Professional Documents

Culture Documents

HSBC Statement

HSBC Statement

Uploaded by

manfred hoglCopyright:

Available Formats

You might also like

- Your Barclays Bank Account StatementDocument1 pageYour Barclays Bank Account StatementTuma NiceNo ratings yet

- Santander Bank Statement BankStatements - Net 1Document3 pagesSantander Bank Statement BankStatements - Net 1FlaymRXZNo ratings yet

- Account Statement HSBC 25JT Euro PDFDocument1 pageAccount Statement HSBC 25JT Euro PDFagni wardhana100% (7)

- HSBC Bank StatementDocument1 pageHSBC Bank StatementJanet Jane100% (3)

- Barclays Bank Statement 3Document3 pagesBarclays Bank Statement 3zainab100% (2)

- Nationwide Bank StatementDocument1 pageNationwide Bank Statementwilliams edwards100% (1)

- Lloyds Bank StatementDocument4 pagesLloyds Bank StatementEve PawleyNo ratings yet

- Monzo Bank StatementDocument3 pagesMonzo Bank StatementBradley Adam50% (6)

- Statement 20150506Document6 pagesStatement 20150506Anastasia Sandu100% (2)

- Natwest StatementDocument2 pagesNatwest Statementshahid2opu100% (4)

- Statement 02-AUG-19 AC 40963607 PDFDocument4 pagesStatement 02-AUG-19 AC 40963607 PDFDanielNo ratings yet

- 2021 07 24 - Statement 1.pdf PDF ExpertDocument2 pages2021 07 24 - Statement 1.pdf PDF ExpertMiki CristinaNo ratings yet

- Bank Barclays StatementDocument2 pagesBank Barclays StatementTuma Nice100% (1)

- Business Bank Statement Lloyds Bank Bank - 231213 - 200928Document2 pagesBusiness Bank Statement Lloyds Bank Bank - 231213 - 200928snelu1178100% (1)

- Statement 27-DEC-19 AC 50127558 - 1 PDFDocument4 pagesStatement 27-DEC-19 AC 50127558 - 1 PDFEbuka Oye80% (5)

- Your Everyday Saver StatementDocument2 pagesYour Everyday Saver StatementDoris Zhao100% (3)

- Statement 21-NOV-22 AC 03013375 23042820Document3 pagesStatement 21-NOV-22 AC 03013375 23042820Vitor BinghamNo ratings yet

- 2023 08 31 - Statement 1Document2 pages2023 08 31 - Statement 1ranielysilvaukNo ratings yet

- Business Account Statement: MR John Doe 20 Sherwood ST, London W1F 7edDocument5 pagesBusiness Account Statement: MR John Doe 20 Sherwood ST, London W1F 7edOmar BouayadNo ratings yet

- UK Natwest Statement - 2 - 3Document2 pagesUK Natwest Statement - 2 - 3shahid2opu33% (3)

- HSBC Bank Statement1Document1 pageHSBC Bank Statement1dongmingNo ratings yet

- HSBC Bank AccountDocument3 pagesHSBC Bank Accountvan tien le100% (1)

- PayMe NocDocument2 pagesPayMe NocS. ShekharNo ratings yet

- A Project Report On Credit AppraisalDocument167 pagesA Project Report On Credit AppraisalParm Sidhu40% (5)

- Statement 10123 16046773 18 12 2021 18 01 2022Document1 pageStatement 10123 16046773 18 12 2021 18 01 2022louisa zhangNo ratings yet

- Barclays Original STDocument6 pagesBarclays Original STEsidor Palushi100% (1)

- 001.HSBC Bank StatementDocument1 page001.HSBC Bank Statement张慧萍No ratings yet

- HSBC IrelandDocument2 pagesHSBC Irelandshahid2opu100% (1)

- Your Statement: 20 May To 19 June 2021Document3 pagesYour Statement: 20 May To 19 June 2021Cristina Rotaru100% (1)

- Lloyds Bank11 PDFDocument2 pagesLloyds Bank11 PDFАнечка Бужинская100% (1)

- Your Statement: Your Bank Account DetailsDocument5 pagesYour Statement: Your Bank Account DetailsIvan Krutko75% (4)

- Statement Standarter 1523Document1 pageStatement Standarter 1523SW Project100% (1)

- 2019 07 02 - Statement PDFDocument9 pages2019 07 02 - Statement PDFGabriel LitaNo ratings yet

- Statement: Branch Details Your Current Details Period 2020 To 202Document6 pagesStatement: Branch Details Your Current Details Period 2020 To 202xxalias100% (1)

- Monzo Bank Statement 2020 08 08 133631Document4 pagesMonzo Bank Statement 2020 08 08 13363113KARATNo ratings yet

- Statement 16jul2020Document6 pagesStatement 16jul2020K DNo ratings yet

- Accounting: Level 1/2 Paper 1: Introduction To Bookkeeping and AccountingDocument18 pagesAccounting: Level 1/2 Paper 1: Introduction To Bookkeeping and AccountingshamNo ratings yet

- Statement: Foundation AccountDocument12 pagesStatement: Foundation AccountJN Adingra0% (1)

- Your Business Current Account: at A GlanceDocument5 pagesYour Business Current Account: at A GlanceAhsan ShabirNo ratings yet

- Statement 31-JUL-20 AC 33211541Document6 pagesStatement 31-JUL-20 AC 33211541meu pau67% (3)

- Statement: Albert FisherDocument3 pagesStatement: Albert FisherЮлия П100% (2)

- Statement: Business Current AccountDocument1 pageStatement: Business Current AccountGrace HillNo ratings yet

- List of Specified Income From Designated InvestmentsDocument3 pagesList of Specified Income From Designated InvestmentsOng Yong Xin, SeanneNo ratings yet

- 2022 06 04 - StatementDocument5 pages2022 06 04 - Statementmaria1983-2014100% (1)

- Current Account Statement - 14012021Document3 pagesCurrent Account Statement - 14012021Vassilios VarotsisNo ratings yet

- 2020 May StatementDocument1 page2020 May StatementPOPESCU BERTHA-ANDREEANo ratings yet

- Barclays Bank Credit Card PDFDocument3 pagesBarclays Bank Credit Card PDFMax Tan50% (2)

- Statement Standarter 1231Document1 pageStatement Standarter 1231SW ProjectNo ratings yet

- Your Statement: Mr. Dominic Abeita Dabb 77 Ballogie Avenue London NW10 1SUDocument3 pagesYour Statement: Mr. Dominic Abeita Dabb 77 Ballogie Avenue London NW10 1SUmeu pau100% (1)

- Statement: Branch Details Your Current Details PeriodDocument2 pagesStatement: Branch Details Your Current Details Periodxxalias100% (2)

- Statements PDFDocument6 pagesStatements PDFEdi ȘtefanNo ratings yet

- Statement 31-MAR-20 AC 33211541Document7 pagesStatement 31-MAR-20 AC 33211541meu pau100% (1)

- Statement: Branch Details Your Current Details Period 10 May 2019 To 10 June 2019Document2 pagesStatement: Branch Details Your Current Details Period 10 May 2019 To 10 June 2019Ali RAZANo ratings yet

- 2008 CrisisDocument60 pages2008 CrisisShreyansh SanchetiNo ratings yet

- WNL Sweden How Cash Became More Trouble Than Its Worth Adv PDFDocument3 pagesWNL Sweden How Cash Became More Trouble Than Its Worth Adv PDFPaula Daniela Labrin OpazoNo ratings yet

- Ed Ms DownloadDocument3 pagesEd Ms DownloadKevin WhitteNo ratings yet

- See Statements - Barclays Online BankingDocument5 pagesSee Statements - Barclays Online BankingRuhul AminNo ratings yet

- Statement Date 13 Feb 2018Document4 pagesStatement Date 13 Feb 2018tom arthur0% (1)

- Bank Statement HSBC BANKDocument1 pageBank Statement HSBC BANKTuma Nice67% (3)

- 3rd Jan - 2nd FebDocument4 pages3rd Jan - 2nd FebPrajakta JoshiNo ratings yet

- Statement 517057 86377450 17 04 2021 17 06 2021Document6 pagesStatement 517057 86377450 17 04 2021 17 06 2021Yeaze100% (1)

- Statement 28nov2014Document3 pagesStatement 28nov2014Daisy-May ParsonsNo ratings yet

- Clydesdale Bank Nov20 Lukasik UkDocument1 pageClydesdale Bank Nov20 Lukasik Ukjulien feuillet100% (1)

- Your Barclays Bank Account StatementDocument4 pagesYour Barclays Bank Account StatementAli RAZA100% (1)

- Statement-H895le ShopDocument1 pageStatement-H895le ShopDRISS TAZINo ratings yet

- 2024 01 19 - StatementDocument2 pages2024 01 19 - StatementjanmejaychhetriNo ratings yet

- CFAS Chapter 4 - Cash and Cash EquivalentsDocument3 pagesCFAS Chapter 4 - Cash and Cash EquivalentsAngelaMariePeñarandaNo ratings yet

- Final Exam ANT FINANCIAL CASE QuestionsDocument4 pagesFinal Exam ANT FINANCIAL CASE Questionsfideliadwiksa krisensiaNo ratings yet

- Mrunal's Economy Win22 Updates For UPSC & Other Competitive ExamsDocument21 pagesMrunal's Economy Win22 Updates For UPSC & Other Competitive ExamsTrial UserNo ratings yet

- Bancos Septiembre 29-09-2021Document193 pagesBancos Septiembre 29-09-2021MARIA LUISA CASTILLO MUÑOZNo ratings yet

- FXSumsDocument5 pagesFXSumsPRANJAL BANSALNo ratings yet

- Tibajia Vs CaDocument2 pagesTibajia Vs CaBrian Jonathan ParaanNo ratings yet

- Chapter 1 Introduction To Financial ManagementDocument30 pagesChapter 1 Introduction To Financial ManagementMark DavidNo ratings yet

- Historical Development of The Banking System in The PhilippinesDocument1 pageHistorical Development of The Banking System in The PhilippinesJane Sudario100% (1)

- UntitledDocument23 pagesUntitledaaaNo ratings yet

- 01 - ARIBA Bank Details Instruction - V2 - 2Document2 pages01 - ARIBA Bank Details Instruction - V2 - 2afzal taiNo ratings yet

- Assigment On Reliance Industry: Master of Business Administration (Talentedge)Document14 pagesAssigment On Reliance Industry: Master of Business Administration (Talentedge)Mayank MalhotraNo ratings yet

- Week 2 - Lecture NoteDocument33 pagesWeek 2 - Lecture NoteChip choiNo ratings yet

- Statement of Axis Account No:918010042472691 For The Period (From: 31-12-2020 To: 12-04-2021)Document3 pagesStatement of Axis Account No:918010042472691 For The Period (From: 31-12-2020 To: 12-04-2021)nareshvenusNo ratings yet

- Mohamed O - The Role of Commercial Banks in Economic Development in KenyaDocument58 pagesMohamed O - The Role of Commercial Banks in Economic Development in KenyaVY PHAN LÊ HÀNo ratings yet

- G30 Reviving and Restructuring The Corporate Sector Post CovidDocument88 pagesG30 Reviving and Restructuring The Corporate Sector Post Covidnuria.balogun3176No ratings yet

- Syllabus BANK-MANAGEMENT-AND-FINANCIAL-SERVICES-huytpDocument8 pagesSyllabus BANK-MANAGEMENT-AND-FINANCIAL-SERVICES-huytpPhạm Thúy HằngNo ratings yet

- Airtel Bill - July 2023Document2 pagesAirtel Bill - July 2023jaideep singhNo ratings yet

- All Journal Entries PDFDocument1 pageAll Journal Entries PDFyahye ahmedNo ratings yet

- Jul Statement FinalDocument3 pagesJul Statement FinalAbdul HadiNo ratings yet

- Wells Fargo 200Document5 pagesWells Fargo 200sam ujuNo ratings yet

- A Foreign Exchange OperationsDocument131 pagesA Foreign Exchange OperationsNiamNo ratings yet

- September Montly Rep 2020Document22 pagesSeptember Montly Rep 2020meskerem hailuNo ratings yet

- Brand Architecture Strategy - IDFC BankDocument7 pagesBrand Architecture Strategy - IDFC BankHarendra KumarNo ratings yet

- About Kotak - Devanshi InterviewDocument5 pagesAbout Kotak - Devanshi InterviewRamneek Singh ChawlaNo ratings yet

HSBC Statement

HSBC Statement

Uploaded by

manfred hoglOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

HSBC Statement

HSBC Statement

Uploaded by

manfred hoglCopyright:

Available Formats

Contact tel 03457 404 404

see reverse for call times

Text phone 03457 125 563

used by deaf or speech impaired customers

www.hsbc.co.uk

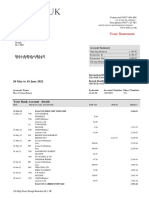

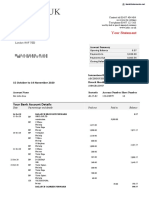

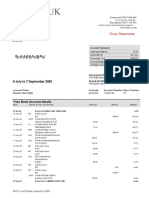

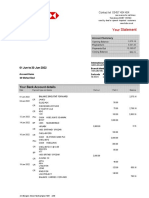

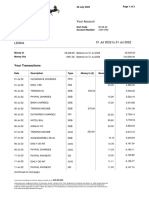

Your Statement

Mr M Bianco

89 Gordon House

Glamis Road

London

E1W 3ED Account Summary

Ope ning Balance 3,61 9.43

Paym e nts In 2,082.17

Paym e nts Out 30.00

Clos ing Balance 5,671.60

.

International Bank Account Number

GB20HBUK40020801692682

13 July to 12 September 2020 Branch Identifier Code

HBUKGB4105T

Acco unt Nam e S o rtcode Acco unt Num ber S he e t Num be r

Mr Mario Bianco 40-02-08 01692682 32

Your Bank Account details

Date Pay m e nt t y p e and de t ails Paid o ut Paid in Balance

A

12 Jul 20 BALANCE BROUGHT FORWARD . 3,619.43

16 Jul 20 CR PRET A MANGER 236.06 3,855.49

23 Jul 20 CR PRET A MANGER 241.02 4,096.51

30 Jul 20 CR PRET A MANGER 236.06 4,332.57

06 Aug 20 CR PRET A MANGER 246.21 4,578.78

13 Aug 20 CR PRET A MANGER 241.02 4,819.80

20 Aug 20 CR PRET A MANGER 236.06 5,055.86

21 Aug 20 BP Mario

Monzo Bank 30.00 5,025.86

27 Aug 20 CR PRET A MANGER 236.26 5,262.12

03 Sep 20 CR PRET A MANGER 246.47 5,508.59

10 Sep 20 CR PRET A MANGER 163.01 5,671.60

12 Sep 20 BALANCE CARRIED FORWARD 5,671.60

Info rmatio n abo ut the Financial S e rvice s Co mpe ns atio n Sche m e

Your deposit is eligible for protection under the Financial Services Compensation Scheme (FSCS). For further information

about the compensation provided by the FSCS, refer to the FSCS website at www.FSCS.org.uk, call into your nearest branch

or call your telephone banking service. Further details can be found on the FSCS Information Sheet and Exclusions List

which is available on our website (www.hsbc.co.uk).

AER Arrange d Ove rdraft EAR

Cre dit Inte re s t Rate s b alance variab le Inte re s t Rate s b alance variable

Cre dit inte re s t is not paid upto 25 0.00%

ove r 25 39.90%

455 Strand London WC2R 0RH

Commercial Banking Customers Overdrafts

Arranged overdraft: Where you ask us for an overdraft before making

Interest and Charges any transactions that take your account overdrawn, or over your current

[Your] Business Banking Terms and Conditions cover how and when we arranged overdraft limit.

can charge our interest rates and charges.

Unarranged overdraft: When you make a payment that takes your

Details of Debit interest together with details of the interest rate we pay account overdrawn if you don’t have an arranged overdraft, or takes your

and charge in full [for all accounts] are available in [our] Business Price account over your arranged overdraft limit.

List. All [our] business current accounts are non-interest bearing when in

credit unless we individually agree a rate with you. Effective from 14 March 2020

Overdrafts: Monthly cap on unarranged overdraft charges

1. Each current account will set a monthly maximum charge for:

Arranged overdraft:

Where you ask us for an overdraft before making any transactions that (a) going overdrawn when you have not arranged an overdraft; or

takes your account overdrawn, or over your current arranged overdraft (b) going over/past your arranged overdraft limit (if you have one).

limit. Interest rates are individually agreed, for a period of 12 months, 2. This cap covers any:

and are linked to the Bank of England base rate. For details of our fees

and charges, please refer to our Business Price List – see Additional (a) interest and fees for going over/past your arranged overdraft limit;

Information below. (b) fees for each payment your bank allows despite lack of funds; and

Unarranged overdraft: (c) fees for each payment your bank refuses due to lack of funds.

When you make a payment that takes your account overdrawn if you The monthly cap on unarranged overdraft charges for the HSBC Advance

don’t have an arranged overdraft limit, or takes your account over your Bank Account, HSBC Bank Account, HSBC Current Account, Home

arranged overdraft limit. When you don’t have an arranged overdraft Management Account and HSBC Graduate Bank Account is £20.

limit, we will charge our Business Standard Debit Interest Rate on any The monthly cap on unarranged overdraft charges is not applicable to

balances. When you have an existing arranged overdraft limit and go over Bank Account Pay Monthly, Basic Bank Account, Student Bank Account,

this limit, we will charge interest at the rate we have agreed with you Amanah Bank Account and MyAccount as these accounts do not incur

on the balance of your arranged overdraft limit and will charge Standard unarranged overdraft charges.

Debit Interest Rate on any balance over your arranged overdraft facility.

In either of these circumstances, unarranged overdraft charges will be Unarranged overdraft charges incurred before 14 March 2020 may debit

applied on each working day that your account is overdrawn (if you don’t your account after this date (we’ll still give advance notice). Charges

have an arranged overdraft) or you go over your arranged overdraft limit incurred before 14 March 2020 won’t count towards the new £20 cap as

(if you have an arranged overdraft). For details of our fees and charges, they’ll relate to the previous month’s charging period.

please see our Business Price List and for information on our Interest Your debit card

Rates, see Additional Information below. When you use your card outside the UK, your statement will show

Your debit card where the transaction took place, the amount spent in foreign currency

For debit card charges and how foreign currency transactions are and the amount converted into sterling. We also monitor transactions to

converted to sterling please refer to the Business Price List. protect you against your card being used fraudulently. Unless you agree

that the currency conversion is done at the point of sale or withdrawal

Additional Information and agree the rate at that time, for example with the shopkeeper or

A copy of [our] Business Price List and the Business Banking Terms and on the self-service machine screen, the exchange rate that applies to

Conditions can be found on our website any foreign currency debit card payments (including cash withdrawals)

www.business.hsbc.uk/en-gb/gb/generic/legal-information. is the VISA Payment Scheme Exchange Rate applying on the day the

Information on our Interest Rates can be found on our website conversion is made. For foreign currency transactions we will charge a

www.business.hsbc.uk/en-gb/interest-rates/interest-rates- fee of 2.75% of the amount of the transaction. This fee will be shown

finance-borrowing. as a separate line on your statement as a ‘Foreign Currency Transaction

Fee’. Details of the current VISA Payment Scheme Exchange Rates

This information is also available in our branches, by calling can be obtained from the card support section of hsbc.co.uk or by

03457 60 60 60 (lines are open GMT 8am to 10pm, Monday to Sunday) calling us on the usual numbers. We will deduct the payment from your

or by textphone 0345 12 55 63. [Details of the interest rates we pay and account once we receive details of the payment from the card scheme,

charge are also separately available through these channels.] at the latest, the next working day. For cash machine withdrawals in a

To help us continuously improve our service and in the interests of currency other than sterling we will charge a Non Sterling Cash Fee of

security, we may monitor and/or record your telephone calls with us. 2% (minimum £1.75, maximum £5). This fee applies to all cash machines

outside the UK, and to cash machines in the UK, if we convert the

Personal Banking Customers withdrawal to Sterling for you. HSBC Advance customers are exempt

Interest from this fee. Some cash machine operators may apply a direct charge

Credit Interest is calculated daily on the cleared credit balance and is for withdrawals from their cash machines and this will be advised on

paid monthly if applicable (this is not paid on all accounts, e.g. Basic screen at the time of withdrawal.

Bank Account, Bank Account and HSBC Advance). For personal current

accounts, overdraft interest is charged on the whole overdraft balance

above any interest free amount. Debit interest is calculated daily on the

cleared debit balance of your account, it accrues during your charging

cycle (usually monthly) and is deducted from your account following the

end of your charging cycle.

Commercial and Personal Banking Customers

Lost and Stolen Cards

If any of your cards are lost or stolen please call 0800 032 7075 or if you are calling from outside the UK, please call us on +44 1442 422 929.

Lines are open 24 hours.

Dispute Resolution

If you have a problem with your agreement, please try to resolve it with us in the first instance. If you are not happy with the way in which we handled

your complaint or the result, you may be able to complain to the Financial Ombudsman Service. If you do not take up your problem with us first you will

not be entitled to complain to the Ombudsman. We can provide details of how to contact the Ombudsman.

Disabled Customers

We offer a number of services such as statements in Braille or large print. Please contact us by calling 03457 60 60 60 (lines are open GMT 8am to

10pm, Monday to Sunday) or textphone 0345 12 55 63 to let us know how we can serve you better.

HSBC UK Bank plc, registered in England and Wales number 09928412. Registered office 1 Centenary Square, Birmingham B1 1HQ.

Authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and the Prudential Regulation Authority under

reference number 765112.

RFB1023 MCP54584 ©HSBC Group 2019. All Rights Reserved.

You might also like

- Your Barclays Bank Account StatementDocument1 pageYour Barclays Bank Account StatementTuma NiceNo ratings yet

- Santander Bank Statement BankStatements - Net 1Document3 pagesSantander Bank Statement BankStatements - Net 1FlaymRXZNo ratings yet

- Account Statement HSBC 25JT Euro PDFDocument1 pageAccount Statement HSBC 25JT Euro PDFagni wardhana100% (7)

- HSBC Bank StatementDocument1 pageHSBC Bank StatementJanet Jane100% (3)

- Barclays Bank Statement 3Document3 pagesBarclays Bank Statement 3zainab100% (2)

- Nationwide Bank StatementDocument1 pageNationwide Bank Statementwilliams edwards100% (1)

- Lloyds Bank StatementDocument4 pagesLloyds Bank StatementEve PawleyNo ratings yet

- Monzo Bank StatementDocument3 pagesMonzo Bank StatementBradley Adam50% (6)

- Statement 20150506Document6 pagesStatement 20150506Anastasia Sandu100% (2)

- Natwest StatementDocument2 pagesNatwest Statementshahid2opu100% (4)

- Statement 02-AUG-19 AC 40963607 PDFDocument4 pagesStatement 02-AUG-19 AC 40963607 PDFDanielNo ratings yet

- 2021 07 24 - Statement 1.pdf PDF ExpertDocument2 pages2021 07 24 - Statement 1.pdf PDF ExpertMiki CristinaNo ratings yet

- Bank Barclays StatementDocument2 pagesBank Barclays StatementTuma Nice100% (1)

- Business Bank Statement Lloyds Bank Bank - 231213 - 200928Document2 pagesBusiness Bank Statement Lloyds Bank Bank - 231213 - 200928snelu1178100% (1)

- Statement 27-DEC-19 AC 50127558 - 1 PDFDocument4 pagesStatement 27-DEC-19 AC 50127558 - 1 PDFEbuka Oye80% (5)

- Your Everyday Saver StatementDocument2 pagesYour Everyday Saver StatementDoris Zhao100% (3)

- Statement 21-NOV-22 AC 03013375 23042820Document3 pagesStatement 21-NOV-22 AC 03013375 23042820Vitor BinghamNo ratings yet

- 2023 08 31 - Statement 1Document2 pages2023 08 31 - Statement 1ranielysilvaukNo ratings yet

- Business Account Statement: MR John Doe 20 Sherwood ST, London W1F 7edDocument5 pagesBusiness Account Statement: MR John Doe 20 Sherwood ST, London W1F 7edOmar BouayadNo ratings yet

- UK Natwest Statement - 2 - 3Document2 pagesUK Natwest Statement - 2 - 3shahid2opu33% (3)

- HSBC Bank Statement1Document1 pageHSBC Bank Statement1dongmingNo ratings yet

- HSBC Bank AccountDocument3 pagesHSBC Bank Accountvan tien le100% (1)

- PayMe NocDocument2 pagesPayMe NocS. ShekharNo ratings yet

- A Project Report On Credit AppraisalDocument167 pagesA Project Report On Credit AppraisalParm Sidhu40% (5)

- Statement 10123 16046773 18 12 2021 18 01 2022Document1 pageStatement 10123 16046773 18 12 2021 18 01 2022louisa zhangNo ratings yet

- Barclays Original STDocument6 pagesBarclays Original STEsidor Palushi100% (1)

- 001.HSBC Bank StatementDocument1 page001.HSBC Bank Statement张慧萍No ratings yet

- HSBC IrelandDocument2 pagesHSBC Irelandshahid2opu100% (1)

- Your Statement: 20 May To 19 June 2021Document3 pagesYour Statement: 20 May To 19 June 2021Cristina Rotaru100% (1)

- Lloyds Bank11 PDFDocument2 pagesLloyds Bank11 PDFАнечка Бужинская100% (1)

- Your Statement: Your Bank Account DetailsDocument5 pagesYour Statement: Your Bank Account DetailsIvan Krutko75% (4)

- Statement Standarter 1523Document1 pageStatement Standarter 1523SW Project100% (1)

- 2019 07 02 - Statement PDFDocument9 pages2019 07 02 - Statement PDFGabriel LitaNo ratings yet

- Statement: Branch Details Your Current Details Period 2020 To 202Document6 pagesStatement: Branch Details Your Current Details Period 2020 To 202xxalias100% (1)

- Monzo Bank Statement 2020 08 08 133631Document4 pagesMonzo Bank Statement 2020 08 08 13363113KARATNo ratings yet

- Statement 16jul2020Document6 pagesStatement 16jul2020K DNo ratings yet

- Accounting: Level 1/2 Paper 1: Introduction To Bookkeeping and AccountingDocument18 pagesAccounting: Level 1/2 Paper 1: Introduction To Bookkeeping and AccountingshamNo ratings yet

- Statement: Foundation AccountDocument12 pagesStatement: Foundation AccountJN Adingra0% (1)

- Your Business Current Account: at A GlanceDocument5 pagesYour Business Current Account: at A GlanceAhsan ShabirNo ratings yet

- Statement 31-JUL-20 AC 33211541Document6 pagesStatement 31-JUL-20 AC 33211541meu pau67% (3)

- Statement: Albert FisherDocument3 pagesStatement: Albert FisherЮлия П100% (2)

- Statement: Business Current AccountDocument1 pageStatement: Business Current AccountGrace HillNo ratings yet

- List of Specified Income From Designated InvestmentsDocument3 pagesList of Specified Income From Designated InvestmentsOng Yong Xin, SeanneNo ratings yet

- 2022 06 04 - StatementDocument5 pages2022 06 04 - Statementmaria1983-2014100% (1)

- Current Account Statement - 14012021Document3 pagesCurrent Account Statement - 14012021Vassilios VarotsisNo ratings yet

- 2020 May StatementDocument1 page2020 May StatementPOPESCU BERTHA-ANDREEANo ratings yet

- Barclays Bank Credit Card PDFDocument3 pagesBarclays Bank Credit Card PDFMax Tan50% (2)

- Statement Standarter 1231Document1 pageStatement Standarter 1231SW ProjectNo ratings yet

- Your Statement: Mr. Dominic Abeita Dabb 77 Ballogie Avenue London NW10 1SUDocument3 pagesYour Statement: Mr. Dominic Abeita Dabb 77 Ballogie Avenue London NW10 1SUmeu pau100% (1)

- Statement: Branch Details Your Current Details PeriodDocument2 pagesStatement: Branch Details Your Current Details Periodxxalias100% (2)

- Statements PDFDocument6 pagesStatements PDFEdi ȘtefanNo ratings yet

- Statement 31-MAR-20 AC 33211541Document7 pagesStatement 31-MAR-20 AC 33211541meu pau100% (1)

- Statement: Branch Details Your Current Details Period 10 May 2019 To 10 June 2019Document2 pagesStatement: Branch Details Your Current Details Period 10 May 2019 To 10 June 2019Ali RAZANo ratings yet

- 2008 CrisisDocument60 pages2008 CrisisShreyansh SanchetiNo ratings yet

- WNL Sweden How Cash Became More Trouble Than Its Worth Adv PDFDocument3 pagesWNL Sweden How Cash Became More Trouble Than Its Worth Adv PDFPaula Daniela Labrin OpazoNo ratings yet

- Ed Ms DownloadDocument3 pagesEd Ms DownloadKevin WhitteNo ratings yet

- See Statements - Barclays Online BankingDocument5 pagesSee Statements - Barclays Online BankingRuhul AminNo ratings yet

- Statement Date 13 Feb 2018Document4 pagesStatement Date 13 Feb 2018tom arthur0% (1)

- Bank Statement HSBC BANKDocument1 pageBank Statement HSBC BANKTuma Nice67% (3)

- 3rd Jan - 2nd FebDocument4 pages3rd Jan - 2nd FebPrajakta JoshiNo ratings yet

- Statement 517057 86377450 17 04 2021 17 06 2021Document6 pagesStatement 517057 86377450 17 04 2021 17 06 2021Yeaze100% (1)

- Statement 28nov2014Document3 pagesStatement 28nov2014Daisy-May ParsonsNo ratings yet

- Clydesdale Bank Nov20 Lukasik UkDocument1 pageClydesdale Bank Nov20 Lukasik Ukjulien feuillet100% (1)

- Your Barclays Bank Account StatementDocument4 pagesYour Barclays Bank Account StatementAli RAZA100% (1)

- Statement-H895le ShopDocument1 pageStatement-H895le ShopDRISS TAZINo ratings yet

- 2024 01 19 - StatementDocument2 pages2024 01 19 - StatementjanmejaychhetriNo ratings yet

- CFAS Chapter 4 - Cash and Cash EquivalentsDocument3 pagesCFAS Chapter 4 - Cash and Cash EquivalentsAngelaMariePeñarandaNo ratings yet

- Final Exam ANT FINANCIAL CASE QuestionsDocument4 pagesFinal Exam ANT FINANCIAL CASE Questionsfideliadwiksa krisensiaNo ratings yet

- Mrunal's Economy Win22 Updates For UPSC & Other Competitive ExamsDocument21 pagesMrunal's Economy Win22 Updates For UPSC & Other Competitive ExamsTrial UserNo ratings yet

- Bancos Septiembre 29-09-2021Document193 pagesBancos Septiembre 29-09-2021MARIA LUISA CASTILLO MUÑOZNo ratings yet

- FXSumsDocument5 pagesFXSumsPRANJAL BANSALNo ratings yet

- Tibajia Vs CaDocument2 pagesTibajia Vs CaBrian Jonathan ParaanNo ratings yet

- Chapter 1 Introduction To Financial ManagementDocument30 pagesChapter 1 Introduction To Financial ManagementMark DavidNo ratings yet

- Historical Development of The Banking System in The PhilippinesDocument1 pageHistorical Development of The Banking System in The PhilippinesJane Sudario100% (1)

- UntitledDocument23 pagesUntitledaaaNo ratings yet

- 01 - ARIBA Bank Details Instruction - V2 - 2Document2 pages01 - ARIBA Bank Details Instruction - V2 - 2afzal taiNo ratings yet

- Assigment On Reliance Industry: Master of Business Administration (Talentedge)Document14 pagesAssigment On Reliance Industry: Master of Business Administration (Talentedge)Mayank MalhotraNo ratings yet

- Week 2 - Lecture NoteDocument33 pagesWeek 2 - Lecture NoteChip choiNo ratings yet

- Statement of Axis Account No:918010042472691 For The Period (From: 31-12-2020 To: 12-04-2021)Document3 pagesStatement of Axis Account No:918010042472691 For The Period (From: 31-12-2020 To: 12-04-2021)nareshvenusNo ratings yet

- Mohamed O - The Role of Commercial Banks in Economic Development in KenyaDocument58 pagesMohamed O - The Role of Commercial Banks in Economic Development in KenyaVY PHAN LÊ HÀNo ratings yet

- G30 Reviving and Restructuring The Corporate Sector Post CovidDocument88 pagesG30 Reviving and Restructuring The Corporate Sector Post Covidnuria.balogun3176No ratings yet

- Syllabus BANK-MANAGEMENT-AND-FINANCIAL-SERVICES-huytpDocument8 pagesSyllabus BANK-MANAGEMENT-AND-FINANCIAL-SERVICES-huytpPhạm Thúy HằngNo ratings yet

- Airtel Bill - July 2023Document2 pagesAirtel Bill - July 2023jaideep singhNo ratings yet

- All Journal Entries PDFDocument1 pageAll Journal Entries PDFyahye ahmedNo ratings yet

- Jul Statement FinalDocument3 pagesJul Statement FinalAbdul HadiNo ratings yet

- Wells Fargo 200Document5 pagesWells Fargo 200sam ujuNo ratings yet

- A Foreign Exchange OperationsDocument131 pagesA Foreign Exchange OperationsNiamNo ratings yet

- September Montly Rep 2020Document22 pagesSeptember Montly Rep 2020meskerem hailuNo ratings yet

- Brand Architecture Strategy - IDFC BankDocument7 pagesBrand Architecture Strategy - IDFC BankHarendra KumarNo ratings yet

- About Kotak - Devanshi InterviewDocument5 pagesAbout Kotak - Devanshi InterviewRamneek Singh ChawlaNo ratings yet