Professional Documents

Culture Documents

JBM Auto (Q2FY21 Result Update)

JBM Auto (Q2FY21 Result Update)

Uploaded by

krippuOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

JBM Auto (Q2FY21 Result Update)

JBM Auto (Q2FY21 Result Update)

Uploaded by

krippuCopyright:

Available Formats

JBM Auto

Buy

On the path of all around growth... CMP Rs 241

JBM Auto (JBMA) reported decent set of performance in 2QFY21. Target / Upside Rs 380 / 57%

Net revenue grew by 7% YoY to Rs 5.17bn led by growth in the NIFTY 12,874

Bus division (+221% YoY) to Rs. 1.2bn on low base and tooling Scrip Details

division (+15% YoY) to Rs. 803mn partially offset by de-growth in

Equity / FV Rs 237mn / Rs 5

component division (-16% YoY) to Rs. 3.16bn.

Market Cap Rs 11bn

Bus division EBIT margin saw sharp up move by 515bps YoY to 7%

led by ramp up in volume, while EBIT margin for Tooling division USD 153mn

contracted by 636bps YoY to 25% and for component division 52-week High/Low Rs 296/ 95

dropped by 57bps YoY to 5%. Avg. Volume (no) 59,090

We expect the bus division continue to deliver strong Bloom Code JBMA IN

performance in coming year on the back of strong order book of Price Performance 1M 3M 12M

600 buses (including 350 electric buses). GoI’s increasing focus

for Make in India, reduce dependency from China and preference Absolute (%) 2 4 8

for local manufacturer augur well for companies like JBM auto. Rel to NIFTY (%) (8) (10) (1)

Sheet metal division also showing sign of recovery in volume in

Result Update

Shareholding Pattern

line with ram up in production for its key clients such as M&M,

Tata Motors, Ford, HCIL, Toyota and VECV. We expect sharp Mar'20 Jun'20 Sep'20

recovery in revenue from H2FY21 led by recovery in PV sales as Promoters 67.5 67.5 67.5

demand for personal mobility continue to be strong. MF/Banks/FIs 0.2 0.1 0.0

Strong revenue potential is foreseen in Tooling business owing FIIs 1.5 1.8 0.9

to increasing focus on ‘Make in India’ encouraging localization of Public / Others 30.9 30.5 31.6

Tooling and new launches. Tooling requirements by major global

OEMs is being aligned to source from within India (cost benefit Valuation (x)

of 25% in India). FY21E FY22E FY23E

JBM Auto’s growth story is premised on 1) recovery in PV P/E 27.8 13.1 9.5

volume; 2) encouraging revenue potential in the tooling business EV/EBITDA 10.1 7.3 6.0

(high margin +30%), given rising localization and outsourcing of

tooling requirements by large global OEMs (cost-benefit of 25% ROE (%) 5.7 11.4 14.0

in India) and 3) increasing economies of scale in the bus division. RoACE (%) 7.1 10.0 11.4

The stock is currently available at 13/9x for FY22/23E. We value

the stock Rs 380 (based on 15xFY23E EPS). Recommend BUY. Estimates (Rs mn)

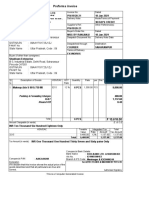

Q2FY21 Result (Rs Mn) FY21E FY22E FY23E

Particulars Q2FY21 Q2FY20 YoY (%) Q1FY21 QoQ (%) Revenue 18,115 22,566 26,497

Revenue 5,174 4,841 6.9 1,291 300.8 EBITDA 1,757 2,448 2,954

Total Expense 4,561 4,239 7.6 1,370 232.9 PAT 411 871 1,197

EBITDA 613 602 1.8 (79) (874.3) EPS (Rs.) 8.7 18.4 25.3

Depreciation 175 183 (4.4) 161 8.7

EBIT 437 419 4.5 (240) (282.1)

Other Income 30 45 (34.7) 14 111.4

Interest 135 164 (17.7) 125 7.4

Analyst: Abhishek Jain

EBT 332 300 10.6 (352) (194.6) Tel: +9122 40969739

Tax 110 108 2.3 (125) (188.3) E-mail: abhishekj@dolatcapital.com

RPAT 205 200 2.3 (259) (179.2)

APAT 205 200 2.3 (259) (179.2)

(bps) (bps)

Associate: Ketul Dalal

Tel: +91 22 4096 9770

Gross Margin (%) 29.2 30.6 (141) 29.5 (24)

E-mail: ketuld@dolatcapital.com

EBITDA Margin (%) 11.8 12.4 (59) (6.1) 1797

NPM (%) 4.0 4.1 (18) (20.0) 2399

Tax Rate (%) 33.2 35.8 (269) 35.5 (235)

EBIT Margin (%) 8.5 8.6 (19) (18.6) 2706

November 18, 2020

Bus division: Next leg of growth

We expect ramp up in bus division will help JBM Auto to generate strong margin and

cash flow over FY22-23. Moreover, GoI’s increasing focus for Make in India, reduce

dependency from China and preference for local manufacturer augur well for

companies like JBM auto. The bus division, which was a drag (Rs.118mn & Rs.46mn

loss at EBIT level in FY18 & FY19 respectively), turned profitable in FY20 to Rs 98.4mn

at EBIT level. The management expects a significant ramp up in the bus division in

the near term, as it has won new orders for both EVs and CNG (600+ buses), which

will provide significant revenue visibility in FY21-22E.

Q2FY21 Segment revenue breakup Q2FY21 Segment EBIT breakup

Source: Company, DART Source: Company, DART

Sheet metal to grow on back of PV volume recovery

JBMs sheet metal division started showing sign of recovery in volume in line with

ram up in production for its key clients such as M&M, Tata Motors, Ford, HCIL,

Toyota and VECV. We expect sharp recovery in revenue from H2FY21 led by recovery

in PV sales as demand for personal mobility continue to be strong.

Tooling Division: High margin business (30%+) to benefit from

new launches:

Strong revenue potential is foreseen in Tooling business (high margin+30%), owing

to increasing focus on ‘Make in India’ encouraging localization of Tooling. Recently

large OEM such MSIL also recommending its supplier to increase localization. We

believe JBM would key beneficiary (through Jay Bharat Maruti) for increasing

localization. Tooling requirements by major global OEMs is being aligned to source

from within India (cost benefit of 25% in India). Tooling capability is upgraded in

terms of Design and Manufacturing skills to cater to increasingly demanding Quality

requirements of tooling due to advent of High strength steels for Safety.

Change in Estimates

Rs Mn FY22E FY23E

New Previous % Cng New Previous % Cng

Net sales 22,566 22,281 1.3 26,497 26,170 1.2

EBITDA 2,448 2,417 1.3 2,954 2,918 1.2

EBITDA Margin (%) 10.9 10.9 (0.0) 11.2 11.2 0.0

APAT 871 861 1.2 1,197 1,176 1.8

EPS 18.4 18.2 1.2 25.3 24.9 1.8

November 18, 2020 2 JBM Auto

Key Assumption

Revenue FY19 FY20 FY21E FY22E FY23E

Component Division 19,312 14,553 10,915 13,316 15,447

Growth (%) 26 (25) -25% 22% 16%

Tool Room Division 1,550 2,526 2,400 3,000 3,300

Growth (%) 84 63 -5% 25% 10%

Bus Division 1,205 2,390 4,800 6,250 7,750

Growth (%) (59) 98 101% 30% 24%

Total Revenue 22,067 19,469 18,115 22,566 26,497

Growth (%) 35 (12) -7% 25% 17%

Source: DART, Company, JV (JBMA) and JBM Auto system ltd. Numbers is amalgamated from FY19.

Segment wise performance (%) Revenue grew 7% YoY

Source: DART, Company Source: DART, Company

EBIDTA margin recovered sharply YoY Gross Margin (%) contracted YoY

Source: DART, Company Source: DART, Company

Segment mix (%) 1 yr fwd PE Band

Source: DART, Company Source: DART, Company

November 18, 2020 3 JBM Auto

Profit and Loss Account

(Rs Mn) FY20A FY21E FY22E FY23E

Revenue 19,467 18,115 22,566 26,497

Total Expense 17,166 16,358 20,118 23,542

COGS 13,557 12,807 15,864 18,534

Employees Cost 2,040 1,956 2,448 2,809

Other expenses 1,569 1,594 1,805 2,199

EBIDTA 2,302 1,757 2,448 2,954

Depreciation 739 732 779 827

EBIT 1,563 1,025 1,669 2,127

Interest 643 620 643 667

Other Income 154 145 150 160

Exc. / E.O. items 0 0 0 0

EBT 1,075 551 1,176 1,620

Tax 384 145 304 418

RPAT 692 411 871 1,197

Minority Interest 0 12 18 24

Profit/Loss share of associates 2 17 18 19

APAT 692 411 871 1,197

Balance Sheet

(Rs Mn) FY20A FY21E FY22E FY23E

Sources of Funds

Equity Capital 237 237 237 237

Minority Interest 0 0 0 0

Reserves & Surplus 6,840 7,025 7,769 8,840

Net Worth 7,077 7,261 8,006 9,076

Total Debt 6,274 6,524 6,774 7,024

Net Deferred Tax Liability 879 897 915 933

Total Capital Employed 14,229 14,681 15,694 17,033

Applications of Funds

Net Block 9,103 9,599 9,720 9,793

CWIP 408 250 250 250

Investments 735 650 800 800

Current Assets, Loans & Advances 9,786 8,610 10,544 12,992

Inventories 2,956 2,730 3,400 3,993

Receivables 4,946 4,963 6,182 7,259

Cash and Bank Balances 225 105 190 803

Loans and Advances 166 159 159 159

Other Current Assets 1,494 653 612 778

Less: Current Liabilities & Provisions 5,803 4,428 5,620 6,802

Payables 4,012 3,366 4,139 4,842

Other Current Liabilities 1,791 1,062 1,481 1,960

sub total

Net Current Assets 3,983 4,182 4,924 6,190

Total Assets 14,229 14,681 15,694 17,033

E – Estimates

November 18, 2020 4 JBM Auto

Important Ratios

Particulars FY20A FY21E FY22E FY23E

(A) Margins (%)

Gross Profit Margin 30.4 29.3 29.7 30.1

EBIDTA Margin 11.8 9.7 10.9 11.2

EBIT Margin 8.0 5.7 7.4 8.0

Tax rate 35.8 26.3 25.9 25.8

Net Profit Margin 3.6 2.3 3.9 4.5

(B) As Percentage of Net Sales (%)

COGS 69.6 70.7 70.3 70.0

Employee 10.5 10.8 10.9 10.6

Other 8.1 8.8 8.0 8.3

(C) Measure of Financial Status

Gross Debt / Equity 0.9 0.9 0.8 0.8

Interest Coverage 2.4 1.7 2.6 3.2

Inventory days 55 55 55 55

Debtors days 93 100 100 100

Average Cost of Debt 9.1 9.7 9.7 9.7

Payable days 75 68 67 67

Working Capital days 75 84 80 85

FA T/O 2.1 1.9 2.3 2.7

(D) Measures of Investment

AEPS (Rs) 14.6 8.7 18.4 25.3

CEPS (Rs) 30.2 24.4 35.3 43.3

DPS (Rs) 1.9 2.7 2.7 2.7

Dividend Payout (%) 13.1 30.7 14.5 10.5

BVPS (Rs) 149.6 153.5 169.3 191.9

RoANW (%) 10.2 5.7 11.4 14.0

RoACE (%) 9.1 7.1 10.0 11.4

RoAIC (%) 10.8 7.2 11.1 13.4

(E) Valuation Ratios

CMP (Rs) 241 241 241 241

P/E 16.5 27.8 13.1 9.5

Mcap (Rs Mn) 11,399 11,399 11,399 11,399

MCap/ Sales 0.6 0.6 0.5 0.4

EV 17,448 17,818 17,983 17,619

EV/Sales 0.9 1.0 0.8 0.7

EV/EBITDA 7.6 10.1 7.3 6.0

P/BV 1.6 1.6 1.4 1.3

Dividend Yield (%) 0.8 1.1 1.1 1.1

(F) Growth Rate (%)

Revenue (11.8) (6.9) 24.6 17.4

EBITDA (10.6) (23.7) 39.3 20.7

EBIT (14.5) (34.4) 62.8 27.5

PBT (27.6) (48.8) 113.5 37.8

APAT (29.1) (40.6) 112.0 37.4

EPS (29.1) (40.6) 112.0 37.4

Cash Flow

(Rs Mn) FY20A FY21E FY22E FY23E

CFO 2,843 1,546 1,655 2,062

CFI (1,306) (1,244) (1,050) (900)

CFF (1,537) (422) (520) (549)

FCFF 1,649 476 755 1,162

Opening Cash 113 225 105 190

Closing Cash 225 105 190 803

E – Estimates

November 18, 2020 5 JBM Auto

DART RATING MATRIX

Total Return Expectation (12 Months)

Buy > 20%

Accumulate 10 to 20%

Reduce 0 to 10%

Sell < 0%

Rating and Target Price History

Month Rating TP (Rs.) Price (Rs.)

(Rs) JBMA Target Price Feb-20 Buy 411 248

440 Mar-20 Buy 339 119

370 Mar-20 Buy 339 127

Apr-20 Buy 309 139

300 Jul-20 Buy 309 214

Sep-20 Buy 309 228

230

Sep-20 Buy 373 213

160

90

Jul-20

Nov-19

Dec-19

Jan-20

Jun-20

Aug-20

Sep-20

Nov-20

Feb-20

Mar-20

Apr-20

Oct-20

May-20

*Price as on recommendation date

DART Team

Purvag Shah Managing Director purvag@dolatcapital.com +9122 4096 9747

Amit Khurana, CFA Head of Equities amit@dolatcapital.com +9122 4096 9745

CONTACT DETAILS

Equity Sales Designation E-mail Direct Lines

Dinesh Bajaj VP - Equity Sales dineshb@dolatcapital.com +9122 4096 9709

Kapil Yadav VP - Equity Sales kapil@dolatcapital.com +9122 4096 9735

Yomika Agarwal VP - Equity Sales yomika@dolatcapital.com +9122 4096 9772

Jubbin Shah VP - Derivatives Sales jubbins@dolatcapital.com +9122 4096 9779

Ashwani Kandoi AVP - Equity Sales ashwanik@dolatcapital.com +9122 4096 9725

Lekha Nahar AVP - Equity Sales lekhan@dolatcapital.com +9122 4096 9740

Equity Trading Designation E-mail

P. Sridhar SVP and Head of Sales Trading sridhar@dolatcapital.com +9122 4096 9728

Chandrakant Ware VP - Sales Trading chandrakant@dolatcapital.com +9122 4096 9707

Shirish Thakkar VP - Head Domestic Derivatives Sales Trading shirisht@dolatcapital.com +9122 4096 9702

Kartik Mehta Asia Head Derivatives kartikm@dolatcapital.com +9122 4096 9715

Dinesh Mehta Co- Head Asia Derivatives dinesh.mehta@dolatcapital.com +9122 4096 9765

Bhavin Mehta VP - Derivatives Strategist bhavinm@dolatcapital.com +9122 4096 9705

Dolat Capital Market Private Limited.

Sunshine Tower, 28th Floor, Senapati Bapat Marg, Dadar (West), Mumbai 400013

Analyst(s) Certification

The research analyst(s), with respect to each issuer and its securities covered by them in this research report, certify that: All of the views expressed in

this research report accurately reflect his or her or their personal views about all of the issuers and their securities; and No part of his or her or their

compensation was, is, or will be directly or indirectly related to the specific recommendations or views expressed in this research report.

I. Analyst(s) and Associate (S) holding in the Stock(s): (Nil)

II. Disclaimer:

This research report has been prepared by Dolat Capital Market Private Limited. to provide information about the company(ies) and sector(s), if any,

covered in the report and may be distributed by it and/or its affiliated company(ies) solely for the purpose of information of the select recipient of this

report. This report and/or any part thereof, may not be duplicated in any form and/or reproduced or redistributed without the prior written consent of

Dolat Capital Market Private Limited. This report has been prepared independent of the companies covered herein. Dolat Capital Market Private Limited.

and its affiliated companies are part of a multi-service, integrated investment banking, brokerage and financing group. Dolat Capital Market Private

Limited. and/or its affiliated company(ies) might have provided or may provide services in respect of managing offerings of securities, corporate finance,

investment banking, mergers & acquisitions, financing or any other advisory services to the company(ies) covered herein. Dolat Capital Market Private

Limited. and/or its affiliated company(ies) might have received or may receive compensation from the company(ies) mentioned in this report for rendering

any of the above services. Research analysts and sales persons of Dolat Capital Market Private Limited. may provide important inputs to its affiliated

company(ies) associated with it. While reasonable care has been taken in the preparation of this report, it does not purport to be a complete description

of the securities, markets or developments referred to herein, and Dolat Capital Market Private Limited. does not warrant its accuracy or completeness.

Dolat Capital Market Private Limited. may not be in any way responsible for any loss or damage that may arise to any person from any inadvertent error

in the information contained in this report. This report is provided for information only and is not an investment advice and must not alone be taken as

the basis for an investment decision. The investment discussed or views expressed herein may not be suitable for all investors. The user assumes the

entire risk of any use made of this information. The information contained herein may be changed without notice and Dolat Capital Market Private Limited.

reserves the right to make modifications and alterations to this statement as they may deem fit from time to time. Dolat Capital Market Private Limited.

and its affiliated company(ies), their directors and employees may; (a) from time to time, have a long or short position in, and buy or sell the securities of

the company(ies) mentioned herein or (b) be engaged in any other transaction involving such securities and earn brokerage or other compensation or act

as a market maker in the financial instruments of the company(ies) discussed herein or act as an advisor or lender/borrower to such company(ies) or may

have any other potential conflict of interests with respect to any recommendation and other related information and opinions. This report is neither an

offer nor solicitation of an offer to buy and/or sell any securities mentioned herein and/or not an official confirmation of any transaction. This report is

not directed or intended for distribution to, or use by any person or entity who is a citizen or resident of or located in any locality, state, country or other

jurisdiction, where such distribution, publication, availability or use would be contrary to law, regulation or which would subject Dolat Capital Market

Private Limited. and/or its affiliated company(ies) to any registration or licensing requirement within such jurisdiction. The securities described herein

may or may not be eligible for sale in all jurisdictions or to a certain category of investors. Persons in whose possession this report may come, are required

to inform themselves of and to observe such restrictions.

For U.S. Entity/ persons only: This research report is a product of Dolat Capital Market Private Limited., which is the employer of the research analyst(s)

who has prepared the research report. The research analyst(s) preparing the research report is/are resident outside the United States (U.S.) and are not

associated persons of any U.S. regulated broker-dealer and therefore the analyst(s) is/are not subject to supervision by a U.S. broker-dealer, and is/are

not required to satisfy the regulatory licensing requirements of FINRA or required to otherwise comply with U.S. rules or regulations regarding, among

other things, communications with a subject company, public appearances and trading securities held by a research analyst account.

This report is intended for distribution by Dolat Capital Market Private Limited. only to "Major Institutional Investors" as defined by Rule 15a-6(b)(4) of

the U.S. Securities and Exchange Act, 1934 (the Exchange Act) and interpretations thereof by U.S. Securities and Exchange Commission (SEC) in reliance

on Rule 15a 6(a)(2). If the recipient of this report is not a Major Institutional Investor as specified above, then it should not act upon this report and return

the same to the sender. Further, this report may not be copied, duplicated and/or transmitted onward to any U.S. person or entity.

In reliance on the exemption from registration provided by Rule 15a-6 of the Exchange Act and interpretations thereof by the SEC in order to conduct

certain business with Major Institutional Investors, Dolat Capital Market Private Limited. has entered into an agreement with a U.S. registered broker-

dealer Ltd Marco Polo Securities Inc. ("Marco Polo"). Transactions in securities discussed in this research report should be effected through Marco Polo

or another U.S. registered broker dealer/Entity as informed by Dolat Capital Market Private Limited. from time to time.

Dolat Capital Market Private Limited.

Corporate Identity Number: U65990DD1993PTC009797

Member: BSE Limited and National Stock Exchange of India Limited.

SEBI Registration No: BSE - INB010710052 & INF010710052, NSE - INB230710031& INF230710031, Research: INH000000685

Registered office: Unit no PO6-02A - PO6-02D, Tower A, WTC, Block 51, Zone-5, Road 5E, Gift City, Gandhinagar, Gujarat – 382355

Board: +9122 40969700 | Fax: +9122 22651278 | Email: research@dolatcapital.com | www.dolatresearch.com

Our Research reports are also available on Reuters, Thomson Publishers, DowJones and Bloomberg (DCML <GO>)

You might also like

- Escorts: CMP: INR1,107 TP: INR 1,175 (+6%) Strong Operating Performance Led by Cost ManagementDocument12 pagesEscorts: CMP: INR1,107 TP: INR 1,175 (+6%) Strong Operating Performance Led by Cost ManagementdfhjhdhdgfjhgdfjhNo ratings yet

- CYIENT Kotak 22102018Document6 pagesCYIENT Kotak 22102018ADNo ratings yet

- Ambuja Cement (ACEM IN) : Q3CY20 Result UpdateDocument6 pagesAmbuja Cement (ACEM IN) : Q3CY20 Result Updatenani reddyNo ratings yet

- Bharat Forge (BHFC IN) : Q4FY21 Result UpdateDocument6 pagesBharat Forge (BHFC IN) : Q4FY21 Result UpdateEquity NestNo ratings yet

- Heidelberg Cement India (HEIM IN) : Q3FY20 Result UpdateDocument6 pagesHeidelberg Cement India (HEIM IN) : Q3FY20 Result UpdateanjugaduNo ratings yet

- MM Forgings (Q1FY24 Result Update) - 15-Aug-2023Document10 pagesMM Forgings (Q1FY24 Result Update) - 15-Aug-2023instiresmilanNo ratings yet

- Quarterly Update Q3FY21: Century Plyboards (India) LTDDocument10 pagesQuarterly Update Q3FY21: Century Plyboards (India) LTDMalolanRNo ratings yet

- India - Bharti Airtel - Q4 Strong Beat Leverage Benefit AheadDocument13 pagesIndia - Bharti Airtel - Q4 Strong Beat Leverage Benefit AheadVrajesh ChitaliaNo ratings yet

- Annual Report of Info Edge by Icici SecurityDocument12 pagesAnnual Report of Info Edge by Icici SecurityGobind yNo ratings yet

- Strategiuc MGMT Session 1 MaterialDocument14 pagesStrategiuc MGMT Session 1 MaterialAPOORVA BALAKRISHNANNo ratings yet

- TVS Motor Company: CMP: INR549 TP: INR548Document12 pagesTVS Motor Company: CMP: INR549 TP: INR548anujonwebNo ratings yet

- NRB Bearing ILFSDocument3 pagesNRB Bearing ILFSapi-3775500No ratings yet

- Latest Ceat ReportDocument6 pagesLatest Ceat Reportshubhamkumar.bhagat.23mbNo ratings yet

- Stock Report On Baja Auto in India Ma 23 2020Document12 pagesStock Report On Baja Auto in India Ma 23 2020PranavPillaiNo ratings yet

- Angel Broking M&MDocument5 pagesAngel Broking M&Mbunny711No ratings yet

- Q2FY22 Result Update Indo Count Industries LTD: Higher Realization Aids FinancialsDocument10 pagesQ2FY22 Result Update Indo Count Industries LTD: Higher Realization Aids FinancialsbradburywillsNo ratings yet

- Vinati Organics: AccumulateDocument7 pagesVinati Organics: AccumulateBhaveek OstwalNo ratings yet

- PRJ 5 2 24 PLDocument7 pagesPRJ 5 2 24 PLcaezarcodmNo ratings yet

- Endurance Technologies: CMP: INR1,400 TP: INR1,750 (+25%)Document10 pagesEndurance Technologies: CMP: INR1,400 TP: INR1,750 (+25%)Live NIftyNo ratings yet

- JK Cement: Valuations Factor in Positive Downgrade To HOLDDocument9 pagesJK Cement: Valuations Factor in Positive Downgrade To HOLDShubham BawkarNo ratings yet

- Ultratech Cement: CMP: Inr6,485 TP: Inr8,050 (+24%) Market Share Gains Con Nue BuyDocument10 pagesUltratech Cement: CMP: Inr6,485 TP: Inr8,050 (+24%) Market Share Gains Con Nue BuyLive NIftyNo ratings yet

- Tata Elxsi 4qfy19 Result Update19Document6 pagesTata Elxsi 4qfy19 Result Update19Ashutosh GuptaNo ratings yet

- Atul Auto: Rural Uptick Holds The KeyDocument10 pagesAtul Auto: Rural Uptick Holds The KeyAnonymous y3hYf50mTNo ratings yet

- Q2FY24 Post Results Review - SMIFS Institutional ResearchDocument17 pagesQ2FY24 Post Results Review - SMIFS Institutional Researchkrishna_buntyNo ratings yet

- 2018 Aug M&M ReportDocument12 pages2018 Aug M&M ReportVivek shindeNo ratings yet

- Ashok Leyland: Performance HighlightsDocument9 pagesAshok Leyland: Performance HighlightsSandeep ManglikNo ratings yet

- Ashok Leyland: CMP: INR115 TP: INR134 (+17%)Document10 pagesAshok Leyland: CMP: INR115 TP: INR134 (+17%)Jitendra GaglaniNo ratings yet

- MOIL 07feb20 Kotak PCG 00210 PDFDocument6 pagesMOIL 07feb20 Kotak PCG 00210 PDFdarshanmadeNo ratings yet

- Kpit TechnologiesDocument7 pagesKpit TechnologiesRanjan BeheraNo ratings yet

- Hero Motocorp: CMP: Inr3,707 TP: Inr3,818 (+3%)Document12 pagesHero Motocorp: CMP: Inr3,707 TP: Inr3,818 (+3%)SAHIL SHARMANo ratings yet

- Weak Balance Sheet Drags Profitability: Q3FY18 Result HighlightsDocument8 pagesWeak Balance Sheet Drags Profitability: Q3FY18 Result Highlightsrishab agarwalNo ratings yet

- Bhel (Bhel In) : Q4FY19 Result UpdateDocument6 pagesBhel (Bhel In) : Q4FY19 Result Updatesaran21No ratings yet

- Heidelberg Cement India (HEIM IN) : Q4FY19 Result UpdateDocument6 pagesHeidelberg Cement India (HEIM IN) : Q4FY19 Result UpdateTamilNo ratings yet

- Quarterly Update Q1FY22: Century Plyboards (India) LTDDocument10 pagesQuarterly Update Q1FY22: Century Plyboards (India) LTDhackmaverickNo ratings yet

- Maruti Suzuki (MSIL IN) : Q1FY20 Result UpdateDocument6 pagesMaruti Suzuki (MSIL IN) : Q1FY20 Result UpdateHitesh JainNo ratings yet

- Colgate-Palmolive: Performance HighlightsDocument4 pagesColgate-Palmolive: Performance HighlightsPrasad DesaiNo ratings yet

- Prabhudas LiladharDocument6 pagesPrabhudas LiladharPreet JainNo ratings yet

- Sagar Cement 0121 NirmalBangDocument10 pagesSagar Cement 0121 NirmalBangSunilNo ratings yet

- Nomura - May 6 - CEATDocument12 pagesNomura - May 6 - CEATPrem SagarNo ratings yet

- Ultratech Cement (UTCEM IN) : Q1FY21 Result UpdateDocument6 pagesUltratech Cement (UTCEM IN) : Q1FY21 Result UpdatewhitenagarNo ratings yet

- HMCL 20240211 Mosl Ru PG012Document12 pagesHMCL 20240211 Mosl Ru PG012Realm PhangchoNo ratings yet

- Sbkuch 1Document8 pagesSbkuch 1vishalpaul31No ratings yet

- Ramco Cement Q2FY24 ResultsDocument8 pagesRamco Cement Q2FY24 ResultseknathNo ratings yet

- Utcem 20211018 Mosl Ru PG012Document12 pagesUtcem 20211018 Mosl Ru PG012Vinayak ChennuriNo ratings yet

- Icmnbo Abn AmroDocument9 pagesIcmnbo Abn AmrodivyakashNo ratings yet

- Bajaj Auto LTD - An AnalysisDocument25 pagesBajaj Auto LTD - An AnalysisDevi YesodharanNo ratings yet

- Kajaria Ceramics: Higher Trading Kept Growth IntactDocument4 pagesKajaria Ceramics: Higher Trading Kept Growth IntactearnrockzNo ratings yet

- Vascon Engineers - Kotak PCG PDFDocument7 pagesVascon Engineers - Kotak PCG PDFdarshanmadeNo ratings yet

- Mahindra & Mahindra: CMP: INR672 TP: INR810 (+20%)Document14 pagesMahindra & Mahindra: CMP: INR672 TP: INR810 (+20%)Yash DoshiNo ratings yet

- Inox RU4QFY2008 110608Document4 pagesInox RU4QFY2008 110608api-3862995No ratings yet

- Bharat Forge: Performance HighlightsDocument13 pagesBharat Forge: Performance HighlightsarikuldeepNo ratings yet

- View: Good Quarter, Better Show From Q3FY21E Maintain Buy: Scrip DetailsDocument9 pagesView: Good Quarter, Better Show From Q3FY21E Maintain Buy: Scrip DetailsDhavalNo ratings yet

- Acc (Acc In) - Q2cy21 Result Update - PL IndiaDocument6 pagesAcc (Acc In) - Q2cy21 Result Update - PL IndiadarshanmaldeNo ratings yet

- Cipla: Performance HighlightsDocument8 pagesCipla: Performance HighlightsKapil AthwaniNo ratings yet

- ABG+Shipyard 11-6-08 PLDocument3 pagesABG+Shipyard 11-6-08 PLapi-3862995No ratings yet

- IDBI Capital Century Plyboards Q1FY23 Result ReviewDocument10 pagesIDBI Capital Century Plyboards Q1FY23 Result ReviewTai TranNo ratings yet

- Initiating Coverage - Orient Cement 171220 PDFDocument16 pagesInitiating Coverage - Orient Cement 171220 PDFJayshree JadhavNo ratings yet

- A E L (AEL) : Mber Nterprises TDDocument8 pagesA E L (AEL) : Mber Nterprises TDdarshanmadeNo ratings yet

- CEAT Annual Report 2019Document5 pagesCEAT Annual Report 2019Roberto GrilliNo ratings yet

- Economic Indicators for South and Central Asia: Input–Output TablesFrom EverandEconomic Indicators for South and Central Asia: Input–Output TablesNo ratings yet

- WACC and Depreciation MethodsDocument18 pagesWACC and Depreciation Methodsrovelyn CabicoNo ratings yet

- Assignment Nos.4 Learning CurveDocument3 pagesAssignment Nos.4 Learning CurvePatricia CruzNo ratings yet

- Data Analytics Mod 2 Netflix Case StudyDocument4 pagesData Analytics Mod 2 Netflix Case Studyapi-643373008No ratings yet

- LEED Green AssociateDocument1 pageLEED Green AssociateRaymond ChettiNo ratings yet

- Oil IndiaDocument420 pagesOil Indiashalininagesh88No ratings yet

- Event Tech - IT Consulting - Software Development - DigitizationDocument13 pagesEvent Tech - IT Consulting - Software Development - DigitizationprinknestNo ratings yet

- Valuation Discussion AnalysisDocument102 pagesValuation Discussion AnalysispriyanshuNo ratings yet

- Chapter 2 REA Part 2Document21 pagesChapter 2 REA Part 2Lê Thái VyNo ratings yet

- Topic 11 A181 - Variance AnalysisDocument38 pagesTopic 11 A181 - Variance AnalysisEngku FarahNo ratings yet

- Cost & Management Accounting (CMA) : SyllabusDocument7 pagesCost & Management Accounting (CMA) : SyllabusMandish AjmeriNo ratings yet

- SiddhantaNaidu 19060322067 PrinciplesofMicroeconomicsSEEDocument7 pagesSiddhantaNaidu 19060322067 PrinciplesofMicroeconomicsSEESmrithika RongaliNo ratings yet

- Costs - Concepts and ClassificationsDocument5 pagesCosts - Concepts and ClassificationsCarlo B CagampangNo ratings yet

- Invoice Guide For Taxi OperatorsDocument2 pagesInvoice Guide For Taxi OperatorsFitri susilowatiNo ratings yet

- MTH095 3.2 NotesDocument4 pagesMTH095 3.2 NotesDebra GoldsteinNo ratings yet

- CHAPTER 2 Key Operating Ratios of Room DivisionDocument10 pagesCHAPTER 2 Key Operating Ratios of Room DivisionBELINO, JONATHAN MITCHELL N.No ratings yet

- Pre Board Class XII Business StudiesDocument8 pagesPre Board Class XII Business StudiesShubham100% (6)

- Literature Review: Group 1 BADB3024 Research MethodDocument32 pagesLiterature Review: Group 1 BADB3024 Research Methodyoyohoney singleNo ratings yet

- Detailed Programme - 19 Global MSME Business Summit 2022Document5 pagesDetailed Programme - 19 Global MSME Business Summit 2022Arvind KumarNo ratings yet

- Future of FMCG DeckDocument16 pagesFuture of FMCG DecksusanNo ratings yet

- A Project Report On Working Capital ManagementDocument84 pagesA Project Report On Working Capital Managementrohit2p50% (4)

- MGMT-5245 Managerial Economics: Market Power: MonopolyDocument22 pagesMGMT-5245 Managerial Economics: Market Power: MonopolyYining LiuNo ratings yet

- Siddu PDFDocument2 pagesSiddu PDFNikhil MohaneNo ratings yet

- CIB UndertakingDocument1 pageCIB UndertakingovifinNo ratings yet

- Improve Business Practice LO 5 & 6Document35 pagesImprove Business Practice LO 5 & 6John YohansNo ratings yet

- CrakRevenue - The Best and Most Trusted CPA NetworkDocument5 pagesCrakRevenue - The Best and Most Trusted CPA NetworkCarlos KrauseNo ratings yet

- Submittal For Approval of Materials Section 13967 - Clean-Agent Fire Extinguishing SystemsDocument1 pageSubmittal For Approval of Materials Section 13967 - Clean-Agent Fire Extinguishing SystemsFaruh IsmatovNo ratings yet

- Shubham PIDocument1 pageShubham PIVarsha JiNo ratings yet

- Atlas Copco 140 YearsDocument136 pagesAtlas Copco 140 YearsJulliana SilvaNo ratings yet

- Self Check Exercises: Exercise 6.2Document11 pagesSelf Check Exercises: Exercise 6.2Bhargav D.S.No ratings yet

- MGMT 30b Chapter 1 HW AnswersDocument8 pagesMGMT 30b Chapter 1 HW AnswershoshixnanaNo ratings yet