Professional Documents

Culture Documents

November 6 - Corporations

November 6 - Corporations

Uploaded by

Darius Delacruz0 ratings0% found this document useful (0 votes)

14 views2 pagesThe document contains information about income taxation for corporations in 6 problems:

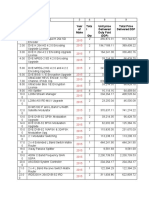

Problem 16.1 shows the MCIT, RCIT, tax due, excess MCIT carryover, tax payable, and excess MCIT usage for a corporation from 2018-2022.

Problem 16.2 provides gross income, deductions, NOLCO, taxable income, tax due, earnings, dividends declared, retained earnings, and income tax for a corporation.

Problem 16.3 lists the taxable income, tax due, tax base, and business tax credits for a corporation.

Problem 16.4 compares the regular and minimum corporate income tax rates for domestic corporations, resident foreign corporations, non-resident foreign corporations

Original Description:

Copyright

© © All Rights Reserved

Available Formats

XLSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document contains information about income taxation for corporations in 6 problems:

Problem 16.1 shows the MCIT, RCIT, tax due, excess MCIT carryover, tax payable, and excess MCIT usage for a corporation from 2018-2022.

Problem 16.2 provides gross income, deductions, NOLCO, taxable income, tax due, earnings, dividends declared, retained earnings, and income tax for a corporation.

Problem 16.3 lists the taxable income, tax due, tax base, and business tax credits for a corporation.

Problem 16.4 compares the regular and minimum corporate income tax rates for domestic corporations, resident foreign corporations, non-resident foreign corporations

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

Download as xlsx, pdf, or txt

0 ratings0% found this document useful (0 votes)

14 views2 pagesNovember 6 - Corporations

November 6 - Corporations

Uploaded by

Darius DelacruzThe document contains information about income taxation for corporations in 6 problems:

Problem 16.1 shows the MCIT, RCIT, tax due, excess MCIT carryover, tax payable, and excess MCIT usage for a corporation from 2018-2022.

Problem 16.2 provides gross income, deductions, NOLCO, taxable income, tax due, earnings, dividends declared, retained earnings, and income tax for a corporation.

Problem 16.3 lists the taxable income, tax due, tax base, and business tax credits for a corporation.

Problem 16.4 compares the regular and minimum corporate income tax rates for domestic corporations, resident foreign corporations, non-resident foreign corporations

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

Download as xlsx, pdf, or txt

You are on page 1of 2

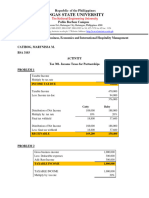

Income Taxation Corporations 06 November 2020

Problem 16.1

2018 2019 2020 2021 2022

MCIT - 120,000 200,000 190,000 170,000

RCIT 90,000 110,000 220,000 - 180,000

Tax Due 90,000 120,000 220,000 190,000 180,000

Excess MCIT Carryover - - (10,000) - (180,000)

Tax Payable 90,000 120,000 210,000 190,000 -

Excess MCIT 10,000 190,000

Usage (10,000) (180,000)

Balance - 10,000

Problem 16.2

Gross Income 4,000,000

Allowable Deductions (3,200,000)

NOLCO (50,000)

Taxable Income 750,000

Tax Due (225,000)

NOLCO 50,000

Interest Income 40,000

Gain on sale 60,000

Total Earnings 675,000

Dividends Declared (400,000)

Common Stocks (400,000)

Retained Earnings, beginning 500,000

Tax Base 375,000

Tax Rate 10%

IAET 37,500

Problem 16.3

Taxable Income 1,200,000

Tax Due (360,000)

Tax Base 840,000

Tax Rate 15%

BPRT 126,000

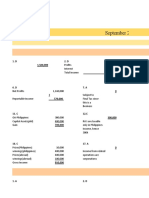

Problem 16.4

Domestic Corporation Regular:

Taxable Income 350,000

Tax Rate 30% 105,000

Minimum:

Gross Income 700,000

Tax Rate 2% 14,000

Higher 105,000

Resident Foreign Corporation Regular:

Taxable Income 200,000

Tax Rate 30% 60,000

Minimum:

Gross Income 400,000

Tax Rate 2% 8,000

Higher 60,000

Non-Resident Foreign Philippine Gross Income 400,000

Corporation Tax Rate 30%

Income Taxation Corporations 06 November 2020

Tax 120,000

Private School/Non-Profit World Taxable Income 350,000

Hospital Tax Rate 10%

Tax Due 35,000

Non-Profit Entity Nil; exempt

GOCC World Taxable Income 350,000

Tax Rate 30%

Tax Due 105,000

International Carriers Gross Philippine Billings 400,000

Tax Rate 2.50%

Tax Due 10,000

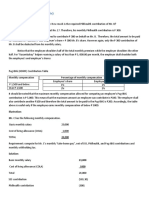

Problem 16.5

Net Income - RBU 1,200,000

Tax Rate 30%

Regular Tax Due 360,000

Problem 16.6

Direct Flight from Cebu to Seoul 2,000,000

Direct Flight from Davao to Taipei 1,800,000

Interconnecting flight from Phnom Penh to Tokyo 1,000,000

Gross Philippine Billings 4,800,000

Tax Rate 2.50%

Income Tax Due 120,000

You might also like

- Accounting 7 Instructions: Choose The Most Correct Answer For Each of The Following Questions. Write The Letter of YourDocument43 pagesAccounting 7 Instructions: Choose The Most Correct Answer For Each of The Following Questions. Write The Letter of YourIzzy B100% (2)

- Chapter c5Document25 pagesChapter c5bobNo ratings yet

- Application - Regular Income Tax On Individuals and CorporationsDocument8 pagesApplication - Regular Income Tax On Individuals and CorporationsElla Marie Lopez0% (1)

- Quiz 2.1 - Individual Taxpayers and Quiz 3.1 - INCOME TAX ON CORPORATIONSDocument5 pagesQuiz 2.1 - Individual Taxpayers and Quiz 3.1 - INCOME TAX ON CORPORATIONSHunternotNo ratings yet

- TAXATION ON INDIVIDUALS Lecture NotesDocument4 pagesTAXATION ON INDIVIDUALS Lecture NotesLucille Rose MamburaoNo ratings yet

- Chapter 06 - SamplesDocument3 pagesChapter 06 - SamplesJessica ZhangNo ratings yet

- SAP BIR 2316 Form ComponentsDocument6 pagesSAP BIR 2316 Form ComponentsMarique2409100% (4)

- Items and Concept of Income Exercise 5-2. True or False QuestionsDocument55 pagesItems and Concept of Income Exercise 5-2. True or False QuestionsMelady Sison Cequeña100% (1)

- Toaz - Info 89bf91d5 1612761367237 PRDocument7 pagesToaz - Info 89bf91d5 1612761367237 PRAEHYUN YENVYNo ratings yet

- Assignment 1 Taxes On IndividualsDocument7 pagesAssignment 1 Taxes On IndividualsMarynissa CatibogNo ratings yet

- Reviewer Finals Tax 301Document4 pagesReviewer Finals Tax 301Jana RamosNo ratings yet

- Activity 13 May 2023 Key To CorrectionDocument1 pageActivity 13 May 2023 Key To CorrectionJohn Paul MagbitangNo ratings yet

- TAÑOTE Daisy AEC7 MEPIIDocument9 pagesTAÑOTE Daisy AEC7 MEPIIDaisy TañoteNo ratings yet

- Catibog, Marynissa M. - Activity On Income Taxes For PartnershipsDocument2 pagesCatibog, Marynissa M. - Activity On Income Taxes For PartnershipsMarynissa CatibogNo ratings yet

- Individuals Assign3Document7 pagesIndividuals Assign3jdNo ratings yet

- Gross Reportable Compensation Income 285,000Document3 pagesGross Reportable Compensation Income 285,000WenjunNo ratings yet

- CPA Review School of The Philippines Manila First Pre-Board Solutions TaxationDocument8 pagesCPA Review School of The Philippines Manila First Pre-Board Solutions TaxationLive LoveNo ratings yet

- He Is Not Subject To Basic Income Tax. However, His 13th Month Pay Exceeds 90,000. ThereforeDocument15 pagesHe Is Not Subject To Basic Income Tax. However, His 13th Month Pay Exceeds 90,000. ThereforeEarl Daniel RemorozaNo ratings yet

- Problem Solving Posttest Week2Document3 pagesProblem Solving Posttest Week2Cale HenituseNo ratings yet

- Income Tax - Corporations Sample Problems: SolutionsDocument12 pagesIncome Tax - Corporations Sample Problems: SolutionsYellow BelleNo ratings yet

- Accounting For Income TaxDocument3 pagesAccounting For Income TaxDaniel Kahn GillamacNo ratings yet

- Taxation 1-5Document6 pagesTaxation 1-5dimpy dNo ratings yet

- Taxation 1Document12 pagesTaxation 1Lady Zyanien DevarasNo ratings yet

- R2. TAX (M.L) Solution CMA May-2023 ExamDocument5 pagesR2. TAX (M.L) Solution CMA May-2023 ExamSharif MahmudNo ratings yet

- 8.2 Assignment - Regular Income Tax For Individuals (For Discussion)Document8 pages8.2 Assignment - Regular Income Tax For Individuals (For Discussion)Roselyn LumbaoNo ratings yet

- September 22 - Chapter 9-Regular Income Tax: Inclusion From Gross Income (Assignment)Document8 pagesSeptember 22 - Chapter 9-Regular Income Tax: Inclusion From Gross Income (Assignment)anitaNo ratings yet

- ExampleDocument8 pagesExampleAli Akand AsifNo ratings yet

- Chapter 5Document5 pagesChapter 5Kristine Jhoy Nolasco SecopitoNo ratings yet

- 8.2 Assignment - Regular Income Tax For IndividualsDocument8 pages8.2 Assignment - Regular Income Tax For Individualssam imperialNo ratings yet

- 14 Marks AnswersDocument42 pages14 Marks Answerskuvira LodhaNo ratings yet

- Quiz (Tax)Document3 pagesQuiz (Tax)Rein ConcepcionNo ratings yet

- Tax HomeworkDocument4 pagesTax HomeworkMatthew WittNo ratings yet

- Lt234. Tvp. (Il-II) Solution Cma May-2023 Exam.Document5 pagesLt234. Tvp. (Il-II) Solution Cma May-2023 Exam.Arif HossainNo ratings yet

- Quiz 1 - StrataxDocument3 pagesQuiz 1 - Strataxspongebob SquarepantsNo ratings yet

- Quiz 3 Key To CorrectionDocument5 pagesQuiz 3 Key To CorrectionanimeilaaaaNo ratings yet

- IAS - 12 (DEFERRED TAX) (Exercise)Document8 pagesIAS - 12 (DEFERRED TAX) (Exercise)Saad AtharNo ratings yet

- Tax ReportDocument5 pagesTax ReportHanna Lyn BaliscoNo ratings yet

- Compensation Income - (250,000 - 400,000) : Dazai OsamuDocument5 pagesCompensation Income - (250,000 - 400,000) : Dazai OsamuGideon Tangan Ines Jr.No ratings yet

- Assignment E & L Env 4 BusiDocument9 pagesAssignment E & L Env 4 BusiSyed Hamza RasheedNo ratings yet

- 3DMC Income Tax Assignment 1Document30 pages3DMC Income Tax Assignment 1Sato TsuyoshiNo ratings yet

- Itemized Deduction Vs Optional Standard Deductions 40OSDDocument4 pagesItemized Deduction Vs Optional Standard Deductions 40OSDjason genitaNo ratings yet

- CAF 2 Spring 2021Document8 pagesCAF 2 Spring 2021Muhammad Ahsan RiazNo ratings yet

- Straight Problems Income Tax Bsa2Document2 pagesStraight Problems Income Tax Bsa2dimpy dNo ratings yet

- 1 BTAXREV Week 2 Income TaxationDocument48 pages1 BTAXREV Week 2 Income TaxationgatotkaNo ratings yet

- ST ND RDDocument6 pagesST ND RDCarlos Miguel MendozaNo ratings yet

- Tax NotesDocument2 pagesTax NotesHyeju SonNo ratings yet

- Tutorial 12 (Answer)Document6 pagesTutorial 12 (Answer)Vidya IntaniNo ratings yet

- Sales 3,000,000.00: Invoice Price 112,000.00Document11 pagesSales 3,000,000.00: Invoice Price 112,000.00Alicia FelicianoNo ratings yet

- Answer 1Document5 pagesAnswer 1mayetteNo ratings yet

- Taxation 1-Midterms Exam-Reynancia, Maria Beatrice N.Document4 pagesTaxation 1-Midterms Exam-Reynancia, Maria Beatrice N.Beatrice ReynanciaNo ratings yet

- Arbitrage Limit: Total Deductible Interest ExpenseDocument2 pagesArbitrage Limit: Total Deductible Interest ExpenseLyka RoguelNo ratings yet

- m2 Answer KeyDocument2 pagesm2 Answer KeyLara Camille CelestialNo ratings yet

- Income Taxation - Chapter 2 - Individual TaxpayersDocument5 pagesIncome Taxation - Chapter 2 - Individual TaxpayerscurlybambiNo ratings yet

- Case Study 2Document2 pagesCase Study 2Anil NagarajNo ratings yet

- 115,200.00 Two 100,200.00 TwoDocument19 pages115,200.00 Two 100,200.00 TwoAlexandra Nicole IsaacNo ratings yet

- Tax Cases Corp FTG Sy22-23Document8 pagesTax Cases Corp FTG Sy22-23charmaineenriquez24No ratings yet

- EstateDocument8 pagesEstateLyka RoguelNo ratings yet

- Solutions For Problem 1Document4 pagesSolutions For Problem 1spongebob SquarepantsNo ratings yet

- 9 & 10corporations - Final Tax, Capital Gains Tax, IAET and BPRT (Module 9 & 10) IllustrationsDocument4 pages9 & 10corporations - Final Tax, Capital Gains Tax, IAET and BPRT (Module 9 & 10) IllustrationsRyan CartaNo ratings yet

- Orca Share Media1540033147945Document17 pagesOrca Share Media1540033147945Melady Sison CequeñaNo ratings yet

- Basic Corporate TaxationDocument11 pagesBasic Corporate TaxationJoy ConsigeneNo ratings yet

- Philhealth Contribution (Table) : Illustration: Mr. C Has The Following Monthly CompensationDocument5 pagesPhilhealth Contribution (Table) : Illustration: Mr. C Has The Following Monthly CompensationMaraiah InciongNo ratings yet

- Wealth Management Planning: The UK Tax PrinciplesFrom EverandWealth Management Planning: The UK Tax PrinciplesRating: 4.5 out of 5 stars4.5/5 (2)

- BADVAC1X - MOD 6 TemplatesDocument16 pagesBADVAC1X - MOD 6 TemplatesDarius DelacruzNo ratings yet

- 2.4 Exercises - Job Oder Costing - Straight Problems (NEW) 1Document3 pages2.4 Exercises - Job Oder Costing - Straight Problems (NEW) 1Darius Delacruz50% (2)

- HXC-FB80: Three 2/3-Inch Exmor ™ CMOS Sensor HD Colour Studio CameraDocument10 pagesHXC-FB80: Three 2/3-Inch Exmor ™ CMOS Sensor HD Colour Studio CameraDarius DelacruzNo ratings yet

- Year of Make Tota L Qty Unit Price Delivered Duty Paid (DDP) Total Price Delivered DDPDocument2 pagesYear of Make Tota L Qty Unit Price Delivered Duty Paid (DDP) Total Price Delivered DDPDarius DelacruzNo ratings yet

- Paul Laurence C. Dela RosaDocument2 pagesPaul Laurence C. Dela RosaDarius DelacruzNo ratings yet

- 3 PDFDocument4 pages3 PDFDarius DelacruzNo ratings yet

- BADVAC1X - Quiz 2 Finals: (1 Point)Document9 pagesBADVAC1X - Quiz 2 Finals: (1 Point)Darius DelacruzNo ratings yet

- Year of SaleDocument12 pagesYear of SaleDarius DelacruzNo ratings yet

- The Country Project: International BusinessDocument3 pagesThe Country Project: International BusinessDarius DelacruzNo ratings yet

- Vii - TechnologicalDocument1 pageVii - TechnologicalDarius DelacruzNo ratings yet

- Population DensityDocument4 pagesPopulation DensityDarius DelacruzNo ratings yet

- 0619F TM2 Apr2020 PDFDocument1 page0619F TM2 Apr2020 PDFDarius DelacruzNo ratings yet

- Abe Post QualDocument3 pagesAbe Post QualDarius DelacruzNo ratings yet

- October 27 - Special DeductionsDocument3 pagesOctober 27 - Special DeductionsDarius DelacruzNo ratings yet

- Final Tax Rates Notes: General CoverageDocument3 pagesFinal Tax Rates Notes: General CoverageDarius DelacruzNo ratings yet

- Franchise Accounting Problem IDocument1 pageFranchise Accounting Problem IDarius DelacruzNo ratings yet

- Complaint Form: Kilusang Kooperatiba NG PTV (PTVKO)Document6 pagesComplaint Form: Kilusang Kooperatiba NG PTV (PTVKO)Darius DelacruzNo ratings yet

- QUESTIONS FOR MICROWAVE-PREBID-.docx 7-24-19.docxsDocument2 pagesQUESTIONS FOR MICROWAVE-PREBID-.docx 7-24-19.docxsDarius DelacruzNo ratings yet

- Proposed Facilities Rental Rates 2019 Version2Document5 pagesProposed Facilities Rental Rates 2019 Version2Darius DelacruzNo ratings yet

- Module 1 - General Principles PDFDocument19 pagesModule 1 - General Principles PDFDarius Delacruz100% (1)

- Final Tax Rates Notes: General CoverageDocument3 pagesFinal Tax Rates Notes: General CoverageDarius DelacruzNo ratings yet

- Polytechnic University of The Philippines: Subject ProfessorDocument6 pagesPolytechnic University of The Philippines: Subject ProfessorMarie Lyne AlanoNo ratings yet

- Tax Planning For IndividualDocument2 pagesTax Planning For IndividualJaynil ShahNo ratings yet

- Corp SolsDocument90 pagesCorp Solssayray55100% (1)

- Module 2Document54 pagesModule 2Aryaman BhauwalaNo ratings yet

- San Sebastian College College of Law Income Taxation Final ExamDocument4 pagesSan Sebastian College College of Law Income Taxation Final ExamMark CastañedaNo ratings yet

- LAS Q2 Week6 FABM2Document8 pagesLAS Q2 Week6 FABM2Angela Delos ReyesNo ratings yet

- Chapter 11-Income Taxation by E. ValenciaDocument10 pagesChapter 11-Income Taxation by E. ValenciaLeonard Cabuyao100% (1)

- Henderson vs. CollectorDocument8 pagesHenderson vs. CollectorMutyaAlmodienteCocjinNo ratings yet

- DTP 2Document72 pagesDTP 2Chaithra MNo ratings yet

- 1702-2012 Biocare Lifesciences, Inc. FinalDocument9 pages1702-2012 Biocare Lifesciences, Inc. FinalMarvin CeledioNo ratings yet

- Acco 440 AP Solutions Lectures 1 To 5Document41 pagesAcco 440 AP Solutions Lectures 1 To 5arhamohNo ratings yet

- Business Taxation SolutionDocument3 pagesBusiness Taxation SolutionBillie MatchocaNo ratings yet

- ACT400 - Mastery ExerciseDocument125 pagesACT400 - Mastery ExerciseKrystal FabianNo ratings yet

- Corporate Income Tax - 1Document22 pagesCorporate Income Tax - 1Katrina Vianca DecapiaNo ratings yet

- Corporate Taxation: Marilou Pacho-Garcia, CPA, MBADocument39 pagesCorporate Taxation: Marilou Pacho-Garcia, CPA, MBAMarilou Garcia100% (3)

- M1 - Chap. 2 Problem 23Document4 pagesM1 - Chap. 2 Problem 23Raychael Ross0% (1)

- CorporationDocument18 pagesCorporationkalai.mae19No ratings yet

- Aprelim - Purely Business IncomeDocument37 pagesAprelim - Purely Business IncomeAshley VasquezNo ratings yet

- Income Taxation Final Exam Please Show Solution (If Necessary)Document5 pagesIncome Taxation Final Exam Please Show Solution (If Necessary)E. RobertNo ratings yet

- Auditing and Taxation: B) Sec 2Document7 pagesAuditing and Taxation: B) Sec 2Kadam KartikeshNo ratings yet

- Income Taxation: Gross Revenue PXXXXX Deductions XXXXXDocument8 pagesIncome Taxation: Gross Revenue PXXXXX Deductions XXXXXPSHNo ratings yet

- 2014 Quizzers On Philippine Corporate TaxationDocument24 pages2014 Quizzers On Philippine Corporate TaxationJonabelle LisingNo ratings yet

- Chapter 12 (Income Tax On Corporations)Document10 pagesChapter 12 (Income Tax On Corporations)libraolrackNo ratings yet

- A Study On Income Tax Law & Accounting 2019Document26 pagesA Study On Income Tax Law & Accounting 2019Novelyn Hiso-anNo ratings yet

- Introduction To Regular Income TaxDocument30 pagesIntroduction To Regular Income TaxAce ReytaNo ratings yet

- Commerce Syllabus Degree Part 3Document21 pagesCommerce Syllabus Degree Part 3मनोज गुप्ता उपाध्यक्षNo ratings yet