Professional Documents

Culture Documents

Range of State Corporate Income Tax Rates

Range of State Corporate Income Tax Rates

Uploaded by

grishma14Copyright:

Available Formats

You might also like

- Oakland Raiders Las Vegas Project Pro Forma SpreadsheetDocument8 pagesOakland Raiders Las Vegas Project Pro Forma SpreadsheetZennie Abraham0% (1)

- CIR vs. PNB 736 SCRA 609 2014 VELOSODocument2 pagesCIR vs. PNB 736 SCRA 609 2014 VELOSOAnonymous MikI28PkJc100% (2)

- Carlos Superdrug Corporation vs. DSWD, Et Al., Test of Police PowerDocument2 pagesCarlos Superdrug Corporation vs. DSWD, Et Al., Test of Police PowerRoward100% (1)

- DT20195775183 PDFDocument18 pagesDT20195775183 PDFAbs SriNo ratings yet

- State Income Tax RatesDocument2 pagesState Income Tax RatesKoko U.No ratings yet

- Template DCF Model Exoon Mobil CaseDocument1 pageTemplate DCF Model Exoon Mobil Casehoifish100% (1)

- Boring Logs - 2022Document13 pagesBoring Logs - 2022Drawing HacksNo ratings yet

- Khushal Rathod 40H249 Tax Regime Comparison20-21Document3 pagesKhushal Rathod 40H249 Tax Regime Comparison20-21yogesh kumar jaiswalNo ratings yet

- 40 - Shahin Selkar - Texas High Speed Rail Corp. - FCF-ECF & WACC WorkingsDocument24 pages40 - Shahin Selkar - Texas High Speed Rail Corp. - FCF-ECF & WACC Workingsshahin selkarNo ratings yet

- BH 1Document28 pagesBH 1Probal ProsoilNo ratings yet

- Mar 8 16 Masville PDFDocument1 pageMar 8 16 Masville PDFMingVitugNo ratings yet

- Reasoning Ability: Groundnut 120º Sunflower 75ºDocument6 pagesReasoning Ability: Groundnut 120º Sunflower 75ºanaswara santhoshNo ratings yet

- FK High Low SS Final AmmendedDocument9 pagesFK High Low SS Final AmmendedSri WatsonNo ratings yet

- Pow 17J00012Document41 pagesPow 17J00012amroussyNo ratings yet

- Plantillas Excel Vio - IiDocument29 pagesPlantillas Excel Vio - IiEduardo Lopez-vegue DiezNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report August 05, 2021Document9 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report August 05, 2021Jun GomezNo ratings yet

- What Secrets Does The Data Hold?: Jan D. FreitagDocument40 pagesWhat Secrets Does The Data Hold?: Jan D. Freitagjgevertz911No ratings yet

- 16 S Appendix 2Document18 pages16 S Appendix 2Jox GullaNo ratings yet

- Ada170798 PDFDocument287 pagesAda170798 PDFOmar José Rojas RuedaNo ratings yet

- 8 - 0E IDU-680 (Rotorcraft) (200-350)Document151 pages8 - 0E IDU-680 (Rotorcraft) (200-350)Alikhan TalgatulyNo ratings yet

- Oakland Raiders Las Vegas NFL Stadium Spreadsheet by Zennie AbrahamDocument11 pagesOakland Raiders Las Vegas NFL Stadium Spreadsheet by Zennie AbrahamZennie AbrahamNo ratings yet

- Project Report: OF M/S Maa Janki Warehouse (Proprietor: Brijlata Chouhan) (Finance Required: 120 Lakhs)Document17 pagesProject Report: OF M/S Maa Janki Warehouse (Proprietor: Brijlata Chouhan) (Finance Required: 120 Lakhs)SHUBHAM SHRIVASTAVANo ratings yet

- S INDHUDocument22 pagesS INDHUsiddharth gautamNo ratings yet

- Oakland Raiders Las Vegas NFL Stadium SpreadsheetDocument11 pagesOakland Raiders Las Vegas NFL Stadium SpreadsheetZennie AbrahamNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report June 01, 2020Document9 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report June 01, 2020craftersxNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report August 04, 2021Document9 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report August 04, 2021Jun GomezNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report August 04, 2021Document9 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report August 04, 2021Jun GomezNo ratings yet

- SLR Liability Upto 31.12.2021Document26 pagesSLR Liability Upto 31.12.2021SLR GKPNo ratings yet

- Appendix C - Unit Pipe Prices C.1 Introduction and SummaryDocument42 pagesAppendix C - Unit Pipe Prices C.1 Introduction and Summarywkwk wkwkNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report October 09, 2018Document9 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report October 09, 2018hezeNo ratings yet

- Adilabad District Action PlanDocument18 pagesAdilabad District Action PlanBUKA RAMAKANTHNo ratings yet

- Ancebmm Auto-Care Center - Vol. III ADocument268 pagesAncebmm Auto-Care Center - Vol. III AAria RosarioNo ratings yet

- Consolidated Results 4Q20: AT&T 4Q20 HighlightsDocument3 pagesConsolidated Results 4Q20: AT&T 4Q20 Highlights田原純平No ratings yet

- Projected Cash Flow Statements and Balance SheetDocument15 pagesProjected Cash Flow Statements and Balance Sheetcabbage_donNo ratings yet

- APN BA6-7 Book 部分22Document3 pagesAPN BA6-7 Book 部分22蒋文政No ratings yet

- PD InterestDocument2 pagesPD InterestKamal ChughNo ratings yet

- Flats Sequencing System Update: Mailer Technical Advisory Committee (MTAC)Document20 pagesFlats Sequencing System Update: Mailer Technical Advisory Committee (MTAC)postaltexan100% (1)

- Sprinkler CalculationDocument16 pagesSprinkler CalculationMeeran MohideenNo ratings yet

- Payroll SummaryDocument3 pagesPayroll Summarynicole.upperNo ratings yet

- Factsheet Jpmorgan Asia Pacific Income FundDocument2 pagesFactsheet Jpmorgan Asia Pacific Income FundNadeem LalaniNo ratings yet

- Stockquotes 07082020 PDFDocument9 pagesStockquotes 07082020 PDFMarlon DNo ratings yet

- 6int 2005 Dec ADocument7 pages6int 2005 Dec Aapi-19836745No ratings yet

- Stockquotes 12012020 PDFDocument9 pagesStockquotes 12012020 PDFXander 4thNo ratings yet

- (A) Scheduled of Dep As Per WDV MethodDocument4 pages(A) Scheduled of Dep As Per WDV MethodtusharNo ratings yet

- (A) Scheduled of Dep As Per WDV MethodDocument4 pages(A) Scheduled of Dep As Per WDV MethodtusharNo ratings yet

- Jaakkola Only) (Compatibility Mode)Document12 pagesJaakkola Only) (Compatibility Mode)wawy66No ratings yet

- Memorandum: TO: JBC Members From: John Ziegler Subject: June Revenue Forecast Date: September 21, 2009Document10 pagesMemorandum: TO: JBC Members From: John Ziegler Subject: June Revenue Forecast Date: September 21, 2009Circuit MediaNo ratings yet

- Ey-570 Trim Sheet Bae Rj100: Cargo Compartment IndexDocument1 pageEy-570 Trim Sheet Bae Rj100: Cargo Compartment Indexali4957270No ratings yet

- DME Absorbing Unit Simulation Using PRO/II With ProvisionDocument28 pagesDME Absorbing Unit Simulation Using PRO/II With ProvisionridhajamelNo ratings yet

- Evans June 10th ReportDocument7 pagesEvans June 10th ReportMitch RyalsNo ratings yet

- Injury Statistics Work Related Claims 2020 Provisional Tables For 2020Document15 pagesInjury Statistics Work Related Claims 2020 Provisional Tables For 2020Carolyn EggersNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report March 18, 2021Document9 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report March 18, 2021Xander 4thNo ratings yet

- Stockquotes 02112014 PDFDocument8 pagesStockquotes 02112014 PDFJohn Paul Samuel ChuaNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report November 08, 2019Document9 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report November 08, 2019craftersxNo ratings yet

- Exhibit 1 Selected Pinkerton's Financial Data (In $millions)Document1 pageExhibit 1 Selected Pinkerton's Financial Data (In $millions)Abhishek KumarNo ratings yet

- Nike Inc - Cost of Capital - Syndicate 10Document16 pagesNike Inc - Cost of Capital - Syndicate 10Anthony KwoNo ratings yet

- PD6IP Plan-Concasnic V1.1 - 05may21Document3 pagesPD6IP Plan-Concasnic V1.1 - 05may21JoseRiveraNo ratings yet

- Annexure D - For Cable Cellar MVWS SystemDocument1 pageAnnexure D - For Cable Cellar MVWS Systemsujay AvatiNo ratings yet

- The Philippine Stock Exchange, Inc. Daily Quotation Report: February 09, 2022Document11 pagesThe Philippine Stock Exchange, Inc. Daily Quotation Report: February 09, 2022craftersxNo ratings yet

- B.O.Q. (BUILT-UP) : S.No. Partmark Description Qty. Unit Weight WeightDocument1 pageB.O.Q. (BUILT-UP) : S.No. Partmark Description Qty. Unit Weight WeightChandan VatsNo ratings yet

- Stockquotes 02012023Document13 pagesStockquotes 02012023Jonathan M.No ratings yet

- The Art of Credit Derivatives: Demystifying the Black SwanFrom EverandThe Art of Credit Derivatives: Demystifying the Black SwanRating: 4 out of 5 stars4/5 (1)

- Modern Portfolio Management: Moving Beyond Modern Portfolio TheoryFrom EverandModern Portfolio Management: Moving Beyond Modern Portfolio TheoryNo ratings yet

- Sales Reviewer Judge AdvientoDocument54 pagesSales Reviewer Judge Advientoandreaivydy1993No ratings yet

- Digested Cases in Civil LawDocument60 pagesDigested Cases in Civil LawLyndon Cris FuentesNo ratings yet

- ICT Enabled Land Administration Systems For Sustainable Development - The Danish WayDocument16 pagesICT Enabled Land Administration Systems For Sustainable Development - The Danish WayGoran KrnjaicNo ratings yet

- Concepts of Donation and DonorDocument7 pagesConcepts of Donation and DonorbeverlyrtanNo ratings yet

- Inflation or Gold StandardDocument34 pagesInflation or Gold StandardHal Shurtleff100% (2)

- 2019 PROBLEM EXERCISES IN INCOME TAXATION and TRAIN LAW (B)Document11 pages2019 PROBLEM EXERCISES IN INCOME TAXATION and TRAIN LAW (B)MGVMonNo ratings yet

- LBO BMC Course Manual - 639b9f6484ec3Document151 pagesLBO BMC Course Manual - 639b9f6484ec3Marc ONo ratings yet

- Advance Receipt Voucher: Reversal of Ibibo Service Fee INR 0.0 Effective Discount INR 0.0Document1 pageAdvance Receipt Voucher: Reversal of Ibibo Service Fee INR 0.0 Effective Discount INR 0.0Ranjith RaviNo ratings yet

- Forbes USA - 25 May 2015.bakDocument156 pagesForbes USA - 25 May 2015.bakhugosalazarNo ratings yet

- RFP For KL IIIDocument98 pagesRFP For KL IIIMausam ShresthaNo ratings yet

- 2019 Tax LMTDocument26 pages2019 Tax LMTchristineNo ratings yet

- The Impact of Capital Structure On The Performance of Microfinance InstitutionsDocument17 pagesThe Impact of Capital Structure On The Performance of Microfinance InstitutionsMuhammadAzharFarooqNo ratings yet

- John Hay Peoples Alternative Coalition Vs LimDocument2 pagesJohn Hay Peoples Alternative Coalition Vs LimDennice Erica DavidNo ratings yet

- Environmental Plan Implementation, Legal Aspects, and AdministrationDocument19 pagesEnvironmental Plan Implementation, Legal Aspects, and AdministrationSure ConsultancyNo ratings yet

- Vietnam Wine - Final Report - 11.12.2014Document17 pagesVietnam Wine - Final Report - 11.12.2014kateanh2501100% (1)

- Analyst PresentationDocument59 pagesAnalyst Presentationsoreng.anupNo ratings yet

- BIR Ruling No 434-12Document3 pagesBIR Ruling No 434-12Em EmNo ratings yet

- An Overview of VAT Law Book1Document44 pagesAn Overview of VAT Law Book1Sema Rani KarmokerNo ratings yet

- Galvez, Glennizze M. Bsat - 4 YrDocument4 pagesGalvez, Glennizze M. Bsat - 4 YrGlenn GalvezNo ratings yet

- Business Plan: This Business Plan Was Prepared by XYZ To Apply For Turkish Businessperson VisaDocument19 pagesBusiness Plan: This Business Plan Was Prepared by XYZ To Apply For Turkish Businessperson VisaSenateriyaNo ratings yet

- Circular Flow of DiagramDocument41 pagesCircular Flow of DiagramRishit KapoorNo ratings yet

- Local TaxationDocument28 pagesLocal TaxationGemale PHNo ratings yet

- Working Paper 5 - Hong Kong Air Cargo - Final (v4)Document31 pagesWorking Paper 5 - Hong Kong Air Cargo - Final (v4)Aniketh Roy ChoudhuriNo ratings yet

- Transfer PricingDocument22 pagesTransfer PricingParamjit Sharma100% (20)

- Impact of GST On Manufacturers, Distributor, and RetailersDocument4 pagesImpact of GST On Manufacturers, Distributor, and RetailersAnkit GuptaNo ratings yet

- EC345 2022 - 23 Week 10 Welfare and PolicyDocument60 pagesEC345 2022 - 23 Week 10 Welfare and Policyfilipa barbosaNo ratings yet

- BinocsTaxReportFY2022-23 Ankit KumarDocument7 pagesBinocsTaxReportFY2022-23 Ankit KumarMayuresh SinghNo ratings yet

Range of State Corporate Income Tax Rates

Range of State Corporate Income Tax Rates

Uploaded by

grishma14Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Range of State Corporate Income Tax Rates

Range of State Corporate Income Tax Rates

Uploaded by

grishma14Copyright:

Available Formats

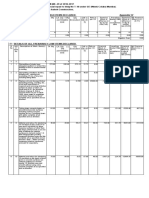

RANGE OF STATE CORPORATE INCOME TAX RATES

(For tax year 2020 -- as of January 1, 2020)

TAX RATE (a) FEDERAL

TAX RATE TAX BRACKETS NUMBER (percent) INCOME TAX

STATE (percent) LOWEST HIGHEST OF BRACKETSFINANCIAL INST. DEDUCTIBLE

ALABAMA 6.5 ----Flat Rate---- 1 6.5 Yes

ALASKA 0 - 9.4 25,000 222,000 10 0 - 9.4

ARIZONA 4.9 (b) ----Flat Rate---- 1 4.9 (b)

ARKANSAS 1.0 - 6.5 3,000 100,001 6 1.0 - 6.5

CALIFORNIA 8.84 (b) ----Flat Rate---- 1 10.84 (b)

COLORADO 4.63 ----Flat Rate---- 1 4.63

CONNECTICUT 7.5 (c) ----Flat Rate---- 1 7.5 (c)

DELAWARE 8.7 ----Flat Rate---- 1 8.7-1.7 (d)

FLORIDA 4.458 (e) ----Flat Rate---- 1 4.458 (e)

GEORGIA 5.75 ----Flat Rate---- 1 5.75

HAWAII 4.4 - 6.4 (f) 25,000 100,001 3 7.92 (f)

IDAHO 6.925 (g) ----Flat Rate---- 1 6.925 (g)

ILLINOIS 9.5 (h) ----Flat Rate---- 1 9.5 (h)

INDIANA 5.5 (i) ----Flat Rate---- 1 6.0

IOWA 6.0 - 12.0 25,000 250,001 4 5.0 Yes (j)

KANSAS 4.0 (k) ----Flat Rate---- 1 2.25 (k)

KENTUCKY 5.0 ----Flat Rate---- 1 --- (a)

LOUISIANA 4.0 - 8.0 25,000 200,001 5 4.0 - 8.0 Yes

MAINE 3.5 - 8.93 350,000 3.5 Million 4 1.0 (l)

MARYLAND 8.25 ----Flat Rate---- 1 8.25

MASSACHUSETTS 8.0 (m) ----Flat Rate---- 1 9.0 (m)

MICHIGAN 6.0 ----Flat Rate---- 1 --- (a)

MINNESOTA 9.8 (n) ----Flat Rate---- 1 9.8 (n)

MISSISSIPPI 0 - 5.0 2,000 10,001 4 0 - 5.0

MISSOURI 4.0 ----Flat Rate---- 1 7.0 Yes (j)

MONTANA 6.75 (o) ----Flat Rate---- 1 6.75 (o)

NEBRASKA 5.58 - 7.81 100,000 2 --- (a)

NEVADA -- No corporate income tax

NEW HAMPSHIRE 7.7 (p) ----Flat Rate---- 1 7.7 (p)

NEW JERSEY 9.0 (q) ----Flat Rate---- 1 9.0 (q)

NEW MEXICO 4.8 - 5.9 500,000 2 4.8 - 5.9

NEW YORK 6.5 (r) ----Flat Rate---- 1 6.5 (r)

NORTH CAROLINA 2.5 ----Flat Rate---- 1 2.5

NORTH DAKOTA 1.41 - 4.31 (s) 25,000 50,001 3 1.41 - 4.31 (s)

OHIO (t) --- (t)

OKLAHOMA 6.0 ----Flat Rate---- 1 6.0

OREGON 6.6 - 7.6 (u) 1 million 2 6.6 - 7.6 (u)

PENNSYLVANIA 9.99 ----Flat Rate---- 1 --- (a)

RHODE ISLAND 7.0 (b) ----Flat Rate---- 1 9.0 (b)

SOUTH CAROLINA 5.0 ----Flat Rate---- 1 4.5 (v)

SOUTH DAKOTA -- No corporate income tax 6.0-0.25% (b)

TENNESSEE 6.5 ----Flat Rate---- 1 6.5

TEXAS (w) (w)

UTAH 4.95 (b) ----Flat Rate---- 4.95 (b)

VERMONT 6.0 - 8.5 (b) 10,000 25,000 3 --- (a)

VIRGINIA 6.0 ----Flat Rate---- 1 6.0

WASHINGTON -- No corporate income tax

WEST VIRGINIA 6.5 ----Flat Rate---- 1 6.5

WISCONSIN 7.9 ----Flat Rate---- 1 7.9

WYOMING -- No corporate income tax

DIST. OF COLUMBIA 8.25 (b) ----Flat Rate---- 1 8.25 (b)

Source: Compiled by FTA from various sources.

Footnotes on next page.

FEDERATION OF TAX ADMINISTRATORS -- FEBRUARY 2020

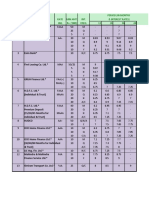

RANGE OF STATE CORPORATE INCOME TAX RATES

(For tax year 2020 -- as of January 1, 2020)

(a) Rates listed are the corporate income tax rate applied to financial institutions or excise taxes based on income. Some

states have other taxes based upon the value of deposits or shares.

(b) Minimum tax is $800 in California, $250 in District of Columbia, $50 in Arizona and North Dakota (banks), $400 ($100

banks) in Rhode Island, $200 per location in South Dakota (banks), $100 in Utah, $300 in Vermont.

(c) Connecticut’s tax is the greater of the 7.5% tax on net income, a 0.31% tax on capital stock and surplus (maximum tax of $1

million), or $250 (the minimum tax). A 10% surcharge is imposed for tax year 2020.

(d) The Delaware Bank marginal rate decreases over 4 brackets ranging from $20 to $650 million in taxable income. Building

and loan associations are taxed at a flat 8.7%.

(e) The Florida tax rate may be adjusted downward if certain revenue targets are met.

(f) Hawaii taxes capital gains at 4%. Financial institutions pay a franchise tax of 7.92% of taxable income (in lieu of the

corporate income tax and general excise taxes).

(g) Idaho’s minimum tax on a corporation is $20. The $10 Permanent Building Fund Tax must be paid by each corporation in a

unitary group filing a combined return. Taxpayers with gross sales in Idaho under $100,000, and with no property or payroll in

Idaho, may elect to pay 1% on such sales (instead of the tax on net income).

(h) The Illinois rate of 9.5% is the sum of a corporate income tax rate of 7.0% plus a replacement tax of 2.5%.

(i) The Indiana Corporate tax rate is scheduled to decrease to 5.25% on July 1, 2020. Bank tax rate is scheduled to decrease to

5.5% on 1/1/21.

(j) 50% of the federal income tax is deductible.

(k) In addition to the flat 4% corporate income tax, Kansas levies a 3.0% surtax on taxable income over $50,000. Banks pay a

privilege tax of 2.25% of net income, plus a surtax of 2.125% (2.25% for savings and loans, trust companies, and federally

chartered savings banks) on net income in excess of $25,000.

(l) The state franchise tax on financial institutions is either (1) the sum of 1% of the Maine net income of the financial institution

for the taxable year, plus 8¢ per $1,000 of the institution's Maine assets as of the end of its taxable year, or (2) 39¢ per $1,000 of

the institution's Maine assets as of the end of its taxable year.

(m) Business and manufacturing corporations pay an additional tax of $2.60 per $1,000 on either taxable Massachusetts

tangible property or taxable net worth allocable to the state (for intangible property corporations). The minimum tax for both

corporations and financial institutions is $456.

(n) In addition, Minnesota levies a 5.8% tentative minimum tax on Alternative Minimum Taxable Income. Minnesota also

imposes a surtax ranging up to $10,380.

(o) Montana levies a 7% tax on taxpayers using water's edge combination. The minimum tax per corporation is $50; the $50

minimum applies to each corporation included on a combined tax return. Taxpayers with gross sales in Montana of $100,000

or less may pay an alternative tax of 0.5% on such sales, instead of the net income tax.

(p) New Hampshire’s 7.7% Business Profits Tax is imposed on both corporations and unincorporated associations with gross

income over $50,000. In addition, New Hampshire levies a Business Enterprise Tax of 0.675% on the enterprise base (total

compensation, interest and dividends paid) for businesses with gross receipts over $208,000 or enterprise base over $104,000,

adjusted every biennium for CPI. The Business Profits Tax is scheduled to decrease to 7.5% for tax year 2021.

(q) New Jersey also imposes a 1.5% surtax on taxpayers with income over $1 million in tax year 2020. Small businesses with

annual entire net income under $100,000 pay a tax rate of 7.5%; businesses with income under $50,000 pay 6.5%. The

minimum Corporation Business Tax is based on New Jersey gross receipts. It ranges from $500 for a corporation with gross

receipts less than $100,000, to $2,000 for a corporation with gross receipts of $1 million or more.

(r) New York’s General business corporate rate shown. Corporations may also be subject to a capital stocks tax, which is

being phased out through 2021. A minimum tax ranges from $25 to $200,000, depending on receipts ($250 minimum for

banks). Certain qualified New York manufacturers pay 0%.

(s) North Dakota imposes a 3.5% surtax for filers electing to use the water’s edge method to apportion income.

(t) Ohio no longer levies a tax based on income (except for a particular subset of corporations), but instead imposes a

Commercial Activity Tax (CAT) equal to $150 for gross receipts sitused to Ohio of between $150,000 and $1 million, plus

0.26% of gross receipts over $1 million. Banks continue to pay a franchise tax of 1.3% of net worth. For those few corporations

for whom the franchise tax on net worth or net income still applies, a litter tax also applies.

(u) Oregon’s minimum tax for C corporations depends on the Oregon sales of the filing group. The minimum tax ranges from

$150 for corporations with sales under $500,000, up to $100,000 for companies with sales of $100 million or above.

(v) South Carolina taxes savings and loans at a 6% rate.

(w) Texas imposes a Franchise Tax, otherwise known as margin tax, imposed on entities with more than $1,130,000 total

revenues at rate of 0.75%, or 0.375% for entities primarily engaged in retail or wholesale trade, on lesser of 70% of total

revenues or 100% of gross receipts after deductions for either compensation or cost of goods sold.

FEDERATION OF TAX ADMINISTRATORS -- FEBRUARY 2020

You might also like

- Oakland Raiders Las Vegas Project Pro Forma SpreadsheetDocument8 pagesOakland Raiders Las Vegas Project Pro Forma SpreadsheetZennie Abraham0% (1)

- CIR vs. PNB 736 SCRA 609 2014 VELOSODocument2 pagesCIR vs. PNB 736 SCRA 609 2014 VELOSOAnonymous MikI28PkJc100% (2)

- Carlos Superdrug Corporation vs. DSWD, Et Al., Test of Police PowerDocument2 pagesCarlos Superdrug Corporation vs. DSWD, Et Al., Test of Police PowerRoward100% (1)

- DT20195775183 PDFDocument18 pagesDT20195775183 PDFAbs SriNo ratings yet

- State Income Tax RatesDocument2 pagesState Income Tax RatesKoko U.No ratings yet

- Template DCF Model Exoon Mobil CaseDocument1 pageTemplate DCF Model Exoon Mobil Casehoifish100% (1)

- Boring Logs - 2022Document13 pagesBoring Logs - 2022Drawing HacksNo ratings yet

- Khushal Rathod 40H249 Tax Regime Comparison20-21Document3 pagesKhushal Rathod 40H249 Tax Regime Comparison20-21yogesh kumar jaiswalNo ratings yet

- 40 - Shahin Selkar - Texas High Speed Rail Corp. - FCF-ECF & WACC WorkingsDocument24 pages40 - Shahin Selkar - Texas High Speed Rail Corp. - FCF-ECF & WACC Workingsshahin selkarNo ratings yet

- BH 1Document28 pagesBH 1Probal ProsoilNo ratings yet

- Mar 8 16 Masville PDFDocument1 pageMar 8 16 Masville PDFMingVitugNo ratings yet

- Reasoning Ability: Groundnut 120º Sunflower 75ºDocument6 pagesReasoning Ability: Groundnut 120º Sunflower 75ºanaswara santhoshNo ratings yet

- FK High Low SS Final AmmendedDocument9 pagesFK High Low SS Final AmmendedSri WatsonNo ratings yet

- Pow 17J00012Document41 pagesPow 17J00012amroussyNo ratings yet

- Plantillas Excel Vio - IiDocument29 pagesPlantillas Excel Vio - IiEduardo Lopez-vegue DiezNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report August 05, 2021Document9 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report August 05, 2021Jun GomezNo ratings yet

- What Secrets Does The Data Hold?: Jan D. FreitagDocument40 pagesWhat Secrets Does The Data Hold?: Jan D. Freitagjgevertz911No ratings yet

- 16 S Appendix 2Document18 pages16 S Appendix 2Jox GullaNo ratings yet

- Ada170798 PDFDocument287 pagesAda170798 PDFOmar José Rojas RuedaNo ratings yet

- 8 - 0E IDU-680 (Rotorcraft) (200-350)Document151 pages8 - 0E IDU-680 (Rotorcraft) (200-350)Alikhan TalgatulyNo ratings yet

- Oakland Raiders Las Vegas NFL Stadium Spreadsheet by Zennie AbrahamDocument11 pagesOakland Raiders Las Vegas NFL Stadium Spreadsheet by Zennie AbrahamZennie AbrahamNo ratings yet

- Project Report: OF M/S Maa Janki Warehouse (Proprietor: Brijlata Chouhan) (Finance Required: 120 Lakhs)Document17 pagesProject Report: OF M/S Maa Janki Warehouse (Proprietor: Brijlata Chouhan) (Finance Required: 120 Lakhs)SHUBHAM SHRIVASTAVANo ratings yet

- S INDHUDocument22 pagesS INDHUsiddharth gautamNo ratings yet

- Oakland Raiders Las Vegas NFL Stadium SpreadsheetDocument11 pagesOakland Raiders Las Vegas NFL Stadium SpreadsheetZennie AbrahamNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report June 01, 2020Document9 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report June 01, 2020craftersxNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report August 04, 2021Document9 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report August 04, 2021Jun GomezNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report August 04, 2021Document9 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report August 04, 2021Jun GomezNo ratings yet

- SLR Liability Upto 31.12.2021Document26 pagesSLR Liability Upto 31.12.2021SLR GKPNo ratings yet

- Appendix C - Unit Pipe Prices C.1 Introduction and SummaryDocument42 pagesAppendix C - Unit Pipe Prices C.1 Introduction and Summarywkwk wkwkNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report October 09, 2018Document9 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report October 09, 2018hezeNo ratings yet

- Adilabad District Action PlanDocument18 pagesAdilabad District Action PlanBUKA RAMAKANTHNo ratings yet

- Ancebmm Auto-Care Center - Vol. III ADocument268 pagesAncebmm Auto-Care Center - Vol. III AAria RosarioNo ratings yet

- Consolidated Results 4Q20: AT&T 4Q20 HighlightsDocument3 pagesConsolidated Results 4Q20: AT&T 4Q20 Highlights田原純平No ratings yet

- Projected Cash Flow Statements and Balance SheetDocument15 pagesProjected Cash Flow Statements and Balance Sheetcabbage_donNo ratings yet

- APN BA6-7 Book 部分22Document3 pagesAPN BA6-7 Book 部分22蒋文政No ratings yet

- PD InterestDocument2 pagesPD InterestKamal ChughNo ratings yet

- Flats Sequencing System Update: Mailer Technical Advisory Committee (MTAC)Document20 pagesFlats Sequencing System Update: Mailer Technical Advisory Committee (MTAC)postaltexan100% (1)

- Sprinkler CalculationDocument16 pagesSprinkler CalculationMeeran MohideenNo ratings yet

- Payroll SummaryDocument3 pagesPayroll Summarynicole.upperNo ratings yet

- Factsheet Jpmorgan Asia Pacific Income FundDocument2 pagesFactsheet Jpmorgan Asia Pacific Income FundNadeem LalaniNo ratings yet

- Stockquotes 07082020 PDFDocument9 pagesStockquotes 07082020 PDFMarlon DNo ratings yet

- 6int 2005 Dec ADocument7 pages6int 2005 Dec Aapi-19836745No ratings yet

- Stockquotes 12012020 PDFDocument9 pagesStockquotes 12012020 PDFXander 4thNo ratings yet

- (A) Scheduled of Dep As Per WDV MethodDocument4 pages(A) Scheduled of Dep As Per WDV MethodtusharNo ratings yet

- (A) Scheduled of Dep As Per WDV MethodDocument4 pages(A) Scheduled of Dep As Per WDV MethodtusharNo ratings yet

- Jaakkola Only) (Compatibility Mode)Document12 pagesJaakkola Only) (Compatibility Mode)wawy66No ratings yet

- Memorandum: TO: JBC Members From: John Ziegler Subject: June Revenue Forecast Date: September 21, 2009Document10 pagesMemorandum: TO: JBC Members From: John Ziegler Subject: June Revenue Forecast Date: September 21, 2009Circuit MediaNo ratings yet

- Ey-570 Trim Sheet Bae Rj100: Cargo Compartment IndexDocument1 pageEy-570 Trim Sheet Bae Rj100: Cargo Compartment Indexali4957270No ratings yet

- DME Absorbing Unit Simulation Using PRO/II With ProvisionDocument28 pagesDME Absorbing Unit Simulation Using PRO/II With ProvisionridhajamelNo ratings yet

- Evans June 10th ReportDocument7 pagesEvans June 10th ReportMitch RyalsNo ratings yet

- Injury Statistics Work Related Claims 2020 Provisional Tables For 2020Document15 pagesInjury Statistics Work Related Claims 2020 Provisional Tables For 2020Carolyn EggersNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report March 18, 2021Document9 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report March 18, 2021Xander 4thNo ratings yet

- Stockquotes 02112014 PDFDocument8 pagesStockquotes 02112014 PDFJohn Paul Samuel ChuaNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report November 08, 2019Document9 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report November 08, 2019craftersxNo ratings yet

- Exhibit 1 Selected Pinkerton's Financial Data (In $millions)Document1 pageExhibit 1 Selected Pinkerton's Financial Data (In $millions)Abhishek KumarNo ratings yet

- Nike Inc - Cost of Capital - Syndicate 10Document16 pagesNike Inc - Cost of Capital - Syndicate 10Anthony KwoNo ratings yet

- PD6IP Plan-Concasnic V1.1 - 05may21Document3 pagesPD6IP Plan-Concasnic V1.1 - 05may21JoseRiveraNo ratings yet

- Annexure D - For Cable Cellar MVWS SystemDocument1 pageAnnexure D - For Cable Cellar MVWS Systemsujay AvatiNo ratings yet

- The Philippine Stock Exchange, Inc. Daily Quotation Report: February 09, 2022Document11 pagesThe Philippine Stock Exchange, Inc. Daily Quotation Report: February 09, 2022craftersxNo ratings yet

- B.O.Q. (BUILT-UP) : S.No. Partmark Description Qty. Unit Weight WeightDocument1 pageB.O.Q. (BUILT-UP) : S.No. Partmark Description Qty. Unit Weight WeightChandan VatsNo ratings yet

- Stockquotes 02012023Document13 pagesStockquotes 02012023Jonathan M.No ratings yet

- The Art of Credit Derivatives: Demystifying the Black SwanFrom EverandThe Art of Credit Derivatives: Demystifying the Black SwanRating: 4 out of 5 stars4/5 (1)

- Modern Portfolio Management: Moving Beyond Modern Portfolio TheoryFrom EverandModern Portfolio Management: Moving Beyond Modern Portfolio TheoryNo ratings yet

- Sales Reviewer Judge AdvientoDocument54 pagesSales Reviewer Judge Advientoandreaivydy1993No ratings yet

- Digested Cases in Civil LawDocument60 pagesDigested Cases in Civil LawLyndon Cris FuentesNo ratings yet

- ICT Enabled Land Administration Systems For Sustainable Development - The Danish WayDocument16 pagesICT Enabled Land Administration Systems For Sustainable Development - The Danish WayGoran KrnjaicNo ratings yet

- Concepts of Donation and DonorDocument7 pagesConcepts of Donation and DonorbeverlyrtanNo ratings yet

- Inflation or Gold StandardDocument34 pagesInflation or Gold StandardHal Shurtleff100% (2)

- 2019 PROBLEM EXERCISES IN INCOME TAXATION and TRAIN LAW (B)Document11 pages2019 PROBLEM EXERCISES IN INCOME TAXATION and TRAIN LAW (B)MGVMonNo ratings yet

- LBO BMC Course Manual - 639b9f6484ec3Document151 pagesLBO BMC Course Manual - 639b9f6484ec3Marc ONo ratings yet

- Advance Receipt Voucher: Reversal of Ibibo Service Fee INR 0.0 Effective Discount INR 0.0Document1 pageAdvance Receipt Voucher: Reversal of Ibibo Service Fee INR 0.0 Effective Discount INR 0.0Ranjith RaviNo ratings yet

- Forbes USA - 25 May 2015.bakDocument156 pagesForbes USA - 25 May 2015.bakhugosalazarNo ratings yet

- RFP For KL IIIDocument98 pagesRFP For KL IIIMausam ShresthaNo ratings yet

- 2019 Tax LMTDocument26 pages2019 Tax LMTchristineNo ratings yet

- The Impact of Capital Structure On The Performance of Microfinance InstitutionsDocument17 pagesThe Impact of Capital Structure On The Performance of Microfinance InstitutionsMuhammadAzharFarooqNo ratings yet

- John Hay Peoples Alternative Coalition Vs LimDocument2 pagesJohn Hay Peoples Alternative Coalition Vs LimDennice Erica DavidNo ratings yet

- Environmental Plan Implementation, Legal Aspects, and AdministrationDocument19 pagesEnvironmental Plan Implementation, Legal Aspects, and AdministrationSure ConsultancyNo ratings yet

- Vietnam Wine - Final Report - 11.12.2014Document17 pagesVietnam Wine - Final Report - 11.12.2014kateanh2501100% (1)

- Analyst PresentationDocument59 pagesAnalyst Presentationsoreng.anupNo ratings yet

- BIR Ruling No 434-12Document3 pagesBIR Ruling No 434-12Em EmNo ratings yet

- An Overview of VAT Law Book1Document44 pagesAn Overview of VAT Law Book1Sema Rani KarmokerNo ratings yet

- Galvez, Glennizze M. Bsat - 4 YrDocument4 pagesGalvez, Glennizze M. Bsat - 4 YrGlenn GalvezNo ratings yet

- Business Plan: This Business Plan Was Prepared by XYZ To Apply For Turkish Businessperson VisaDocument19 pagesBusiness Plan: This Business Plan Was Prepared by XYZ To Apply For Turkish Businessperson VisaSenateriyaNo ratings yet

- Circular Flow of DiagramDocument41 pagesCircular Flow of DiagramRishit KapoorNo ratings yet

- Local TaxationDocument28 pagesLocal TaxationGemale PHNo ratings yet

- Working Paper 5 - Hong Kong Air Cargo - Final (v4)Document31 pagesWorking Paper 5 - Hong Kong Air Cargo - Final (v4)Aniketh Roy ChoudhuriNo ratings yet

- Transfer PricingDocument22 pagesTransfer PricingParamjit Sharma100% (20)

- Impact of GST On Manufacturers, Distributor, and RetailersDocument4 pagesImpact of GST On Manufacturers, Distributor, and RetailersAnkit GuptaNo ratings yet

- EC345 2022 - 23 Week 10 Welfare and PolicyDocument60 pagesEC345 2022 - 23 Week 10 Welfare and Policyfilipa barbosaNo ratings yet

- BinocsTaxReportFY2022-23 Ankit KumarDocument7 pagesBinocsTaxReportFY2022-23 Ankit KumarMayuresh SinghNo ratings yet