Professional Documents

Culture Documents

Retail Assets-KYC Annx. Addl To Appl - Form-Mortgage-V3

Retail Assets-KYC Annx. Addl To Appl - Form-Mortgage-V3

Uploaded by

sourav84Copyright:

Available Formats

You might also like

- Indemnity Bond For Lost Document by Seller To PurchaserDocument2 pagesIndemnity Bond For Lost Document by Seller To Purchasersourav84100% (2)

- Sample Motion For Execution and Issuance of Warrant of ArrestDocument3 pagesSample Motion For Execution and Issuance of Warrant of ArrestFaridEshwerC.DeticioNo ratings yet

- Taxation of Charitable TrustsDocument61 pagesTaxation of Charitable TrustsABC 123No ratings yet

- Account Opening FormDocument10 pagesAccount Opening FormGk MageshNo ratings yet

- WEL TB PAY002 Account Activation Form PDFDocument1 pageWEL TB PAY002 Account Activation Form PDFAnonymous Z6ve7AqWKNo ratings yet

- SBI Loan Account StatementDocument5 pagesSBI Loan Account Statementsourav84No ratings yet

- Extended KYC Annexure IndividualsDocument2 pagesExtended KYC Annexure IndividualsNarendra Reddy BhumaNo ratings yet

- System Zdalnej RejestracjiDocument4 pagesSystem Zdalnej RejestracjiRahatNo ratings yet

- 3Document3 pages3Amith VishwanathNo ratings yet

- DownloadDocument3 pagesDownloadAshok GNo ratings yet

- Extended KYC - FATCADocument2 pagesExtended KYC - FATCASianga SiangaNo ratings yet

- FATCA CRS DeclarationDocument4 pagesFATCA CRS Declarationashokdas test5No ratings yet

- Extended KYC Annexure Individuals PDFDocument2 pagesExtended KYC Annexure Individuals PDFPurushothamNo ratings yet

- Kindly Execute The Following Request/sDocument2 pagesKindly Execute The Following Request/sAxtella Global for Information Technology CompanyqNo ratings yet

- KYC Updation Form - DSL - NSDL - 1615548970Document10 pagesKYC Updation Form - DSL - NSDL - 1615548970raj kiranNo ratings yet

- Know Your Customer (Kyc) Update Form Resident Customers: Important InformationDocument12 pagesKnow Your Customer (Kyc) Update Form Resident Customers: Important InformationChethan KumarNo ratings yet

- Yesbank Re Designation Request Form Resident To Non Savings NroDocument6 pagesYesbank Re Designation Request Form Resident To Non Savings NroCh GaneshNo ratings yet

- SIB Car Loan Closure DocumentsDocument3 pagesSIB Car Loan Closure DocumentsRamNo ratings yet

- Modfication Form Latest-2Document2 pagesModfication Form Latest-2navin vargheseNo ratings yet

- Simplified CDD Form For Natural PersonsDocument2 pagesSimplified CDD Form For Natural PersonsskyanikinNo ratings yet

- FATCA Individual Form 21012016Document2 pagesFATCA Individual Form 21012016Aakash SharmaNo ratings yet

- Zerodha Account OpeningDocument8 pagesZerodha Account OpeningDeerajKumarNo ratings yet

- Application Form For Loan Under Pradhan Mantri Mudra Yojana: Applicationno: DateDocument2 pagesApplication Form For Loan Under Pradhan Mantri Mudra Yojana: Applicationno: DateKevin ArnoldNo ratings yet

- Extended KYC Annexure - Individuals (Including Sole-Proprietors) (Applicable For Resident and Non-Resident Customers) (Mandatory)Document2 pagesExtended KYC Annexure - Individuals (Including Sole-Proprietors) (Applicable For Resident and Non-Resident Customers) (Mandatory)Leo SaimNo ratings yet

- DCB NRE Account OpeningDocument8 pagesDCB NRE Account OpeningAbhay AgrawalNo ratings yet

- PL App FormDocument2 pagesPL App Formsabefoy840No ratings yet

- Credit Card Application Form Indian BankDocument2 pagesCredit Card Application Form Indian BankKishwar MNo ratings yet

- Resident To Nro Conversion FormDocument2 pagesResident To Nro Conversion Formsagaralva7373No ratings yet

- Demat PDFDocument8 pagesDemat PDFparchure123No ratings yet

- Personal Account Opening Form 20240129Document15 pagesPersonal Account Opening Form 20240129Md Afsar SagorNo ratings yet

- Personal Account Opening Form: WNMV Ei BVG (Evsjvq)Document15 pagesPersonal Account Opening Form: WNMV Ei BVG (Evsjvq)muslimnswNo ratings yet

- NRI Form Ver5Document12 pagesNRI Form Ver5enterprisesshreemarutiNo ratings yet

- Zeta Kyc Form & Prepaid Terms of Use: Your DetailsDocument2 pagesZeta Kyc Form & Prepaid Terms of Use: Your DetailsSonam RaiNo ratings yet

- Page - 1Document8 pagesPage - 1Abhi ChandranNo ratings yet

- FATCA CRS Individual Declaration FormDocument2 pagesFATCA CRS Individual Declaration FormSrigandh's WealthNo ratings yet

- SB NreDocument7 pagesSB NreAsutosaNo ratings yet

- Jammu & Kashmir BankDocument1 pageJammu & Kashmir BankPay TekNo ratings yet

- ProgrammingDocument1 pageProgrammingsamreenimran1702No ratings yet

- Kotak Multi Currency World Travel Application FormDocument2 pagesKotak Multi Currency World Travel Application FormVivek ShuklaNo ratings yet

- CarProposal QVPN107614961Document6 pagesCarProposal QVPN107614961sajithmon785No ratings yet

- Signature CardDocument1 pageSignature CardAKASHNo ratings yet

- Account Opening Application Form Non-Resident Individuals: (Non Face To Face)Document10 pagesAccount Opening Application Form Non-Resident Individuals: (Non Face To Face)RISHIKESH KUMARNo ratings yet

- Application Form For Loan Under Pradhan Mantri Mudra Yojana (PMMY) (For Loan Upto Rs. 50,000/-Under Shishu)Document2 pagesApplication Form For Loan Under Pradhan Mantri Mudra Yojana (PMMY) (For Loan Upto Rs. 50,000/-Under Shishu)PradeepMathadNo ratings yet

- KYC - IndividualDocument1 pageKYC - IndividualBibin DhasNo ratings yet

- LIC121 - REAL ID and Standard CDL-ID Documentation Checklist - 0723 - 0Document2 pagesLIC121 - REAL ID and Standard CDL-ID Documentation Checklist - 0723 - 0rodriguezyamo777No ratings yet

- App For Registration Instructions Work Permit ID Form ALPCD 11 Rev 7 30 ...Document4 pagesApp For Registration Instructions Work Permit ID Form ALPCD 11 Rev 7 30 ...Retchh Ihsel De TorresNo ratings yet

- 2022 KYC - Business Client (09072022)Document1 page2022 KYC - Business Client (09072022)Rhea SebastianNo ratings yet

- MyTrade Form 2020Document6 pagesMyTrade Form 2020Mia ValdezNo ratings yet

- Section 1: INDIVIDUAL CLIENT (Please Complete The Relevant Fields in BLOCK Letters)Document4 pagesSection 1: INDIVIDUAL CLIENT (Please Complete The Relevant Fields in BLOCK Letters)xaver lawNo ratings yet

- LATESTNRI Scheme CIF Conversion Cum Upgrade-DowngradeLATESTDocument1 pageLATESTNRI Scheme CIF Conversion Cum Upgrade-DowngradeLATESTemailmetomymailNo ratings yet

- युनाइटेड बक ऑफ इंडया United Bank of India: United Demat Account Opening FormDocument12 pagesयुनाइटेड बक ऑफ इंडया United Bank of India: United Demat Account Opening Formjay meskaNo ratings yet

- DownloadDocument6 pagesDownloadAbdul Jaleel MohammedNo ratings yet

- Customer Due Diligence Form CDDDocument2 pagesCustomer Due Diligence Form CDDRavi AhujaNo ratings yet

- CRF-1 A (CPC)Document4 pagesCRF-1 A (CPC)SafwanNo ratings yet

- Data Correction FormDocument4 pagesData Correction Formsuanxun 93No ratings yet

- New Personal FormDocument2 pagesNew Personal Formcacious mwewaNo ratings yet

- KYC ResidentialDocument4 pagesKYC Residentialdocpt76No ratings yet

- LIC115 - ID Documentation Checklist-1222Document2 pagesLIC115 - ID Documentation Checklist-1222H G2TNo ratings yet

- PR22005 Car Shield - Private Car Package Policy Proposal Form - Set 1Document4 pagesPR22005 Car Shield - Private Car Package Policy Proposal Form - Set 1Rajiv SethNo ratings yet

- NZMIT No 2 Fund Investment Application FormDocument4 pagesNZMIT No 2 Fund Investment Application FormKing fairNo ratings yet

- NRI AcntDocument16 pagesNRI AcntShanmuka NalliNo ratings yet

- Customer Acknowledgment Form: Applicant InformationDocument2 pagesCustomer Acknowledgment Form: Applicant InformationKamlesh SonareNo ratings yet

- ACT - NET BillDocument2 pagesACT - NET Billsourav84No ratings yet

- BR - MGK PrintingDocument2 pagesBR - MGK Printingsourav84No ratings yet

- Statement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument19 pagesStatement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing Balancesourav84No ratings yet

- New Adhar Consent FormDocument1 pageNew Adhar Consent Formsourav84No ratings yet

- BR - MGK PrintingDocument2 pagesBR - MGK Printingsourav84No ratings yet

- BBA CHD (1) - CompressedDocument17 pagesBBA CHD (1) - Compressedsourav84No ratings yet

- Saurabh Kansal - Statement 01.11.20 To 08.02.21Document3 pagesSaurabh Kansal - Statement 01.11.20 To 08.02.21sourav84No ratings yet

- RavinderDocument50 pagesRavindersourav84No ratings yet

- Legal Heir DeclarationDocument1 pageLegal Heir Declarationsourav84No ratings yet

- Affidavit FormatDocument1 pageAffidavit Formatsourav84No ratings yet

- Loss of Prior ChainDocument1 pageLoss of Prior Chainsourav84No ratings yet

- Research Background - SampleDocument1 pageResearch Background - Samplesourav84No ratings yet

- 03C ITPL-Authority Letter - SP Appointment (Firm) INVESTMENT-MARTDocument2 pages03C ITPL-Authority Letter - SP Appointment (Firm) INVESTMENT-MARTsourav84No ratings yet

- Customer Relation Form IndividualDocument2 pagesCustomer Relation Form Individualsourav84No ratings yet

- Meerut Plot 12-Dec-2020 16-14-31Document21 pagesMeerut Plot 12-Dec-2020 16-14-31sourav84No ratings yet

- Standard Fire and Special Perils Insurance: ScheduleDocument13 pagesStandard Fire and Special Perils Insurance: Schedulesourav84No ratings yet

- PL 1Document22 pagesPL 1sourav84No ratings yet

- Customer Relation Form Non Individual 1Document2 pagesCustomer Relation Form Non Individual 1sourav84No ratings yet

- AmalgamationDocument46 pagesAmalgamationmayurkapse100% (1)

- What Is Adm LawDocument3 pagesWhat Is Adm LawMaria Linda GavinoNo ratings yet

- Petitioner Vs Vs Respondent: Second DivisionDocument7 pagesPetitioner Vs Vs Respondent: Second DivisionChingNo ratings yet

- Class Report22a HRDocument2 pagesClass Report22a HRramilflecoNo ratings yet

- MPT Money Merchant Agreement (Template)Document22 pagesMPT Money Merchant Agreement (Template)zayar ooNo ratings yet

- Landbank vs. CADocument2 pagesLandbank vs. CAMikkaEllaAnclaNo ratings yet

- Republic Vs Sereno GR No. 237428 May 11, 2018Document17 pagesRepublic Vs Sereno GR No. 237428 May 11, 2018Jacquelyn RamosNo ratings yet

- Philippine Judges Assn. v. Prado (227 SCRA 703)Document9 pagesPhilippine Judges Assn. v. Prado (227 SCRA 703)Jomarc MalicdemNo ratings yet

- 0 - 1601998074625 - Final Moot Memo.Document14 pages0 - 1601998074625 - Final Moot Memo.Littz MandumpalaNo ratings yet

- Last Seen TogetherDocument9 pagesLast Seen TogetherKumar NaveenNo ratings yet

- Confidential Non-Disclosure AgreementDocument1 pageConfidential Non-Disclosure AgreementTammie WalkerNo ratings yet

- Clog On RedemptionDocument1 pageClog On RedemptionZeesahn100% (1)

- OFFICE OF THE CITY MAYOR OF PARA+æAQUE CITY Et. Al V MARIO D. EBIO, G.R. No. 178411, 621 SCRA 555Document7 pagesOFFICE OF THE CITY MAYOR OF PARA+æAQUE CITY Et. Al V MARIO D. EBIO, G.R. No. 178411, 621 SCRA 555karl_baqNo ratings yet

- Relinquishment DeedDocument4 pagesRelinquishment DeedSudesh GoyalNo ratings yet

- Unit-Ii The Indian Partnership Act, 1932Document42 pagesUnit-Ii The Indian Partnership Act, 1932trustme77No ratings yet

- ID Act Simplified by ChawDocument25 pagesID Act Simplified by ChawSaurabhChoudharyNo ratings yet

- PAPER 3 Revised PDFDocument37 pagesPAPER 3 Revised PDFDeepa BhatiaNo ratings yet

- Understanding The Rizal Law-1Document3 pagesUnderstanding The Rizal Law-1JL WoofNo ratings yet

- Selected Bar Q&a On WillsDocument5 pagesSelected Bar Q&a On WillsMarie Antoinette PascuaNo ratings yet

- Evidence Cases 2Document198 pagesEvidence Cases 2Chris ZialcitaNo ratings yet

- SeniorityDocument37 pagesSenioritySonali AroraNo ratings yet

- G.R. No. 881 August 30, 1902 THE UNITED STATES, Complainant-Appellee, vs. PEDRO ALVAREZ, Defendant-AppellantDocument3 pagesG.R. No. 881 August 30, 1902 THE UNITED STATES, Complainant-Appellee, vs. PEDRO ALVAREZ, Defendant-AppellantRache BaodNo ratings yet

- Adjudicative Support Functions of A COCDocument31 pagesAdjudicative Support Functions of A COCNadine Diamante100% (1)

- Gayler v. WilderDocument3 pagesGayler v. WilderPamela TungNo ratings yet

- Corporate Directors Training Programme Fundamental: The Dynamics of A CompanyDocument42 pagesCorporate Directors Training Programme Fundamental: The Dynamics of A CompanyBushral YusobNo ratings yet

- Torts OutlineDocument40 pagesTorts OutlineBrian PalmerNo ratings yet

- PFR Case NotebookDocument362 pagesPFR Case NotebookjmarkgamonnacNo ratings yet

- United States v. Nevcherlian, 1st Cir. (1994)Document35 pagesUnited States v. Nevcherlian, 1st Cir. (1994)Scribd Government DocsNo ratings yet

- Consti 2 3rd SetDocument27 pagesConsti 2 3rd SetNMNGNo ratings yet

Retail Assets-KYC Annx. Addl To Appl - Form-Mortgage-V3

Retail Assets-KYC Annx. Addl To Appl - Form-Mortgage-V3

Uploaded by

sourav84Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Retail Assets-KYC Annx. Addl To Appl - Form-Mortgage-V3

Retail Assets-KYC Annx. Addl To Appl - Form-Mortgage-V3

Uploaded by

sourav84Copyright:

Available Formats

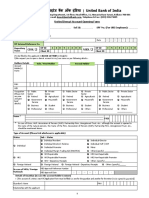

Extended KYC Annexure - Individuals

Application Form Number:

Please fill the information below as Loan Applicant Name Loan Co-Applicant Name

requested

Name of the Customer (as per ID proof with

prefix)

KYC Number (if available/as per Central

KYC Registry)

Maiden Name (if any)

Mother’s Name

Nationality □ Indian □ Others _______________________ □ Indian □ Others ____________________

Residential Status □ Resident Individual □ Non Resident Indians □ Resident Individual □ Non Resident Indians

□ Foreign National □ Person of Indian Origin □ Foreign National □ Person of Indian Origin

Proof of Identity – Documents to be □ Passport Date of Expiry DD /MM /YYYY □ Passport Date of Expiry DD /MM/YYYY

submitted as detailed. □ PAN □ PAN

□ Election / Voter’s ID card □ Election / Voter’s ID card

□ Driving License- Date of Expiry DD /MM /YYYY □ Driving License-Date of Expiry DD /MM/YYYY

□ Aadhaar card / letter □ Aadhaar card / letter

□ NREGA Job ID Card □ NREGA Job ID Card

□ Government ID Card □ Government ID Card

□ Others (Notified by Central Government) □ Others (Notified by Central Government)

______________________________________ ____________________________________

Proof of Identity - Identification Number for

above mentioned proof.

Please tick Type of Address □ Residential and Business □ Residential and Business

□ Residential □ Residential

□ Business □ Business

□ Registered Office □ Registered Office

□ Unspecified □ Unspecified

Certification: I/We have understood the information requirements of this Form as per the CBDT notified Rules 114F to 114H and hereby confirm that the

information provided by me/us on this Form is true, correct, and complete. I/We also confirm that I/We have read and understood the Terms and Conditions

below and hereby accept the same. I/We understand that my personal details as provided /available in the bank records will be used for CBDT reporting.

Signature of first holder Signature of second holder

CBDT Terms and Conditions: The Central Board of Direct Taxes (CBDT) has notified Rules 114F to 114H, as part of the Income-tax Rules, 1962, which

Rules require Indian financial institutions such as the Bank to seek additional personal, tax and beneficial owner information and certain certifications and

documentation from all our account holders. In relevant cases, information will have to be reported to tax authorities/ appointed agencies. Towards

compliance, we may also be required to provide information to any institutions such as withholding agents for the purpose of ensuring appropriate

withholding from the account or any proceeds in relation thereto. Should there be any change in any information provided by you, please ensure you

advise us promptly, i.e., within 30 days. Please note that you may receive more than one request for information if you have multiple relationships with

HDFC Bank or its group entities. Therefore, it is important that you respond to our request, even if you believe you have already supplied any previously

requested information.

For Bank use only :

Sourcing Branch Name: ____________________________

Employee Code & Name: ___________________________ Employee Designation: ________________________

Signature & Date: _______________________

You might also like

- Indemnity Bond For Lost Document by Seller To PurchaserDocument2 pagesIndemnity Bond For Lost Document by Seller To Purchasersourav84100% (2)

- Sample Motion For Execution and Issuance of Warrant of ArrestDocument3 pagesSample Motion For Execution and Issuance of Warrant of ArrestFaridEshwerC.DeticioNo ratings yet

- Taxation of Charitable TrustsDocument61 pagesTaxation of Charitable TrustsABC 123No ratings yet

- Account Opening FormDocument10 pagesAccount Opening FormGk MageshNo ratings yet

- WEL TB PAY002 Account Activation Form PDFDocument1 pageWEL TB PAY002 Account Activation Form PDFAnonymous Z6ve7AqWKNo ratings yet

- SBI Loan Account StatementDocument5 pagesSBI Loan Account Statementsourav84No ratings yet

- Extended KYC Annexure IndividualsDocument2 pagesExtended KYC Annexure IndividualsNarendra Reddy BhumaNo ratings yet

- System Zdalnej RejestracjiDocument4 pagesSystem Zdalnej RejestracjiRahatNo ratings yet

- 3Document3 pages3Amith VishwanathNo ratings yet

- DownloadDocument3 pagesDownloadAshok GNo ratings yet

- Extended KYC - FATCADocument2 pagesExtended KYC - FATCASianga SiangaNo ratings yet

- FATCA CRS DeclarationDocument4 pagesFATCA CRS Declarationashokdas test5No ratings yet

- Extended KYC Annexure Individuals PDFDocument2 pagesExtended KYC Annexure Individuals PDFPurushothamNo ratings yet

- Kindly Execute The Following Request/sDocument2 pagesKindly Execute The Following Request/sAxtella Global for Information Technology CompanyqNo ratings yet

- KYC Updation Form - DSL - NSDL - 1615548970Document10 pagesKYC Updation Form - DSL - NSDL - 1615548970raj kiranNo ratings yet

- Know Your Customer (Kyc) Update Form Resident Customers: Important InformationDocument12 pagesKnow Your Customer (Kyc) Update Form Resident Customers: Important InformationChethan KumarNo ratings yet

- Yesbank Re Designation Request Form Resident To Non Savings NroDocument6 pagesYesbank Re Designation Request Form Resident To Non Savings NroCh GaneshNo ratings yet

- SIB Car Loan Closure DocumentsDocument3 pagesSIB Car Loan Closure DocumentsRamNo ratings yet

- Modfication Form Latest-2Document2 pagesModfication Form Latest-2navin vargheseNo ratings yet

- Simplified CDD Form For Natural PersonsDocument2 pagesSimplified CDD Form For Natural PersonsskyanikinNo ratings yet

- FATCA Individual Form 21012016Document2 pagesFATCA Individual Form 21012016Aakash SharmaNo ratings yet

- Zerodha Account OpeningDocument8 pagesZerodha Account OpeningDeerajKumarNo ratings yet

- Application Form For Loan Under Pradhan Mantri Mudra Yojana: Applicationno: DateDocument2 pagesApplication Form For Loan Under Pradhan Mantri Mudra Yojana: Applicationno: DateKevin ArnoldNo ratings yet

- Extended KYC Annexure - Individuals (Including Sole-Proprietors) (Applicable For Resident and Non-Resident Customers) (Mandatory)Document2 pagesExtended KYC Annexure - Individuals (Including Sole-Proprietors) (Applicable For Resident and Non-Resident Customers) (Mandatory)Leo SaimNo ratings yet

- DCB NRE Account OpeningDocument8 pagesDCB NRE Account OpeningAbhay AgrawalNo ratings yet

- PL App FormDocument2 pagesPL App Formsabefoy840No ratings yet

- Credit Card Application Form Indian BankDocument2 pagesCredit Card Application Form Indian BankKishwar MNo ratings yet

- Resident To Nro Conversion FormDocument2 pagesResident To Nro Conversion Formsagaralva7373No ratings yet

- Demat PDFDocument8 pagesDemat PDFparchure123No ratings yet

- Personal Account Opening Form 20240129Document15 pagesPersonal Account Opening Form 20240129Md Afsar SagorNo ratings yet

- Personal Account Opening Form: WNMV Ei BVG (Evsjvq)Document15 pagesPersonal Account Opening Form: WNMV Ei BVG (Evsjvq)muslimnswNo ratings yet

- NRI Form Ver5Document12 pagesNRI Form Ver5enterprisesshreemarutiNo ratings yet

- Zeta Kyc Form & Prepaid Terms of Use: Your DetailsDocument2 pagesZeta Kyc Form & Prepaid Terms of Use: Your DetailsSonam RaiNo ratings yet

- Page - 1Document8 pagesPage - 1Abhi ChandranNo ratings yet

- FATCA CRS Individual Declaration FormDocument2 pagesFATCA CRS Individual Declaration FormSrigandh's WealthNo ratings yet

- SB NreDocument7 pagesSB NreAsutosaNo ratings yet

- Jammu & Kashmir BankDocument1 pageJammu & Kashmir BankPay TekNo ratings yet

- ProgrammingDocument1 pageProgrammingsamreenimran1702No ratings yet

- Kotak Multi Currency World Travel Application FormDocument2 pagesKotak Multi Currency World Travel Application FormVivek ShuklaNo ratings yet

- CarProposal QVPN107614961Document6 pagesCarProposal QVPN107614961sajithmon785No ratings yet

- Signature CardDocument1 pageSignature CardAKASHNo ratings yet

- Account Opening Application Form Non-Resident Individuals: (Non Face To Face)Document10 pagesAccount Opening Application Form Non-Resident Individuals: (Non Face To Face)RISHIKESH KUMARNo ratings yet

- Application Form For Loan Under Pradhan Mantri Mudra Yojana (PMMY) (For Loan Upto Rs. 50,000/-Under Shishu)Document2 pagesApplication Form For Loan Under Pradhan Mantri Mudra Yojana (PMMY) (For Loan Upto Rs. 50,000/-Under Shishu)PradeepMathadNo ratings yet

- KYC - IndividualDocument1 pageKYC - IndividualBibin DhasNo ratings yet

- LIC121 - REAL ID and Standard CDL-ID Documentation Checklist - 0723 - 0Document2 pagesLIC121 - REAL ID and Standard CDL-ID Documentation Checklist - 0723 - 0rodriguezyamo777No ratings yet

- App For Registration Instructions Work Permit ID Form ALPCD 11 Rev 7 30 ...Document4 pagesApp For Registration Instructions Work Permit ID Form ALPCD 11 Rev 7 30 ...Retchh Ihsel De TorresNo ratings yet

- 2022 KYC - Business Client (09072022)Document1 page2022 KYC - Business Client (09072022)Rhea SebastianNo ratings yet

- MyTrade Form 2020Document6 pagesMyTrade Form 2020Mia ValdezNo ratings yet

- Section 1: INDIVIDUAL CLIENT (Please Complete The Relevant Fields in BLOCK Letters)Document4 pagesSection 1: INDIVIDUAL CLIENT (Please Complete The Relevant Fields in BLOCK Letters)xaver lawNo ratings yet

- LATESTNRI Scheme CIF Conversion Cum Upgrade-DowngradeLATESTDocument1 pageLATESTNRI Scheme CIF Conversion Cum Upgrade-DowngradeLATESTemailmetomymailNo ratings yet

- युनाइटेड बक ऑफ इंडया United Bank of India: United Demat Account Opening FormDocument12 pagesयुनाइटेड बक ऑफ इंडया United Bank of India: United Demat Account Opening Formjay meskaNo ratings yet

- DownloadDocument6 pagesDownloadAbdul Jaleel MohammedNo ratings yet

- Customer Due Diligence Form CDDDocument2 pagesCustomer Due Diligence Form CDDRavi AhujaNo ratings yet

- CRF-1 A (CPC)Document4 pagesCRF-1 A (CPC)SafwanNo ratings yet

- Data Correction FormDocument4 pagesData Correction Formsuanxun 93No ratings yet

- New Personal FormDocument2 pagesNew Personal Formcacious mwewaNo ratings yet

- KYC ResidentialDocument4 pagesKYC Residentialdocpt76No ratings yet

- LIC115 - ID Documentation Checklist-1222Document2 pagesLIC115 - ID Documentation Checklist-1222H G2TNo ratings yet

- PR22005 Car Shield - Private Car Package Policy Proposal Form - Set 1Document4 pagesPR22005 Car Shield - Private Car Package Policy Proposal Form - Set 1Rajiv SethNo ratings yet

- NZMIT No 2 Fund Investment Application FormDocument4 pagesNZMIT No 2 Fund Investment Application FormKing fairNo ratings yet

- NRI AcntDocument16 pagesNRI AcntShanmuka NalliNo ratings yet

- Customer Acknowledgment Form: Applicant InformationDocument2 pagesCustomer Acknowledgment Form: Applicant InformationKamlesh SonareNo ratings yet

- ACT - NET BillDocument2 pagesACT - NET Billsourav84No ratings yet

- BR - MGK PrintingDocument2 pagesBR - MGK Printingsourav84No ratings yet

- Statement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument19 pagesStatement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing Balancesourav84No ratings yet

- New Adhar Consent FormDocument1 pageNew Adhar Consent Formsourav84No ratings yet

- BR - MGK PrintingDocument2 pagesBR - MGK Printingsourav84No ratings yet

- BBA CHD (1) - CompressedDocument17 pagesBBA CHD (1) - Compressedsourav84No ratings yet

- Saurabh Kansal - Statement 01.11.20 To 08.02.21Document3 pagesSaurabh Kansal - Statement 01.11.20 To 08.02.21sourav84No ratings yet

- RavinderDocument50 pagesRavindersourav84No ratings yet

- Legal Heir DeclarationDocument1 pageLegal Heir Declarationsourav84No ratings yet

- Affidavit FormatDocument1 pageAffidavit Formatsourav84No ratings yet

- Loss of Prior ChainDocument1 pageLoss of Prior Chainsourav84No ratings yet

- Research Background - SampleDocument1 pageResearch Background - Samplesourav84No ratings yet

- 03C ITPL-Authority Letter - SP Appointment (Firm) INVESTMENT-MARTDocument2 pages03C ITPL-Authority Letter - SP Appointment (Firm) INVESTMENT-MARTsourav84No ratings yet

- Customer Relation Form IndividualDocument2 pagesCustomer Relation Form Individualsourav84No ratings yet

- Meerut Plot 12-Dec-2020 16-14-31Document21 pagesMeerut Plot 12-Dec-2020 16-14-31sourav84No ratings yet

- Standard Fire and Special Perils Insurance: ScheduleDocument13 pagesStandard Fire and Special Perils Insurance: Schedulesourav84No ratings yet

- PL 1Document22 pagesPL 1sourav84No ratings yet

- Customer Relation Form Non Individual 1Document2 pagesCustomer Relation Form Non Individual 1sourav84No ratings yet

- AmalgamationDocument46 pagesAmalgamationmayurkapse100% (1)

- What Is Adm LawDocument3 pagesWhat Is Adm LawMaria Linda GavinoNo ratings yet

- Petitioner Vs Vs Respondent: Second DivisionDocument7 pagesPetitioner Vs Vs Respondent: Second DivisionChingNo ratings yet

- Class Report22a HRDocument2 pagesClass Report22a HRramilflecoNo ratings yet

- MPT Money Merchant Agreement (Template)Document22 pagesMPT Money Merchant Agreement (Template)zayar ooNo ratings yet

- Landbank vs. CADocument2 pagesLandbank vs. CAMikkaEllaAnclaNo ratings yet

- Republic Vs Sereno GR No. 237428 May 11, 2018Document17 pagesRepublic Vs Sereno GR No. 237428 May 11, 2018Jacquelyn RamosNo ratings yet

- Philippine Judges Assn. v. Prado (227 SCRA 703)Document9 pagesPhilippine Judges Assn. v. Prado (227 SCRA 703)Jomarc MalicdemNo ratings yet

- 0 - 1601998074625 - Final Moot Memo.Document14 pages0 - 1601998074625 - Final Moot Memo.Littz MandumpalaNo ratings yet

- Last Seen TogetherDocument9 pagesLast Seen TogetherKumar NaveenNo ratings yet

- Confidential Non-Disclosure AgreementDocument1 pageConfidential Non-Disclosure AgreementTammie WalkerNo ratings yet

- Clog On RedemptionDocument1 pageClog On RedemptionZeesahn100% (1)

- OFFICE OF THE CITY MAYOR OF PARA+æAQUE CITY Et. Al V MARIO D. EBIO, G.R. No. 178411, 621 SCRA 555Document7 pagesOFFICE OF THE CITY MAYOR OF PARA+æAQUE CITY Et. Al V MARIO D. EBIO, G.R. No. 178411, 621 SCRA 555karl_baqNo ratings yet

- Relinquishment DeedDocument4 pagesRelinquishment DeedSudesh GoyalNo ratings yet

- Unit-Ii The Indian Partnership Act, 1932Document42 pagesUnit-Ii The Indian Partnership Act, 1932trustme77No ratings yet

- ID Act Simplified by ChawDocument25 pagesID Act Simplified by ChawSaurabhChoudharyNo ratings yet

- PAPER 3 Revised PDFDocument37 pagesPAPER 3 Revised PDFDeepa BhatiaNo ratings yet

- Understanding The Rizal Law-1Document3 pagesUnderstanding The Rizal Law-1JL WoofNo ratings yet

- Selected Bar Q&a On WillsDocument5 pagesSelected Bar Q&a On WillsMarie Antoinette PascuaNo ratings yet

- Evidence Cases 2Document198 pagesEvidence Cases 2Chris ZialcitaNo ratings yet

- SeniorityDocument37 pagesSenioritySonali AroraNo ratings yet

- G.R. No. 881 August 30, 1902 THE UNITED STATES, Complainant-Appellee, vs. PEDRO ALVAREZ, Defendant-AppellantDocument3 pagesG.R. No. 881 August 30, 1902 THE UNITED STATES, Complainant-Appellee, vs. PEDRO ALVAREZ, Defendant-AppellantRache BaodNo ratings yet

- Adjudicative Support Functions of A COCDocument31 pagesAdjudicative Support Functions of A COCNadine Diamante100% (1)

- Gayler v. WilderDocument3 pagesGayler v. WilderPamela TungNo ratings yet

- Corporate Directors Training Programme Fundamental: The Dynamics of A CompanyDocument42 pagesCorporate Directors Training Programme Fundamental: The Dynamics of A CompanyBushral YusobNo ratings yet

- Torts OutlineDocument40 pagesTorts OutlineBrian PalmerNo ratings yet

- PFR Case NotebookDocument362 pagesPFR Case NotebookjmarkgamonnacNo ratings yet

- United States v. Nevcherlian, 1st Cir. (1994)Document35 pagesUnited States v. Nevcherlian, 1st Cir. (1994)Scribd Government DocsNo ratings yet

- Consti 2 3rd SetDocument27 pagesConsti 2 3rd SetNMNGNo ratings yet