Professional Documents

Culture Documents

Expected Return of Your Portfolio Be 17% Explanation

Expected Return of Your Portfolio Be 17% Explanation

Uploaded by

Kara0 ratings0% found this document useful (0 votes)

16 views1 pageA portfolio is constructed using a risk-free asset earning 8% and a risky asset earning an expected 20% return with a 40% standard deviation. To achieve a portfolio standard deviation of 30%, the risky asset must make up 75% of the portfolio. With a 25% allocation to the risk-free asset, the expected portfolio return is calculated to be 17%.

Original Description:

Original Title

Q4

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentA portfolio is constructed using a risk-free asset earning 8% and a risky asset earning an expected 20% return with a 40% standard deviation. To achieve a portfolio standard deviation of 30%, the risky asset must make up 75% of the portfolio. With a 25% allocation to the risk-free asset, the expected portfolio return is calculated to be 17%.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

16 views1 pageExpected Return of Your Portfolio Be 17% Explanation

Expected Return of Your Portfolio Be 17% Explanation

Uploaded by

KaraA portfolio is constructed using a risk-free asset earning 8% and a risky asset earning an expected 20% return with a 40% standard deviation. To achieve a portfolio standard deviation of 30%, the risky asset must make up 75% of the portfolio. With a 25% allocation to the risk-free asset, the expected portfolio return is calculated to be 17%.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 1

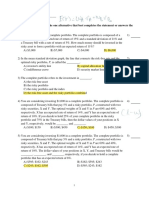

Q4.

Suppose you have the following investment options available: (a) Risk-free asset with a

rate of return 8%, and (b) Risky asset earning an expected return 20%, and standard deviation

40%. If you construct a portfolio of the above two instruments with a standard deviation of

30%, what will the expected return of your portfolio be?

Ans: Expected return of your portfolio be 17%

Explanation:

If you construct a portfolio of the above two instruments with a standard deviation of 30%

Weight of Risky Asset = standard deviation of Portfolio/standard deviation of risky asset

Weight of Risky Asset = 30%/40%

Weight of Risky Asset = 75%

Weight of Risk-free asset = 1-Weight of Risky Asset

Weight of Risk-free asset = 1-75%

Weight of Risk-free asset = 25%

Expected return of your portfolio be = Weight of Risk-free asset x Expected return of Risk-free

asset + Weight of Risky Asset x Expected return of Risky Asset

Expected return of your portfolio be = 25%*8% + 75%*20%

Expected return of your portfolio be = 17%

You might also like

- CAPM Questions and AnswersDocument2 pagesCAPM Questions and AnswersKennedy Waweru90% (10)

- Problem Set 4Document3 pagesProblem Set 4teoluoNo ratings yet

- 4 - Problem - Set FRM - PS PDFDocument3 pages4 - Problem - Set FRM - PS PDFValentin IsNo ratings yet

- Topic 4. The Characteristics of The Opportunity Set Under Risk QuestionsDocument3 pagesTopic 4. The Characteristics of The Opportunity Set Under Risk QuestionsZei Di Jay0% (2)

- Finding Alphas: A Quantitative Approach to Building Trading StrategiesFrom EverandFinding Alphas: A Quantitative Approach to Building Trading StrategiesRating: 3.5 out of 5 stars3.5/5 (3)

- Jill Table - AnswersDocument3 pagesJill Table - AnswersKaraNo ratings yet

- Capital Asset Pricing Model HomeworkDocument14 pagesCapital Asset Pricing Model Homeworktonynugan100% (1)

- We Need To Find The Expected Return On PortfolioDocument1 pageWe Need To Find The Expected Return On PortfolioChellapandiNo ratings yet

- Portfolio Investments at RiskDocument16 pagesPortfolio Investments at RiskCindy permatasariNo ratings yet

- Chapter 5Document5 pagesChapter 5Khue NgoNo ratings yet

- Chapter 5Document5 pagesChapter 5Tran Phuong ThaoNo ratings yet

- MPT - Modern Portfolio Theory: Business 2039Document64 pagesMPT - Modern Portfolio Theory: Business 2039KARISHMAATNo ratings yet

- Utility Theory and Portfolio ManagementDocument3 pagesUtility Theory and Portfolio ManagementMd Roni HasanNo ratings yet

- Econ 252 Spring 2011 Problem Set 2Document5 pagesEcon 252 Spring 2011 Problem Set 2Tu ShirotaNo ratings yet

- Act7 2Document4 pagesAct7 2Helen B. EvansNo ratings yet

- Portfolio Return and RiskDocument4 pagesPortfolio Return and RiskPinkyChoudharyNo ratings yet

- Act std4Document3 pagesAct std4Helen B. EvansNo ratings yet

- Tutorial 4 - SolutionsDocument7 pagesTutorial 4 - SolutionsstoryNo ratings yet

- Practice Question 6&7 SDocument32 pagesPractice Question 6&7 Smehalbisht456No ratings yet

- Review of Portfolio Analysis-2Document7 pagesReview of Portfolio Analysis-2Santu EstradaNo ratings yet

- Problem Set 1Document3 pagesProblem Set 1ikramraya0No ratings yet

- Tutorial 5 - SolutionsDocument8 pagesTutorial 5 - SolutionsstoryNo ratings yet

- Week 4 Tutorial QuestionsDocument2 pagesWeek 4 Tutorial QuestionsThomas Kong Ying LiNo ratings yet

- Portfolio AnalysisDocument30 pagesPortfolio AnalysisJitendra RaghuwanshiNo ratings yet

- Risk and Rates of ReturnDocument107 pagesRisk and Rates of ReturnTABAH RIZKINo ratings yet

- FIN604 MID - Farhan Zubair - 18164052Document7 pagesFIN604 MID - Farhan Zubair - 18164052ZNo ratings yet

- IACFMAS-ASSIGN MarjDocument4 pagesIACFMAS-ASSIGN MarjMarjorie PagsinuhinNo ratings yet

- Homework3 With AnsDocument14 pagesHomework3 With AnsLiangWei KhoNo ratings yet

- Chapter 6Document13 pagesChapter 6John W. Paterson IVNo ratings yet

- Chapter 22 Estimating Risk and Return On AssetsDocument4 pagesChapter 22 Estimating Risk and Return On Assetsgeminailna25% (4)

- Tutorial 3-IpmDocument6 pagesTutorial 3-IpmNguyễn Phương ThảoNo ratings yet

- Exercise chapter 6 - ChẵnDocument4 pagesExercise chapter 6 - ChẵnAnh Lê Thị LanNo ratings yet

- Stocks: - Return Capital Gain/loss + Dividends - Price Earnings Ratio - Book Value Ratio - Earnings Per ShareDocument27 pagesStocks: - Return Capital Gain/loss + Dividends - Price Earnings Ratio - Book Value Ratio - Earnings Per ShareJuanc1989No ratings yet

- Capital MarketDocument27 pagesCapital MarketJoebet DebuyanNo ratings yet

- William Arrata - ESSEC FINM31261 - Exercises 6 7 8 9 10 11Document3 pagesWilliam Arrata - ESSEC FINM31261 - Exercises 6 7 8 9 10 11Bietto 10No ratings yet

- Lecture 13Document31 pagesLecture 13Fazli WadoodNo ratings yet

- HomeworkDocument6 pagesHomeworkHayden Rutledge EarleNo ratings yet

- Chapter 2Document61 pagesChapter 2Meseret HailemichaelNo ratings yet

- Revision Questions and Classwork 8Document8 pagesRevision Questions and Classwork 8Sams HaiderNo ratings yet

- Lecture 4Document38 pagesLecture 4SenalNaldoNo ratings yet

- HW 6 - AkDocument6 pagesHW 6 - AkSuvaid KcNo ratings yet

- Illustrative Case 22-3 Suppose The Ff. Projections Are Available For Three Alternative Investments in Equity Shares (Stock)Document10 pagesIllustrative Case 22-3 Suppose The Ff. Projections Are Available For Three Alternative Investments in Equity Shares (Stock)aizaNo ratings yet

- Chapter 6 - Risk and Rates of ReturnDocument137 pagesChapter 6 - Risk and Rates of ReturnjawadzaheerNo ratings yet

- Fnce 220: Business Finance: Topic: Risk & Return RelationshipsDocument26 pagesFnce 220: Business Finance: Topic: Risk & Return RelationshipsVincent KamemiaNo ratings yet

- Chapter 5.pptx Risk and ReturnDocument25 pagesChapter 5.pptx Risk and ReturnKevin Kivanc IlgarNo ratings yet

- Study Questions Risk and ReturnDocument4 pagesStudy Questions Risk and ReturnAlif SultanliNo ratings yet

- Midterm 2010 DanielandreiinfoDocument11 pagesMidterm 2010 DanielandreiinfoCindy MaNo ratings yet

- Tute 5 PDFDocument4 pagesTute 5 PDFRony Rahman100% (1)

- Assig 2Document7 pagesAssig 2Katie CookNo ratings yet

- استثمارDocument3 pagesاستثمارV VORTEXNo ratings yet

- CF Mock1Document7 pagesCF Mock1Pujitha PuppalaNo ratings yet

- BT TCDNDocument6 pagesBT TCDNVõ Hoàng NhânNo ratings yet

- Chapter 6 Risk and Return, and The Capital Asset Pricing Model ANSWERS TO END-OF-CHAPTER QUESTIONSDocument10 pagesChapter 6 Risk and Return, and The Capital Asset Pricing Model ANSWERS TO END-OF-CHAPTER QUESTIONSSolutionz Manual50% (2)

- FE 2013 PS3 Solution PDFDocument6 pagesFE 2013 PS3 Solution PDFBharath RaghunathNo ratings yet

- 2011 - 1st ExamDocument10 pages2011 - 1st ExamcataNo ratings yet

- Module #04 - Risk and Rates ReturnDocument13 pagesModule #04 - Risk and Rates ReturnRhesus UrbanoNo ratings yet

- Week 4 Lecture PDFDocument69 pagesWeek 4 Lecture PDFAkshat TiwariNo ratings yet

- Risk and Return - Capital Market TheoryDocument37 pagesRisk and Return - Capital Market TheoryHelen TuberaNo ratings yet

- Practice Midterm 1Document6 pagesPractice Midterm 1dominicbcooper0603No ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Financial Risk Forecasting: The Theory and Practice of Forecasting Market Risk with Implementation in R and MatlabFrom EverandFinancial Risk Forecasting: The Theory and Practice of Forecasting Market Risk with Implementation in R and MatlabRating: 4 out of 5 stars4/5 (1)

- Indian History PDFDocument105 pagesIndian History PDFKaraNo ratings yet

- Reshaping India Into A Life Sciences Innovation Hub: March 2020Document24 pagesReshaping India Into A Life Sciences Innovation Hub: March 2020KaraNo ratings yet

- Commerce UpDocument11 pagesCommerce UpKaraNo ratings yet

- Digital Commerce 2017: MobileDocument14 pagesDigital Commerce 2017: MobileKaraNo ratings yet

- Chapter 18 - Managing Mass Communication PDFDocument54 pagesChapter 18 - Managing Mass Communication PDFKaraNo ratings yet

- ITC - An Investor's Dilemma - Divyansh Agnani - MediumDocument38 pagesITC - An Investor's Dilemma - Divyansh Agnani - MediumKaraNo ratings yet

- Chapter 11: The Efficient Market Hypothesis: Problem SetsDocument11 pagesChapter 11: The Efficient Market Hypothesis: Problem SetsKaraNo ratings yet

- Economic Outlook - May 2020Document8 pagesEconomic Outlook - May 2020KaraNo ratings yet

- Invest Like Warren Buffett Powerful Strategies For Building Wealth (2nd Ed.) (Kratter 2016-08-05) (28DC2D32)Document43 pagesInvest Like Warren Buffett Powerful Strategies For Building Wealth (2nd Ed.) (Kratter 2016-08-05) (28DC2D32)Kara100% (1)

- Economy Impact - MoneycontrolDocument3 pagesEconomy Impact - MoneycontrolKaraNo ratings yet

- Economic Outlook - July 2020Document8 pagesEconomic Outlook - July 2020KaraNo ratings yet

- Industry Outlook - Worst HitDocument4 pagesIndustry Outlook - Worst HitKaraNo ratings yet

- Ifr 11 23 2019 PDFDocument108 pagesIfr 11 23 2019 PDFKaraNo ratings yet