Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

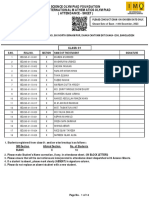

12 viewsQ1) Assess The Differences and The Similarities in Characteristics, Pricing and Output Between Perfect Competition and Monopolistic Competition.

Q1) Assess The Differences and The Similarities in Characteristics, Pricing and Output Between Perfect Competition and Monopolistic Competition.

Uploaded by

Sumble NaeemCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You might also like

- The Danger of A Single Story WorksheetDocument1 pageThe Danger of A Single Story WorksheetSaraA.Delgado100% (2)

- Assignment - Market StructureDocument5 pagesAssignment - Market Structurerhizelle19No ratings yet

- A Report On MonopolyDocument15 pagesA Report On MonopolyMahmudur RahmanNo ratings yet

- A level Economics Revision: Cheeky Revision ShortcutsFrom EverandA level Economics Revision: Cheeky Revision ShortcutsRating: 3 out of 5 stars3/5 (1)

- Bitfinex Preview BFX Conversion PitchDocument25 pagesBitfinex Preview BFX Conversion PitchAnonymous wRn8eDNo ratings yet

- marketstructureandpricingpractices-130119101444-phpapp01Document37 pagesmarketstructureandpricingpractices-130119101444-phpapp01AbhiNo ratings yet

- PSR 07Document24 pagesPSR 07Nirmal mehtaNo ratings yet

- Group4 BSA 1A Monopolistic Competition Research ActivityDocument11 pagesGroup4 BSA 1A Monopolistic Competition Research ActivityRoisu De KuriNo ratings yet

- Diagram of MonopolyDocument3 pagesDiagram of MonopolysanaakramtufailNo ratings yet

- Introduction To Market: - Akshay UmbarkarDocument22 pagesIntroduction To Market: - Akshay Umbarkarraghu charkhaNo ratings yet

- Price and Output Under A Pure MonopolyDocument5 pagesPrice and Output Under A Pure MonopolysumayyabanuNo ratings yet

- Market StructureDocument20 pagesMarket StructureSunny RajpalNo ratings yet

- Monopoly & Imperfect CompetitionDocument22 pagesMonopoly & Imperfect CompetitionLovely Salazar100% (1)

- Perfect Competition Describes Markets Such That No Participants Are Large Enough To HauctDocument17 pagesPerfect Competition Describes Markets Such That No Participants Are Large Enough To HauctRrisingg MishraaNo ratings yet

- 2 Nds em EconomicsDocument142 pages2 Nds em EconomicsMohsinNo ratings yet

- Monopolistic Competition, Oligopoly, and Pure MonopolyDocument5 pagesMonopolistic Competition, Oligopoly, and Pure MonopolyImran SiddNo ratings yet

- Resume of Principles of Economics: Firms in Competitive Market (Chapter 14)Document4 pagesResume of Principles of Economics: Firms in Competitive Market (Chapter 14)Wanda AuliaNo ratings yet

- Price and Output Determination Under Different Market StructuresDocument19 pagesPrice and Output Determination Under Different Market StructuresAnkush Bhoria43% (7)

- Advantages of Monopolies: The Monopoly MarketDocument7 pagesAdvantages of Monopolies: The Monopoly MarketJo MalaluanNo ratings yet

- A2 - Model Answer 2Document7 pagesA2 - Model Answer 2Damion BrusselNo ratings yet

- Mefa Unit 3Document33 pagesMefa Unit 3prasanna anjaneyulu tanneruNo ratings yet

- Market Structures by Dedicatoria, Intino, VillaramaDocument14 pagesMarket Structures by Dedicatoria, Intino, VillaramaAlpha CapacitorNo ratings yet

- Chap V Competitive Market StructureDocument31 pagesChap V Competitive Market StructureKidikuki KukiesNo ratings yet

- Monopoly MergedDocument58 pagesMonopoly Mergedsaundarya.m2003No ratings yet

- MonopolyDocument23 pagesMonopolyraviNo ratings yet

- Unit 3 MonopolyDocument12 pagesUnit 3 MonopolyJagdish BhattNo ratings yet

- Market StrucureDocument43 pagesMarket StrucureGEORGENo ratings yet

- Market Structure & Pricing DecisionsDocument6 pagesMarket Structure & Pricing DecisionsDivyang BhattNo ratings yet

- Market Structure and Pricing PracticesDocument14 pagesMarket Structure and Pricing Practicesdurgesh7998No ratings yet

- Chapter 8Document29 pagesChapter 8RheaNo ratings yet

- Market Analysis in Modern BusinessDocument30 pagesMarket Analysis in Modern BusinessDip Kumar DeyNo ratings yet

- Is It Inevitable That The Monopoly Prices Are Higher Than The Competitive PriceDocument17 pagesIs It Inevitable That The Monopoly Prices Are Higher Than The Competitive PriceMuhammad AbdullahNo ratings yet

- Market Structures unit 4Document12 pagesMarket Structures unit 4dshivansh195No ratings yet

- Chap 8 - Managing in Competitive, Monopolistic, and Monopolistically Competitive MarketsDocument48 pagesChap 8 - Managing in Competitive, Monopolistic, and Monopolistically Competitive MarketsjeankerlensNo ratings yet

- (Me) Types of CompetitionsDocument28 pages(Me) Types of CompetitionsAbhkn krishnaNo ratings yet

- Section 01: Market Structures Market Structure CharacteristicsDocument31 pagesSection 01: Market Structures Market Structure CharacteristicsRajshree DewooNo ratings yet

- ECO XII - Topic X (FORMS OF MARKET)Document17 pagesECO XII - Topic X (FORMS OF MARKET)Tanisha PoddarNo ratings yet

- Econ ReviewerDocument2 pagesEcon ReviewerIriz BelenoNo ratings yet

- Market Structures EditedDocument11 pagesMarket Structures EditedJalmone Jade FisherNo ratings yet

- Market Structures: BarriersDocument4 pagesMarket Structures: BarriersAdelwina AsuncionNo ratings yet

- E. Break-Even PointDocument2 pagesE. Break-Even PointMarfe BlancoNo ratings yet

- Final Exam (Answer) : ECO1132 (Fall-2020)Document13 pagesFinal Exam (Answer) : ECO1132 (Fall-2020)Nahid Mahmud ZayedNo ratings yet

- Perfect and Imperfect CompetitionDocument7 pagesPerfect and Imperfect CompetitionShirish GutheNo ratings yet

- Zishan Eco AssignmentDocument5 pagesZishan Eco AssignmentAnas AliNo ratings yet

- Market Structures: Structures, All Dependent Upon The Extent To Which Buyers and SellingDocument10 pagesMarket Structures: Structures, All Dependent Upon The Extent To Which Buyers and SellingMekbib MulugetaNo ratings yet

- Monopolistic Comeptition: M. Shivarama Krishna 10HM28Document19 pagesMonopolistic Comeptition: M. Shivarama Krishna 10HM28Powli HarshavardhanNo ratings yet

- Monopoly and Imperfect CompetitionDocument29 pagesMonopoly and Imperfect Competitionaminajubril8No ratings yet

- Robinson and Imperfect CompetitionDocument5 pagesRobinson and Imperfect CompetitionNingning 3No ratings yet

- Wk10 11 - Basic MicroeconomicsDocument10 pagesWk10 11 - Basic MicroeconomicsWhats PoppinNo ratings yet

- Chapter 7 Firm Competition Market StructureDocument10 pagesChapter 7 Firm Competition Market StructureMaria Teresa VillamayorNo ratings yet

- Litrature - Perfect CompetitionDocument4 pagesLitrature - Perfect CompetitionFaris HanisNo ratings yet

- Managerial EconDocument5 pagesManagerial EconJulienne CaitNo ratings yet

- MARKET STRUCTURE - 4th UnitDocument22 pagesMARKET STRUCTURE - 4th UnitDr VIRUPAKSHA GOUD GNo ratings yet

- Economics AssigmentDocument5 pagesEconomics AssigmentAditya JoshiNo ratings yet

- Presetation On Perfectly Competittive Market Vs Monopoly: Rafi Ahmed (11100100030)Document16 pagesPresetation On Perfectly Competittive Market Vs Monopoly: Rafi Ahmed (11100100030)Rafi AhmêdNo ratings yet

- Econ Notes 5Document12 pagesEcon Notes 5Engineers UniqueNo ratings yet

- Mefa Unit-3Document20 pagesMefa Unit-3rosieNo ratings yet

- Competition, Profit and Other Objectives: What Does Normal Profit Mean?Document7 pagesCompetition, Profit and Other Objectives: What Does Normal Profit Mean?Ming Pong NgNo ratings yet

- Mastering the 15 Laws of Business and Life: Navigating Success through Timeless PrinciplesFrom EverandMastering the 15 Laws of Business and Life: Navigating Success through Timeless PrinciplesNo ratings yet

- Summary of Austin Frakt & Mike Piper's Microeconomics Made SimpleFrom EverandSummary of Austin Frakt & Mike Piper's Microeconomics Made SimpleNo ratings yet

- The Market Makers (Review and Analysis of Spluber's Book)From EverandThe Market Makers (Review and Analysis of Spluber's Book)No ratings yet

- FOSS V Harbottle Case StudyDocument6 pagesFOSS V Harbottle Case StudyAbhay Singh SengarNo ratings yet

- GAZ12 - Golden Khan of EthengarDocument118 pagesGAZ12 - Golden Khan of EthengarPascal Leroy100% (3)

- Latest RFQ (Hospet Bellary Karntaka Dated - 29102010Document69 pagesLatest RFQ (Hospet Bellary Karntaka Dated - 29102010xanblakeNo ratings yet

- CPP Proc Ug 38 0804Document165 pagesCPP Proc Ug 38 0804janeNo ratings yet

- Political Law QuestionsDocument4 pagesPolitical Law QuestionsImranAbubakarPangilinanNo ratings yet

- Tausug (Any)Document15 pagesTausug (Any)Fharhan Dacula100% (2)

- IBD295Document14 pagesIBD295olympiadpreparation.2024No ratings yet

- Đảo Ngữ (Inversions) : * Phần Ii: Bài Tập Vận DụngDocument8 pagesĐảo Ngữ (Inversions) : * Phần Ii: Bài Tập Vận DụngĐỗ Thùy TrangNo ratings yet

- Magic and SpellsDocument4 pagesMagic and SpellsAshref MohamedNo ratings yet

- Derivative Securities: FINA 3204Document27 pagesDerivative Securities: FINA 3204BillyNo ratings yet

- 2019 Sec 4 English SA1 Compassvale Secondary AnswerDocument18 pages2019 Sec 4 English SA1 Compassvale Secondary AnswerGilbert ChiaNo ratings yet

- 4 Cemerlang Unit Beruniform 2016Document2 pages4 Cemerlang Unit Beruniform 2016matangpakuNo ratings yet

- Republic Act No 11573Document6 pagesRepublic Act No 11573Ced Jabez David Enoc100% (1)

- QS World University Rankings 2020 - Las Mejores Universidades Mundiales - Universidades PrincipalesDocument36 pagesQS World University Rankings 2020 - Las Mejores Universidades Mundiales - Universidades PrincipalesSamael AstarothNo ratings yet

- "Financial Model of Mughal Iron & Steel Limited": Institute of Business ManagementDocument7 pages"Financial Model of Mughal Iron & Steel Limited": Institute of Business ManagementMUSADDIQ MAROOF TALIBNo ratings yet

- Syed Rehman Vs Umer Zad BegumDocument6 pagesSyed Rehman Vs Umer Zad BegumSHUMAILA ZUBAIRNo ratings yet

- Intestate Estate of Vda de Carungcong V People Centeno Vs Villalon PornillosDocument4 pagesIntestate Estate of Vda de Carungcong V People Centeno Vs Villalon PornillosMichael A. BerturanNo ratings yet

- Perception of SHS Students On School Policies at MNHSDocument13 pagesPerception of SHS Students On School Policies at MNHSJakimar Diamanse100% (1)

- Dwi Herinanto-Semnas DJ 2021 Old 2Document9 pagesDwi Herinanto-Semnas DJ 2021 Old 2Bernadhita HerindriNo ratings yet

- Alternative DevelopmentDocument28 pagesAlternative DevelopmentOmar100% (1)

- Grapphite IndiaDocument16 pagesGrapphite IndiaShubham KumarNo ratings yet

- PG DTL Gst1-Paper 3-MCQ - FinalDocument10 pagesPG DTL Gst1-Paper 3-MCQ - FinalNilkanth KarlekarNo ratings yet

- Tucker TownhomesDocument96 pagesTucker TownhomesZachary HansenNo ratings yet

- Fs2011 FullDocument242 pagesFs2011 FullryankckoNo ratings yet

- Module 1 - Lecture 2Document6 pagesModule 1 - Lecture 2jbb_sitNo ratings yet

- Test IslamiatDocument3 pagesTest IslamiatWaqas AliNo ratings yet

- Sas7 Death and MeaningDocument4 pagesSas7 Death and MeaningRj ArenasNo ratings yet

- Castillo v. CruzDocument2 pagesCastillo v. CruzLuna BaciNo ratings yet

Q1) Assess The Differences and The Similarities in Characteristics, Pricing and Output Between Perfect Competition and Monopolistic Competition.

Q1) Assess The Differences and The Similarities in Characteristics, Pricing and Output Between Perfect Competition and Monopolistic Competition.

Uploaded by

Sumble Naeem0 ratings0% found this document useful (0 votes)

12 views6 pagesOriginal Title

Q1.docx

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

12 views6 pagesQ1) Assess The Differences and The Similarities in Characteristics, Pricing and Output Between Perfect Competition and Monopolistic Competition.

Q1) Assess The Differences and The Similarities in Characteristics, Pricing and Output Between Perfect Competition and Monopolistic Competition.

Uploaded by

Sumble NaeemCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 6

Q1) Assess the differences and the similarities in characteristics, pricing and

output between perfect competition and monopolistic competition. [12]

Perfect competition is a market structure in which there are numerous

sellers in the market, selling similar goods that are produced/manufactured

using a standard method and each firm has all information regarding the

market and price, which is known as a perfectly competitive market.

Monopolistic competition is a type of imperfect market structure. In a

monopolistic competition structure, a number of sellers sell similar products

but not identical products. Products or services offered by sellers are

substitutes of each other with certain differences. A market can be

described as a place where buyers and sellers meet, directly or through a

dealer for transactions in a competitive market the number of buyers and

sellers are large. The price is determined by the industry keeping in view

the aggregate demand and aggregate supply. The firms are price taker and

output adjuster. Under Monopoly there is no difference between firm and

industry. Firm itself is an industry. The firm determines the price and output.

In perfect competition Price = MC; in monopoly P > MC. Under perfect

competition the individual firm’s output is a small part of the total output.

Variation of its output has no effect on prices and therefore marginal

revenue is equal to price. But the Monopolist competition is by definition the

sole producer. Therefore, if he wants to sell more he must reduce the price.

Hence, under Monopoly the marginal revenue is less than price. The

supply curve of a firm under perfect competition is perfectly elastic. The

individual firm under perfect competition has an insignificant part of the

industry and variation of its output does not affect prices. Therefore, he can

sell as much or as little of his output as he chooses at the current price The

average revenue curve of the individual firm under perfect competition is

therefore a straight line parallel to the X-axis. But the monopolist is the

sole-producer. Therefore, variation of his output will cause variation in

prices. The average revenue curve of the monopolist is a downwards

sloping curve. Under Perfect Competition, price equals marginal cost, while

under Monopoly price exceeds marginal cost. There is an exception to the

rule that Monopoly price is higher than competitive price. There may be a

commodity with a very steeply decreasing cost curve and a highly elastic

demand. In such a case, Monopolist will make maximum gain by selling it

at a price which is lower than what the price would be under competition.

This is however, a highly improbable situation. The Monopoly output may

be higher than the competitive output in the case of a commodity having a

steeply decreasing cost curve and a highly elastic demand The monopolist

restricts output, increases price to maximize his profits and hold price

above the marginal cost and marginal revenue. Whereas the perfect

competition leads to maximum allocation of resources and produces more

than Monopoly. Under Perfect Competition, the firm in the long-run makes

normal profit. Under Monopoly, the firm gets super-natural profits. From the

facts stated above we can say that Monopoly leads to an inefficient

allocation of resources from the economy point of view.The monopolist

restricts output, increases price to maximize his profits and hold price

above the marginal cost and marginal revenue. Whereas the perfect

competition leads to maximum allocation of resources and produces more

than Monopoly. However In both the market situations, firms can earn

super normal profits or incur losses in the short period. But in the long

period, firms earn only normal profit. In both, the equilibrium is established

at the point of equality of marginal cost and marginal revenue.

Q2) Consider whether it is true that prices are always higher and output always

lower under monopoly conditions than they are under perfectly competitive

conditions. [13]

Market conduct and performance in atomistic industries provide standards

against which to measure behavior in other types of industry. The atomistic

category includes both perfect competition and monopolistic competition. In

perfect competition, a large number of small sellers supply a homogeneous

product to a common buying market. In this situation no individual seller

can perceptibly influence the market price at which he sells but must accept

a market price that is impersonally determined by the total supply of the

product offered by all sellers and the total demand for the product of all

buyers. The large number of sellers precludes the possibility of a common

agreement among them, and each must therefore act independently. At

any going market price, each seller tends to adjust his output to match the

quantity that will yield him the largest aggregate profit, assuming that the

market price will not change as a result. But the collective effect of such

adjustments by all sellers will cause the total supply in the market to

change significantly, so that the market price falls or rises the process will

go on until a market price is reached at which the total output that sellers

wish to produce is equal to the total output that all buyers wish to purchase

A market can be structured differently depending on the characteristics of

competition within that market. At one extreme is perfect competition. In a

perfectly competitive market, there are many producers and consumers, no

barriers to enter and exit the market, perfectly homogeneous goods, perfect

information, and well-defined property rights. This produces a system in

which no individual economic actor can affect the price of a good – in other

words, producers are price takers that can choose how much to produce,

but not the price at which they can sell their output. In reality there are few

industries that are truly perfectly competitive, but some come very close.

For example, commodity markets (such as coal or copper) typically have

many buyers and multiple sellers. There are few differences in quality

between providers so goods can be easily substituted, and the goods are

simple enough that both buyers and sellers have full information about the

transaction. It is unlikely that a copper producer could raise their prices

above the market rate and still find a buyer for their product, so sellers are

price takers. A monopoly, on the other hand, exists when there is only one

producer and many consumers. Monopolies are characterized by a lack of

economic competition to produce the good or service and a lack of viable

substitute goods. As a result, the single producer has control over the price

of a good – in other words, the producer is a price maker that can

determine the price level by deciding what quantity of a good to produce.

Public utility companies tend to be monopolies. In the case of electricity

distribution, for example, the cost to put up power lines is so high it is

inefficient to have more than one provider. There are no good substitutes

for electricity delivery so consumers have few options. If the electricity

distributor decided to raise their prices it is likely that most consumers

would continue to purchase electricity, so the seller is a price maker. In

traditional economics, the goal of a firm is to maximize their profits. This

means they want to maximize the difference between their earnings, i.e.

revenue, and their spending, i.e. costs. To find the profit maximizing point,

firms look at marginal revenue (MR) – the total additional revenue from

selling one additional unit of output – and the marginal cost (MC) – the total

additional cost of producing one additional unit of output. When the

marginal revenue of selling a good is greater than the marginal cost of

producing it, firms are making a profit on that product. This leads directly

into the marginal decision rule, which dictates that a given good should

continue to be produced if the marginal revenue of one unit is greater than

its marginal cost. Therefore, the maximizing solution involves setting

marginal revenue equal to marginal cost. This is relatively straightforward

for firms in perfectly competitive markets, in which marginal revenue is the

same as price. Monopoly production, however, is complicated by the fact

that monopolies have demand curves and MR curves that are distinct,

causing price to differ from marginal revenue.

Monopoly and perfect competition mark the two extremes of market

structures, but there are some similarities between firms in a perfectly

competitive market and monopoly firms. Both face the same cost and

production functions, and both seek to maximize profit. The shutdown

decisions are the same, and both are assumed to have perfectly

competitive factors markets. However, there are several key distinctions. In

a perfectly competitive market, price equals marginal cost and firms earn

an economic profit of zero. In a monopoly, the price is set above marginal

cost and the firm earns a positive economic profit. Perfect competition

produces an equilibrium in which the price and quantity of a good is

economically efficient. Monopolies produce an equilibrium at which the

price of a good is higher, and the quantity lower, than is economically

efficient. For this reason, governments often seek to regulate monopolies

and encourage increased competition. Monopolies can influence a good’s

price by changing output levels, which allows them to make an economic

profit. Monopolies, unlike perfectly competitive firms, are able to influence

the price of a good and are able to make a positive economic profit. While a

perfectly competitive firm faces a single market price, represented by a

horizontal demand/marginal revenue curve, a monopoly has the market all

to itself and faces the downward-sloping market demand curve. An

important consequence is worth noticing: typically a monopoly selects a

higher price and lesser quantity of output than a price-taking company

You might also like

- The Danger of A Single Story WorksheetDocument1 pageThe Danger of A Single Story WorksheetSaraA.Delgado100% (2)

- Assignment - Market StructureDocument5 pagesAssignment - Market Structurerhizelle19No ratings yet

- A Report On MonopolyDocument15 pagesA Report On MonopolyMahmudur RahmanNo ratings yet

- A level Economics Revision: Cheeky Revision ShortcutsFrom EverandA level Economics Revision: Cheeky Revision ShortcutsRating: 3 out of 5 stars3/5 (1)

- Bitfinex Preview BFX Conversion PitchDocument25 pagesBitfinex Preview BFX Conversion PitchAnonymous wRn8eDNo ratings yet

- marketstructureandpricingpractices-130119101444-phpapp01Document37 pagesmarketstructureandpricingpractices-130119101444-phpapp01AbhiNo ratings yet

- PSR 07Document24 pagesPSR 07Nirmal mehtaNo ratings yet

- Group4 BSA 1A Monopolistic Competition Research ActivityDocument11 pagesGroup4 BSA 1A Monopolistic Competition Research ActivityRoisu De KuriNo ratings yet

- Diagram of MonopolyDocument3 pagesDiagram of MonopolysanaakramtufailNo ratings yet

- Introduction To Market: - Akshay UmbarkarDocument22 pagesIntroduction To Market: - Akshay Umbarkarraghu charkhaNo ratings yet

- Price and Output Under A Pure MonopolyDocument5 pagesPrice and Output Under A Pure MonopolysumayyabanuNo ratings yet

- Market StructureDocument20 pagesMarket StructureSunny RajpalNo ratings yet

- Monopoly & Imperfect CompetitionDocument22 pagesMonopoly & Imperfect CompetitionLovely Salazar100% (1)

- Perfect Competition Describes Markets Such That No Participants Are Large Enough To HauctDocument17 pagesPerfect Competition Describes Markets Such That No Participants Are Large Enough To HauctRrisingg MishraaNo ratings yet

- 2 Nds em EconomicsDocument142 pages2 Nds em EconomicsMohsinNo ratings yet

- Monopolistic Competition, Oligopoly, and Pure MonopolyDocument5 pagesMonopolistic Competition, Oligopoly, and Pure MonopolyImran SiddNo ratings yet

- Resume of Principles of Economics: Firms in Competitive Market (Chapter 14)Document4 pagesResume of Principles of Economics: Firms in Competitive Market (Chapter 14)Wanda AuliaNo ratings yet

- Price and Output Determination Under Different Market StructuresDocument19 pagesPrice and Output Determination Under Different Market StructuresAnkush Bhoria43% (7)

- Advantages of Monopolies: The Monopoly MarketDocument7 pagesAdvantages of Monopolies: The Monopoly MarketJo MalaluanNo ratings yet

- A2 - Model Answer 2Document7 pagesA2 - Model Answer 2Damion BrusselNo ratings yet

- Mefa Unit 3Document33 pagesMefa Unit 3prasanna anjaneyulu tanneruNo ratings yet

- Market Structures by Dedicatoria, Intino, VillaramaDocument14 pagesMarket Structures by Dedicatoria, Intino, VillaramaAlpha CapacitorNo ratings yet

- Chap V Competitive Market StructureDocument31 pagesChap V Competitive Market StructureKidikuki KukiesNo ratings yet

- Monopoly MergedDocument58 pagesMonopoly Mergedsaundarya.m2003No ratings yet

- MonopolyDocument23 pagesMonopolyraviNo ratings yet

- Unit 3 MonopolyDocument12 pagesUnit 3 MonopolyJagdish BhattNo ratings yet

- Market StrucureDocument43 pagesMarket StrucureGEORGENo ratings yet

- Market Structure & Pricing DecisionsDocument6 pagesMarket Structure & Pricing DecisionsDivyang BhattNo ratings yet

- Market Structure and Pricing PracticesDocument14 pagesMarket Structure and Pricing Practicesdurgesh7998No ratings yet

- Chapter 8Document29 pagesChapter 8RheaNo ratings yet

- Market Analysis in Modern BusinessDocument30 pagesMarket Analysis in Modern BusinessDip Kumar DeyNo ratings yet

- Is It Inevitable That The Monopoly Prices Are Higher Than The Competitive PriceDocument17 pagesIs It Inevitable That The Monopoly Prices Are Higher Than The Competitive PriceMuhammad AbdullahNo ratings yet

- Market Structures unit 4Document12 pagesMarket Structures unit 4dshivansh195No ratings yet

- Chap 8 - Managing in Competitive, Monopolistic, and Monopolistically Competitive MarketsDocument48 pagesChap 8 - Managing in Competitive, Monopolistic, and Monopolistically Competitive MarketsjeankerlensNo ratings yet

- (Me) Types of CompetitionsDocument28 pages(Me) Types of CompetitionsAbhkn krishnaNo ratings yet

- Section 01: Market Structures Market Structure CharacteristicsDocument31 pagesSection 01: Market Structures Market Structure CharacteristicsRajshree DewooNo ratings yet

- ECO XII - Topic X (FORMS OF MARKET)Document17 pagesECO XII - Topic X (FORMS OF MARKET)Tanisha PoddarNo ratings yet

- Econ ReviewerDocument2 pagesEcon ReviewerIriz BelenoNo ratings yet

- Market Structures EditedDocument11 pagesMarket Structures EditedJalmone Jade FisherNo ratings yet

- Market Structures: BarriersDocument4 pagesMarket Structures: BarriersAdelwina AsuncionNo ratings yet

- E. Break-Even PointDocument2 pagesE. Break-Even PointMarfe BlancoNo ratings yet

- Final Exam (Answer) : ECO1132 (Fall-2020)Document13 pagesFinal Exam (Answer) : ECO1132 (Fall-2020)Nahid Mahmud ZayedNo ratings yet

- Perfect and Imperfect CompetitionDocument7 pagesPerfect and Imperfect CompetitionShirish GutheNo ratings yet

- Zishan Eco AssignmentDocument5 pagesZishan Eco AssignmentAnas AliNo ratings yet

- Market Structures: Structures, All Dependent Upon The Extent To Which Buyers and SellingDocument10 pagesMarket Structures: Structures, All Dependent Upon The Extent To Which Buyers and SellingMekbib MulugetaNo ratings yet

- Monopolistic Comeptition: M. Shivarama Krishna 10HM28Document19 pagesMonopolistic Comeptition: M. Shivarama Krishna 10HM28Powli HarshavardhanNo ratings yet

- Monopoly and Imperfect CompetitionDocument29 pagesMonopoly and Imperfect Competitionaminajubril8No ratings yet

- Robinson and Imperfect CompetitionDocument5 pagesRobinson and Imperfect CompetitionNingning 3No ratings yet

- Wk10 11 - Basic MicroeconomicsDocument10 pagesWk10 11 - Basic MicroeconomicsWhats PoppinNo ratings yet

- Chapter 7 Firm Competition Market StructureDocument10 pagesChapter 7 Firm Competition Market StructureMaria Teresa VillamayorNo ratings yet

- Litrature - Perfect CompetitionDocument4 pagesLitrature - Perfect CompetitionFaris HanisNo ratings yet

- Managerial EconDocument5 pagesManagerial EconJulienne CaitNo ratings yet

- MARKET STRUCTURE - 4th UnitDocument22 pagesMARKET STRUCTURE - 4th UnitDr VIRUPAKSHA GOUD GNo ratings yet

- Economics AssigmentDocument5 pagesEconomics AssigmentAditya JoshiNo ratings yet

- Presetation On Perfectly Competittive Market Vs Monopoly: Rafi Ahmed (11100100030)Document16 pagesPresetation On Perfectly Competittive Market Vs Monopoly: Rafi Ahmed (11100100030)Rafi AhmêdNo ratings yet

- Econ Notes 5Document12 pagesEcon Notes 5Engineers UniqueNo ratings yet

- Mefa Unit-3Document20 pagesMefa Unit-3rosieNo ratings yet

- Competition, Profit and Other Objectives: What Does Normal Profit Mean?Document7 pagesCompetition, Profit and Other Objectives: What Does Normal Profit Mean?Ming Pong NgNo ratings yet

- Mastering the 15 Laws of Business and Life: Navigating Success through Timeless PrinciplesFrom EverandMastering the 15 Laws of Business and Life: Navigating Success through Timeless PrinciplesNo ratings yet

- Summary of Austin Frakt & Mike Piper's Microeconomics Made SimpleFrom EverandSummary of Austin Frakt & Mike Piper's Microeconomics Made SimpleNo ratings yet

- The Market Makers (Review and Analysis of Spluber's Book)From EverandThe Market Makers (Review and Analysis of Spluber's Book)No ratings yet

- FOSS V Harbottle Case StudyDocument6 pagesFOSS V Harbottle Case StudyAbhay Singh SengarNo ratings yet

- GAZ12 - Golden Khan of EthengarDocument118 pagesGAZ12 - Golden Khan of EthengarPascal Leroy100% (3)

- Latest RFQ (Hospet Bellary Karntaka Dated - 29102010Document69 pagesLatest RFQ (Hospet Bellary Karntaka Dated - 29102010xanblakeNo ratings yet

- CPP Proc Ug 38 0804Document165 pagesCPP Proc Ug 38 0804janeNo ratings yet

- Political Law QuestionsDocument4 pagesPolitical Law QuestionsImranAbubakarPangilinanNo ratings yet

- Tausug (Any)Document15 pagesTausug (Any)Fharhan Dacula100% (2)

- IBD295Document14 pagesIBD295olympiadpreparation.2024No ratings yet

- Đảo Ngữ (Inversions) : * Phần Ii: Bài Tập Vận DụngDocument8 pagesĐảo Ngữ (Inversions) : * Phần Ii: Bài Tập Vận DụngĐỗ Thùy TrangNo ratings yet

- Magic and SpellsDocument4 pagesMagic and SpellsAshref MohamedNo ratings yet

- Derivative Securities: FINA 3204Document27 pagesDerivative Securities: FINA 3204BillyNo ratings yet

- 2019 Sec 4 English SA1 Compassvale Secondary AnswerDocument18 pages2019 Sec 4 English SA1 Compassvale Secondary AnswerGilbert ChiaNo ratings yet

- 4 Cemerlang Unit Beruniform 2016Document2 pages4 Cemerlang Unit Beruniform 2016matangpakuNo ratings yet

- Republic Act No 11573Document6 pagesRepublic Act No 11573Ced Jabez David Enoc100% (1)

- QS World University Rankings 2020 - Las Mejores Universidades Mundiales - Universidades PrincipalesDocument36 pagesQS World University Rankings 2020 - Las Mejores Universidades Mundiales - Universidades PrincipalesSamael AstarothNo ratings yet

- "Financial Model of Mughal Iron & Steel Limited": Institute of Business ManagementDocument7 pages"Financial Model of Mughal Iron & Steel Limited": Institute of Business ManagementMUSADDIQ MAROOF TALIBNo ratings yet

- Syed Rehman Vs Umer Zad BegumDocument6 pagesSyed Rehman Vs Umer Zad BegumSHUMAILA ZUBAIRNo ratings yet

- Intestate Estate of Vda de Carungcong V People Centeno Vs Villalon PornillosDocument4 pagesIntestate Estate of Vda de Carungcong V People Centeno Vs Villalon PornillosMichael A. BerturanNo ratings yet

- Perception of SHS Students On School Policies at MNHSDocument13 pagesPerception of SHS Students On School Policies at MNHSJakimar Diamanse100% (1)

- Dwi Herinanto-Semnas DJ 2021 Old 2Document9 pagesDwi Herinanto-Semnas DJ 2021 Old 2Bernadhita HerindriNo ratings yet

- Alternative DevelopmentDocument28 pagesAlternative DevelopmentOmar100% (1)

- Grapphite IndiaDocument16 pagesGrapphite IndiaShubham KumarNo ratings yet

- PG DTL Gst1-Paper 3-MCQ - FinalDocument10 pagesPG DTL Gst1-Paper 3-MCQ - FinalNilkanth KarlekarNo ratings yet

- Tucker TownhomesDocument96 pagesTucker TownhomesZachary HansenNo ratings yet

- Fs2011 FullDocument242 pagesFs2011 FullryankckoNo ratings yet

- Module 1 - Lecture 2Document6 pagesModule 1 - Lecture 2jbb_sitNo ratings yet

- Test IslamiatDocument3 pagesTest IslamiatWaqas AliNo ratings yet

- Sas7 Death and MeaningDocument4 pagesSas7 Death and MeaningRj ArenasNo ratings yet

- Castillo v. CruzDocument2 pagesCastillo v. CruzLuna BaciNo ratings yet