Professional Documents

Culture Documents

Supplementary GN GIC

Supplementary GN GIC

Uploaded by

ABC 123Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Supplementary GN GIC

Supplementary GN GIC

Uploaded by

ABC 123Copyright:

Available Formats

www.icmai.

in

SUPPLEMENTARY GUIDANCE NOTE

ON THE

IMPACT OF COVID-19 AND

FUTURE STRATEGIES FOR INTERNAL AUDIT OF

GENERAL INSURANCE COMPANIES

THE INSTITUTE OF COST ACCOUNTANTS OF INDIA

Statutory Body under an Act of Parliament

Behind every successful business decision, there is always a CMA

Published By

THE INSTITUTE OF COST ACCOUNTANTS OF INDIA

CMA Bhawan

12 Sudder Street, Kolkata-700016

Delhi Office

CMA Bhawan

3, Institutional Area, Lodhi Road , New Delhi 110003

THE INSTITUTE OF COST ACCOUNTANTS OF INDIA

© All Rights Reserved

Behind every successful business decision, there is always a CMA

Supplementary Guidance Note on the IMPACT of COVID-19 and Future Strategies for Internal Audit of General Insurance Companies

SUPPLEMENTARY GUIDANCE NOTE

ON THE

IMPACT OF COVID-19 AND

FUTURE STRATEGIES FOR

INTERNAL AUDIT OF GENERAL

INSURANCE COMPANIES

THE INSTITUTE OF COST ACCOUNTANTS OF INDIA

(Statutory Body under an Act of Parliament)

www.icmai.in

The Institute of Cost Accountants of India

Supplementary Guidance Note on the IMPACT of COVID-19 and Future Strategies for Internal Audit of General Insurance Companies

PREFACE

T

he Institute of Cost Accountants of India had brought out the Guidance Note on the Internal

Audit of General Insurance Companies and the same was released in January 2020 at the Global

Summit. The same was well received by Industry and members of the Institute. In March 2020

the World Health Organization (WHO) declared the spread of Corona Virus or COVID-19 as a pandemic

spread. In India due to spread of COVID-19 Pandemic and resultant LOCKDOWN of nearly 8 weeks, the

economic activities in the country had come to agrinding halt and meanwhile the world economy also

faces a decisive recession due to COVID-19 and growing unemployment. The value of investments began

shrinking. To contain the economic slowdown, the Government of India had taken a number of steps.

IRDA also quickly acted and issued various orders and guidance to the Indian Insurance Industry for

operation post Covid.

In view of this lockdown and commencement of new normal economy, it was felt that a Supplementary

Guidance Note: may also be added to the existing one, taking into consideration the latest developments

in the economy, for the benefit of the members doing Internal Audit of General Insurance Companies.

While preparing this supplementary guidance note, the latest guidelines of the IRDA and GoI are taken

into account. Hope the Insurance Industry and Members will receive these supplementary guidance note

overwhelmingly as done to the main guidance note.

CMA Chittaranjan Chattopadhyay

Chairman

Banking and Insurance Committee

The Institute of Cost Accountants of India

The Institute of Cost Accountants of India

Supplementary Guidance Note on the IMPACT of COVID-19 and Future Strategies for Internal Audit of General Insurance Companies

INDEX

CMA Chittaranjan Chattopadhyay

Preface Chairman, Banking and Insurance Committee

The Institute of Cost Accountants of India

Chapter Description Page No

1 Introduction 1

2 General Insurance 4

3 Conclusion 12

The Institute of Cost Accountants of India

Supplementary Guidance Note on the IMPACT of COVID-19 and Future Strategies for Internal Audit of General Insurance Companies

CHAPTER 1

INTRODUCTION

1.1 BRIEF OF THE SCENERIO

The COVID-19 pandemic was inflicting high and rising human costs worldwide. Protecting lives

and allowing health care systems to cope have required isolation, lockdowns, and widespread

closures to slow the spread of the virus. The health crisis is therefore having a severe impact on

economic activity. As a result of the pandemic, as well as recessionary trends in world

economies, IMF (April 2020) predicted that the global economy is projected to contract sharply

by (–)3 percent in 2020, much worse than during the 2008–09 financial crises. In a baseline

scenario, which assumes that the pandemic fades in the second half of 2020 and containment

efforts can be gradually unwound, the global economy is projected to grow by 5.8 percent in

2021 as economic activity normalizes, helped by policy support. There is extreme uncertainty

around the global growth forecast. The economic fallout depends on factors that interact in ways

that are hard to predict, including the pathway of the pandemic, the intensity and efficacy of

containment efforts, the extent of supply disruptions, the repercussions of the dramatic tightening

in global financial market conditions, shifts in spending patterns, behavioral changes (such as

people avoiding shopping malls and public transportation), confidence effects, and volatile

commodity prices. Many countries face a multi-layered crisis comprising a health shock,

domestic economic disruptions, plummeting external demand, capital flow reversals, and a

collapse in commodity prices.

1.2 EFFECTOF COVID-19

In India, following the COVID-19 outbreak, the economic activities of the country came to a

standstill and almost 8 week Lockdown was implemented. Road, Rail and Air Transports were

stopped. The values of risk assets collapsed and market volatility spiked. Expectations of

widespread unemployment, reverse movement of labor, liquidity crunch, virtual absence of

economic activities, forced wages without productivity, loss of tax revenue to government due to

The Institute of Cost Accountants of India 1

Supplementary Guidance Note on the IMPACT of COVID-19 and Future Strategies for Internal Audit of General Insurance Companies

the above effects are some of the threats to the Indian Economy. Several factors amplified asset

price moves: previously overstretched asset valuations, pressures to unwind leveraged trades,

dealers’ balance-sheet constraints, and deterioration in market liquidity. Emerging market

economies experienced the sharpest reversal of portfolio flows on record. As a result, financial

conditions tightened at an unprecedented speed. It is expected that there would be a lot of issues

on non-life insurance sectors which also suffered due to these financial effects. In the present

chapter it would be discussed what are the threats post COVID-19 Lockdown and how they can

be overcome with opportunities and it is for the Insurance Companies to utilize them. In the

following chapters it is discussed the specific segments in which more issues would arise and

how the internal audit would tackle the same and advise the companies.

1.3 POST COVID-19 LOCKDOWN SCENARIO:

1.3.1 THREATS

Post COVID-19 Lockdown, in India, it is expected that the economic activity would pick up

from scratch. On the one side there would be reduction in Income at the same time there would

be a lot of opportunities availablein the new normal economy especially in Insurance Sector. It is

expected the new normal life would change the economic activities as a lot of enterprises would

force their existing work-force to do Work Form Home (WFH) for many time thus paving way

for lesser transport cost. The unproductive human cost for all most 8 weeks had spiked the

economic growth. There was virtually no production in the entire months of April 2020 and to a

major extent in May 2020. The working capitals of most of the enterprises were already spent on

idle wages/salaries in these days. Moreover, there is huge carrying cost of inventory for almost 2

months apart from lot of work-in progress in various industries lying idle. It is feared that some

stock/ goods (both raw material as well as under process) may detoriate in quality and cannot be

utilised. Fear of cancellation of export orders are also there.

The Net Asset Value of their Investment funds had already shrunk due to volatility in stock and

bond markets and some of the investments would be downgraded due to revised corporate rating

of bonds and debentures in which these Insurance Companies had invested the shareholders as

well as policy holders’ funds. Some may also lose their solvency margins also.

The Institute of Cost Accountants of India 2

Supplementary Guidance Note on the IMPACT of COVID-19 and Future Strategies for Internal Audit of General Insurance Companies

1.3.2 OPPORTUNITIES:

As state above, though there were threats to the Insurance Industries, there is vast scope that

these threats can be converted into opportunities by them in this new normal economy. In the

new normal economy there bound to be pick up of economic activities as it is expected some

industries may relocate from China to India which would further employment. There would be

demand for inclusion of unspecified diseases in the treatment portfolio in the health insurance

sector and the premium may go up. The fear of footing bills for treatment of hitherto unknown

diseases like COVID-19 would force many to opt for Health Insurance. This would increase the

coverage of health insurance from the present 100 million families to atleast 150 million

families. Apart from the Union Govt.’s coverage of health sector, the States would also increase

their share in spending in health sector which would promote more number of institutions

offering health care which would increase the competition. Similarly, in other Insurance

products, there would be scope for more coverage.

In the following chapters the risks involved due to COVID-19 and LOCKDOWN to Insurance

Industry policies especially under Fire, Engineering, Health, Motor Marine, Investments and

Reinsurance along with the checks an Internal Auditor has to do and report would be discussed.

The Institute of Cost Accountants of India 3

Supplementary Guidance Note on the IMPACT of COVID-19 and Future Strategies for Internal Audit of General Insurance Companies

CHAPTER 2

GENERAL INSURANCE

2.1 INTROUDCTION

The details of how the non-life Insurance policies were managed and the checklist for auditor to

examine the items to be verified in audit were discussed in the Guidance Note of Internal Audit

of General Insurance Companies. Due to Lockdown, IRDAI had issued directions to the life

Insurance companies that any premium due in March 2020 would automatically be extended

upto 3 May 2020. As far as non-life insurance policies are concerned IRDA issued specific

orders for some type of policies to regulate them. Therefore the claims may arise even the

original normal date of expiry. In this chapter, the additional areas where the Internal Auditor’s

exercise on COVID-19 and LOCKDOWN claims to be checked are discussed below.

2.2 STANDARD FIRE & PERILS

Normally the following claims are admissible in a Fire Insurance Policy if add on premium was

paid. The circumstances are

a. Terrorism

b. Removal of debris

c. Spoilage and Material Damage

d. Leakage and contamination

e. Earth quack.

Similarly, the claims of following types are not admissible in Fire & Perils policies.

a. Spontaneous combustions fermentation

b. Burning of property by public authority

c. Explosion of boilers

d. Total or Partial cessation of work

e. Permanent and temporary dispossession by order of Government

f. War and warlike operations

The Institute of Cost Accountants of India 4

Supplementary Guidance Note on the IMPACT of COVID-19 and Future Strategies for Internal Audit of General Insurance Companies

The above are only illustrative.

A detailed audit approach was discussed in Chapter 5 of the Guidance Note. The auditor should

verify the following claims relating to COVID and Lockdown period which may arise to which

the insurance companies can regulate.

a) As per policy conditions, the spoilage or material damage to the raw material/process

stock was allowable or not?

b) If so whether add on premium was received to cover the peril

c) (The claims may arise due to raw materials spoilage due to long storage or detoriation

in quality). The insured had taken adequate care in storage of raw materials both at

storage as well as at shop floor or not. If not the claim is not admissible.

d) (The cessations of operations were due to Government order). Therefore, the claims

on detoriation in stocks due to stoppage could not be entertained.

e) Similarly, no loss of profit for the stoppage period could be entertained as the

stoppage was not of any insured perils.

f) After stoppage, and restart of manufacturing facilities, certain breakdown may occur

and combustion may also occur as in case of some chemical companies. Therefore

while regulating the claims, Audit would examine, whether proper operating

procedure was followed by the insurer to restart the facilities.

g) The insured assets were not utilised during the lockdown period. Therefore, the policy

normally lapses if an asset is not utilised for more than one month. But the same were

exempted by insurers. Hence Auditor should check the admissibility of the claims if

any.

2.3 INDUSTRIAL ALL RISK POLICIES

These policies are normally covered under Fire policies. The Scope of the Policy are under two

sections Section 1 covers Fire, Burglary, theft Machinery Breakdown, Boiler explosion etc.,

Section 2 covers consequential Loss (Fire Loss of Profit) and Machinery Loss of Profit.

However, the inadmissible claims are as detailed below.

Interruption loss due to failure of gas, electricity and water supply

The Institute of Cost Accountants of India 5

Supplementary Guidance Note on the IMPACT of COVID-19 and Future Strategies for Internal Audit of General Insurance Companies

Collapse or cracking of buildings

Larceny fraud or dishonesty

Wilful negligence on the part of the insured

War group of perils

Nuclear group of perils and

Destruction of property by public order

Faulty design of materials, workmanship and construction

The following losses would not be covered in the Industrial all risk policies.

Lack of sufficient capital with the Insured

Any restrictions imposed by public authorities

Loss of business due to cancellation of order/Lease

Damage of boilers machinery etc.,

Loss of profit claims should exclude indemnity for lockdown period

2.4 MACHINERY BREAKDOWN POLICIS.

The losses arising of Machinery Breakdown were insured normally. The replacement cost is also

covered in these policies.

Partial Loss: Full cost of parts plus labour charges plus to and fro charges including duties and

taxes if any for dismantling, repairs and reerection charges for the affected machinery

Total Loss: Actual value of items before the occurance of loss less appropriate depreciation. If

under insured, they may be regulated by applying average clause.

Against this, the following claims are not admissible.

Fire and allied perils

War and warlike operations

Wilful act or gross negligence, existing defects, normal wear and tear and

consequential loss and

Loss or damage under manufacturers’ warranty.

The Institute of Cost Accountants of India 6

Supplementary Guidance Note on the IMPACT of COVID-19 and Future Strategies for Internal Audit of General Insurance Companies

A detailed audit approach was discussed in Chapter 4 of the Guidance Note. Normally the

following types of claims are admissible for Machinery Breakdown policies. The auditor should

verify the following claims relating to COVID and Lockdown period which may arise to which

the insurance companies can regulate.

a) Due to prolonged non-operation and non-maintenance, the Machinery after lockdown

may on start would breakdown and production may affect. The insured should take

adequate pre-operation protectiveness like overhauling the machinery, lubrication,

maintenance etc., before commencement of operations as well as to follow the standard

operation procedure issued by Ministry of Home Affairs. Therefore the Auditor would

check for any such claims, whether the insured had followed proper procedure before

commencement of operations which resulted in breakdown.

b) The above same procedure may also be adopted for checking the LOP claims for

Machinery Breakdown.

2.5 HEALTH INSURANCE POLICIES

The detailed audit methodology for Health Insurance Policies was discussed in Chapter 6 of the

Guidance Note for Internal Audit of General Insurance Companies. Due to outbreak of COVID-

19, IRDA had issued guidelines (24thMarch 2020) and in its subsequent guidelines directed that

all the health insurance policies should cover the treatment under existing Health Insurance

Policies. Also these policies were validated till the end of Lockdown. This means that all the

policies which should have been terminated on due dates from 24 March 2020 till the end of the

Lockdown is extended to be live. Though the treatment of COVID is done mostly at government

health centres/ hospitals, very few private hospitals were added for treatment of COVID.

Therefore the auditor has to verify the following

a. Auditor should examine whether the policy is in force at the time of issue of IRDA order

or not to allow the claims.

b. Wherever the claims on COVID treatment is there, it should be verified whether the

hospital was authorised by the Government to treat COVID and the rates charged are as

per Governments’ fixed rates.

The Institute of Cost Accountants of India 7

Supplementary Guidance Note on the IMPACT of COVID-19 and Future Strategies for Internal Audit of General Insurance Companies

c. Also the auditor has to verify whether the claims were honoured quickly as per the

directions of IRDA.

d. Auditor can verify the reasonableness of premium rates fixed for new policies covering

COVID like health issues.

2.6 MARINE INSURANCE

The Marine Hull Policies Marine Cargo (International) policies are regulated not only by Indian

Insurance Act, IRDA guidelines, but also on International laws. The detailed audit

methodology for Marine Insurance Policies was discussed in Chapter 8 of the Guidance Note

for Internal Audit of General Insurance Companies. Hence no separate additional guidance is

issued here for Marine Hull Policies. But for the Marine inland Cargo they were mostly

affected due to Lockdown. Normally marine cargo is of two type namely open cover and open

policy. Open cover is used in international trade. Our concentration for additional guidance

note is for open policy. It was underwritten with a condition that the total annual value of goods

transported would be of a specific value and distance and for each consignment the maximum

value of goods and distance to be transported were specified. Marine policies with specific

destination with period and value are also issued.

As per Media reports, it was feared that goods worth nearly Rs. 15000 crore were loaded into

the trucks before lockdown for transportation and nearly 30 to 40 per cent of them were either

not started from their place of origin or place of destination. Rest were on road. The media

reports confirmed that most truck drivers have left the vehicles unattended and returned to their

home. So the safety of the goods as well as the vehicles is in question. Some goods might have

been lost due to theft, evaporation, detoriation of quality, damaged goods etc., and the claims

have to be acknowledged. Therefore, the auditor has to examine the following:

a. For claims in all types of policies, it has to be examined whether the policy was in force or

extended to be in force.

b. If any claim had occurred, it has to be examined whether the claims were reported in time

with proper police FIR, Etc.

c. There may be constrains in appointing Loss assessors due to LOCKDOWN. Hence the

auditor has to examine how the loss was assessed and claim paid.

The Institute of Cost Accountants of India 8

Supplementary Guidance Note on the IMPACT of COVID-19 and Future Strategies for Internal Audit of General Insurance Companies

d. Auditor should also examine whether the Insurance Company had taken over the damaged

goods exercising right of subrogation and also made claims with the transporter.

e. The claims on the transporter by that Insurer would be dealt in Motor Policy guidelines.

2.7 MOTOR INSURANCE:

The detailed audit methodology for Motor Insurance Policies was discussed in Chapter 7 of the

Guidance Note for Internal Audit of General Insurance Companies. In the following paragraph,

the audit approach on the claims arising out of outbreak of COVID-19, and its after effects of

LOCKDOWN were discussed. This is mainly restricted to Four Wheelers and Goods Transport

Vehicles. For all kinds, Government of India vide gazette notification dated 1 April 2020,

ordered as follows.

“The policy holders whose motor vehicle third party insurance policies fall due for renewal

during the period on and from the 25th March, 2020 up to the 14th April, 2020 (which was

subsequently extended) and who are unable to make payment of their renewal premium on time

in view of the prevailing situation in the country as a result of Corona Virus disease (COVID-

19), are allowed to make such payment for renewal of policies to their insurers on or before the

21st April, 2020 to ensure continuity of the statutory motor vehicle third party insurance cover

from the date on which the policy falls due for renewal.”.

Therefore the Auditor has to examine the following.

a. In case of renewal during this period, whether subsequent renewal was made by the

vehicle holder after lockdown to renew the policy was made or not to be studied

b. IF any claims arising during these periods, it has to be checked whether the claim was

only for Third party.

c. If any own claim was admitted for this period, it has to be checked whether the policy

was in force or not.

d. Similarly, in case of Goods Transport Vehicles, any claims arising out during this period

has to be regulated according to the policy conditions only.

The Institute of Cost Accountants of India 9

Supplementary Guidance Note on the IMPACT of COVID-19 and Future Strategies for Internal Audit of General Insurance Companies

2.8 REINSURANCE

The detailed audit methodology for Reinsurance Policies was discussed in Chapter 10 of the

Guidance Note for Internal Audit of General Insurance Companies. World economic outlook

(April 2020) predicted a worldwide recession in the world economy and estimated a negative

GDP growth between 6 to 16 per cent. But it predicted a positive growth of less than one per cent

for India. Due to recession, the value of financial assets is losing value and investments were

downgraded. In the light of the above, it is feared many Reinsurers especially CBRs may lose

their solvency margins or capital adequacy to participate in the Reinsurance Programs. Also it is

feared that some of them may fail in their obligation to honour claims on them. In view of the

above, the audit approach on the claims arising due to the economic situation in the world

financial markets is prescribed as additional guidance note.

a. In case of new treaties, audit would examine whether the CBRs are adequate solvency

margins or capital adequacy

b. Audit would examine whether the Insurer had adequate knowledge of the past history of

the CBRs.

c. Audit would examine the history of past receivables from CBRs

d. Audit would examine the monthly/quarterly review of the financial positions of the CBRs

to cede

e. As per IRDA’S (Assets & Liabilities, Solvency Margin) Regulations 2016, the Insurance

companies are allowed capital gearing treaties in various forms including Quota Share

Reinsurance Treaty. Since based on the examination by IRDA, it was found that these

treaties were of financial arrangements and not a primarily risk transfer arrangement as

reinsurance. Therefore IRDA banned such arrangements w.e.f. 28-3-2020. Therefore,

Auditors have to examine such treaties and how they are detrimental to the reinsurance

arrangements have to be brought out.

f. Audit would examine the steps taken by the Insurer to improve its solvency and capital

adequacy to increase their retention.

The Institute of Cost Accountants of India 10

Supplementary Guidance Note on the IMPACT of COVID-19 and Future Strategies for Internal Audit of General Insurance Companies

2.9 INVESTMENTS:

The detailed audit methodology for Investments by Insurance companies was discussed in

Chapter 10 of the Guidance Note for Internal Audit of General Insurance Companies. In view of

a shocking world economic survey by IMF in April 2020 and IRDA’s directions in March and

April 2020, it was felt that the following additional areas the Auditor has to examine.

a. IRDA had authorised the Insurance Companies to give three months moratorium for term

loans advanced by them. Audit would examine whether the Insurance Companies have

charged Interest for these moratorium period

b. Audit would further examine whether these term loans were rescheduled for the three

months period and asset classification was done accordingly

c. Due to adverse stock market conditions, the value of investments would be down. Audit

would examine the effect of such reduction in value and how they were classified

between shareholder funds and insurance funds.

d. Due to reduction in Market value of Bonds as well as value reduction in equity, Audit

would examine the capital adequacy of the Insurance Company and its retention capacity.

e. IRDA has advised all the Insurance companies that in view of the prevailing financial

market conditions, it is advisable not to declare dividends for the year 2019-20 and

increase the reserves to shore up the capital adequacy in the declining value of

Investments. The audit would therefore examine in case of dividend declared, the

adequacy of capital of the company is sufficient to meet future obligations.

The above additional points are only indicative and based on the latest circulars issued by IRDA

in March and April 2020 and the Auditor has to update his checklist depending upon the

operations of the respective companies as well as further guidelines by IRDAI.

The Institute of Cost Accountants of India 11

Supplementary Guidance Note on the IMPACT of COVID-19 and Future Strategies for Internal Audit of General Insurance Companies

CHAPTER 3

CONCLUSION

Audit is not complete unless it brings out any suggestions/recommendations for value addition to

the organisation. Therefore, at the end of each audit, the Auditor has to give a workable

suggestion as value additions based on his observations. The following are some of the areas

where auditor can play a vital role in value addition.

1. Strengthening the internal control system

2. Standardisation of terms and conditions of different types of policies

3. Robust methodology in fixation of premiums for various policies

4. Standardisation of discount policy

5. Strengthening claims management and control

6. Strengthening Receivables Management in Reinsurance

7. Robust methodology in selection of TPAs

8. Robust methodology in selection of Investment Managers and Brokers

9. Robust methodology in selection of Reinsurers

10. Appropriateness in fixation of Retention money.

It is pertinent to mention here that the Insurance Industry is a dynamic one and the Internal

Auditor has to update his knowledge with change of time as well as update his databank of

IRDA orders and circulars issued from time to time to update his checklist and risk assessment.

References

1. IMF’s Global Economic Outlook (April 2020)

2. Circulars and guidance issued by IRDA during March and April 2020

The Institute of Cost Accountants of India 12

Behind every successful business decision, there is always a CMA

THE INSTITUTE OF COST ACCOUNTANTS OF INDIA

Statutory Body under an Act of Parliament

www.icmai.in

HEADQUARTERS

CMA Bhawan

12, Sudder Street, Kolkata - 700016

DELHI OFFICE

CMA Bhawan

3, Institutional Area, Lodhi Road, New Delhi -110003

Behind every successful business decision, there is always a CMA

You might also like

- Manual Instructions For Sap Note 3167391 Edocument Mexico - Annex 20 V4.0: Full SolutionDocument4 pagesManual Instructions For Sap Note 3167391 Edocument Mexico - Annex 20 V4.0: Full SolutionDarioNo ratings yet

- Globalization and Its Impact of Insurance Industry in IndiaDocument10 pagesGlobalization and Its Impact of Insurance Industry in IndiaRiaz Ahmed100% (1)

- MBA Project On General InsuranceDocument71 pagesMBA Project On General InsuranceJoshi Ambeah75% (16)

- Joint Initiative Of: Icai Accounting & Auditing AdvisoryDocument48 pagesJoint Initiative Of: Icai Accounting & Auditing AdvisoryBhanu prasanna kumarNo ratings yet

- The Impact of Covid-19 On The Automotive Industry in IndiaDocument8 pagesThe Impact of Covid-19 On The Automotive Industry in IndiaIAEME PublicationNo ratings yet

- IJAAS Covid 19PandemicandFinancialReportingJoshiprintDocument10 pagesIJAAS Covid 19PandemicandFinancialReportingJoshiprintTaymaa OmoushNo ratings yet

- In Press, Accepted Manuscript - Note To UsersDocument9 pagesIn Press, Accepted Manuscript - Note To UsersSabbir AhmmedNo ratings yet

- Auditors Responsibility in Assessing Going ConcerDocument17 pagesAuditors Responsibility in Assessing Going ConcerNasrullah DjamilNo ratings yet

- Plagiarism Scan Report: Exclude Url: NoneDocument2 pagesPlagiarism Scan Report: Exclude Url: NoneSaurabh SinghNo ratings yet

- Retail Market Conduct Task Force Report Initial Findings and Observations About The Impact of COVID-19 On Retail Market ConductDocument30 pagesRetail Market Conduct Task Force Report Initial Findings and Observations About The Impact of COVID-19 On Retail Market ConductTarbNo ratings yet

- Bajaj AllianzDocument99 pagesBajaj AllianzYASH PRAJAPATINo ratings yet

- HDFC Ergo Annual Report Fy 2020 21Document136 pagesHDFC Ergo Annual Report Fy 2020 21krishnashastriNo ratings yet

- Bajaj Allianz Life: Company Based ResearchDocument18 pagesBajaj Allianz Life: Company Based ResearchInika jainNo ratings yet

- Ey Impact of The Pandemic On Indian Corporate ResultsDocument37 pagesEy Impact of The Pandemic On Indian Corporate ResultsAbhinav NaiduNo ratings yet

- COVID-19 and Indian Economy: Impact On Growth, Manufacturing, Trade and MSME SectorDocument25 pagesCOVID-19 and Indian Economy: Impact On Growth, Manufacturing, Trade and MSME SectorVipul ManglaNo ratings yet

- Financial Review and Financial Distress On Covid 19 Pandemic A Comparison of Two South East Asia Countries in The Real Estate and Property Sub SectorsDocument8 pagesFinancial Review and Financial Distress On Covid 19 Pandemic A Comparison of Two South East Asia Countries in The Real Estate and Property Sub SectorsInternational Journal of Innovative Science and Research Technology100% (1)

- Report On Public Issues by General Insurance Companies: SEBI Committee On Disclosures and Accounting Standards (SCODA)Document37 pagesReport On Public Issues by General Insurance Companies: SEBI Committee On Disclosures and Accounting Standards (SCODA)Chandra KumarNo ratings yet

- Covid-19 Impact On Indian Economy-1Document9 pagesCovid-19 Impact On Indian Economy-1samama lodhiNo ratings yet

- Covid 19 Impact On Indian EconomyDocument15 pagesCovid 19 Impact On Indian EconomyPratik WankhedeNo ratings yet

- Synopsis: Impact of COVID-19 On Indian Industry: Challenges and OpportunitiesDocument7 pagesSynopsis: Impact of COVID-19 On Indian Industry: Challenges and OpportunitiesSarita MoreNo ratings yet

- Impact of COVID-19 On IBCDocument13 pagesImpact of COVID-19 On IBCdevendra bankarNo ratings yet

- Chapter - 1 (Industry Analysis) : M S Ramaiah Institute of Management, BangaloreDocument72 pagesChapter - 1 (Industry Analysis) : M S Ramaiah Institute of Management, BangaloreAnubhav SoodNo ratings yet

- Bhumika 18132006Document4 pagesBhumika 18132006Jay MarwahaNo ratings yet

- PWC Insights Examples Reporting Impact of Covid 19 On Going Concern and Subsequent EventsDocument10 pagesPWC Insights Examples Reporting Impact of Covid 19 On Going Concern and Subsequent EventsSuman UroojNo ratings yet

- Impact of Covid 19 On Banking and Insurance SectorDocument6 pagesImpact of Covid 19 On Banking and Insurance SectorPrasanna KumarNo ratings yet

- Conduct of Business Regulation and Covid-19: A Review of The Gulf Insurance IndustryDocument14 pagesConduct of Business Regulation and Covid-19: A Review of The Gulf Insurance IndustryRAVI SONKARNo ratings yet

- Iais Global Insurance Market Report 2020Document15 pagesIais Global Insurance Market Report 2020JorkosNo ratings yet

- Globalization and Its Impact of Insurance Industry in India: Riaz AhemadDocument10 pagesGlobalization and Its Impact of Insurance Industry in India: Riaz AhemadAlok NayakNo ratings yet

- KSHITIJA SIP FinalDocument57 pagesKSHITIJA SIP Finalkshitija upadhyayNo ratings yet

- Challenges To MSME During Covid 19Document6 pagesChallenges To MSME During Covid 19robertphilNo ratings yet

- A. Survive, Revive and Growth Strategies Adopted by EmamiDocument9 pagesA. Survive, Revive and Growth Strategies Adopted by EmamiShivani DuttNo ratings yet

- Group Annual Report 2020Document260 pagesGroup Annual Report 2020Prysmian GroupNo ratings yet

- Role of Private Sector in Insurance BusinessDocument52 pagesRole of Private Sector in Insurance BusinessTrilok AshpalNo ratings yet

- IBC After COVIDDocument6 pagesIBC After COVIDRitwik PrakashNo ratings yet

- HR Project in HDFCDocument69 pagesHR Project in HDFCJdahiya90No ratings yet

- Accounting HammadDocument7 pagesAccounting Hammadshan khanNo ratings yet

- Behavioral nanceandCOVID-19 Cognitive Errors That Determine The Nancial FutureDocument6 pagesBehavioral nanceandCOVID-19 Cognitive Errors That Determine The Nancial FutureWahyuni MertasariNo ratings yet

- Assignment Financial Impact On EntitiesDocument5 pagesAssignment Financial Impact On EntitiesannyswardahNo ratings yet

- Impact of Covid-19 On MSME Sector in India A LiterDocument7 pagesImpact of Covid-19 On MSME Sector in India A LiterHashmita MistriNo ratings yet

- The Impact of COVID-19 Pandemic On The Financial Performance of Firms On The Indonesia Stock ExchangeDocument18 pagesThe Impact of COVID-19 Pandemic On The Financial Performance of Firms On The Indonesia Stock Exchange409005091No ratings yet

- The COVID-19 pandemic will have a significant impact on Financial Reporting for companies around the world. Discuss the validity of this statement with reference to specific areas of the financial statementsDocument6 pagesThe COVID-19 pandemic will have a significant impact on Financial Reporting for companies around the world. Discuss the validity of this statement with reference to specific areas of the financial statementsMaria GeorgiouNo ratings yet

- Case Study Asc302Document17 pagesCase Study Asc302Izzah Batrisyia Khairul HadiNo ratings yet

- Project On General Insurance in IndiaDocument26 pagesProject On General Insurance in IndiarajNo ratings yet

- Final Draft Report - 14 SeptDocument50 pagesFinal Draft Report - 14 Septneelove1No ratings yet

- Value Conservation To Value Creation: COVID-19: Path To RecoveryDocument25 pagesValue Conservation To Value Creation: COVID-19: Path To RecoveryPrem RavalNo ratings yet

- Insurance Sector in INDIADocument61 pagesInsurance Sector in INDIAAnkita JoshiNo ratings yet

- Preprint Not Peer Reviewed: Economic Re-Engineering: Covid-19Document5 pagesPreprint Not Peer Reviewed: Economic Re-Engineering: Covid-19Lavu NqabaNo ratings yet

- CoronavirusPandemicandBusinessDisruption IJAMR200514Document9 pagesCoronavirusPandemicandBusinessDisruption IJAMR200514Rizki NurhidayahNo ratings yet

- Privatization of InsuranceDocument60 pagesPrivatization of InsurancePrashant NathaniNo ratings yet

- Indian Insurance Sector: An Analytical Report by Group 3Document45 pagesIndian Insurance Sector: An Analytical Report by Group 3Kpvs ThusharNo ratings yet

- HDFC Recruitment of Financial Consultant of HDFC Standard Charterd Life InsuranceDocument98 pagesHDFC Recruitment of Financial Consultant of HDFC Standard Charterd Life InsuranceRajni MadanNo ratings yet

- Understanding of Risk Management Processes Applicable To Indian Life Insurance SectorDocument14 pagesUnderstanding of Risk Management Processes Applicable To Indian Life Insurance SectorSiva SankariNo ratings yet

- Minor Project PresentationDocument35 pagesMinor Project PresentationNikitha GeorgeNo ratings yet

- 2020 Third Quarter Results PresentationDocument36 pages2020 Third Quarter Results PresentationVincent ChanNo ratings yet

- Acquisory News Chronicle September 2020Document8 pagesAcquisory News Chronicle September 2020Acquisory Consulting LLPNo ratings yet

- 1607546412443 - final project منهجيةDocument4 pages1607546412443 - final project منهجيةSabreen IssaNo ratings yet

- Quickheal AnnualreportDocument229 pagesQuickheal AnnualreportPiyush HarlalkaNo ratings yet

- Malhotra CommitteeDocument5 pagesMalhotra CommitteeBibhash RoyNo ratings yet

- Indian Insurance Scenario A Critical Review On Life Insurance IndustryDocument8 pagesIndian Insurance Scenario A Critical Review On Life Insurance Industrykesharwanigopal123No ratings yet

- COVID-19 and Public–Private Partnerships in Asia and the Pacific: Guidance NoteFrom EverandCOVID-19 and Public–Private Partnerships in Asia and the Pacific: Guidance NoteNo ratings yet

- Management Accountant Jan-2016Document124 pagesManagement Accountant Jan-2016ABC 123No ratings yet

- Management Accountant March-2016Document124 pagesManagement Accountant March-2016ABC 123No ratings yet

- Guidance Note On Internal Audit of General Insurance CompaniesDocument128 pagesGuidance Note On Internal Audit of General Insurance CompaniesABC 123No ratings yet

- Management Accountant June-2016Document124 pagesManagement Accountant June-2016ABC 123No ratings yet

- Management Accountant OCTOBER 2017Document124 pagesManagement Accountant OCTOBER 2017ABC 123No ratings yet

- Management Accountant Dec-2016Document124 pagesManagement Accountant Dec-2016ABC 123No ratings yet

- Management Accountant Feb-2016Document124 pagesManagement Accountant Feb-2016ABC 123No ratings yet

- Management Accountant May-2016Document124 pagesManagement Accountant May-2016ABC 123No ratings yet

- Management Accountant Aug-2016Document124 pagesManagement Accountant Aug-2016ABC 123No ratings yet

- Management Accountant March-2017Document124 pagesManagement Accountant March-2017ABC 123No ratings yet

- Management Accountant April-2016Document124 pagesManagement Accountant April-2016ABC 123No ratings yet

- Management Accountant Feb-2017Document124 pagesManagement Accountant Feb-2017ABC 123No ratings yet

- Management Accountant May-2017Document124 pagesManagement Accountant May-2017ABC 123No ratings yet

- Management Accountant Nov 2017Document124 pagesManagement Accountant Nov 2017ABC 123No ratings yet

- Management Accountant June 2018Document124 pagesManagement Accountant June 2018ABC 123No ratings yet

- Management Accountant - June 2017Document132 pagesManagement Accountant - June 2017ABC 123No ratings yet

- Management Accountant Nov 2018Document124 pagesManagement Accountant Nov 2018ABC 123No ratings yet

- Management Accountant Jan-2017Document124 pagesManagement Accountant Jan-2017ABC 123No ratings yet

- Management Accountant Oct 2018Document124 pagesManagement Accountant Oct 2018ABC 123No ratings yet

- Management Accountant Dec 2018Document124 pagesManagement Accountant Dec 2018ABC 123No ratings yet

- Management Accountant April-2017Document124 pagesManagement Accountant April-2017ABC 123No ratings yet

- Management Accountant March 2018Document124 pagesManagement Accountant March 2018ABC 123No ratings yet

- Management Accountant March 2019Document124 pagesManagement Accountant March 2019ABC 123No ratings yet

- Management Accountant July 2018Document124 pagesManagement Accountant July 2018ABC 123No ratings yet

- Management Accountant FEBRUARY-2019Document124 pagesManagement Accountant FEBRUARY-2019ABC 123No ratings yet

- Management Accountant Jan-2019Document124 pagesManagement Accountant Jan-2019ABC 123No ratings yet

- Management Accountant January - 2018Document124 pagesManagement Accountant January - 2018ABC 123No ratings yet

- Management Accountant May2019Document124 pagesManagement Accountant May2019ABC 123No ratings yet

- Management Accountant Nov 2019Document124 pagesManagement Accountant Nov 2019ABC 123No ratings yet

- Templates in Text and Chat - 327d21 PDFDocument3 pagesTemplates in Text and Chat - 327d21 PDFKRYSTEL WENDY LAHOMNo ratings yet

- Create A Seat Booking Form With Google Forms, Google Sheets and Google Apps Script - Yagisanatode - AppsScriptPulseDocument3 pagesCreate A Seat Booking Form With Google Forms, Google Sheets and Google Apps Script - Yagisanatode - AppsScriptPulsebrandy57279No ratings yet

- Law of Agency NotesDocument19 pagesLaw of Agency NotesChiedza Caroline ChikwehwaNo ratings yet

- Unit-8 Project Monitoring and ControlDocument98 pagesUnit-8 Project Monitoring and ControlPrà ShâñtNo ratings yet

- Report Sample-Supplier Factory AuditDocument24 pagesReport Sample-Supplier Factory AuditCarlosSánchezNo ratings yet

- Lista Fontes e Cabos Reparos 10.2023Document4 pagesLista Fontes e Cabos Reparos 10.2023amsacessorios00No ratings yet

- DLL in Commercial Cooking 7-Week 5Document5 pagesDLL in Commercial Cooking 7-Week 5JeeNha BonjoureNo ratings yet

- Kuala Lumpur: Answer Sheets: GBHDHFH: 23525: ABMC2054 Cost & Management Accounting IDocument30 pagesKuala Lumpur: Answer Sheets: GBHDHFH: 23525: ABMC2054 Cost & Management Accounting IJUN XIANG NGNo ratings yet

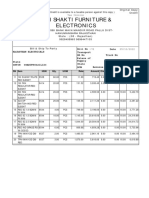

- Shri Shakti Furniture & Electronics: Credit OrginalDocument1 pageShri Shakti Furniture & Electronics: Credit OrginalRahul BansalNo ratings yet

- Outline ReportDocument11 pagesOutline ReportYt HuongNo ratings yet

- Semence Bonane Resume 2Document5 pagesSemence Bonane Resume 2api-240351783No ratings yet

- Making Omnichannel An Augmented Reality: The Current and Future State of The ArtDocument15 pagesMaking Omnichannel An Augmented Reality: The Current and Future State of The ArtRosario MoroccoNo ratings yet

- Relationship of Bank and CustomerDocument7 pagesRelationship of Bank and CustomerSelvenderan RamasamyNo ratings yet

- InternsDocument7 pagesInternsSadath KhanNo ratings yet

- Communication Skills: "Basic Principles of Effective Communication P-3"Document14 pagesCommunication Skills: "Basic Principles of Effective Communication P-3"Viral ShortsNo ratings yet

- Checklist of Requirements: Resource-Based Industries Service (Rbis)Document1 pageChecklist of Requirements: Resource-Based Industries Service (Rbis)MeowthemathicianNo ratings yet

- Ea 14Document4 pagesEa 14Nicole BatoyNo ratings yet

- Materiality AssessmentDocument4 pagesMateriality AssessmentDavid BoyerNo ratings yet

- EWB - App Form 07012020Document2 pagesEWB - App Form 07012020Francisco TaquioNo ratings yet

- Cloze TestDocument2 pagesCloze TestDuje GlavinaNo ratings yet

- Company Profile KAP Heliantono & Rekan Mei 2023Document12 pagesCompany Profile KAP Heliantono & Rekan Mei 2023Rezza PahlevyNo ratings yet

- End Term - Corporate FinanceDocument3 pagesEnd Term - Corporate FinanceDEBAPRIYA SARKARNo ratings yet

- FRABB IA Lubes&Greases EN042018Document24 pagesFRABB IA Lubes&Greases EN042018Hassan Ahmed100% (3)

- Report PDF Response ServletDocument2 pagesReport PDF Response ServletDeveshNo ratings yet

- 3dprinting at Gordon LibraryDocument1 page3dprinting at Gordon LibraryMatthew LinNo ratings yet

- Offer Letter 27-Dec-2019 PDFDocument25 pagesOffer Letter 27-Dec-2019 PDFIonutz AsafteiNo ratings yet

- FCA Checklist and Guide For Building Owners & Operators - AkitaBox EbookDocument7 pagesFCA Checklist and Guide For Building Owners & Operators - AkitaBox Ebooksenora dolce azulNo ratings yet

- Revaluation ModelDocument36 pagesRevaluation ModelMarjorie PalmaNo ratings yet

- Tourism Good Practice Guide PDFDocument38 pagesTourism Good Practice Guide PDFEva MarieNo ratings yet