Professional Documents

Culture Documents

ICICI Direct - Research Report

ICICI Direct - Research Report

Uploaded by

Mudit KediaCopyright:

Available Formats

You might also like

- Netflix Equity Analysis ReportDocument15 pagesNetflix Equity Analysis Reportapi-739767325No ratings yet

- Prestige Estates - Initiating coverage-Oct-23-NUVAMADocument54 pagesPrestige Estates - Initiating coverage-Oct-23-NUVAMAalfaresearch1No ratings yet

- Demarcus Key - Press ReleaseDocument2 pagesDemarcus Key - Press ReleaseJavon WilliamsNo ratings yet

- Frost and Sullivan - Prefab MarketDocument171 pagesFrost and Sullivan - Prefab MarketMudit Kedia100% (1)

- India Electric Motor Market - 2017Document178 pagesIndia Electric Motor Market - 2017Mudit Kedia100% (1)

- Digital Marketing AssignmentDocument15 pagesDigital Marketing AssignmentRIYA JAIN76% (21)

- 500 Days of SummerDocument3 pages500 Days of SummerWilliam BehNo ratings yet

- Real Santa PDFDocument1 pageReal Santa PDFionutNo ratings yet

- Balaji - IndsecDocument6 pagesBalaji - IndsecMudit KediaNo ratings yet

- Dish TV (Dishtv) : Bracing For Next Leg of GrowthDocument21 pagesDish TV (Dishtv) : Bracing For Next Leg of GrowthMeghna ParekhNo ratings yet

- IDirect SunTV Q2FY22Document7 pagesIDirect SunTV Q2FY22Sarah AliceNo ratings yet

- Motilal Oswal PVR Q2FY21 Result UpdateDocument12 pagesMotilal Oswal PVR Q2FY21 Result Updateumaj25No ratings yet

- Havells India: Added Aspirational PortfolioDocument10 pagesHavells India: Added Aspirational PortfolioDinesh ChoudharyNo ratings yet

- PVR LTD: Healthy PerformanceDocument9 pagesPVR LTD: Healthy PerformanceGaurav KherodiaNo ratings yet

- Everest Case Study - Team ZenithDocument9 pagesEverest Case Study - Team ZenithRohan CoelhoNo ratings yet

- Wabco India (WABIND) : Higher Content Per Vehicle To Fuel Growth!Document5 pagesWabco India (WABIND) : Higher Content Per Vehicle To Fuel Growth!darshanmadeNo ratings yet

- Axiata Group BHD: Company ReportDocument6 pagesAxiata Group BHD: Company Reportlimml63No ratings yet

- UT V Software (UTVSOF) : Unlocking Value..Document7 pagesUT V Software (UTVSOF) : Unlocking Value..api-19978586No ratings yet

- TCPL Packaging LTD: Environment Friendly GrowthDocument17 pagesTCPL Packaging LTD: Environment Friendly Growthswati choudharyNo ratings yet

- Nocil LTD (Nocil) : Industry Leader Well Poised For Growth..Document6 pagesNocil LTD (Nocil) : Industry Leader Well Poised For Growth..greyistariNo ratings yet

- Bosch LTD (BOSLIM) : Multiple Variables Drag Margins!Document13 pagesBosch LTD (BOSLIM) : Multiple Variables Drag Margins!SahanaNo ratings yet

- Cochin Shipyard LTD - : A Robust Play On India DefenceDocument14 pagesCochin Shipyard LTD - : A Robust Play On India DefencepremNo ratings yet

- Bharti Airtel: CMP: INR349 TP: INR420 (+20%) Stability EmergingDocument14 pagesBharti Airtel: CMP: INR349 TP: INR420 (+20%) Stability EmergingDivyansh SinghNo ratings yet

- Bosch LTD: Investment RationaleDocument10 pagesBosch LTD: Investment RationaleBharti PuratanNo ratings yet

- Action Construction Equipment: Turn-Around On The CardsDocument21 pagesAction Construction Equipment: Turn-Around On The CardsGirish S ReddyNo ratings yet

- Ashiana Housing (ASHHOU) : New Geographies Transition To Drive GrowthDocument7 pagesAshiana Housing (ASHHOU) : New Geographies Transition To Drive GrowthNikhilKapoor29No ratings yet

- Music BroadcastDocument12 pagesMusic BroadcastSBNo ratings yet

- C1. Netflix S 2020 Strategy For Battling RivalsDocument27 pagesC1. Netflix S 2020 Strategy For Battling RivalsregulacionesandorraNo ratings yet

- Crompton Gr. Con: CMP: INR455Document28 pagesCrompton Gr. Con: CMP: INR455Jayash KaushalNo ratings yet

- Ceat LTD: India - Auto AncillariesDocument13 pagesCeat LTD: India - Auto AncillariesNeeraj KumarNo ratings yet

- Zee Entertainment (ZEEENT) : Strong Show Future Portends Heavy SpendingDocument13 pagesZee Entertainment (ZEEENT) : Strong Show Future Portends Heavy SpendingAshokNo ratings yet

- SL AL: The HISAB School of AccountancyDocument1 pageSL AL: The HISAB School of AccountancySR TGNo ratings yet

- SS Report 2 March 11Document32 pagesSS Report 2 March 11ankush10186No ratings yet

- Atul LTD Buy Report IIFLDocument6 pagesAtul LTD Buy Report IIFLBhaveek OstwalNo ratings yet

- AngelBrokingResearch TTK Prestige Inititatingcoverage 17082018Document14 pagesAngelBrokingResearch TTK Prestige Inititatingcoverage 17082018Pancham HegishteNo ratings yet

- PVR LTD: Strong Fundamentals To Withstand UncertaintiesDocument4 pagesPVR LTD: Strong Fundamentals To Withstand UncertaintiesVinay HonnattiNo ratings yet

- IDirect Symphony Q2FY22Document8 pagesIDirect Symphony Q2FY22darshanmaldeNo ratings yet

- AIA-Engineering-Limited 27 QuarterUpdateDocument12 pagesAIA-Engineering-Limited 27 QuarterUpdatevalueinvestor123No ratings yet

- Vinati Organics LTD: Expansions and New Project To Drive Earnings GrowthDocument6 pagesVinati Organics LTD: Expansions and New Project To Drive Earnings GrowthBhaveek OstwalNo ratings yet

- Systematix Apollo Pipes Initiating CoverageDocument27 pagesSystematix Apollo Pipes Initiating Coveragebhairav singhNo ratings yet

- Balajitelefilms 181001052043Document31 pagesBalajitelefilms 181001052043Rohit rajeNo ratings yet

- Ashoka BuildconDocument11 pagesAshoka Buildconpritish070No ratings yet

- HFCL - Initiating Coverage - KSL 210521Document14 pagesHFCL - Initiating Coverage - KSL 210521Dhiren DesaiNo ratings yet

- Shemaroo Entertainment Multibagger Stock PicDocument19 pagesShemaroo Entertainment Multibagger Stock PicArunesh SinghNo ratings yet

- Dolby Laboratories - Henry Fund PDFDocument32 pagesDolby Laboratories - Henry Fund PDFKsl VajralaNo ratings yet

- JSW Energy: Fully PricedDocument13 pagesJSW Energy: Fully Pricedmihir_ajNo ratings yet

- Reliance Communication Ltd.Document2 pagesReliance Communication Ltd.ratika_bvpNo ratings yet

- 09january2024 India DailyDocument64 pages09january2024 India Dailypradeep kumarNo ratings yet

- Greaves +angel+ +04+01+10Document6 pagesGreaves +angel+ +04+01+10samaussieNo ratings yet

- Access Research ReportDocument8 pagesAccess Research ReporthaffaNo ratings yet

- Suprajit IC Oct23 LKPDocument23 pagesSuprajit IC Oct23 LKPpp3794386No ratings yet

- Dish TV India: CMP: Inr74 TP: INR90 (+22%) BuyDocument12 pagesDish TV India: CMP: Inr74 TP: INR90 (+22%) BuyPrashantNo ratings yet

- IDirect PGElectroplast ManagementMeetDocument7 pagesIDirect PGElectroplast ManagementMeetbharat.divineNo ratings yet

- Ugly Duckling On A Seamless Growth Path: Key PointsDocument5 pagesUgly Duckling On A Seamless Growth Path: Key PointsamolgadiyaNo ratings yet

- 354466122018909bharat Forge LTD Q4FY18 Result Updates - SignedDocument5 pages354466122018909bharat Forge LTD Q4FY18 Result Updates - Signedakshara pradeepNo ratings yet

- Power Grid: CMP: Inr197 Expect Strong Double-Digit Irrs in TBCB ProjectsDocument12 pagesPower Grid: CMP: Inr197 Expect Strong Double-Digit Irrs in TBCB ProjectsdcoolsamNo ratings yet

- Ashok Leyland: Preparing To Reap Fruits When The Recovery StartsDocument10 pagesAshok Leyland: Preparing To Reap Fruits When The Recovery StartsKiran KudtarkarNo ratings yet

- Bhansali Engineering Polymers - 34 AGM HighlightsDocument4 pagesBhansali Engineering Polymers - 34 AGM HighlightsAbhinav SrivastavaNo ratings yet

- Britannia Industries - Initiating coverage-Jan-16-EDEL PDFDocument58 pagesBritannia Industries - Initiating coverage-Jan-16-EDEL PDFRecrea8 EntertainmentNo ratings yet

- Media and Entertainment Industry BriefDocument11 pagesMedia and Entertainment Industry Briefrutveek shahNo ratings yet

- Tanla - Update - Jul23 - HSIE-202307191442519944993Document13 pagesTanla - Update - Jul23 - HSIE-202307191442519944993jatin khannaNo ratings yet

- Faze Three Initial (HDFC)Document11 pagesFaze Three Initial (HDFC)beza manojNo ratings yet

- Indo Count: (Indcou)Document5 pagesIndo Count: (Indcou)Romelu MartialNo ratings yet

- Cipla 20100827 Mosl Cu pg008Document8 pagesCipla 20100827 Mosl Cu pg008Niraj SinghNo ratings yet

- AngelBrokingResearch AshokLayland 1QFY2016RU 140815 PDFDocument11 pagesAngelBrokingResearch AshokLayland 1QFY2016RU 140815 PDFAbhishek SinhaNo ratings yet

- Valuable OSS - Delivering a Return on Your Investment in Operational Support Systems (OSS)From EverandValuable OSS - Delivering a Return on Your Investment in Operational Support Systems (OSS)No ratings yet

- Glencore: Management Transition Accelerating?Document31 pagesGlencore: Management Transition Accelerating?Mudit KediaNo ratings yet

- Global Motor Market - Outlook 2020Document151 pagesGlobal Motor Market - Outlook 2020Mudit KediaNo ratings yet

- Glencore: Revised Guidance Highlights Cash Flow Underpin. BUYDocument13 pagesGlencore: Revised Guidance Highlights Cash Flow Underpin. BUYMudit KediaNo ratings yet

- Essar Bulk Terminal (Salaya) LimitedDocument30 pagesEssar Bulk Terminal (Salaya) LimitedMudit KediaNo ratings yet

- MSKA & Associates (Formerly Known As MZSK & Associates)Document35 pagesMSKA & Associates (Formerly Known As MZSK & Associates)Mudit KediaNo ratings yet

- List of MSOs PDFDocument117 pagesList of MSOs PDFMudit KediaNo ratings yet

- Essar Bulk Terminal Paradip LimitedDocument33 pagesEssar Bulk Terminal Paradip LimitedMudit KediaNo ratings yet

- Chetinad - Cement AR 2015Document72 pagesChetinad - Cement AR 2015Mudit KediaNo ratings yet

- Ar Cy 2014 PDFDocument270 pagesAr Cy 2014 PDFMudit KediaNo ratings yet

- Ar Cy 2015 PDFDocument258 pagesAr Cy 2015 PDFMudit KediaNo ratings yet

- Annual Report FY'19Document300 pagesAnnual Report FY'19Mudit KediaNo ratings yet

- Ar Cy 2013 PDFDocument274 pagesAr Cy 2013 PDFMudit KediaNo ratings yet

- Annual Report FY'18Document190 pagesAnnual Report FY'18Mudit KediaNo ratings yet

- ILO - India - 2019Document31 pagesILO - India - 2019Mudit KediaNo ratings yet

- Annual Report FY'17Document304 pagesAnnual Report FY'17Mudit KediaNo ratings yet

- Latin American LiteratureDocument23 pagesLatin American Literaturesafego companyNo ratings yet

- Biol 1002 Exam2 NotesDocument21 pagesBiol 1002 Exam2 NotesJashayla GillespieNo ratings yet

- Atal Bihari VajpayeeDocument33 pagesAtal Bihari VajpayeeFiraFfirehsNo ratings yet

- Present ProgressiveDocument5 pagesPresent ProgressiveGeraldineC.PáezHNo ratings yet

- Mapping The Value StreamDocument8 pagesMapping The Value StreamMahipal Singh RatnuNo ratings yet

- Chronic DiarrheaDocument47 pagesChronic DiarrheaAly MorsyNo ratings yet

- 3 ConceptualDesignPhaseDocument12 pages3 ConceptualDesignPhaseNgọc YếnNo ratings yet

- The Primary Purpose of Corporate Leadership Is To Create Wealth Legally and EthicallyDocument43 pagesThe Primary Purpose of Corporate Leadership Is To Create Wealth Legally and EthicallyrampunjaniNo ratings yet

- Pusheen Pastel LlaveroDocument4 pagesPusheen Pastel Llaverotjred4No ratings yet

- Ryan Beitel ResumeDocument2 pagesRyan Beitel Resumeapi-371068740No ratings yet

- Defining The Future of Monofocals.: Model: DIB00Document2 pagesDefining The Future of Monofocals.: Model: DIB00jajajNo ratings yet

- The Organizational Career - Not Dead But in Need of Redefinition (Clarke, M. 2012)Document21 pagesThe Organizational Career - Not Dead But in Need of Redefinition (Clarke, M. 2012)Pickle_PumpkinNo ratings yet

- P4 Revision Handout - 2017Document14 pagesP4 Revision Handout - 2017Dlamini SiceloNo ratings yet

- Practic Kopia OCRDocument140 pagesPractic Kopia OCRMichał MiszaNo ratings yet

- Management of Hypersensitivity ReactionDocument6 pagesManagement of Hypersensitivity Reactionmbeng bessonganyiNo ratings yet

- Ch.1 - Introduction: Study Guide To Accompany Operating Systems Concepts 9Document7 pagesCh.1 - Introduction: Study Guide To Accompany Operating Systems Concepts 9John Fredy Redondo MoreloNo ratings yet

- Lab Manual 2.3 - LEVEL 0 - Determination of Metacentric HeightDocument6 pagesLab Manual 2.3 - LEVEL 0 - Determination of Metacentric HeightMuhamad IzzanNo ratings yet

- Understanding The Nigerian Public Service RulesDocument7 pagesUnderstanding The Nigerian Public Service RulesVicktor100% (1)

- Sampling Final Revision 2023Document16 pagesSampling Final Revision 2023Bbb AaNo ratings yet

- Cats PDFDocument44 pagesCats PDFAbdul WahabNo ratings yet

- Doru Costache - Glimpses of A Symbolic Anthropology 4Document2 pagesDoru Costache - Glimpses of A Symbolic Anthropology 4Doru CostacheNo ratings yet

- Family Law II NotesDocument10 pagesFamily Law II NotesAnirudh SoodNo ratings yet

- AAPSI For CY 2016 - CPD COPY FOR GCG COMPLIANCE PDFDocument123 pagesAAPSI For CY 2016 - CPD COPY FOR GCG COMPLIANCE PDFLyka Mae Palarca IrangNo ratings yet

- 1Document9 pages1JONUS DSOUZANo ratings yet

- Final Project IkbalDocument60 pagesFinal Project Ikbalikbal666No ratings yet

- Cost & Management AccountingDocument77 pagesCost & Management AccountingDhanaperumal VarulaNo ratings yet

ICICI Direct - Research Report

ICICI Direct - Research Report

Uploaded by

Mudit KediaOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

ICICI Direct - Research Report

ICICI Direct - Research Report

Uploaded by

Mudit KediaCopyright:

Available Formats

Management Meet Note

April 26, 2017

Rating matrix

Rating

Target

:

:

Unrated

NA

Balaji Telefims (BALTEL) | 103

Target Period : NA

Potential Upside : NA

Betting on digital play...

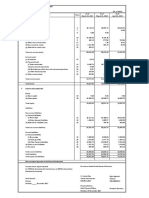

Key financials

We met the management of Balaji Telefilms (BTL) to get a deeper insight

| Crore FY14 FY15 FY16 9MFY17

Net Sales 407.5 346.5 292.8 262.9

into its strategies for coming years. BTL is one of the leading production

EBITDA (21.8) 6.1 5.9 (23.7) houses that distributes content to general entertainment channels (GEC)

Net Profit (17.2) 5.6 2.7 (30.1) and is also coming out with niche content for its OTT offering Alt Digital.

EPS (|) (2.6) 0.9 0.4 (4.0) Recently launched Alt Digital; remains focus area

Balaji recently launched its OTT platform called Alt Digital, which would

Valuation summary

be offering 250 hours of annual original programming across genres and

(x) FY13 FY14 FY15 FY16

undertaking a capex of | 300 crore towards content for the coming three

P/E 45.9 NA 119.0 277.1

EV / EBITDA 95.9 (35.4) 127.0 129.8

years. The content would be designed with primary focus on top 50 cities

P/BV 1.9 2.0 2.0 1.5 with an aim to tap the urban and suburban population. The management

RoCE (%) 0.0 (7.3) (0.6) (0.7) is targeting a million subscribers by year end and ~4-5 million

RoNW (%) 3.6 (4.5) 1.5 0.5 subscribers by 2020. The platform is based on a subscription based

model with pricing at | 90 per month (pm) while introductory pricing is at

Stock data an attractive | 300 for a year. The pricing is much lower compared to

Particular Amount | 500 pm by Netflix & | 499 per year by Amazon Prime. Further, Alt Balaji

Market Capitalization (| Crore) 778.7 can be streamed simultaneously on five devices and entails entertainment

Total Debt (FY16) (| Crore) - for the entire family at a single cost.

Cash (FY16) (| Crore) 17.3

EV (| Crore) 761.4 Balaji certainly has an edge over competitors such as Amazon Prime &

52 week H/L 120 / 73 Netflix with regard to original India based content owing to its rich lineage

Equity capital (| crore) 15.2 of home based content to TV for the last two decades. Content

Face value 2.0 distribution from the OTT platform will help it to own the content IP as

well the consumer. However, monetisation of content, based on

Price Chart popularity of the shows, could be a challenge given the availability of

10,000 160 several other free (advertisement based) niche OTT players.

9,000 140 Healthy show line-up for TV production; scaling down movie business

8,000

120 The company has been providing premium content to leading GECs such

7,000

6,000 100

as Star Plus, Zee TV, etc for an average realisation of ~| 25 lakh per hour

5,000 80

4,000 of content. The company is currently running ~eight to 10 shows on TV

60

3,000 and earns ~16-17% EBITDA margin from the segment. BTL expects

40

2,000 sustainable growth from the segment. On the movie production business,

1,000 20

0 0

the company intends to scale down given the relatively higher risk and

Jul-15 Dec-15 Jun-16 Nov-16 Apr-17 the company’s limited success in the field.

Price (R.H.S) Nifty (L.H.S)

Digital business performance to remain key monitorable

Balaji is aggressively investing in its digital platform (~| 165 crore/year

Research Analysts towards content, marketing & other expense over next three years) to be

funded by a mix of internal accruals & external funding. We wait to see

Bhupendra Tiwary

investments bear fruit in an era of hyper competition (major global OTT

bhupendra.tiwary@icicisecurities.com

players such as Netflix, Amazon along with domestic broadcasters betting

Sneha Agarwal

big) and a huge plethora of free content available across platforms.

sneha.agarwal@icicisecurities.com

Exhibit 1: Key Financials

| crore FY12 FY13 FY14 FY15 FY16

Net Sales 187.8 186.0 407.5 346.5 292.8

EBITDA (0.4) 8.0 (21.8) 6.1 5.9

PAT 20.4 14.6 -17.2 5.6 2.7

EPS (|) 3.1 2.2 (2.6) 0.9 0.4

P/E (x) 33 46 NA 119 277

Price / Book (x) 2.0 1.9 2.0 2.0 1.5

EV/EBITDA (x) -1,880.1 95.9 -35.4 127.0 129.8

RoCE (%) (1.9) 0.0 (7.3) (0.6) (0.7)

RoE (%) 5.2 3.6 -4.5 1.5 0.5

Source: Company, Capitaline, ICICIdirect.com Research

ICICI Securities Ltd | Retail Equity Research

Exhibit 2: Key Financials

450.0 407.5

400.0 346.5

350.0

292.8

300.0

250.0

187.8 186.0

200.0

150.0

100.0

50.0

0.0

-50.0 FY12 FY13 FY14 FY15 FY16

Net Sales EBITDA PAT

Source: Company, ICICIdirect.com Research

Exhibit 3: Operating margins trend Exhibit 4: Return ratios trend

6.0 6.0

5.2

4.0 4.3 4.0 3.6

2.0 1.5

2.0 1.8 2.0

- 0.0 0.5

- (0.6) (0.7)

(0.2)

(%)

(%)

(2.0) FY12 (1.9) FY13 FY14 FY15 FY16

FY12 FY13 FY14 FY15 FY16

(2.0)

(4.0) -4.5

(4.0) (6.0)

(5.3) (7.3)

(6.0) (8.0)

EBITDA (%) RoCE (%) RoE (%)

Source: Capitaline, ICICIdirect.com Research Source: Capitaline, ICICIdirect.com Research

Exhibit 5: Revenue break-up (FY16)

Other Operating

Sale from managing

Income, 3%

events, 4%

Sale of Film rights,

8%

Commissioned

Sales, 85%

Source: FY16 Annual report, ICICIdirect.com Research

The company derives majority of its revenues from the sale of

commissioned programming and earned | 249.6 crore from the segment

in FY16. The segment is a steady business and would continue to witness

mid to high teens growth based on the number of shows and realisations

earned.

ICICI Securities Ltd | Retail Equity Research Page 2

RATING RATIONALE

ICICIdirect.com endeavours to provide objective opinions and recommendations. ICICIdirect.com assigns

ratings to its stocks according to their notional target price vs. current market price and then categorises them

as Strong Buy, Buy, Hold and Sell. The performance horizon is two years unless specified and the notional

target price is defined as the analysts' valuation for a stock.

Strong Buy: >15%/20% for large caps/midcaps, respectively, with high conviction;

Buy: >10%/15% for large caps/midcaps, respectively;

Hold: Up to +/-10%;

Sell: -10% or more;

Pankaj Pandey Head – Research pankaj.pandey@icicisecurities.com

ICICIdirect.com Research Desk,

ICICI Securities Limited,

1st Floor, Akruti Trade Centre,

Road No 7, MIDC,

Andheri (East)

Mumbai – 400 093

research@icicidirect.com

ICICI Securities Ltd | Retail Equity Research Page 3

ANALYST CERTIFICATION

We /I, Bhupendra Tiwary MBA, Sneha Agarwal, MBA Research Analysts, authors and the names subscribed to this report, hereby certify that all of the views expressed in this research report accurately

reflect our views about the subject issuer(s) or securities. We also certify that no part of our compensation was, is, or will be directly or indirectly related to the specific recommendation(s) or view(s) in this

report.

Terms & conditions and other disclosures:

ICICI Securities Limited (ICICI Securities) is a full-service, integrated investment banking and is, inter alia, engaged in the business of stock brokering and distribution of financial products. ICICI Securities

Limited is a Sebi registered Research Analyst with Sebi Registration Number – INH000000990. ICICI Securities is a wholly-owned subsidiary of ICICI Bank which is India’s largest private sector bank and has

its various subsidiaries engaged in businesses of housing finance, asset management, life insurance, general insurance, venture capital fund management, etc. (“associates”), the details in respect of which

are available on www.icicibank.com.

ICICI Securities is one of the leading merchant bankers/ underwriters of securities and participate in virtually all securities trading markets in India. We and our associates might have investment banking

and other business relationship with a significant percentage of companies covered by our Investment Research Department. ICICI Securities generally prohibits its analysts, persons reporting to analysts

and their relatives from maintaining a financial interest in the securities or derivatives of any companies that the analysts cover.

The information and opinions in this report have been prepared by ICICI Securities and are subject to change without any notice. The report and information contained herein is strictly confidential and

meant solely for the selected recipient and may not be altered in any way, transmitted to, copied or distributed, in part or in whole, to any other person or to the media or reproduced in any form, without

prior written consent of ICICI Securities. While we would endeavour to update the information herein on a reasonable basis, ICICI Securities is under no obligation to update or keep the information current.

Also, there may be regulatory, compliance or other reasons that may prevent ICICI Securities from doing so. Non-rated securities indicate that rating on a particular security has been suspended

temporarily and such suspension is in compliance with applicable regulations and/or ICICI Securities policies, in circumstances where ICICI Securities might be acting in an advisory capacity to this

company, or in certain other circumstances.

This report is based on information obtained from public sources and sources believed to be reliable, but no independent verification has been made nor is its accuracy or completeness guaranteed. This

report and information herein is solely for informational purpose and shall not be used or considered as an offer document or solicitation of offer to buy or sell or subscribe for securities or other financial

instruments. Though disseminated to all the customers simultaneously, not all customers may receive this report at the same time. ICICI Securities will not treat recipients as customers by virtue of their

receiving this report. Nothing in this report constitutes investment, legal, accounting and tax advice or a representation that any investment or strategy is suitable or appropriate to your specific

circumstances. The securities discussed and opinions expressed in this report may not be suitable for all investors, who must make their own investment decisions, based on their own investment

objectives, financial positions and needs of specific recipient. This may not be taken in substitution for the exercise of independent judgment by any recipient. The recipient should independently evaluate

the investment risks. The value and return on investment may vary because of changes in interest rates, foreign exchange rates or any other reason. ICICI Securities accepts no liabilities whatsoever for any

loss or damage of any kind arising out of the use of this report. Past performance is not necessarily a guide to future performance. Investors are advised to see Risk Disclosure Document to understand the

risks associated before investing in the securities markets. Actual results may differ materially from those set forth in projections. Forward-looking statements are not predictions and may be subject to

change without notice.

ICICI Securities or its associates might have managed or co-managed public offering of securities for the subject company or might have been mandated by the subject company for any other assignment

in the past twelve months.

ICICI Securities or its associates might have received any compensation from the companies mentioned in the report during the period preceding twelve months from the date of this report for services in

respect of managing or co-managing public offerings, corporate finance, investment banking or merchant banking, brokerage services or other advisory service in a merger or specific transaction.

ICICI Securities or its associates might have received any compensation for products or services other than investment banking or merchant banking or brokerage services from the companies mentioned

in the report in the past twelve months.

ICICI Securities encourages independence in research report preparation and strives to minimize conflict in preparation of research report. ICICI Securities or its associates or its analysts did not receive any

compensation or other benefits from the companies mentioned in the report or third party in connection with preparation of the research report. Accordingly, neither ICICI Securities nor Research Analysts

and their relatives have any material conflict of interest at the time of publication of this report.

It is confirmed that Bhupendra Tiwary MBA, Sneha Agarwal, MBA, Research Analysts of this report have not received any compensation from the companies mentioned in the report in the preceding

twelve months.

Compensation of our Research Analysts is not based on any specific merchant banking, investment banking or brokerage service transactions.

ICICI Securities or its subsidiaries collectively or Research Analysts or their relatives do not own 1% or more of the equity securities of the Company mentioned in the report as of the last day of the month

preceding the publication of the research report.

Since associates of ICICI Securities are engaged in various financial service businesses, they might have financial interests or beneficial ownership in various companies including the subject

company/companies mentioned in this report.

It is confirmed that Bhupendra Tiwary MBA, Sneha Agarwal, MBA, Research Analysts do not serve as an officer, director or employee of the companies mentioned in the report.

ICICI Securities may have issued other reports that are inconsistent with and reach different conclusion from the information presented in this report.

Neither the Research Analysts nor ICICI Securities have been engaged in market making activity for the companies mentioned in the report.

We submit that no material disciplinary action has been taken on ICICI Securities by any Regulatory Authority impacting Equity Research Analysis activities.

This report is not directed or intended for distribution to, or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or other jurisdiction, where such distribution,

publication, availability or use would be contrary to law, regulation or which would subject ICICI Securities and affiliates to any registration or licensing requirement within such jurisdiction. The securities

described herein may or may not be eligible for sale in all jurisdictions or to certain category of investors. Persons in whose possession this document may come are required to inform themselves of and

to observe such restriction.

ICICI Securities Ltd | Retail Equity Research Page 4

You might also like

- Netflix Equity Analysis ReportDocument15 pagesNetflix Equity Analysis Reportapi-739767325No ratings yet

- Prestige Estates - Initiating coverage-Oct-23-NUVAMADocument54 pagesPrestige Estates - Initiating coverage-Oct-23-NUVAMAalfaresearch1No ratings yet

- Demarcus Key - Press ReleaseDocument2 pagesDemarcus Key - Press ReleaseJavon WilliamsNo ratings yet

- Frost and Sullivan - Prefab MarketDocument171 pagesFrost and Sullivan - Prefab MarketMudit Kedia100% (1)

- India Electric Motor Market - 2017Document178 pagesIndia Electric Motor Market - 2017Mudit Kedia100% (1)

- Digital Marketing AssignmentDocument15 pagesDigital Marketing AssignmentRIYA JAIN76% (21)

- 500 Days of SummerDocument3 pages500 Days of SummerWilliam BehNo ratings yet

- Real Santa PDFDocument1 pageReal Santa PDFionutNo ratings yet

- Balaji - IndsecDocument6 pagesBalaji - IndsecMudit KediaNo ratings yet

- Dish TV (Dishtv) : Bracing For Next Leg of GrowthDocument21 pagesDish TV (Dishtv) : Bracing For Next Leg of GrowthMeghna ParekhNo ratings yet

- IDirect SunTV Q2FY22Document7 pagesIDirect SunTV Q2FY22Sarah AliceNo ratings yet

- Motilal Oswal PVR Q2FY21 Result UpdateDocument12 pagesMotilal Oswal PVR Q2FY21 Result Updateumaj25No ratings yet

- Havells India: Added Aspirational PortfolioDocument10 pagesHavells India: Added Aspirational PortfolioDinesh ChoudharyNo ratings yet

- PVR LTD: Healthy PerformanceDocument9 pagesPVR LTD: Healthy PerformanceGaurav KherodiaNo ratings yet

- Everest Case Study - Team ZenithDocument9 pagesEverest Case Study - Team ZenithRohan CoelhoNo ratings yet

- Wabco India (WABIND) : Higher Content Per Vehicle To Fuel Growth!Document5 pagesWabco India (WABIND) : Higher Content Per Vehicle To Fuel Growth!darshanmadeNo ratings yet

- Axiata Group BHD: Company ReportDocument6 pagesAxiata Group BHD: Company Reportlimml63No ratings yet

- UT V Software (UTVSOF) : Unlocking Value..Document7 pagesUT V Software (UTVSOF) : Unlocking Value..api-19978586No ratings yet

- TCPL Packaging LTD: Environment Friendly GrowthDocument17 pagesTCPL Packaging LTD: Environment Friendly Growthswati choudharyNo ratings yet

- Nocil LTD (Nocil) : Industry Leader Well Poised For Growth..Document6 pagesNocil LTD (Nocil) : Industry Leader Well Poised For Growth..greyistariNo ratings yet

- Bosch LTD (BOSLIM) : Multiple Variables Drag Margins!Document13 pagesBosch LTD (BOSLIM) : Multiple Variables Drag Margins!SahanaNo ratings yet

- Cochin Shipyard LTD - : A Robust Play On India DefenceDocument14 pagesCochin Shipyard LTD - : A Robust Play On India DefencepremNo ratings yet

- Bharti Airtel: CMP: INR349 TP: INR420 (+20%) Stability EmergingDocument14 pagesBharti Airtel: CMP: INR349 TP: INR420 (+20%) Stability EmergingDivyansh SinghNo ratings yet

- Bosch LTD: Investment RationaleDocument10 pagesBosch LTD: Investment RationaleBharti PuratanNo ratings yet

- Action Construction Equipment: Turn-Around On The CardsDocument21 pagesAction Construction Equipment: Turn-Around On The CardsGirish S ReddyNo ratings yet

- Ashiana Housing (ASHHOU) : New Geographies Transition To Drive GrowthDocument7 pagesAshiana Housing (ASHHOU) : New Geographies Transition To Drive GrowthNikhilKapoor29No ratings yet

- Music BroadcastDocument12 pagesMusic BroadcastSBNo ratings yet

- C1. Netflix S 2020 Strategy For Battling RivalsDocument27 pagesC1. Netflix S 2020 Strategy For Battling RivalsregulacionesandorraNo ratings yet

- Crompton Gr. Con: CMP: INR455Document28 pagesCrompton Gr. Con: CMP: INR455Jayash KaushalNo ratings yet

- Ceat LTD: India - Auto AncillariesDocument13 pagesCeat LTD: India - Auto AncillariesNeeraj KumarNo ratings yet

- Zee Entertainment (ZEEENT) : Strong Show Future Portends Heavy SpendingDocument13 pagesZee Entertainment (ZEEENT) : Strong Show Future Portends Heavy SpendingAshokNo ratings yet

- SL AL: The HISAB School of AccountancyDocument1 pageSL AL: The HISAB School of AccountancySR TGNo ratings yet

- SS Report 2 March 11Document32 pagesSS Report 2 March 11ankush10186No ratings yet

- Atul LTD Buy Report IIFLDocument6 pagesAtul LTD Buy Report IIFLBhaveek OstwalNo ratings yet

- AngelBrokingResearch TTK Prestige Inititatingcoverage 17082018Document14 pagesAngelBrokingResearch TTK Prestige Inititatingcoverage 17082018Pancham HegishteNo ratings yet

- PVR LTD: Strong Fundamentals To Withstand UncertaintiesDocument4 pagesPVR LTD: Strong Fundamentals To Withstand UncertaintiesVinay HonnattiNo ratings yet

- IDirect Symphony Q2FY22Document8 pagesIDirect Symphony Q2FY22darshanmaldeNo ratings yet

- AIA-Engineering-Limited 27 QuarterUpdateDocument12 pagesAIA-Engineering-Limited 27 QuarterUpdatevalueinvestor123No ratings yet

- Vinati Organics LTD: Expansions and New Project To Drive Earnings GrowthDocument6 pagesVinati Organics LTD: Expansions and New Project To Drive Earnings GrowthBhaveek OstwalNo ratings yet

- Systematix Apollo Pipes Initiating CoverageDocument27 pagesSystematix Apollo Pipes Initiating Coveragebhairav singhNo ratings yet

- Balajitelefilms 181001052043Document31 pagesBalajitelefilms 181001052043Rohit rajeNo ratings yet

- Ashoka BuildconDocument11 pagesAshoka Buildconpritish070No ratings yet

- HFCL - Initiating Coverage - KSL 210521Document14 pagesHFCL - Initiating Coverage - KSL 210521Dhiren DesaiNo ratings yet

- Shemaroo Entertainment Multibagger Stock PicDocument19 pagesShemaroo Entertainment Multibagger Stock PicArunesh SinghNo ratings yet

- Dolby Laboratories - Henry Fund PDFDocument32 pagesDolby Laboratories - Henry Fund PDFKsl VajralaNo ratings yet

- JSW Energy: Fully PricedDocument13 pagesJSW Energy: Fully Pricedmihir_ajNo ratings yet

- Reliance Communication Ltd.Document2 pagesReliance Communication Ltd.ratika_bvpNo ratings yet

- 09january2024 India DailyDocument64 pages09january2024 India Dailypradeep kumarNo ratings yet

- Greaves +angel+ +04+01+10Document6 pagesGreaves +angel+ +04+01+10samaussieNo ratings yet

- Access Research ReportDocument8 pagesAccess Research ReporthaffaNo ratings yet

- Suprajit IC Oct23 LKPDocument23 pagesSuprajit IC Oct23 LKPpp3794386No ratings yet

- Dish TV India: CMP: Inr74 TP: INR90 (+22%) BuyDocument12 pagesDish TV India: CMP: Inr74 TP: INR90 (+22%) BuyPrashantNo ratings yet

- IDirect PGElectroplast ManagementMeetDocument7 pagesIDirect PGElectroplast ManagementMeetbharat.divineNo ratings yet

- Ugly Duckling On A Seamless Growth Path: Key PointsDocument5 pagesUgly Duckling On A Seamless Growth Path: Key PointsamolgadiyaNo ratings yet

- 354466122018909bharat Forge LTD Q4FY18 Result Updates - SignedDocument5 pages354466122018909bharat Forge LTD Q4FY18 Result Updates - Signedakshara pradeepNo ratings yet

- Power Grid: CMP: Inr197 Expect Strong Double-Digit Irrs in TBCB ProjectsDocument12 pagesPower Grid: CMP: Inr197 Expect Strong Double-Digit Irrs in TBCB ProjectsdcoolsamNo ratings yet

- Ashok Leyland: Preparing To Reap Fruits When The Recovery StartsDocument10 pagesAshok Leyland: Preparing To Reap Fruits When The Recovery StartsKiran KudtarkarNo ratings yet

- Bhansali Engineering Polymers - 34 AGM HighlightsDocument4 pagesBhansali Engineering Polymers - 34 AGM HighlightsAbhinav SrivastavaNo ratings yet

- Britannia Industries - Initiating coverage-Jan-16-EDEL PDFDocument58 pagesBritannia Industries - Initiating coverage-Jan-16-EDEL PDFRecrea8 EntertainmentNo ratings yet

- Media and Entertainment Industry BriefDocument11 pagesMedia and Entertainment Industry Briefrutveek shahNo ratings yet

- Tanla - Update - Jul23 - HSIE-202307191442519944993Document13 pagesTanla - Update - Jul23 - HSIE-202307191442519944993jatin khannaNo ratings yet

- Faze Three Initial (HDFC)Document11 pagesFaze Three Initial (HDFC)beza manojNo ratings yet

- Indo Count: (Indcou)Document5 pagesIndo Count: (Indcou)Romelu MartialNo ratings yet

- Cipla 20100827 Mosl Cu pg008Document8 pagesCipla 20100827 Mosl Cu pg008Niraj SinghNo ratings yet

- AngelBrokingResearch AshokLayland 1QFY2016RU 140815 PDFDocument11 pagesAngelBrokingResearch AshokLayland 1QFY2016RU 140815 PDFAbhishek SinhaNo ratings yet

- Valuable OSS - Delivering a Return on Your Investment in Operational Support Systems (OSS)From EverandValuable OSS - Delivering a Return on Your Investment in Operational Support Systems (OSS)No ratings yet

- Glencore: Management Transition Accelerating?Document31 pagesGlencore: Management Transition Accelerating?Mudit KediaNo ratings yet

- Global Motor Market - Outlook 2020Document151 pagesGlobal Motor Market - Outlook 2020Mudit KediaNo ratings yet

- Glencore: Revised Guidance Highlights Cash Flow Underpin. BUYDocument13 pagesGlencore: Revised Guidance Highlights Cash Flow Underpin. BUYMudit KediaNo ratings yet

- Essar Bulk Terminal (Salaya) LimitedDocument30 pagesEssar Bulk Terminal (Salaya) LimitedMudit KediaNo ratings yet

- MSKA & Associates (Formerly Known As MZSK & Associates)Document35 pagesMSKA & Associates (Formerly Known As MZSK & Associates)Mudit KediaNo ratings yet

- List of MSOs PDFDocument117 pagesList of MSOs PDFMudit KediaNo ratings yet

- Essar Bulk Terminal Paradip LimitedDocument33 pagesEssar Bulk Terminal Paradip LimitedMudit KediaNo ratings yet

- Chetinad - Cement AR 2015Document72 pagesChetinad - Cement AR 2015Mudit KediaNo ratings yet

- Ar Cy 2014 PDFDocument270 pagesAr Cy 2014 PDFMudit KediaNo ratings yet

- Ar Cy 2015 PDFDocument258 pagesAr Cy 2015 PDFMudit KediaNo ratings yet

- Annual Report FY'19Document300 pagesAnnual Report FY'19Mudit KediaNo ratings yet

- Ar Cy 2013 PDFDocument274 pagesAr Cy 2013 PDFMudit KediaNo ratings yet

- Annual Report FY'18Document190 pagesAnnual Report FY'18Mudit KediaNo ratings yet

- ILO - India - 2019Document31 pagesILO - India - 2019Mudit KediaNo ratings yet

- Annual Report FY'17Document304 pagesAnnual Report FY'17Mudit KediaNo ratings yet

- Latin American LiteratureDocument23 pagesLatin American Literaturesafego companyNo ratings yet

- Biol 1002 Exam2 NotesDocument21 pagesBiol 1002 Exam2 NotesJashayla GillespieNo ratings yet

- Atal Bihari VajpayeeDocument33 pagesAtal Bihari VajpayeeFiraFfirehsNo ratings yet

- Present ProgressiveDocument5 pagesPresent ProgressiveGeraldineC.PáezHNo ratings yet

- Mapping The Value StreamDocument8 pagesMapping The Value StreamMahipal Singh RatnuNo ratings yet

- Chronic DiarrheaDocument47 pagesChronic DiarrheaAly MorsyNo ratings yet

- 3 ConceptualDesignPhaseDocument12 pages3 ConceptualDesignPhaseNgọc YếnNo ratings yet

- The Primary Purpose of Corporate Leadership Is To Create Wealth Legally and EthicallyDocument43 pagesThe Primary Purpose of Corporate Leadership Is To Create Wealth Legally and EthicallyrampunjaniNo ratings yet

- Pusheen Pastel LlaveroDocument4 pagesPusheen Pastel Llaverotjred4No ratings yet

- Ryan Beitel ResumeDocument2 pagesRyan Beitel Resumeapi-371068740No ratings yet

- Defining The Future of Monofocals.: Model: DIB00Document2 pagesDefining The Future of Monofocals.: Model: DIB00jajajNo ratings yet

- The Organizational Career - Not Dead But in Need of Redefinition (Clarke, M. 2012)Document21 pagesThe Organizational Career - Not Dead But in Need of Redefinition (Clarke, M. 2012)Pickle_PumpkinNo ratings yet

- P4 Revision Handout - 2017Document14 pagesP4 Revision Handout - 2017Dlamini SiceloNo ratings yet

- Practic Kopia OCRDocument140 pagesPractic Kopia OCRMichał MiszaNo ratings yet

- Management of Hypersensitivity ReactionDocument6 pagesManagement of Hypersensitivity Reactionmbeng bessonganyiNo ratings yet

- Ch.1 - Introduction: Study Guide To Accompany Operating Systems Concepts 9Document7 pagesCh.1 - Introduction: Study Guide To Accompany Operating Systems Concepts 9John Fredy Redondo MoreloNo ratings yet

- Lab Manual 2.3 - LEVEL 0 - Determination of Metacentric HeightDocument6 pagesLab Manual 2.3 - LEVEL 0 - Determination of Metacentric HeightMuhamad IzzanNo ratings yet

- Understanding The Nigerian Public Service RulesDocument7 pagesUnderstanding The Nigerian Public Service RulesVicktor100% (1)

- Sampling Final Revision 2023Document16 pagesSampling Final Revision 2023Bbb AaNo ratings yet

- Cats PDFDocument44 pagesCats PDFAbdul WahabNo ratings yet

- Doru Costache - Glimpses of A Symbolic Anthropology 4Document2 pagesDoru Costache - Glimpses of A Symbolic Anthropology 4Doru CostacheNo ratings yet

- Family Law II NotesDocument10 pagesFamily Law II NotesAnirudh SoodNo ratings yet

- AAPSI For CY 2016 - CPD COPY FOR GCG COMPLIANCE PDFDocument123 pagesAAPSI For CY 2016 - CPD COPY FOR GCG COMPLIANCE PDFLyka Mae Palarca IrangNo ratings yet

- 1Document9 pages1JONUS DSOUZANo ratings yet

- Final Project IkbalDocument60 pagesFinal Project Ikbalikbal666No ratings yet

- Cost & Management AccountingDocument77 pagesCost & Management AccountingDhanaperumal VarulaNo ratings yet