Professional Documents

Culture Documents

Hungary Europe V4

Hungary Europe V4

Uploaded by

Swastik GroverOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Hungary Europe V4

Hungary Europe V4

Uploaded by

Swastik GroverCopyright:

Available Formats

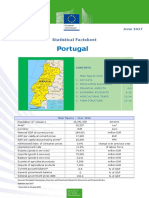

Hungary UNITARY COUNTRY

EUROPe

Basic socio-economic indicators Income group - HIGH INCOME: OECD Local currency - Forint (HUF)

Population and geography Economic data

AREA: 93 028 km2 GDP: 247.3 billion (current PPP international dollars)

i.e. 25 061 dollars per inhabitant (2014)

POPULATION: 9.867 million inhabitants (2014), a decrease

REAL GDP GROWTH: 3.7% (2014 vs 2013)

of -0.3% per year (2010-14)

UNEMPLOYMENT RATE: 7.7% (2014)

DENSITY: 106 inhabitants/km 2

FOREIGN DIRECT INVESTMENT, NET INFLOWS (FDI): 12 400 (BoP, current

USD millions, 2014)

URBAN POPULATION: 70.8% of national population

GROSS FIXED CAPITAL FORMATION (GFCF): 22% of GDP (2014)

CAPITAL CITY: Budapest (17.3% of national population) HUMAN DEVELOPMENT INDEX: 0.828 (very high), rank 44

Sources: OECD, Eurostat, World Bank, UNDP, ILO

Territorial organisation and subnational government RESPONSIBILITIES

MUNICIPAL LEVEL INTERMEDIATE LEVEL REGIONAL OR STATE LEVEL TOTAL NUMBER OF SNGs

3 178 - 19 3 197

local authorities counties

(települési önkormányzatok) (megyék)

Average municipal size:

3 125 inhabitantS

Main features of territorial organisation. Hungary has a two-tier system of local government, made up of 19 counties and 3 178 munici-

pal authorities comprising villages, cities, cities of county rank and the capital city of Budapest and its 23 districts. The number of counties

excludes Budapest which has had special status since 1991 and has an organisation similar to a county. The 2012 Constitutional reform and

the 2011 Local Government Act (LGA, in effect from 2013) have profoundly transformed SNGs, reducing their scope, functions and financing

resources. In parallel, a large State reform in 2013 introduced a new administrative structure in the form of 175 districts (járás), including

three districts in the capital. These new central government offices at the local level took over many functions exercised previously by munici-

palities and are also in charge of SNG legal and financial supervision.

Main subnational governments responsibilities. The LGA has drastically reduced SNG responsibilities. It recentralised several (or parts

of) functions in education (primary and secondary education), healthcare (free medical services, hospitals, excluding specialised clinics),

social protection (social allowances e.g. for the elderly, families, etc.), public hygiene, water works, and administration (document office

duties). Municipal responsibilities are of two types: compulsory and voluntary. Compulsory tasks include road maintenance, public transport,

child protection support, social provision tied to local government ordinances, issuance of various permits, some administrative tasks, etc.

Most county responsibilities which included health, secondary and specialised education, economic development, spatial planning, environ-

ment protection, tourism have been recentralised. Counties are now primarily responsible for regional development.

Subnational government finance

% GENERAL GOVERNMENT % SUBNATIONAL

Expenditure % GDP (same expenditure category) GOVERNMENT

Total expenditure (2013) 7.5% 15.1% 100%

Current expenditure 5.6% - 74.9%

Staff expenditure 2.4% 23.3% 31.4%

Investment 1.6% 39.4% 21.8%

As a result of the recentralisation of a large part of SNG responsibilities, the share of SNG expenditure in GDP and public expenditure decreased

significantly, by respectively 5 and almost 10 percentage points between 2010 and 2013. The share of SNG staff spending in total staff spending

went from 50% to 23%, resulting from large transfers of personnel from SNGs to the central government, in particular to the new government

offices. Similarly, the share of SNGs in public investment and GDP has fallen, respectively from 59% to 39% and from 2.2% to 1.6% of GDP.

EXPENDITURE BY FUNCTION % SUBNATIONAL GOVERNMENT EXPENDITURE

14.2

General public services 22.7

defence

Security and public order

Economic affairs 16.5 0.5

environmental protection %

Housing and Community Amenities

Health 16.3

Recreation, Culture And Religion 8.7

Education

Social protection 4.6 8.7

7.8

Main categories of SNG spending in 2013 included general public services, education (municipalities continue to manage school buildings and facili-

ties but are no longer responsible for teaching and administrative staff) and economic affairs (mainly transport) and social protection.

% GENERAL GOVERNMENT % SUBNATIONAL

REVENUE BY TYPE % GDP (same revenue category) GOVERNMENT

Total revenue (2013) 10.0% 21.2% 100%

Tax revenue 2.3% 8.9% 22.5%

Grants and subsidies 6.7% - 67.1%

Other revenues 1.0% - 10.4%

The new Local Government Act also modified SNG sources of financing and borrowing rules.

tax revenue. Counties are not allowed to levy taxes. The highest municipal tax is by far the local business tax (74% of local tax revenue in 2013)

which is imposed on companies located or registered in the municipal area and based on corporate gross margins. The rate is decided by the municipa-

lity, but capped at 2%. Property taxes are the second highest tax (18% of local tax revenue i.e. 0.4% of GDP). Including a building tax and a land tax,

they are paid by owners, based either on area or floor space or on the adjusted market value. Tax rates are set by each municipality, up to certain limits.

There are some other minor taxes such as a tax on motor vehicle or the communal tax on households, tourist tax, etc.

grants and subsidies. The 2011 reform also modified the grants system and reduced their amounts, in accordance to the recentralisation of several

responsibilities, for example fall of funds from the Health Insurance Fund. A stricter grant system was set up in 2013, going from an income-based

system to a task-based, expenditure-oriented system. Grants are now earmarked. The reform included the tightening of distribution rules and new

equalisation criteria based on the tax capacity of each municipality.

other revenues. Other revenues for municipalities include mostly user tariffs and fees for public services which represent around 9% of local

revenue.

Outstanding debt % GDP % GENERAL GOVERNMENT

Outstanding debt (2013) 2.1% 2.2%

Tighter budgetary restrictions and new borrowing controls have been introduced for SNGs by the LGA. It forbids any operating deficit, and

stipulates that SNGs are responsible for their own financial management. The LGA also set up an authorisation framework for local borrowing

in 2012. Following the 2013 reform, SNG debt has also been recentralised, the central government taking over local debt. It was done progres-

sively in three stages based on the size of SNGs. As a result, the amount and the structure of outstanding debt in 2014 profoundly changed,

SNG debt accounting for 0.7% of GDP and 0.7% of public debt. It is made up other accounts payable for 79%, the remaining part being financial

debt (18% of loans and 3% of bonds instead of 48% and 26% in 2013).

A joint- study of: Sources: OECD National Accounts Statistics • OECD (2015 and 2016) Subnational Governments in OECD Countries:

Key data • OECD (2015) Hungary: Towards a Strategic State Approach, OECD Public Governance Review • Lentner

C. (2014) The Debt Consolidation of Hungarian Local Governments, Public Finance Quarterly • Sivák J. (2014) A

systemic approach to the Local Government System, Public Finance Quarterly • Hajnal G. and Kovacs E. (2014)

“Government Windows”: One-Stop Shops For Administrative Services In Hungary’ COCOPS • Soós G. and Dobos G.

(2014) Against the Trend: Recentralization of the Local Government System in Hungary • Government of Hungary

(2014) Convergence Programme of Hungary 2014 – 2017 • Council of Europe (2013) Local and regional democracy

Publication date: October 2016 in Hungary, CG(25)7FINAL.

You might also like

- The Main Features of The Romanian Welfare SystemDocument2 pagesThe Main Features of The Romanian Welfare SystemGiuliaRusuNo ratings yet

- Profile SwedenDocument2 pagesProfile SwedenKicki AnderssonNo ratings yet

- Profile New ZealandDocument2 pagesProfile New Zealandjalhareem511No ratings yet

- Republic of Moldova: Euro-AsiaDocument2 pagesRepublic of Moldova: Euro-AsiaamNo ratings yet

- Profile ArmeniaDocument2 pagesProfile ArmeniamrtooncesNo ratings yet

- Profile PhilippinesDocument2 pagesProfile PhilippinesLyrics DistrictNo ratings yet

- Profile ParaguayDocument2 pagesProfile ParaguayNC ExistentialNo ratings yet

- Profile ColombiaDocument2 pagesProfile Colombiafert certNo ratings yet

- Profile MalaysiaDocument2 pagesProfile MalaysiaRichard T. PetersonNo ratings yet

- Profile EcuadorDocument2 pagesProfile Ecuadorroysugar25No ratings yet

- 1 PDFDocument2 pages1 PDFNA NANo ratings yet

- Profile ThailandDocument2 pagesProfile Thailanddarling nanaNo ratings yet

- Profile MoroccoDocument2 pagesProfile MoroccoOMAR EL OUAKILINo ratings yet

- United Republic of Tanzania: AfricaDocument2 pagesUnited Republic of Tanzania: AfricamatijciogeraldineNo ratings yet

- Profile EthiopiaDocument2 pagesProfile Ethiopiasademhusen563No ratings yet

- 4d434dfd enDocument3 pages4d434dfd enTalila SidaNo ratings yet

- Agricultura - Fisa UE 2020Document18 pagesAgricultura - Fisa UE 2020Marina CojocaruNo ratings yet

- Socio Economic Indicators - (English 2017)Document2 pagesSocio Economic Indicators - (English 2017)Abir Hasan SojibNo ratings yet

- Chapter 13 (English 2020) - Poverty AlleviationDocument26 pagesChapter 13 (English 2020) - Poverty AlleviationM Tariqul Islam MishuNo ratings yet

- Ind AagDocument2 pagesInd AagRupali SharmaNo ratings yet

- Market OverviewDocument14 pagesMarket OverviewAyo TundeNo ratings yet

- Socio-Economic Indicators (English-2016) FinalDocument2 pagesSocio-Economic Indicators (English-2016) FinalBISHAASH বিশ্বাসNo ratings yet

- Welfareeconomy2021 Chapter3Document46 pagesWelfareeconomy2021 Chapter3Kopija KopijaNo ratings yet

- SoHRR in Gauteng 2020-2021Document28 pagesSoHRR in Gauteng 2020-2021janet100% (1)

- 66c185f2 enDocument18 pages66c185f2 enerjon himajNo ratings yet

- Poverty NewsDocument2 pagesPoverty Newssatendra121No ratings yet

- 15-Rural & Urban Development PDFDocument19 pages15-Rural & Urban Development PDFShradha SmoneeNo ratings yet

- Abrar Karim ID-17206002 Budget EssayDocument4 pagesAbrar Karim ID-17206002 Budget EssayAbrarNo ratings yet

- EIR2022-Global TrendsDocument36 pagesEIR2022-Global Trends2XO YTNo ratings yet

- Afghanistan: Demographic Trends HealthDocument2 pagesAfghanistan: Demographic Trends HealthMohammad Edris YawarNo ratings yet

- Singapore - Economic Studies - CofaceDocument2 pagesSingapore - Economic Studies - CofaceTifani RosaNo ratings yet

- Socio Economic Indicators 2020Document2 pagesSocio Economic Indicators 2020Roonil WazlibNo ratings yet

- Republic of Austria Investor Information PDFDocument48 pagesRepublic of Austria Investor Information PDFMi JpNo ratings yet

- Govt FinDocument9 pagesGovt Finshovon mukitNo ratings yet

- Wednesday HoaglandDocument29 pagesWednesday HoaglandNational Press FoundationNo ratings yet

- 647e1269017b6a1e238c38b6 EIR2023-EthiopiaDocument27 pages647e1269017b6a1e238c38b6 EIR2023-EthiopiaMoges AlemuNo ratings yet

- Chile 2020Document1 pageChile 2020Benas MalinauskasNo ratings yet

- 647f1fc6e4a6b1effb674603 EIR2023-MontenegroDocument27 pages647f1fc6e4a6b1effb674603 EIR2023-Montenegroaciddreams100No ratings yet

- Amendment in Tax Laws by Budget 20761Document60 pagesAmendment in Tax Laws by Budget 20761Mukunda BhusalNo ratings yet

- Cultural & Creative: Industries in MoroccoDocument27 pagesCultural & Creative: Industries in MoroccoFATI ALAOUINo ratings yet

- Local FinanceDocument7 pagesLocal FinanceGelyn RabanesNo ratings yet

- Chapter-13 (English-2023)Document26 pagesChapter-13 (English-2023)42MD ASIFUR RAHMAN ASIFNo ratings yet

- The Situation of Children in AlgeriaDocument8 pagesThe Situation of Children in AlgeriaSamraNo ratings yet

- Idn AagDocument2 pagesIdn AagsarifeganNo ratings yet

- Socio-Economic Context and Role of Agriculture: March 2015Document6 pagesSocio-Economic Context and Role of Agriculture: March 2015myticmoneyNo ratings yet

- Portugal: Statistical FactsheetDocument16 pagesPortugal: Statistical Factsheetmathavan_00No ratings yet

- 3) Financial and Operational Performance Analysis 2018-2021Document33 pages3) Financial and Operational Performance Analysis 2018-2021Tomas LeonardelliNo ratings yet

- Document 39Document9 pagesDocument 39Hannah Vannesa A. MondayNo ratings yet

- The Political Economy of Environmental Policy in Indonesia - PresentationDocument20 pagesThe Political Economy of Environmental Policy in Indonesia - PresentationADB Poverty ReductionNo ratings yet

- Iveta Štarhová: 322996@mail - Muni.czDocument37 pagesIveta Štarhová: 322996@mail - Muni.czDEREJENo ratings yet

- 2011 Prelim City Budget FinalDocument53 pages2011 Prelim City Budget FinalEarlynoftenNo ratings yet

- Socio-Economic IndicatorsDocument2 pagesSocio-Economic IndicatorsKassaf ChowdhuryNo ratings yet

- Socio-Economic Indicators PDFDocument2 pagesSocio-Economic Indicators PDFsukdeb balaNo ratings yet

- MOEF Press Release - 2023 Budget ProposalDocument7 pagesMOEF Press Release - 2023 Budget ProposalJACKNo ratings yet

- Uiidp Pom Volume 2. Additional Annexes - Final.april 25, 2018Document503 pagesUiidp Pom Volume 2. Additional Annexes - Final.april 25, 2018Asmerom MosinehNo ratings yet

- EconomicimpactofCOVID 19ontourisminbrazilDocument7 pagesEconomicimpactofCOVID 19ontourisminbrazilfarid affanNo ratings yet

- Key Socio-Economic IndicatorsDocument2 pagesKey Socio-Economic IndicatorsRoss GellerNo ratings yet

- AP6171 - 1.2 - 2020APM008 - Siddharth Soumya Roy Report PDFDocument9 pagesAP6171 - 1.2 - 2020APM008 - Siddharth Soumya Roy Report PDFsiddharthasoumyaroyNo ratings yet

- Economy of Argentina - WikipediaDocument20 pagesEconomy of Argentina - WikipediaTomasNo ratings yet

- Social Protection Program Spending and Household Welfare in GhanaFrom EverandSocial Protection Program Spending and Household Welfare in GhanaNo ratings yet

- Harnessing Uzbekistan’s Potential of Urbanization: National Urban AssessmentFrom EverandHarnessing Uzbekistan’s Potential of Urbanization: National Urban AssessmentNo ratings yet

- 134 Harv. L. Rev. F. 11Document23 pages134 Harv. L. Rev. F. 11Swastik GroverNo ratings yet

- Invitation Brochure 9th RMLNLU SCC Online® International Media Law Moot Court Competition 2021Document24 pagesInvitation Brochure 9th RMLNLU SCC Online® International Media Law Moot Court Competition 2021Swastik GroverNo ratings yet

- 114 Penn St. L. Rev. 1003Document44 pages114 Penn St. L. Rev. 1003Swastik GroverNo ratings yet

- Lessons From Indonesian Tax Administration Reform Phase 1 (2001-2008) : Does Good Governance Matter?Document49 pagesLessons From Indonesian Tax Administration Reform Phase 1 (2001-2008) : Does Good Governance Matter?Swastik GroverNo ratings yet

- Indonesia Third Indonesia Fiscal Reform Development Policy Loan ProjectDocument81 pagesIndonesia Third Indonesia Fiscal Reform Development Policy Loan ProjectSwastik GroverNo ratings yet

- Atlantic City: Building A Foundation For A Shared ProsperityDocument64 pagesAtlantic City: Building A Foundation For A Shared ProsperitySwastik GroverNo ratings yet

- Can Indonesia Reform Its Tax System? Problems and Options: Tulane Economics Working Paper SeriesDocument46 pagesCan Indonesia Reform Its Tax System? Problems and Options: Tulane Economics Working Paper SeriesSwastik GroverNo ratings yet

- PRN 2011-028 (43 NJR 278 (A) )Document3 pagesPRN 2011-028 (43 NJR 278 (A) )Swastik GroverNo ratings yet

- Indonesia's New Tax Reform: Potential and Direction: Mohamad Ikhsan, Ledi Trialdi, Syarif SyahrialDocument3 pagesIndonesia's New Tax Reform: Potential and Direction: Mohamad Ikhsan, Ledi Trialdi, Syarif SyahrialSwastik GroverNo ratings yet

- Tax Administration Reform and The Society in Indonesia Prasetyo PDFDocument32 pagesTax Administration Reform and The Society in Indonesia Prasetyo PDFSwastik GroverNo ratings yet

- Working Papers: The Wiiw Balkan ObservatoryDocument46 pagesWorking Papers: The Wiiw Balkan ObservatorySwastik GroverNo ratings yet

- Croatia World Bank WPS8203Document54 pagesCroatia World Bank WPS8203Swastik GroverNo ratings yet

- Constitution Seminar 2020 by RMLNLUDocument1 pageConstitution Seminar 2020 by RMLNLUSwastik GroverNo ratings yet

- Perspectives of Tax Reforms in Croatia: Expert Opinion SurveyDocument35 pagesPerspectives of Tax Reforms in Croatia: Expert Opinion SurveySwastik GroverNo ratings yet

- The Impact of Tax Reform On The Hospitality Sector: Some Evidence of The Republic of CroatiaDocument4 pagesThe Impact of Tax Reform On The Hospitality Sector: Some Evidence of The Republic of CroatiaSwastik GroverNo ratings yet

- Foreign Exchange Refers To Foreign Currency and Where The Exchange of These Foreign CurrenciesDocument8 pagesForeign Exchange Refers To Foreign Currency and Where The Exchange of These Foreign CurrenciesSwastik GroverNo ratings yet

- The Reinvention of Atlantic City New Jersey Institutional Investors Conference April 9, 2015Document17 pagesThe Reinvention of Atlantic City New Jersey Institutional Investors Conference April 9, 2015Swastik GroverNo ratings yet

- Assignment SynopsisDocument6 pagesAssignment SynopsisSwastik GroverNo ratings yet

- Tax Administration Reform in Transition: The Case of CroatiaDocument40 pagesTax Administration Reform in Transition: The Case of CroatiaSwastik GroverNo ratings yet

- Assignment Synopsis ForexDocument6 pagesAssignment Synopsis ForexSwastik GroverNo ratings yet

- Aftermath of Artificial Intelligence On TeslaDocument5 pagesAftermath of Artificial Intelligence On TeslaSwastik GroverNo ratings yet

- A Synopsis On: Submitted By-ABHILASH MISHRA (B.A LL. B Semester - 1) Submitted To - Mr. HARISH CHAND SINGHDocument5 pagesA Synopsis On: Submitted By-ABHILASH MISHRA (B.A LL. B Semester - 1) Submitted To - Mr. HARISH CHAND SINGHSwastik GroverNo ratings yet

- Legislative Drafting P M BakshiDocument9 pagesLegislative Drafting P M BakshiSwastik GroverNo ratings yet

- Topic: Gentle Justice in Contemporary Indaian SocietyDocument6 pagesTopic: Gentle Justice in Contemporary Indaian SocietySwastik GroverNo ratings yet

- Legislative DraftingDocument14 pagesLegislative DraftingSwastik GroverNo ratings yet

- Topic: Gentle Justice in Contemporary Indaian SocietyDocument6 pagesTopic: Gentle Justice in Contemporary Indaian SocietySwastik GroverNo ratings yet

- Unemployment ArticleDocument7 pagesUnemployment Articledeepthi k thomasNo ratings yet

- Fed Reserve Member Banks 6-20-09Document229 pagesFed Reserve Member Banks 6-20-09Ragnar DanneskjoldNo ratings yet

- Indian Economy On The Eve of IndependenceDocument5 pagesIndian Economy On The Eve of IndependenceAshiga RajendaranNo ratings yet

- EntrepreneurshipDocument3 pagesEntrepreneurshipVandita KhudiaNo ratings yet

- 购买 SATOR LNG 中介支付承诺书: Letter Of Commitment To Purchase Satorlng Intermediary PaymentDocument3 pages购买 SATOR LNG 中介支付承诺书: Letter Of Commitment To Purchase Satorlng Intermediary PaymentJIN YuanNo ratings yet

- Foreign TradeDocument2 pagesForeign TradeSuniel ChhetriNo ratings yet

- Mapping The Potential Impact of Brexit On Indian EconomyDocument7 pagesMapping The Potential Impact of Brexit On Indian Economyaruba ansariNo ratings yet

- If MCQ 40 Nos.Document7 pagesIf MCQ 40 Nos.gowthamNo ratings yet

- Women's Employment in IndiaDocument7 pagesWomen's Employment in IndiaHSOUMYANo ratings yet

- Unwto Tourism Highlights: 2018 EditionDocument20 pagesUnwto Tourism Highlights: 2018 Editionкристина раджабоваNo ratings yet

- Jurists Bar Review Center™: Tax 1 Pre-Week Notes Taxation 1Document2 pagesJurists Bar Review Center™: Tax 1 Pre-Week Notes Taxation 1nomercykillingNo ratings yet

- Ethiopian Sugar Industry ProfileDocument33 pagesEthiopian Sugar Industry Profilegetachew yetena100% (3)

- Chapter 10 Foreign Trade of IndiaDocument6 pagesChapter 10 Foreign Trade of IndiaKajal YadavNo ratings yet

- Sample Final Exam Bbek4203 - 1Document4 pagesSample Final Exam Bbek4203 - 1Marlissa Nur OthmanNo ratings yet

- Overview of The BSPDocument22 pagesOverview of The BSPelaineNo ratings yet

- Agriculture in India: Euromonitor International March 2021Document24 pagesAgriculture in India: Euromonitor International March 2021DDNo ratings yet

- Griffin Chap 05Document19 pagesGriffin Chap 05Spil_vv_IJmuidenNo ratings yet

- Railways in AssamDocument3 pagesRailways in Assamtiewkhongwir77100% (1)

- Planning in IndiaDocument7 pagesPlanning in Indiaabhiraj11No ratings yet

- Analysis of RBI's Quarterly StatementsDocument3 pagesAnalysis of RBI's Quarterly StatementsNitish BajajNo ratings yet

- Overview of Industry 2020Document6 pagesOverview of Industry 2020Ashvin SinghNo ratings yet

- Answer - Essay PDFDocument11 pagesAnswer - Essay PDFNguyễn Quốc HưngNo ratings yet

- IMPACT of FDI IN INDIADocument17 pagesIMPACT of FDI IN INDIABharathyNo ratings yet

- By Brgy. Final Grade 7-12 Clustering-Tac-PastranaDocument19 pagesBy Brgy. Final Grade 7-12 Clustering-Tac-PastranaIzel E. VargasNo ratings yet

- Fundamentals of Political EconomyDocument208 pagesFundamentals of Political Economypsyops008No ratings yet

- Test International TradeDocument4 pagesTest International TradeszkNo ratings yet

- Itas User Manual 46871eac18Document17 pagesItas User Manual 46871eac18JamesXavierNo ratings yet

- Comparative Analysis of Bkash Limited With Other Mobile Banking InstitutionsDocument2 pagesComparative Analysis of Bkash Limited With Other Mobile Banking InstitutionsMazbahul IslamNo ratings yet

- 6 Zimbabwean DollarDocument32 pages6 Zimbabwean DollarArjun Nayak100% (1)