Professional Documents

Culture Documents

Department of Commerce, Bahauddin Zakariya University, Multan Instructions For The Exam

Department of Commerce, Bahauddin Zakariya University, Multan Instructions For The Exam

Uploaded by

THIND TAXLAW0 ratings0% found this document useful (0 votes)

52 views1 pageThis document contains instructions for a final exam in financial statement analysis. It includes 3 questions assessing understanding of financial statement effects of bond issuances and conversions, equity transactions for a start-up company, and analysis of risk ratios and bankruptcy prediction models for an airline company. Question 1 has two parts examining journal entries for bond transactions under US GAAP and IFRS. Question 2 discusses types of bankruptcy prediction models and defines the Altman Z-score, assessing its role in predicting bankruptcy. Question 3 has two parts, with part A examining journal entries for various dividend events and part B calculating risk ratios and the Altman Z-score for an airline company from 2016-2018 to assess bankruptcy likelihood.

Original Description:

Original Title

Final Paper MCOM4th

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document contains instructions for a final exam in financial statement analysis. It includes 3 questions assessing understanding of financial statement effects of bond issuances and conversions, equity transactions for a start-up company, and analysis of risk ratios and bankruptcy prediction models for an airline company. Question 1 has two parts examining journal entries for bond transactions under US GAAP and IFRS. Question 2 discusses types of bankruptcy prediction models and defines the Altman Z-score, assessing its role in predicting bankruptcy. Question 3 has two parts, with part A examining journal entries for various dividend events and part B calculating risk ratios and the Altman Z-score for an airline company from 2016-2018 to assess bankruptcy likelihood.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

52 views1 pageDepartment of Commerce, Bahauddin Zakariya University, Multan Instructions For The Exam

Department of Commerce, Bahauddin Zakariya University, Multan Instructions For The Exam

Uploaded by

THIND TAXLAWThis document contains instructions for a final exam in financial statement analysis. It includes 3 questions assessing understanding of financial statement effects of bond issuances and conversions, equity transactions for a start-up company, and analysis of risk ratios and bankruptcy prediction models for an airline company. Question 1 has two parts examining journal entries for bond transactions under US GAAP and IFRS. Question 2 discusses types of bankruptcy prediction models and defines the Altman Z-score, assessing its role in predicting bankruptcy. Question 3 has two parts, with part A examining journal entries for various dividend events and part B calculating risk ratios and the Altman Z-score for an airline company from 2016-2018 to assess bankruptcy likelihood.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 1

Department of Commerce, Bahauddin Zakariya University, Multan

Final Examination of M.COM -4th semester (Morning )

Subject: Financial Statement Analysis Marks: 50 Instructor: Dr Muhammad Sadiq Shahid Time:02Hr

Instructions for the exam

1. Please provide your answer as handwritten.

2. Write your name and roll number on top of each answer sheet which must be numbered(e.g.,1/4).

3. Answer your question by providing “answer to question 1” for example. Do not reproduce the question pl.

a. Having finished the exam, scan it and send it by email at dcomexam@gmail.com and sshahidmalik@bzu.edu.pk

5. Do not submit your paper in the group.

Question 01: [15 Marks]

[A]:PTCL Company issued 3%, 10-year convertible bonds on January 1, 2015, at their par value of $600 million. Each $1,000 bond is

convertible into 50 shares of PTCL’s $1 par value common stock. Use the template below to show the financial statement effects under U.S.

GAAP and IFRS of the following transactions.

(a). Original issue. For the IFRS treatment, assume that PTCL would have borrowed at 10% if it did not offer a conversion privilege. (b).

Recognition of one year’s interest effect. (c). Conversion of the bonds when a share of PTCL common stock trades at $40. (1) Using the

“book value method” and (2) Using the “market value method”

Assets = Liabilities + Shareholdersʼ Equity

CC AOCI RE

Journal entry:

[B]: Assume that a start-up manufacturing company raises capital through a series of equity issues. a). Using the financial statement template

below, summarize the financial statement effects of the following transactions. Identify the account affected and use plus and minus signs to

indicate the increases and decreases in the specific element of the balance sheet (assets, liabilities, components of shareholders’ equity).

(1) Issues 100,000 shares of $1 par value common stock for $10 per share. (2) Receives land in exchange for 10,000 shares of $1 par common

stock when the common stock is trading in the market at $15 per share. The land has no readily determinable market value. (3) Receives

subscriptions for the issue of 40,000 shares of $1 par value common.

Share issue price is $20, of which 30 percent is received as a down payment. Subsequently, remaining 60% is received.

Assets = Liabilities + Shareholdersʼ Equity

CC AOCI RE

Journal entry:

b). In each case, how does the company measure the transaction? What measurement attribute is used?

Question 02: [15 Marks]

[A]: Discuss the types of bankruptcy prediction models.

[B]: Define the Altman z-score. Discuss its role in bankruptcy prediction.

[C]: Altman’s bankruptcy risk model utilizes the values of the variables at a particular point in time (balance sheet variables) or for a period

of time (income statement values). For the most part, Beneish’s earnings manipulation risk model utilizes changes in variables from one

period to the next. Why might the levels of values in Altman’s model be more appropriate for predicting bankruptcy and changes in values in

Beneish’s model be more appropriate for identifying earnings manipulation?

Question 03: [05+15 Marks]

[A]: The shareholders’ equity section of All-Wood Doors on a day its common stock is trading at $125 per share.

Common stock ($2 par value, 45,000 shares issued and outstanding) $ 90,000

Additional paid-in capital on common stock 1,600,000

Retained earnings 3,500,000

A). Use the financial statement template below to show the financial statement effects of the following dividend events.

(1) Cash dividend declaration and payment of $1 per share (2) Property dividend declaration and payment of shares representing a short-term

investment in Screen Products, Ltd., with a fair value of $10,000 (3) 10 percent stock dividend (4) 100 percent stock dividend (5) 3-for-1

stock split (6) 1-for-2 reverse stock split

Assets = Liabilities + Shareholdersʼ Equity

CC AOCI RE

Journal entry:

b). Which events changed the book value of common equity? what conditions will these events lead to future increases and decreases in

ROE?

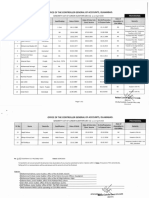

[B]:Delta Air Lines is one of the largest airlines in the United States. It has operated on the verge of bankruptcy for several years. Financial

data for Delta Air Lines for each of the years ending December 31, 2016, to December 31, 2018.

2016 2017 2018

Sales $15,002 $15,657 $14,087

Interest Expense $ 824 $ 380 $ 499

Net Income (Loss) (1,272) $1,216 $ 828

Current Assets $ 3,606 $ 3,567 $ 3,205

Total Assets $21,801 $23,605 $21,931

Current Liabilities $ 5,941 $ 6,403 $ 5,245

Long-Term Debt $12,507 $11,040 $ 5,797

Total Liabilities $27,320 $19,581 $16,354

Retained Earnings $ 4,373 $ 2,930 $ 4,176

Shareholders’ Equity $ 1,157 $ 4,024 $ 5,577

Cash Flow Provided by Operations $ 225 $ 236 $ 2,898

Common Shares Outstanding 123.4 123.2 123.0

Market Price per Share $ 7.48 $ 11.81 $ 29.26

(a) Compute the value of each of the following risk ratios (at the end of 2005–2009)

(1) Current Ratio ; (2) Operating Cash Flow to Current Liabilities Ratio (3) Liabilities to Assets Ratio ; (4) Long-Term Debt to Long-Term

Capital Ratio ; 5) Operating Cash Flow to Total Liabilities Ratio (6) Interest Coverage Ratio

(b). Compute the value of Altman’s Z-score for Sun Microsystems for each year from 2005–2009.

(c). Using the analyses in Parts a and b, discuss the most important factors that signal the likelihood of bankruptcy of Sun Microsystems in

2010.

You might also like

- SBR - Mock A - QuestionsDocument8 pagesSBR - Mock A - Questionsriya_pramodNo ratings yet

- CostAccounting 2016 VanderbeckDocument396 pagesCostAccounting 2016 VanderbeckAngel Kitty Labor88% (32)

- Solution Manual For Fundamental Financial Accounting Concepts 7th Edition by EdmondsDocument9 pagesSolution Manual For Fundamental Financial Accounting Concepts 7th Edition by EdmondsDiane Jones100% (29)

- CMA Part2 MT 1-10 Q&ADocument893 pagesCMA Part2 MT 1-10 Q&ASandeep SawanNo ratings yet

- Cash Flow Estimation Brigham Case SolutionDocument8 pagesCash Flow Estimation Brigham Case SolutionShahid MehmoodNo ratings yet

- Practice QuestionsDocument19 pagesPractice QuestionsAbdul Qayyum Qayyum0% (2)

- New Scientist International Edition - August 07 2021Document62 pagesNew Scientist International Edition - August 07 2021Thảo HoàngNo ratings yet

- ACCA - Financial Management (FM) - Course Exam 1 Questions - 2019 PDFDocument6 pagesACCA - Financial Management (FM) - Course Exam 1 Questions - 2019 PDFADELINE LIONIVIA100% (1)

- ACCA F9 Mock Examination 2Document5 pagesACCA F9 Mock Examination 2daria0% (1)

- Mid Term ExamDocument4 pagesMid Term ExamChris Rosbeck0% (1)

- Solutions in AppendixDocument13 pagesSolutions in Appendixtfytf70% (2)

- Sheet (3) : Corporations: Dividends, Retained Earnings, and Income ReportingDocument28 pagesSheet (3) : Corporations: Dividends, Retained Earnings, and Income ReportingMagdy KamelNo ratings yet

- B.6.23 - STD SPECS - For Plum Concrete & Plum MasonaryDocument3 pagesB.6.23 - STD SPECS - For Plum Concrete & Plum MasonaryBijay Krishna Das100% (3)

- List of Government WebsitesDocument1 pageList of Government Websitessumit-7No ratings yet

- Muet 2006 To 2019 Past PapersDocument148 pagesMuet 2006 To 2019 Past PapersUmaid Ali Keerio100% (2)

- Measuring Team ProductivityDocument27 pagesMeasuring Team ProductivityAdhitya Setyo Pamungkas100% (1)

- Iefinmt Reviewer For Quiz (#1) : I. Definition of TermsDocument11 pagesIefinmt Reviewer For Quiz (#1) : I. Definition of TermspppppNo ratings yet

- University of Zimbabwe: Professional and Industrial Studies AUGUST 2010 Engin. CE 309Document4 pagesUniversity of Zimbabwe: Professional and Industrial Studies AUGUST 2010 Engin. CE 309Brightwell InvestmentsNo ratings yet

- Question and AnsDocument33 pagesQuestion and AnsHawa MudalaNo ratings yet

- 1 Mock Adv, Test (Q-Only) - Acf (Sgpin) - March 17th Final v23Document16 pages1 Mock Adv, Test (Q-Only) - Acf (Sgpin) - March 17th Final v23LuisaNo ratings yet

- Copfin 1B August Block 2018Document4 pagesCopfin 1B August Block 2018tawandaNo ratings yet

- Chapter 9 - Annand, D. (2018) :: Concept Self-Check: 1 To 6Document6 pagesChapter 9 - Annand, D. (2018) :: Concept Self-Check: 1 To 6Minh HuyyNo ratings yet

- Liquidity, Leverage, Coverage and Activity (LLCA) RatiosDocument91 pagesLiquidity, Leverage, Coverage and Activity (LLCA) RatiosJess AlexNo ratings yet

- Sample Midterm 2Document9 pagesSample Midterm 2hjgNo ratings yet

- BHMH2113 - Question Paper - Take - Home ExamDocument7 pagesBHMH2113 - Question Paper - Take - Home Examwd edenNo ratings yet

- FIN300 Homework 1Document7 pagesFIN300 Homework 1JohnNo ratings yet

- Financial Statement Analysis MBA 6thDocument4 pagesFinancial Statement Analysis MBA 6thShahzad MalikNo ratings yet

- f9 2018 Marjun QDocument6 pagesf9 2018 Marjun QDilawar HayatNo ratings yet

- Relationship, Agency Problem and Agency Cost?: Instruction: Answer All Questions QUESTION 1 (15 Marks)Document6 pagesRelationship, Agency Problem and Agency Cost?: Instruction: Answer All Questions QUESTION 1 (15 Marks)sarah_200285No ratings yet

- More Ratio ExercisesDocument23 pagesMore Ratio Exercisesbaillon.andreamaria9No ratings yet

- Assignment FM I (2020)Document11 pagesAssignment FM I (2020)ShaggYNo ratings yet

- Check - Chapter 10 - She Part 1Document4 pagesCheck - Chapter 10 - She Part 1ARNEL CALUBAGNo ratings yet

- Sample MCQDocument8 pagesSample MCQJacky LamNo ratings yet

- 2.1 Firms' Disclosure of Financial Information: Chapter 2 Introduction To Financial Statement AnalysisDocument38 pages2.1 Firms' Disclosure of Financial Information: Chapter 2 Introduction To Financial Statement AnalysisSawsan Al-jamalNo ratings yet

- FM AsmtDocument3 pagesFM Asmtgebremedhn100% (1)

- ACCT10002 Tutorial 1 Exercises, 2020 SM1Document5 pagesACCT10002 Tutorial 1 Exercises, 2020 SM1JING NIENo ratings yet

- Dec 15Document8 pagesDec 15cacow83838No ratings yet

- Revision Questions - Final Exam - QDocument3 pagesRevision Questions - Final Exam - Qrosario correiaNo ratings yet

- Paper T6 (Uk) Drafting Financial Statements: Sample Multiple Choice Questions - June 2009Document8 pagesPaper T6 (Uk) Drafting Financial Statements: Sample Multiple Choice Questions - June 2009Jeremy LuNo ratings yet

- Sep23 Ques-1Document5 pagesSep23 Ques-1absankey770No ratings yet

- PREP COF Sample Exam QuestionsDocument10 pagesPREP COF Sample Exam QuestionsLNo ratings yet

- Management Accounting - 1Document4 pagesManagement Accounting - 1amaljacobjogilinkedinNo ratings yet

- FINANCIAL ACCOUNTING & REPORTING - JA-23 - Suggested - AnswersDocument11 pagesFINANCIAL ACCOUNTING & REPORTING - JA-23 - Suggested - AnswerssummerfashionlimitedNo ratings yet

- B Exercises: E24-1B (Post-Balance-Sheet Events) (A) (B)Document4 pagesB Exercises: E24-1B (Post-Balance-Sheet Events) (A) (B)Saleh RaoufNo ratings yet

- Toaz - Info 15089702 Acca Cat Paper t6 Drafting Financial Statements Solved Past Papers PRDocument155 pagesToaz - Info 15089702 Acca Cat Paper t6 Drafting Financial Statements Solved Past Papers PRmiss ainaNo ratings yet

- R13 Intercorporate InvestmentsDocument34 pagesR13 Intercorporate InvestmentsWilliam VũNo ratings yet

- Financial Reporting - Final Revision - With SolDocument12 pagesFinancial Reporting - Final Revision - With SolMariam YasserNo ratings yet

- Chapter 3 Lecture Notes STUDENTS SEPT 2023Document20 pagesChapter 3 Lecture Notes STUDENTS SEPT 2023evelyngoveaNo ratings yet

- Exercises of Session 11Document8 pagesExercises of Session 11MaiPhương LinhhNo ratings yet

- Bài tập FRA - FRCDocument12 pagesBài tập FRA - FRCThủy VũNo ratings yet

- Exam 1 Fall 19Document9 pagesExam 1 Fall 19April Grace TrinidadNo ratings yet

- Copfin 1B April 2019Document4 pagesCopfin 1B April 2019tawandaNo ratings yet

- Maf5102 Accounting and Finance Virt MainDocument4 pagesMaf5102 Accounting and Finance Virt Mainshobasabria187No ratings yet

- Ilovepdf MergedDocument21 pagesIlovepdf MergedsakschamcNo ratings yet

- 14 Corporate Accounting - April May 2021 (Repeaters 2013-14 and Onwards)Document8 pages14 Corporate Accounting - April May 2021 (Repeaters 2013-14 and Onwards)premium info2222No ratings yet

- Ratio AnalysisDocument66 pagesRatio AnalysisRenny WidyastutiNo ratings yet

- FM Eco Q Mtp2 Inter Nov21Document7 pagesFM Eco Q Mtp2 Inter Nov21rridhigolchha15No ratings yet

- Ratios - Profitability, Market &Document46 pagesRatios - Profitability, Market &Jess AlexNo ratings yet

- Chapter 4Document12 pagesChapter 4jeo beduaNo ratings yet

- Midterm Test - Code 37 - FA - Sem 2 - 21.22Document5 pagesMidterm Test - Code 37 - FA - Sem 2 - 21.22Đoàn Tài ĐứcNo ratings yet

- Class 12 AMU Model PapersDocument77 pagesClass 12 AMU Model PapersMohammad FarazNo ratings yet

- © The Institute of Chartered Accountants of IndiaDocument7 pages© The Institute of Chartered Accountants of IndiaSarvesh JoshiNo ratings yet

- Accounting Assignment Sample SolutionsDocument20 pagesAccounting Assignment Sample SolutionsHebrew JohnsonNo ratings yet

- Assignment - Doc-401 FIM - 24042016113313Document10 pagesAssignment - Doc-401 FIM - 24042016113313Ahmed RaajNo ratings yet

- The Handbook of Credit Risk Management: Originating, Assessing, and Managing Credit ExposuresFrom EverandThe Handbook of Credit Risk Management: Originating, Assessing, and Managing Credit ExposuresNo ratings yet

- Before The Federal Tax Ombudsman: MultanDocument7 pagesBefore The Federal Tax Ombudsman: MultanTHIND TAXLAWNo ratings yet

- Seniority Listofjunior Auditors (Bs-11) As Onapril 2020Document2 pagesSeniority Listofjunior Auditors (Bs-11) As Onapril 2020THIND TAXLAWNo ratings yet

- OBS NDI Black Screen On Streaming PC FIXED!Document1 pageOBS NDI Black Screen On Streaming PC FIXED!THIND TAXLAWNo ratings yet

- Wuxga or Full HD?: The Unexpected Difference For PresentationsDocument5 pagesWuxga or Full HD?: The Unexpected Difference For PresentationsTHIND TAXLAWNo ratings yet

- Vegetable Policy - 2020: Fresh Cash Only - No Credit, No B.GDocument3 pagesVegetable Policy - 2020: Fresh Cash Only - No Credit, No B.GTHIND TAXLAWNo ratings yet

- SM ch04Document5 pagesSM ch04THIND TAXLAWNo ratings yet

- Advance Audit Assignment: Topic Internal Control Weakness of King CoDocument2 pagesAdvance Audit Assignment: Topic Internal Control Weakness of King CoTHIND TAXLAWNo ratings yet

- SM ch04Document5 pagesSM ch04THIND TAXLAWNo ratings yet

- Ghulam Haider C.VDocument1 pageGhulam Haider C.VTHIND TAXLAWNo ratings yet

- Annual Report-2017 PDFDocument223 pagesAnnual Report-2017 PDFTHIND TAXLAWNo ratings yet

- Nemo Complete Documentation 2017Document65 pagesNemo Complete Documentation 2017Fredy A. CastañedaNo ratings yet

- Power Electronics ProjectDocument38 pagesPower Electronics Projectvishwatheja198950% (2)

- Basic First Aid Handbook v2Document47 pagesBasic First Aid Handbook v2maeveley9dayne9chuaNo ratings yet

- 2018 Weekly CalendarDocument3 pages2018 Weekly CalendarFabian FebianoNo ratings yet

- Ent Secretory Otitis MediaDocument3 pagesEnt Secretory Otitis MediaIrena DayehNo ratings yet

- Plastic and Paper PDFDocument12 pagesPlastic and Paper PDFBhanu Pratap SolankiNo ratings yet

- 5054 s16 Ms 41 PDFDocument3 pages5054 s16 Ms 41 PDFKritish RamnauthNo ratings yet

- Technical Drawings of PlasticwareDocument69 pagesTechnical Drawings of PlasticwareGuldu KhanNo ratings yet

- D5F-F5 (Draft Aug2021)Document6 pagesD5F-F5 (Draft Aug2021)Lame GamerNo ratings yet

- REVISING EXERCISES 1baDocument3 pagesREVISING EXERCISES 1baAlvaro LorcaNo ratings yet

- EXOS Quick Guide - Cheat SheetDocument19 pagesEXOS Quick Guide - Cheat Sheetmaverick2689No ratings yet

- Title of Project:-Military Hospital Report Management SystemDocument4 pagesTitle of Project:-Military Hospital Report Management SystemAkbar AliNo ratings yet

- PR m1Document15 pagesPR m1Jazmyn BulusanNo ratings yet

- Ericka Joyce O. Reynera: PERSONAL - INFORMATIONDocument2 pagesEricka Joyce O. Reynera: PERSONAL - INFORMATIONdead insideNo ratings yet

- Wider World 4 Grammar Presentation 1 4Document6 pagesWider World 4 Grammar Presentation 1 4veronika rugunNo ratings yet

- 04-46 Analysis of Gold-Copper Braze Joint in Glidcop For UHV Components at The APS W.Toter S.SharmaDocument10 pages04-46 Analysis of Gold-Copper Braze Joint in Glidcop For UHV Components at The APS W.Toter S.SharmaKai XuNo ratings yet

- 4final Examination Prof Ed 10Document7 pages4final Examination Prof Ed 10Danelle EsparteroNo ratings yet

- Onco, TSG & CancerDocument8 pagesOnco, TSG & Cancersumera120488No ratings yet

- EC Physical Sciences Grade 11 November 2022 P1 and MemoDocument25 pagesEC Physical Sciences Grade 11 November 2022 P1 and MemokhulntandoNo ratings yet

- Whittaker Dynamics 17Document442 pagesWhittaker Dynamics 17Mahmoud Ahmed 202201238No ratings yet

- Urushi ArtDocument24 pagesUrushi ArtGuadalupeCaravajalNo ratings yet

- 21CC 4 U6Document10 pages21CC 4 U6Adrian Spanu100% (1)

- Moxa PT g7728 Series Manual v1.4Document128 pagesMoxa PT g7728 Series Manual v1.4Walter Oluoch OtienoNo ratings yet

- B94-6 R1995 E1984Document21 pagesB94-6 R1995 E1984zojoNo ratings yet