Professional Documents

Culture Documents

Sarfraz Khan07XQCM6093

Sarfraz Khan07XQCM6093

Uploaded by

Tarun SharmaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Sarfraz Khan07XQCM6093

Sarfraz Khan07XQCM6093

Uploaded by

Tarun SharmaCopyright:

Available Formats

The Performance of IPOs after the expiry of lock-up periods in India

The Performance of IPOs after the expiry of

lock-up periods in India

Submitted in partial fulfillment of the requirements for the award

of MBA Degree of Bangalore University

by

Sarfraz Ahmed Khan

REG.NO. – 07XQCM6093

2007- 2009

MBA FOURTH SEMESTER

UNDER THE GUIDANCE AND SUPERVISION OF

Prof Dr. NAGESH .S MALAVALLI

M.P BIRLA INSTITUTE OF MANAGEMENT

ASSOCIATE BHARATIYA VIDYA BHAVAN

# 43, Race Course Road

Bangalore-560001

M.P Birla Institute of Management, Bangalore -1-

The Performance of IPOs after the expiry of lock-up periods in India

DECLARATION

I am Sarfraz Ahmed Khan, the student of M. P. Birla Institute of

Management hereby declaring that the project titled “the performance of IPOs

after the expiry of lock-up periods in India” is an original work carried out by

me as a partial fulfillment for the requirement of MBA Degree of Bangalore

University. This project has not been previously submitted for award of any

degree or diploma of Bangalore University or any other University.

Place: Bangalore

Date: 12 may 2009 Sarfraz Ahmed Khan

M.P Birla Institute of Management, Bangalore -2-

The Performance of IPOs after the expiry of lock-up periods in India

PRINCIPAL’S CERTIFICATE

This to certify that this report titled “The Performance of IPOs

after the expiry of lock-up periods in India ” has been prepared by Sarfraz

Ahmed Khan bearing the registration no. 07XQCM6093 under the guidance

and supervision of Dr. N.S.MALAVALLI ,MPBIM, Bangalore.

Place: Bangalore Principal

Date: 12 May 2009 (Dr.N.S.Malavalli)

M.P Birla Institute of Management, Bangalore -3-

The Performance of IPOs after the expiry of lock-up periods in India

GUIDE’S CERTIFICATE

This is to certify that the Research Report entitled “The Performance

of IPOs after the expiry of lock-up periods in India ”, done by Sarfraz Ahmed

Khan bearing Registration No.07XQCM6093 is a bonafide work done carried

under my guidance during the academic year 2007-09 in a partial fulfillment of the

requirement for the award of MBA degree by Bangalore University. To the best of

my knowledge this report has not formed the basis for the award of any other

degree.

Place: Bangalore Prof. Dr. Nagesh Malvalli

Date: 12 May 2009 (Internal guide)

M.P Birla Institute of Management, Bangalore -4-

The Performance of IPOs after the expiry of lock-up periods in India

ACKNOWLEDGEMENT

I would like to express my indebtedness Prof. Nagesh Malvalli, Project guide &

Principal, M. P. Birla Institute of Management., for his valuable guidance at every

stage for the completion of this project work.

I would also like to thank Prof. S. Santhanam, M.P.Birla Institute of

Management, Bangalore who helped me to analysis data with his expertise

knowledge in statistics.

And further I would like to thank all the faculty members of MPBIM who

have helped me in completing my project. I have gained a lot of knowledge

throughout the course of carrying out this project.

I would like to sincerely thank my parents and all my friends who have

helped me in completing this project by providing me with the psychological and

academic support.

Place: Bangalore

Date: 12 May 2009 Sarfraz Ahmed Khan

M.P Birla Institute of Management, Bangalore -5-

The Performance of IPOs after the expiry of lock-up periods in India

EXECUTIVE SUMMARY

When a company goes for a public issue, to raise capital for its

business. The total issue subscribed is subject to be distribution as a minimum

amount is held by the promoters, financers, employees of the company. Merchant

bankers discover a price, lead underwriters apply a restriction on the insiders not

to sell their shares in secondary market till a certain lock-in period. What happens

after the expiration of the lock-in period ? Does the share price or the share value

remain the same, or will the retail investors benefit from it after the lock-in

period.?

The main purpose of this research is to investigate the

aftermarket performances of the Indian (IPOs) in order to find out that how safe

they are for investors to hold their money in it . In this dissertation, I will study the

after market performances of Indian IPOs over three years after listing as well

as use some corporate characteristics and the study focuses on the IPOs that

were issued and performed between 2000 and 2005 on and performed over a

specified period and after the scheduled lock-up period (post-issue) of 3 years as

per SEBI Guidelines.

M.P Birla Institute of Management, Bangalore -6-

The Performance of IPOs after the expiry of lock-up periods in India

Table of contents

Chapter Particulars Page no.

I Introduction 1

Introduction to IPOs 2

Trends in IPO 11

SEBI and IPO 26

II Literature survey 39

IPO lock-ups stop Insider selling 40

IPO lock-in agreements in U.K 45

IPO lock-up period : Implications of 45

Market efficiency and downward sloping

III Problem Statement 46

Research Objectives 48

Research Methodology 49

Area of enquiry 52

Research Limitations 54

IV Data analysis and inferences 55

V Research and Findings 71

M.P Birla Institute of Management, Bangalore -7-

The Performance of IPOs after the expiry of lock-up periods in India

Suggestions and Recommendations 77

Bibliography

List of tables, charts and graphs

Table Particulars Page no.

1 IPOs at here different 56,57

time periods

2 IPO prices in on and 63-66

after lock-in periods

showing difference in

price as well as

percentage decrease

Graphs Particular Page no.

1 IPO offerings from 13

1991 to 2005

2 IPOs issued on NSE 16

from 2000 to 2007

3 IPO performance in 58-62

three different time

periods

4 Price variation of the 67-70

prices on and after

expiry of lock-in

period

M.P Birla Institute of Management, Bangalore -8-

The Performance of IPOs after the expiry of lock-up periods in India

Chapter – I

Introduction

M.P Birla Institute of Management, Bangalore -9-

The Performance of IPOs after the expiry of lock-up periods in India

Introduction to IPOs

When a business entity needs money the general course of action that it

follows is that it goes to the bank. However banks may not be ready to provide

huge finance for a long time especially if the returns are not fixed. The best way to

raise money is through offer of shares. The securities which the companies issue

for the first time to the public and other financial institutions either after

incorporation or on conversion from private to public company is called “INITIAL

PUBLIC OFFER” or “IPO”. Raising equity gives boost to economical

development of the country.

Raising money through IPO is a very complex process. It requires

analysis and implementation of various commercial laws applicable to IPO-

Prospectus. These laws are Companies Act, Income Tax Act, FEMA, Securities

Contract Act and SEBI Guidelines on “Disclosure and Investor Protection”. It is

also necessary to implement circulars from time to time by SEBI. The introduction

of SEBI attracted the Foreign Institutional Investors to invest money in stock

market in India. It has also helped Indian Companies to offer securities in most

scientific method to Indian and Foreign investors.

Initial Public Offerings (IPOs) are the public offering or flotation

when a company issues common stock or shares to the public for the first time in

the country’s capital markets. It is done through various methods like book

building, method of fixed price or a mixture of both.

IPOs have been an important source of corporate financing for a

long time. The empirical evidence on the pricing and performance of IPOs

provides a puzzle to those who otherwise believe in efficient financial markets.

The puzzle of IPOs pricing both in short and long runs has become a leading

example of pervasive market inefficiency. The IPO uncertainties that bother the

M.P Birla Institute of Management, Bangalore - 10 -

The Performance of IPOs after the expiry of lock-up periods in India

researchers are the positive mean initial return also known as underpricing, the hot

issue market and the long run underperformance.

FINANCIAL MARKETS AND THE IPOs

The Financial Market is an amorphous set of players who come together to trade

in financial assets.

Financial Markets in any economic system that acts as a conduit between the

organizations who need funds and the investors who wish to invest their money

into profitable opportunity. Thus, it helps institutions and organizations that need

money to have an access to it and on the other hand, it helps the public in general

to earn savings.

Thus they perform the crucial function of bringing

together the entries who are either financially scarce or who are financially slush.

This helps generally in a smoother economic functioning in the sense that

economic resources go to the actual productive purposes. In modern economic

systems Stock Exchanges are the epicenter of the financial activities in any

economy as this is the place where actual trading in securities takes place.

Modern day Stock Exchanges are most of the centers to trade in the

existing financial assets. In this respect, they have come a long way in the sense

that these days, they act as a platform to launch new securities as well as act as

most authentic and real time indicator of the general economic sentiment.

The zone of activities in the capital market is dependent partly

on the savings and investment in the economy and partly on the performance of

the industry and economy in general. In other words capital market constitutes the

M.P Birla Institute of Management, Bangalore - 11 -

The Performance of IPOs after the expiry of lock-up periods in India

channel through which the capital resources generated in the society and made

available for economic development of the nation.

As such, Financial Markets are functionally classified as having two parts, namely,

1. The Primary Market

2. The Secondary Market

Primary Market comprises of the new securities which are offered to the public by

new companies. It is the mechanism through which the resources of the

community are mobilized and invested in various types of industrial securities.

Whenever a new company wants to enter the market it has to first enter the

primary market.

Secondary Market comprises of further issues which are floated by the

existing companies to enhance their liquidity position. Once the new issues are

floated and subscribed by the public then these are traded in the secondary market.

It provides easy liquidity, transferability and continuous price formation of

securities to enable investors to buy and sell them with ease. The volume of

activity in the Secondary Market is much higher compared to the Primary Market

M.P Birla Institute of Management, Bangalore - 12 -

The Performance of IPOs after the expiry of lock-up periods in India

PRIMARY MARKET

GENESIS AND GROWTH

When a business entity needs money the general course of action that it follows is

that it goes to the bank. However banks may not be ready to provide huge finance

for a long time especially if the returns are not fixed. The best way to raise money

is through offer of shares and for this: primary market is the solution

The Primary Market deals with the new securities which were previously not

tradable to the public. The main function is to facilitate the transfer of resources

from savers to entrepreneurs seeking to establish or to expand and diversify

existing events. The mobilization of funds through the Primary Market is adopted

by the state government and corporate sector. In other words the Primary Market

is an integral part of the capital market of a country and together with the

securities market. The development of security as well as the scope for higher

productive capacity and social welfare depends upon the efficiency of the Primary

Market.

What is an IPO ?

The securities which the companies issue for the first time to the public either after

incorporation or on conversion from private to public company is called the

“INITIAL PUBLIC OFFER” or the “IPO”.

M.P Birla Institute of Management, Bangalore - 13 -

The Performance of IPOs after the expiry of lock-up periods in India

GROWTH OF IPOs IN INDIA

HISTORY OF PRIMARY MARKET

Indian capital market was initiated with establishing the Bombay stock exchange

in the year 1875.at that time the main function of stock exchange was to provide

place for trading in the stocks. Now the exchange has completed more than 25

years. It has undergone several changes.

Initially the IPO was called ‘New Issue’ and the issues in the Primary Market were

controlled by CCI (Controller of capital issue). It was working as a department of

MOF (ministry of finance). There were very few issues every year. CCI was

highly conservative and hardly allowed any premium issues. Also, the regulatory

framework was inadequate to control several issues relating to Primary Market.

Therefore, in the year 1992 it was abolished.

There was no awareness of new issues among the investing public. In fact,

during 1950s-1960s, the investment in stock market was considered to be

gambling. It was prerogative to highly elite business community to participate in

new issues. More than 99% of Indian population never participated in any issue

during CCI regime.

There was tremendous growth in capital market in U.S.A. and

Western Europe. In these markets they had established Security Exchange

Commission (SEC). It is most powerful autonomous body. The Government of

India realized the importance of a similar body in India for healthy and fast growth

of Capital Market. Thus Security Exchange Board of India (SEBI) was

M.P Birla Institute of Management, Bangalore - 14 -

The Performance of IPOs after the expiry of lock-up periods in India

established with headquarters in Mumbai in 1992.SEBI is the most powerful body

in India.

SEBI has come up with the guidelines for disclosures and

investors protection. SEBI has framed rules for various intermediaries like

Merchant Bankers, Underwriters, Brokers, Bankers, Registrars and Transfer

Agents, Depositories, Stock Exchanges etc. These rules are on the line of similar

rules in western world. This has attracted foreign institutional and individual

investors to invest money in India. This has resulted in exponential growth of

Capital Market in this last decade.

POPULARISING THE NEW ISSUE.

Late Mr Dhirubhai Ambani can be considered as ‘Bhishmapita’ of

new issues, though initially he also had to struggle to get subscribers but he always

used innovative ides for marketing IPOs. It is said that investor never lost money

in his pricing methods. There are several incidences of the common man

participated in his issues, got allotment, sold shares and created fabulous wealth

for themselves. As on 31-12-2003, Reliance Group has more than 3.5 million

shareholders.

The first public offer of securities by a company

after its inception is known as Initial Public Offer (IPO). Going public (or

participating in an “initial public offer” or IPO) is a process by which a business

owned by one or several individuals is converted in to a business owned by many.

It involves the offer of part ownership of the company to the public through the

sale of equity securities (stock). IPO dilutes the ownership stake and diffuses

corporate control as it provides ownership to investors in the form of equity

shares. It can be used as exit strategy and finance strategy.

As a financing strategy, its main purpose is to raise funds for the company.

M.P Birla Institute of Management, Bangalore - 15 -

The Performance of IPOs after the expiry of lock-up periods in India

When used as an exit strategy, existing investors can offload equity holdings to the

public.

REASONS FOR GOING PUBLIC

• To raise funds for financing capital expenditure needs like

expansion, diversification etc.

• To finance increased working capital requirement as well as debt

financing

• As an exit route for existing investors

.ADVANTAGES OF GOING PUBLIC

• Stock holder Diversification As a company grows and becomes more valuable,

its founders often have most of its wealth tied up in the company. By selling some

of their stock in a public offer, the founders can diversify their holdings and

thereby reduce somewhat the risk of their personal portfolios.

• Easier to raise new capital

If a privately held company wants to raise capital a sale of a new stock, it must

either go to its existing shareholders or shop around for other investors. This can

often be a difficult and sometimes impossible process. By going public it becomes

easier to find new investors for the business.

• Enhances liquidity

The stock of a closely held firm is not liquid. If one of the holders wants to sell

some of his shares, it is hard to find potential buyers-especially if the sum

involved is large. Even if a buyer is located there is no establishes price at which

to complete the transaction. These problems are easily overcome in a publicly

M.P Birla Institute of Management, Bangalore - 16 -

The Performance of IPOs after the expiry of lock-up periods in India

owned company

• Establishes value for the firm

This can be very useful in attracting key employees with stock options because the

underlying stock have a market value and a market for them to be traded that

allows for liquidity for them.

• Image

The reputation and visibility of the company increases. It helps to increase

company and personal prestige.

• Other advantages

Additional incentive for employees in the form of the companies stocks.

This also helps to attract potential employees.

It commands better valuation of the company

Better situated for making acquisitions

DISADVANTAGES OF GOING PUBLIC

Costs of Reporting

A publicly owned company must file quarterly reports with the Securities and

exchange Board of India. These reports can be costly especially for small firms.

M.P Birla Institute of Management, Bangalore - 17 -

The Performance of IPOs after the expiry of lock-up periods in India

Disclosure

Management may not like the idea or reporting operating data, because such data

will then be available to competitors.

Self dealings

The owner’s managers of closely held companies have many opportunities for

self-transactions, although legal they may not want to disclose to the public.

Inactive market low price

If a firm is very small and its and its shares are not traded frequently, then its stock

will not really be liquid and the market price may not be truly representative of the

stocks value.

Control

Owning less than 50% of the shares could lead to a loss of control in the

management.

Other disadvantages

The profit earned by the company should be shared with its investors in the form

of dividend

An IPO is a costly affair. Around 15-20% of the amount realized is spent on

raising the same.

A substantial amount of time and effort has to be invest

M.P Birla Institute of Management, Bangalore - 18 -

The Performance of IPOs after the expiry of lock-up periods in India

TRENDS IN IPO

PRIMARY REASONS FOR A COMPANY GOING PUBLIC.

Most people label a public offer as a marketing event, which it typically is. For the

majority of firms going public, they need additional capital to execute long-range

business models, increase brand name, to finance possible acquisitions or to take

up new projects. By converting to corporate status, a company can always dip

back into the market and offer additional shares through a rights issue.

PERFORMANCE IN 90s

Let us have a look at the general development of the Primary Markets in the

nineties. There have been many regulatory changes in the regulation of primary

market in order to save investors from fraudulent companies. The most path

breaking development in the primary market regulation has been the abolition of

CCI (Controller of capital issues). The aim was to give the freedom to the

companies to decide on the pricing of the issue and this was supposed to bring

about a self-managing culture in the financial system. But the move was

hopelessly misused in the years of 1994-1995 and many companies came up with

issues at sky-high prices and the investors lost heavily. That phase took a heavy

toll on the investor’s sentiment and the result was the amount of money raised

through IPO route.

M.P Birla Institute of Management, Bangalore - 19 -

The Performance of IPOs after the expiry of lock-up periods in India

1993-96: SUNRISE, SUNSET.

With controls over pricing gone, companies rushed to tap the Primary Market and

they did so, with remarkable ease thanks to overly optimistic merchant bankers

and gullible investors. Around Rs20000 crores were raised through 4053 issues

during this period. Some of the prominent money mobilizes were the so called

‘sunrise sectors’-polyester, textiles, finance, aquaculture. The euphoria spilled

over to the Secondary Market. But reality soon set in. Issuers soon failed to meet

projections, many disappeared or sank. Result: the small investor deserted both

markets-till the next boom!

1998-2000: ICE ON A HOT STREAK

As the great Indian software story played itself out, software stocks led a bull

charge on the bourses. The Primary Market caught up, and issues from the

software markets flooded the market. With big IPOs from companies in the ICE

(Information Technology, Communication and Entertainment) sectors, the average

issue price shot up from Rs.5 crore in 1994-96 to Rs.30 crore. But gradually, hype

took over and valuations reached absurd levels. Both markets tanked.

M.P Birla Institute of Management, Bangalore - 20 -

The Performance of IPOs after the expiry of lock-up periods in India

2001-2002-ALMOST CLOSED

There were hardly any IPOs and those who ventured, got a lukewarm response. A

depressed Secondary Market had ensured that the doors for the Primary Market

remained closed for the entire FY 2001-2002.There were hardly any IPOs in FY

2001-2002.

2002: QUALITY ON OFFER.

The Primary Market boom promises to be different. To start with, the cream of

corporate India is queuing up, which ensures quality. In this fragile market, issue

pricing remains to be conservative, which could potentially mean listing gains.

This could rekindle the interest of small investors in stocks and draw them back

into the capital market. The taste of gains from the primary issues is expected to

have a spillover effect on the secondary market, where valuations today are very

M.P Birla Institute of Management, Bangalore - 21 -

The Performance of IPOs after the expiry of lock-up periods in India

attractive.

2003: IPO- IMPROVED PERFORMANCE OVERALL !

Even as the secondary market moved into top gear in 2003 the primary

market too scripted its own revival story, buoyed largely by the Maruti IPO which

was oversubscribed six and a half times. In 2003 almost all primary issues did well

on domestic bourses after listing, prompting retail investors to flock to IPO’s. All

IPO’s, including Indraprastha Gas and TV Today Network which was

oversubscribed 51 times showed the growing appetite for primary issues.

Divi Labs hit the market in February followed by Maruti. Initially, the

Maruti share price was considered steep at Rs125 per share for a Rs5 paid-up

share. By the end of the year, the stock had climbed to over Rs355. Close on the

heels of Maruti, came the Uco Bank IPO, which attracted about 1mn applicants.

The primary issue of Indian Overseas Bank attracted about 4.5mn applicants and

Vijaya Bank over Rs40bn in subscriptions. The last one to get a huge response

was Indraprastha Gas, which reportedly garnered about Rs30bn. TV Today’s

public offer was expected to draw in excess of Rs30bn. In overseas listings, the

only notable IPOs were Infosys Technology's secondary ADR offer and the dull

debut of Sterlite Group company Vedanta on the London Stock Exchange.

It was really Maruti Udyog that took the lead with its new issue

in June. The issue was heavily over-subscribed and by the middle of December

the share value appreciated 186 per cent. The near trebling of the investment in

less than 6 months inspired the retail investor who is now back again in the market

scouting for good scrips.

After the phenomenal success of Maruti issue, a number of

M.P Birla Institute of Management, Bangalore - 22 -

The Performance of IPOs after the expiry of lock-up periods in India

companies have approached the capital market and a lot more are waiting for

SEBI approval. SEBI has taken enough care to force companies to make relevant

disclosures for the investor to judge the quality of new issues. Besides, the

companies themselves have been careful not to over-price the shares. On the

contrary, some of the companies have deliberately under-priced them to let the

issue get over-subscribed and to let the investor share some of the capital gain

after listing. With the care taken by SEBI and the companies it is unlikely that the

experience of 1995 will be repeated.

In the financial year just ended, 23 companies tapped

the primary market and managed to garner less than Rs200 billion .The latest

development in the primary market has been the Indian players thirst for money

satiating offshore.

M.P Birla Institute of Management, Bangalore - 23 -

The Performance of IPOs after the expiry of lock-up periods in India

M.P Birla Institute of Management, Bangalore - 24 -

The Performance of IPOs after the expiry of lock-up periods in India

INITIAL PUBLIC OUTBURST

Riding high on the market bull, companies are preparing to lap up investor’s

money through Initial Public Offer’s (IPO’s). The fundamentally good economy

makes us very positive about the initial public offer market. Nearly 600 companies

wish to raise over Rs50,000 Crore, for a variety of reasons—public sector units for

capital (Power Finance Corporation and National Thermal Power Corporation),

residual sale (CMC and IBP), divestment (ONGC and Gas Authority of India Ltd),

banks for capital (Central Bank of India and Punjab & Sind Bank), for market

valuations (Tata Consultancy Services), for venture capital exit (UTV and Secure

Meters), and for expansion (Biocon and NDTV).

Among these Biocon the first Indian Biotech company to come with an

IPO was oversubscribed by 33% and raised as much as Rs.315 Crore. Other mega

issues included TCS which was oversubscribed 5.46 times and raised Rs.417

Crore. The much awaited government companies ONGC was oversubscribed by 6

times and raised a whooping capital of Rs.1069.49 Crore another government

company which was a huge success was IPCL which too was oversubscribed by

1.18 times raising a capital of Rs.1010.45 Crore. The media company NDTV was

oversubscribed 3 times its size.Other IPO’s to hit the market this year were Shah

Petroleum (31.78 Crore) Crew Bos Products (12.25 Crore) Texmaco (15.49 Crore)

Vishal Export Overseas (27 Crore).

A slew of IPO’s have been lined up in the coming months from the

public as well as the private sector. The IPO’s are estimated to raise Rs25,000-

30,000 Crore. The sentiment for IPO’s has been bolstered after the government

came out with fair pricing of its stake sale in IPCL.

Among the companies slated to come out with IPO’s include: SET India,

Shoppers Stop, Central Bank of India, NTPC and Hutchinson Max Telecom.

M.P Birla Institute of Management, Bangalore - 25 -

The Performance of IPOs after the expiry of lock-up periods in India

PRICING OF ISSUE

Controller Of Capital Issue

During the Controller of Capital Issue (CCI) regime the issues were priced by the

company and approved by CCI. Generally the CCI was very conservative and

hardly allowed premium issues.

Arrival of SEBI

After the Arrival of SEBI free market policy is followed for pricing of issue.

Merchant Bankers are responsible for justifying the premium. The company was

allowed to give future profit projections. A company can issue shares to applicants

in the firm allotment category at higher price than the price at which securities are

offered to public. Further, an eligible company is free to make public/rights issue

in any denomination determined by it in accordance with the Companies Act,

1956 and SEBI norms.

During the booming period stock market

issues got oversubscribed beyond imagination. Number of companies came in

with stiff premium and faced investor resistance. This resulted in cautious

approach by the merchant bankers and underwriters for taking up underwriting of

the future issues.

Deciding Premium by Bid System

Since year 2000 SEBI has changed pricing formula. The promoters cannot give

future projections and merchant banker alone cannot decide the pricing of IPO.

At present, 50%of the IPO is reserved for the wholesale investors and 50% is for

the small investor. The Lead-Manager starts road show in consultation with

Institutional Investors. Then they call for bid at recommended prices. Once, bids

are received pricing is open for discussion. The mean bid price is accepted and

M.P Birla Institute of Management, Bangalore - 26 -

The Performance of IPOs after the expiry of lock-up periods in India

allocation is done. The lead manager has to ensure full subscription of the full

quota. Then the price is declared in the newspapers. The retail investor has to

follow this price and submit application with cheque or demand draft. This part of

the issue should also be fully subscribed. If the issue is not underwritten and

subscription received is less than 90% then the IPO is considered as fail and

whatever fund has been received has to refunded. The company loses money it has

spent on IPO.

Thus pricing is most important and difficult aspects of IPO.

However in the present scenario most of the issues are priced by the book building

method. Accurate pricing is essential for the success of IPO.

BOOK BULIDING

The basic motto of Book Building is that “the market knows the best”. Ever since

SEBI allowed companies with no profitability record to come up with IPO via

Book Building route, there has been a good rush of such issues.

What is Book Building?

Book Building is basically a capital issuance process used in Initial Public Offer

(IPO), which aids price and demand discovery. Its a process used for marketing a

public offer of equity shares of a company and is a common practice in most

developed countries. Book Building is so-called because the collection of bids

from investors is entered in a "book". These bids are based on an indicative price

range. The issue price is fixed after the bid closing date.

Persons Involved in the Book-Building Process

M.P Birla Institute of Management, Bangalore - 27 -

The Performance of IPOs after the expiry of lock-up periods in India

The principal intermediaries involved in the Book Building process are the

company; Book Running Lead Managers (BRLM) and syndicate members who

are intermediaries registered with SEBI and are eligible to act as underwriters.

Syndicate members are appointed by the BRLM.

How is the book built?

A company that is planning an initial public offer appoints a category-I Merchant

Banker as a book runner. Initially, the company issues a draft prospectus which

does not mention the price, but gives other details about the company with regards

to issue size, past history and future plans among other mandatory disclosures.

After the draft prospectus is filed with the SEBI, a particular period is fixed as the

bid period and the details of the issue are advertised. The book runner builds an

order book, that is, collates the bids from various investors, which shows the

demand for the shares of the company at various prices. For instance, a bidder may

quote that he wants 50,000 shares at Rs.500 while another may bid for 25,000

shares at Rs.600. Prospective investors can revise their bids at anytime during the

bid period that is, the quantity of shares or the bid price or any of the bid options.

Basis of Deciding the Final Price

On closure of the book, the quantum of shares ordered and the respective prices

offered are known. The price discovery is a function of demand at various prices,

and involves negotiations between those involved in the issue. The book runner

and the company conclude the pricing and decide the allocation to each syndicate

member.

M.P Birla Institute of Management, Bangalore - 28 -

The Performance of IPOs after the expiry of lock-up periods in India

Payment for the shares

The bidder has to pay the maximum bid price at the time of bidding based on the

highest bidding option of the bidder. The bidder has the option to make different

bids like quoting a lower price for higher number of shares or a higher price for

lower number of shares. The syndicate member may waive the payment of bid

price at the time of bidding. In such cases, the issue price may be paid later to the

syndicate member within four days of confirmation of allocation. Where a bidder

has been allocated lesser number of shares than he or she had bid for, the excess

amount paid on bidding, if any will be refunded to such bidder.

Advantage of the Book Building process versus the Normal IPO marketing

process

Unlike in Book Building, IPO’s are usually marketed at a fixed price. Here the

demand cannot be anticipated by the merchant banker and only after the issue is

over the response is known. In book building, the demand for the share is known

before the issue closes. The issue may be deferred if the demand is less.

This process allows for price and demand discovery. Also, the cost of the public

issue is reduced and so is the time taken to complete the entire process.

Features Fixed Price Process Book Building Process

Pricing :

Price at which the Security is offered/allotted is known in advance to the

investor. Price at which the Security will be offered/allotted is not known in

advance to the investor. Only an indicative price range is known.

M.P Birla Institute of Management, Bangalore - 29 -

The Performance of IPOs after the expiry of lock-up periods in India

Demand :

Demand for the securities offered is known only after the closure of the issue.

Demand for the securities offered can be known everyday as the book is built.

Payment :

Payment if made at the times of subscription wherein refund is given after

allocation payment only after allocation.

Guidelines for Issues to be made through 100% Book Building

Route

SEBI had issued guidelines in October 1997 for book building which were

applicable for 100% of the issue size and for issues above Rs.100 Crore. The

guidelines were revised subsequently to reduce the limit to issues of Rs.25 crore to

encourage the use of this facility. However, no issuer used this facility. SEBI

modified the framework for Book

Building further in October 1999 to make it more attractive. The modified

framework does not replace the existing guidelines. The issuer would have option

to issue securities using book building facility under the existing framework:

1. The present requirement of graphical display of demand at bidding terminals to

syndicate members as well as the investors has been made optional.

2. The 15% reservation for individual investors bidding for up to 10 marketable

lots may be merged with the 10% fixed price offer.

3. Allotment for the book built portions shall be made in demat form only.

4. The issuer may be allowed to disclose either the issue size or the number of

securities to be offered to the public.

5. Additional disclosure with respect to the scheme for making up the deficit in the

sources of financing and the pattern of deployment of excess funds shall be made

M.P Birla Institute of Management, Bangalore - 30 -

The Performance of IPOs after the expiry of lock-up periods in India

in the offer document.

Is the process followed in India different from abroad?

Unlike international markets, India has a large number of retail investors who

actively participate in IPO’s. Internationally, the most active investors are the

Mutual Funds and Other Institutional Investors. So the entire issue is book built.

But in India, 25 per cent of the issue has to be offered to the general public. Here

there are two options to the company. According to the first option, 25 per cent of

the issue has to be sold at a fixed price and 75 per cent is through Book Building.

The other option is to split the 25 per cent on offer to the public (small investors)

into a fixed price portion of 10 per cent and a reservation in the book built portion

amounting to 15 per cent of the issue size. The rest of the book built portion is

open to any investor.

COST OF PUBLIC ISSUE.

The cost of public issue is normally between 8 and 12 percent depending on the

size of the issue and on the level of marketing efforts. The important expenses

incurred for a public issue are as follows:

• Underwriting expenses:

The underwriting commission is fixed at 2.5 % of the nominal value (including

premium, if any) of the equity capital being issued to public.

Brokerage applicable to all types of public issues of industrial securities are fixed

at 1.5% whether the issue is underwritten or not. The managing brokers (if any)

M.P Birla Institute of Management, Bangalore - 31 -

The Performance of IPOs after the expiry of lock-up periods in India

can be paid a maximum remuneration of 0.5% of the nominal value of the capital

being issued to public.

• Fees to the Managers to the Issues:

The aggregate amount payable as fees to the managers to the issue was previously

subject to certain limits. Presently, however, there is no restriction on the fee

payable to the managers of the issue.

• Fees for Registrars to the Issue:

The compensation to he registrars, typically based on a piece rate system, depends

on the number of applications received, number of allotters, and the number of

unsuccessful applicants.

This is the concerned fee payable to concerned stock exchange where

the securities are listed. It consists of two components: initial listing fees and

annual listing fees.

BRIEF NOTE ON INTERMEDIARIES

The process of IPO is highly complex and its success is extremely important for

the company. In this process it is important that all the intermediaries should work

cohesively and within a framework of law. Any serious error by any intermediary

can affect the IPO.

M.P Birla Institute of Management, Bangalore - 32 -

The Performance of IPOs after the expiry of lock-up periods in India

The following are the important intermediaries involved in the process-

MERCHANT BANKERS

Eligibility criteria-SEBI issues an authorization letter to the finance companies,

which are eligible to work as merchant bankers. The eligibility criteria depend on

network and infrastructure of the company. The company should not be engaged

in activities that are banned for merchant bankers by SEBI. SEBI issues

authorization letter valid for 3 years and the company has to pay necessary fees.

Such merchant banker can be appointed as lead manager for IPO.

Functions- Merchant banker can work as lead manager co lead manager

investment banker underwriter etc.

Responsibility-lead managers are fully responsible for the

content and correctness of the prospectus. They must ensure the commencement to

the completion of the IPO. Certain guidelines are laid down in section 30 of the

SEBI act 1992 on the maximum limits of the intermediaries associated with the

issue.

Size of the Issue No of Lead Managers

50 cr. is 2

50-100 cr. Is 3

100-200 cr. Is 4

200-400 cr. Is 5

M.P Birla Institute of Management, Bangalore - 33 -

The Performance of IPOs after the expiry of lock-up periods in India

SEBI AND IPO

ELIGIBILITY NORMS :

FOR UNLISTED COMPANIES

- It should have a pre issue network of a minimum amount of Rs1 crore in 3 out of

the preceding 5 financial years. In addition the company should compulsorily

need the minimum network level during the two immediately preceding years.

- It should have a track record¬ distributable profits as given in section 205 of

companies act 1956 for at least 3 years in the preceding 5 years period.

- The issue size (i.e. Offer +¬ Form allotment + Promoters contribution through

the offer document) should not exceed an amount equal to 5 times its pre issue

worth.

FOR LISTED COMPANIES

- It should have a track record distributable profits as given in Section 205 of

Companies Act 1956 for at least 3 years in the preceding 5 years period.

- It should have a pre issue network of a minimum amount of Rs1 crore in

3 out of the preceding 5 financial years with the minimum net worth to be

met during the immediately preceding 2 years.

M.P Birla Institute of Management, Bangalore - 34 -

The Performance of IPOs after the expiry of lock-up periods in India

- SEBI NORMS

SEBI has come up with Investor Protection and Disclosure Norms for

raising funds through IPO. These rules are amended from time to time to

meet with the requirement of changing market conditions.

Disclosure Norms.

• Risk Factor-

The Company/Merchant Banker must specify the major risk factor in the front

page of the offer document.

• General Risk.-

Attention of the investor must be drawn on these risk factors.

• Issuers Responsibility-

It is the absolute responsibility of the issuer company about the true and correct

information in the prospectus. Merchant Banker is also responsible for giving true

and correct information regarding all the documents such as material contracts,

capital structure, appointment of intermediaries and other matters.

• Listing Arrangement-

It must clearly state that once the issue is subscribed where the shares will be

listed for trading.

• Disclosure Clause-

M.P Birla Institute of Management, Bangalore - 35 -

The Performance of IPOs after the expiry of lock-up periods in India

It is compulsory to mention this clause to distinctly inform the investors that

though the prospectus is submitted and approved by SEBI it is not responsible for

the financial soundness of the IPO.

• Merchant Bankers Responsibility-

Disclaimer Clause the Lead Manager has to certify that disclosures made in the

prospectus are generally adequate and are in conformity with the SEBI Guidelines.

• Capital Structure-

The company must give complete information about the Authorised capital,

Subscribed Capital with top ten shareholders holding pattern, Promoters interest

and their subscription pattern etc. Also about the reservation in the present issue

for Promoters, FII`s, Collaborators, NRI`s etc. Then the net public offer must be

stated very clearly.

• Auditors Report-

The Auditors have to clearly mention about the past performances, Cost of Project,

Means of Finance, Receipt of Funds and its usage prior to the IPO. Auditor must

also give the tax-benefit note for the company and investors.

INVESTOR PROTECTION NORMS.

M.P Birla Institute of Management, Bangalore - 36 -

The Performance of IPOs after the expiry of lock-up periods in India

• Pricing of Issue-

The pricing of all the allocations for the present issue must follow the

bid system. The reservation must be disclosed for different categories of investors

and their pricing must be specified clearly.

• Minimum Subscription-

If the company does not receive minimum subscription of 90% of

subscription in each category of offer and if the issue is not underwritten or the

underwriters are unable to meet their obligation, then fund so collected must be

refunded back to all applicants.

• Basis of Allotment-

In case of full subscription of the issue, the allotment must be made with the

full consultation of the concerned stock exchange and the company must be

impartial in allotting the shares.

• Allotment/Refund-

Once the allotment is finalized, the refund of the excess money must be made

within the specified time limits otherwise the company must pay interest on

delayed refund orders.

• Dematerialization of Shares-

As per the provisions of the Depositories Act, 1996, And SEBI Rules,

now all IPO will be in Demat form only.

• Listing of Shares-

It is mandatory on the part of the promoters that once the IPO is fully

subscribed, and then the underlying shares must be listed on the stock exchange.

M.P Birla Institute of Management, Bangalore - 37 -

The Performance of IPOs after the expiry of lock-up periods in India

This provides market and exit routes to the investors.

. The SEBI has provided rules for every possible situation.

SEBI GUIDELINES

IPO of Small Companies

Public issue of less than five crores has to be through OTCEI (Over the

Counter Exchange of India) and separate guidelines apply for floating and listing

of these issues.

Public Offer of Small Unlisted Companies (Post-Issue Paid-Up Capital upto

Rs.5 crores)

Public issues of small ventures which are in operation for not more than two

years and whose paid up capital after the issue is greater than 3 crores but less than

5 crores the following guidelines apply.

1. Securities can be listed where listing of securities is screen based.

2. If the paid up capital is less than 3 crores then they can be listed on the Over

The Counter Exchange of India (OTCEI)

3. Appointment of market makers mandatory on all the stock exchanges where

securities are proposed to be listed.

M.P Birla Institute of Management, Bangalore - 38 -

The Performance of IPOs after the expiry of lock-up periods in India

Size of the Public Issue :

Issue of shares to general public cannot be less than 25%of the total

issue. Incase of IT, Media and Telecommunication sectors, this stipulation is

reduced subject to the conditions that :

1. Offer to the public is not less than 10% of the securities issued.

2. A minimum number of 20 lakh securities is offered to the public

3. Size of the net offer to the public is not less than Rs.30 crores.

Promoters Contribution :

1. Promoters should bring in their contribution including premium fully before the

issue

2. Minimum promoter’s contribution is 20-25% of the public issue.

3. Minimum lock in period for promoter’s contribution is five years.

4. Minimum lock in period for firm allotment is three years.

5. The post-issue capital is subject to a lock-in period of 3 years

Collection Centers for Receiving Applications:

1. There should be at least 30 mandatory collection centers, which should include

invariably the places where stock exchanges have been established.

M.P Birla Institute of Management, Bangalore - 39 -

The Performance of IPOs after the expiry of lock-up periods in India

2. For issues not exceeding Rs.10 crores the collection centers shall be situated at:-

• The 4 metropolitan centres. Mumbai, Delhi, Calcutta and Chennai

• All such centres where stock exchanges are located in the region in which the

registered office of the company is situated.

Regarding allotments of shares

1. Net Offer the general public has to be atleast 25% of the total issue size for

listing on a stock exchange

2. It is mandatory for a company to get its shares listed at the regional stock

exchange where the registered office of the issuer is located.

3. In an issue of more than 25 crores the issuer is allowed to place the whole issue

by book-building.

4. Minimum of 50% of the Net Offer to the public has to be reserved for the

investors applying for less than 1000 shares.

5. There should be atleast 5 investors for every 1 lakh equity offered.

M.P Birla Institute of Management, Bangalore - 40 -

The Performance of IPOs after the expiry of lock-up periods in India

6. Quoting of PAN or GIR No. in application for the allotment of securities is

compulsory where monetary value of investment is Rs.50000/- or above.

7. Indian development financial institutions and Mutual Fund can be allotted

securities upto 75% of the issue amount.

8. A venture capital fund shall not be entitled to get its securities listed on any

stock exchange till the expiry of 3 years from the date of issuance of securities.

9. Allotment to categories of FIIs and NRIs/OCBs is upto maximum of 24%,

which can be further extended to 30% by an application to the RBI-supported by a

resolution passed in the General Meeting.

Timeframes for Issue and Post-Issue Formalities

1. The minimum period for which the public issue is to be kept open is 3 working

M.P Birla Institute of Management, Bangalore - 41 -

The Performance of IPOs after the expiry of lock-up periods in India

days and the maximum for which it can be kept open is 10 working days. The

minimum period for right issue is 15 working days and the maximum is 60

working days.

2. A public issue is effected if the issue is able to procure 90% of the total issue

size within 60 days from the date of the earliest closure of the public issue.

3. In case of oversubscription the company may have he right to retain the excess

application money and allot shares more than the proposed issue, which is referred

to as “green-shoe” option

4. Allotment has to be made within 30 days of the closure of the Public issue and

42 days in case of Rights issue

5. All the listing formalities of a Public Issue have to be completed within 70 days

from the date of closure of the subscription list.

Dispatch of Refund Orders.

1. Refund orders have to be dispatched within 30 days of the closure of the issue.

M.P Birla Institute of Management, Bangalore - 42 -

The Performance of IPOs after the expiry of lock-up periods in India

2. Refunds of excess application money i.e. non-allotted shares have to be made

within 30 days of the closure of the issue.

Other Regulations:

1. Underwriting is not mandatory but 90% subscription is mandatory for each

issue of capital to public unless it is disinvestment where it is not

applicable.

2. If the issue is undersubscribed then the collected amount should be

returned back

3. If the issue size is more than Rs500 crores, voluntary disclosures should

be made regarding the deployment of funds and an adequate monitoring

mechanism put in place to ensure compliance.

4. There should not be any outstanding warrants for financial instruments of

any other nature, at the time of the IPO.

5. In the event of the initial public offer being at a premium and if the rights

under warrants or other instruments have been exercised within 12 months

prior to such offer, the resultant shares will be not taken into account for

reckoning the minimum promoters contribution further, the same will also be

subject to lock-in.

M.P Birla Institute of Management, Bangalore - 43 -

The Performance of IPOs after the expiry of lock-up periods in India

6. Code of advertisement as specified by SEBI should be adhered to.

7. Draft prospectus submitted to SEBI should also be submitted

simultaneously to all stock exchanges where it is proposed to be listed.

Restrictions on Allotments

1. Firm allotments to mutual funds, FII and employees are not subject to any

lock-in period.

2. Within 12 months of the public issue no bonus issue should be made.

3. Maximum percentage of shares, which can be distributes to employees cannot

be more than 5% and maximum shares to be allotted to each employee cannot be

more than 200.

With a view channelize greater flow of funds to infrastructure

companies, SEBI granted a number of relaxations to infrastructure companies.

These included:

Exemption from the requirement of making a minimum public offer of 25 percent

of securities and also from the requirement of 5 shareholders per Rs.1 lakh of

offer made.

Exemption from the minimum subscription of 90 per cent provided

M.P Birla Institute of Management, Bangalore - 44 -

The Performance of IPOs after the expiry of lock-up periods in India

disclosure is made about the alternate source of funding considered by the

company, in the event of under-subscription in the public issue.

Permission to freely price the offer in the domestic market

provided the promoter companies along with equipment supplier sand other

strategic investors subscribe to 50 percent of the equity at the same price as the

price offered to the public or at a price higher than that offered to the public.

Permission to keep the issues open for 21 days to enable the companies to

mobilize funds.

Exemption from requirement to create and maintain a debenture

redemption reserve in case of debenture issues as provided in the SEBI Disclosure

& Investor Protection Guidelines

These concessions are available to them if these are appraised by a

Development Financial Institution, Infrastructure Development Finance

Corporation or Infrastructure Leasing and Financing Services Ltd. and there is a

minimum financial participation by them. The minimum participation of the

appraising agency, initially fixed at 10% of project cost, was reduced to 5%.

Further, the minimum participation can be met by any of the appraising agencies,

jointly or severally, irrespective of whether they appraise the project or not.

Eligibility norms for public issues/offers for sale by companies in

the IT Sector

Eligibility norms were modified to provide that a company in the IT Sector going

for IPO/offer for sale shall have track record of distributable profits as per Section

205 of the Companies Act in three out of five years in the IT business/from out of

IT activities.

M.P Birla Institute of Management, Bangalore - 45 -

The Performance of IPOs after the expiry of lock-up periods in India

It can also access the market through the alternative route of appraisal and

financing by a bank or financial institution.

The same conditions would apply also to a listed company which has

changed its name to reflect activities in IT sector.

CHAPTER II

M.P Birla Institute of Management, Bangalore - 46 -

The Performance of IPOs after the expiry of lock-up periods in India

LITERATURE

SURVEY

1.) IPO Lock-Ups Stop Insider Selling

By Doug McIntyre

When companies "go public", the number of shares offered in the initial public

offering (IPO) is typically a relatively small portion of the overall ownership. The

balance of the shares is held by insiders, which include management, founders and

M.P Birla Institute of Management, Bangalore - 47 -

The Performance of IPOs after the expiry of lock-up periods in India

venture capitalists (VC) who funded the company while it was private.

The exact number of shares that is offered in each IPO will differ from company

to company. For example, in 2004, Google offered 7% of its shares to the public,

while Vonage offered 20% of its shares to the public during its 2006 IPO.

Insider’s locked up

Although the number of shares offered will differ from one IPO to another, nearly

all IPOs have some sort of lock-up period. A lock-up period is a warning placed

on insiders and pre-IPO holders that prevents them from selling their shares for a

set period of time after the company has gone public. A typical lock-up period is

four to six months.

There is no federal law or Securities and Exchange

Commission requirement that forces insiders or pre-IPO shareholders to be

"locked up", but the investment banks underwriting the IPO almost always request

it so that insiders do not flood the market with shares right after the company's

initial public offering. The lock-up in the prospectus (Form 424B4) is a contract

between the insiders and the purchasers of the IPO, so it is highly unlikely that it

would be violated.

This information is disclosed in the S-1 when the IPO

documents are filed with the SEC. The best sources for lock-up information are

the SEC website and several paid services including Edgar Online. The lock-up

period will be stipulated in the prospectus, called the S-1, but it is very important

that investors watch each revision of this document, called S-1As, because there

could be a change in the lock-up terms.

M.P Birla Institute of Management, Bangalore - 48 -

The Performance of IPOs after the expiry of lock-up periods in India

The Reason for Lock-ups

As a company goes public, underwriters want to be able to see what outside

investors believe the new entity is worth based on information like that found on

the balance sheet, the income statement (profits and losses) and executive

overviews of the business (business risks).

If inside investors are allowed to sell immediately at the time of the

IPO, it may well obscure the price that the markets put on the company by putting

selling pressure on the shares on the first day of trading.

The Positives of Insider Sales

The end of the lock-up period is as important as an earnings report or other

big event at a public company. There are several factors that investors should

watch for to determine whether post lock-up selling is a warning sign.

First, determine how long inside investors have had shares. Some

founders may have been with companies for several years, so the sales of their

shares may be the only way that they have to make significant money from their

work. Both the S-1 and proxy show terms of service for officers.

Another factor to consider is whether a venture capitalist

has one of its partners on the company's board of directors. If so, the VC firm may

be less likely to sell because of a concern that the board member could have inside

information about the company's activities. This also holds true for officers. Quite

often a lock-up period will end, but insiders cannot sell stock because they have

information on earnings or have access to other critical data that the public

shareholders do not.

Insiders are probably more likely to sell if a stock has gone up sharply since the

IPO. There is no hard data on this, but shareholders in a company with a falling

M.P Birla Institute of Management, Bangalore - 49 -

The Performance of IPOs after the expiry of lock-up periods in India

share price post-IPO do not want to add to investor concerns by selling shares.

Remember, insider selling after a lock-up period is not necessarily bad.

As said above, often company management has worked for a number of years to

build the business, and its entire net worth is tied up in the value of the firm. There

is also the fact that venture capitalists may have had money in the company for

several years as well. If insiders begin to sell a very large portion of their holdings,

it should be viewed with concern, but not worried over. It would be difficult to

view this as a vote of confidence, but it shouldn't cause too much alarm either.

Factors to Determine the Impact of Ending Lock-ups

According to a study entitled, "The IPO Lock-Up Period:

Implications for Market Efficiency And Downward Sloping Demand Curves"

(New York University, 2000), at the end approximately 1,000 lock-ups in a

sample analyzed by the Stern Business School at New York University, trading

volumes of public companies permanently rose about 30% after lock-ups expired,

while price dropped 1% to 3%.

One of the most critical factors in IPO lock-up selling is the average daily

trading volume of the shares after the day of the IPO. If trading volume is very

low compared to the number of shares in the lock-up, the price may well have

more trouble holding up because there are few buyers in the market. An outside

shareholder has much more to be concerned about if a company has 20 million

shares in a lock-up and average daily volume of 10,000 shares than if the

company's volume is a million shares a day.

Another sign of concern about lock-up selling is the short

position in the stock right before the lock-up ends. Are short sellers betting that the

stock will drop sharply as the lock-up period ends? The major exchanges all

M.P Birla Institute of Management, Bangalore - 50 -

The Performance of IPOs after the expiry of lock-up periods in India

publish short data once a month and owners of IPO shares should watch these as

lock-up periods end.

Conclusion

It is difficult to view sales by insiders as a positive move. On the other hand,

founders and venture capitalists who have built a company can hardly be forced to

hold shares indefinitely. Investors have to keep a checklist that includes the

percent of all shares that are locked up, average trading volume of the IPO

company in the months between the offering and the expiration of the lock-up,

board membership of insider shareholders that may limit their ability to sell, and

the overall financial performance of the company and its stock. Even with insiders

selling, shares in companies like Google have done very well.

2.) IPO Lock-in Agreements in the UK

Susanne Espenlaub

M.P Birla Institute of Management, Bangalore - 51 -

The Performance of IPOs after the expiry of lock-up periods in India

University of Manchester - Division of Accounting and Finance

Marc Goergen

Cardiff University - Cardiff Business School; European Corporate Governance

Institute (ECGI)

Arif Khurshed

University of Manchester - School of Accounting Finance

Journal of Business Finance & Accounting, Vol. 28, No. 9-10,

November/December 2001

When a company offers shares in an initial public offering (IPO),

existing owners often enter into lock-in agreements prohibiting them from selling

shares for a specified period after the IPO. There is some recent U.S. evidence of

predictable share-price movements at the time of expiry of these lock-in periods.

Using a sample of 188 firms, 83 classified as high-tech and 105 others, that went

public on the London Stock Exchange (LSE) during 1992-1998, we focus on the

characteristics of lock-in agreements in the UK and on the behavior of stocks

returns around the lock-in expiry date. We find that the lock-in contracts of LSE-

listed firms are much more complex, varied and diverse than U.S. contracts, which

usually standardize the lock-in period at 180 days after the IPO. We also find

evidence of negative abnormal stock returns at and around lock-in expiry of

similar magnitude to those reported in U.S. studies. However, these abnormal

returns are typically not statistically significant. While the deterioration in stock

returns immediately around the expiry date appears to be much more particularly

pronounced for high-tech stocks than for others, the differences in performance are

not statistically significant

M.P Birla Institute of Management, Bangalore - 52 -

The Performance of IPOs after the expiry of lock-up periods in India

3.) The IPO Lock-Up Period: Implications for Market Efficiency And

Downward Sloping Demand Curves

Eli Ofek

Matthew Richardson

After an initial public offering, most existing shareholders are subject

to a lock-up period in which they cannot sell their shares for a prespecifed time. At

the end of the lock-up, there is a permanent and large shift in the supply of shares.

The lock-up expiration is a particularly interesting event to study because it is

(i) completely known and observable, and (ii) potentially meaningful

economically given the existing literature on supply shocks. This paper

investigates volume and price patterns around this period, and documents several

interesting results. Specifically, even though the event is totally anticipated, there

is a 1% - 3% drop in the stock price, and a 40% increase in volume, when the

lock-up ends. Various explanations are considered and rejected, suggesting a new

anomalous fact against market efficiency. However, convincing evidence is

provided which shows that this inefficiency is not exploitable, i.e., arbitrage is not

violated. This aside, the evidence points to a downward sloping demand curve for

shares, with the most likely explanation pointing to a permanent, long-run effect.

M.P Birla Institute of Management, Bangalore - 53 -

The Performance of IPOs after the expiry of lock-up periods in India

CHAPTER -III

PROBLEM

STATEMENT :

M.P Birla Institute of Management, Bangalore - 54 -

The Performance of IPOs after the expiry of lock-up periods in India

The problem statement for the purpose of our project revolves around the fact that

though the IPOs have generated increasing returns in the short run , either due to

the bull run, oversubscription or efficient price discoveries in, why have they not

sustained he same returns in he after market period. The after market period is the

period a 3 month to 9 month after the expiry of lock-in period .As IPO issues are

subject to a minimum lock-up period agreement any where in the world markets.

There is a similar binding on the Indian companies for a promoter lock-in period

of 3 years for the post-issue for the companies getting listed. The period in which

the insiders are restricted from selling the shares in the secondary market.

The problem statement :

“ Do IPOs really underperform after the expiry of

lock-in periods “

RESEARCH OBJECTIVES :

M.P Birla Institute of Management, Bangalore - 55 -

The Performance of IPOs after the expiry of lock-up periods in India

The main objectives of this project are :

• To analyze how safe is it for the retail investors to hold their investment in

IPOs.

• To study the effect on prices of IPOs before and after the lock-up periods.

• To know what extent is the impact on the post-issue lock-up period on the

share prices.

RESEARCH METHODOLOGY

M.P Birla Institute of Management, Bangalore - 56 -

The Performance of IPOs after the expiry of lock-up periods in India

The study is quantitative, exploratory and analytical.

The study consists of companies which have raised capital and have been listed

between 2000 and 2005 ,

The research methodology for this is that the IPOs listed and performed over a

period have performed and their performance after the expiry of post-issue

lockin period that is 3 years after the day of listing as per SEBI guidelines for

Promoters.

The lock-in period for companies listed before

September 2006 was 3 years from the date of allotment . As a result only those

companies which have been listed between 2000 and 2005 and performed 3 years

till the date of expiration of lockin period as well as the closing price of the next

quarter of the respective companies is recorded and considered for the research.

i) The study is quantitative

The sample size and the data selected for this purpose

is a size of 60 IPOs selected carefully and considering the objective of the

project.

The share prices considered are the closing prices of all the respective

dates : I,e

Prior and after the date of listing :

Prior and after the lockup period of the shares

Prior and after the first quarter i,e 3 months after the expiry of the lock-in period

of the respective shares(post-issue).

M.P Birla Institute of Management, Bangalore - 57 -

The Performance of IPOs after the expiry of lock-up periods in India

ii) The research is exploratory

Enough data searching is done on the historical prices of the share prices

.

Their trends and performances on or after the lock-in perod is examined. Though

the parameters set to choose a company was done in a way that

the companies are not delisted during the time period selected for research.

there is sound fundamentals (such as P/E multiples.)

the companies has evolved well while raising for the IPOs and fulfilled all the

requirements, legal norms of SEBI. DIP regulations 2000

The companies which have gone public for the are listing for the first time.

iii) The research is analytical because

M.P Birla Institute of Management, Bangalore - 58 -

The Performance of IPOs after the expiry of lock-up periods in India

The data collected is been subject to statistical interpretation since :

The sample of stocks have been compared for two to three different time periods i

And considering the “ lock-in period “ factor constant the variations are

evaluated.

The individual pairs of data are correlated with each other and the correlation

coefficient is calculated using Ms-excel.

The analysis is put to a test of significance .

Two tailed test of Pearsons r correlation

At 5 % level of significance, hence the hypothesis is proved

M.P Birla Institute of Management, Bangalore - 59 -

The Performance of IPOs after the expiry of lock-up periods in India

AREA OF ENQUIRY

The study has been restricted to the companies which raised

capital during the period under study because a new regulatory regime became

functional from 1992 onwards with Securities and Exchange Board of India

(SEBI) replacing the Controller Of Capital Issues (CCI).

Of all the IPOs the companies have been selected on the

following criteria:

• The initial public offering is of common stock.

• The IPO is from post-SEBI period and offered under free pricing era

• The IPOs listed are either book- built or fixed price or a combination of

both.

• The stocks have performed well on the market over a period

• The stocks which have been delisted or the IPOs which have been raised

with be as a result of merger are not included for this purpose.

M.P Birla Institute of Management, Bangalore - 60 -

The Performance of IPOs after the expiry of lock-up periods in India

Sample:

The sample of the study consists of about 60 Indian companies

which have been listed between 2000 and 2005 and performed till the

promoter’s post-issue lock up period of 3 years from the as per SEBI guidelines.

And the performance of those

Share price at the end of the 1st quarter respectively.

Data collection :

The source of data is secondary data from Capitaline

database.

The available historical prices of the relevant shares after listing are available.

RESEARCH LIMITATIONS :

M.P Birla Institute of Management, Bangalore - 61 -

The Performance of IPOs after the expiry of lock-up periods in India

The limitations of this research are:

i.) The share prices are based on data collected from Capitaline Database and

any error may reflect in the study.

ii) There is a limitation of time available for this study.

iii) There a few stocks as banks which have yielded positive returns

irrespective of the lock-up period factor. Those IPOs cannot be considered to be

following this inference.

iv) The sample size selected for this purpose is before 2006, keeping the

lock-up period of shares constant, no other factors are really considered.

Therefore the study is free from other factors such as liquidity, etc

M.P Birla Institute of Management, Bangalore - 62 -

The Performance of IPOs after the expiry of lock-up periods in India

CHAPTER IV

DATA ANALYSIS

AND

INFERENCES

M.P Birla Institute of Management, Bangalore - 63 -

The Performance of IPOs after the expiry of lock-up periods in India

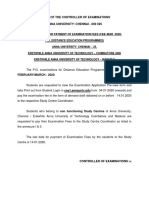

1.) Table showing prices of IPOs at three different periods

:

price on price 3

expiry of months

day of after

lock-in lockin

NO. Company list year list price period pd

Moschip Semiconductor

1 Technology Ltd 2000 18 49.6 36.8

2 Adlabs Films Ltd 122 129.85 99.1

3 Aztecsoft Ltd 99 29.78 18.7

4 Axis IT&T Ltd 75 18.25 9.9

5 Balaji Telefilms Ltd 171 73.55 55.05

6 Opto Circuits (India) Ltd 392 74.55 47.85

7 D-Link (India) Ltd 2001 220 203.2 124.1

8 Mid-Day Multimedia Ltd 55 33.8 33.2

9 Andhra Bank 9.5 45.5 46

10 Canara Bank 2002 43 228.55 261

11 Allahabad Bank 12.05 47.1 74.5

12 Union Bank of India 17 131.05 122

13 Punjab National Bank 40.1 375 379.5

14 Bharti Airtel Ltd 55 218.15 242.85

15 T.V. Today Network Ltd 2003 210 98.4 123.45

16 Indraprastha Gas Ltd 120 115.2 99.95

17 Vijaya Bank 32.9 53.2 38

18 B A G Films & Media Ltd 16 9.19 8.92

19 Indian Overseas Bank 28.1 115.85 110.7

20 UCO Bank 17.9 23.15 21.2

21 Maruti Suzuki India Ltd 158.4 805.35 819.7

22 Divi's Laboratories Ltd 161.1 176.25 1303.6

23 Impex Ferro Tech Ltd 2004 17.4 20.75 14.5

24 Bharati Shipyard Ltd 130 769 541.65

Deccan Chronicle Holdings

25 Ltd 192 211.65 70.05

26 S.A.L Steel Ltd 23.5 20.7 17.05

27 Spanco Ltd 47.1 201.2 161.25

28 NTPC Ltd 70 236.8 197

Indiabulls Financial

29 Services Ltd 25 598.45 414.2

30 Sah Petroleums Ltd 35 23.15 21.2

M.P Birla Institute of Management, Bangalore - 64 -

The Performance of IPOs after the expiry of lock-up periods in India

31 Crew B.O.S. Products Ltd 39 15.88 14.9

Tata Consultancy Services

32 Ltd 1050 1025.65 1072.05

33 New Delhi Television Ltd 100 415.5 462.8

34 Ramkrishna Forgings Ltd 30 147.25 40.2

35 Dishman Pharmaceuticals 301 243.15 370.85

36 Biocon Ltd 400 244.08 235.78

37 PTC India Ltd 31.1 59.6 64

38 Petronet LNG Ltd 16.5 42.2 56.2

39 GAIL (India) Ltd 205 180 205

Dredging Corporation of

40 India 455 493.65 493.25

41 Bank of Maharashtra 35 38.75 50.05

42 CMC Ltd 530 1221.8 1002.67

43 Four Soft Ltd 20.1 60.85 48.15

Patni Computer Systems

44 Ltd 305 431.4 469.9

45 IDFC LTD 2005 69.55 108.4 70.8

46 SPL Industries Ltd 90 13.39 14.1

47 Nectar Lifescience Ltd 29.8 30.76 31.79