Professional Documents

Culture Documents

BRS Practice Questions

BRS Practice Questions

Uploaded by

syed ali raza kazmiCopyright:

Available Formats

You might also like

- Precise DIY Metro2 Credit Ebook (DC17 - )Document16 pagesPrecise DIY Metro2 Credit Ebook (DC17 - )Tbonds82% (11)

- Royal College Grade 11 Business and Accounting Studies Second Term Paper 2022 English MediumDocument18 pagesRoyal College Grade 11 Business and Accounting Studies Second Term Paper 2022 English MediumAafiya YasirNo ratings yet

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- Q-10 Prepare Bank Reconciliation Statement As On 31Document2 pagesQ-10 Prepare Bank Reconciliation Statement As On 31krish mehtaNo ratings yet

- 39759Document3 pages39759MonikaNo ratings yet

- SET B 11th Acc BRS N RECT.Document2 pagesSET B 11th Acc BRS N RECT.Mohammad Tariq AnsariNo ratings yet

- BRS PDFDocument14 pagesBRS PDFGautam KhanwaniNo ratings yet

- 6 BRS 08-2023 RegularDocument7 pages6 BRS 08-2023 RegularjahnaviNo ratings yet

- 0c26dbank Reconciliation Statement Practice QuestionsDocument2 pages0c26dbank Reconciliation Statement Practice QuestionsRahul AgarwalNo ratings yet

- Adobe Scan Apr 10, 2023Document12 pagesAdobe Scan Apr 10, 2023ineshbanerjee80No ratings yet

- BRS Statement IllustrationsDocument3 pagesBRS Statement Illustrationssurekha khandebharadNo ratings yet

- Bank Reconciliation StatementDocument12 pagesBank Reconciliation StatementBhuvan PrajapatiNo ratings yet

- Worksheet BRSDocument2 pagesWorksheet BRSCA Chhavi Gupta100% (1)

- Bank Reconciliation Statement Practice ProblemsDocument2 pagesBank Reconciliation Statement Practice ProblemsHaya DanishNo ratings yet

- BRS WSDocument2 pagesBRS WSShrajith A NatarajanNo ratings yet

- Section "B" (Short-Answer Questions) (30 Marks) : Government Boys Degree College (M) Gulistan-E-Johar, KarachiDocument4 pagesSection "B" (Short-Answer Questions) (30 Marks) : Government Boys Degree College (M) Gulistan-E-Johar, KarachiArshad KhanNo ratings yet

- CA F BRS WithDocument10 pagesCA F BRS WithG. DhanyaNo ratings yet

- 5.bank Reconcile Question and AnswerDocument42 pages5.bank Reconcile Question and AnswerSwarna Mishra100% (1)

- Exercises of Bank Reconciliation Statement: Exercise No. IDocument9 pagesExercises of Bank Reconciliation Statement: Exercise No. ITayyab AliNo ratings yet

- Business Acoounting (2020)Document4 pagesBusiness Acoounting (2020)harshdeepgarg5No ratings yet

- Tsgrewal BRSDocument11 pagesTsgrewal BRSDhruvNo ratings yet

- WS - Xi BRS - 2Document5 pagesWS - Xi BRS - 2richshivamshahNo ratings yet

- Problem 1Document7 pagesProblem 1tsegay169No ratings yet

- Bank Reconciliaton Statement Practice Questions: ST ST STDocument2 pagesBank Reconciliaton Statement Practice Questions: ST ST STHuma SamuelNo ratings yet

- Chapter 11 - Bank Reconciliation StatementDocument29 pagesChapter 11 - Bank Reconciliation StatementRoh100% (1)

- Dkgoel BRS 11Document15 pagesDkgoel BRS 11DhruvNo ratings yet

- FA1 Bank ReconciliationDocument4 pagesFA1 Bank Reconciliationamir100% (1)

- BRS Class 11Document1 pageBRS Class 11tarun aroraNo ratings yet

- Work Book Unit 12 Bank Reconcilaition Statement (Solved)Document9 pagesWork Book Unit 12 Bank Reconcilaition Statement (Solved)Zaheer SwatiNo ratings yet

- Accountancy XI Half Yearly WorksheetDocument8 pagesAccountancy XI Half Yearly WorksheetDeivanai K CSNo ratings yet

- BRS RevisionDocument2 pagesBRS RevisionHarsh ModiNo ratings yet

- Accountancy XI: Pankaj Rajan 9810194206Document4 pagesAccountancy XI: Pankaj Rajan 9810194206A4S ARMY Akshdeep singhNo ratings yet

- BRS PPT StudentDocument26 pagesBRS PPT StudentgganyanNo ratings yet

- Worksheet 3 - Solutions: Topic: Cash Book & Bank ReconciliationDocument2 pagesWorksheet 3 - Solutions: Topic: Cash Book & Bank ReconciliationvipulNo ratings yet

- Worksheet 3 - Solutions: Topic: Cash Book & Bank ReconciliationDocument2 pagesWorksheet 3 - Solutions: Topic: Cash Book & Bank ReconciliationvipulNo ratings yet

- Accounting RevisionDocument8 pagesAccounting RevisionAnish KanthetiNo ratings yet

- Prime Entry Books ActivitiesDocument12 pagesPrime Entry Books ActivitiesHiruni Mallawa arachchiNo ratings yet

- Practice With MT - BRSDocument6 pagesPractice With MT - BRSsrushtibhawsar07No ratings yet

- Class: XI Department: Commerce Worksheet No: Topic: Ledger & Trial BalanceDocument3 pagesClass: XI Department: Commerce Worksheet No: Topic: Ledger & Trial BalanceVansh SharmaNo ratings yet

- Question 1Document3 pagesQuestion 1Mohammad Tariq AnsariNo ratings yet

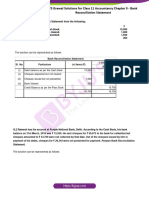

- Ts Grewal Solutions For Class 11 Accountancy Chapter 9 BankDocument34 pagesTs Grewal Solutions For Class 11 Accountancy Chapter 9 Bankmyankjindal9No ratings yet

- 06 SLLC - 2021 - Acc - Review Question - Set 03Document7 pages06 SLLC - 2021 - Acc - Review Question - Set 03Chamela MahiepalaNo ratings yet

- Accounting For Manager: - CA Ankita JainDocument13 pagesAccounting For Manager: - CA Ankita JainrahulthexNo ratings yet

- 06 BRS - Practice QuestionsDocument1 page06 BRS - Practice QuestionsNeelanjana RayNo ratings yet

- Additional Practical Problems-13-1Document5 pagesAdditional Practical Problems-13-1sharmaarmaan103No ratings yet

- Time:-01:00Hr. F.M.:-25Document2 pagesTime:-01:00Hr. F.M.:-25mishralakshay629No ratings yet

- CHP 2 - BRSDocument5 pagesCHP 2 - BRSPayal Mehta DeshpandeNo ratings yet

- BRSDocument3 pagesBRSAimen ImranNo ratings yet

- Bank Reconciliation Statement AssignmentDocument3 pagesBank Reconciliation Statement AssignmentDev KumarNo ratings yet

- Amazing RaceDocument6 pagesAmazing RaceHanns Lexter PadillaNo ratings yet

- Bank Reconciliation StatementDocument44 pagesBank Reconciliation StatementDubai SheikhNo ratings yet

- FINANCIAL ACCOUNITNG B.com-I Rizwan AnjumDocument2 pagesFINANCIAL ACCOUNITNG B.com-I Rizwan AnjumsajidNo ratings yet

- Ch-3 BRSDocument8 pagesCh-3 BRSAFTAB KHANNo ratings yet

- File 9563Document29 pagesFile 9563dhananijeneelNo ratings yet

- CA Foundation BRS Practice Questions - DRS - CTC ClassesDocument2 pagesCA Foundation BRS Practice Questions - DRS - CTC ClassesAnas AzeemNo ratings yet

- Class Exercise Bank ReconciliationDocument6 pagesClass Exercise Bank ReconciliationDalia ElarabyNo ratings yet

- Assignment Subject Code BM 0001 (4 Credits) 60 Marks Set I Subject: Financial Accounting - An IntroductionDocument6 pagesAssignment Subject Code BM 0001 (4 Credits) 60 Marks Set I Subject: Financial Accounting - An IntroductionAbdul Lateef KhanNo ratings yet

- Cash Book ProblemsDocument6 pagesCash Book Problemsshahid sjNo ratings yet

- Test of BRSDocument3 pagesTest of BRSPervaiz AkhterNo ratings yet

- AC101 Quiz 2Document2 pagesAC101 Quiz 2irene TogaraNo ratings yet

- Accountancy Worksheet PracticeDocument4 pagesAccountancy Worksheet PracticeChandni JeswaniNo ratings yet

- Bank ReconcilationDocument1 pageBank ReconcilationddssNo ratings yet

- Customer Acknowledgment Form: Applicant InformationDocument2 pagesCustomer Acknowledgment Form: Applicant InformationKamlesh SonareNo ratings yet

- DocumentsDocument2 pagesDocumentsswanbernard56No ratings yet

- Credit Card Debt AssignmentDocument5 pagesCredit Card Debt Assignmentapi-581454156No ratings yet

- FMI Unit 1Document30 pagesFMI Unit 1Debajit DasNo ratings yet

- Ch.1 Overview of Financial Management and Financial EnvironmentDocument37 pagesCh.1 Overview of Financial Management and Financial EnvironmentNguyễn ThảoNo ratings yet

- Bank of BarodaDocument92 pagesBank of BarodaAnkit BhudharNo ratings yet

- Morin BSDocument4 pagesMorin BSMD HOSSAINNo ratings yet

- Shashank CVDocument2 pagesShashank CVShashank RaoNo ratings yet

- ReferencesDocument9 pagesReferencesBông GấuNo ratings yet

- FPSAA5 - Finance SourcesDocument3 pagesFPSAA5 - Finance SourcesNuriel AguilarNo ratings yet

- 14.17 Al MuqasatDocument5 pages14.17 Al Muqasatamelia stephanie100% (1)

- Chapter 14 - Raising Debt and Equity GloballyDocument46 pagesChapter 14 - Raising Debt and Equity GloballyDuong TrinhNo ratings yet

- Abhijeet Panchariya: Advocate Rajasthan High CourtDocument3 pagesAbhijeet Panchariya: Advocate Rajasthan High Courtabhijeet panchariyaNo ratings yet

- Document (1) : Article: The Consumer Debt Crisis and The Reinforcement of Class Position, 40 Loy. U. Chi. L.J. 557Document39 pagesDocument (1) : Article: The Consumer Debt Crisis and The Reinforcement of Class Position, 40 Loy. U. Chi. L.J. 557Huyền MinhNo ratings yet

- IVY Fee StatementDocument3 pagesIVY Fee StatementIVYNo ratings yet

- Case Study On ICICI BankDocument3 pagesCase Study On ICICI BankMaheshNo ratings yet

- Chapter 11 HWDocument5 pagesChapter 11 HWariana rodriguezNo ratings yet

- Analysis On Customer Service Department Activities Of: HBL, Itahari BranchDocument50 pagesAnalysis On Customer Service Department Activities Of: HBL, Itahari BranchSujan BajracharyaNo ratings yet

- Zoya ProjectDocument60 pagesZoya Projectanas khanNo ratings yet

- Applyonline OcmrDocument9 pagesApplyonline Ocmrjafarjsk95No ratings yet

- Admission Process Schedule: Directorate of Education (Secondary and Higher Secondary) MS, PuneDocument4 pagesAdmission Process Schedule: Directorate of Education (Secondary and Higher Secondary) MS, PuneArnav SinghNo ratings yet

- Fbi Last AssignmentDocument3 pagesFbi Last Assignmenttanmay agarwalNo ratings yet

- Accountancy XI Final Question Paper (2020-21)Document9 pagesAccountancy XI Final Question Paper (2020-21)Ashir SinghNo ratings yet

- CompaDocument2 pagesCompaClint AnthonyNo ratings yet

- Zeeshan ABL Report FinalDocument29 pagesZeeshan ABL Report FinalSami UllahNo ratings yet

- Cir 210485133300Document2 pagesCir 210485133300Bea LouiseNo ratings yet

- Chapter 6 Rural BanksDocument49 pagesChapter 6 Rural BanksChichay KarenJoyNo ratings yet

- 4 5845754552065723218Document23 pages4 5845754552065723218Mehari TemesgenNo ratings yet

BRS Practice Questions

BRS Practice Questions

Uploaded by

syed ali raza kazmiOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

BRS Practice Questions

BRS Practice Questions

Uploaded by

syed ali raza kazmiCopyright:

Available Formats

Bank Reconciliation Statement

Practice Questions

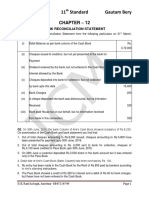

Q no:1 From the following transaction prepare a bank reconciliation statement

of Mr. Alyan as on 31st March, 2020.

I. Balance as per cash book Rs 37,000

II. Cheque deposited into bank on 28th March but not collected by bank by 31st March, Rs

1000

III. Cheque issued but not presented by 31st March Rs 1550

IV. The bank has credited dividend of Rs 1500 on 31st march but the intimation was received

by the trader on 5th April,2020.

V. A cheque of Rs 500 was received from a customer and was entered into the bank column

of cash book, but was paid into the Bank on 1st April,2020.

VI. Insurance premium of Rs 1000 paid by bank for which there is no record in the cash book.

VII. Interest of Rs 200 credited by bank in the pass book only which is not recorded in the cash

book

VIII. Cheques of Rs 12000 were deposited into bank in March but a cheque of Rs 3000 out of

them was credited in April.

IX. A cheque of Rs. 6500 was deposited into bank in March but in April the cheque returns by

bank as dishourned.

X. Interest on overdraft Rs 40 and the bank charges Rs 20 are only debited in pass book only.

Q No:2 From the following transaction prepare a bank reconciliation statement

of Mr. Ali as on 31st April, 2020.

i. Balance as per Pass Book Rs 40,000

ii. Cheque deposited yet not collected by bank Rs 20,200

iii. Cheque issued but not paid by bank Rs 2000

iv. Interest credited by bank but not recorded in cash book Rs 3000

v. Bank charges debited by bank but not entered in Cash book Rs 50

vi. Cheque issued but not presented for the payment by 31st April ,2020

vii. Cheques of Rs 4000 were issued to the creditor out of which a cheque of Rs 1800 presented

after 31st April ,2020

viii. Cheques of Rs 10000 were paid in April 19, out of these Rs. 5000 credited by the bank on

20th April and Rs 1000 on April 28th and the balance on 2nd May ,2020.

ix. An entry of Rs 500 being payment by a customer direct appear in the pass book.

x. Dividend collected by the Bank Rs 300 credited in the pass book.

Q No:3 Abram Cash Book showed a bank overdraft of Rs 30,000 on May,

2015. 0n comparison of both book the following differences were observed.

A. An outstation cheque of Rs 2000, lodged on 30th May, 2015 did not appeared in the

pass book.

B. Cheques issued of Rs 5000 had not been presented at the bank.

C. Insurance premium paid and debited by the bank in the pass book Rs 2000 but not

entered in the cash book.

D. Interest on investment collected by bank appeared in the pass book only Rs 500

E. Dividend on shares collected by bank 700 credited in pass book only.

F. Cheques amounting to Rs 1600, Rs 1800 and Rs. 20,00 issued during the month

and cheque of Rs 1800 was presented in the bank 2nd June,2020

G. Bill proceeds collected by the bank but not recorded in the cash book Rs 2000

H. Cheque issued and paid by the bank but wrongly entered in the cash column of the

cash book, Rs 8000

I. Cheque deposited but credited by the bank in the month of June ,2020 Rs 5000

Prepare the bank reconciliation statement from the above-mentioned Transactions.

Q No:4 From the following transactions prepare a bank reconciliation

statement of Mr. Zulfiqar as on 31st April, 2020.

a) Overdraft balance as per pass book Rs 25000

b) Cheques of Rs 2000, Rs 3000, Rs 1000, Rs 500, Rs 4000 are deposited in the

bank, but out of them cheques of Rs 3000 and Rs 4000 were collected in May,

2020.

c) Interest debited in the pass book Rs 2000 but not recorded in the cash book.

d) A cheque of Rs 500 deposited but credited by the bank in the month of May 2020

e) A cheque received of Rs 2000, recorded in the cash book was not sent to the bank

for collection

f) Cheque paid in but not cleared by the bank Rs 1300

g) Interest on Govt security Rs 300 collected and credited in the pass book

h) Cheque issued but not presented for payment Rs 6000

You might also like

- Precise DIY Metro2 Credit Ebook (DC17 - )Document16 pagesPrecise DIY Metro2 Credit Ebook (DC17 - )Tbonds82% (11)

- Royal College Grade 11 Business and Accounting Studies Second Term Paper 2022 English MediumDocument18 pagesRoyal College Grade 11 Business and Accounting Studies Second Term Paper 2022 English MediumAafiya YasirNo ratings yet

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- Q-10 Prepare Bank Reconciliation Statement As On 31Document2 pagesQ-10 Prepare Bank Reconciliation Statement As On 31krish mehtaNo ratings yet

- 39759Document3 pages39759MonikaNo ratings yet

- SET B 11th Acc BRS N RECT.Document2 pagesSET B 11th Acc BRS N RECT.Mohammad Tariq AnsariNo ratings yet

- BRS PDFDocument14 pagesBRS PDFGautam KhanwaniNo ratings yet

- 6 BRS 08-2023 RegularDocument7 pages6 BRS 08-2023 RegularjahnaviNo ratings yet

- 0c26dbank Reconciliation Statement Practice QuestionsDocument2 pages0c26dbank Reconciliation Statement Practice QuestionsRahul AgarwalNo ratings yet

- Adobe Scan Apr 10, 2023Document12 pagesAdobe Scan Apr 10, 2023ineshbanerjee80No ratings yet

- BRS Statement IllustrationsDocument3 pagesBRS Statement Illustrationssurekha khandebharadNo ratings yet

- Bank Reconciliation StatementDocument12 pagesBank Reconciliation StatementBhuvan PrajapatiNo ratings yet

- Worksheet BRSDocument2 pagesWorksheet BRSCA Chhavi Gupta100% (1)

- Bank Reconciliation Statement Practice ProblemsDocument2 pagesBank Reconciliation Statement Practice ProblemsHaya DanishNo ratings yet

- BRS WSDocument2 pagesBRS WSShrajith A NatarajanNo ratings yet

- Section "B" (Short-Answer Questions) (30 Marks) : Government Boys Degree College (M) Gulistan-E-Johar, KarachiDocument4 pagesSection "B" (Short-Answer Questions) (30 Marks) : Government Boys Degree College (M) Gulistan-E-Johar, KarachiArshad KhanNo ratings yet

- CA F BRS WithDocument10 pagesCA F BRS WithG. DhanyaNo ratings yet

- 5.bank Reconcile Question and AnswerDocument42 pages5.bank Reconcile Question and AnswerSwarna Mishra100% (1)

- Exercises of Bank Reconciliation Statement: Exercise No. IDocument9 pagesExercises of Bank Reconciliation Statement: Exercise No. ITayyab AliNo ratings yet

- Business Acoounting (2020)Document4 pagesBusiness Acoounting (2020)harshdeepgarg5No ratings yet

- Tsgrewal BRSDocument11 pagesTsgrewal BRSDhruvNo ratings yet

- WS - Xi BRS - 2Document5 pagesWS - Xi BRS - 2richshivamshahNo ratings yet

- Problem 1Document7 pagesProblem 1tsegay169No ratings yet

- Bank Reconciliaton Statement Practice Questions: ST ST STDocument2 pagesBank Reconciliaton Statement Practice Questions: ST ST STHuma SamuelNo ratings yet

- Chapter 11 - Bank Reconciliation StatementDocument29 pagesChapter 11 - Bank Reconciliation StatementRoh100% (1)

- Dkgoel BRS 11Document15 pagesDkgoel BRS 11DhruvNo ratings yet

- FA1 Bank ReconciliationDocument4 pagesFA1 Bank Reconciliationamir100% (1)

- BRS Class 11Document1 pageBRS Class 11tarun aroraNo ratings yet

- Work Book Unit 12 Bank Reconcilaition Statement (Solved)Document9 pagesWork Book Unit 12 Bank Reconcilaition Statement (Solved)Zaheer SwatiNo ratings yet

- Accountancy XI Half Yearly WorksheetDocument8 pagesAccountancy XI Half Yearly WorksheetDeivanai K CSNo ratings yet

- BRS RevisionDocument2 pagesBRS RevisionHarsh ModiNo ratings yet

- Accountancy XI: Pankaj Rajan 9810194206Document4 pagesAccountancy XI: Pankaj Rajan 9810194206A4S ARMY Akshdeep singhNo ratings yet

- BRS PPT StudentDocument26 pagesBRS PPT StudentgganyanNo ratings yet

- Worksheet 3 - Solutions: Topic: Cash Book & Bank ReconciliationDocument2 pagesWorksheet 3 - Solutions: Topic: Cash Book & Bank ReconciliationvipulNo ratings yet

- Worksheet 3 - Solutions: Topic: Cash Book & Bank ReconciliationDocument2 pagesWorksheet 3 - Solutions: Topic: Cash Book & Bank ReconciliationvipulNo ratings yet

- Accounting RevisionDocument8 pagesAccounting RevisionAnish KanthetiNo ratings yet

- Prime Entry Books ActivitiesDocument12 pagesPrime Entry Books ActivitiesHiruni Mallawa arachchiNo ratings yet

- Practice With MT - BRSDocument6 pagesPractice With MT - BRSsrushtibhawsar07No ratings yet

- Class: XI Department: Commerce Worksheet No: Topic: Ledger & Trial BalanceDocument3 pagesClass: XI Department: Commerce Worksheet No: Topic: Ledger & Trial BalanceVansh SharmaNo ratings yet

- Question 1Document3 pagesQuestion 1Mohammad Tariq AnsariNo ratings yet

- Ts Grewal Solutions For Class 11 Accountancy Chapter 9 BankDocument34 pagesTs Grewal Solutions For Class 11 Accountancy Chapter 9 Bankmyankjindal9No ratings yet

- 06 SLLC - 2021 - Acc - Review Question - Set 03Document7 pages06 SLLC - 2021 - Acc - Review Question - Set 03Chamela MahiepalaNo ratings yet

- Accounting For Manager: - CA Ankita JainDocument13 pagesAccounting For Manager: - CA Ankita JainrahulthexNo ratings yet

- 06 BRS - Practice QuestionsDocument1 page06 BRS - Practice QuestionsNeelanjana RayNo ratings yet

- Additional Practical Problems-13-1Document5 pagesAdditional Practical Problems-13-1sharmaarmaan103No ratings yet

- Time:-01:00Hr. F.M.:-25Document2 pagesTime:-01:00Hr. F.M.:-25mishralakshay629No ratings yet

- CHP 2 - BRSDocument5 pagesCHP 2 - BRSPayal Mehta DeshpandeNo ratings yet

- BRSDocument3 pagesBRSAimen ImranNo ratings yet

- Bank Reconciliation Statement AssignmentDocument3 pagesBank Reconciliation Statement AssignmentDev KumarNo ratings yet

- Amazing RaceDocument6 pagesAmazing RaceHanns Lexter PadillaNo ratings yet

- Bank Reconciliation StatementDocument44 pagesBank Reconciliation StatementDubai SheikhNo ratings yet

- FINANCIAL ACCOUNITNG B.com-I Rizwan AnjumDocument2 pagesFINANCIAL ACCOUNITNG B.com-I Rizwan AnjumsajidNo ratings yet

- Ch-3 BRSDocument8 pagesCh-3 BRSAFTAB KHANNo ratings yet

- File 9563Document29 pagesFile 9563dhananijeneelNo ratings yet

- CA Foundation BRS Practice Questions - DRS - CTC ClassesDocument2 pagesCA Foundation BRS Practice Questions - DRS - CTC ClassesAnas AzeemNo ratings yet

- Class Exercise Bank ReconciliationDocument6 pagesClass Exercise Bank ReconciliationDalia ElarabyNo ratings yet

- Assignment Subject Code BM 0001 (4 Credits) 60 Marks Set I Subject: Financial Accounting - An IntroductionDocument6 pagesAssignment Subject Code BM 0001 (4 Credits) 60 Marks Set I Subject: Financial Accounting - An IntroductionAbdul Lateef KhanNo ratings yet

- Cash Book ProblemsDocument6 pagesCash Book Problemsshahid sjNo ratings yet

- Test of BRSDocument3 pagesTest of BRSPervaiz AkhterNo ratings yet

- AC101 Quiz 2Document2 pagesAC101 Quiz 2irene TogaraNo ratings yet

- Accountancy Worksheet PracticeDocument4 pagesAccountancy Worksheet PracticeChandni JeswaniNo ratings yet

- Bank ReconcilationDocument1 pageBank ReconcilationddssNo ratings yet

- Customer Acknowledgment Form: Applicant InformationDocument2 pagesCustomer Acknowledgment Form: Applicant InformationKamlesh SonareNo ratings yet

- DocumentsDocument2 pagesDocumentsswanbernard56No ratings yet

- Credit Card Debt AssignmentDocument5 pagesCredit Card Debt Assignmentapi-581454156No ratings yet

- FMI Unit 1Document30 pagesFMI Unit 1Debajit DasNo ratings yet

- Ch.1 Overview of Financial Management and Financial EnvironmentDocument37 pagesCh.1 Overview of Financial Management and Financial EnvironmentNguyễn ThảoNo ratings yet

- Bank of BarodaDocument92 pagesBank of BarodaAnkit BhudharNo ratings yet

- Morin BSDocument4 pagesMorin BSMD HOSSAINNo ratings yet

- Shashank CVDocument2 pagesShashank CVShashank RaoNo ratings yet

- ReferencesDocument9 pagesReferencesBông GấuNo ratings yet

- FPSAA5 - Finance SourcesDocument3 pagesFPSAA5 - Finance SourcesNuriel AguilarNo ratings yet

- 14.17 Al MuqasatDocument5 pages14.17 Al Muqasatamelia stephanie100% (1)

- Chapter 14 - Raising Debt and Equity GloballyDocument46 pagesChapter 14 - Raising Debt and Equity GloballyDuong TrinhNo ratings yet

- Abhijeet Panchariya: Advocate Rajasthan High CourtDocument3 pagesAbhijeet Panchariya: Advocate Rajasthan High Courtabhijeet panchariyaNo ratings yet

- Document (1) : Article: The Consumer Debt Crisis and The Reinforcement of Class Position, 40 Loy. U. Chi. L.J. 557Document39 pagesDocument (1) : Article: The Consumer Debt Crisis and The Reinforcement of Class Position, 40 Loy. U. Chi. L.J. 557Huyền MinhNo ratings yet

- IVY Fee StatementDocument3 pagesIVY Fee StatementIVYNo ratings yet

- Case Study On ICICI BankDocument3 pagesCase Study On ICICI BankMaheshNo ratings yet

- Chapter 11 HWDocument5 pagesChapter 11 HWariana rodriguezNo ratings yet

- Analysis On Customer Service Department Activities Of: HBL, Itahari BranchDocument50 pagesAnalysis On Customer Service Department Activities Of: HBL, Itahari BranchSujan BajracharyaNo ratings yet

- Zoya ProjectDocument60 pagesZoya Projectanas khanNo ratings yet

- Applyonline OcmrDocument9 pagesApplyonline Ocmrjafarjsk95No ratings yet

- Admission Process Schedule: Directorate of Education (Secondary and Higher Secondary) MS, PuneDocument4 pagesAdmission Process Schedule: Directorate of Education (Secondary and Higher Secondary) MS, PuneArnav SinghNo ratings yet

- Fbi Last AssignmentDocument3 pagesFbi Last Assignmenttanmay agarwalNo ratings yet

- Accountancy XI Final Question Paper (2020-21)Document9 pagesAccountancy XI Final Question Paper (2020-21)Ashir SinghNo ratings yet

- CompaDocument2 pagesCompaClint AnthonyNo ratings yet

- Zeeshan ABL Report FinalDocument29 pagesZeeshan ABL Report FinalSami UllahNo ratings yet

- Cir 210485133300Document2 pagesCir 210485133300Bea LouiseNo ratings yet

- Chapter 6 Rural BanksDocument49 pagesChapter 6 Rural BanksChichay KarenJoyNo ratings yet

- 4 5845754552065723218Document23 pages4 5845754552065723218Mehari TemesgenNo ratings yet