Professional Documents

Culture Documents

SOLUTIONS - Mother Goose

SOLUTIONS - Mother Goose

Uploaded by

Vivian Loraine Borres0 ratings0% found this document useful (0 votes)

6K views2 pagesThis document contains 4 accounting problems related to pricing and costing. Problem 1 provides financial statement data for a company and requires calculating prime cost, conversion cost, total inventory cost, and total period cost. Problem 2 provides estimated unit cost data for a company and requires calculating total variable costs, variable cost per unit, total manufacturing cost, and manufacturing cost per unit. Problem 3 provides additional cost data and requires calculating variable manufacturing cost per unit, variable cost per unit, full manufacturing cost per unit, and full cost to make and sell per unit. Problem 4 provides monthly production and electricity cost data for a company and requires using the high-low method to calculate the variable cost per machine hour, monthly fixed electricity costs, and total electricity costs

Original Description:

Original Title

SOLUTIONS- mother goose

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document contains 4 accounting problems related to pricing and costing. Problem 1 provides financial statement data for a company and requires calculating prime cost, conversion cost, total inventory cost, and total period cost. Problem 2 provides estimated unit cost data for a company and requires calculating total variable costs, variable cost per unit, total manufacturing cost, and manufacturing cost per unit. Problem 3 provides additional cost data and requires calculating variable manufacturing cost per unit, variable cost per unit, full manufacturing cost per unit, and full cost to make and sell per unit. Problem 4 provides monthly production and electricity cost data for a company and requires using the high-low method to calculate the variable cost per machine hour, monthly fixed electricity costs, and total electricity costs

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

6K views2 pagesSOLUTIONS - Mother Goose

SOLUTIONS - Mother Goose

Uploaded by

Vivian Loraine BorresThis document contains 4 accounting problems related to pricing and costing. Problem 1 provides financial statement data for a company and requires calculating prime cost, conversion cost, total inventory cost, and total period cost. Problem 2 provides estimated unit cost data for a company and requires calculating total variable costs, variable cost per unit, total manufacturing cost, and manufacturing cost per unit. Problem 3 provides additional cost data and requires calculating variable manufacturing cost per unit, variable cost per unit, full manufacturing cost per unit, and full cost to make and sell per unit. Problem 4 provides monthly production and electricity cost data for a company and requires using the high-low method to calculate the variable cost per machine hour, monthly fixed electricity costs, and total electricity costs

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 2

QUEZON CITY UNIVERSITY

San Bartolome, Novaliches, Quezon City

ACCOUNTING 3

Pricing and Costing

ASSIGNMENT NO.1 4 problems

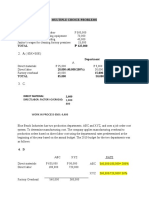

Problem: 1 4 POINTS

The financial statements of Mother Goose Company included these items:

Marketing costs 160,000.00

Direct labor cost 245,000.00

Administrative costs 145,000.00

Direct materials used 285,000.00

Fixed factory overhead costs 175,000.00

Variable factory overhead cost 155,000.00

Requirement:

Compute:

1. Prime cost

Solution:

(PRIME COST= DM+DL) 285,000.00 + 245,000.00=530,000.00

2. Conversion cost

(CONVERSION= DL+FOH) 245,000.00+330,000.00= 575,000.00

3. Total invetoriable /product cost

(Product cost = DM+DL+FOH) 285,000.00+245,000.00+330,000.00=860,000.00

4. Total period cost

(MC+AC) 160,000.00+145,000.00=305,000.00

Problem: 2 4 POINTS

Blance Corporation estimated its unit costs of producing and selling 12,000

units per month as follows:

Direct materials used 32

Direct labor cost 20

Variable manufacturing overhead cost 15

Fixed manufacturing overhead cost 6

Variable marketing cost 3

Fixed marketing cost 4

Estimiated unit cost 80

Requirement:

Compute:

1. Total variable costs per month

12,000X80=960,000

2. Variable cost per unit produced

960,000/12,000=80

3. Total manufacturing cost

12,000X73=876,000

4. Manufacturing cost per unit

(DM+DL+VOH+FOH)=73

Problem: 3 4 POINTS

CAR Corporation has the following facts, complete the requirements below: Sales

price 200.00 per unit

Fixed cost:

Marketing and Administrative 24,000 per period

Manufacturing overhead 30,000 per period

Variable cost:

Marketing and Administrative 6 per unit

Marketing overhead 9 per unit

Direct materials used 30 per unit

Direct labor cost 60 per unit

Units produced and sold 1,200 per period

Requirement:

Compute:

1. Variable manufacturing cost per unit

1,200/99=12.12

2. Variable cost per unit

1,200/105=11.43

3. Full manufacturing cost per unit

54,105/1,200=45.08

4. Full cost to make and sell per unit

Problem: 4 3 POINTS

Westinghouse Company manufactures major appliances. Because of growing

interest it its product it has just had its most successful year. In preparing the

budget for next year, its controller compiled these data:

MONTH VOL. IN MACH. HRS ELECTRICITY COST

July 6,000 60,000

Augsut 5,000 53,000

Sptember 4,500 49,500

october 4,000 46,000

November 3,500 42,500

December 3,000 39,000

6-MONTH TOTAL 26,000 290,000

Using the high-low method, compute:

1. The variable cost per machine hour

HIGH LOW

COST 60,000 39,000 =21,000

HR 6,000 3,000 = 3,000

--------------

7HR

2. The monthly fixed electricity costs

HIGH LOW

ELEC. COST 60,000 39,000

42,000 (7HRX600) 21,000 (7X3000)

+ -----------------------------------------------------------------------

18,000 18,000

3. The total electricity costs if 4,800 machine hours are projected to be

used next month.

4,000X7HR=33,600

TOTAL POINT 15 POINTS

You might also like

- Multiple Choice-Problems: Total 225,000Document13 pagesMultiple Choice-Problems: Total 225,000IT GAMING50% (2)

- Accounting For LaborDocument7 pagesAccounting For LaborKrizel Dixie ParraNo ratings yet

- Chapter 4. AssignmentDocument13 pagesChapter 4. AssignmentAnne Thea AtienzaNo ratings yet

- Mont Blanc - FinalDocument39 pagesMont Blanc - FinalSagar Shrikant Jalui20% (5)

- Chapter 3 - Accumulating Costs For Products and Services (1-20)Document24 pagesChapter 3 - Accumulating Costs For Products and Services (1-20)JAY AUBREY PINEDA100% (1)

- Prelim ExaminationDocument46 pagesPrelim ExaminationJenny Rose M. YocteNo ratings yet

- Syscopy MT 199 HSBC deDocument3 pagesSyscopy MT 199 HSBC deSWIFT S.CNo ratings yet

- PHP e Wallet Source CodeDocument2 pagesPHP e Wallet Source CodeShankerNo ratings yet

- Accounting For Manufacturing OverheadDocument9 pagesAccounting For Manufacturing OverheadKenzel lawasNo ratings yet

- Solution Guide - Activity On Accounting For Materials CostDocument4 pagesSolution Guide - Activity On Accounting For Materials CostMirasol100% (2)

- Chapter 5Document12 pagesChapter 5?????0% (1)

- Costs - Concepts and Classification: JmcnncpaDocument37 pagesCosts - Concepts and Classification: JmcnncpaMari Mar100% (1)

- Cost Accounting 7 8 - Solution Manual Cost Accounting 7 8 - Solution ManualDocument27 pagesCost Accounting 7 8 - Solution Manual Cost Accounting 7 8 - Solution ManualMARIA100% (1)

- FInal Exam KeyDocument27 pagesFInal Exam KeyQasim AtharNo ratings yet

- Management Accounting Individual AssignmentDocument10 pagesManagement Accounting Individual AssignmentendalNo ratings yet

- Problems 1 ProblemsDocument3 pagesProblems 1 ProblemsAlyza Noeri Mercado80% (5)

- T F Cosacc PDFDocument4 pagesT F Cosacc PDFAyra PelenioNo ratings yet

- Toaz - Info Chapter 5 2019 Problem 1 Alexis Company PRDocument3 pagesToaz - Info Chapter 5 2019 Problem 1 Alexis Company PRAngela Ruedas33% (3)

- Problem 5 COSTACDocument3 pagesProblem 5 COSTACEms DelRosario100% (1)

- Cost Accounting and Control: Process CostingDocument14 pagesCost Accounting and Control: Process CostingAloha Bu-ucan100% (2)

- M8 CHP 12 4 Allocation of Joint CostsDocument2 pagesM8 CHP 12 4 Allocation of Joint CostsQueennie EllamNo ratings yet

- Multiple Choice-Problems 1. A: Direct MaterialDocument11 pagesMultiple Choice-Problems 1. A: Direct MaterialIT GAMINGNo ratings yet

- Chapter 1-2 COST Accounting AND Control BY DE LEON 2019 Chapter 1-2 COST Accounting AND Control BY DE LEON 2019Document10 pagesChapter 1-2 COST Accounting AND Control BY DE LEON 2019 Chapter 1-2 COST Accounting AND Control BY DE LEON 2019somethingNo ratings yet

- Cost Accounting & Control: Unit 1, Topic 2: Job Order Cost SystemDocument13 pagesCost Accounting & Control: Unit 1, Topic 2: Job Order Cost SystemAna Marie AllamNo ratings yet

- CH 15Document4 pagesCH 15huongthuy1811100% (1)

- Chapter 3 Cost Accounting Cycle Multiple Choice - TheoriesDocument36 pagesChapter 3 Cost Accounting Cycle Multiple Choice - TheoriesAyra Pelenio100% (2)

- Chapter 12 1Document8 pagesChapter 12 1Princess Via Ira EstacioNo ratings yet

- Cost AccountingDocument9 pagesCost Accountingnicole friasNo ratings yet

- 6-LaborDocument37 pages6-LaborYeppeudda100% (1)

- Q3 Part 2 Problem On Job Order CostingDocument9 pagesQ3 Part 2 Problem On Job Order CostingLadybellereyann A TeguihanonNo ratings yet

- Marvin Manufacturing Company: Cost of Goods Sold P 884,000Document8 pagesMarvin Manufacturing Company: Cost of Goods Sold P 884,000Ryze100% (1)

- Chapter 12Document9 pagesChapter 12Gonzales JhayVee100% (2)

- Cost - Concepts and ClassificationsDocument23 pagesCost - Concepts and ClassificationsYehetNo ratings yet

- Cost AccountingDocument128 pagesCost AccountingCarl Adrian Valdez50% (2)

- Chapter-8 de Leon 2014Document4 pagesChapter-8 de Leon 2014'Jaurie'TwentyFour86% (7)

- Quiz On Cost Accounting and Control - Ch. 1-3-1Document3 pagesQuiz On Cost Accounting and Control - Ch. 1-3-1Elmarie Versaga DesuyoNo ratings yet

- Cost Accounting and Control Activity 2-Finals (Manufacturing Overhead: Actual and Applied)Document7 pagesCost Accounting and Control Activity 2-Finals (Manufacturing Overhead: Actual and Applied)Saarah KylueNo ratings yet

- 10 Acct 1abDocument16 pages10 Acct 1abJerric Cristobal100% (1)

- Cost AccountinCAgADocument86 pagesCost AccountinCAgAJenifer Belangel100% (4)

- Garcia, Phoebe Stephane C. Cost Accounting BS Accountancy 1-A CHAPTER 10: Process Costing True or FalseDocument26 pagesGarcia, Phoebe Stephane C. Cost Accounting BS Accountancy 1-A CHAPTER 10: Process Costing True or FalsePeabeeNo ratings yet

- Answers To Cost Accounting Chapter 10Document15 pagesAnswers To Cost Accounting Chapter 10Raffy Roncales100% (2)

- Multiple Choices - TheoreticalDocument8 pagesMultiple Choices - TheoreticalIsabelle AmbataliNo ratings yet

- Cost Accounting Answers Chapter 4Document17 pagesCost Accounting Answers Chapter 4Raffy RoncalesNo ratings yet

- 625009eef26fe Cost Accounting and Cost Management 1 Quiz No. 2Document2 pages625009eef26fe Cost Accounting and Cost Management 1 Quiz No. 2El Jehn Grace Babor - Ledesma100% (1)

- AssignmentDocument2 pagesAssignmentspongebob squarepantsNo ratings yet

- C13 Standard CostingDocument12 pagesC13 Standard CostingPaula BautistaNo ratings yet

- BACOSTMX Module 2 Learning Activity StudentsDocument8 pagesBACOSTMX Module 2 Learning Activity StudentsRodolfo Jr. LasquiteNo ratings yet

- Cost Accounting Chapter1Document6 pagesCost Accounting Chapter1Jhon Ariel JulatonNo ratings yet

- Tự luận KTQTRI 1 TIẾNG ANHDocument7 pagesTự luận KTQTRI 1 TIẾNG ANHduyentang02082004No ratings yet

- Module 11 Activity Based CostingDocument13 pagesModule 11 Activity Based CostingMarjorie NepomucenoNo ratings yet

- COST ALLOCATION and ACTIVITY-BASED COSTINGDocument5 pagesCOST ALLOCATION and ACTIVITY-BASED COSTINGBeverly Claire Lescano-MacagalingNo ratings yet

- Bco322 Budgeting and ControlDocument10 pagesBco322 Budgeting and ControlHà Biên Lê ĐặngNo ratings yet

- Required:: Cost Pool Overhead Costs Activity-Cost DriverDocument3 pagesRequired:: Cost Pool Overhead Costs Activity-Cost DriverjaneperdzNo ratings yet

- Problems and Exercises in Introduction in Acctg and CVPDocument4 pagesProblems and Exercises in Introduction in Acctg and CVPJanelleNo ratings yet

- AccDocument15 pagesAccMartin TrịnhNo ratings yet

- U Win Bo Myint Cost and Management Overhead Homework - 2Document3 pagesU Win Bo Myint Cost and Management Overhead Homework - 2Theint Myat KyalsinNo ratings yet

- F2 Management Accounting: Eagles Business SchoolDocument10 pagesF2 Management Accounting: Eagles Business SchoolCourage KanyonganiseNo ratings yet

- Lesson 1 Cluster 2 FSUU AccountingDocument6 pagesLesson 1 Cluster 2 FSUU AccountingRobert CastilloNo ratings yet

- MSC Management & MSC Marketing & MSC International Business: Assessment 2-60%Document6 pagesMSC Management & MSC Marketing & MSC International Business: Assessment 2-60%Lu YangNo ratings yet

- FInal Exam KeyDocument27 pagesFInal Exam KeyQasim AtharNo ratings yet

- FInal Exam KeyDocument27 pagesFInal Exam KeyQasim AtharNo ratings yet

- Semi-Finals (Intro To Cost Accounting, Cost of Goods Sold, High-Low Method and Regression Analysis, Standard Costing)Document6 pagesSemi-Finals (Intro To Cost Accounting, Cost of Goods Sold, High-Low Method and Regression Analysis, Standard Costing)Alyssa Nichole CastilloNo ratings yet

- Flexible Budget and VarianceDocument8 pagesFlexible Budget and VarianceLhorene Hope DueñasNo ratings yet

- Garnier - Sustainability Progress Report - 2020 Final LDDocument29 pagesGarnier - Sustainability Progress Report - 2020 Final LDSimaSenNo ratings yet

- (Standard) Memorandum of Agreement - Vserve ClientsDocument3 pages(Standard) Memorandum of Agreement - Vserve ClientsJhunessa HerreraNo ratings yet

- Pfrs 15 Revenue From Contracts With CustomersDocument3 pagesPfrs 15 Revenue From Contracts With CustomersR.A.No ratings yet

- Market Reserarch & Consumer Behavours of SamsungDocument62 pagesMarket Reserarch & Consumer Behavours of SamsungRitesh SonawaneNo ratings yet

- Kuala Lumpur: Answer Sheets: GBHDHFH: 23525: ABMC2054 Cost & Management Accounting IDocument30 pagesKuala Lumpur: Answer Sheets: GBHDHFH: 23525: ABMC2054 Cost & Management Accounting IJUN XIANG NGNo ratings yet

- Application Letter Sample For Fresh Graduate AccountingDocument8 pagesApplication Letter Sample For Fresh Graduate AccountinghlizshggfNo ratings yet

- ARDIENTE-Research QuestionnaireDocument6 pagesARDIENTE-Research QuestionnaireHennessy Shania Gallera ArdienteNo ratings yet

- Book 3Document3 pagesBook 3Devansh ChauhanNo ratings yet

- C Ewm 95 PDFDocument6 pagesC Ewm 95 PDFRohit DangeNo ratings yet

- Chapter 1 and 2Document56 pagesChapter 1 and 2Snn News TubeNo ratings yet

- Mint Delhi 27-01-2023 PDFDocument16 pagesMint Delhi 27-01-2023 PDFParkhee TyagiNo ratings yet

- Fabrication Guide HYDDocument71 pagesFabrication Guide HYDSunil GhosalkarNo ratings yet

- 1.3. Partnership DissolutionDocument6 pages1.3. Partnership DissolutionKPoPNyx EditsNo ratings yet

- Factory Talk Pharma SuiteDocument2 pagesFactory Talk Pharma SuiteAdel AdelNo ratings yet

- Chapter 2Document9 pagesChapter 2api-25939187No ratings yet

- Plan Version: Skip To End of Metadata Luis Francisco Herranz Guillermo Ballesteros Oct 19, 2017 Go To Start of MetadataDocument64 pagesPlan Version: Skip To End of Metadata Luis Francisco Herranz Guillermo Ballesteros Oct 19, 2017 Go To Start of Metadatazafer nadeemNo ratings yet

- Unit 1 History and New Directions of Accounting Research Exercise 1Document5 pagesUnit 1 History and New Directions of Accounting Research Exercise 1Ivan AnaboNo ratings yet

- Green Constro Infra PVT LTD Quality Assurance Plan (Qap) : Manufacture At: Qap No.:& DetailsDocument1 pageGreen Constro Infra PVT LTD Quality Assurance Plan (Qap) : Manufacture At: Qap No.:& DetailsNAGARJUNANo ratings yet

- Process of Raising Funds Through Unsecured NCDDocument1 pageProcess of Raising Funds Through Unsecured NCDNisha MunkaNo ratings yet

- Diamond Agrovet InvoiceDocument1 pageDiamond Agrovet Invoicesourav agarwalNo ratings yet

- ASTM D97 and 2500 SolutionDocument10 pagesASTM D97 and 2500 SolutionKamruzaman MiahNo ratings yet

- ktxd bản sửa cuốiDocument74 pagesktxd bản sửa cuốicumeo09092004No ratings yet

- The Complete Servicenow System Administrator Course: Section 4 - CustomizationsDocument31 pagesThe Complete Servicenow System Administrator Course: Section 4 - CustomizationsyusufNo ratings yet

- Research 2 Final Defense Thesis Defended Cutie Copy AnnDocument12 pagesResearch 2 Final Defense Thesis Defended Cutie Copy AnnCher Angeline Rico RodriguezNo ratings yet

- Castrol Oil - Consumer Behavior of in Pune CityDocument47 pagesCastrol Oil - Consumer Behavior of in Pune CitySohel Bangi100% (1)

- AbiyotDocument30 pagesAbiyotEyob HaylemariamNo ratings yet

- 7 Types of Business StrategiesDocument7 pages7 Types of Business StrategiesJaine Pantua GratilNo ratings yet