Professional Documents

Culture Documents

Top Three Recommendations PDF

Top Three Recommendations PDF

Uploaded by

Emerson Richard0 ratings0% found this document useful (0 votes)

20 views2 pagesThe document outlines recommendations to reform policies in the Philippines to promote the digital economy. It recommends streamlining permits for infrastructure projects to improve connectivity affordability and availability. It also recommends mandating e-permitting and payments for government agencies to promote social distancing and efficiency. Finally, it recommends establishing strong consumer protection frameworks and regulations to make e-commerce and digital transactions safer and more trustworthy. The recommendations aim to accelerate digital adoption through infrastructure investment, government modernization, and protecting consumers online. Responsible agencies are given deadlines ranging from immediate to 12 months to implement the reforms.

Original Description:

Original Title

Top Three Recommendations.pdf

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document outlines recommendations to reform policies in the Philippines to promote the digital economy. It recommends streamlining permits for infrastructure projects to improve connectivity affordability and availability. It also recommends mandating e-permitting and payments for government agencies to promote social distancing and efficiency. Finally, it recommends establishing strong consumer protection frameworks and regulations to make e-commerce and digital transactions safer and more trustworthy. The recommendations aim to accelerate digital adoption through infrastructure investment, government modernization, and protecting consumers online. Responsible agencies are given deadlines ranging from immediate to 12 months to implement the reforms.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

20 views2 pagesTop Three Recommendations PDF

Top Three Recommendations PDF

Uploaded by

Emerson RichardThe document outlines recommendations to reform policies in the Philippines to promote the digital economy. It recommends streamlining permits for infrastructure projects to improve connectivity affordability and availability. It also recommends mandating e-permitting and payments for government agencies to promote social distancing and efficiency. Finally, it recommends establishing strong consumer protection frameworks and regulations to make e-commerce and digital transactions safer and more trustworthy. The recommendations aim to accelerate digital adoption through infrastructure investment, government modernization, and protecting consumers online. Responsible agencies are given deadlines ranging from immediate to 12 months to implement the reforms.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 2

TOP THREE RECOMMENDATIONS

Philippines Digital Economy

Nature of the policy Expected

Reform Goals Reform Actions Responsible agency Timeline

action result/impact

STREAMLINE PERMITS FOR INFRASTRUCTURE PROVISION, AND RATIONALIZE FEES IMPOSED BY NATIONAL AND LOCAL GOVERNMENT AGENCIES, AS WELL AS PRIVATE

SECTOR ASSOCIATIONS

Make fast internet • Passage of Public Services Act amendment and Open Legislature Improved mobile Congress 6 months

affordable and Access Bill and broadband

available for connectivity

Filipinos • Passage of Common Tower, Infrastructure Sharing and Memorandum Shared use of DICT 6 months

Pole Attachment Policies Circular (MC) infrastructure

• Passage of Joint Memorandum Circulars on streamlining Joint Memorandum Increased private ARTA, DICT, DILG, 6 months

of permits for cell towers, and cable laying Circular (JMC) investment in DHSUD, DOE,

telecom DPWH

infrastructure

• Passage of Spectrum Management Policy JMC More efficient use DICT 6 months

of spectrum

MANDATE GOVERNMENT AGENCIES TO GO DIGITAL BY OFFERING E-PERMITS AND E-PAYMENTS

Digitalize • Policy mandating the use of electronic permit JMC Improved NEDA, DOF, ARTA, 3 months

government processing, including equivalence of scanned copies, administrative BTr, all government

processes to digital payments and electronic or scanned receipts efficiency, and agencies

promote social increased digital

distancing and adoption

administrative • Policy requiring all government agencies to utilize e- MC Greater digital DICT Immediate

efficiency signatures adoption

• Policy clarifying government rules on the acceptance of Issuances Clarification of legal BIR, COA, BTr, BSP 3 months

electronic payments and issuance of electronic or bases

scanned receipts as per government accounting

requirements

ESTABLISH STRONG CONSUMER PROTECTION FRAMEWORK AND REGULATIONS

Make e-commerce • Passage of Financial Consumer Protection Law (including Legislature Increased usage of Congress 6 months

transactions safer a consolidated ombudsman for financial services) digital transactions

and trustworthy (payments, financial

services)

• Strengthening a general consumer protection MC Increase use of DTI, NEDA 12 months

framework including grievance mechanism digital services (e-

commerce, digital

content, etc)

• In addition to strengthen a general consumer protection, Issuances Increase usage of DOF, BSP, SEC, IC 6 months

policy and supervisory framework on financial consumer digital payments and PDIC

protection (coordinated among financial regulators and financial

(DOF, BSP, SEC, IC and PDIC) services

You might also like

- Medium-Term Philippine Development Plan 1999-2004Document127 pagesMedium-Term Philippine Development Plan 1999-2004Emerson Richard0% (2)

- Electronic Records Management StandardDocument44 pagesElectronic Records Management StandardMwaura100% (1)

- Nigeria Digital Economy Diagnostic Report Recommendation ChecklistDocument13 pagesNigeria Digital Economy Diagnostic Report Recommendation Checklistebitechukwudi100% (1)

- Principles of E-KrantiDocument8 pagesPrinciples of E-Krantisanjay singhNo ratings yet

- Briefing Report: Standing Committee On AppropriationDocument16 pagesBriefing Report: Standing Committee On AppropriationIta NurjanahNo ratings yet

- Eco 3Document26 pagesEco 3anon_137608313No ratings yet

- Introduction of E-Governance and E-Government in The PhilippinesDocument23 pagesIntroduction of E-Governance and E-Government in The PhilippinesRandy SalamatNo ratings yet

- The Edge Computing in The Era of Covid 19Document20 pagesThe Edge Computing in The Era of Covid 19Michelle ElwindrefNo ratings yet

- Digital IndiaDocument24 pagesDigital Indiapriyanka joshi100% (1)

- RDSS GuidelinesDocument56 pagesRDSS GuidelinesAnkushNo ratings yet

- Covid19 - Govtech Solutions Cem Dener EngDocument29 pagesCovid19 - Govtech Solutions Cem Dener EngMoises PompaNo ratings yet

- Digital IndiaDocument20 pagesDigital IndiaMohammedAlQureshiNo ratings yet

- E-Government: Santos, Nikki Jane S. BPA-4ADocument7 pagesE-Government: Santos, Nikki Jane S. BPA-4AJhe Cie BautistaNo ratings yet

- White Paper: DPI and PolicyDocument17 pagesWhite Paper: DPI and PolicyAnonymous SmYjg7gNo ratings yet

- Digital Government Transformation Strategy 2018 - 2022Document106 pagesDigital Government Transformation Strategy 2018 - 2022Shehnaaz Begum DURGAHENo ratings yet

- Integrated E-Government: White Paper - June 2009Document14 pagesIntegrated E-Government: White Paper - June 2009ictQATARNo ratings yet

- Cloud Computing: Helping Financial Institutions Leverage The Cloud To Improve IT EfficiencyDocument15 pagesCloud Computing: Helping Financial Institutions Leverage The Cloud To Improve IT EfficiencyIBMBankingNo ratings yet

- Digital India PresentationDocument20 pagesDigital India PresentationSahil AroraNo ratings yet

- 제안요청서 수정본Document66 pages제안요청서 수정본canada.yoonjrNo ratings yet

- Khyber Pakhtunkhwa Digital Policy 2018-2023Document23 pagesKhyber Pakhtunkhwa Digital Policy 2018-2023Insaf.PKNo ratings yet

- E-Governance BriefDocument3 pagesE-Governance BriefArya SenNo ratings yet

- Digital Trade RoadmapDocument8 pagesDigital Trade RoadmapAimi SuhailaNo ratings yet

- Sandro Bazzanella Itu-Ec Project Cto June 2012Document13 pagesSandro Bazzanella Itu-Ec Project Cto June 2012raed messaoudiNo ratings yet

- Avasant Blockchain Services 2023 2024 Market Insights ExcerptDocument9 pagesAvasant Blockchain Services 2023 2024 Market Insights ExcerptMai Phương LêNo ratings yet

- S6 Kiyoung KoDocument12 pagesS6 Kiyoung KoYahya RowniNo ratings yet

- E-Governance in India This Article Discussed About E-Governance, Models, Successes, Limitations. Before That What Is E-Governance E-GovernanceDocument7 pagesE-Governance in India This Article Discussed About E-Governance, Models, Successes, Limitations. Before That What Is E-Governance E-GovernancePraveen RajNo ratings yet

- KRA ICT STRATEGY Online VersionDocument50 pagesKRA ICT STRATEGY Online Version2108074No ratings yet

- Frost & Sullivan - State of Cloud Computing in The Public Sector - FinalDocument17 pagesFrost & Sullivan - State of Cloud Computing in The Public Sector - FinalHimanshu GondNo ratings yet

- True Financial Publications 2q2023Document20 pagesTrue Financial Publications 2q2023jjaikongNo ratings yet

- Amplifying Beneficiary Impact and Experience in The G2P Digital TransformationDocument4 pagesAmplifying Beneficiary Impact and Experience in The G2P Digital TransformationMd. Abdur RakibNo ratings yet

- Designing and Implementing E-Government Strategy: Deepak BhatiaDocument47 pagesDesigning and Implementing E-Government Strategy: Deepak BhatiaAnji ReddyNo ratings yet

- DR A.K. Tiwari: Original Research PaperDocument3 pagesDR A.K. Tiwari: Original Research PaperDrAshok Kumar TiwariNo ratings yet

- DigitalIndiaPresentation 2Document26 pagesDigitalIndiaPresentation 2Ruchi JainNo ratings yet

- Ict: The Philippine ExperienceDocument36 pagesIct: The Philippine ExperienceJaiDomeyegNo ratings yet

- Doing More With Less Through Strategic Investments: Federal Information TechnologyDocument10 pagesDoing More With Less Through Strategic Investments: Federal Information TechnologyFedScoopNo ratings yet

- Baker McKenzie - 2020 Cloud Survey - Key Takeways For FIsDocument9 pagesBaker McKenzie - 2020 Cloud Survey - Key Takeways For FIsMaksym HlotovNo ratings yet

- Viet Nam Regulatory Landscape Digital Payment and Implications Development Smart CitiesDocument9 pagesViet Nam Regulatory Landscape Digital Payment and Implications Development Smart CitiesCường MạnhNo ratings yet

- PWC - Payment Trends in APACDocument18 pagesPWC - Payment Trends in APACVinay SudershanNo ratings yet

- E GovernanceDocument5 pagesE Governancesandesh negiNo ratings yet

- Transforming Government Through DigitizationDocument5 pagesTransforming Government Through DigitizationGanjar DaniswaraNo ratings yet

- Chap 5 2003Document19 pagesChap 5 2003Wahid Rahman RahmaniNo ratings yet

- Pramod Agrawal: Presentation byDocument26 pagesPramod Agrawal: Presentation byp&t audit nagpur admnNo ratings yet

- Digital Transformation Roadmap Presentation - 190423Document25 pagesDigital Transformation Roadmap Presentation - 190423Moses HenryNo ratings yet

- Indian Digital PolicyDocument11 pagesIndian Digital PolicyUdit AggarwalNo ratings yet

- Information Technology Activities in The PhilippinesDocument37 pagesInformation Technology Activities in The PhilippinesBong SemanaNo ratings yet

- HIPCAR Assessment CybercrimesDocument120 pagesHIPCAR Assessment CybercrimesNirosha RathnayakeNo ratings yet

- MGT7103 Group 4 - Maxis - Presentation 1Document48 pagesMGT7103 Group 4 - Maxis - Presentation 1hpone.mbaNo ratings yet

- National Common Mobility Card NCMC Integrated Multi Modal Ticketing PWCDocument13 pagesNational Common Mobility Card NCMC Integrated Multi Modal Ticketing PWCMmNo ratings yet

- Digital India PresentationDocument23 pagesDigital India PresentationRuchi JainNo ratings yet

- The Value Added Tax (Digital Marketplace Supply) Regulations, 2020Document10 pagesThe Value Added Tax (Digital Marketplace Supply) Regulations, 2020HerbertNo ratings yet

- Arc - Gov.in 11threp Arc 11threport Ch2Document7 pagesArc - Gov.in 11threp Arc 11threport Ch2Prakash AzadNo ratings yet

- Project Information Document (Pid) Appraisal Stage Project Name Region Sector Project ID Borrower(s) Implementing AgencyDocument12 pagesProject Information Document (Pid) Appraisal Stage Project Name Region Sector Project ID Borrower(s) Implementing AgencyA-Jay N. GalizaNo ratings yet

- Short-To Medium-Term Roadmap For Eastern Africa Power Systems IntegrationDocument17 pagesShort-To Medium-Term Roadmap For Eastern Africa Power Systems IntegrationEdward Baleke SsekulimaNo ratings yet

- 7.6.1 National ICT Ecosystem FrameworkDocument12 pages7.6.1 National ICT Ecosystem Frameworkfmc&de NigeriaNo ratings yet

- Qos/Qoe Strategies Monitoring in Senegal: Head of Qos & Coverage Department ArtpDocument23 pagesQos/Qoe Strategies Monitoring in Senegal: Head of Qos & Coverage Department ArtpkenedyNo ratings yet

- Information & Communications Technology Strategy 2020-2025Document39 pagesInformation & Communications Technology Strategy 2020-2025somaliyow17No ratings yet

- Rationale For The M&A: Recent Stock Price Trend For BDCOMDocument12 pagesRationale For The M&A: Recent Stock Price Trend For BDCOMtazimNo ratings yet

- Thailand Digital Transformation in Public Sector Aug19Document19 pagesThailand Digital Transformation in Public Sector Aug19Nakunta ChaiyanajitNo ratings yet

- CHINA'S SOCIAL CREDIT SYSTEM A Big-Data Enabled Approach To Market Regulation With Broad Implications For Doing Business in ChinaDocument13 pagesCHINA'S SOCIAL CREDIT SYSTEM A Big-Data Enabled Approach To Market Regulation With Broad Implications For Doing Business in ChinaVucjipastir77No ratings yet

- Ed11 Notes - Module 1Document14 pagesEd11 Notes - Module 1Jianna Tang IndingNo ratings yet

- An Introduction to SDN Intent Based NetworkingFrom EverandAn Introduction to SDN Intent Based NetworkingRating: 5 out of 5 stars5/5 (1)

- Agenda M01-S2020Document2 pagesAgenda M01-S2020Emerson RichardNo ratings yet

- Matrix of House/Senate Bills On Amending The Public Service ActDocument6 pagesMatrix of House/Senate Bills On Amending The Public Service ActEmerson RichardNo ratings yet

- Notice M01-S2020 PDFDocument1 pageNotice M01-S2020 PDFEmerson RichardNo ratings yet

- Appendix A.13 - Sample Data Sharing Agreement - 508Document3 pagesAppendix A.13 - Sample Data Sharing Agreement - 508Emerson RichardNo ratings yet

- 6 Steps in Settling The Estate of A Dead Person in The Philippines - REALTTORNEYDocument20 pages6 Steps in Settling The Estate of A Dead Person in The Philippines - REALTTORNEYEmerson Richard100% (1)

- PressRelease Fitch Affirms The Philippines at 'BBB - Outlook Positive - 2016Document3 pagesPressRelease Fitch Affirms The Philippines at 'BBB - Outlook Positive - 2016Emerson RichardNo ratings yet

- Spatial Economterics Using SMLEDocument29 pagesSpatial Economterics Using SMLEEmerson RichardNo ratings yet

- TaxDocument89 pagesTaxEmerson RichardNo ratings yet

- Forecasting Domestic Credit GrowthDocument14 pagesForecasting Domestic Credit GrowthEmerson RichardNo ratings yet

- Classification of CountriesDocument7 pagesClassification of CountriesEmerson RichardNo ratings yet

- List of Verbs For Formulating Learning Objectives: Those That Communicate Knowledge: InformationDocument2 pagesList of Verbs For Formulating Learning Objectives: Those That Communicate Knowledge: InformationEmerson RichardNo ratings yet

- Potential Growth in Emerging AsiaDocument26 pagesPotential Growth in Emerging AsiaEmerson RichardNo ratings yet

- TheImpactOfFDIOnChildLaborInsigh PreviewDocument32 pagesTheImpactOfFDIOnChildLaborInsigh PreviewEmerson RichardNo ratings yet

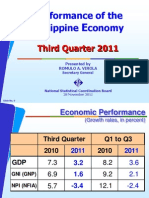

- Supply Side: Iii. Monetary and Banking Sector (%) (BSP) I. Real SectorDocument1 pageSupply Side: Iii. Monetary and Banking Sector (%) (BSP) I. Real SectorEmerson RichardNo ratings yet

- Rav 3Q 2011Document44 pagesRav 3Q 2011Emerson RichardNo ratings yet

- GOLD - BUSINESS - ACCOUNT - 23 August 2023 To 23 September 2023Document4 pagesGOLD - BUSINESS - ACCOUNT - 23 August 2023 To 23 September 2023Charmaine BamusiNo ratings yet

- Assignment No. 2 - Cash and Cash EquivalentsDocument1 pageAssignment No. 2 - Cash and Cash EquivalentsAngel MarieNo ratings yet

- Management Assessment 1 - Short AnswersDocument16 pagesManagement Assessment 1 - Short AnswersArbabNo ratings yet

- 1 PBDocument5 pages1 PBSITI NUR HARUM PUJAYANTINo ratings yet

- A Study of Employee Training in State Bank of India: A Project Submitted ToDocument43 pagesA Study of Employee Training in State Bank of India: A Project Submitted ToZaii Vohra50% (2)

- EF Lecture 1 2022Document41 pagesEF Lecture 1 2022Simon GalvizNo ratings yet

- Branch Accounting Lecture... 1 1Document84 pagesBranch Accounting Lecture... 1 1WILBROAD THEOBARDNo ratings yet

- Mini-Bar in GuestroomDocument5 pagesMini-Bar in GuestroomAngelica CasullaNo ratings yet

- Characteristics of MicroeconomicsDocument11 pagesCharacteristics of MicroeconomicsMaria JessaNo ratings yet

- C1 Writing ChartsDocument16 pagesC1 Writing ChartsIldiko BiroNo ratings yet

- 22 XXX XXX TP Cibil ReportDocument5 pages22 XXX XXX TP Cibil ReportMahakaal Digital PointNo ratings yet

- Statement of Accountrcelispromotircppc112123032023111117Document2 pagesStatement of Accountrcelispromotircppc112123032023111117jack.rccorpNo ratings yet

- Conveyancing Practice (Law 4612) QUIZ (30%)Document7 pagesConveyancing Practice (Law 4612) QUIZ (30%)Alia PalilNo ratings yet

- Financial Situation (2016-2018) GalaxoDocument3 pagesFinancial Situation (2016-2018) GalaxoAmr MekkawyNo ratings yet

- Marico Limited - Investor Presentation - June 2023Document44 pagesMarico Limited - Investor Presentation - June 2023Anamika RoyNo ratings yet

- MS EconomicsDocument16 pagesMS EconomicsSachinNo ratings yet

- Valuatio of Goodwill WS-1Document2 pagesValuatio of Goodwill WS-1Srishti SinghNo ratings yet

- Sheela Foam LTD.: Issue Type: DebtDocument15 pagesSheela Foam LTD.: Issue Type: DebtIshaan DuaNo ratings yet

- Version 5.0 (PASS5) : November 12, 2008Document5 pagesVersion 5.0 (PASS5) : November 12, 2008Otis MelbournNo ratings yet

- Lecture - Salvatore Iare-Mefa-PptsDocument519 pagesLecture - Salvatore Iare-Mefa-PptsKahimbiNo ratings yet

- The General Ledger of Corso Care Corp A Veterinary CompanyDocument2 pagesThe General Ledger of Corso Care Corp A Veterinary CompanyBube KachevskaNo ratings yet

- World in 2020Document467 pagesWorld in 2020shuvam banerjeeNo ratings yet

- Watson Accounting ProceduresDocument3 pagesWatson Accounting ProceduresLevi Lazareno EugenioNo ratings yet

- 02 - Corporate Governance Scorecard and SEC by Austin UdehDocument12 pages02 - Corporate Governance Scorecard and SEC by Austin UdehAustin Sams UdehNo ratings yet

- Cost AccountingDocument3 pagesCost AccountingXen XeonNo ratings yet

- Group Assignment QuestionsDocument6 pagesGroup Assignment QuestionsRishabh GigrasNo ratings yet

- 254-Test 2.1 - GeetaDocument2 pages254-Test 2.1 - GeetasansarnathNo ratings yet

- 10 36543-Kauiibfd 2021 048-1675635Document19 pages10 36543-Kauiibfd 2021 048-1675635Golles Avril Eunica C.No ratings yet

- Direct Imports To Kenya Previously Registered in KenyaDocument3 pagesDirect Imports To Kenya Previously Registered in KenyaisaacNo ratings yet

- Spa AssumedDocument4 pagesSpa AssumedJenifer RubioNo ratings yet