Professional Documents

Culture Documents

100%(1)100% found this document useful (1 vote)

896 viewsFlowchart of Remedies For Assessment

Flowchart of Remedies For Assessment

Uploaded by

GEiA Dr.The document outlines the procedure for assessing taxes, including:

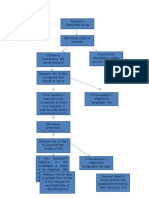

1) Taxpayers receive a notice of informal conference and have 15 days to file a reply or receive a preliminary notice of assessment.

2) They then have 15 days to file a reply to the preliminary notice or be declared in default and sent a formal demand letter.

3) Taxpayers can then file one of two types of protests within 30 days and submit documents, with the BIR having 180 days to make a decision before an appeal can be made.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You might also like

- Flowchart of Tax RemediesDocument3 pagesFlowchart of Tax RemediesPetrovich Tamag50% (4)

- Tax Remedies in Flowchart 102019Document2 pagesTax Remedies in Flowchart 102019Cecilbern ayen BernabeNo ratings yet

- Cases On Constructive Possession in Drugs CasesDocument53 pagesCases On Constructive Possession in Drugs CasesGEiA Dr.No ratings yet

- A Multidimensional Approach To The Adoption of InnovationDocument15 pagesA Multidimensional Approach To The Adoption of InnovationmarcbonnemainsNo ratings yet

- Tax Remedies Flowchart RevisedDocument1 pageTax Remedies Flowchart RevisedJake MacTavishNo ratings yet

- Procedure For Assessment TaxDocument3 pagesProcedure For Assessment TaxkawaiimiracleNo ratings yet

- Tax AssessmentDocument11 pagesTax AssessmentRon VillanuevaNo ratings yet

- 2ND MEETING Business Taxation NotesDocument3 pages2ND MEETING Business Taxation NotesIT GAMINGNo ratings yet

- Flowchart of Tax RemediesDocument3 pagesFlowchart of Tax RemediesJunivenReyUmadhayNo ratings yet

- Bir Process On Tax AssessmentDocument8 pagesBir Process On Tax AssessmentAnonymous qjsSkwF50% (2)

- Remedies of A TaxpayerDocument1 pageRemedies of A TaxpayerPrincess Mae SamborioNo ratings yet

- Remedies For National Taxes Period Reckoning DayDocument4 pagesRemedies For National Taxes Period Reckoning DayAnn SaturayNo ratings yet

- Assessment FlowchartDocument6 pagesAssessment FlowchartJess SerranoNo ratings yet

- Tax Remedies: (Lecture Notes)Document27 pagesTax Remedies: (Lecture Notes)WilsonNo ratings yet

- Tax Remidies of The TaxpayerDocument8 pagesTax Remidies of The TaxpayerNikki Coleen SantinNo ratings yet

- Tax Remedies and Tax Assessment in General and PrescriptionDocument34 pagesTax Remedies and Tax Assessment in General and PrescriptionipbsalanguitNo ratings yet

- TAX - Meting 1 To 4 (01-23 To TR Part 1)Document56 pagesTAX - Meting 1 To 4 (01-23 To TR Part 1)Karen Daryl BritoNo ratings yet

- Government RemediesDocument3 pagesGovernment RemediesShan ElisNo ratings yet

- Tax Assessment ProcessDocument1 pageTax Assessment ProcessMarie MoralesNo ratings yet

- Lumbera Tax Easy NotesDocument19 pagesLumbera Tax Easy NotesMark Gregory SalayaNo ratings yet

- Tax Remidies of The TaxpayerDocument6 pagesTax Remidies of The TaxpayerJustin Robert RoqueNo ratings yet

- W12-Module Penalties and Remedies of The Taxpayer - PPTDocument20 pagesW12-Module Penalties and Remedies of The Taxpayer - PPTDanica VetuzNo ratings yet

- (Tax Refunds & Remedies) : Saint Louis University School of LawDocument5 pages(Tax Refunds & Remedies) : Saint Louis University School of LawSui JurisNo ratings yet

- Annex A Table of RemediesDocument10 pagesAnnex A Table of RemediesAkiko AbadNo ratings yet

- Tax Remedies MappingDocument6 pagesTax Remedies MappingRikka Cassandra ReyesNo ratings yet

- Tax Remedies DiagramDocument15 pagesTax Remedies DiagramDomie AbataNo ratings yet

- Tax Remedies: Statute of Limitation/Prescriptive PeriodDocument3 pagesTax Remedies: Statute of Limitation/Prescriptive PeriodMary Christine Formiloza MacalinaoNo ratings yet

- Tax Remedies - Mcle LectureDocument132 pagesTax Remedies - Mcle LectureJuliet Czarina Furia EinsteinNo ratings yet

- Tax RemediesDocument14 pagesTax RemediesMatt Marqueses PanganibanNo ratings yet

- TAXATION LAW REVIEW. Sababan. 2008 Ed. PPG 181-200: A.The Remedies of The GovernmentDocument9 pagesTAXATION LAW REVIEW. Sababan. 2008 Ed. PPG 181-200: A.The Remedies of The GovernmentRein DrewNo ratings yet

- Procedures On Issuance of Deficiency Tax AssessmentDocument15 pagesProcedures On Issuance of Deficiency Tax AssessmentmirabelvidalNo ratings yet

- Matching Process ChartDocument1 pageMatching Process Chartnfbpx4f2wgNo ratings yet

- Flowchart DidmDocument1 pageFlowchart DidmRseven CalabarzonNo ratings yet

- TAX 2 Tax Remedies 2020 PDFDocument5 pagesTAX 2 Tax Remedies 2020 PDFAlex Buzarang SubradoNo ratings yet

- Assessment Tax Flow ChartDocument3 pagesAssessment Tax Flow ChartkawaiimiracleNo ratings yet

- Tax Refund/Tax Credit (Sec. 229 Nirc)Document1 pageTax Refund/Tax Credit (Sec. 229 Nirc)MonalieNo ratings yet

- Rights and Remedies of Taxpayers Under The NIRC: I. Amend ReturnDocument41 pagesRights and Remedies of Taxpayers Under The NIRC: I. Amend ReturnxdesczaNo ratings yet

- Flowchart of Remedies (NIRC)Document3 pagesFlowchart of Remedies (NIRC)Lorelyn FNo ratings yet

- Table of Remedies LumberaDocument30 pagesTable of Remedies LumberaVenTenNo ratings yet

- Joshua Razen E. Nolsol BSA 2-2 Assignment No. 6Document14 pagesJoshua Razen E. Nolsol BSA 2-2 Assignment No. 6Mary Christine Formiloza MacalinaoNo ratings yet

- Flow Chart On Pre-Charge Evaluation, Admin CaseDocument28 pagesFlow Chart On Pre-Charge Evaluation, Admin Caseecjaybersandayan100% (1)

- Philippine Taxation 101Document2 pagesPhilippine Taxation 101Allan SantosNo ratings yet

- Tax Remedies - Mcle LectureDocument150 pagesTax Remedies - Mcle LectureKiko BautistaNo ratings yet

- BIR Tax Assessment Process - OutlineDocument2 pagesBIR Tax Assessment Process - OutlineNicole Aldrianne OmegaNo ratings yet

- Revised Rules of Procedure Re NMC 2016 002Document20 pagesRevised Rules of Procedure Re NMC 2016 002eli laropNo ratings yet

- Rules of Procedure For Fixing Minimum Wage (Flowchart)Document2 pagesRules of Procedure For Fixing Minimum Wage (Flowchart)BordibordNo ratings yet

- Administrative Protest in Taxation - Process Flow (Simplified)Document1 pageAdministrative Protest in Taxation - Process Flow (Simplified)Alena Icao-AnotadoNo ratings yet

- Quick Rundown of The Protest ProcedureDocument5 pagesQuick Rundown of The Protest ProcedureYasha Min HNo ratings yet

- The Respondent Shall Be Deemed Formally Filed and Pending Upon Receipt and Entry of The Same in The Official Docket)Document4 pagesThe Respondent Shall Be Deemed Formally Filed and Pending Upon Receipt and Entry of The Same in The Official Docket)makatiplebNo ratings yet

- Commitment Letter SignedDocument1 pageCommitment Letter SignedjohnNo ratings yet

- Remedies of The TP Post TRAINDocument27 pagesRemedies of The TP Post TRAINArren RelucioNo ratings yet

- Tax Reviewer: Law of Basic Taxation in The Philippines Chapter 8: Taxpayer'S RemediesDocument4 pagesTax Reviewer: Law of Basic Taxation in The Philippines Chapter 8: Taxpayer'S RemediesMariko IwakiNo ratings yet

- Chapter 7 - TAXDocument7 pagesChapter 7 - TAXLittle GirlblueNo ratings yet

- GROUP 1 Tax RemediesDocument6 pagesGROUP 1 Tax RemediesEunice Kalaw VargasNo ratings yet

- 9 Control Sheet - AppealsDocument2 pages9 Control Sheet - AppealsUsman Ahmed ManiNo ratings yet

- Remedies and Prescriptive Periods Prepared By: Dr. Jeannie P. LimDocument14 pagesRemedies and Prescriptive Periods Prepared By: Dr. Jeannie P. LimCourt StenographerNo ratings yet

- Tax Remedies and IncrementsDocument16 pagesTax Remedies and Incrementscobe.johnmark.cecilioNo ratings yet

- For TaxationDocument6 pagesFor Taxationhydoe james elanNo ratings yet

- Dispute Reseloution ProcedureDocument4 pagesDispute Reseloution Procedureaminalex122No ratings yet

- Table of Remedies by LumberaDocument10 pagesTable of Remedies by LumberaJodea Pearl AbalosNo ratings yet

- Sps. Domingo vs. ReedDocument8 pagesSps. Domingo vs. ReedGEiA Dr.No ratings yet

- Glino vs. Civil Registrar of QCDocument6 pagesGlino vs. Civil Registrar of QCGEiA Dr.No ratings yet

- People vs. ManlangitDocument8 pagesPeople vs. ManlangitGEiA Dr.No ratings yet

- BIR Ruling Involving CGTDocument3 pagesBIR Ruling Involving CGTGEiA Dr.No ratings yet

- Rules On NotaryDocument10 pagesRules On NotaryGEiA Dr.No ratings yet

- People vs. Fernando Ranchie Havana Jan. 2016Document6 pagesPeople vs. Fernando Ranchie Havana Jan. 2016GEiA Dr.No ratings yet

- LUZ vs. PEOPLE, Invalid Arrest, DrugsDocument37 pagesLUZ vs. PEOPLE, Invalid Arrest, DrugsGEiA Dr.No ratings yet

- People vs. Pineda, 2004Document22 pagesPeople vs. Pineda, 2004GEiA Dr.No ratings yet

- Ruel Tuano y Hernandez vs. PP June 2016Document5 pagesRuel Tuano y Hernandez vs. PP June 2016GEiA Dr.No ratings yet

- 3 Idiots As Part of Our Daily LivesDocument7 pages3 Idiots As Part of Our Daily LivesGEiA Dr.No ratings yet

- Supreme Court: First Division People of The Philippines, G.R. No. 183830Document10 pagesSupreme Court: First Division People of The Philippines, G.R. No. 183830GEiA Dr.No ratings yet

- Definition of TermsDocument2 pagesDefinition of TermsGEiA Dr.No ratings yet

- Cir vs. Ironcon BuildersDocument1 pageCir vs. Ironcon BuildersGEiA Dr.No ratings yet

- A Book Review On Maritess VitugDocument7 pagesA Book Review On Maritess VitugGEiA0% (1)

- Research Grants On Education SmallDocument17 pagesResearch Grants On Education SmallTakhacheyNo ratings yet

- Approaches To Strategy Implementation (Methods) : Cres Cive Appr OachDocument7 pagesApproaches To Strategy Implementation (Methods) : Cres Cive Appr OachSachin KumarNo ratings yet

- Nikhil Sinha: Work Experience SkillsDocument1 pageNikhil Sinha: Work Experience SkillsNikhil SinhaNo ratings yet

- Week 1 and 2 Fractions, Decimals, and PercentageDocument7 pagesWeek 1 and 2 Fractions, Decimals, and PercentageJhonPaul RabanoNo ratings yet

- Indigo Child ChecklistDocument8 pagesIndigo Child ChecklistmapperkidNo ratings yet

- 1 1 Discussion - EditedDocument4 pages1 1 Discussion - EditedProfessor MutaliNo ratings yet

- Math Unit: Tables, Charts, and Graphing: Section 1Document55 pagesMath Unit: Tables, Charts, and Graphing: Section 1api-211634867No ratings yet

- Cambridge PET Mid-Term QuestionDocument4 pagesCambridge PET Mid-Term QuestionHein Htet NaingNo ratings yet

- High School Science Teachers Training Program (Bangalore)Document4 pagesHigh School Science Teachers Training Program (Bangalore)Amby GovindNo ratings yet

- Garjan0007: 12-B Alcalde Jose, Pasig, 1600 Metro ManilaDocument3 pagesGarjan0007: 12-B Alcalde Jose, Pasig, 1600 Metro ManilaArnold PeregrineNo ratings yet

- Group Task Module 2 Lesson 1Document4 pagesGroup Task Module 2 Lesson 1Her Shey Capilitan PongautanNo ratings yet

- Willink 1972Document6 pagesWillink 1972Bolívar Rafael Garcete BarrettNo ratings yet

- Saxophone Useful ChartsDocument14 pagesSaxophone Useful ChartsSquaw100% (2)

- Indian Sensibility Through English Language: A Critical Analysis of Keats Was A Tuber by Poile SenguptaDocument2 pagesIndian Sensibility Through English Language: A Critical Analysis of Keats Was A Tuber by Poile SenguptaIJELS Research JournalNo ratings yet

- Weekly Home Learning Plan For COTDocument6 pagesWeekly Home Learning Plan For COTMARY JANE MARFILNo ratings yet

- Learning Guide Educ 2 Week 1 17 RDRDocument54 pagesLearning Guide Educ 2 Week 1 17 RDRGuenevere EsguerraNo ratings yet

- DR Joan Shin Best Practice ForTEYLDocument89 pagesDR Joan Shin Best Practice ForTEYLngotrancheetahNo ratings yet

- DFOT Answer Sheet 1Document1 pageDFOT Answer Sheet 1Edmon Gumasing100% (1)

- Introduction: Aristotle's Definition of Happiness: Aristotle: A Little BackgroundDocument6 pagesIntroduction: Aristotle's Definition of Happiness: Aristotle: A Little BackgroundFabrizio ArenasNo ratings yet

- Alamo Colleges District Schedule of Tuition and Fees Effective Fall 2022 FY 2022-2023Document4 pagesAlamo Colleges District Schedule of Tuition and Fees Effective Fall 2022 FY 2022-2023aldaNo ratings yet

- Living and NonlivingDocument5 pagesLiving and NonlivingAndres Rivera RodriguezNo ratings yet

- What Is The Percentage of IITians in A Batch at IIM, Especially at IIM A, B and C - Quora PDFDocument3 pagesWhat Is The Percentage of IITians in A Batch at IIM, Especially at IIM A, B and C - Quora PDFAnuj KansalNo ratings yet

- Code Blue Chapter 1 QuestionsDocument2 pagesCode Blue Chapter 1 Questionsapi-297640644100% (1)

- Lesson PlanDocument3 pagesLesson PlanMT HannaNo ratings yet

- Republika NG Pilipinas Kagawaran NG Edukasyon Rehiyon Xi Sangay NG Davao OccidentalDocument1 pageRepublika NG Pilipinas Kagawaran NG Edukasyon Rehiyon Xi Sangay NG Davao OccidentalLester Gene Villegas ArevaloNo ratings yet

- Openmind 1 Unit 1 Grammar and Vocabulary Test BDocument2 pagesOpenmind 1 Unit 1 Grammar and Vocabulary Test BMaria Eduarda PedrosoNo ratings yet

- Economics 0455 Paper 2 hv3f4f - 243549 - 1706949819Document31 pagesEconomics 0455 Paper 2 hv3f4f - 243549 - 1706949819Vivaan KothariNo ratings yet

- Harvey WhitehouseDocument6 pagesHarvey WhitehouseburnnotetestNo ratings yet

- African Handbook-TextDocument164 pagesAfrican Handbook-TextThe_Castle_Of_Letter100% (1)

Flowchart of Remedies For Assessment

Flowchart of Remedies For Assessment

Uploaded by

GEiA Dr.100%(1)100% found this document useful (1 vote)

896 views1 pageThe document outlines the procedure for assessing taxes, including:

1) Taxpayers receive a notice of informal conference and have 15 days to file a reply or receive a preliminary notice of assessment.

2) They then have 15 days to file a reply to the preliminary notice or be declared in default and sent a formal demand letter.

3) Taxpayers can then file one of two types of protests within 30 days and submit documents, with the BIR having 180 days to make a decision before an appeal can be made.

Original Description:

Original Title

Flowchart of Remedies for Assessment

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document outlines the procedure for assessing taxes, including:

1) Taxpayers receive a notice of informal conference and have 15 days to file a reply or receive a preliminary notice of assessment.

2) They then have 15 days to file a reply to the preliminary notice or be declared in default and sent a formal demand letter.

3) Taxpayers can then file one of two types of protests within 30 days and submit documents, with the BIR having 180 days to make a decision before an appeal can be made.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

100%(1)100% found this document useful (1 vote)

896 views1 pageFlowchart of Remedies For Assessment

Flowchart of Remedies For Assessment

Uploaded by

GEiA Dr.The document outlines the procedure for assessing taxes, including:

1) Taxpayers receive a notice of informal conference and have 15 days to file a reply or receive a preliminary notice of assessment.

2) They then have 15 days to file a reply to the preliminary notice or be declared in default and sent a formal demand letter.

3) Taxpayers can then file one of two types of protests within 30 days and submit documents, with the BIR having 180 days to make a decision before an appeal can be made.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 1

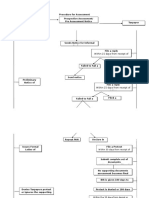

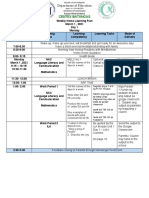

PROCEDURE FOR ASSESSMENT:

Notice of Informal Conference

w/in 15 days from receipt of notice

FILE A REPLY

FAILED TO FILE A REPLY FILED A REPLY

SEND NOTCIE AGAIN PRELIMINARY NOTICE OF ASSESSMENT

(PAN)

15 days upon receipt of PAN

FILE A REPLY

FAILED TO FILE A REPLY

REPEAT PAN DECLARE IN DEFAULT, SEND FORMAL

LETTER OF DEMAND AND NOTICE TO PAY

TAX (FAN)

w/in 30days fr receipt of FAN

FILE A PROTEST:

2 KINDS OF PROTESTS:

(1) Motion for reconsideration-60 day period NOT applicable

(2) Motion for reinvestigation –60 days from filing of protest

SUBMIT COMPLETE SET OF DOCUMENTS

BIR IS GIVEN 180 DAYS TO DECIDE

PROTEST IS DENIED; or 180 HAS LAPSED

W/in 30 days from denial/lapse

APPEAL to the Court of Tax Appeals IN DIVISION

W/in 15 days from receipt

Motion for Reconsideration with

the DIVISION

W/in 15 days from receipt

APPEAL to the Court of Tax

Appeals EN BANC

W/in 15 days from receipt

APPEAL to the

SUPREME COURT

You might also like

- Flowchart of Tax RemediesDocument3 pagesFlowchart of Tax RemediesPetrovich Tamag50% (4)

- Tax Remedies in Flowchart 102019Document2 pagesTax Remedies in Flowchart 102019Cecilbern ayen BernabeNo ratings yet

- Cases On Constructive Possession in Drugs CasesDocument53 pagesCases On Constructive Possession in Drugs CasesGEiA Dr.No ratings yet

- A Multidimensional Approach To The Adoption of InnovationDocument15 pagesA Multidimensional Approach To The Adoption of InnovationmarcbonnemainsNo ratings yet

- Tax Remedies Flowchart RevisedDocument1 pageTax Remedies Flowchart RevisedJake MacTavishNo ratings yet

- Procedure For Assessment TaxDocument3 pagesProcedure For Assessment TaxkawaiimiracleNo ratings yet

- Tax AssessmentDocument11 pagesTax AssessmentRon VillanuevaNo ratings yet

- 2ND MEETING Business Taxation NotesDocument3 pages2ND MEETING Business Taxation NotesIT GAMINGNo ratings yet

- Flowchart of Tax RemediesDocument3 pagesFlowchart of Tax RemediesJunivenReyUmadhayNo ratings yet

- Bir Process On Tax AssessmentDocument8 pagesBir Process On Tax AssessmentAnonymous qjsSkwF50% (2)

- Remedies of A TaxpayerDocument1 pageRemedies of A TaxpayerPrincess Mae SamborioNo ratings yet

- Remedies For National Taxes Period Reckoning DayDocument4 pagesRemedies For National Taxes Period Reckoning DayAnn SaturayNo ratings yet

- Assessment FlowchartDocument6 pagesAssessment FlowchartJess SerranoNo ratings yet

- Tax Remedies: (Lecture Notes)Document27 pagesTax Remedies: (Lecture Notes)WilsonNo ratings yet

- Tax Remidies of The TaxpayerDocument8 pagesTax Remidies of The TaxpayerNikki Coleen SantinNo ratings yet

- Tax Remedies and Tax Assessment in General and PrescriptionDocument34 pagesTax Remedies and Tax Assessment in General and PrescriptionipbsalanguitNo ratings yet

- TAX - Meting 1 To 4 (01-23 To TR Part 1)Document56 pagesTAX - Meting 1 To 4 (01-23 To TR Part 1)Karen Daryl BritoNo ratings yet

- Government RemediesDocument3 pagesGovernment RemediesShan ElisNo ratings yet

- Tax Assessment ProcessDocument1 pageTax Assessment ProcessMarie MoralesNo ratings yet

- Lumbera Tax Easy NotesDocument19 pagesLumbera Tax Easy NotesMark Gregory SalayaNo ratings yet

- Tax Remidies of The TaxpayerDocument6 pagesTax Remidies of The TaxpayerJustin Robert RoqueNo ratings yet

- W12-Module Penalties and Remedies of The Taxpayer - PPTDocument20 pagesW12-Module Penalties and Remedies of The Taxpayer - PPTDanica VetuzNo ratings yet

- (Tax Refunds & Remedies) : Saint Louis University School of LawDocument5 pages(Tax Refunds & Remedies) : Saint Louis University School of LawSui JurisNo ratings yet

- Annex A Table of RemediesDocument10 pagesAnnex A Table of RemediesAkiko AbadNo ratings yet

- Tax Remedies MappingDocument6 pagesTax Remedies MappingRikka Cassandra ReyesNo ratings yet

- Tax Remedies DiagramDocument15 pagesTax Remedies DiagramDomie AbataNo ratings yet

- Tax Remedies: Statute of Limitation/Prescriptive PeriodDocument3 pagesTax Remedies: Statute of Limitation/Prescriptive PeriodMary Christine Formiloza MacalinaoNo ratings yet

- Tax Remedies - Mcle LectureDocument132 pagesTax Remedies - Mcle LectureJuliet Czarina Furia EinsteinNo ratings yet

- Tax RemediesDocument14 pagesTax RemediesMatt Marqueses PanganibanNo ratings yet

- TAXATION LAW REVIEW. Sababan. 2008 Ed. PPG 181-200: A.The Remedies of The GovernmentDocument9 pagesTAXATION LAW REVIEW. Sababan. 2008 Ed. PPG 181-200: A.The Remedies of The GovernmentRein DrewNo ratings yet

- Procedures On Issuance of Deficiency Tax AssessmentDocument15 pagesProcedures On Issuance of Deficiency Tax AssessmentmirabelvidalNo ratings yet

- Matching Process ChartDocument1 pageMatching Process Chartnfbpx4f2wgNo ratings yet

- Flowchart DidmDocument1 pageFlowchart DidmRseven CalabarzonNo ratings yet

- TAX 2 Tax Remedies 2020 PDFDocument5 pagesTAX 2 Tax Remedies 2020 PDFAlex Buzarang SubradoNo ratings yet

- Assessment Tax Flow ChartDocument3 pagesAssessment Tax Flow ChartkawaiimiracleNo ratings yet

- Tax Refund/Tax Credit (Sec. 229 Nirc)Document1 pageTax Refund/Tax Credit (Sec. 229 Nirc)MonalieNo ratings yet

- Rights and Remedies of Taxpayers Under The NIRC: I. Amend ReturnDocument41 pagesRights and Remedies of Taxpayers Under The NIRC: I. Amend ReturnxdesczaNo ratings yet

- Flowchart of Remedies (NIRC)Document3 pagesFlowchart of Remedies (NIRC)Lorelyn FNo ratings yet

- Table of Remedies LumberaDocument30 pagesTable of Remedies LumberaVenTenNo ratings yet

- Joshua Razen E. Nolsol BSA 2-2 Assignment No. 6Document14 pagesJoshua Razen E. Nolsol BSA 2-2 Assignment No. 6Mary Christine Formiloza MacalinaoNo ratings yet

- Flow Chart On Pre-Charge Evaluation, Admin CaseDocument28 pagesFlow Chart On Pre-Charge Evaluation, Admin Caseecjaybersandayan100% (1)

- Philippine Taxation 101Document2 pagesPhilippine Taxation 101Allan SantosNo ratings yet

- Tax Remedies - Mcle LectureDocument150 pagesTax Remedies - Mcle LectureKiko BautistaNo ratings yet

- BIR Tax Assessment Process - OutlineDocument2 pagesBIR Tax Assessment Process - OutlineNicole Aldrianne OmegaNo ratings yet

- Revised Rules of Procedure Re NMC 2016 002Document20 pagesRevised Rules of Procedure Re NMC 2016 002eli laropNo ratings yet

- Rules of Procedure For Fixing Minimum Wage (Flowchart)Document2 pagesRules of Procedure For Fixing Minimum Wage (Flowchart)BordibordNo ratings yet

- Administrative Protest in Taxation - Process Flow (Simplified)Document1 pageAdministrative Protest in Taxation - Process Flow (Simplified)Alena Icao-AnotadoNo ratings yet

- Quick Rundown of The Protest ProcedureDocument5 pagesQuick Rundown of The Protest ProcedureYasha Min HNo ratings yet

- The Respondent Shall Be Deemed Formally Filed and Pending Upon Receipt and Entry of The Same in The Official Docket)Document4 pagesThe Respondent Shall Be Deemed Formally Filed and Pending Upon Receipt and Entry of The Same in The Official Docket)makatiplebNo ratings yet

- Commitment Letter SignedDocument1 pageCommitment Letter SignedjohnNo ratings yet

- Remedies of The TP Post TRAINDocument27 pagesRemedies of The TP Post TRAINArren RelucioNo ratings yet

- Tax Reviewer: Law of Basic Taxation in The Philippines Chapter 8: Taxpayer'S RemediesDocument4 pagesTax Reviewer: Law of Basic Taxation in The Philippines Chapter 8: Taxpayer'S RemediesMariko IwakiNo ratings yet

- Chapter 7 - TAXDocument7 pagesChapter 7 - TAXLittle GirlblueNo ratings yet

- GROUP 1 Tax RemediesDocument6 pagesGROUP 1 Tax RemediesEunice Kalaw VargasNo ratings yet

- 9 Control Sheet - AppealsDocument2 pages9 Control Sheet - AppealsUsman Ahmed ManiNo ratings yet

- Remedies and Prescriptive Periods Prepared By: Dr. Jeannie P. LimDocument14 pagesRemedies and Prescriptive Periods Prepared By: Dr. Jeannie P. LimCourt StenographerNo ratings yet

- Tax Remedies and IncrementsDocument16 pagesTax Remedies and Incrementscobe.johnmark.cecilioNo ratings yet

- For TaxationDocument6 pagesFor Taxationhydoe james elanNo ratings yet

- Dispute Reseloution ProcedureDocument4 pagesDispute Reseloution Procedureaminalex122No ratings yet

- Table of Remedies by LumberaDocument10 pagesTable of Remedies by LumberaJodea Pearl AbalosNo ratings yet

- Sps. Domingo vs. ReedDocument8 pagesSps. Domingo vs. ReedGEiA Dr.No ratings yet

- Glino vs. Civil Registrar of QCDocument6 pagesGlino vs. Civil Registrar of QCGEiA Dr.No ratings yet

- People vs. ManlangitDocument8 pagesPeople vs. ManlangitGEiA Dr.No ratings yet

- BIR Ruling Involving CGTDocument3 pagesBIR Ruling Involving CGTGEiA Dr.No ratings yet

- Rules On NotaryDocument10 pagesRules On NotaryGEiA Dr.No ratings yet

- People vs. Fernando Ranchie Havana Jan. 2016Document6 pagesPeople vs. Fernando Ranchie Havana Jan. 2016GEiA Dr.No ratings yet

- LUZ vs. PEOPLE, Invalid Arrest, DrugsDocument37 pagesLUZ vs. PEOPLE, Invalid Arrest, DrugsGEiA Dr.No ratings yet

- People vs. Pineda, 2004Document22 pagesPeople vs. Pineda, 2004GEiA Dr.No ratings yet

- Ruel Tuano y Hernandez vs. PP June 2016Document5 pagesRuel Tuano y Hernandez vs. PP June 2016GEiA Dr.No ratings yet

- 3 Idiots As Part of Our Daily LivesDocument7 pages3 Idiots As Part of Our Daily LivesGEiA Dr.No ratings yet

- Supreme Court: First Division People of The Philippines, G.R. No. 183830Document10 pagesSupreme Court: First Division People of The Philippines, G.R. No. 183830GEiA Dr.No ratings yet

- Definition of TermsDocument2 pagesDefinition of TermsGEiA Dr.No ratings yet

- Cir vs. Ironcon BuildersDocument1 pageCir vs. Ironcon BuildersGEiA Dr.No ratings yet

- A Book Review On Maritess VitugDocument7 pagesA Book Review On Maritess VitugGEiA0% (1)

- Research Grants On Education SmallDocument17 pagesResearch Grants On Education SmallTakhacheyNo ratings yet

- Approaches To Strategy Implementation (Methods) : Cres Cive Appr OachDocument7 pagesApproaches To Strategy Implementation (Methods) : Cres Cive Appr OachSachin KumarNo ratings yet

- Nikhil Sinha: Work Experience SkillsDocument1 pageNikhil Sinha: Work Experience SkillsNikhil SinhaNo ratings yet

- Week 1 and 2 Fractions, Decimals, and PercentageDocument7 pagesWeek 1 and 2 Fractions, Decimals, and PercentageJhonPaul RabanoNo ratings yet

- Indigo Child ChecklistDocument8 pagesIndigo Child ChecklistmapperkidNo ratings yet

- 1 1 Discussion - EditedDocument4 pages1 1 Discussion - EditedProfessor MutaliNo ratings yet

- Math Unit: Tables, Charts, and Graphing: Section 1Document55 pagesMath Unit: Tables, Charts, and Graphing: Section 1api-211634867No ratings yet

- Cambridge PET Mid-Term QuestionDocument4 pagesCambridge PET Mid-Term QuestionHein Htet NaingNo ratings yet

- High School Science Teachers Training Program (Bangalore)Document4 pagesHigh School Science Teachers Training Program (Bangalore)Amby GovindNo ratings yet

- Garjan0007: 12-B Alcalde Jose, Pasig, 1600 Metro ManilaDocument3 pagesGarjan0007: 12-B Alcalde Jose, Pasig, 1600 Metro ManilaArnold PeregrineNo ratings yet

- Group Task Module 2 Lesson 1Document4 pagesGroup Task Module 2 Lesson 1Her Shey Capilitan PongautanNo ratings yet

- Willink 1972Document6 pagesWillink 1972Bolívar Rafael Garcete BarrettNo ratings yet

- Saxophone Useful ChartsDocument14 pagesSaxophone Useful ChartsSquaw100% (2)

- Indian Sensibility Through English Language: A Critical Analysis of Keats Was A Tuber by Poile SenguptaDocument2 pagesIndian Sensibility Through English Language: A Critical Analysis of Keats Was A Tuber by Poile SenguptaIJELS Research JournalNo ratings yet

- Weekly Home Learning Plan For COTDocument6 pagesWeekly Home Learning Plan For COTMARY JANE MARFILNo ratings yet

- Learning Guide Educ 2 Week 1 17 RDRDocument54 pagesLearning Guide Educ 2 Week 1 17 RDRGuenevere EsguerraNo ratings yet

- DR Joan Shin Best Practice ForTEYLDocument89 pagesDR Joan Shin Best Practice ForTEYLngotrancheetahNo ratings yet

- DFOT Answer Sheet 1Document1 pageDFOT Answer Sheet 1Edmon Gumasing100% (1)

- Introduction: Aristotle's Definition of Happiness: Aristotle: A Little BackgroundDocument6 pagesIntroduction: Aristotle's Definition of Happiness: Aristotle: A Little BackgroundFabrizio ArenasNo ratings yet

- Alamo Colleges District Schedule of Tuition and Fees Effective Fall 2022 FY 2022-2023Document4 pagesAlamo Colleges District Schedule of Tuition and Fees Effective Fall 2022 FY 2022-2023aldaNo ratings yet

- Living and NonlivingDocument5 pagesLiving and NonlivingAndres Rivera RodriguezNo ratings yet

- What Is The Percentage of IITians in A Batch at IIM, Especially at IIM A, B and C - Quora PDFDocument3 pagesWhat Is The Percentage of IITians in A Batch at IIM, Especially at IIM A, B and C - Quora PDFAnuj KansalNo ratings yet

- Code Blue Chapter 1 QuestionsDocument2 pagesCode Blue Chapter 1 Questionsapi-297640644100% (1)

- Lesson PlanDocument3 pagesLesson PlanMT HannaNo ratings yet

- Republika NG Pilipinas Kagawaran NG Edukasyon Rehiyon Xi Sangay NG Davao OccidentalDocument1 pageRepublika NG Pilipinas Kagawaran NG Edukasyon Rehiyon Xi Sangay NG Davao OccidentalLester Gene Villegas ArevaloNo ratings yet

- Openmind 1 Unit 1 Grammar and Vocabulary Test BDocument2 pagesOpenmind 1 Unit 1 Grammar and Vocabulary Test BMaria Eduarda PedrosoNo ratings yet

- Economics 0455 Paper 2 hv3f4f - 243549 - 1706949819Document31 pagesEconomics 0455 Paper 2 hv3f4f - 243549 - 1706949819Vivaan KothariNo ratings yet

- Harvey WhitehouseDocument6 pagesHarvey WhitehouseburnnotetestNo ratings yet

- African Handbook-TextDocument164 pagesAfrican Handbook-TextThe_Castle_Of_Letter100% (1)