesPolicy Certificate 38892205jecaw39027No ratings yet

- Thyrocare QuotationDocument4 pagesThyrocare Quotationsnehi56No ratings yet

- Employees' State Insurance Corporation E-Pehchan Card: Insured Person: Insurance No.: Date of RegistrationDocument3 pagesEmployees' State Insurance Corporation E-Pehchan Card: Insured Person: Insurance No.: Date of RegistrationTushar SharmaNo ratings yet

- Esi - Benefit at A GlanceDocument3 pagesEsi - Benefit at A GlanceSaba SaleemNo ratings yet

- Comparison Between Employees Benefit ProductsDocument3 pagesComparison Between Employees Benefit ProductsSAURABH CHAUHANNo ratings yet

- Toll Free Helpline: 1800-22-6465 WWW - Bluechipindia.co - In: Icici Pru Gold Tata Aia Fortune Guarantee SupremeDocument6 pagesToll Free Helpline: 1800-22-6465 WWW - Bluechipindia.co - In: Icici Pru Gold Tata Aia Fortune Guarantee SupremesnghadiaNo ratings yet

- 19c157c7-bb83-4fab-8d2d-5c792c1af156Document7 pages19c157c7-bb83-4fab-8d2d-5c792c1af156vonamal985No ratings yet

- Fair Work Information StatementDocument6 pagesFair Work Information Statementjje.hill33No ratings yet

- Employees' State Insurance Corporation E-Pehchan Card: Insured Person: Insurance No.: Date of RegistrationDocument3 pagesEmployees' State Insurance Corporation E-Pehchan Card: Insured Person: Insurance No.: Date of RegistrationVisu VijiNo ratings yet

- Group Medical PolicyDocument28 pagesGroup Medical PolicyMuthuchziyan KathiresanNo ratings yet

- Everything You Always Wanted to Know About Social Security Disability LawFrom EverandEverything You Always Wanted to Know About Social Security Disability LawNo ratings yet

- mathsbyankit: HeçeflemeleDocument6 pagesmathsbyankit: HeçeflemeleMithlesh YadavNo ratings yet

- mathsbyankit: Heefhe Deewj ŠbkeâerDocument3 pagesmathsbyankit: Heefhe Deewj ŠbkeâerMithlesh YadavNo ratings yet

- E-Ticket For Taj Mahal (With Mausoleum) : Important InformationDocument2 pagesE-Ticket For Taj Mahal (With Mausoleum) : Important InformationMithlesh YadavNo ratings yet

- Participles: A Participle Is A Verb Form That Can Be UsedDocument2 pagesParticiples: A Participle Is A Verb Form That Can Be UsedMithlesh YadavNo ratings yet

- Ibps Po Prelims - 2020: Expected PaperDocument18 pagesIbps Po Prelims - 2020: Expected PaperMithlesh YadavNo ratings yet

- Nationalism: Meaning and Concept: Chapter - 1Document18 pagesNationalism: Meaning and Concept: Chapter - 1Mithlesh YadavNo ratings yet

- Ankul Sir English Classes: Synonym Set - IDocument18 pagesAnkul Sir English Classes: Synonym Set - IMithlesh YadavNo ratings yet

- GNRTK00205010000000078 NewDocument12 pagesGNRTK00205010000000078 NewMithlesh YadavNo ratings yet

- Telegram ChannelsDocument1 pageTelegram ChannelsMithlesh Yadav100% (2)

- Interpretation: Index Value Result: Immunology Test Name Result Bio. Ref. Range MethodDocument2 pagesInterpretation: Index Value Result: Immunology Test Name Result Bio. Ref. Range MethodMithlesh YadavNo ratings yet

- Match The Two Halves To Form Full Questions:: Can MayDocument1 pageMatch The Two Halves To Form Full Questions:: Can MayMithlesh YadavNo ratings yet

- Match The Words and The Pictures! 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. 11. 12. 13. 14. 15. 16. 17. 18. 19. 20. 21. 22Document3 pagesMatch The Words and The Pictures! 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. 11. 12. 13. 14. 15. 16. 17. 18. 19. 20. 21. 22Mithlesh YadavNo ratings yet

- Present Simple TenseDocument1 pagePresent Simple TenseMithlesh YadavNo ratings yet

- "S", "ES" OR "IES": ADD To The VerbsDocument1 page"S", "ES" OR "IES": ADD To The VerbsMithlesh YadavNo ratings yet

- Andy Warhol - Claude Monet - Edvard Munch - Leonardo Da Vinci - Pablo Picasso - Piet Mondrian - Pieter Bruegel The Elder - Rene Magritte - Salvador Dali - Vincent Van GoghDocument2 pagesAndy Warhol - Claude Monet - Edvard Munch - Leonardo Da Vinci - Pablo Picasso - Piet Mondrian - Pieter Bruegel The Elder - Rene Magritte - Salvador Dali - Vincent Van GoghMithlesh YadavNo ratings yet

- Extract: - Ɪk Strækt 1) To Remove or Take Something Out. 2) To Get Information or SMTNGDocument1 pageExtract: - Ɪk Strækt 1) To Remove or Take Something Out. 2) To Get Information or SMTNGMithlesh YadavNo ratings yet

- True or False? Correct The False Sentences.: These Past Tenses - All in This Text - Are Jumbled /scrambled UpDocument2 pagesTrue or False? Correct The False Sentences.: These Past Tenses - All in This Text - Are Jumbled /scrambled UpMithlesh Yadav100% (1)

- Tanuj Services: Akash GamblerDocument1 pageTanuj Services: Akash GamblerMithlesh YadavNo ratings yet

- Extract: - Ɪk Strækt 1) To Remove or Take Something Out. 2) To Get Information or SMTNGDocument1 pageExtract: - Ɪk Strækt 1) To Remove or Take Something Out. 2) To Get Information or SMTNGMithlesh YadavNo ratings yet

- Hari Shakti Kitchen Equipment PDF File of All ItemsDocument11 pagesHari Shakti Kitchen Equipment PDF File of All ItemsMithlesh YadavNo ratings yet

- NXF Perforated Cable Tray en 2017Document65 pagesNXF Perforated Cable Tray en 2017LANKAPALLISURINo ratings yet

- PDF - Marine Bio Semester One Review SheetDocument2 pagesPDF - Marine Bio Semester One Review Sheetapi-205313794No ratings yet

- Qafe Green Coffee-Power Point Presentation-FinalDocument11 pagesQafe Green Coffee-Power Point Presentation-FinalPrem MathewNo ratings yet

- APH PresentationDocument36 pagesAPH PresentationBhargav Chaudhari100% (1)

- Home - Link - 4.6 PerimeterDocument2 pagesHome - Link - 4.6 Perimetergiselle andalanNo ratings yet

- 1st Periodical Test in IctDocument3 pages1st Periodical Test in IctWander Mary81% (16)

- Course Curriculum of PGP Renewable EnergyDocument6 pagesCourse Curriculum of PGP Renewable EnergyRonanki RaviNo ratings yet

- Uv-Visibles Electronic TransitionDocument25 pagesUv-Visibles Electronic TransitionZareen Rashid Choudhury100% (1)

- Types of Evaporators Castro EdgarDocument18 pagesTypes of Evaporators Castro EdgarJeshua Llorera100% (1)

- Cida Bulletin of Construction Statistics January 2021Document29 pagesCida Bulletin of Construction Statistics January 2021Niruban ThaventhiranNo ratings yet

- Manufacturing Planning and Control: MPC 6 EditionDocument44 pagesManufacturing Planning and Control: MPC 6 EditionSagar GuptaNo ratings yet

- 2013 Example 03Document107 pages2013 Example 03eouahiauNo ratings yet

- Proposed Syllabus: University of North BengalDocument53 pagesProposed Syllabus: University of North BengalDebolina BhattacharyaNo ratings yet

- 1 Concept Paper On The 6-Year CurriculumDocument9 pages1 Concept Paper On The 6-Year CurriculumJoseph Tabadero Jr.100% (3)

- 'The Real Book Guide' by Jazz TutorialDocument4 pages'The Real Book Guide' by Jazz Tutorialchrismovie100% (2)

- Successful InterviewsDocument3 pagesSuccessful InterviewsRia SeprianiNo ratings yet

- Relate Tables, Graphs, and Equations: BatchesDocument2 pagesRelate Tables, Graphs, and Equations: Batchesahmeeeeeeeeee.expmdNo ratings yet

- Oral Iron ProductsDocument2 pagesOral Iron ProductsOlga BabiiNo ratings yet

- The Pure Land On Earth The Chronicles of PDFDocument9 pagesThe Pure Land On Earth The Chronicles of PDFBhikshu GovindaNo ratings yet

- Error-Free - An Analysis of Art For Heart's Sake by Rube GoldbergDocument3 pagesError-Free - An Analysis of Art For Heart's Sake by Rube Goldbergwad elshaikhNo ratings yet

- Coatings Knowledge, Basic Paint Technology - HMG Paints LimitedDocument3 pagesCoatings Knowledge, Basic Paint Technology - HMG Paints LimitedShyam Yadav0% (1)

- Areeb CVDocument2 pagesAreeb CVMuhammad AreebNo ratings yet

- Reed Solomon CodesDocument6 pagesReed Solomon CodesMohammed MouftiNo ratings yet

- Assignment Parts of SpeechDocument2 pagesAssignment Parts of SpeechFarman Ali KhaskheliNo ratings yet

- Computer and Interfacing Chapter Six Pin and Clock GeneratorDocument78 pagesComputer and Interfacing Chapter Six Pin and Clock GeneratormigadNo ratings yet

- Maintenance and Inspection ChecklistDocument1 pageMaintenance and Inspection ChecklistRony NiksonNo ratings yet

- PC/SC Partial Documentation of The API: PMDZ061-AE 24/09/2009Document32 pagesPC/SC Partial Documentation of The API: PMDZ061-AE 24/09/2009manskebe6121No ratings yet

- 2018 2019 Enrolees PCDocument73 pages2018 2019 Enrolees PCMellize Royo DamyongNo ratings yet

- 8) Copper & Copper Alloy SpecificationsDocument3 pages8) Copper & Copper Alloy Specificationsnavas1972No ratings yet