Professional Documents

Culture Documents

MAS8702

MAS8702

Uploaded by

LJ Aggabao0 ratings0% found this document useful (0 votes)

692 views16 pagesCopyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

Download as pdf

0 ratings0% found this document useful (0 votes)

692 views16 pagesMAS8702

MAS8702

Uploaded by

LJ AggabaoCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

Download as pdf

You are on page 1of 16

CPAR

(CPA REVIEW SCHOOL OF THE PHILIPPINES

wera MAs 8702

MANAGEMENT ADVISORY SERVICES

ACTIVITY BASED COSTING SYSTEM

BROAD AVERAGING OR “PEANUT-BUTTER COSTING” - describes 2 costing approach that

uses broad averages for assigning (or spreading, as in spreading peanut butter) the cost of

resources uniformly to cost objects when the individual products or services, n fact, use those

resources in non-uniform ways.

‘Product undercosting - 2 product consumes a high level of resources but is reported

to have a low cost per uit.

Product overcosting- a product consumes a low level of resources but is reported to

have a high cost per uni. 4

Product-cost cross-subs-ization - if @ company undercosts one of its products,

it wil overcost at least one of its other products.

COSTING SYSTEM REFINEMENT - making changes to a simple costing system that reduces

the use of broad averages for assigning the cost of resources to cost objects and provides

better measurement of the costs of overhead resources used by different cost objects.

‘An actvty-based approach refines a costing system by focusing on individual activities as

the fundamental cost objects. It uses the cost ofthese activities as the basis for assigning costs

to other cost objects such as products or services.

ACTIVITY BASED COSTING (ABC) SYSTEM ~ allocates overhead to multiple activity cost

‘pools and assigns the activity cost pools to products by means of cost drivers,

Cost driver ~ a factor that causes a change in the cost pool for a particular activity: Ttis used

'a5.@ basis for cost allocation; any factor or activity that has a direct cause-effect

relationship

[Activity — any event, action, transaction, or work sequence that incurs costs when producing &

Product or providing @ service.

‘Activity Cost Pool - 2 "bucket” in which costs are accumulated that relate to a single activity

measure in the ABC System

VaLwe-AooiNG ACTIVITIES ~ activities that ae necessary (non-eliminable) to produce the

products,

NON-VALUE-ADOING ACTIVITIES ~ activities that do not make the product or service more

valuable to the customer

BENEFITS OF ABC:

1. ABC leads to more cost poots

2. ABC leads to enhanced control over overhead costs

3, ABC leads to better management decisions

FOUR DECISIONS FOR WHICH ABC INFORMATION IS USEFUL:

pricing and product mix decisions,

‘cost reduction and process Improvement decisions,

product design decisions, and

decisions for planning and managing activites.

‘MAS 8702 ACTIVITY BASED COSTING Page 2of 16

LIMITATIONS OF ABC:

1. ABC can be expensive

2, Some arbitrary allozations continue

WHEN TO SWITCH TO ABC - The presence of one or more of the following factors indicates

‘ABC as the superior costing system:

1. Product lines differ greatly in volume and manufacturing compleaity.

2. Product lines are numerous, diverse, and require differing degrees of support services.

3, Overhead costs constitute a significant portion of total costs

4, The manufacturing process or the number of products has changed significantly.

5. Production or marketing managers are ignoring data provided by the existing system.

HIERARCY OF ACTIVITY LEVELS

1. Unit-level Activities ~ are performed each tme a unit is produced.

2. Batch-ievel Activities ~ performed each time a batch is handled or processed, regardless of

how many units are in the batch. ens

3, Productlevel Activities ~ relate to specific products and typically must be carried out

regardless of hovr many batches are run or units of product are produced or sold.

4, Customer-level activities - relate to specific customers

5. Organization-sustaining activites - carried out regardless of which customers are served,

wiich products are produced, how many batches are run, or how many units are made.

‘STEPS FOR IMPLEMENTING ACTIVITY-BASED COSTING:

1. Define activities, activity cost pools, and activity measures.

2. Assign overhead costs to activity cost pools.

3. Colculate activity rates.

4. Assign overhead costs to cost objects using the activity rates and activity measures.

5. Prepare management reports.

Exencises:

12, Rue Components produces two types of wafers: wafer A and wafer B. A wafer is a'thin

slice of siicon used as a base for integrated crcuits or other electronic components. The

dies on each wafe: represent a particular configuration designed for use by @ particular

fend product. Rue produces wafers in batches, where each batch corresponds to @

Particular type of wafer (A or 8). In the wafer inserting and sorting process, dies are

inserted, and the wafers are tested to ensure that the dies are not defective. Materials are

‘ordered and received justin time for production. Terms for payment of materials are 2/10,

'n/30, Discounts are aiways taken (payment occurs on the last date possible)

‘The following activities are listed in Rue's activity dictionary:

Developing test programs

Making probe cards,

Testing products

Setting up batches

Engineering design

Handling wafer lots

Inserting cies

Purchasing materials

Receivin materials

10. Paying suppliers

11, Providing utilities (heat, lighting, and so on)

12. Providing space

ReQuiReD:

Which actives are done each time a wafer is produced (unitievel actives)?

1.

2. Which activites ae done each time a batch is produced (batt-evel activites)?

3. Which activities are done to enable production to take place (product-level activities)?

4. Which activities are done to sustain production processes (facility-level activities)?

wees ACTIVITY BASED COSTING Page 3 of 16

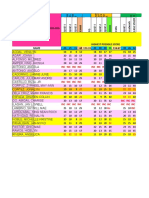

2. Montante Company produces speakers (Model A and Model 8). Both products pass

through two producing departments, Model A’s production is much more labor intensive

than Model B's, Mode! Bis also the more popular of the two speakers. The folowing data

have been gathered forthe two products:

Uni 33.00 *500,000

ts produced 30,000 x

ime cots 200,000 2,000,000

Direct labor hours 140,000 "300,000

Machine hours: 20,000 200,000

Production runs 40 60

Inspection hours 800 1,200

Maintenance hours 10,000 90,000

Overhead costs: :

Setup costs P 360,000,

Inspection costs 280,000

Machining $320,000

Maintenance $360,000

Total i.320,000

REQUIRED:

1. Compute the overhead cost per unit for each product using a plantwide rate

based on direct labor hours.

2. Compute the overhead cost per unit for each product using activity-based

costing.

3. Suppose that Montante decides to use departmental overhead rates, There are

‘two departments: Department 1 (machine intensive) with a rate of 4.66 per

‘machine hour, and Department 2 (labor intensive) with a rate of P1.20 per direct

labor hour. The consumption of these two drivers is given below:

Department 1 Department 2

Model A 410,000 130,000 .

Model B 370,000 270,000

‘Compute the overhead cost per unit for each product using departmental rates.

4. Using the actvty-baced product costs asthe standard, comment on the abilty of

departmental rates to improve the accuracy of product costing. (Did the

departmental rates co better than the plentide rate?)

3. Lukub, Inc,, produces two types of doors, interior and exterior. The company’s simple

costing system has two direct cost categories (materials and labor) and one indirect cost

pool. The simple costing system allocates indirect costs on the basis of machine hours.

Recently, the owners of Lukub have been concerned about a decline in the market share

for their interior doors, usually their biggest seller. Information related to. Lukub

production for the most recent year follows:

Interior Exterior

Units sold 3,200 1,800 :

Selling price P15 P'200

| Direct ma‘erial cost per unit P30 Pas

| Direct manufacturing labor cost per hour P16. P16

Direct manufacturing labor-hours per unit 1.50, 225

Production runs 40 85

Material moves. : R 168

Machine setups 45 155

Machine-hours 5,500 4,500

Number of inspections 250 150

‘The owners have heard of other companies in the industry that are now using an activity-

based costing system end are curious how an ABC system would affect their product

MAS 8702 ACTIVITY BASED COSTING Page 401 16

costing decisions. After analyzing the indirect cost pool for Lukub, si activities were

Identified as generating indirect costs: production scheduling, material handling, machine

setup, assembly, inspection, and marketing. Lukub collected the folowing data related to

the indirect cost activities:

Activity ‘Acthity Cost ‘Activity cost Driver

Production scheduling _-P95,000 Production runs

Material handling 45,000, Material moves

Machine setup 25,000, Machine setups

Assembly 60,000 Machine-hours

Inspection, 8,000 Number of inspections

Marketing costs were determined to be 3% of the sales revenue for each type of door.

REQUIRED:

1. Calculate the cost of an interior door and an exterior door under the existing

simple costing system.

2. Calculate the cost of an interior door and an exterior door under an activty-

based costing system,

3. Compare the costs of the doors in requirements 1 and 2. Why do the simple

‘and actvity-based costing systems differ in the cost of an interior and exterior

door?

4. How might Open Door, Inc., use the new cost information from its activity-

bbased costing system to address the decining market share for interior doors?

Lemue! Office Equipment Corporation manufactures two types of fling cabinets—Deluxe

‘and Executive—and applies manufacturing overhead to all units atthe rate of P8O per

‘machine hour. Production information follows.

Relwe — Executive

Direct-material cost P40 P65

Direct-iabr cost 3 25

Budgeted volume (units) 16,000 30,000

The controller, who is studying the use of actvity-based casting, has determined that the

firm’s overhead can be. Identified with three activities: manufacturing setups, machine

processing, and procuct shipping. Data on the number of setups, machine hours, and

‘outgoing shipments, which are the activities’ three respective cost driver, follow.

Dewxe — Executive Tota

Setups 100 60 160

Machine hours 32,000 45,000 77,000

Outgoing shipments 200 150 350

‘The firms total overhead of P6, 160,000 is subdivided as follows: manufacturing setups,

1,344,000; machine processing, P3,696,020; and product shipping, P1,120,000.

REQUIRED:

1. Compute the unit manufacturing cost of Deluxe and Executive fing cabinets by

Using the company’s current overhead costing procedures.

2. Compute the unit manufacturing cost of Deluxe and Executive fing cabinets by

using activity based costing.

43, Is the cost of the Deluxe fling cabinet overstated or understated (Le, distorted) by

the use of machine hours to alocate total manufacturing overhead to production? By

how much?

44. Caleuate the aggregate amount by wihich the Deluxe cabinet line Is undercosted by

the companys current traditional overhead costing procedures. Then calculate the

aggregate amount by wrich the traditional system overcosts the Executive cabinet

line.

mas

\S 8702 ACTIVITY BASED COSTING Page 6 016

5. Assume thatthe curent sting price of 2 Dene fing cabinet 6 270 and the

‘marketing manager is contemplating @ P30 discount to stimulate volume. Is. this

discount advisable? Briefly discuss.

- The folowing data are for the two products produced by Johan Company.

Product A Product 8

Direct materials AS per unit 24 per unit

Direct labor hours (0.3 DLM per unit 1.6 DLH per unit

Machine hours 0.1 MH per unit 1.2 MH per unit

Batches 125 batches 225 batches

Volume 10,000 units 2,000 units

Engineering modifications 12 modifications 58 modifications.

‘Number of customers 500 customers 400 customers

* Market price 30 per unit 120 per unit

The company’s direc: labor rate is P20 per direct labor hour (DLH). Additional information

follows.

Costs Driver

Indirect manufacturing:

Engineering support 24,500 Engineering modifications

Electricity 34,000 Machine hours

Setup costs 52,500 Batches

Nonmanufacturing:

Customer service 81,000 Number of customers

Require:

1, Compute the manufacturing cost per unit using the plant-wide overhead rate based on

direct labor hours. What is the grass profit per unit? (1) Product P2637 per un os, 8 PEA

{Ge per un 73.5% 8735.63. :

How much gross profit is generated by each customer of Product A using the plant-wide

‘ovethead rete? How much gross profit is generated by each customer of Product 8 using

the plant-wide overhead rate? What is the cost of providing customer service to each

‘customer? What information is provided by this comparison? GP per custo er A P72.60, 8

176 80; Cust. Senice Cost per customer FSC

3, Determine the manufacturing cost per unit of each product line using ABC. What is the

[gross profit per unit? Produc, P24.20 pr unit cast BPB5.025; GP per unt A P5705, 8 P24.975

4. How much gross profit Is generated by each customer of Product A using ABC? How

much gross profit is generated by each customer of Product B using ABC? Ts the gross

profit per customer adequate? GP per Customer A P114.10, 8 P1248

5, Which method of product costing gives better information to managers of this company?

Explain why.

1 Materats Pas em

Labor 0.20% 20 6 1.60x20 3

Inarect mfg. 0:3 x (111,000/5,200) 3.37 1.60 x(11,000/6,200) 28.64

“oral ng. cost er unit Ba Pee

Selina price £3.00 iz0.00

Hig. cost er unit But ae

(Gross profit per unt bis Ese

2. Gross prof per unit P3503 P3535

units Avan =2.000

Total gross proft 36,300 Pr0,720

“nur ber of custémers 500 == 400

Gross prof per customer Esa eee

Customer service cost per customer 8: 000+ 900 = Ba

‘MAS 8702 ACTIVITY BASED COSTING Page 6 of 16

3. Indirect fg, costs:

Sovre(12 7250 #4200 (sex aso 20200

Eeisty(oawH 1000 ute x10) "sObo {L2'2000xP10) "24000

Sp (125 tones ¥ PSL) 18280 (225% F180) “iso

‘lin geo 2980 Fr

eins 2000

indi, cost per unt ras

Notre FA

tober es a

ig easter ut mes as

Sating pee 3.009

Gres operant as esas

rss rf er ant P sms » mors

sont 10.00 2.00

Fol goss ao 0380

usb eononers S00 a0

Gessprontperastomer ETA ect

Customer service cost per customer P82 000 + 900 = B30.

6. Meditech, Inc. manufactures two types of madical devices, Medform and Procel, and applies

‘overhead on the basis of direct-labor hours. Anticipated overhead and direct-labor time for the

‘upcoming accounting period are P710,000 and 20,000 hours, respectively. Information about the

‘company’s products follows.

Medform:

Estimated production volume, 2,500 units

Direct-materal cost, P30 per unit

Direct labor per unit, 3 hours at P15 per hour

Pracel:

Estimated production volume, 3,125 units

Divect-material cost, P4S per unit

Direct labor per unit, 4 hours at P1S per hour

Meditech’s overhead of P710,000 can be identified with three major activities: order processing

(P120,000), machine processing (P500,000), end product inspection (P90,000). These activities

‘are driven’ by number of orders processed, machine hours worked, and inspection hours,

respectively. Data relevant to these activities follow.

Orders Machine Hours Inspection

Processed Worked Hours

Medform 360 23,000 4,000

Procel 250 27,000 11,000

Total 600 50,000 15,000

Management is very concerned about deciinirg proftablity despite a healthy incréase in Sales

volume. The decrease in income is especially puzzling because the company recently undertook

‘a massive plant renovation during which new, highly automated machinery was installed —

‘machinery that was e:pected to produce significant operating efficiencies.

REQUIRED:

1. Assuming use of dlrect-labor hours to apply overhead to production, compute the’ unit

manufacturing costs of the Medform and Procel products i the expected manufacturing

volume is attained. 181.50; 2247

2. Assuming use of activty-based costing, compute the unit manufacturing costs of the

Medform and Procel products ifthe expected manufacturing volume is atta

204.60; P226.52

3. Meditech’s selling prices are based heavily on cost.

MAS ar02 ACTIVITY BASED COSTING Page 7 of 16

BY Using drect-labor hours as an application base, which product is overcosted and

Wiich product is undercosted? Calculate the amount of the cost distortion for each

Product. Proce) by P18.48

. Js it possible that overcosting and undercasting (ie., cost distortion) and the

‘Subsequent determination of seling prices are contributing to the company's profit

Woes? Explain.

7. Super Cool Inc. manufactures cooling units for commercial buildings. The price and cost of

‘900d sold for each unit are as follows:

Price 'P40,500 per unit

Cost of goods sold 25.500

Gr2ss profit 1B1S.000 per unit

In addition, the compeny incurs selling and acministrative expenses of P160,400. The company

Wishes to assign these costs to its three major customers, Goljes University, Biggest Arena, and

INE Hospital. These expenses are related to three major nonmanufacturing activities: customer

service, project bidding, and engineering support. The engineering support is in the form of

‘engineering changes that are placed by the customer to change the design of a product. The

‘activity cost pool and activity bases associated with these activities are:

Actiity Activity Cost Pool Activity Base

Customer service 66,500 Number of service requests

Project bidding 34;500 Number of bids

Engineering support 59,400 ‘Number of customer design changes

Total costs 60.400

‘Activty-base usage and unit vclume information for the three customers is as follows:

Goies Unversiy Gionest Avena — NEHospial =Total

‘Number of service recuests 110 35 45 390

Number of bids 14 2 20 46

Number of customer design changes 75 25 35 135

Unit volume 5 10 5 30

Requineo:

1. Determine the activity rates for each ofthe three nonmanufacturing activity pools.

350; 750; 440

2, Determine the activity costs allocated to the three customers, using the activity rates in

(1). 82,000; 32,250; 46,150

3. Construct customer profitability reports for the three customers, using the activity costs in

(2). The reports should cisclose the gross profit and income from operations associated

with each customer. Profit (loss) = (7,006); 117,750; 178,850

4, Construct customer profitably reports for the three customers, using the traditjonal

costing system where the company allocates non-manufacturing costs using the unit

volume. The reports should disclose the gross profit and income from operations

associated with each customer. Non-manufecturing cost per unit = P160,400/30 units =

PE LAGEZ Proft = 48,267; 96,523; 144,800

2 cous ——aiccesT Ne

Customer service 8,500 12,250, 15,730

Project org 9,500 31000 15/000

Engineering suppor: 8.000 ji.o00 soo

Total pon-marufecuing ost B.000 maa Beso

~ cOues , BIGGEST Ne

Gross profit (uns 15,000) P75,000 * PSI,000 ©—_—F225,000

Nor-manufocurng cos wizooo = _ 32.250 46.150

(Operating income em = ie we

‘MAS 8702 ACTIVITY BASED COSTING Page 8 of 16

4 ous slGcesT Ne

Grose profit ants x 15,000) P'5,000 150,000 225,000,

Nen-manufacturing coss

(Unt x P5,346.67), asm sagt m2

operating income Bike = as isso

WINDING-UI

THEORY

1. An accounting system that collects financial snd operating data on the basis of the underiying

nature and extent ofthe cost divers Is.

2. Direct costing. © Cycle-time costing

i Activiy-based costing 4. Variable costing

2. The resource utilized by a given product divided by the total amount of the resource available is

called the

a. Activity driver. Cost object

'b. Consumption rai. 4d. Sustaining activily

3. Which ofthe following statements is true?

2. The traditional approach to costing uses many diferent cost drivers.

. Costs that are indirect to products are by definition traceable directly to products

©. Costs that are indirect to products are traceable to some activi.

4. All of the above statements are true,

4. Mass customization can be achieved through the use of

a. Activty-based costing, ‘c. Flexible manufacturing systems.

1. justin-time inventory. 4. allof the above.

5. Process value analysis is a key component of activity-based management that links product

‘costing and ‘

‘a, Reduction of the number of cost pools

. Continuous improvement,

Accumulation of heterogeneous cast pools

4. Overhead rates based on broad averages,

6. An approach to developing new ways to perfonn exiting activites is called

a. Process value analysis, Caveat analysis,

b. Re-engineering d. Benchmarking,

7. Alo) method fist races costs to a department and then to products

a. direct costing ©. traditional costing

. absorption costing @. activity-based costing

8 An) __method frst traces costs to activities and then to products

a. direct costing ©. traditional costing

b._ absorption costing - activity-based costing

9. Uniformly assigning the costs of resources to cost objects when those resources are actully

tsed n'a nonuniform way i called

2. overcosting © peanutbuter costing

B. Undereosing 4. Separment costing

10. An objective of actvity-based management isto

‘2. eliminate the majorly of centralized activites in an organization

. reduce or eliminate non-value-added actives incurred to make a product or provide @

service.

Insitute responsibilty accounting systems in decentralized organizations.

c

d. all ofthe above ,

11. Symptoms of an outdated cost system include all ofthe following EXCEPT.

MAS 6702 ACTIVITY BASED COSTING Page 9 of 16

12.

43,

14

48,

16.

17,

18

19

20.

a

22.

product costs change because of changes in financial reporting

[Products that are difficult to produce show ite profit.

‘competitors’ prices appear unrealistically low.

‘the company has a highly profitable niche allo itset.

apse

‘Traditional overhead allocations resuit in which ofthe following situations?

2. Overhead costs are assigned as period costs to manufacturing operations,

b._High-volume products are assigned too much overhead, and low-volume products are «

assigned too litte overhead.

. Lowevolume products ae assigned too much, and high-volume products are assigned 199

litle overhead.

4d. The resulting allocations cannot be used for financial reports.

‘Traditionally, managers have focused cost reduction efforts on

a activites. '.. processes. ‘c deparments. 4. costs.

‘Which ofthe folowing is NOT a trait ofa traitional cost management system?

2. unitbased drivers ‘c._allocation intensive

Bb. focus on managing activities 6. narrow and rigid product costing

Unitevel cost drivers are most appropriate as an overhead assignment base when

‘2. several complex products are manufactured.

only one product is manufactured,

©, direct labor costs are low.

1d. factories produce a varied mix of products.

Which ofthe following is NOT a sign of poor cost data?

2. Competitors’ prices for high-volume products appear much too high.

. The company seems to have a highly proftably niche alt itset.

Customers don't balk at price increases for low-volume products,

3. Competitors’ prices for low-volume products eppear much too high,

In Actvty-based Costing, which ofthe following would be considered a value-added activity?

a. Repair of machines. ©. Bookkeeping.

b. Engineering designs. 4. Storage of inventory

In the pharmaceutical or food industries, quality control inspections would most likely be viewed

. non-value-added activities, ©. value-added-actvites.

Db. business-value-added activites. J. process-effciency activities

A basic assumption of actvity-based costing (ABC) is that

‘2. All manufacturing costs vary directy with units of production

B._ Products or services require the performance of activities, and activities consume resourbes,

©. Only costs that respond to unitlevel drivers are product costs.

{. Only variable costs are included in activity-2ost poots.

‘Acthity-based costing and generally accepted accounting principles difer in that ABC

‘2. does not define product costs in the same manner as GAAP.

B. cannot be used to compute an income statement, but GAAP can,

is concerned only with costs generated from automated processes, but GAAP is concerned

with costs generated from both manual and automated processes.

4. information is useful only to managers, while GAAP information is useful to all organizational

stakeholders.

‘ABC should be used in which ofthe folowing situations?

single-product firme with multiple steps

‘multipte-product fms with only a single Process

‘muliple-product firms with multiple processing steps

in all manufacturing fms

aeoe

All ofthe following are examples of non-value-added activities except

‘A. reworking B. handling C. assembling. expediting

‘MAS 8702 ACTIVITY BASED COSTING Page 10 of 16

23, Products make diverse demands on resources because of differences in all of the following

EXCEPT

a. volume. . soling price. c._ batch size. 4. complenity,

24, The UNIQUE feature of an ABC systam is the emphasis on

costing individual jobs. . muttiple-cost pools.

b. department indirec-cost rates, 4. individual activites. .

25. Design of an ABC system requires

‘a. thatthe job bid process be redesigned.

, that a cause-and-effect relationship exists between resource costs and individual activities.

an adjustment to product mix.

d, both (b) and (c),

26. ABC systems create

‘a. one large cost pool,

. homogenous activity-related cost pools,

©. activity-cost pools witha broad focus.

4. activity-cost poots containing many direct costs.

27, Which ofthe following statements about actvity-based costing isnot true?

2. Activty-based costing is useful for allocating marketing and cistrbution costs

b. Activty-based costing is more likely to result in major differences from traditional costing

systems ifthe frm manufactures only one preduct rather than multiple products.

c. In actiity-based costing, cost crvers are what cause costs to be incurred.

J. Actvity-based costing differs from traditional costing systems in that products are not cross~

subsidizes.

28. If actvity-based costing is implemented in an organization without any other changes being

effected, total overhead costs wl

1 be reduced because of te elimination of non-value-added activities,

. be reduced because organizational casts will not be assigned to products or services,

be increased because ofthe need for additonal people o gather information on cost drivers.

and cost pools.

‘6. remain constant and simply be spread over products diferent

29, The use of act based costing normaly resus in

Substantially greater unit costs for low-volume products than is reported by traditional

product costing.

. Substantially lower unt costs for low-volume products than is reported by traditional product

costing,

‘c. Decreased setup costs being charged to low-volume products, a

6. Equalizing setup costs forall roduc lines.

30. are those perfcrmed each time a unit is praduced or sol,

a Balch-tevel actives, Sustaining activities.

b. Failty-sustaining activities, dd. Unitievel actives,

31..What is the normal effect on the numbers of cost pools and allocation bases when an activity:

based cost (ABC) sen se 2 acon com xem

“Cost Pools

Allocation Bases

32. Book Co. uses the actviy-based costing approach for cost allocation and product costing

purposes. Printing, cutting, and binding ‘unctons make up the manufocturing process.

Machinery and equipment are arranged in operating cells that produce a complete. product

Siarting with Taw materials. Which of the folowing are charactaristc of Boo's activity based

costing approach?

Cost cvs are used asa basis for costal oation

Il Costs are accumulated by department or funcion for purposes of product costing.

Il, Aces that do not add value to the product are identifed and reduced to the extent

possible,

a. lon. b. Fandit Vand i 4. Mand i,

MAS a702 ACTIVITY BASED COSTING Page 11 of 16

38. The ideal standard quantity for norwalue-added activites is.

the cost of resources acquired it fu

Te rece eenuae scraes cance of uray

©. the currently attainable quantity standard

4. zero

34. Exainples of activites a the unit level of costs include:

‘A. cutting, painting, end packaging ‘C. designing, changing, and advertising

BL scheduling, setting up. and moving . heating, ighting, and securty

35, ____are those that a company performs when it makes a group of units

& Batch-level activites, ‘e. Sustaining activities.

. Facity-sustaining activites. 4. Unit-evel activites.

36, Examples of activities at the batch level of costs include:

‘A. cutting, painting, and packaging ‘C. designing, changing, and advertising

scheduling, setting up. and moving 1. heating lighting, and security

37, IfJIT manufacturing is used, maintenance ofthe production equipment would be classified as 2

8. unitievel activity ¢. celblevel activity

b. productive activity 4. faciliy-evel activity

38. Which ofthe following isnot atype of sustaining activity?

a. Capacity-sustaining ._ Distibution-channel sustaining

b. Gustomer-sustainng, <._ Uni-sustaining

39. Testing a prototype of a new product is an examole of 2

2, Unitievel activity. ©, Product level activity.

». Batch-level activity 4. Organization sustaining activity.

40. Examples of activites atthe product level of costs include:

‘A. cutting, painting, and packaging (C. designing, changing, and advertising

BB scheduling, setting up. nd moving 1. heating, lighting, and security

41, In allocating variable costs to products,

1, 2 volume-based cost driver should be used.

direct labor hours should always be used as the allocation base.

a company should use the same allocation base that it uses for fixed costs,

Ga company should never use more than one cost driver.

42. The following items are used in tracing costs in an ABC system. In which order are they used?

(1) cost abject (2) cost diver (8) activity driver (4) cost pool

812,34 b. 23,41 © 24,31 6. 4,3,4.2

43, _ relate to an entire plant as a whole.

Batchlevel activites. Sustaining activites.

Facity-sustaining activities, d. Unitlevel activites.

44. Examples of activities atthe plant level of costs include:

‘A. cuting, painting, and packaging . designing, changing, and advertising

BB. scheduling, setting up. and moving D. heating, lighting, and security

45, An item or event that has a cause-effect relationship with the incurtence of a variable cost is

called a

a. mixed cost ._ predictor. ©. direct cos. 4d. cost driver.

48. Which ofthe following is typically regarded as a cost driver in traditional accounting practices?

‘2. number of purchase orders processed ~—_¢._number of transactions processed

. numberof customers served + a number of direct labor hours worked.

AT. A cist pools

a. Allofthe costs of a particular department.

Bb. Alleosts in a group such as variable costs or discretionary fixed costs.

c Allcoss related to a product or product ne.

4, All costs that have the same driver.

MAS 8702 ACTIVITY BASED COSTING Page 1201 16

48. The activities that drive resource requirements are called the

a. Activity drivers. ©, Resource drivers.

b. Cost objects. 4. Sustaining activities. Aes

49. are causal factors that explain the consumption of overhead.

a Rally divers. Cost pools 'd. Costcatchers —¢. Cost objectives

50. All of the following are unit-based activity drivers EXCEPT.

‘2. machine hous. number of setups c. number of units. direct labor hours,

S1VAl ofthe following are non-uni-based activity rivers EXCEPT

‘a, number of setups numberof inspections

._ numberof direct labor hours d._ number of material moves

52. In an actviy-based costing system, wha: should be used to assign @ departments

manufacturing overhead cost to products produced in varying lt sizes?

‘A single cause and effect relationship. c._ Relative net sales values of the products,

. Multiple cause and effect relationships. d._A product's abilty to bear cost allocations.

'53. In acivity-based costing, preliminary cost allocations assign costs to

a. departments, processes. products. 4. activities.

54. in activity-based costing final cost allocations assign costs to

2. departments. b. processes, products 4. activities.

PROBLEMS

1. A time-and-motion study revealed that it shou'd take 1 hour to produce a product that currently

‘takes 3 hours to produce. Labor is P8 per hour. Nonvalue-added costs are

a PB b. P16 P24 d. PO

2. Setup time for a product is six hours. A fir that uses JIT and produces the same product has

feduced setup time to 30 minutes. Setup labor is P24 per hour. Value-added costs are

a Piad b. P13 P24 4. P12

3, Each unit of product requires 8 gallons of raw material. Due to scrap and rework, each unit has

been averaging © gallons of raw material, The raw material costs P4 per gallon. Value-added

costs are

a. P2 b. PA c. P32 . P36

4. A company keeps 20 days of raw materials inventory on hand to avoid shutdowns due to raw

‘materials shortages. Carrying costs average P2,000 per day. A competitor keeps 10 days of

inventory on hand the competitor's carrying casts average P1000 per day. Value-added costs

a. P40,000 b. 20,000 10,000 4. PO

5. New Rage Cosmetics has used a traditional cost accounting system io apply quality control

‘costs uniformly to all products at a rate of 14.5% of direct labor cost. Monthly direct labor cost

for Satin Sheen makeup is P27,500. In an attempt to distribute quality control costs more

equitably, New Rage is considering activity-based costing. The monthly data shown in the chart

below have been gathered for Satin Sheen,

Quantity for

Activity CostOrver _CostRates Satin Sheen

Incoming material inspection Type ofmelersl 17.80 per'ype 12 types

ineprocess inspection Numberofumts POi@perunt’” 17.600 uns

Product certification Per order PrTper order 28 orders

“The monthly qualty contol cost assigned to Satin Sheen makeup using actvty-based costing is

a. P88,64 por order.

3 25.50 tower than the cost using the tredtona! system,

& 8,500.50

&._ 526 50 higher than the cost using the racional system.

MAS 8702 ACTIVITY BASED COSTING Page 14 of 16.

‘The equipment is used for two activities: improving processes and designing tooling. Thirty-five

percent of the equipment’ time is used for Improving processes and sixty-five percent is used for

‘esigniig tools, The saleries are for two engineers. One is paid P100,000, while the other eams

P50,000. The P100,000 engineer spends 40% of his time training employees in new processes and

{60% of his time on improving processes. The remaining engineer spends equal time on all activities.

‘Supplies are consumed inthe following proportions

‘Creating BOMs- 25%

Studying capabilites 10%

Improving processes 20%

“Training employees 25%

Designing tooling 20%

10. What isthe cost assigned tothe creating BOMs activity?

a. 62,500 b. 15,000 ©. 87,500 4. 250,000

11 What isthe cost assigned tothe improving processes activity?

a. 260,000 'b.P50,000 ©. P87,500 4. P102,000

12, Whats the cost assigned to ths training employees activity?

a. P55,000 'b. P250,000 62,500 4. P162,500

18, What isthe cost assigned to the designing toolng activity?

a. P162,500 b, 66,000, 50,000 4. P250,000

QUESTIONS 14 THROUGH 16 ARE BASED ON THE FOLLOWING INFORMATION.

‘A compary has identified the following overhead costs and cost drivers for the coming year.

‘Overhead item CostDriver Budaeted Gast Budaeted Activity Level

Machine setup No, of setups 20,000 200

Inspection No. of inspections 130,000 6500

Material handling No.of material moves P 80,000 8,000

Engineering Engineering hours P 50,000 1,000

280,000

‘The folowing information was collected on three obs that were completed during the year

ob 101 Job 102, Job 103

Direct materials, 5,000 12,000, 8,000

Direct labor 2,000 > 2,000 4,000

Units completed 100 50 200

Number of setups 1 2 4

Number of inspections 20 10 30

‘Number of material moves 30 10 50

Engineering hours 10 50 10

Budgeted direct labor cost was P100,000, and budgeted direct material cost was P280.000.

14, the company uses activ

101?

a 1,300 b. 2,000 © 5,000 4. P5,600

ty-based costing, how much overhead cost should be allocable to Job

15, Ifthe company uses activity-based costing, compute the cost of each unit of Job 102

a. P340 b. P302 & P4ao 4. P520

16. The’company prices ts products at 140% of cost. Ifthe company uses activiy-based cost,

the price of each unit 3f Job 103 would be

a. PO b. Poo co Pi 4. Prag

QUESTIONS 17 THRU 22 ARE BASED ON THE FOLLOWING INFORMATION

Special Products recently installed an actvity-besed relational data base. Using the information

Contained in the activity relational table, the following poo! rates were computed

ACTIVITY BASED COSTING Page 13. 18

MAS 8702

QUESTIONS 6 THRU 8 ARE BASED ON THE FOLLOWING INFORMATION.

Dierich Company uses an acivty-based costing system with three actity cost pools. The compiny

hae provided the folowing data Concerring its costs and is actly based costing system:

Costs:

Manufacturrg overhead 600,000

Selling and admin. expenses 220,000

Distribution of resource consumption:

‘Activity Cost Pools

Order Size CustomerSuoport Other Total

‘Manufacturing overhead 15% 75% 10% 100%

60% 20% 20% © 100%

Selling and admin. Expenses

‘Tne “Other acy cost poo! consists ofthe coss of ale capacity and orgarization-susailing ost.

eae eer ca to complete the first-stage allocation of costs to the activity cost pools.

6. How much cost in total, woud be allocated in the fst-stage allocation othe Order Size activity

cost pool?

a. P222,000 . 307,500 fe. 123,000 . 492,000

oducts in the second stage of

ternal decision-making?

d, P164,000.

7. How much cost, in total, should NOT be allocated to orders and pr

the allocation process ithe actvity-based costing system is used fori

2. P82,000. . P104,000. PO.

How much cost in total, woul be allocated inthe rs-tage allocation to the Customer Support

activity cost post?

‘a. 389,600 b. P615,000

‘an assistediving facity that provides services In the form of residential spa0e:

{OOA) to its occupants. ALF currently uses 2 tradtional

vided as assisted living, with service output

©. 164,000 4. P494,000

9. ALF Co.

Imeals, and other occupant assistance

Cost account system that defines the service pro

cost account aye of occupant days. Each occupant is charged a daly rate equal to ALPS

sree J of providing residential space, meals and OOA divided by total occupant days.

ar tn acauty baved costing (ABC) analysis has revealed that occupant’s use of DOA

Howevet sttantally This analyst determined that occupants could be grouped into three

Wetegories flow, moderate, and high usage of OOA) and thatthe activty driver of OOA is nurehg

Cea grtver of the other actives is occupant days, The following quanttative information

was also provides:

‘Occupant category ‘Annual Ocoupant Days ‘Annual Nursing Hours

Low Usage 36,000 120,000

Medium Usage 48,600 90,000

High Usage 6,000 120,000

60,000 300,000

“The total annual cost of OOA was P7.5 milion, and the total annual cost of providing residential

space and meals was P7-2 millon. Accordingly, the ABC analysis indicates that the dally costing

rate should be

{2. P182.50 for occupants inthe low-usage category.

1b. 145.00 for occupants inthe medium-usage category.

2 P245.00 for occupants in the high-usage category

4. P520,00 forall occupants.

QUESTIONS 10 THROUGH 13 ARE BASED ON THE FOLLOWING INFORMATION.

Zebra Corporation has the following actives: creating bills of materials (BOM), studying

manufacturing capabilities, improving manufactutag processes, training employees, and desi

, tran snd designing

fooling, ‘The general ledger accounts reveal the following expenditures for manufacturing

engineering

‘Seaton, 150,000

Equipment 20,000

‘Supplies 20,000

Total 260,000

‘MAS 8702 ACTIVITY BASED COSTING Page 16.6116

26. The overhead cust per unit of Product A under the activity-based costing system is closest to

a. P8697. b. P70.79, P8120. d. P1124,

PROBLEMS

3 esi. @ [a0 [ao

8 [32 "D [12 A [2A

fae a [B.D cp 8] 2. 0

4¢ [3a A [ao [is A [24 A

8 8 [38 A 50 [15 A }25. 8

6.8 [6.8 [écA [16 A [26.4

7€ 7B [37 78 [i7.A |

80 0] 38. 0 aoje8) |

3.¢ [19,8 [2% A[38.C 3A [19.C]

To, [20.4 [30D] 40. c i ]2)

MAS 8702 ACTIVITY BASED COSTING

P200 per purchase order

P12 per machine hour, process A

P15 per machine hour, process

P40 per engineering hour

Page 18 .0f16

‘Two products are produced by Special Products: A and B. Each product has an area in the plant that

is dedicated to its production, The plant has two manufacturing processes, process A and process B,

Other processes include engineering, product handiing and procurement. The product relational

table for Special is as follows:

Activity Usage

Activity Driver # Name Product Product B

1 Units 200,000 25,000

2 Purchase orders 250 125

3 Machine hours 0,000 10,000

4 Engineering hours 4,250 4,500

117. How much overhead cost will be assigned to product A using the number of purchase orders?

‘a, P50,000 b. P25,000 c. P40,000,000 d._P66,750

418. How much overhead vost willbe assigned to product B using engineering hours?

a. P50,000 b. P60,000 . P1,000,000 — d._P400,500

19. How much overhead cost will be assigned to product A using process A?

a. P4,200,000 b. P2,400,000 —& P960,000 4. 120,000

20. How much overhead cost will be assigned to product B using process 8?

a. 1,200,000 be. P960,000 ©. P120,000 4, P150,000

21, Whats the unit cost of Product A?

a PATI b. 376 ©. P252.00 4. P5.30

22, Whatis the unt cost of Product 8?

a. P94 b. P6.00 ©. 252.00 , P641

QUESTIONS 23 THRU 26 ARE BASED ON THE FOLLOWING INFORMATION

‘Acton Company has two products’ A and 8. The annual production and sales of Product A is 600

Units and of Product 8 is 00 units. The company has traditionally used direct labor-hours as the

basis for applying al man sfacturing overhead fo products. Product A requires 0.3 direct labor hours

per unt and Product B requires 0.2 direct labor hours per unit. The total estimated overhead for next

period is P92,023.

‘Tie company is considering’ switching to an actviy-based costing system for the purpose of

‘computing unit product costs for extemal repors. The new actvity-based costing system would have

three overhead activity cost pcols-Activity 1, Activity 2, and Geneial Factory-with estimated

overhead costs and expected activity as follows:

Estimated Overhead Expected Activity

Activity Cost Poo! Costs Product ~ Product 8 Total

Activity 1 Pia.4e7 500) 609 4,100

‘Activity 2 64,800 2,500 500 3,000

General Factory P12 736 240 700 340

Total 92,023

(Note: The General Factory activity cost poo''s cos's are allocated on the basis of direct labor hours.)

23, The predetermined overhead rate under the tredtional costing system is closest

a. P3748. be P2160. & P18.17 d. P2706

24..The overhead cost per unt of Product 8 under the traditional costing system is closest to

a. P5413, b. P7.49, o P4392, d. P2883.

25. The predetermined overhead rate (\e., activity rate) for Activity 1 under the activty-based costing

system is closest to:

a. P2887. b P1317, cc. P83.86 3. P26.18.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5822)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (898)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Bank StatementDocument14 pagesBank StatementLJ AggabaoNo ratings yet

- Afar 8617Document5 pagesAfar 8617LJ AggabaoNo ratings yet

- CPAR87 Final PB - AFARDocument15 pagesCPAR87 Final PB - AFARLJ AggabaoNo ratings yet

- ASSIGNMENTDocument4 pagesASSIGNMENTLJ AggabaoNo ratings yet

- Government Accounting Exam PhilippinesDocument4 pagesGovernment Accounting Exam PhilippinesLJ Aggabao100% (1)

- Law 101-The Law On Obligation and Contracts: Prelims Dterms FinalsDocument2 pagesLaw 101-The Law On Obligation and Contracts: Prelims Dterms FinalsLJ AggabaoNo ratings yet

- Nature of Government AccountingDocument16 pagesNature of Government AccountingLJ AggabaoNo ratings yet

- A11 9.8.23Document4 pagesA11 9.8.23LJ AggabaoNo ratings yet

- Advanced Accounting Chapter 21Document9 pagesAdvanced Accounting Chapter 21LJ AggabaoNo ratings yet

- Hospital Revenues (1-32)Document13 pagesHospital Revenues (1-32)LJ AggabaoNo ratings yet

- Advanced Accounting Chapter 22Document9 pagesAdvanced Accounting Chapter 22LJ AggabaoNo ratings yet

- Leave Revised FloricelDocument2 pagesLeave Revised FloricelLJ AggabaoNo ratings yet

- Seatwork Joint ArrangementsDocument1 pageSeatwork Joint ArrangementsLJ AggabaoNo ratings yet

- Advanced Accounting Chapter 20Document12 pagesAdvanced Accounting Chapter 20LJ AggabaoNo ratings yet

- Final PB87 Sol. MASDocument2 pagesFinal PB87 Sol. MASLJ AggabaoNo ratings yet

- Quiz Acctng 603Document10 pagesQuiz Acctng 603LJ AggabaoNo ratings yet

- Mas 8711Document12 pagesMas 8711LJ AggabaoNo ratings yet

- Acctg 403 SyllabusDocument12 pagesAcctg 403 SyllabusLJ AggabaoNo ratings yet

- Afar 8722Document2 pagesAfar 8722LJ AggabaoNo ratings yet

- Not For Profit OrganizationsDocument19 pagesNot For Profit OrganizationsLJ AggabaoNo ratings yet

- Income Taxation - 2020 - 2021Document9 pagesIncome Taxation - 2020 - 2021LJ AggabaoNo ratings yet

- Quiz NPO Multiple ChoiceDocument4 pagesQuiz NPO Multiple ChoiceLJ Aggabao0% (1)