Professional Documents

Culture Documents

DT - One Page Summary - Accreted Tax (Exit Tax)

DT - One Page Summary - Accreted Tax (Exit Tax)

Uploaded by

Aruna RajappaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

DT - One Page Summary - Accreted Tax (Exit Tax)

DT - One Page Summary - Accreted Tax (Exit Tax)

Uploaded by

Aruna RajappaCopyright:

Available Formats

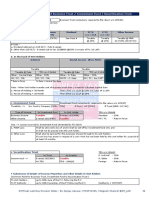

Sec 115TD - Tax on Accreted Income [Exit Tax] Tax Rate - MMR 34.

944% (30+12+4)

Specified Date for Pay Tax within 14 days from

Taxable when Valuation of Note- Interest u/s 115TE @ 1% pm / part of month

Assets & Liability. for non-payment of tax within 14 days.

Iss date ko valuation

3 condition me exit tax lagega Yaha pe tax pay karna hai

Karna hai

a. Conversion of trust / institution into a form

not eligible for registration u/s 12AA

Case 1 - Registration granted u/s12 AA has Date of order 14 days from

been cancelled cancelling registration a) the period for filling appeal to ITAT against order

u/s 12AA rejecting the application expires & no appeal filed by

trust OR

b) the order is any appeal confirming the rejection

the application is recd. by trust.

Case 2 - It has adopted or undertaken Date of adoption or i) Not applied - 14 days from end of P.Y.

modification of its objects which do not modification of any

conform to the conditions of regn. And objects ii) Applied but rejected - 14 days from

a) the period for filling appeal to ITAT against order

i) Not applied for fresh regn. rejecting the application expires & no appeal filed by

trust OR

ii) Applied but application has been b) the order is any appeal confirming the rejection

rejected the application is recd. by trust.

b. Merger into an entity not having similar Date of merger 14 days from the date of merger

objects and registered u/s 12AA

c. Non-distribution of assets on dissolution to Date of Dissolution 14 days from the date on which period of 12 months

any other trust / institution reg u/s 12AA, (at the end of the month in which dissolution took

10(23C) within 12 months from the end of the place) expires.

month in which dissolution takes place

Accreted Income Aggregate FMV (see Rule 17CB) of Total Asset xxx

shall be computed on "specified date" Less - Total Liabilities of Trust (xxx)

Accreted Income xxx

Following assets & liabilities in respect of that assets shall not be considered in accreted income.

a. Asset acquired out of agriculture Income. b. Asset acquired before registration

Method of Valuation for the purpose of Sec 115TD Rule 17CB

The aggregate FMV of Total Asset shall be reduced by : 1) TDS, TCS, Advance Tax and 2) Deferred Expenditure

Part A- Assets

1. Quoted Shares 3. Unquoted Shares / Security

--> Average of Lowest Highest price on valuation date on a recognize stock (Other than Equity Shares):

exchange --> FMV/NRV on Valuation bate on the

Note: If No trading of such shares and security on valuation date then average of basis of valuation report of merchant

Highest & Lowest price of immediately preceding the valuation date when such banker / accountant.

shares and security traded in recognize stock exchange

2. Unquoted Equity shares --> A+ B - L x (PV/PE) 4. Immovable Property

A : Book Value of All Assets (other than Covered in B) exclude TDS, Advance Tax & --> Higher of the following

deferred expenditure shown in the Asset side a. Open Market Value or

B : FMV of bullion, jewellery, precious stone, artistic work, shares, securities & b. SDV

immovable property as determined in the manner provided in this rule.

L : Book value of liabilities, but not include 5. A Business Undertaking

i) Paid-up capital in respect of equity shares ii) Amount set apart for payment of --> A+B-L

dividends on preference shares and equity shares

iii) Unascertained liabilities iv) Tax Provisions v) Contingent Liabilities

6. Any Other Assets:

PV : Total amount of paid up Eq Share capital as shown in the BS. --> FMV/NRV on Valuation bate

PE : Paid up value of such equity shares

Part B - Liabilities does not include : a. Capital Fund, Corpus Fund c. Contingent Liability

b. Reserve and Surplus d. Income Tax, TDS, TCS liability

DT(Final) Last Day Revision Notes - By Sanjay Zanwar, 9765974365, Telegram Channel @DT_LDR 1

You might also like

- Accounting Gov ReviewerDocument19 pagesAccounting Gov ReviewerAira Jaimee GonzalesNo ratings yet

- MECN430 Homework 3 Winter 2020 - RCGDocument5 pagesMECN430 Homework 3 Winter 2020 - RCGRamon GondimNo ratings yet

- Accounting For LawyersDocument51 pagesAccounting For Lawyersnamratha minupuri100% (2)

- FedEx Corporation FinalDocument56 pagesFedEx Corporation FinalAjay Meena67% (3)

- Taxation - Donors-Tax - Quizzer - 2018Document6 pagesTaxation - Donors-Tax - Quizzer - 2018Kenneth Bryan Tegerero Tegio67% (6)

- MFE Solutions 2016 021517Document473 pagesMFE Solutions 2016 021517david smithNo ratings yet

- Statement of Financial PositionDocument5 pagesStatement of Financial PositionOscar NorbeNo ratings yet

- GST Handout - ITC Eligibility Secs 16-21Document1 pageGST Handout - ITC Eligibility Secs 16-21debNo ratings yet

- 2016 Tax 2 Bar Q&ADocument3 pages2016 Tax 2 Bar Q&Achristine100% (1)

- Tax Remedies NotesDocument8 pagesTax Remedies NotesLaurene Ashley Sore-YokeNo ratings yet

- Taxation LectureDocument4 pagesTaxation LecturePAMELA DOLINANo ratings yet

- GA Secured Transactions Lean SheetDocument2 pagesGA Secured Transactions Lean SheetJames HutchinsNo ratings yet

- 18.liquidation of Companies PDFDocument6 pages18.liquidation of Companies PDFAngelinaGupta50% (2)

- Registration of ChargesDocument15 pagesRegistration of ChargesRehanbhikanNo ratings yet

- Module 4 Loans and ReceivablesDocument55 pagesModule 4 Loans and Receivableschuchu tvNo ratings yet

- Tax Remedies: Statute of Limitation/Prescriptive PeriodDocument3 pagesTax Remedies: Statute of Limitation/Prescriptive PeriodMary Christine Formiloza MacalinaoNo ratings yet

- CA Shubham Singhal Chapter 6 - Registration of Charges 1656206682Document7 pagesCA Shubham Singhal Chapter 6 - Registration of Charges 1656206682Priyanshu DewanganNo ratings yet

- Definitions - No Definition in The Code For: G. Capital Gains & LossesDocument5 pagesDefinitions - No Definition in The Code For: G. Capital Gains & LossesJen MoloNo ratings yet

- 8 CLSP Mortgages and ChargesDocument5 pages8 CLSP Mortgages and ChargesSyed Mujtaba Hassan100% (1)

- Corporate LiquidationDocument2 pagesCorporate Liquidationnclann.martinNo ratings yet

- Strategic Tax MNGT 2Document3 pagesStrategic Tax MNGT 2accpco.100No ratings yet

- Super 50 Cma Final Dt June 2024Document52 pagesSuper 50 Cma Final Dt June 2024Raja MunagalaNo ratings yet

- 2020 Reme TPDocument24 pages2020 Reme TPManuel VillanuevaNo ratings yet

- Joshua Razen E. Nolsol BSA 2-2 Assignment No. 6Document14 pagesJoshua Razen E. Nolsol BSA 2-2 Assignment No. 6Mary Christine Formiloza MacalinaoNo ratings yet

- CompiledDocument17 pagesCompiledMeghna SinghNo ratings yet

- 1688120722TSDocument3 pages1688120722TSSomesh IngaleNo ratings yet

- Transaction Audit ReportDocument72 pagesTransaction Audit Reportmokshgodani45No ratings yet

- Definitions:: VOL-1 - Ca Pratik JagatiDocument3 pagesDefinitions:: VOL-1 - Ca Pratik JagatiNiranjan JainNo ratings yet

- NpaDocument182 pagesNpaabhishek heerfNo ratings yet

- Tax LawDocument32 pagesTax Lawgilbert213No ratings yet

- Case Digest of CIR V Aichi ForgingDocument4 pagesCase Digest of CIR V Aichi ForgingArvi RiveraNo ratings yet

- GST PresentationDocument22 pagesGST PresentationSakshi SinghNo ratings yet

- Government RemediesDocument3 pagesGovernment RemediesShan ElisNo ratings yet

- Chapter 17 Loan CapitalDocument3 pagesChapter 17 Loan CapitalBryan TengNo ratings yet

- Tax FinalsDocument4 pagesTax FinalsNikki Beverly G. BacaleNo ratings yet

- Summary Chapter 5Document3 pagesSummary Chapter 5adityanagar363No ratings yet

- Theory of AccountsDocument8 pagesTheory of AccountsDariNo ratings yet

- Uniform LayoutDocument7 pagesUniform LayoutJade CoritanaNo ratings yet

- Module 6Document6 pagesModule 6Mary Joy CabilNo ratings yet

- Customs Act 1962Document13 pagesCustoms Act 1962ashwani0% (1)

- Chapter 5 - Deposit VfinalDocument9 pagesChapter 5 - Deposit VfinalAryan KapoorNo ratings yet

- RemediesDocument53 pagesRemedieslynne tahilNo ratings yet

- S. 16: Eligibility & Conditions: Receipt of Document Forward Charge Cases (FCM)Document3 pagesS. 16: Eligibility & Conditions: Receipt of Document Forward Charge Cases (FCM)MANU SHANKARNo ratings yet

- Documentary Stamp Tax (DST) : Don't Watch The Clock. Do What It Does: Keep GoingDocument6 pagesDocumentary Stamp Tax (DST) : Don't Watch The Clock. Do What It Does: Keep GoingRubierosseNo ratings yet

- Preferential TransactionDocument6 pagesPreferential Transactionakira menonNo ratings yet

- CIR Vs San Roque Taganito and Philex MiningDocument3 pagesCIR Vs San Roque Taganito and Philex MiningBeryl Joyce BarbaNo ratings yet

- TAX.3404 Withholding TaxesDocument13 pagesTAX.3404 Withholding TaxesJUARE MaxineNo ratings yet

- Ga Chapter6 MCQDocument4 pagesGa Chapter6 MCQargoNo ratings yet

- Profit & Gain From Business or Profession: Section 145: Taxability As Per Method of Accounting Followed by AssesseeDocument25 pagesProfit & Gain From Business or Profession: Section 145: Taxability As Per Method of Accounting Followed by AssesseeRajesh NangaliaNo ratings yet

- Refund ChartDocument1 pageRefund ChartManiGandan CNo ratings yet

- CIR v. TEAM SUALDocument3 pagesCIR v. TEAM SUALDawn Bernabe100% (1)

- CIR V Deutsche Knowledge ServicesDocument3 pagesCIR V Deutsche Knowledge ServicesWilbert ChongNo ratings yet

- Types of AssessmentDocument9 pagesTypes of AssessmentRasel AshrafulNo ratings yet

- Module 2Document29 pagesModule 2Althea mary kate MorenoNo ratings yet

- DPT-3 Requirement NewDocument3 pagesDPT-3 Requirement NewAnonymous 2mqDN4No ratings yet

- Corporate LiquidationDocument7 pagesCorporate LiquidationLloyd SonicaNo ratings yet

- SCH IiiDocument4 pagesSCH IiiSheet RavalNo ratings yet

- TAX.3504 Withholding Tax SystemDocument17 pagesTAX.3504 Withholding Tax SystemMarinoNo ratings yet

- Tax RemediesDocument8 pagesTax RemediesKhim BebicNo ratings yet

- FEMA A Summary of Compounding OrdersDocument17 pagesFEMA A Summary of Compounding OrdersRajesh Mahesh BohraNo ratings yet

- CIR vs. OcierDocument9 pagesCIR vs. OcierAdrian HughesNo ratings yet

- Accounting For Special Transactions ReviewerDocument6 pagesAccounting For Special Transactions ReviewerKaye Mariz TolentinoNo ratings yet

- Title VIII Tax Remedies NotesDocument7 pagesTitle VIII Tax Remedies NotesAnthony Yap100% (1)

- 5 Ethics SampleDocument31 pages5 Ethics SampleAruna RajappaNo ratings yet

- Roles FamilyDocument40 pagesRoles FamilyAruna RajappaNo ratings yet

- Role of GenderDocument25 pagesRole of GenderAruna RajappaNo ratings yet

- House Property - Summary (PY 2020-21 AY 2021-22)Document5 pagesHouse Property - Summary (PY 2020-21 AY 2021-22)Aruna RajappaNo ratings yet

- Accounts Test 100 Marks PDFDocument9 pagesAccounts Test 100 Marks PDFAruna RajappaNo ratings yet

- Are Important For Exam Purpose. This Question Bank and Questions Marked Important Herein Are JustDocument2 pagesAre Important For Exam Purpose. This Question Bank and Questions Marked Important Herein Are JustAruna RajappaNo ratings yet

- DT - One Page Summary - Business Trust, Inv Fund, Sec. TrustDocument1 pageDT - One Page Summary - Business Trust, Inv Fund, Sec. TrustAruna RajappaNo ratings yet

- Index: SA 200 - 299 SA 300 - 450 SA 500 - 580Document7 pagesIndex: SA 200 - 299 SA 300 - 450 SA 500 - 580Aruna Rajappa100% (1)

- Test Series: October, 2020 Mock Test Paper Intermediate (New) : Group - Ii Paper - 5: Advanced AccountingDocument7 pagesTest Series: October, 2020 Mock Test Paper Intermediate (New) : Group - Ii Paper - 5: Advanced AccountingAruna RajappaNo ratings yet

- SA 700 (R) Forming An Opinion and Reporting On Financial StatementsDocument22 pagesSA 700 (R) Forming An Opinion and Reporting On Financial StatementsAruna RajappaNo ratings yet

- Lecture 15 - Standards On Auditing (SA 260, 265 and 299Document6 pagesLecture 15 - Standards On Auditing (SA 260, 265 and 299Aruna RajappaNo ratings yet

- Audit SA 51 Most Imp Phrases PDFDocument10 pagesAudit SA 51 Most Imp Phrases PDFAruna RajappaNo ratings yet

- CA-Ipcc Old Course: Advanced AccountingDocument125 pagesCA-Ipcc Old Course: Advanced AccountingAruna Rajappa100% (1)

- Accounts Test 100 Marks PDFDocument9 pagesAccounts Test 100 Marks PDFAruna RajappaNo ratings yet

- Chapter - 2 "Audit Strategy, Planning & Execution": Lecture - 18Document6 pagesChapter - 2 "Audit Strategy, Planning & Execution": Lecture - 18Aruna RajappaNo ratings yet

- Lecture 16 - Standards On Auditing (SA 300 and 315)Document8 pagesLecture 16 - Standards On Auditing (SA 300 and 315)Aruna RajappaNo ratings yet

- Lecture 21 - Standards On Auditing (SA 320 and 402) PDFDocument6 pagesLecture 21 - Standards On Auditing (SA 320 and 402) PDFAruna RajappaNo ratings yet

- Lecture 17 - Standards On Auditing (SA 330 and 450)Document6 pagesLecture 17 - Standards On Auditing (SA 330 and 450)Aruna RajappaNo ratings yet

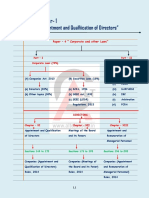

- Chapter - 1 "Appointment and Qualification of Directors": Lecture - 7Document4 pagesChapter - 1 "Appointment and Qualification of Directors": Lecture - 7Aruna RajappaNo ratings yet

- Lecture 10 - Standards On Auditing (SA 505, 510 and 520) PDFDocument8 pagesLecture 10 - Standards On Auditing (SA 505, 510 and 520) PDFAruna RajappaNo ratings yet

- Chapter-1: "Appointment and Qualfiication of Directors"Document7 pagesChapter-1: "Appointment and Qualfiication of Directors"Aruna RajappaNo ratings yet

- Lecture 20 - Risk Assessment and Internal Control PDFDocument4 pagesLecture 20 - Risk Assessment and Internal Control PDFAruna RajappaNo ratings yet

- HGHGKJDocument66 pagesHGHGKJHuyenDaoNo ratings yet

- Unit 4Document2 pagesUnit 4Sweta YadavNo ratings yet

- 1 Introduction To Accommodation Management - Lecture NoteDocument30 pages1 Introduction To Accommodation Management - Lecture Note京 Jing 張芸50% (2)

- Types of Construction Contracts and Their ComparisonDocument5 pagesTypes of Construction Contracts and Their ComparisonVincent OryangNo ratings yet

- Din InventoryDocument19 pagesDin InventoryDinesh SharmaNo ratings yet

- Channel Roles in A Dynamic Marketplace at Bec DomsDocument7 pagesChannel Roles in A Dynamic Marketplace at Bec DomsBabasab Patil (Karrisatte)No ratings yet

- VW Ratios AnalysedDocument5 pagesVW Ratios AnalysedSrinivas KannanNo ratings yet

- Chapter 6 Public Service ActDocument12 pagesChapter 6 Public Service ActIluminada Muñoz Vaflor FabroaNo ratings yet

- University of Cambridge International Examinations International General Certificate of Secondary EducationDocument12 pagesUniversity of Cambridge International Examinations International General Certificate of Secondary EducationsilNo ratings yet

- RevenueDocument5 pagesRevenueTanya AroraNo ratings yet

- MCQsDocument3 pagesMCQsVikas guptaNo ratings yet

- ASX - A Systematic Approach To Selling PremiumDocument4 pagesASX - A Systematic Approach To Selling PremiumPablo PaolucciNo ratings yet

- MSD - Sales Budgeting & Forecasting 1Document25 pagesMSD - Sales Budgeting & Forecasting 1Sajith PrasangaNo ratings yet

- ECO113 Lecture 3Document26 pagesECO113 Lecture 3Shivam YadavNo ratings yet

- DCF AAPL Course Manual PDFDocument175 pagesDCF AAPL Course Manual PDFShivam Kapoor100% (1)

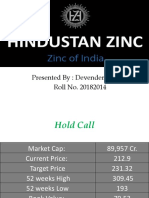

- Hindustan ZincDocument8 pagesHindustan ZincDevender SharmaNo ratings yet

- Form 26QB: Income Tax DepartmentDocument3 pagesForm 26QB: Income Tax DepartmentAnand JaiswalNo ratings yet

- Accountancy Journal Entries BoeDocument9 pagesAccountancy Journal Entries BoelalmanoNo ratings yet

- SwotsDocument2 pagesSwotsMohd RafiqNo ratings yet

- ECO007 Quiz 3Document3 pagesECO007 Quiz 3CM MIGUELNo ratings yet

- Assignment 111Document20 pagesAssignment 111Mary Ann F. MendezNo ratings yet

- International Finance by Jeff MaduraDocument91 pagesInternational Finance by Jeff MaduraMeng Dahug94% (18)

- CFGHS Sheryl Fulgencio IGP DoneDocument15 pagesCFGHS Sheryl Fulgencio IGP DoneSherylReyesFulgencioNo ratings yet

- EMT40818375 Ranchi-DelhiDocument2 pagesEMT40818375 Ranchi-DelhikukuNo ratings yet

- Advanced Corporate Finance: Lecture 15: Takeovers - Large ShareholderDocument17 pagesAdvanced Corporate Finance: Lecture 15: Takeovers - Large ShareholderDorNo ratings yet

- What Is Economic Growth: Sri Lanka GDPDocument5 pagesWhat Is Economic Growth: Sri Lanka GDPAchala JayasekaraNo ratings yet