Professional Documents

Culture Documents

La-Bugal-Blaan-Tribal-Association-vs-Ramos

La-Bugal-Blaan-Tribal-Association-vs-Ramos

Uploaded by

Aleric MondanoOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

La-Bugal-Blaan-Tribal-Association-vs-Ramos

La-Bugal-Blaan-Tribal-Association-vs-Ramos

Uploaded by

Aleric MondanoCopyright:

Available Formats

La Bugal-B'laan Tribal Association vs Ramos

421SCRA 148 (2004)

FACTS:

● March 30, 1995, the President entered into a Financial or Technical

Assistance Agreement (FTAA) with Western Mining Corporation

Philippines WMCP, a major Australian mining and exploration

company, covering 99,387 hectares of land in South Cotabato,

Sultan Kudarat, Davao del Sur and North Cotabato.

● On August 15, 1995, then DENR Secretary Victor O. Ramos issued DENR

Administrative Order (DAO) No. 95-23, s. 1995, otherwise known as the

Implementing Rules and Regulations of R.A. No. 7942. This was later

repealed by DAO No. 96-40, s. 1996 which was adopted on December 20,

1996.

● On January 10, 1997, counsels for petitioners sent a letter to the

DENR Secretary demanding that the DENR stop the implementation

of R.A. No. 7942 and DAO No. 96-40, giving the DENR fifteen days

from receipt to act thereon. The DENR, however, has yet to respond

or act on petitioners’ letter.

● Petitioners thus filed the present petition for prohibition and

mandamus, with a prayer for a temporary restraining order. They

allege that at the time of the filing of the petition, 100 FTAA

applications had already been filed, covering an area of 8.4 million

hectares, 64 of which applications are by fully foreign-owned

corporations covering a total of 5.8 million hectares, and at least

one by a fully foreign-owned mining company over offshore areas.

● Petitioners claim that the DENR Secretary acted without or in excess

of jurisdiction

ISSUE

1. Whether or not the FTAA between the government and WMCP is a

―service contract that permits fully foreign owned companies to exploit

the Philippine mineral resources.

2. Whether or not the Philippine Mining Act is unconstitutional for allowing

fully foreign-owned corporations to exploit the Philippine mineral

resources

RULING

1. Yes. Section 1.3 of the FTAA grants WMCP a fully foreign owned

corporation the exclusive right to explore, exploit, utilize and

dispose of all minerals and by-products that may be produced from

the contract area. Section 1.2 of the same agreement provides that

EMCP shall provide all financing, technology, management, and

personnel necessary for the Mining Operations

● These contractual stipulations and related provisions in the FTAA

taken together, grant WMCP beneficial ownership over natural

resources that properly belong to the State and are intended for the

benefit of its citizens. Hence, constituting the provisions under this

act as a service contract that permits fully foreign owned companies

to exploit the Philippine mineral resources.

2. YES, RA 7942 or the Philippine Mining Act of 1995 is

unconstitutional for permitting fully foreign owned

corporations to exploit the Philippine natural resources. Court

found it as invalid insofar as said Act authorizes service contracts.

Although the statute employs the phrase "financial and technical

agreements" in accordance with the 1987 Constitution, it actually

treats these agreements as service contracts that grant beneficial

ownership to foreign contractors’ contrary to the fundamental law.

● The underlying assumption in all these provisions is that the foreign

contractor manages the mineral resources, just like the foreign

contractor in a service contract. under the Act, an FTAA contractor

warrants that it "has or has access to all the financing, managerial,

and technical expertise.”

● This suggests that an FTAA contractor is bound to provide some

management assistance – a form of assistance that has been

eliminated and, therefore, proscribed by the present Charter. By

allowing foreign contractors to manage or operate all the aspects of

the mining operation, the above-cited provisions of R.A. No. 7942

have in effect conveyed beneficial ownership over the nation's

mineral resources to these contractors, leaving the State with

nothing but bare title thereto.

● The same provisions, whether by design or inadvertence, permit a

circumvention of the constitutionally ordained 60-40% capitalization

requirement for corporations or associations engaged in the

exploitation, development and utilization of Philippine natural

resources.

● When the parts of the statute are so mutually dependent and

connected as conditions, considerations, inducements, or

compensations for each other, as to warrant a belief that the

legislature intended them as a whole, and that if all could not be

carried into effect, the legislature would not pass the residue

independently, then, if some parts are unconstitutional, all the

provisions which are thus dependent, conditional, or connected,

must fall with them.

● As it the law implies, Under Article XII Section 2 of the 1987

Charter, foreign owned corporations are limited only to merely

technical or financial assistance to the State for large scale

exploration, development and utilization of minerals, petroleum and

other mineral oils. As RA 7942 is viewed as a service contract, these

stipulations are abhorrent to the 1987 Constitution. They are

precisely the vices that the fundamental law seeks to avoid, the

evils that it aims to suppress. Consequently, the contract from

which they spring must be struck down. Hence, such an act is

unconstitutional.

You might also like

- LA BUGAL B'LAAN TRIBAL ASSOCIATION INC., ET AL. V. RAMOS Case DigestDocument3 pagesLA BUGAL B'LAAN TRIBAL ASSOCIATION INC., ET AL. V. RAMOS Case DigestJhanelyn V. Inopia63% (8)

- Solution Manual For Introduction To Mathematical Statistics 7 e 7th Edition Robert V Hogg Joeseph Mckean Allen T CraigDocument24 pagesSolution Manual For Introduction To Mathematical Statistics 7 e 7th Edition Robert V Hogg Joeseph Mckean Allen T CraigCarrieFloresgxoa100% (39)

- 11 LA BUGAL B'LAAN TRIBAL ASSN. V RAMOS (2004) CASE DIGESTDocument2 pages11 LA BUGAL B'LAAN TRIBAL ASSN. V RAMOS (2004) CASE DIGESTAbigail Tolabing71% (7)

- La Bugal V Ramos (421 SCRA 148)Document3 pagesLa Bugal V Ramos (421 SCRA 148)Earl TheFingerroll ReyesNo ratings yet

- Natres CasesDocument46 pagesNatres Casesfennyrose nunalaNo ratings yet

- La Bugal B'laan Tribal Association Inc Vs Ramos Case DigestDocument2 pagesLa Bugal B'laan Tribal Association Inc Vs Ramos Case DigestClimz Aether100% (4)

- Nikki Haley Is Not A Natural Born Citizen of USA To Constitutional StandardsDocument5 pagesNikki Haley Is Not A Natural Born Citizen of USA To Constitutional Standardsprotectourliberty100% (3)

- 01 - La Bugal V Ramos (Jan 2004) - ReventarDocument4 pages01 - La Bugal V Ramos (Jan 2004) - ReventarJam ZaldivarNo ratings yet

- La Bugal-B - Laan Tribal Assn Vs Ramos G.R. No. 127882 January 27, 2004Document3 pagesLa Bugal-B - Laan Tribal Assn Vs Ramos G.R. No. 127882 January 27, 2004MichyLG100% (1)

- La Bugal Case DigestDocument3 pagesLa Bugal Case DigestKiko OralloNo ratings yet

- La Bugal - B'laan Tribal Ass., Inc., V Sec. DenrDocument45 pagesLa Bugal - B'laan Tribal Ass., Inc., V Sec. DenrLyra AguilarNo ratings yet

- Facts: The Petition For Prohibition and Mandamus Before The Court Challenges TheDocument3 pagesFacts: The Petition For Prohibition and Mandamus Before The Court Challenges TheJames OcampoNo ratings yet

- Blaan Tribal Assoc Vs RamosDocument1 pageBlaan Tribal Assoc Vs RamosJani MisterioNo ratings yet

- Natres Case Digest (Mining)Document6 pagesNatres Case Digest (Mining)ptbattungNo ratings yet

- La Bugal BDocument3 pagesLa Bugal BRalph Sembrano CatipayNo ratings yet

- La Bugal-B'Laan Vs RamosDocument2 pagesLa Bugal-B'Laan Vs RamosXyra Krezel GajeteNo ratings yet

- La Bugal Bulaan DigestDocument6 pagesLa Bugal Bulaan DigestMyrna Espina LasamNo ratings yet

- La Bugal B - Laan Tribal Assoc Inc. VS, RamosDocument5 pagesLa Bugal B - Laan Tribal Assoc Inc. VS, RamosJezenEstherB.PatiNo ratings yet

- Arce Leave A Response: Published by On September 7, 2013Document55 pagesArce Leave A Response: Published by On September 7, 2013fennyrose nunalaNo ratings yet

- La Bugal ConsolidatedDocument8 pagesLa Bugal ConsolidatedAllan Carlo Hernaez SollerNo ratings yet

- 1st Batch AssignedDocument7 pages1st Batch AssignedEmmanuel Enrico de VeraNo ratings yet

- La Bugal DigestDocument3 pagesLa Bugal DigestKirsten Denise B. Habawel-VegaNo ratings yet

- La Bugal B'laan Tribal Association Inc PowerpointDocument17 pagesLa Bugal B'laan Tribal Association Inc PowerpointJuris PoetNo ratings yet

- Case Digest NatresDocument3 pagesCase Digest NatresoihahNo ratings yet

- La Bugal Case.Document3 pagesLa Bugal Case.Karen GinaNo ratings yet

- La Bugal Case DigestDocument5 pagesLa Bugal Case DigestJonah NaborNo ratings yet

- La Bugal B'Laan v. RamosDocument3 pagesLa Bugal B'Laan v. RamosElise Rozel DimaunahanNo ratings yet

- La Bugal DigestDocument5 pagesLa Bugal DigestoihahNo ratings yet

- La Bugal B'Laan Tribal Assoc. v. RamosDocument8 pagesLa Bugal B'Laan Tribal Assoc. v. RamosElise Rozel DimaunahanNo ratings yet

- Land TitlesDocument3 pagesLand TitlesJoyleen HebronNo ratings yet

- CASE DIGEST-Cases On LimitationsDocument10 pagesCASE DIGEST-Cases On LimitationsCrisDBNo ratings yet

- Facts:: La Bugal-B'laan Tribal Association, Inc. Vs RamosDocument10 pagesFacts:: La Bugal-B'laan Tribal Association, Inc. Vs Ramosberryb_07No ratings yet

- Class 1 LTD2018Document3 pagesClass 1 LTD2018Jong CjaNo ratings yet

- Labugal Balaan DigestDocument4 pagesLabugal Balaan DigestAnonymous SBT3XU6I60% (5)

- G.R. No. 127882, 27 January 2004, en Banc (Carpio-Morales, J.)Document3 pagesG.R. No. 127882, 27 January 2004, en Banc (Carpio-Morales, J.)izaNo ratings yet

- La Bugal-B'laan Tribal Association, Inc. Et Al. v. Ramos Et Al. FactsDocument2 pagesLa Bugal-B'laan Tribal Association, Inc. Et Al. v. Ramos Et Al. Factsamyr felipeNo ratings yet

- IX. National Economy and PatrimonyDocument31 pagesIX. National Economy and PatrimonyCourtney TirolNo ratings yet

- La Bugal-B'Laan Tribal Association, Inc. vs. RamosDocument12 pagesLa Bugal-B'Laan Tribal Association, Inc. vs. RamosylessinNo ratings yet

- La Bugal V Sec. Ramos DigestsDocument3 pagesLa Bugal V Sec. Ramos DigestsAnisah AquilaNo ratings yet

- La Bugal-Bulaan Tribal Association v. RamosDocument4 pagesLa Bugal-Bulaan Tribal Association v. RamosRomarie AbrazaldoNo ratings yet

- La Bugal-B'Laan Tribal Association Inc. vs. Denr Secretary: July 04, 2013Document32 pagesLa Bugal-B'Laan Tribal Association Inc. vs. Denr Secretary: July 04, 2013AD ANTHONY CRISOSTOMONo ratings yet

- This Act Shall Govern The Exploration, Development, Utilization and Processing of All Mineral ResourcesDocument2 pagesThis Act Shall Govern The Exploration, Development, Utilization and Processing of All Mineral ResourcesYanalagunilaNo ratings yet

- Envi Digest Feb 20Document14 pagesEnvi Digest Feb 20Nikki BarenaNo ratings yet

- 4 La Bugal v. Ramos December 2004Document4 pages4 La Bugal v. Ramos December 2004Hazel DeeNo ratings yet

- Garcia, Hanna Keila H. D2015Document4 pagesGarcia, Hanna Keila H. D2015LaurenOrtegaNo ratings yet

- Didipio Earth-Saver's Multi-Purpose Association vs. Ramos G.R. No. 157882 Mar. 30, 2006Document4 pagesDidipio Earth-Saver's Multi-Purpose Association vs. Ramos G.R. No. 157882 Mar. 30, 2006Jakie CruzNo ratings yet

- Atok Big Wedge vs. Court of Appeals G.R. No. 63528Document24 pagesAtok Big Wedge vs. Court of Appeals G.R. No. 63528Hans Christian ChavezNo ratings yet

- LA BUGAL B’LAAN TRIBAL ASSOCIATION INC., et. al. v. V. O. RAMOS, Secretary Department of Environment and Natural Resources; H. RAMOS, Director, Mines and Geosciences Bureau (MGB-DENR); R. TORRES, Executive Secretary; and WMC (PHILIPPINES) INC.Document2 pagesLA BUGAL B’LAAN TRIBAL ASSOCIATION INC., et. al. v. V. O. RAMOS, Secretary Department of Environment and Natural Resources; H. RAMOS, Director, Mines and Geosciences Bureau (MGB-DENR); R. TORRES, Executive Secretary; and WMC (PHILIPPINES) INC.ELDA QUIROGNo ratings yet

- 9 - La Bugal-Blaan Tribal Association, Inc. v. RamosDocument2 pages9 - La Bugal-Blaan Tribal Association, Inc. v. RamosJudel MatiasNo ratings yet

- La Bugal-B'laan Tribal Association, Inc. Et Al. v. Ramos Et Al. 27 January 2004Document5 pagesLa Bugal-B'laan Tribal Association, Inc. Et Al. v. Ramos Et Al. 27 January 2004Calagui Tejano Glenda JaygeeNo ratings yet

- La Bugal-B'laan Tribal Association v. Ramos FactsDocument2 pagesLa Bugal-B'laan Tribal Association v. Ramos Factsemman carlNo ratings yet

- Case 10 La Bugal-BLaan v. Ramos, G.R. No. 127882 Dec. 01, 2004 - SummaryDocument7 pagesCase 10 La Bugal-BLaan v. Ramos, G.R. No. 127882 Dec. 01, 2004 - Summaryblude cosingNo ratings yet

- Verba LegisDocument2 pagesVerba LegisMaria Angela GasparNo ratings yet

- Didipio Earth Savers Multipurpose Association Et Al Vs DENR Sec Elisea Gozun Et AlDocument2 pagesDidipio Earth Savers Multipurpose Association Et Al Vs DENR Sec Elisea Gozun Et Alchey_anneNo ratings yet

- National Economy, Patrimony and Ammendment CasesDocument26 pagesNational Economy, Patrimony and Ammendment Casescatapult25100% (1)

- La Bugal Vs RamosDocument5 pagesLa Bugal Vs RamosBuddies Ian-Daine100% (1)

- Patent Laws of the Republic of Hawaii and Rules of Practice in the Patent OfficeFrom EverandPatent Laws of the Republic of Hawaii and Rules of Practice in the Patent OfficeNo ratings yet

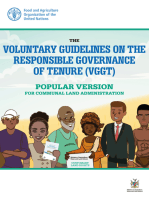

- The Voluntary Guidelines on the Responsible Governance of Tenure (VGGT) - Popular Version for Communal Land AdministrationFrom EverandThe Voluntary Guidelines on the Responsible Governance of Tenure (VGGT) - Popular Version for Communal Land AdministrationNo ratings yet

- De Leon Vs Esguerra 152 Scra 602Document13 pagesDe Leon Vs Esguerra 152 Scra 602Aleric MondanoNo ratings yet

- Dennis A B Funa Vs The Chairman Commission On Audit Reynaldo A VillarDocument58 pagesDennis A B Funa Vs The Chairman Commission On Audit Reynaldo A VillarAleric MondanoNo ratings yet

- New Central Bank Act NotesDocument14 pagesNew Central Bank Act NotesAleric Mondano75% (4)

- DEPOSIT INSURANCE Handout PDFDocument13 pagesDEPOSIT INSURANCE Handout PDFAleric MondanoNo ratings yet

- The Law, Litigation and Politics Surrounding Legislators' Pension in Cross River State, NigeriaDocument6 pagesThe Law, Litigation and Politics Surrounding Legislators' Pension in Cross River State, NigeriaKIU PUBLICATION AND EXTENSIONNo ratings yet

- Assam Rajiv Gandhi University of Cooperative ManagementDocument3 pagesAssam Rajiv Gandhi University of Cooperative ManagementMotiurNo ratings yet

- Be159-183643 1049 Jatin-Kishore Rank 2Document52 pagesBe159-183643 1049 Jatin-Kishore Rank 2Sachin Jagtap PatilNo ratings yet

- 20230820-Mr G. H. Schorel-Hlavka O.W.B. To R Kershaw Chief Commissioner of AFP-Suppl 102-Shadow Banning, EtcDocument70 pages20230820-Mr G. H. Schorel-Hlavka O.W.B. To R Kershaw Chief Commissioner of AFP-Suppl 102-Shadow Banning, EtcGerrit Hendrik Schorel-HlavkaNo ratings yet

- Maratha Reservation Struck DownDocument2 pagesMaratha Reservation Struck DownMayank KhaitanNo ratings yet

- Politics of Women's Reservation in India: Satarupa PalDocument5 pagesPolitics of Women's Reservation in India: Satarupa PalAbhishek SaravananNo ratings yet

- Kedudukan Dan Fungsi Pembukaan Undang-Undang Dasar 1945: Pembelajaran Dari Tren GlobalDocument20 pagesKedudukan Dan Fungsi Pembukaan Undang-Undang Dasar 1945: Pembelajaran Dari Tren GlobalRaissa OwenaNo ratings yet

- Seventh Schedule of Indian Constitution Article 246Document4 pagesSeventh Schedule of Indian Constitution Article 246Shivani BhandariNo ratings yet

- Regularity Origin Against Irregularities of OriginDocument66 pagesRegularity Origin Against Irregularities of OriginSupremo Consejo de la República MexicanaNo ratings yet

- Ang Nars Partylist NotesDocument6 pagesAng Nars Partylist NotesmauNo ratings yet

- Rizal & His Times: University of San Agustin Iloilo CityDocument42 pagesRizal & His Times: University of San Agustin Iloilo CityEdgar Dumagpi100% (1)

- Political Science (852) : Class XiiDocument5 pagesPolitical Science (852) : Class XiiMariamNo ratings yet

- Philippine Politics and GovernanceDocument23 pagesPhilippine Politics and GovernanceJohn Asher Fajardo100% (6)

- Constitution in Nutshell PDFDocument19 pagesConstitution in Nutshell PDFel capitanNo ratings yet

- The Constitution of India - Pranika Paresh Potdar 7CS ResearchDocument4 pagesThe Constitution of India - Pranika Paresh Potdar 7CS Researchpranika.potdar16No ratings yet

- Maria Chin Abdullah V Ketua Pengarah ImigreseDocument8 pagesMaria Chin Abdullah V Ketua Pengarah ImigreseNajumuddinNo ratings yet

- Unit 2 Lesson 4 RIPHDocument2 pagesUnit 2 Lesson 4 RIPHjade shuksNo ratings yet

- HL Lesson 9Document2 pagesHL Lesson 9Nuria Martinez AlonsoNo ratings yet

- Case Digest SUFFRAGEDocument3 pagesCase Digest SUFFRAGEYour Public ProfileNo ratings yet

- Rules ProDocument180 pagesRules ProprasannandaNo ratings yet

- Bernas, J. (2003) - The 1987 Constitution of The Republic of The Philippines: A Commentary (P. 1157) - Quezon City, Philippines: REX Book Store, IncDocument1 pageBernas, J. (2003) - The 1987 Constitution of The Republic of The Philippines: A Commentary (P. 1157) - Quezon City, Philippines: REX Book Store, IncBonn PustaNo ratings yet

- Kerala Jail Subordinate Service (Amendment) Special Rules, 2022Document3 pagesKerala Jail Subordinate Service (Amendment) Special Rules, 2022doniamuttamNo ratings yet

- Translated Copy of Political MCQ CH 10Document6 pagesTranslated Copy of Political MCQ CH 10WHAT IF??No ratings yet

- Strategic Management of Technological Innovation 4Th Edition Schilling Solutions Manual Full Chapter PDFDocument23 pagesStrategic Management of Technological Innovation 4Th Edition Schilling Solutions Manual Full Chapter PDFariadneamelindasx7e100% (6)

- Project Report On "Article 370"of Indian ConstitutionDocument5 pagesProject Report On "Article 370"of Indian ConstitutionALKA LAKRANo ratings yet

- Federalism MCQ QuestionDocument6 pagesFederalism MCQ QuestionRochak SrivastavNo ratings yet

- 016 - Local Government System in Bangladesh - An Assessment (96-108) PDFDocument13 pages016 - Local Government System in Bangladesh - An Assessment (96-108) PDFKM GALIB DAUD100% (1)

- Constituent Assembly of India Debates (Proceedings) Volume IVDocument20 pagesConstituent Assembly of India Debates (Proceedings) Volume IVRicha KesarwaniNo ratings yet