Professional Documents

Culture Documents

Advanced Accounting C-Outline

Advanced Accounting C-Outline

Uploaded by

AkkamaCopyright:

Available Formats

You might also like

- Schaum's Outline of Bookkeeping and Accounting, Fourth EditionFrom EverandSchaum's Outline of Bookkeeping and Accounting, Fourth EditionRating: 5 out of 5 stars5/5 (1)

- Company Valuation Under IFRS - 3rd edition: Interpreting and forecasting accounts using International Financial Reporting StandardsFrom EverandCompany Valuation Under IFRS - 3rd edition: Interpreting and forecasting accounts using International Financial Reporting StandardsNo ratings yet

- Annexes Syllabi Effective October 2022Document26 pagesAnnexes Syllabi Effective October 2022Rhad Estoque100% (9)

- Advanced Financial Accounting & Reporting (Afar) : The Cpa Licensure Examination SyllabusDocument4 pagesAdvanced Financial Accounting & Reporting (Afar) : The Cpa Licensure Examination SyllabusFeem Operario100% (1)

- Fundamentals of Accounting-I New Course OutlineDocument3 pagesFundamentals of Accounting-I New Course OutlineGedion100% (2)

- Employee Job Description in Manufacturing IndustryDocument5 pagesEmployee Job Description in Manufacturing IndustryAkkamaNo ratings yet

- Chapter 5 Installment SalesDocument10 pagesChapter 5 Installment SalesAkkama100% (1)

- 20 - Reversing Entries PDFDocument3 pages20 - Reversing Entries PDFAB CloydNo ratings yet

- Damic Barber ShopDocument6 pagesDamic Barber ShopMikaelaMaeVillaluzNo ratings yet

- Advanced I Course OutlineDocument2 pagesAdvanced I Course OutlineSamuel DebebeNo ratings yet

- Course Outline - 2019264164advanced Financial AccountingDocument2 pagesCourse Outline - 2019264164advanced Financial AccountingZelalem YilkalNo ratings yet

- Advance Course OutlineDocument2 pagesAdvance Course OutlineAdugna MegenasaNo ratings yet

- 001 Course Outline Advanced Financial AccountingDocument2 pages001 Course Outline Advanced Financial AccountingTemesgen Lealem100% (1)

- Acc 202 Acctg Special Transactions OutlineDocument5 pagesAcc 202 Acctg Special Transactions OutlineQueenel MabbayadNo ratings yet

- Actg 7 Advanced Financial Accounting & Reporting, Part IDocument3 pagesActg 7 Advanced Financial Accounting & Reporting, Part IAcademic OfficeNo ratings yet

- Advance Two Course OutlineDocument2 pagesAdvance Two Course OutlineMinyichel BayeNo ratings yet

- Course Title Fundamentals of Accounting IDocument1 pageCourse Title Fundamentals of Accounting IMinyichel BayeNo ratings yet

- Financial AccountingDocument944 pagesFinancial Accountingsivachandirang695492% (24)

- Course Outline Advanced Financial AccountingDocument2 pagesCourse Outline Advanced Financial Accountingbona birra100% (1)

- Financial Reporting Analysis 2 EdgDocument315 pagesFinancial Reporting Analysis 2 EdgPeter Snell100% (1)

- College of St. John - Roxas: Member: Association of LASSSAI Accredited Superschools (ALAS)Document4 pagesCollege of St. John - Roxas: Member: Association of LASSSAI Accredited Superschools (ALAS)Miles SantosNo ratings yet

- Paper 5 Revised PDFDocument576 pagesPaper 5 Revised PDFameydoshiNo ratings yet

- Financial AccountingDocument5 pagesFinancial AccountingIfiokobong AkpanNo ratings yet

- Cma Inter Paper12Document532 pagesCma Inter Paper12Aishwarya Krishnan100% (1)

- Paper 5new PDFDocument600 pagesPaper 5new PDFAbhi100% (1)

- Afar 1 Module - Topic 1Document17 pagesAfar 1 Module - Topic 1mallarijhoana21No ratings yet

- ACC143 Module OutlineDocument4 pagesACC143 Module Outlineknwb9ny78jNo ratings yet

- Financial Accounting: 1. Aims and ObjectivesDocument8 pagesFinancial Accounting: 1. Aims and Objectivessalifu mansarayNo ratings yet

- WASSCE WAEC Financial Accounting SyllabusDocument6 pagesWASSCE WAEC Financial Accounting SyllabusAmazing SuccessNo ratings yet

- PACRADocument516 pagesPACRABenjamin Banda100% (1)

- Dps 103 Basic Financial Accounting PDFDocument129 pagesDps 103 Basic Financial Accounting PDFlizzy mandenda100% (1)

- Course Syllabus-Fundamentals of Accounting IDocument4 pagesCourse Syllabus-Fundamentals of Accounting ITewodrose Teklehawariat BelayhunNo ratings yet

- 111Document5 pages111rain06021992No ratings yet

- Accountancy 12 English Main PDFDocument173 pagesAccountancy 12 English Main PDFAshu SinghNo ratings yet

- FAR TOS - QUALI Aug 2022Document5 pagesFAR TOS - QUALI Aug 2022Reghis AtienzaNo ratings yet

- Paper-5 Financial Accounting PDFDocument534 pagesPaper-5 Financial Accounting PDFAshish Rai50% (2)

- Paper 5Document534 pagesPaper 5VijayMMuruganNo ratings yet

- Course outline-MBA 631 FINANCIAL MANAGERIAL ACCOUNTINGDocument5 pagesCourse outline-MBA 631 FINANCIAL MANAGERIAL ACCOUNTINGmeseretdemissieNo ratings yet

- Col For ModuleDocument26 pagesCol For ModuleIfaNo ratings yet

- Ebook Fundamentals of Corporate Finance PDF Full Chapter PDFDocument67 pagesEbook Fundamentals of Corporate Finance PDF Full Chapter PDFjesse.moore314100% (31)

- Advanced Financial Accounting and Reporting Course OutlineDocument3 pagesAdvanced Financial Accounting and Reporting Course Outlineselman AregaNo ratings yet

- Fundamentals of Accounting IDocument5 pagesFundamentals of Accounting Itarekegn gezahegn0% (1)

- Institute of Administration & Commerce (Zimbabwe) : Financial Accounting 2 Syllabus (W.E.F May 2009)Document4 pagesInstitute of Administration & Commerce (Zimbabwe) : Financial Accounting 2 Syllabus (W.E.F May 2009)Ronnie Vond McRyttsson MudyiwaNo ratings yet

- CPALE Oct 2022 SyllabusDocument25 pagesCPALE Oct 2022 SyllabusAngelica DizonNo ratings yet

- Cpale Cpa Exam Far 1 PDFDocument6 pagesCpale Cpa Exam Far 1 PDFJohn Rashid HebainaNo ratings yet

- Ncert Book Accountancy I - XiiDocument264 pagesNcert Book Accountancy I - Xiinikhilam.comNo ratings yet

- HDJJDDocument15 pagesHDJJDjustin maharlikaNo ratings yet

- Coures Out Line Principle Accounting - I and IIDocument4 pagesCoures Out Line Principle Accounting - I and IIAbraham RayaNo ratings yet

- Paper 12 Sep 2021Document542 pagesPaper 12 Sep 2021Ajmal SalihNo ratings yet

- Financial Accounting R. Kit PDFDocument342 pagesFinancial Accounting R. Kit PDFBenson100% (2)

- Learning Outcomes No L01 L02 L03 L04 L05Document11 pagesLearning Outcomes No L01 L02 L03 L04 L05AbiNo ratings yet

- Financial AccountingDocument2 pagesFinancial AccountingMbu Javis EnowNo ratings yet

- MBA 8 Year 2 Accounting For Decision Making Workbook January 2020Document94 pagesMBA 8 Year 2 Accounting For Decision Making Workbook January 2020weedforlifeNo ratings yet

- Fin ZC415Document11 pagesFin ZC415vigneshNo ratings yet

- Finance Report MbaDocument35 pagesFinance Report MbaManoj BeheraNo ratings yet

- Mba ZC415 Course HandoutDocument11 pagesMba ZC415 Course HandoutareanNo ratings yet

- Paper 5newDocument625 pagesPaper 5newratikanta pradhan100% (1)

- Financial Accounting TextbookDocument905 pagesFinancial Accounting TextbookLikamva Mgqamqho100% (1)

- Handbook of Asset and Liability Management: From Models to Optimal Return StrategiesFrom EverandHandbook of Asset and Liability Management: From Models to Optimal Return StrategiesNo ratings yet

- Principles of Cash Flow Valuation: An Integrated Market-Based ApproachFrom EverandPrinciples of Cash Flow Valuation: An Integrated Market-Based ApproachRating: 3 out of 5 stars3/5 (3)

- International Financial Statement AnalysisFrom EverandInternational Financial Statement AnalysisRating: 1 out of 5 stars1/5 (1)

- Wereya 1Document4 pagesWereya 1AkkamaNo ratings yet

- Fund CH 4 &5Document16 pagesFund CH 4 &5AkkamaNo ratings yet

- Akka HyuiDocument15 pagesAkka HyuiAkkamaNo ratings yet

- Ammalele JennaanDocument4 pagesAmmalele JennaanAkkamaNo ratings yet

- Amala Kee Yaa ShureeDocument4 pagesAmala Kee Yaa ShureeAkkamaNo ratings yet

- Abad 1Document2 pagesAbad 1AkkamaNo ratings yet

- Dabbal Mootii GaaraaDocument3 pagesDabbal Mootii GaaraaAkkamaNo ratings yet

- Leba AmalaDocument1 pageLeba AmalaAkkamaNo ratings yet

- Chapter 8 Consolidation IDocument18 pagesChapter 8 Consolidation IAkkama100% (1)

- 8.7.1 Allowance MethodDocument5 pages8.7.1 Allowance MethodAkkamaNo ratings yet

- The Accounting SystemDocument2 pagesThe Accounting SystemAkkamaNo ratings yet

- DafarDocument2 pagesDafarAkkamaNo ratings yet

- Basis of OpinionDocument11 pagesBasis of OpinionAkkamaNo ratings yet

- Chapter 4 Branch AccountingDocument31 pagesChapter 4 Branch AccountingAkkamaNo ratings yet

- Chapter 1 PartnershipsDocument46 pagesChapter 1 PartnershipsAkkamaNo ratings yet

- 3.2.2 Knowledge of The BusinessDocument10 pages3.2.2 Knowledge of The BusinessAkkamaNo ratings yet

- Chapter 6 Consignment SalesDocument12 pagesChapter 6 Consignment SalesAkkamaNo ratings yet

- Chapter Three: Obtaining, Evaluating and Documenting Audit Data Over Viewing Audit EvidenceDocument7 pagesChapter Three: Obtaining, Evaluating and Documenting Audit Data Over Viewing Audit EvidenceAkkamaNo ratings yet

- Chapter 7 BUSINESS COMBINATIONSDocument19 pagesChapter 7 BUSINESS COMBINATIONSAkkama100% (1)

- Chapter FiveDocument3 pagesChapter FiveAkkamaNo ratings yet

- Chapter Ten Auditing Liabilities: Audit For Accounts PayableDocument4 pagesChapter Ten Auditing Liabilities: Audit For Accounts PayableAkkamaNo ratings yet

- C6Document20 pagesC6AkkamaNo ratings yet

- CHAPTER 2 Joint VentureDocument5 pagesCHAPTER 2 Joint VentureAkkamaNo ratings yet

- Chapter 3 Public EnterprisesDocument6 pagesChapter 3 Public EnterprisesAkkamaNo ratings yet

- Advance Accounting Table of ContentDocument1 pageAdvance Accounting Table of ContentAkkamaNo ratings yet

- Unit 3. Accounting For Merchandising BusinessesDocument9 pagesUnit 3. Accounting For Merchandising BusinessesAkkamaNo ratings yet

- Background and HistoryDocument1 pageBackground and HistoryAkkamaNo ratings yet

- Table of ContentsDocument1 pageTable of ContentsAkkamaNo ratings yet

- CH 1 - Class NotesDocument12 pagesCH 1 - Class NotesAndrew EngelhardtNo ratings yet

- Stress Testing Made Easy: No More US Banks Stumbling and Facing Public Embarrassment Due To The Federal Reserve's Qualitative ObjectionDocument18 pagesStress Testing Made Easy: No More US Banks Stumbling and Facing Public Embarrassment Due To The Federal Reserve's Qualitative ObjectionJohn TaskinsoyNo ratings yet

- Private Equity PDFDocument17 pagesPrivate Equity PDFParas SavaiNo ratings yet

- Corporate Restructuring Ch.23Document13 pagesCorporate Restructuring Ch.23Elizabeth StephanieNo ratings yet

- Multiple Choice QuestionDocument3 pagesMultiple Choice QuestionEka FerranikaNo ratings yet

- TIN Application - Statement of Estimate (Entity)Document5 pagesTIN Application - Statement of Estimate (Entity)Christian Nicolaus MbiseNo ratings yet

- ACCA F9 Notes by Seah Chooi KhengDocument75 pagesACCA F9 Notes by Seah Chooi KhengHuzaifa Ahmed100% (2)

- 10 D HL and Murrey Math ExcelDocument10 pages10 D HL and Murrey Math ExcelNihilisticDelusionNo ratings yet

- Case Class or MassDocument5 pagesCase Class or Massarif_budiman_pcpNo ratings yet

- Reading Financial Statement by CFIDocument66 pagesReading Financial Statement by CFIVidya MishraNo ratings yet

- Companies Act, 2013 NotesDocument18 pagesCompanies Act, 2013 NotesGoutam ChakrabortyNo ratings yet

- FM303 2019Document4 pagesFM303 2019Ashley ChandNo ratings yet

- BSBFIM601 Manage FinanceDocument6 pagesBSBFIM601 Manage FinanceMichelle Tseng0% (2)

- Senior 12 FABM2 Q1 - M4Document25 pagesSenior 12 FABM2 Q1 - M4Sitti Halima Amilbahar AdgesNo ratings yet

- Ch13 Wiley Plus Wk3Document58 pagesCh13 Wiley Plus Wk3Prakash VaidhyanathanNo ratings yet

- MFIN6003 AssignmentsDocument4 pagesMFIN6003 AssignmentscccNo ratings yet

- Strategic Planning Handbook For CooperativesDocument37 pagesStrategic Planning Handbook For Cooperativesសរ ឧត្តម100% (1)

- 7QQMM203 Class 2 - SolutionsDocument25 pages7QQMM203 Class 2 - SolutionsRicky GargNo ratings yet

- City of BaltimoreDocument4 pagesCity of BaltimoreAnonymous Feglbx5No ratings yet

- FCA Approach Payment Services Electronic Money 2017Document238 pagesFCA Approach Payment Services Electronic Money 2017CrowdfundInsiderNo ratings yet

- Consortium BankingDocument4 pagesConsortium BankingSnigdha DasNo ratings yet

- Hanjin LocalchagreDocument5 pagesHanjin LocalchagreTrần Minh CườngNo ratings yet

- Bethlehem DemmelashDocument62 pagesBethlehem DemmelashAbreham AwokeNo ratings yet

- Unit 5 - Credit Management - Problem 1Document3 pagesUnit 5 - Credit Management - Problem 1Dennis BijuNo ratings yet

- Motion To Reduce Bail Bond Cambri 4591-92Document2 pagesMotion To Reduce Bail Bond Cambri 4591-92Jholo AlvaradoNo ratings yet

- Merchant BankingDocument18 pagesMerchant BankingRashi TutejaNo ratings yet

- Emtek LK TW III 2022Document202 pagesEmtek LK TW III 2022Daniel Pandapotan MarpaungNo ratings yet

- Continuity and Change in Philanthropic Housing Organisations The Octavia Hill Housing Trust and The Guinness TrustDocument21 pagesContinuity and Change in Philanthropic Housing Organisations The Octavia Hill Housing Trust and The Guinness TrustGillian WardellNo ratings yet

Advanced Accounting C-Outline

Advanced Accounting C-Outline

Uploaded by

AkkamaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Advanced Accounting C-Outline

Advanced Accounting C-Outline

Uploaded by

AkkamaCopyright:

Available Formats

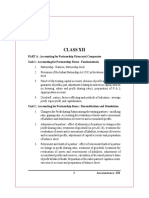

CITY UNIVERSITY COLLEGE

COURSE OUTLINE

COURSE TITLE: Advanced Accounting COURSE CODE: ACCT 411

ACADEMIC YEAR: 2008/2009 CREDITS: 3

INSTRUCTOR: Kiros A. PRE-REQUISITE: ACCT 301/2

Chap Chapter Topic

No.

I PARTNERSHIP ACCOUNTING

1.1Partnership organization and operation

1.1.1Characteristics and principles of partnership

1.1.1. Choosing between partnership and corporation

1.1.2. Types of partnership

1.1.3. Partnership provisions in Ethiopia

1.1.4. Partnership versus partners

1.2Accounting for formation and operations

1.2.1Owners’ equity accounts

1.2.2Loans to and from

1.23Valuation of investment of partners

1.2.4Income sharing arrangements

1.2.5Changes in personnel

1.2.6Questions exercises, cases, and problems

1.3Accounting for dissolution and liquidation

1.3.1Conditions for dissolution and liquidation

1.3.2Distribution of loss or gain

1.3.3Distribution of cash

1.3.4Settlement of partners’ capital balances

1.3.5Questions, exercises, cases, and problems

II JOINT VENTURE

2.1.Characteristics and historical background

2.2Single versus joint venture

2.3Accounting for a joint venture

III PUBLIC ENTERPRISE (S)

3.1.Characteristics and types of public enterprises

3.2.Appropriations, accumulation, and distribution of earnings

3.3.Proclamation 25/1992

IV AGENCY AND PRINCIPAL, HEAD OFFICE AND BRANCH

4.1. Characteristics and principles

4.2. Distinguishing agency and branch

4.3. Accounting for sales agency

4.4. Accounting for branch

4.5.Reciprocal accounts and their reconciliation

4.6.Transaction between branches

4.7.Billings of merchandise to branch

4.8.Combined financial statements – Consolidation

4.9.Accounting for foreign branches and foreign currency translations

V INSTALMENT CONTRACT SALES

5.1. Characteristics and principles

5.2. Methods of recognition of profit on installment sales

5.3. Accounting for branch

5.4. Reciprocal Accounts and their reconciliation

5.5. Transaction between branches

5.6. Billings of merchandise to branch

5.7. Combined financial statements – Consolidation

5.8. Accounting for foreign branches and foreign currency translations

VI CONSIGNMENT SALES

6.1. Definitions

6.2. Distinguishing sales on consignment and regular sales

6.3. Accounting for consignor and consignee

6.4. Allocating costs on partial sales

6.5. Questions, exercises, cases, and problems

VII BUSINESS COMBINATIONS

7.1. Nature of business combinations

7.2. Methods of accounting for business combinations

7.3. Comparison of Purchase and pooling accounting

7.4. Appraisal of Accounting standards for Business combinations

VIII CONSLIDATIONS: ON DATE OF PURCHASE-TYPE BUSINESS

COMBINATION

8.1. Parent Company–subsidiary relationships

8.2. Consolidation of wholly owned subsidiaries

8.3. Consolidation of Partially owned subsidiaries

IX CONSLIDATIONS: SUBSEQUENT TO DATE OF PURCHASE-TYPE

BUSINESS COMBINATION

9.1 Accounting for wholly owned subsidiaries

9.2 Accounting for partially owned subsidiaries

TEXT-BOOK(S)

NO Text-book Title Author(s) Ed. Year BOOK CODE

nd

1 Modern Advanced Accounting Meig, Mosich and Larson 2 AA-TXT-01

2 Advanced Financial Accounting Baker, Lembke,King 4th

Other books on advanced accounting

You might also like

- Schaum's Outline of Bookkeeping and Accounting, Fourth EditionFrom EverandSchaum's Outline of Bookkeeping and Accounting, Fourth EditionRating: 5 out of 5 stars5/5 (1)

- Company Valuation Under IFRS - 3rd edition: Interpreting and forecasting accounts using International Financial Reporting StandardsFrom EverandCompany Valuation Under IFRS - 3rd edition: Interpreting and forecasting accounts using International Financial Reporting StandardsNo ratings yet

- Annexes Syllabi Effective October 2022Document26 pagesAnnexes Syllabi Effective October 2022Rhad Estoque100% (9)

- Advanced Financial Accounting & Reporting (Afar) : The Cpa Licensure Examination SyllabusDocument4 pagesAdvanced Financial Accounting & Reporting (Afar) : The Cpa Licensure Examination SyllabusFeem Operario100% (1)

- Fundamentals of Accounting-I New Course OutlineDocument3 pagesFundamentals of Accounting-I New Course OutlineGedion100% (2)

- Employee Job Description in Manufacturing IndustryDocument5 pagesEmployee Job Description in Manufacturing IndustryAkkamaNo ratings yet

- Chapter 5 Installment SalesDocument10 pagesChapter 5 Installment SalesAkkama100% (1)

- 20 - Reversing Entries PDFDocument3 pages20 - Reversing Entries PDFAB CloydNo ratings yet

- Damic Barber ShopDocument6 pagesDamic Barber ShopMikaelaMaeVillaluzNo ratings yet

- Advanced I Course OutlineDocument2 pagesAdvanced I Course OutlineSamuel DebebeNo ratings yet

- Course Outline - 2019264164advanced Financial AccountingDocument2 pagesCourse Outline - 2019264164advanced Financial AccountingZelalem YilkalNo ratings yet

- Advance Course OutlineDocument2 pagesAdvance Course OutlineAdugna MegenasaNo ratings yet

- 001 Course Outline Advanced Financial AccountingDocument2 pages001 Course Outline Advanced Financial AccountingTemesgen Lealem100% (1)

- Acc 202 Acctg Special Transactions OutlineDocument5 pagesAcc 202 Acctg Special Transactions OutlineQueenel MabbayadNo ratings yet

- Actg 7 Advanced Financial Accounting & Reporting, Part IDocument3 pagesActg 7 Advanced Financial Accounting & Reporting, Part IAcademic OfficeNo ratings yet

- Advance Two Course OutlineDocument2 pagesAdvance Two Course OutlineMinyichel BayeNo ratings yet

- Course Title Fundamentals of Accounting IDocument1 pageCourse Title Fundamentals of Accounting IMinyichel BayeNo ratings yet

- Financial AccountingDocument944 pagesFinancial Accountingsivachandirang695492% (24)

- Course Outline Advanced Financial AccountingDocument2 pagesCourse Outline Advanced Financial Accountingbona birra100% (1)

- Financial Reporting Analysis 2 EdgDocument315 pagesFinancial Reporting Analysis 2 EdgPeter Snell100% (1)

- College of St. John - Roxas: Member: Association of LASSSAI Accredited Superschools (ALAS)Document4 pagesCollege of St. John - Roxas: Member: Association of LASSSAI Accredited Superschools (ALAS)Miles SantosNo ratings yet

- Paper 5 Revised PDFDocument576 pagesPaper 5 Revised PDFameydoshiNo ratings yet

- Financial AccountingDocument5 pagesFinancial AccountingIfiokobong AkpanNo ratings yet

- Cma Inter Paper12Document532 pagesCma Inter Paper12Aishwarya Krishnan100% (1)

- Paper 5new PDFDocument600 pagesPaper 5new PDFAbhi100% (1)

- Afar 1 Module - Topic 1Document17 pagesAfar 1 Module - Topic 1mallarijhoana21No ratings yet

- ACC143 Module OutlineDocument4 pagesACC143 Module Outlineknwb9ny78jNo ratings yet

- Financial Accounting: 1. Aims and ObjectivesDocument8 pagesFinancial Accounting: 1. Aims and Objectivessalifu mansarayNo ratings yet

- WASSCE WAEC Financial Accounting SyllabusDocument6 pagesWASSCE WAEC Financial Accounting SyllabusAmazing SuccessNo ratings yet

- PACRADocument516 pagesPACRABenjamin Banda100% (1)

- Dps 103 Basic Financial Accounting PDFDocument129 pagesDps 103 Basic Financial Accounting PDFlizzy mandenda100% (1)

- Course Syllabus-Fundamentals of Accounting IDocument4 pagesCourse Syllabus-Fundamentals of Accounting ITewodrose Teklehawariat BelayhunNo ratings yet

- 111Document5 pages111rain06021992No ratings yet

- Accountancy 12 English Main PDFDocument173 pagesAccountancy 12 English Main PDFAshu SinghNo ratings yet

- FAR TOS - QUALI Aug 2022Document5 pagesFAR TOS - QUALI Aug 2022Reghis AtienzaNo ratings yet

- Paper-5 Financial Accounting PDFDocument534 pagesPaper-5 Financial Accounting PDFAshish Rai50% (2)

- Paper 5Document534 pagesPaper 5VijayMMuruganNo ratings yet

- Course outline-MBA 631 FINANCIAL MANAGERIAL ACCOUNTINGDocument5 pagesCourse outline-MBA 631 FINANCIAL MANAGERIAL ACCOUNTINGmeseretdemissieNo ratings yet

- Col For ModuleDocument26 pagesCol For ModuleIfaNo ratings yet

- Ebook Fundamentals of Corporate Finance PDF Full Chapter PDFDocument67 pagesEbook Fundamentals of Corporate Finance PDF Full Chapter PDFjesse.moore314100% (31)

- Advanced Financial Accounting and Reporting Course OutlineDocument3 pagesAdvanced Financial Accounting and Reporting Course Outlineselman AregaNo ratings yet

- Fundamentals of Accounting IDocument5 pagesFundamentals of Accounting Itarekegn gezahegn0% (1)

- Institute of Administration & Commerce (Zimbabwe) : Financial Accounting 2 Syllabus (W.E.F May 2009)Document4 pagesInstitute of Administration & Commerce (Zimbabwe) : Financial Accounting 2 Syllabus (W.E.F May 2009)Ronnie Vond McRyttsson MudyiwaNo ratings yet

- CPALE Oct 2022 SyllabusDocument25 pagesCPALE Oct 2022 SyllabusAngelica DizonNo ratings yet

- Cpale Cpa Exam Far 1 PDFDocument6 pagesCpale Cpa Exam Far 1 PDFJohn Rashid HebainaNo ratings yet

- Ncert Book Accountancy I - XiiDocument264 pagesNcert Book Accountancy I - Xiinikhilam.comNo ratings yet

- HDJJDDocument15 pagesHDJJDjustin maharlikaNo ratings yet

- Coures Out Line Principle Accounting - I and IIDocument4 pagesCoures Out Line Principle Accounting - I and IIAbraham RayaNo ratings yet

- Paper 12 Sep 2021Document542 pagesPaper 12 Sep 2021Ajmal SalihNo ratings yet

- Financial Accounting R. Kit PDFDocument342 pagesFinancial Accounting R. Kit PDFBenson100% (2)

- Learning Outcomes No L01 L02 L03 L04 L05Document11 pagesLearning Outcomes No L01 L02 L03 L04 L05AbiNo ratings yet

- Financial AccountingDocument2 pagesFinancial AccountingMbu Javis EnowNo ratings yet

- MBA 8 Year 2 Accounting For Decision Making Workbook January 2020Document94 pagesMBA 8 Year 2 Accounting For Decision Making Workbook January 2020weedforlifeNo ratings yet

- Fin ZC415Document11 pagesFin ZC415vigneshNo ratings yet

- Finance Report MbaDocument35 pagesFinance Report MbaManoj BeheraNo ratings yet

- Mba ZC415 Course HandoutDocument11 pagesMba ZC415 Course HandoutareanNo ratings yet

- Paper 5newDocument625 pagesPaper 5newratikanta pradhan100% (1)

- Financial Accounting TextbookDocument905 pagesFinancial Accounting TextbookLikamva Mgqamqho100% (1)

- Handbook of Asset and Liability Management: From Models to Optimal Return StrategiesFrom EverandHandbook of Asset and Liability Management: From Models to Optimal Return StrategiesNo ratings yet

- Principles of Cash Flow Valuation: An Integrated Market-Based ApproachFrom EverandPrinciples of Cash Flow Valuation: An Integrated Market-Based ApproachRating: 3 out of 5 stars3/5 (3)

- International Financial Statement AnalysisFrom EverandInternational Financial Statement AnalysisRating: 1 out of 5 stars1/5 (1)

- Wereya 1Document4 pagesWereya 1AkkamaNo ratings yet

- Fund CH 4 &5Document16 pagesFund CH 4 &5AkkamaNo ratings yet

- Akka HyuiDocument15 pagesAkka HyuiAkkamaNo ratings yet

- Ammalele JennaanDocument4 pagesAmmalele JennaanAkkamaNo ratings yet

- Amala Kee Yaa ShureeDocument4 pagesAmala Kee Yaa ShureeAkkamaNo ratings yet

- Abad 1Document2 pagesAbad 1AkkamaNo ratings yet

- Dabbal Mootii GaaraaDocument3 pagesDabbal Mootii GaaraaAkkamaNo ratings yet

- Leba AmalaDocument1 pageLeba AmalaAkkamaNo ratings yet

- Chapter 8 Consolidation IDocument18 pagesChapter 8 Consolidation IAkkama100% (1)

- 8.7.1 Allowance MethodDocument5 pages8.7.1 Allowance MethodAkkamaNo ratings yet

- The Accounting SystemDocument2 pagesThe Accounting SystemAkkamaNo ratings yet

- DafarDocument2 pagesDafarAkkamaNo ratings yet

- Basis of OpinionDocument11 pagesBasis of OpinionAkkamaNo ratings yet

- Chapter 4 Branch AccountingDocument31 pagesChapter 4 Branch AccountingAkkamaNo ratings yet

- Chapter 1 PartnershipsDocument46 pagesChapter 1 PartnershipsAkkamaNo ratings yet

- 3.2.2 Knowledge of The BusinessDocument10 pages3.2.2 Knowledge of The BusinessAkkamaNo ratings yet

- Chapter 6 Consignment SalesDocument12 pagesChapter 6 Consignment SalesAkkamaNo ratings yet

- Chapter Three: Obtaining, Evaluating and Documenting Audit Data Over Viewing Audit EvidenceDocument7 pagesChapter Three: Obtaining, Evaluating and Documenting Audit Data Over Viewing Audit EvidenceAkkamaNo ratings yet

- Chapter 7 BUSINESS COMBINATIONSDocument19 pagesChapter 7 BUSINESS COMBINATIONSAkkama100% (1)

- Chapter FiveDocument3 pagesChapter FiveAkkamaNo ratings yet

- Chapter Ten Auditing Liabilities: Audit For Accounts PayableDocument4 pagesChapter Ten Auditing Liabilities: Audit For Accounts PayableAkkamaNo ratings yet

- C6Document20 pagesC6AkkamaNo ratings yet

- CHAPTER 2 Joint VentureDocument5 pagesCHAPTER 2 Joint VentureAkkamaNo ratings yet

- Chapter 3 Public EnterprisesDocument6 pagesChapter 3 Public EnterprisesAkkamaNo ratings yet

- Advance Accounting Table of ContentDocument1 pageAdvance Accounting Table of ContentAkkamaNo ratings yet

- Unit 3. Accounting For Merchandising BusinessesDocument9 pagesUnit 3. Accounting For Merchandising BusinessesAkkamaNo ratings yet

- Background and HistoryDocument1 pageBackground and HistoryAkkamaNo ratings yet

- Table of ContentsDocument1 pageTable of ContentsAkkamaNo ratings yet

- CH 1 - Class NotesDocument12 pagesCH 1 - Class NotesAndrew EngelhardtNo ratings yet

- Stress Testing Made Easy: No More US Banks Stumbling and Facing Public Embarrassment Due To The Federal Reserve's Qualitative ObjectionDocument18 pagesStress Testing Made Easy: No More US Banks Stumbling and Facing Public Embarrassment Due To The Federal Reserve's Qualitative ObjectionJohn TaskinsoyNo ratings yet

- Private Equity PDFDocument17 pagesPrivate Equity PDFParas SavaiNo ratings yet

- Corporate Restructuring Ch.23Document13 pagesCorporate Restructuring Ch.23Elizabeth StephanieNo ratings yet

- Multiple Choice QuestionDocument3 pagesMultiple Choice QuestionEka FerranikaNo ratings yet

- TIN Application - Statement of Estimate (Entity)Document5 pagesTIN Application - Statement of Estimate (Entity)Christian Nicolaus MbiseNo ratings yet

- ACCA F9 Notes by Seah Chooi KhengDocument75 pagesACCA F9 Notes by Seah Chooi KhengHuzaifa Ahmed100% (2)

- 10 D HL and Murrey Math ExcelDocument10 pages10 D HL and Murrey Math ExcelNihilisticDelusionNo ratings yet

- Case Class or MassDocument5 pagesCase Class or Massarif_budiman_pcpNo ratings yet

- Reading Financial Statement by CFIDocument66 pagesReading Financial Statement by CFIVidya MishraNo ratings yet

- Companies Act, 2013 NotesDocument18 pagesCompanies Act, 2013 NotesGoutam ChakrabortyNo ratings yet

- FM303 2019Document4 pagesFM303 2019Ashley ChandNo ratings yet

- BSBFIM601 Manage FinanceDocument6 pagesBSBFIM601 Manage FinanceMichelle Tseng0% (2)

- Senior 12 FABM2 Q1 - M4Document25 pagesSenior 12 FABM2 Q1 - M4Sitti Halima Amilbahar AdgesNo ratings yet

- Ch13 Wiley Plus Wk3Document58 pagesCh13 Wiley Plus Wk3Prakash VaidhyanathanNo ratings yet

- MFIN6003 AssignmentsDocument4 pagesMFIN6003 AssignmentscccNo ratings yet

- Strategic Planning Handbook For CooperativesDocument37 pagesStrategic Planning Handbook For Cooperativesសរ ឧត្តម100% (1)

- 7QQMM203 Class 2 - SolutionsDocument25 pages7QQMM203 Class 2 - SolutionsRicky GargNo ratings yet

- City of BaltimoreDocument4 pagesCity of BaltimoreAnonymous Feglbx5No ratings yet

- FCA Approach Payment Services Electronic Money 2017Document238 pagesFCA Approach Payment Services Electronic Money 2017CrowdfundInsiderNo ratings yet

- Consortium BankingDocument4 pagesConsortium BankingSnigdha DasNo ratings yet

- Hanjin LocalchagreDocument5 pagesHanjin LocalchagreTrần Minh CườngNo ratings yet

- Bethlehem DemmelashDocument62 pagesBethlehem DemmelashAbreham AwokeNo ratings yet

- Unit 5 - Credit Management - Problem 1Document3 pagesUnit 5 - Credit Management - Problem 1Dennis BijuNo ratings yet

- Motion To Reduce Bail Bond Cambri 4591-92Document2 pagesMotion To Reduce Bail Bond Cambri 4591-92Jholo AlvaradoNo ratings yet

- Merchant BankingDocument18 pagesMerchant BankingRashi TutejaNo ratings yet

- Emtek LK TW III 2022Document202 pagesEmtek LK TW III 2022Daniel Pandapotan MarpaungNo ratings yet

- Continuity and Change in Philanthropic Housing Organisations The Octavia Hill Housing Trust and The Guinness TrustDocument21 pagesContinuity and Change in Philanthropic Housing Organisations The Octavia Hill Housing Trust and The Guinness TrustGillian WardellNo ratings yet