Professional Documents

Culture Documents

2018 Quarter 1 Financials PDF

2018 Quarter 1 Financials PDF

Uploaded by

Kaystain Chris IhemeOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

2018 Quarter 1 Financials PDF

2018 Quarter 1 Financials PDF

Uploaded by

Kaystain Chris IhemeCopyright:

Available Formats

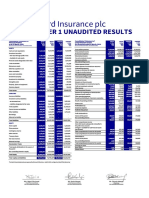

AXA Mansard Insurance plc

2018 QUARTER 1 UNAUDITED RESULTS

Consolidated Statement of GROUP GROUP COMPANY COMPANY Consolidated Statement of GROUP GROUP COMPANY COMPANY

Financial Position 31 Mar 31 Dec 31 Mar 31 Dec Comprehensive Income 31 Mar 31 Mar 31 Mar 31 Mar

as at 31 March, 2018. 2018 2017 2018 2017 for the period ended 31 March, 2018 2018 2017 2018 2017

(All amounts in thousands of Naira unless otherwise stated) N'000 N'000 N'000 N'000 (All amounts in thousands of Naira unless otherwise stated) N'000 N'000 N'000 N'000

ASSETS

4,779,865 Gross written premium 14,168,279 12,873,532 11,290,912 10,827,536

Cash and cash equivalents 2,007,416 5,333,318 1,139,497

Gross premium income 7,275,895 6,210,851 5,474,032 5,130,192

Available-for-sale assets 25,191,065 22,691,784 19,564,136 17,677,702

Re-insurance expenses (2,959,884) (2,899,233) (2,931,259) (2,881,179)

Financial assets designated at fair value 2,537,206 3,272,242 2,537,206 3,272,242 Net premium income 4,316,011 3,311,618 2,542,773 2,249,013

Trade receivables 5,037,797 1,961,018 2,848,137 251,383 Fee and commission income:

Insurance contracts 486,706 485,832 486,706 485,832

Reinsurance assets 15,945,641 10,165,983 15,905,816 10,115,242

Net underwriting income 4,802,717 3,797,450 3,029,479 2,734,845

Deferred acquisition cost 745,947 494,584 737,430 481,077

Claims expenses (Gross) (4,704,291) (3,170,053) (3,199,198) (2,328,331)

Other receivables 1,383,492 909,097 995,285 649,146 Claims expenses recovered from reinsurers 1,869,454 1,179,959 1,860,387 1,178,434

Loans and receivables 4,061,060 3,843,254 7,892,200 7,562,215 Underwriting expenses (753,703) (625,119) (669,499) (588,584)

Change in individual life fund (54,254) 59,629 (54,254) 59,629

Investment property 14,212,689 14,072,384 - -

Change in annuity reserves (67,660) 14,591 (67,660) 14,591

Investment in subsidiaries - - 3,919,573 3,919,573 (Impairment)/writeback of premium receivables 3,486 - - -

Intangible assets 1,639,155 1,648,896 211,390 218,772 Net underwriting expenses (3.706.968) (2,540,993) (2,130,224) (1,664,261)

Property, plant and equipment 1,738,741 1,672,516 1,522,463 1,437,960 Total underwriting profit 1,095,749 1,256,457 899,255 1,070,584

Investment income 1,267,773 1,118,914 550,677 562,408

Statutory deposit 500,000 500,000 500,000 500,000

Net (loss)/gains on financial assets 31,245 75,533 (2,215) 32,595

Total assets 75,000,208 66,565,076 57,773,133 50,865,177 Net gains on investment property 140,305 - - -

Profit on investment contracts 81,917 45,228 81,918 45,228

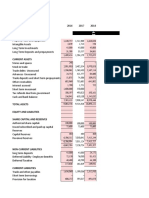

LIABILITIES Other income 77,950 43,034 191,764 74,777

30,156,296 21,167,952 25,559,090 17,824,172 Total investment income 1,599,190 1,282,709 822,144 715,008

Insurance liabilities

Expenses for marketing and administration (370,244) (351,671) (307,371) (283,571)

Investment contract liabilities: (648,682) (633,030) (471,122) (490,216)

Employee benefit expense

– At amortised cost 3,243,592 3,108,070 3,241,958 3,108,070 Other operating expenses (648,086) (534,238) (525,478) (430,238)

– Liabilities designated at fair Results of operating activities 1,027,927 1,020,227 417,428 581,567

2,537,206 3,272,242 2,537,206 3,272,242 Finance cost (75,647) (108,409) - -

value

Profit before tax 952,280 911,818 417,428 581,567

Trade payables 7,336,568 8,524,336 7,319,893 8,511,603 Income tax expense (129,917) (173,872) (91,534)

(46,535)

Current income tax liabilities 512,260 444,688 281,494 234,959 Profit for the period 822,363 737,946 370,893 490,033

Other liabilities 2,577,996 2,333,758 1,697,898 1,358,567 Profit attributable to:

Borrowings 3,296,484 3,295,031 - - Owners of the parent 720,843 677,942 370,893 490,033

Non-controlling interest 101,520 60,004 - -

Deferred tax liability 536,531 656,407 - 183,220

822,363 737,946 370,893 490,033

Total liabilities 50,196,933 42,802,484 40.637,539 34,309,613 Other comprehensive income:

EQUITY Items that may be subsequently reclassified to

the profit or loss account:

Share capital 5,250,000 5,250,000 5,250,000 5,250,000 Changes in available-for-sale financial assets 227,155 (113,434) 217,972 (111,870)

Share premium 4,443,453 4,443,453 4,443,453 4,443,453 (net of taxes)

Other comprehensive income / (loss) for the 227,155 (113,434) 217,972 (111,870)

Contingency reserve 3,615,451 3,615,451 3,615,451 3,615,451 period

Other reserves 2,618,848 2,625,479 2,586,268 2,595,103 Total comprehensive income for the 1,049,518 624,512 588,865 378,163

Treasury shares period

(304,924) (304,924) (304,924) (304,924)

Attributable to:

Fair value reserves 653,286 426,131 486,814 268,842

Owners of the parent 947,998 564,508 588,865 378,163

Retained earnings 4,952,549 4,229,226 1,058,532 687,639

Non-controlling interests 101,520 60,004 - -

Shareholders' funds 21,228,663 20,284,816 17,135,594 16,555,564 Total comprehensive income for the 1,049,518 624,512 588,865 378,163

period

Total equity attributable to the owners of 21,228,663 20,284,816 17,135,594 16,555,564

Earnings per share

the parent

Basic (Kobo) 6.98 6.57 3.59 4.75

Non-controlling interest in equity 3,574,612 3,477,776 - - Diluted (Kobo) 6.87 6.46 3.54 4.67

Total equity 24,803,275 19,618,894

23,762,592 17,135,594 16,555,564

15,397,161

Total equity and liabilities 75,000,208 51,207,026

66,565,076 57,773,133 37,920,074

50,865,177

The interim financial statements were approved by the board of directors on 26 April, 2018 and signed on behalf of the directors by:

Mrs. Ngozi Ola-Israel Mr. Kunle Ahmed Mr. Olusola Adeeyo

Chairman

FRC/2017/ANAN/00000017349 FRC/2017/CIIN/00000017019 FRC/2013/NIM/00000001919

You might also like

- Awasr Oman and Partners SAOC - FS 2020 EnglishDocument42 pagesAwasr Oman and Partners SAOC - FS 2020 Englishabdullahsaleem91No ratings yet

- Complaint To Recover Damages For Personal InjuriesDocument11 pagesComplaint To Recover Damages For Personal InjuriesleonrhuntNo ratings yet

- Economic SurveyDocument5 pagesEconomic SurveyRhuaibaNo ratings yet

- 2019 Quarter 1 FInancial StatementsDocument1 page2019 Quarter 1 FInancial StatementsKaystain Chris IhemeNo ratings yet

- 2019 Quarter 2 FInancial StatementsDocument1 page2019 Quarter 2 FInancial StatementsKaystain Chris IhemeNo ratings yet

- 2018 Quarter 2 Financials PDFDocument1 page2018 Quarter 2 Financials PDFKaystain Chris IhemeNo ratings yet

- 2018 Audited Financial StatementsDocument1 page2018 Audited Financial StatementsKaystain Chris IhemeNo ratings yet

- ProntoForms 2023 Q2 FinancialsDocument18 pagesProntoForms 2023 Q2 Financialsprincehalder0027No ratings yet

- Quarterly Report 20200930Document18 pagesQuarterly Report 20200930Ang SHNo ratings yet

- BK Group PLC Financial Results: Net Interest Income 51,762,974 46,360,210Document3 pagesBK Group PLC Financial Results: Net Interest Income 51,762,974 46,360,210chegeNo ratings yet

- Quarterly Report 20191231Document21 pagesQuarterly Report 20191231Ang SHNo ratings yet

- Interim Financial Statements - English q2Document12 pagesInterim Financial Statements - English q2yanaNo ratings yet

- 3rd Quarter Report 2018Document1 page3rd Quarter Report 2018Tanzir HasanNo ratings yet

- Statement of Financial Position: 2018 2017 (Rupees in Thousand)Document18 pagesStatement of Financial Position: 2018 2017 (Rupees in Thousand)Alina Binte EjazNo ratings yet

- Summary Consolidated and Separate Financial Statements For The Period Ended 30 Sept 2021 (Unaudited)Document1 pageSummary Consolidated and Separate Financial Statements For The Period Ended 30 Sept 2021 (Unaudited)Fuaad DodooNo ratings yet

- UBA FS-31Dec2021Document2 pagesUBA FS-31Dec2021Fuaad DodooNo ratings yet

- Q4 2022 Bursa Announcement - 2Document13 pagesQ4 2022 Bursa Announcement - 2Quint WongNo ratings yet

- Financial Publication MarchDocument2 pagesFinancial Publication MarchFuaad DodooNo ratings yet

- NIB Financial Statements 2017Document12 pagesNIB Financial Statements 2017rahim Abbas aliNo ratings yet

- United Bank For Africa (Ghana) Limited Summary Financial Statements For The Year Ended 31 December 2020Document2 pagesUnited Bank For Africa (Ghana) Limited Summary Financial Statements For The Year Ended 31 December 2020Fuaad DodooNo ratings yet

- Gma FSDocument13 pagesGma FSMark Angelo BustosNo ratings yet

- Bangladesh q2 Report 2020 Tcm244 553471 enDocument8 pagesBangladesh q2 Report 2020 Tcm244 553471 entdebnath_3No ratings yet

- Financial Statement 2020Document3 pagesFinancial Statement 2020Fuaad DodooNo ratings yet

- Masteel 4Q 2023Document12 pagesMasteel 4Q 2023GZHNo ratings yet

- 2018 Audited Financial StatementDocument73 pages2018 Audited Financial Statementnicole bancoroNo ratings yet

- Swisstek (Ceylon) PLC Swisstek (Ceylon) PLCDocument7 pagesSwisstek (Ceylon) PLC Swisstek (Ceylon) PLCkasun witharanaNo ratings yet

- Annual Financial Statement 2021Document3 pagesAnnual Financial Statement 2021kofiNo ratings yet

- 2004 Annual ReportDocument10 pages2004 Annual ReportThe Aspen InstituteNo ratings yet

- Consolidated Financial Statements Mar 09Document15 pagesConsolidated Financial Statements Mar 09Naseer AhmadNo ratings yet

- Income Statement and Balance SheetDocument8 pagesIncome Statement and Balance SheetMyustafizzNo ratings yet

- SIRA1H11Document8 pagesSIRA1H11Inde Pendent LkNo ratings yet

- Q3 Financial Statement q3 For Period 30 September 2021Document2 pagesQ3 Financial Statement q3 For Period 30 September 2021Fuaad DodooNo ratings yet

- SCB BursaAnnFSNotes 4th Quarter Ended 30.6.2022Document13 pagesSCB BursaAnnFSNotes 4th Quarter Ended 30.6.2022kimNo ratings yet

- Seven Up Bottling Co PLC: For The Ended 31 March, 2014Document4 pagesSeven Up Bottling Co PLC: For The Ended 31 March, 2014Gina FelyaNo ratings yet

- Atlas Honda (2019 22)Document6 pagesAtlas Honda (2019 22)husnainbutt2025No ratings yet

- Capital Alliance PLC: Interim Financial StatementsDocument10 pagesCapital Alliance PLC: Interim Financial Statementskasun witharanaNo ratings yet

- Unaudited Financials BSX December 2023Document2 pagesUnaudited Financials BSX December 2023BernewsNo ratings yet

- BPI Capital Audited Financial StatementsDocument66 pagesBPI Capital Audited Financial StatementsGes Glai-em BayabordaNo ratings yet

- Assignment FSADocument15 pagesAssignment FSAJaveria KhanNo ratings yet

- COMPANY 1 - SupaFood Financial Statements - 240102 - 143648Document5 pagesCOMPANY 1 - SupaFood Financial Statements - 240102 - 143648Marcel JonathanNo ratings yet

- Financial PlanDocument25 pagesFinancial PlanAyesha KanwalNo ratings yet

- Balance Sheet: 2016 2017 2018 Assets Non-Current AssetsDocument6 pagesBalance Sheet: 2016 2017 2018 Assets Non-Current AssetsAhsan KamranNo ratings yet

- Statement of Cash FlowsDocument2 pagesStatement of Cash FlowsKartik SharmaNo ratings yet

- Ain 20201025074Document8 pagesAin 20201025074HAMMADHRNo ratings yet

- Chapter-5 Analysis of Financial Statement: Statement of Profit & Loss Account For The Year Ended 31 MarchDocument5 pagesChapter-5 Analysis of Financial Statement: Statement of Profit & Loss Account For The Year Ended 31 MarchAcchu RNo ratings yet

- Balance Sheet (December 31, 2008)Document6 pagesBalance Sheet (December 31, 2008)anon_14459No ratings yet

- UploadDocument83 pagesUploadAli BMSNo ratings yet

- Statements of Financial Position As at December 31 Assets Current AssetsDocument8 pagesStatements of Financial Position As at December 31 Assets Current AssetsCalix CasanovaNo ratings yet

- Financial ReportsDocument14 pagesFinancial Reportssardar amanat aliHadian00rNo ratings yet

- Unaudited Summary Consolidated and Separate Financial StatementsDocument2 pagesUnaudited Summary Consolidated and Separate Financial Statementsbentilwilliams65No ratings yet

- Financial Statement 2017 - 2019Document14 pagesFinancial Statement 2017 - 2019Audi Imam LazuardiNo ratings yet

- Balance Sheet As at 31 March 2022 Profit and Loss Account For The Year Ended 31 March 2022Document1 pageBalance Sheet As at 31 March 2022 Profit and Loss Account For The Year Ended 31 March 2022burhan mattooNo ratings yet

- Accounts May 20 Ver 4Document66 pagesAccounts May 20 Ver 4Abdurrehman ShaheenNo ratings yet

- ATA IMS - Q3 2023 Ended 31 Dec 2022 270223 (Final)Document15 pagesATA IMS - Q3 2023 Ended 31 Dec 2022 270223 (Final)eunjoNo ratings yet

- Antler Fabric Printers (PVT) LTD 2016Document37 pagesAntler Fabric Printers (PVT) LTD 2016IsuruNo ratings yet

- Blackstone 22Q1 Press Release and PresentationDocument41 pagesBlackstone 22Q1 Press Release and Presentation魏xxxappleNo ratings yet

- Beximco Pharmaceuticals Limited Statement of Financial PositionDocument55 pagesBeximco Pharmaceuticals Limited Statement of Financial Positionrimon dasNo ratings yet

- Consolicated PL AccountDocument1 pageConsolicated PL AccountDarshan KumarNo ratings yet

- SPL - 3rd QTR BL-PNL-DEC 2018-2019 (Full)Document17 pagesSPL - 3rd QTR BL-PNL-DEC 2018-2019 (Full)MedulNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- J.K. Lasser's Small Business Taxes 2007: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2007: Your Complete Guide to a Better Bottom LineNo ratings yet

- 2018 Audited Financial StatementsDocument1 page2018 Audited Financial StatementsKaystain Chris IhemeNo ratings yet

- Normal - Slickline ManualDocument3 pagesNormal - Slickline ManualKaystain Chris IhemeNo ratings yet

- 2018 Quarter 2 Financials PDFDocument1 page2018 Quarter 2 Financials PDFKaystain Chris IhemeNo ratings yet

- 2019 Quarter 1 FInancial StatementsDocument1 page2019 Quarter 1 FInancial StatementsKaystain Chris IhemeNo ratings yet

- 2019 Quarter 2 FInancial StatementsDocument1 page2019 Quarter 2 FInancial StatementsKaystain Chris IhemeNo ratings yet

- Judgement Prayers PDF-1Document7 pagesJudgement Prayers PDF-1Kaystain Chris IhemeNo ratings yet

- Samsung Galaxy A52Document3 pagesSamsung Galaxy A52Viraldi LowdiansyahNo ratings yet

- HRMS Compensation and BenefitsDocument790 pagesHRMS Compensation and Benefitsmallikarjun50% (2)

- Spotlight On Benefits Report - Indonesia All IndustriesDocument46 pagesSpotlight On Benefits Report - Indonesia All IndustriesebacemanNo ratings yet

- CB2 CMP Upgrade 2022Document84 pagesCB2 CMP Upgrade 2022Linh TinhNo ratings yet

- Insurance NewDocument3 pagesInsurance Newkrishna salesNo ratings yet

- 51 0205 Retiree Enrollment Guide 2023Document56 pages51 0205 Retiree Enrollment Guide 2023Benhamou AllanNo ratings yet

- Tan v. CA, 174 SCRA 403 (1989)Document5 pagesTan v. CA, 174 SCRA 403 (1989)KristineSherikaChyNo ratings yet

- DL3 Sde 0905Document4 pagesDL3 Sde 0905md. alamNo ratings yet

- Metro Manila Transit v. Cuevas (167797)Document3 pagesMetro Manila Transit v. Cuevas (167797)Josef MacanasNo ratings yet

- Bhopal City Link LimitedDocument50 pagesBhopal City Link LimitedSAM RAHULNo ratings yet

- Motor Insurance Amendment Form - Updated May 2023Document1 pageMotor Insurance Amendment Form - Updated May 2023bibi138913No ratings yet

- Week 2 Quarter 2 GenmathDocument83 pagesWeek 2 Quarter 2 Genmathjohn umiponNo ratings yet

- 18 - Filipinas Cia. de Seguros Vs Christen Huenfeld 89 Phil 54 (1951)Document3 pages18 - Filipinas Cia. de Seguros Vs Christen Huenfeld 89 Phil 54 (1951)hainako3718No ratings yet

- Risk Management - ITCDocument65 pagesRisk Management - ITCVenugopal VutukuruNo ratings yet

- History of Insurance: Ancient EraDocument43 pagesHistory of Insurance: Ancient EraSarvagya GuptaNo ratings yet

- Handicraft Entrepreneurship Development in The Republic of UzbekistanDocument9 pagesHandicraft Entrepreneurship Development in The Republic of UzbekistanresearchparksNo ratings yet

- Town of Woodstock: Financial Activities and Information TechnologyDocument26 pagesTown of Woodstock: Financial Activities and Information TechnologyTony AdamisNo ratings yet

- 10 - Tr12methodnotesDocument9 pages10 - Tr12methodnotesapi-198396065No ratings yet

- TVS Jupiter InsuranceDocument2 pagesTVS Jupiter InsurancekarteekguptaaNo ratings yet

- Zenith Vs CADocument2 pagesZenith Vs CAAnonymous 5MiN6I78I0No ratings yet

- Decinal LiabilityDocument3 pagesDecinal LiabilityDale McBurnieNo ratings yet

- Actuary India July Final WebDocument36 pagesActuary India July Final Webyash mallNo ratings yet

- Management Information System Lect 2 - Application in ServiceDocument40 pagesManagement Information System Lect 2 - Application in ServiceSagar100% (7)

- Ifrs 4 Practical Guide PDFDocument5 pagesIfrs 4 Practical Guide PDFAdrianaNo ratings yet

- Week 7 Chapter 15Document27 pagesWeek 7 Chapter 15Ogweno OgwenoNo ratings yet

- THIS CONSTRUCTION AGREEMENT, Herein Referred To The "Agreement," and BeingDocument13 pagesTHIS CONSTRUCTION AGREEMENT, Herein Referred To The "Agreement," and BeingMohit DudhmogreNo ratings yet

- Revised Instructions To TenderersDocument22 pagesRevised Instructions To TenderersAbir MohammadNo ratings yet

- 10 Cases, Book IV Labor CodeDocument28 pages10 Cases, Book IV Labor CodeMikaelGo-OngNo ratings yet

- Insurance and Pension PlansDocument9 pagesInsurance and Pension PlansKazzi ColmenarNo ratings yet