Professional Documents

Culture Documents

Tugas Pertemuan 10 - Sopianti (1730611006)

Tugas Pertemuan 10 - Sopianti (1730611006)

Uploaded by

sopiantiOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Tugas Pertemuan 10 - Sopianti (1730611006)

Tugas Pertemuan 10 - Sopianti (1730611006)

Uploaded by

sopiantiCopyright:

Available Formats

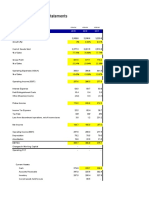

Income Statement and Balance Sheet for Vitex Corp

Income Statement ($ Million)

Forecast Pe

1999 2000 2001 2002 2003

Sales 1,234.9 1,251.7 1,300.4 1,334.4 1,401.1

Cost of Sales 679.1 659.0 681.3 667.0 728.6

Gross Operating income 555.8 592.7 619.1 667.4 672.5

Selling, General & Admin. Expenses 339.7 348.6 351.2 373.3 406.3

Depreciation 47.5 52.0 55.9 75.2 81.1

Other Net (Income)/Expenses (11.8) (7.6) (7.0) (8.2) (9.8)

EBIT 180.4 199.7 219.0 227.1 194.9

Interest (Income) (1.3) (1.4) (1.7) (2.0) (1.7)

Interest Expense 16.2 15.1 20.5 23.7 21.2

Pre-Tax Income 165.5 186.0 200.2 205.4 175.5

Income Taxes 56.8 64.2 67.5 72.6 61.4

Net Income 108.7 121.8 132.7 132.8 114.0

Dividends 38.3 38.7 67.5 40.1 45.6

Addition to Retained Earnings 70.4 83.1 65.2 92.7 68.4

Balance Sheet ($ Million)

Assets

Cash and Marketable Securities 25.6 23.0 32.1 28.4 29.4

Accounts Receivable 99.4 102.9 107.3 120.1 117.7

Inventories 109.6 108.0 114.9 116.8 123.3

Other Current Assets 96.7 91.4 103.7 97.5 106.5

Total Current Assets 331.3 325.3 358.0 362.8 376.9

Property, Plant and Equipment, Gross 680.9 734.3 820.8 913.1 1,013.5

Accumulated Depreciation 244.8 296.8 352.7 427.9 509.0

Property, Plant and Equipment, Net 436.1 437.5 468.1 485.2 504.6

Other Non Current Assets 203.2 205.1 407.0 456.3 501.9

Total Non Current Assets 639.3 642.6 875.1 941.5 1,006.5

Total Assets 970.6 967.9 1,233.1 1,304.3 1,383.4

Liabilities and Shareholders' Equity

Accounts Payable 82.8 77.1 71.8 80.5 85.5

Short Term Debt 39.1 29.7 79.8 110.3 110.3

Other Current Liabilities 152.0 123.8 172.1 111.3 116.3

Total Current Liabilities 273.9 230.6 323.7 302.1 312.1

Long Term Debt 163.5 145.0 201.8 218.1 218.1

Deferred Income Taxes 22.3 19.6 15.0 12.7 19.6

Other Non Current Liabilities 100.6 80.1 115.0 94.5 106.5

Total Liabilities 560.3 475.3 655.5 627.4 656.3

Paid in Capital 46.9 46.1 38.2 44.8 44.8

Retained Earning 363.4 446.5 539.4 632.1 700.5

Total Shareholders' Equity 410.3 492.6 577.6 676.9 745.3

Total Liabilities and Shareholders' Equity 970.6 967.9 1,233.1 1,304.3 1,401.6

Discretionary Funding Need (DFN) (18.2)

Others Data

Stock Price (year end) 55.5 65.3 55.7 51.4

Average number of shares oustanding (millions) 48.0 47.3 46.8 46.2

Sensitivity Analysis for Vitex Corp

For

Net Income

Sales growth rates per year>

Cost of sales to sales ratio>

Sales growth rates per years>

Forecast Period Forecasting

2004 2005 2006 Factor

1,471.2 1,544.7 1,622.0 5%

765.0 803.3 843.4 52%

706.2 741.5 778.5

426.6 448.0 470.4 29%

90.0 99.9 110.9 8%

(10.3) (10.8) (11.4) -0.7%

199.8 204.4 208.6

(1.8) (1.9) (2.0) 6%

21.2 21.2 21.2 7%

180.4 185.1 189.4

63.1 64.8 66.3 35%

117.3 120.3 123.1

46.9 48.1 49.2 40%

70.4 72.2 73.9

30.9 32.4 34.1 2.1%

123.6 129.8 136.2 8.4%

129.5 135.9 142.7 8.8%

111.8 117.4 123.3 7.6%

395.7 415.5 436.3

1,125.0 1,248.8 1,386.2 11%

599.0 698.9 809.8

526.0 549.9 576.4

552.1 607.3 668.1 10%

1,078.2 1,157.2 1,244.4

1,473.9 1,572.8 1,680.7

89.7 94.2 98.9 6.1%

110.3 110.3 110.3

122.1 128.2 134.6 8.3%

322.1 332.7 343.9

218.1 218.1 218.1

20.6 21.6 22.7 1.4%

111.8 117.4 123.3 7.6%

672.7 689.9 707.9

44.8 44.8 44.8

770.9 843.1 916.9

815.7 887.9 961.7

1,488.3 1,577.7 1,669.7

(14.43) (5.0) 11.1

For 2006

EPS Div./Share Stock Price

EBIT for 2003

Income Statement and Balance Sheet for Vitex Corp

Income Statement ($ Million)

Forecast Period

2002 2003 2004 2005

Sales 1,334.4 1,401.1 1,471.2 1,544.7

Cost of Sales 667.0 728.6 765.0 803.3

Gross Operating income 667.4 672.5 706.2 741.5

Selling, General & Admin. Expenses 373.3

Depreciation 75.2

Other Net (Income)/Expenses (8.2)

EBIT 227.1

Interest (Income) (2.0)

Interest Expense 23.7

Pre-Tax Income 205.4

Income Taxes 72.6

Net Income 132.8

Dividends 40.1

Addition to Retained Earnings 92.7

Balance Sheet ($ Million)

Assets

Cash and Marketable Securities 28.4

Accounts Receivable 120.1

Inventories 116.8

Other Current Assets 97.5

Total Current Assets 362.8

Property, Plant and Equipment, Gross 913.1

Accumulated Depreciation 427.9

Property, Plant and Equipment, Net 485.2

Other Non Current Assets 456.3

Total Non Current Assets 941.5

Total Assets 1,304.3

Liabilities and Shareholders' Equity

Accounts Payable 80.5

Short Term Debt 110.3

Other Current Liabilities 111.3

Total Current Liabilities 302.1

Long Term Debt 218.1

Deferred Income Taxes 12.7

Other Non Current Liabilities 94.5

Total Liabilities 627.4

Paid in Capital 44.8

Retained Earning 632.1

Total Shareholders' Equity 676.9

Total Liabilities and Shareholders' Equity 1,304.3

Discretionary Funding Need (DFN)

Sensitivity Analysis for Vitex Corp

For 2006

Net Income EPS Div./Share

Sales growth rates per year>

EBIT for 2003

Cost of sales to sales ratio>

Sales growth rates per years>

Forecasting

2006 Factor

1,622.0 5%

843.4 52%

778.5

006

Stock Price

BIT for 2003

Scenario Summary

Changing Cells

Sales growth rate

Cost of sales to sales ratio

SG&A to sales ratio

Gross PP&E growth rate

Result Cells:

2003

Net Income

EPS

Dividend per Share

Return on Equity

Times Interest earned

2006

Net Income

EPS

Dividend per Share

Return on Equity

Times Interest earned

You might also like

- Case 11 Horniman Horticulture 20170504Document16 pagesCase 11 Horniman Horticulture 20170504Chittisa Charoenpanich100% (4)

- Bidding For Hertz Leveraged Buyout, Spreadsheet SupplementDocument12 pagesBidding For Hertz Leveraged Buyout, Spreadsheet SupplementAmit AdmuneNo ratings yet

- 6 Polaroid Corporation 1996Document64 pages6 Polaroid Corporation 1996jk kumarNo ratings yet

- S9 - XLS069-XLS-ENG MarriottDocument12 pagesS9 - XLS069-XLS-ENG MarriottCarlosNo ratings yet

- CASE Exhibits - HertzDocument15 pagesCASE Exhibits - HertzSeemaNo ratings yet

- Stryker Corporation: Capital BudgetingDocument8 pagesStryker Corporation: Capital Budgetinggaurav sahuNo ratings yet

- Marriott (2) ..Document13 pagesMarriott (2) ..veninsssssNo ratings yet

- Weekends TareaDocument9 pagesWeekends Tareasergio ramozNo ratings yet

- XLS EngDocument26 pagesXLS EngcellgadizNo ratings yet

- Caso 2 Excel 1Document8 pagesCaso 2 Excel 1Carolina NunezNo ratings yet

- Wassim Zhani Starbucks Valuation 2007-2011Document13 pagesWassim Zhani Starbucks Valuation 2007-2011wassim zhaniNo ratings yet

- Fima Midterm ActsDocument4 pagesFima Midterm ActsKatrina PaquizNo ratings yet

- Case 2 - Marriott CorporationDocument29 pagesCase 2 - Marriott CorporationMorten LassenNo ratings yet

- Review: Ten Year (Standalone)Document10 pagesReview: Ten Year (Standalone)maruthi631No ratings yet

- Exhibit 1: Income Taxes 227.6 319.3 465.0 49.9Document11 pagesExhibit 1: Income Taxes 227.6 319.3 465.0 49.9rendy mangunsongNo ratings yet

- Financial Statements-Kingsley AkinolaDocument4 pagesFinancial Statements-Kingsley AkinolaKingsley AkinolaNo ratings yet

- Exhibit 1 Horniman Horticulture Projected Horniman Horticulture Financial Summary (In Thousands of Dollars)Document2 pagesExhibit 1 Horniman Horticulture Projected Horniman Horticulture Financial Summary (In Thousands of Dollars)Hằng Dương Thị MinhNo ratings yet

- BIOCON Ratio AnalysisDocument3 pagesBIOCON Ratio AnalysisVinuNo ratings yet

- Golden State Canning Company, Inc.: Selected Income Statement Items, Year Ending December 31Document1 pageGolden State Canning Company, Inc.: Selected Income Statement Items, Year Ending December 31dynaNo ratings yet

- Projections & ValuationDocument109 pagesProjections & ValuationPulokesh GhoshNo ratings yet

- Siddhi Chokhani - 65: Rahul Gupta - 31 Shyam Parasrampuria - 40 Reema Parkar - 54 Vidhi Gala - 57 Radhika Bajaj - 64Document31 pagesSiddhi Chokhani - 65: Rahul Gupta - 31 Shyam Parasrampuria - 40 Reema Parkar - 54 Vidhi Gala - 57 Radhika Bajaj - 64avinash singhNo ratings yet

- Caso HertzDocument32 pagesCaso HertzJORGE PUENTESNo ratings yet

- FinanceDocument9 pagesFinancekamran040302No ratings yet

- Adidas Chartgenerator ArDocument2 pagesAdidas Chartgenerator ArTrần Thuỳ NgânNo ratings yet

- 6 Years at A Glance: 2015 Operating ResultsDocument2 pages6 Years at A Glance: 2015 Operating ResultsHassanNo ratings yet

- D.statistical - Appendix (English-2020)Document98 pagesD.statistical - Appendix (English-2020)ArthurNo ratings yet

- Adv EnzDocument4 pagesAdv EnzSafwan BhikhaNo ratings yet

- Management Control CaseDocument9 pagesManagement Control Casera.manriquedNo ratings yet

- Complete P&L Statement TemplateDocument4 pagesComplete P&L Statement TemplateGolamMostafaNo ratings yet

- Altagas Green Exhibits With All InfoDocument4 pagesAltagas Green Exhibits With All InfoArjun NairNo ratings yet

- AirThread Valuation SheetDocument11 pagesAirThread Valuation SheetAngsuman BhanjdeoNo ratings yet

- Profit N Loss of ParleDocument3 pagesProfit N Loss of ParleHoney AliNo ratings yet

- Pidilite Industries Financial ModelDocument39 pagesPidilite Industries Financial ModelKeval ShahNo ratings yet

- Ten Year Review - Standalone: Asian Paints LimitedDocument10 pagesTen Year Review - Standalone: Asian Paints Limitedmaruthi631No ratings yet

- Supplemental Financial Information Q2'24 Quarterly - VFDocument10 pagesSupplemental Financial Information Q2'24 Quarterly - VFjbsNo ratings yet

- WorkingsDocument10 pagesWorkingsKi KiNo ratings yet

- Balance Sheet (2009-2001) of Maruti Suzuki: All Numbers Are in INR and in x10MDocument16 pagesBalance Sheet (2009-2001) of Maruti Suzuki: All Numbers Are in INR and in x10MGirish RamachandraNo ratings yet

- Du Pont AnalysisDocument5 pagesDu Pont Analysisbhavani67% (3)

- Case 1 MarriottDocument14 pagesCase 1 Marriotthimanshu sagar100% (1)

- AirThread SecBC Group9Document4 pagesAirThread SecBC Group9Vishal BhanushaliNo ratings yet

- SWM Annual Report 2016Document66 pagesSWM Annual Report 2016shallynna_mNo ratings yet

- 14-10 Years HighlightsDocument1 page14-10 Years HighlightsJigar PatelNo ratings yet

- Case 3Document53 pagesCase 3ShirazeeNo ratings yet

- BCTC Case 2Document10 pagesBCTC Case 2Trâm Nguyễn QuỳnhNo ratings yet

- Statistical - Appendix Eng-21Document96 pagesStatistical - Appendix Eng-21S M Hasan ShahriarNo ratings yet

- CH 32Document2 pagesCH 32Mukul KadyanNo ratings yet

- Exhibit 1: Gross Profit 3,597.1Document15 pagesExhibit 1: Gross Profit 3,597.1Rendy Setiadi MangunsongNo ratings yet

- Profit and Loss AccountDocument2 pagesProfit and Loss AccountNitish KanreshNo ratings yet

- Nike Balance Sheet RevisedDocument1 pageNike Balance Sheet RevisedawaabieaNo ratings yet

- Annual Trading Report: Strictly ConfidentialDocument3 pagesAnnual Trading Report: Strictly ConfidentialMunazza FawadNo ratings yet

- Polaroid Corporation ENGLISHDocument14 pagesPolaroid Corporation ENGLISHAtul AnandNo ratings yet

- Statistical Appendix (English-2023)Document103 pagesStatistical Appendix (English-2023)Fares Faruque HishamNo ratings yet

- FCFF Vs Fcfe StudentDocument5 pagesFCFF Vs Fcfe StudentKanchan GuptaNo ratings yet

- Colgate Palmolive - DCF Valuation Model - Latest - Anurag 2Document44 pagesColgate Palmolive - DCF Valuation Model - Latest - Anurag 2Anrag Tiwari100% (1)

- XLS728 XLS EngDocument10 pagesXLS728 XLS EngFRANKNo ratings yet

- Tarson Products (Woking Sheet - FRA)Document9 pagesTarson Products (Woking Sheet - FRA)RR AnalystNo ratings yet

- Power Markets and Economics: Energy Costs, Trading, EmissionsFrom EverandPower Markets and Economics: Energy Costs, Trading, EmissionsNo ratings yet

- Securities Operations: A Guide to Trade and Position ManagementFrom EverandSecurities Operations: A Guide to Trade and Position ManagementRating: 4 out of 5 stars4/5 (3)

- Theory, Culture & Society: The AestheticDocument8 pagesTheory, Culture & Society: The AestheticJaime UtrerasNo ratings yet

- 3310-Ch 10-End of Chapter solutions-STDocument30 pages3310-Ch 10-End of Chapter solutions-STArvind ManoNo ratings yet

- Practical 2 Mohd Fahmi Bin Ahmad Jamizi BEHP22106112Document138 pagesPractical 2 Mohd Fahmi Bin Ahmad Jamizi BEHP22106112Tunnel The4thAvenueNo ratings yet

- CIR Vs Filinvest (Case Digest)Document3 pagesCIR Vs Filinvest (Case Digest)Togz Mape100% (1)

- Alternative Dispute Resolution Syllabus LLMDocument5 pagesAlternative Dispute Resolution Syllabus LLMprernaNo ratings yet

- SavitaDocument1 pageSavitaSDM GurugramNo ratings yet

- GeffonDocument6 pagesGeffonDaniel HopsickerNo ratings yet

- Mobilia Products, Inc. v. Umezawa, 452 SCRA 736Document15 pagesMobilia Products, Inc. v. Umezawa, 452 SCRA 736JNo ratings yet

- Economics of PiggeryDocument3 pagesEconomics of Piggerysrujan NJNo ratings yet

- Lichauco, Picazo and Agcaoili For Plaintiffs-Appellants. Cebu City Fiscal and Quirico Del Mar For Defendants-AppelleesDocument22 pagesLichauco, Picazo and Agcaoili For Plaintiffs-Appellants. Cebu City Fiscal and Quirico Del Mar For Defendants-AppelleesSugar Fructose GalactoseNo ratings yet

- Profiles of For-Profit Education Management Companies: Fifth Annual Report 2002-2003Document115 pagesProfiles of For-Profit Education Management Companies: Fifth Annual Report 2002-2003National Education Policy CenterNo ratings yet

- Afisco Insurance Corp v. CADocument3 pagesAfisco Insurance Corp v. CAJulianNo ratings yet

- Award Certificates EDITABLE 1Document7 pagesAward Certificates EDITABLE 1Ruby Ann Gervacio GimenezNo ratings yet

- E-Commerce Assignment For MISDocument11 pagesE-Commerce Assignment For MISIrfan Amin100% (1)

- Group Practice Agency AuthorizationDocument2 pagesGroup Practice Agency AuthorizationAurangzeb JadoonNo ratings yet

- Mayank Mehta EYDocument10 pagesMayank Mehta EYyasmeenfatimak52No ratings yet

- External Commercial BorrowingDocument9 pagesExternal Commercial Borrowingapi-3822396100% (3)

- State-Wise and Year-Wise Details of Minority Status Certificates IssuedDocument3 pagesState-Wise and Year-Wise Details of Minority Status Certificates IssuedSridhar KrishnaNo ratings yet

- FDI and Corporate StrategyDocument15 pagesFDI and Corporate StrategyKshitij TandonNo ratings yet

- Ancient History 12 - Daily Notes - (Sankalp (UPSC 2024) )Document16 pagesAncient History 12 - Daily Notes - (Sankalp (UPSC 2024) )nigamkumar2tbNo ratings yet

- MerchandisingDocument18 pagesMerchandisinghamida sarip100% (2)

- Ers. Co M: JANA Master Fund, Ltd. Performance Update - December 2010 Fourth Quarter and Year in ReviewDocument10 pagesErs. Co M: JANA Master Fund, Ltd. Performance Update - December 2010 Fourth Quarter and Year in ReviewVolcaneum100% (2)

- Nnadili v. Chevron U.s.a., Inc.Document10 pagesNnadili v. Chevron U.s.a., Inc.RavenFoxNo ratings yet

- TIK Single Touch Payroll Processing GuideDocument23 pagesTIK Single Touch Payroll Processing GuideMargaret MationgNo ratings yet

- The Special Activities DivisionDocument4 pagesThe Special Activities DivisionSpencer PearsonNo ratings yet

- Memorial For The Appellants-Team Code L PDFDocument44 pagesMemorial For The Appellants-Team Code L PDFAbhineet KaliaNo ratings yet

- Mini Cases DireccionamientoDocument2 pagesMini Cases DireccionamientoJuliet Suesca0% (1)

- Digest Partnership CaseDocument12 pagesDigest Partnership Casejaynard9150% (2)

- Khelo India Event Wise Bib ListDocument20 pagesKhelo India Event Wise Bib ListSudhit SethiNo ratings yet