Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

44 viewsHome Office and Branch Accounting General Procedures PDF

Home Office and Branch Accounting General Procedures PDF

Uploaded by

Christine Joy LanabanCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5835)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (350)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (824)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (405)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Hebner Housing Corporation: Sales 1,250,000Document3 pagesHebner Housing Corporation: Sales 1,250,000Christine Joy LanabanNo ratings yet

- Construction Contracts-Journal EntriesDocument2 pagesConstruction Contracts-Journal EntriesChristine Joy Lanaban100% (1)

- Name: - Course and Year: - Problem No. 1Document2 pagesName: - Course and Year: - Problem No. 1Christine Joy LanabanNo ratings yet

- Seatwork 01 Statement of Financial PositionDocument3 pagesSeatwork 01 Statement of Financial PositionChristine Joy LanabanNo ratings yet

- Consignment Sales MillanDocument6 pagesConsignment Sales MillanChristine Joy LanabanNo ratings yet

- Home Office and Branch Accounting-ExerciseDocument2 pagesHome Office and Branch Accounting-ExerciseChristine Joy LanabanNo ratings yet

- Problem 12-1Document1 pageProblem 12-1Christine Joy LanabanNo ratings yet

- Home Office and Branch Accounting-Exercise PDFDocument2 pagesHome Office and Branch Accounting-Exercise PDFChristine Joy LanabanNo ratings yet

- Seatwork 02 Statement of Income (TEST I) Multiple Choice: Shade Your Answer With YELLOWDocument5 pagesSeatwork 02 Statement of Income (TEST I) Multiple Choice: Shade Your Answer With YELLOWChristine Joy LanabanNo ratings yet

- Quizzer Financial Position and Income StatementDocument9 pagesQuizzer Financial Position and Income StatementChristine Joy LanabanNo ratings yet

- Gross Profit in Prior YearsDocument2 pagesGross Profit in Prior YearsChristine Joy LanabanNo ratings yet

- Consumption Savings Investment. ParadoxDocument46 pagesConsumption Savings Investment. ParadoxChristine Joy LanabanNo ratings yet

Home Office and Branch Accounting General Procedures PDF

Home Office and Branch Accounting General Procedures PDF

Uploaded by

Christine Joy Lanaban0 ratings0% found this document useful (0 votes)

44 views23 pagesOriginal Title

Home-Office-and-Branch-Accounting-General-Procedures.pdf

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

Download as pdf

0 ratings0% found this document useful (0 votes)

44 views23 pagesHome Office and Branch Accounting General Procedures PDF

Home Office and Branch Accounting General Procedures PDF

Uploaded by

Christine Joy LanabanCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

Download as pdf

You are on page 1of 23

Chapter 1]

Home Office And

Branch RC at Ye

General Procedures

In their effort to generate more sales, business firms usually widen the geographical

area they cover. Their services are available in more areas through their travelling

salesmen or by shipments on consigment, Frequently however, better results are

achieved with new sales outlets established at strategic locations. The creation of

these outlets develops business in distant areas or improves the company’s share

of existing markets through more effective and efficient contact with the customers.

Selling activities are undertaken by the different sales offices at the direction of

the home office. Hence, customers need not deal with the far away head office

but with the nearest operating sales unit. The desired goods, services and

information are made more readily availabe to customers

The new sales outlets may be organized as sales agencies or branches. Regardless

of which form of operation is used, the financial statements of each separate unit

are combined with those of the controlling unit to come up with financial statements

of the economic entity as a whole

Sales Agency and Branch Di

inguished

While both the sales agency and the branch office are vehicles for enlargingsales volume,

they exhibit a number of significant operational differences. A sales agency usually

carries line of samples or displays merchandise but doesshot tarry stocks of it. Orders

are taken from customers and sent to the home office for approval of credit. The ‘home

office then ships the merchandise directly to the customers. The receivable accounts are

maintained in the home office which also performs the collection fiction. A working

fund for sales agency expenses is provided by the home office and replenished when

exhausted. No other cash is handled by the sales agency.

451

452 Chapter)

On the other hand, branch office normally Carries stocks of merchandise, which may

be obtained solely from the home office or a portion may be purchased from outside

suppliers. The branch makes the usual warranties with respect to quality, makes collections

of accounts receivable, and functions in most respect as an independent business unit,

Abranch may be restricted until it isa little more than a sales agency. A sales agency

may be expanded until it resembles a branch. The accounting procedures discussed in

this chapter are for strictly defined sales agencies and brar:zhes.

ACCOUNTING SYSTEM FOR SALES AGENCIES.

The accounting process for the operation of a sales agency does not introduce any new

accounting problem because a sales agency is simply an extension of existing sales

territories. A sales agency neither keeps a complete set of books nor uses a double-

entry system of accounts. Ordinarily, a record of sales to customers and a list of cash

payments supported by vouchers are sufficient. An imprest system is usually-adopted >

by the home office for the working fund of the sales agency.

che entries made by the home officedepend on whether sales agency net income is

determined separately or not separately. If the home office wants to determine the net

income of each of its sales agencies separately, it must maintain in the general ledger

distinct revenue and expense accounts in the name of the sales agency. For example,

Sales — Sales Agency, Rent Expense — Sales Agency. The cost of goods sold of each

agency must also be determine. If the perpetual inventory system i used, shipments to

customers of the sales agencies are debited to Cost of Goods Sold —Sales Agency and

credited'to Merchandise Inventory. On the other hand, if the periodic inventory system

is maintained, shipments to sales agency customers are recorded by debiting Cost of

Goods Sold — Sales Ageney and crediting Shipments of Merchandise ~ Sales Agency.

‘At the end of the accounting period, the account Shipments of Merchandise —Sales

Agency is deducted from the total of beginning inventory and purchases to determine

the cost of goods available for sale by the home office for its own operations.

If the home office electsnotto determine separately the sales agency net income, the

transactions of the sales agency are recorded in the home office’s own revenue and

expense accounts. Upon closing the books, the Income Summary account shows the

results of both operations.

When the home office transfers fixed assets to the sales agencies, the home office debits

aan appropriate asset account identified with the sales agency (For example, Furniture

and Fixtures ~ Sales Agency) and credits the appropriate asset account.

Home Office And Branch Aecounting ~ General Procedures 453

Illustrative Entries

‘Assume a Manila Trader, Inc. established a sales agency in Cebu. The revenues and

coer of the home office are recorded separately from those of the sales agency.

loreover, operating results of the sales agency and the home office are determined

separately at the end ofeach accounting period.

The accounting entries prepared by Manila Trader, Inc. as a result of the establishment

of Cebu Agency and the subsequent activities are shown in Illustraiton 11-1. Assume

that the home office uses the’periodic inventory system.

Mlustration 11-1

Transactions Home Office Books

1. Aworking fund of P10,000 is Working Fund-Cebu Agency 10,000

established Cash 10,000

2. Shipped merchandise to ‘Samples Inventory-Cebu

Cebu Agency for use as samples, Agency’ 2,000

2,000. ‘Shipments to Agency 2,000

3 sales orders from Cebu Accounts Receivable 90,000

Agency, P90,000. Sales-Cebu Agency 90,000

4. Cost of goods sold identified Cost of Sales-Cebu Agency 60,000

with agency sales, P60,000. ‘Shipments to Agency 60,000

5, Replenishment of working fund Various expense accounts-

ofthe agency, P8,000. Cebu Agency 8,000

Cash 8,000

6. Close revenue and expense Sales-Cebu Agency 90,000

accounts of the agency Cost of Sales-Cebu Agency 60,000

Various expense accounts-

Cebu Agency 8,000

Cebu Agency Income 22,000

2 ‘Agency income to Cebu Agency Income 22,000

Chase Ca Income Summary 22,000

Income Summary account.

From the above entries,

assets, revenues, and expen

the home office computes the income o

it can be seen how

the books of the home office. The home office specifically. e

Ta snses as relating to the sales agency. ‘At the end of the period,

ei f the agency to evaluate its operation.

the operations of the sales agency are

esignate all

454 Chapter!

ACCOUNTING FOR BRANCH OPERATIONS

Normally, the home office and the branch maintain separate accounting systems. Each

maintains a full set of books with a complete self-balancing set of accounts. Each records

its transactions with outside parties in its own accounting system in the usual manner. In

addition, both the hor the branch must record transactions with one another

(inter-office transactions) in their respective accounting systems.

Even though the home office and each branch maintain separate books, all accounts are

combined for external reporting so that the external financial statements w ill represent

the company asa single economic enterprise. As to the preparation of combined financial

statements, by just adding together the balances of the accounts in each accounting

system will not result in the presentation ofa single economic entity. Certain elimination

is necessary.

Reciprocal (Intracompany) Accounts

‘Transactions with outside parties are recorded in the usual manner. Transactions between

the home office and a branch are recorded in intracompany accounts, These accounts

are reciprocal accounts between the home office and the branch. When the books of

both the home office and the branch arecompletely up to date, the balance in a reciprocal

account on the home office books will be uit opposite that of the related reciprocal

account on the bratich books. For example, ifa reciprocal account on the home office

books has a P50,000 debit balance, the related reciprocal account on the branch books

should have a credit balance of the same amount.

The reciprocal account on the books of the home office often is called Investmentin

Branch or Branch Current, while the reciprocal account on the branch books may be

labeled Home Office or Home Office Current. When a company has several branches,

separate investment account for each branch ismaintained on the home office books.

‘The balance of the Investment in Branch account shows the extent of the home office’s

investment in a particular branch. The reciprocal Home Office account on the books of.

the branch represents the home oflice’s equity in the branch and the balance is shown in

place of owner’s equity in the separate financial statements of the branch.

The balances of the two reciprocal accounts: sara isied for the same inter-company

transactions. The account balances are ine! for asset transfers from the home

office to the branch and decreased for asset transfers from the branch to the home

office. Adjustments to the accounts are also made for profits and losses of the branch,

vt profits increasing the account balances and branch losses leading to a

coe a that increases in the home office’s Investment in Branch account are

“complished with debit entries and decreases with credit entries. The opposite is true

with respect to the Branch’s Home Office account.

Home Office And Branch Accounting — General Procedures ve.

The reciprocal nature of the Investment in Branch and the Home Office accounts, and

the way in which they are affected by various transactions, can be shown as follows:

(Home Office Books) (Branch Books)

Home Office

Investment in Branch

2K Asset transfers to branch XXX

XXX

XXX Asset transfers fom branch

XXX Branch profit XXX

XXX Branch loss XXX

Establishment of Branch

When a company establishes a branch, the transfer of a

by the home office in the Investment in Bran

the transfer with an entry to the Home Office accot

Corporation of Makati, establishes a branch in Cebu. The home office transfers to the

branch P100,000 in cash, new office equipment that cost P20,000. The home office

records the transfer with the following entry:

H(1)_ Investment in Cebu Branch 120,000

100,000

Cash

Office Equipment 20,000

foumal entries are numbered consecutively throughout the chapter so that each

‘ed. Those entries made on the home office books are designated in this

hile those on the branch books are identified with B.

Note: J

entry is identifi

chapter by H, w!

Cebu branch records the transfer of assets from the home office with the following

entry:

BQ) Cash 100,000

Office Equipment 20,000

Home Office 120,000

Note that after both the home office and the branch have recorded the transfer, the

Investment jin Cebu Branch account on the home office books and the Home Office

account on the branch books have reciprocal balances of P120,000.

456 Chapteri}

Recognition of Branch Income or Loss

Income for each branch is computed periodically in the normal manner. Branches eldom)

compute income taxes on individual income or record income tax expense on their

books. Because the home office and its branches are separate legal entities, income

taxes are computed for the company as a whole.

All of the branch’s revenue and expense accounts are closed to its Income Summary

account in the usual manner. The balance of the Income Summary account represents

the branch’s income or loss, and is closed to the Home Office account. The Home

Office account serves in place of retained earnings and other owners’ equity accounts

on the books of the branch. When the branch income or loss is reported to the home

office, an entry is made on the home office books to recognize the income or loss of the

ich.

For example, assume there isa credit balance of P60,000 in the Cebu branch’s Income

Summary account at the end of the Cebu branch:

BG) Income Summary 60,000

Home Office 60,000

Close income summary.

Upon receiving a report of Cebu branch’s income for the period, the home office records

the followingentry:

H(4) Investment in Cebu Branch 60,000

Cebu Branch Income 60,000

Record Cebu branch income.

These entries maintain the reciprocal relationship of the Investment in Cebu Branch.

account and the Home Office account.

Merchandise Shipments to a Branch

Merchandise sold by the branch may be obtained éntirely from the home office ort

may be allowed to acquire some merchandise from outside parties. Purchases of

merchandise from outsiders are recorded in the normal manner. Cebu branch purchases

P10,000 of merchandise from outside parties, and the branch uses a periodic inventory

system, the branch records the transaction as follows:

BOS) Purchases 10,000

Cash or Accounts Payable 10,000

Record purchase of merchandise from outsiders

Home Office And Branch Accou i

ting ~ General Procedures “

Under the perpetual i

When merchandise a ony stem Inventory accountis debited instead of Purchases,

the branch must record the cones from the home toa branch, both the home office and

branch eitherat the original fer. Merchandise is transferred from the home office toa

“cost. In this chapter gf ne cot! the home office or at some amount in excess of that

£08 Preronly the merchandise transfer at original cost will be discussed.

eee ee at Cost. Both the home office and the branch treat the transfer

that AMG's home offen nya the transfer of any other asset, To illustrate, assume

hanchand the rece transfers merchandise with a cost of P80,000 to its Cebu

h use periodic i : 0

the home office books with the ‘Ellowi ie ony system. The transfer is recorded on

H(6) Investment in Cebu Branch 80,000

Shipments to Branch :

Transfer of merchandise to Cebu branch.

80,000

The balance of the Shipments to Branch account is subtracted from the total of beginning

inventory and purchases in the computation of the home office's cost of goods sold for

the period. This reduces the total goods available for sale and avoids an overstatement

of cost of goods sold.

‘The branch records the merchandise received with the following entry:

B(7) Shipments from Home Office 80,000

Home Office 80,000

Transfer of merchandise fiom home office.

The Shipments from Home Office account on the branch books is inch

computation of the branch's cost of goods sold as an addition to purchases; itincreases >

the branch's total goods available for sale.

The home office's Shipments to Branch account and the branch's Shipments from Home

Office account are nominal accounts and therefore closed at the end of the period to

Income Summary account together with the other revenue and expense accounts.

es on Merchandise Shipments. Freight costs incurred in shipping

Freight Chargé

merchandise from the home office toa branch become part of the cost of the branch

‘ume that AMG's home office pays P5.000 to transport

inventory. For example, ass'

80,000 of merchandise tot

office with the following entry:

H(8)_ Investment in Cebu Branch 85,000

Shipments to Branch 50,000

he Cebu branch. The transfer is recorded by the home

Cash S

Transfer of merchandise to Cebu branch.

458 Chaptert

ae ee ern ae uisld

Cebu branch records the transfer as follows:

BQ) Shipments from Home Office 80,000

Freight-In 5,000

‘Home Office 85,000

Transfer of merchandise from home office.

Accounting for Branch Plant Assets

‘The procedures to be used in accounting for branch plant assets will depend on whether

branch plant assets are recorded in the branch books or in the home office books.

Ifbranch plant assets are recorded in the books of the branch, and plant assets are

purchased by the home office for the branch, an entry is required on the books ofboth

the home office and the branch. Asan illustration of this, assume that the home office

purchases P30,000 of office equipment for its Cebu branch. The home office records

the purchase with the following entry:

H(10) Investment in Cebu Branch 30,000

Cash 30,000

Purchase of equipment for Cebu branch.

The purchase is recorded by the branch with the following entry:

BUI) Office Equipment 30,000

Home Office 30,000

Purchase of equipment by the home office.

If branch plant assets are recorded in the books of the home office rather than on the

books of the branch, no entry is needed on the books of the branch if the ome offie

makes thepurchase? For example, if the home office purchases P30,000 of office

equipment for the Cebu branch, the home office records the purchase as follows:

H(12) Office Equipment - Cebu Branch 30,000

Cash 30,000

Purchase of equipment for Cebu branch.

No entry is recorded on the books of the branch.

Home Office And Branch Ace

inch Accounting — General Procedures eae

On the other hand, i ms =

aatheborepme ns ‘lant assets that are recorded on the Books

example, assume ieee are needed by both the home office and the branch. As an

by the branch. The brane eran Purchases P30,000 of office equipment to be used

ranch records the purchase with the following entry:

B(12) Home Ofice 30,000

Cash

: 0,000

Purchase of equipment. :

The home office records the purchase as follows:

H(13) Office Equipment - Cebu Branch 30,000

Investment in Branch 201000

Purchase of branch equipment by Cebu branch

‘When the branch purchases an asset that is carried on the home office books. the

balance of both the reciprocal accounts is redtged, The transaction is treated as ifthe

branch had purchased equipment for he home office.

Apportionment of Expenses

Branch expenses incurred and paid by the branch are recorded directly on the books of

the branch in the usual manner, However, the home office may allocate expenses to a

branch. These allocated expenses might be of several types:

a. Expenses incurred by the branch but paid by the home office.

b. Expenses incurred by the home office on behalf of the branch; for example,

depreciation on branch equipment carried on the home office books.

¢. Allocations of expenses incured by the home office: for example, aportion of the

cost of general advertising.

Illustration

Asan illustration of the treatment of the allocated home office expenses to the branch,

assume that the home office incurs the following expenses assigned to its: Cebu branch:

itilities expense (expenses incurred by Cebu branch

and billed to home office account) P15,000

Depreciation expense (on Cebu branch fixed assets

carried on home office books) 5000

‘Advertising expense (allocated to Cebu branch) 10,000

Total 30,000

ene ee) ie ee

460 Chapterty

‘The home office already has recorded these expenses in the usual manner, asifthey are

related to the home office. Periodically, the home office notifies the branch of the allocated

expenses. The home office records the following entry upon notifying the branch of the

P30,000 of allocated expenses:

30,000

H(I4) Investment in Cebu Branch

Utilities Expense tO

Déprecaition Expense 008

Advertising Expense

Allocated expenses to Cebu branch,

Upon notification of the expenses by the home office, the branch, records the expenses

as follows:

B(IS) Utilities Expense 15,000

Depreciation Expense 5,000

Advertising Expense 10000 oa

Home Office

Allocated expenses from the home office.

Without these entries, the home office income would be understated and the branch

income overstated.

PREPARATION OF COMBINED FINANCIAL STATEMENTS

In the preparation of combined financial statements for the company, the accounts of

the home office and its branches are combined. Reciprocal or intracompany account

balances must be eliminated becausse they relate to activities within the company rather

than activities between the company and outside parties.

To facilitate the preparation of combined financial statements, a working paper normally

is used to combine the accounts of the home office and its branches, and to eliminate the

reciprocal accounts. All eliminations are only made in the working paper, not on the

separate books of the units being combined.

Illustration

As anillustration of the basic working elimination entries needed to prepare combined

financial statements for a company with branch operations, assume the following balances

of the reciprocal accounts on December 31, 201 6 after adjusting and closing entries

have been prepared:

Investment in Branch P295,000

Home Office 295,000

Shipments to Branch 85,000

85,000

Shipments from Home Office

Home Offic

To facilitate the preparation of comb;

working paper is to be used, T

needed: The fol

ce And Bra inch Accounting. General Procedures 7

ined financial statements on December 31, 2016,

lowing working paper elimination entries (E) are

E(16) Home Office

295,000

Investment in Branch ee

Eliminate reciprocal accounts,

E(I7) Shipments to Branch 00)

Shipments from Home Office

5 85,000

Eliminate shipments of merchandise.

These entries do not appear on the books of either the home office or the branch. A

working paper for combining the accounts of a home office and a branch is illustrated in

the next section,

ACCOUNTING FOR BRANCH OPERATIONS ILLUSTRATED

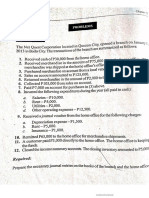

Asacomprehensive illustration of accounting for branch operations, assume that MCG,

Inc. of Quezon City, a distributor of computer equipment, establishes a branch sales

office in Cebu City. Both the home office and the branch use the periodic inventory

system. Branch fixed assets are recorded on the home office books. Transactions during

2016, the first year of branch operations, are summarized below:

a.

b

©

a

e

rae

Cash is sent to Cebu branch, P10,000.

Merchandise is shipped to the branch at cost, P100,000.

Store equipment is purchased by the branch and carried in the home office books,

5,000.

Credit sales:

Home office, P450,000.

Branch, P120,000.

Collection of accounts receivable:

Home office, P500,000.

Branch, P110,000.

Operating expenses paid:

Home office, P76,000.

Branch, P30,000.

Cash remittance by Cebu branch to home office, P50,000.

Operating expenses charged by home office to branch, P6,000.

462 Chapter}

‘The journal entries to record the 2016 transactions on the books of MCG’s home

- office and the Cebu branch are shown in Ilustration 11-2. Thenecessary closing entries

on December 31, 2016 are presented in Illustration 11-3. In the journal entries recording

inter-office transactions, take note the reciprocal relationship of the reciprocal accounts,

Mlustration 11-2

Cebu Branch Books

Home Office Books

(a) Investment in Cebu Branch — 10,000 Cash 10,000

Cot 40,000 Home Office 10,000

Transfer of cash to Cebu Transfer of cash from

Branch home office.

(6) Investment 9 Cebu Branch 100,000 Shipment from HO 100.000

‘Shipment to branch 100.000 Home Office 100,000

Transfer of merchandise Transfer of merchandise

to branch From home office

(6) Store Equipment ~ Cebu Home Office 5.000

Branch 5.000 Cash 5.000

Investment in Cebu Office equipment purchase

Branch 5,000 ty the home office

Store equipment purchase

Jor the branch,

(a) Accounts Recetvable 450,000 Accounts Receivable 430,000

‘Sales 430,000 Sales 450,000

Sates of merchandise Sale of merchandise

(e) Cash 500,000 Cash 110,000

“decounts Receivabie. 500,000 “Accounts Receivable 110,000

Collections on account Collections on account

@ Operating Expenses 76,000 Operating Expenses 30,000

Cash 76,000 Cash 30,000

Operating expenses paid. Operaiing expenses paid

(g)Cash 50,000 Home Office 50,000

Timvestient in Cebu Cash 50,000

Branch $0,000 Cash remittance (0 home

Cash remittance from office

Cebu branch

(n) Invesiment in Cebu Branch 6,000 Operating Expenses 6,000

6,000 Home Office 6,000

Operating Expenses

Operating expenses

Operating expenses

allocated to Cebu branch. allocated by the home office.

off

Home Office And Branch Accounting —General Proceds

eneral Procedures

463

Closing Entri

to PA0,000. The cosines that the branch inventory on December 31, 2016 amounts

'g entries on the books of the Cebu branch and the home office

are presented below:

Mlustration 11-3

Home 01

Office Books Cebu Branch Books

1) Sates

, Income Summary fea Sales: ¥20,000

Ciara 450,000 oltre Simmary 120,000

(2) Income Summary ae

icc 290, Income Summary 460,000

Inventory, 12/31 90,000 Inventory, 123 40,000

Shipments to Branch 100,000. ‘Shipment from HO 100,000

ieawentrons “U7 0,000 Close cost of sales.

Purchases soainoe

Close of cost of sales

)income Summary 70,000 Income Summary 36,000

Operating Expenses 70,000 Operating Expenses 36,000

Close operating expenses. Close operating expenses

(A) Investment in Cebu Branch 24,000 Income Summary 24,000

Cebu Branch income 24,000 Home Office 24,000

Record income from Cebu Close income summary.

branch

(5)Cebu Branch Income 24,000

Income Summary 24,000

Close Cebu branch income

(6) Income Summary 114,000

114,000

Retained Earnings

Close income summary.

Note: Some of the amounts in closing entry (2) are

assumed.

464 Chapter?

After the entries in Illustrations 11-2 and 11-3 have been posted, the Investment in

Cebu Branch account on the books of the home office will have a debit balance of

85,000. The balance of the account is determined as follows:

Mlustration 11-4;

(Home Office Books)

Investment in Cebu Branch

Cash sent to branch P 10000 Equipment purchased by

branch recorded on

: home office books P 5,000

Merchandise shipped to Cash received from Cebu

Cebu branch 100,000 branch 50,000

Operating expenses charged

to Cebu branch 6.000

Cebu branch income 24,000 Balance forwarded 85,000

140,000

Balance P 85,000

On the other hand, the Home Office account on the books of the branch will have a

credit balance of P85,000 , determined as follows:

(Branch Books)

Home Office

Equipment purchased, recorded Cash received from home

in home office books 5.000 office P10,000

Cash sent to home office 50,000 Merchandise received

from home office 100,000

Operating expenses charged

by home office 6,000

Balance forwarded Netincome 24000

Balance 85,000

Home Office And Branch

ich Accounting ~ General Procedures seh

Separate Financial Statements

Normally, the brancl :

the we office ai neepe red its own financial statements so that the management of

the branch, The homecya evaluate the operating results and financial position of

‘gus citeleiareyt sere also prepares its own finacial statements so that it may

tly the results of its own operation and its own financial position.

Based on the data in Ilustration 11-2. separal i

-2, 11-3 and 11-4, the separate financial statements

for the branch and the home office are presented below and in the next page.

Ilustration 11-5

Financial Statements—Cebu branch:

MCG Company—Cebu Branch

‘Statement of Financial Position

December 31, 2016

Assets

Cash P 35,000

Accounts receivable 10,000

Inventory 40,000

Total P 85,000

Liabilities and Equity

Home Office 85,000

MCG Company~Cebu Branch

Statement of Comprehensive Income

For the Year Ended December 31, 2016

Sales P120,000

Cost of sales:

Shipment from home office 100,000

Inventory, December 31 40,000 60,000

Gross income 60,000

Operating expenses 36,000

P 24,000

Comprehensive Income

466 Chapter!)

Financial Statements — Home Office:

MCG Company—Home Office

‘Statement of Financial Position

December 31, 2016

Assets

— P 54,000,

Accounts receivable co

Inventory 20mm

Store equipment

Less: Accumulated depreciation LOO

Store equipment ~ Cebu branch Spot

Investment in branch —

Total

Liabilities and Equity

‘Accounts payable Resin)

Capital stock 200,000

84,000

Retained earnings

Total

MCG Company — Home Office

Statement of Comprehensive Income

For the Year Ended December 31,2016

Sales 450,000

Cost of sales:

Inventory, January I P 80,000

Purchases 400,000

Merchandise available for sale 480,000

Shipments to branch 100,000

Merchandise available for own sale 380,000

Inventory, December 31 90,000 290,000

Gross income 160,000

Operating expenses 70,000

Net income from own operation 90,000

Cebu branch income 24,000

114,000

Comprehensive income

Home Office And Branch Account

ting - General Procedures 457

Combined Financial Statements

Ca nance of the home office and the branch are prepared to show

ie eer ass transactions ofthe business entity with ouside. To achive this,

ETS tote be eliminated. To facilitate the preparation of combined

aaa, the tral beh arene. Two formats of working paper may

abut ee ince working paper and the three-section working paper. In

1 for branch operations the tral balance working paper is normally used. The

other format will be used in parent-subsidiary accountit

The combined statements workin; i i

¢ paper using the trial balance approach for MCG

Company for 2016 appears in lustation 11-6. “

The following elimination entries are required in the working paper:

Fl) Home Office 85,000

Investment in Cebu Branch 85,000

Eliminate Home Office account against Investment

in Branch account

EQ) Shipments to Branch 100,000

he 100,000

Shipments from Home Office

Eliminate Shipments to Branch and Shipments

from Home Office accounts

‘The following points should be noted in the working paper:

1, Accounts having debit balances are first listed followed by accounts with credit

balances. Beginning inventories are reported in the adjusted trial balances as debits;

these are to be recognized in arriving at cost of sales. Ending inventories are presented

as debits so that they may be recognized as assets in the preparation of the balance

ae Accordingly, they are also presented under the eredits so that they may be

recognized asdeductions: from cost of merchandise available for sale in arriving at the

ited under the credits should be the beginning

cost of sales. Retained earnings present

balance.

2. The Home Office account is eliminated agai

(elimination entry no. 1)

3.Shipments to Branch account is eliminated against the Shipments from Home Office

account (elimination entry no. 2).

ed financial statements for MCG Company prepared from the working

tration 11-6 are shown in Illustration 11-7.

inst the Investment in Branch account

The combin

paper in lus

Chapter

468

‘syuauucys asypuryouous Yo sjunodse 2p

OL (9)

“sjunoase je2oudtoe4 ay)

‘uo s9pun pourejurew Mou auP syo0g 991450 21t04 oL ()

yours. ap pus 201yo auoy ayy jo yuauidinbsy ax

Soares Toorerrd [ oTanEr [oo OEs yh Sees a) Goer bao

000'SLE__| 000°68r | 000°00L _| O00'98s__| O00"I9Id 000°19 1d eae

‘00008 O00 | 0006 Sy

00°18 td

000001 (9)

ooo'oesa ooor0et ‘

00°04 000°0L | Avenues “sBuyuzeo par

a90"00 00°00 sed 001d

" 00019 d () | 00019 A

000's8, 000's8 aiqes WINODdy

800% a 00" awaudba pue ate)

~ wontroaup pas

000°0E1 000°06 d| (gy fo

ve s4ts3oq1

000°901 00 $64

‘ ‘00002 sostodys Rusodg,

oo0'001 4) ny 1 5

000'00r o-ad coorooy | “0 aHou HoH sods

abe 20019 4 ) eo

000" =

00'0 oe 9

ones 000'rS a]

2 x 2 “@ 0 "G weung |e

a Po nawams Peau al 2m

(Pogues mete oDUp8 pg

a a

9107 *1¢ 4aquis29q papug sk9Q 104

Wwroueury pauyquiog soy sadeg Burys0A4

Auvdwwoy DOW

syuauay

S11 wonpasny

Home Office And Br:

'¢ Office And Branch Accounting - General Procedures =

Combined Financial Statements Illustrated

The el combined statements are easily prepared using the data found in the working

paper. The combined statements of MCG Company are presented below:

Mlustration 11-7

MCGCompany

‘Combined Statement of C1

For Year Ended December 31,2016

Sales 570,000

Cost of goods sold:

Inventory, January 1 P 80,000

Add Purchases 400,000

Cost of goods available for sale 480,000

Inventory, December 31 130,000 350,000

Gross profit 220,000

Operating expenses 106,000

Comprehensive income 114,000

MCGCompany

Combined Statement of Financial Position

December 31, 2016

Assets

Cash P 89,000

Accounts receivable 70,000

Inventory, December 31 130,000

Store equipment + 200,000

Less Accumulated depreciation 20,000 _ 180,000,

Total Assets PA69,000

Liabilities and Stockholders" Equity

Liabilities:

85,000

‘Accounts payable

Stockholders’ equity:

Capital stock, P100 par value 200,000

Retained earnings 184,000 _ 384,000

Total Liabilities and Stockholders’ Equity 469,000

470 Chapter}

RECONCILIATION OF RECIPROCALACCOUNTS

The Investment in Branch account on the home office books and the Home Office

account on the branch books are reciprocal accounts and theoretically, should have the

same balance at the end of the accounting period. However, this condition seldom»

€xistsin practice because of bookkeeping or mechanical errors such as. duplication of

entries, slides and transpositions on either set of books that have occured, or certain

transactions may already have been recorded by one office and not yet by the other, or

there isa time lag between the recording of the same transaction on’ the home office and

branch books.

The home office, for example, debits Investment in Branch account immediately upon

the shipment of merchandise to the branch. The branch, on the other hand, credits

Home Office account only at a later time when the merchandise are received, which

may be several days after the shipment by the home office. Another example of a

transaction which causes different balances in the two accounts is the remittance of cash

by the branch to the home office. Entry on the branch books of the cash remittance is

not recorded by the home office while the cash is still in transit The lack of agreement

between the reciprocal accounts poses no problem during the accounting period.

However, at the end of the accounting period, the reciprocal accounts must be brought

into agreement before combined financial statements are prepared.

‘The data to be considered in reconciling the two accounts may be classified as follows:

Debits in the Investment in Branch account without corresponding credits in the

Home Office account.

Credits in the Investment in Branch account without corresponding debits in the

Home Office account.

Debits in the Home Office account without corresponding credits in the Investment

1.

w

in Branch account.

Credits in the Home Office account without corresponding debits in the Investment

in Branch account.

5. Bookkeeping or mechanical errors on either set of books.

Home Office And Branch 4

ich Accounting ~ General Procedures 471

Se tome sie thet 3 pets Teconciling account balancesat, year-end, assume

following data on December 31,2016 records of Sweet Company contain the

Investment in Branch (Home Office Books)

Nov. 30 Balance

50,000 | Dee. 9 Cash recived from

ec. 1 Expenses paid chara branch 30,000

i vane chargeable ; 28 Collection of branch

iheniier econ 450 accounts restvable 5,000

Late 20,000 Balance forwarded 36,450

P71,450 71,450

Balance, December 31 eas oe

Home Office (Branch Books)

Dec, & Cash sent to home Nov. 30 Balance 50,000

oitice 30,000

29 Purchased office Abe panes 1540

equipment 8,000 28 Callection of home office

Balance forwarded 19,540 accounts receivable 6,000

757.540

Blane, December 31 Pi9,s40

‘Ananalysis of the accounts shows the existence of five reconcilling items, which are

discussed below.

1. Adebit of P20,000 in the Investment Branch account without a corresponding

credit in the Home Office account.

home office shipped merchandise to the branch in the amount

of P20,000. The shipment has not yet reached the branch as of December 31

ments appears on its books. The required

and, therefore, no entry for the ship pears

adjustment at year-end fortis type of reconcilingitem will bean entry on the

branch books as follows:

On December 30, the

‘Shipments from Home Office ~In Transit 20,000

Home Office 20,000

Chapter 1)

Mite TE Gin ee es

The account Shipments from Home Office In Transit is tied to the Income

Summary account. In the preparation ft t fom soe Onne

for the branch, the P20,000 balance inthe account Shipments" a6 ice

Tn Transit is added to the balance ofthe account Shipments from Home Oflcs,

The total of these two accounts is now equal to the amount shown a the home

office records as its shipments to branch. Therefore, the two reciprocal accounts

can now be eliminated for the purpose of preparing acombined statement,

ust add to its inventory

Inaddition, the branch in determining its ending invento! ventor

onhand the P20,000 worth of merchandise in transit. lot of merchandise will

appear in the branch statement of financial position and will also be a part of the

total inventory in the combined financial statements.

2. Acredit of P5,000 in the Investment Branch accout

debit in the Home Office account.

's receivable of the branch was collected by the

‘omer. The collection was recorded by the home

‘urrent account. No entry has

ntry is required on the branch

int without a corresponding

On December 28, an account:

home office from a branch cust

office by a debit to Cash and a credit to Branch C\

been made by the branch, therefore, the following

books:

Home Office 5,000

Accounts Receivable 5,000

3. Adebit of P8.000 in the Home Office account without a corresponding credit in

the Investment in Branch account.

OnDecember29, the branch purchased office equipment for P8,000. Since assets

used by the branch ate carried in the home office records, the entry made by the

branch for the purchase was a debit to Home Office and a credit to Cash. No

entry has been made by the home offic, therefore, the following entry should be

made in the home office books:

Office Equipment - Branch 8,000

Investment in Branch 8,000

4, Acredit of P6,000 in the Home office account without a corresponding debit in

the investment in branch account.

On December 28, the branch collected for the home office an accounts

receivable amounting to P6,000 from a home office customer. The collection was

recorded by the branch by a debit to Cash and a credit to Home Office account.

Home Off

ice And Branch Accounting ~ General Procedures ”

wo entry has been made by ing entry is

required on the home office fe dices office; therefore, the following

Investment in branch 000

Accounts receivable oe

A debit of P1,450 in the Investment in Branch account was erroneously recorded

by the branch in the Home Office account as P1,540, resulting to a difference of

P90 (P1,540— P 1,450). The home office entry is assumed to be correct. The

following enry is required on the books ofthe branch:

Home Office 90

Expenses 90,

The effect of these five end-of-period adjusting entries is to bring the reciprocal

accounts into agreement, as shown by the following reconciliation statement.

Illustration 11-8

‘Sweet Company— Home Office and Branch

Reconciliation of Reciprocal Accounts

December 31,2016

(Home Office Books) (Branch Books)

Invesiment in Branch Home Office

Account Account

Balances before adjustments P36,450 (Dr) PI9.540 (Cr)

Additions:

(I) Merchandise shipped to branch

still in transit 20,000

(4) Receivable of home office

collected by branch 6,000

Total 42.450 30,540

Deductions:

Q) Receivable of branch collected

by home office (5,000)

@) Office equipment purchased

by branch ( 8,000)

(5) _ Error made by branch in recording

expenses

Adjusted balances P34,450_(Dr)

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5835)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (350)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (824)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (405)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Hebner Housing Corporation: Sales 1,250,000Document3 pagesHebner Housing Corporation: Sales 1,250,000Christine Joy LanabanNo ratings yet

- Construction Contracts-Journal EntriesDocument2 pagesConstruction Contracts-Journal EntriesChristine Joy Lanaban100% (1)

- Name: - Course and Year: - Problem No. 1Document2 pagesName: - Course and Year: - Problem No. 1Christine Joy LanabanNo ratings yet

- Seatwork 01 Statement of Financial PositionDocument3 pagesSeatwork 01 Statement of Financial PositionChristine Joy LanabanNo ratings yet

- Consignment Sales MillanDocument6 pagesConsignment Sales MillanChristine Joy LanabanNo ratings yet

- Home Office and Branch Accounting-ExerciseDocument2 pagesHome Office and Branch Accounting-ExerciseChristine Joy LanabanNo ratings yet

- Problem 12-1Document1 pageProblem 12-1Christine Joy LanabanNo ratings yet

- Home Office and Branch Accounting-Exercise PDFDocument2 pagesHome Office and Branch Accounting-Exercise PDFChristine Joy LanabanNo ratings yet

- Seatwork 02 Statement of Income (TEST I) Multiple Choice: Shade Your Answer With YELLOWDocument5 pagesSeatwork 02 Statement of Income (TEST I) Multiple Choice: Shade Your Answer With YELLOWChristine Joy LanabanNo ratings yet

- Quizzer Financial Position and Income StatementDocument9 pagesQuizzer Financial Position and Income StatementChristine Joy LanabanNo ratings yet

- Gross Profit in Prior YearsDocument2 pagesGross Profit in Prior YearsChristine Joy LanabanNo ratings yet

- Consumption Savings Investment. ParadoxDocument46 pagesConsumption Savings Investment. ParadoxChristine Joy LanabanNo ratings yet