Professional Documents

Culture Documents

Problem 2 - Aging Project

Problem 2 - Aging Project

Uploaded by

dimenmarkOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Problem 2 - Aging Project

Problem 2 - Aging Project

Uploaded by

dimenmarkCopyright:

Available Formats

Problem 2 – Aging Schedule preparation

The total accounts receivable of Canque Company amounted to 6,000,000. Subsidiary ledger reveals the

following balances of customer’s accounts on December 31, of the current year:

L. Alforque 1,000,000

R. Albores 1,500,000

M. Requillo 1,800,000

C. Lim 1,200,000

D. Teh 500,000

Subsidiary ledgers of each customers are presented below for your analysis and aging:

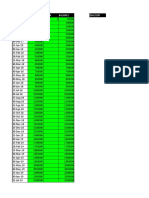

L. Alforque January 25 160,000 160,000

March 11 60,000 100,000

March 21 80,00 180,000

April 12 120,000 300,000

June 1 70,000 370,000

July 20 50,000 420,000

September 15 150,000 270,000

October 15 100,000 370,000

November 15 200,000 170,000

November 20 300,000 470,000

December 15 270,000 200,000

December 20 800,000 1,000,000

R. Albores January 5 250,000 250,000

March 3 250,000 -

March 21 320,000 320,000

April 7 130,000 450,000

June 1 70,000 520,000

July 18 220,000 300,000

September 1 350,000 650,000

October 5 400,000 1,050,000

November 5 100,000 950,000

November 10 250,000 1,200,000

December 8 200,000 1,000,000

December 15 500,000 1,500,000

M. Requillo January 1 525,000 525,000

March 3 250,000 275,000

April 21 320,000 595,000

May 7 230,000 825,000

June 22 70,000 755,000

July 1 80,000 675,000

September 1 250,000 925,000

September 15 300,000 1,225,000

October 5 200,000 1,025,000

November 5 450,000 1,475,000

November 20 400,000 1,075,000

December 15 725,000 1,800,000

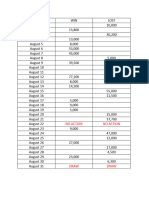

C. Lim January 14 1,110,000 1,110,000

March 10 325,000 785,000

April 16 380,000 1,165,000

May 20 230,000 935,000

June 18 170,000 765,000

July 25 270,000 1,035,000

September 4 180,000 1,215,000

September 22 110,000 1,105,000

October 15 320,000 785,000

November 1 240,000 1,025,000

November 12 150,000 875,000

December 6 325,000 1,200,000

D. Teh January 14 195,000 195,000

March 10 125,000 70,000

April 16 800,000 870,000

May 20 230,000 640,000

June 18 170,000 470,000

July 25 170,000 640,000

September 4 280,000 920,000

September 22 100,000 820,000

October 15 220,000 600,000

November 1 260,000 860,000

November 12 155,000 705,000

December 10 205,000 500,000

All invoices have a credit term of 45 days.

The estimated bad debt rates below are based on the company’s receivable collection experience.

Past due accounts Rate

0-45 days 1%

46-90 days 1.50%

91-135 days 3%

136-180 days 10%

Over 180 days 50%

Required: Prepare an Aging schedule in good form.

Follow this format:

Customer Invoice Date Amount 0-45 46-90 91-135 136-180 Over 180 days

Total

*1% *1.5% *3% *10% *50%

Required Amount

Answer:

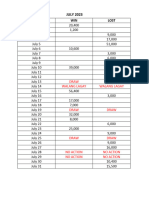

Customer Invoice Date Amount 0-45 46-90 91-135 136-180 Over 180 days

L. Alforque Dec. 20 800,000 800,000

Nov. 20 200,000 200,000

A. Albores Dec. 15 500,000 500,000

Nov. 10 250,000 250,000

Oct 5 400,000 400,000

Sept. 1 350,000 350,000

M. Requillo Dec. 15 725,000 725,000

Nov. 5 450,000 450,000

Sept 15 300,000 300,000

Sept. 1 250,000 250,000

May 7 75,000 75,000

C. Lim Dec. 6 325,000 325,000

Nov. 1 240,000 240,000

Sept. 4 180,000 180,000

July 25 270,000 270,000

April 16 185,000 185,000

D. The Dec.10 205,000 205,000

Nov. 1 260,000 260,000

Sept 4 35,000 35,000_________________________

Total 6,000,000 2,755,000 1,600,000 1,115,000 270,000 260,000

X .01 .015 .03 .10 .50_____

Req. Allow. 27,550 24,000 33,450 27,000 130,000

Total Req. Allow. = 242,000

If beginning allowance is 100,000, provision for bad debts will be 142,000;

Bad det expense 142,000

Allow for bad debts 142,000

If no beginning allowance for bad debts, provision for bad debts will be 242,000;

Bade debt expense 242,000

Allow. For bad debts 242,000

If the beginning allowance for bad debts is a debit balance of 10,000; provision for bad debts will be

252,000;

Bad debts expense 252,000

Allow. For bad debts 252,000

You might also like

- SuperbudDocument50 pagesSuperbudapi-4578794210% (1)

- Hayden CompanyDocument1 pageHayden CompanydimenmarkNo ratings yet

- Acknowledge ReceiptDocument4 pagesAcknowledge Receiptdimenmark0% (1)

- Tata Motors Annual Report 2007 08Document124 pagesTata Motors Annual Report 2007 08MorningLight97% (31)

- Detailed Revenue StreamDocument4 pagesDetailed Revenue StreamWijdane BroukiNo ratings yet

- Company: Tequila Reef Basic Price: 600/head Maximum Customers A Day: 180 Minimum Customers A Day: 70 Peak Season: December Lean SeasonDocument5 pagesCompany: Tequila Reef Basic Price: 600/head Maximum Customers A Day: 180 Minimum Customers A Day: 70 Peak Season: December Lean SeasonMaikaNo ratings yet

- Company: Tequila Reef Basic Price: 600/head Maximum Customers A Day: 180 Minimum Customers A Day: 70 Peak Season: December Lean SeasonDocument6 pagesCompany: Tequila Reef Basic Price: 600/head Maximum Customers A Day: 180 Minimum Customers A Day: 70 Peak Season: December Lean SeasonMaikaNo ratings yet

- Company: Tequila Reef Basic Price: 600/head Maximum Customers A Day: 180 Minimum Customers A Day: 70 Peak Season: December Lean SeasonDocument5 pagesCompany: Tequila Reef Basic Price: 600/head Maximum Customers A Day: 180 Minimum Customers A Day: 70 Peak Season: December Lean SeasonMaikaNo ratings yet

- Repayment ScheduleDocument3 pagesRepayment Scheduleirp.cirp.sruiNo ratings yet

- Financial Statement Example Entrep BSME 2Document8 pagesFinancial Statement Example Entrep BSME 2Mark Adrian TagabanNo ratings yet

- FinanceDocument6 pagesFinanceWijdane BroukiNo ratings yet

- Return of InvestmentDocument27 pagesReturn of InvestmentTrainingDigital Marketing BandungNo ratings yet

- 1 Lakh ChitiDocument3 pages1 Lakh ChitiRamadeviPothuNo ratings yet

- 52-Week Money Challenge: Amount: GoalDocument8 pages52-Week Money Challenge: Amount: GoalRJ BelaNo ratings yet

- Scooter Advance::-Interest Calculation As Follows (IBB Method)Document3 pagesScooter Advance::-Interest Calculation As Follows (IBB Method)api-19729864100% (1)

- SUBHANULLAH (Investment 2,500,000) : Date CHQ# Particulars Month Debit BalanceDocument6 pagesSUBHANULLAH (Investment 2,500,000) : Date CHQ# Particulars Month Debit Balancesubhanullah khanNo ratings yet

- Solution For C. Alvarez ManufacturingDocument12 pagesSolution For C. Alvarez ManufacturingHarvey AguilarNo ratings yet

- Details of CostDocument4 pagesDetails of CostSUNNY AHMED RIYADNo ratings yet

- 52 Week Saving PlanDocument10 pages52 Week Saving PlanpapimorokaNo ratings yet

- Gross Insurance Total Ins. 2017 Ins 1 Ins 2 40%: JAN FEB MAR APR MAY JUN JUL AUG SEP OCT NOV DEC TargetDocument12 pagesGross Insurance Total Ins. 2017 Ins 1 Ins 2 40%: JAN FEB MAR APR MAY JUN JUL AUG SEP OCT NOV DEC TargetJohn Zoren HugoNo ratings yet

- RenuDocument1 pageRenukotterenu3112No ratings yet

- MoviePass - 2Document6 pagesMoviePass - 2utopianzhereNo ratings yet

- Leejoedel Cruz ASSESSMENT TASK NO. 3Document1 pageLeejoedel Cruz ASSESSMENT TASK NO. 3JyNo ratings yet

- Liab SolutionDocument8 pagesLiab SolutionAngelshine LacanlaleNo ratings yet

- Income CollectionDocument2 pagesIncome CollectionThabz ChubyNo ratings yet

- Cash Budget Perbulan 2Document118 pagesCash Budget Perbulan 2Ahaddian AqilNo ratings yet

- Expense WiseDocument4 pagesExpense WiseSaad SalmanNo ratings yet

- Assignment Question 1Document9 pagesAssignment Question 1AbhipsaNo ratings yet

- Month Customer Numbers Average Spend (Food) Average Spend (Beverage)Document8 pagesMonth Customer Numbers Average Spend (Food) Average Spend (Beverage)milan shresthaNo ratings yet

- Video FIFO, LIFO AVCODocument6 pagesVideo FIFO, LIFO AVCOUmer Farooq AhmadNo ratings yet

- Prelim RequirementDocument1 pagePrelim RequirementMary Kaye Yvonne OtillaNo ratings yet

- Weekly Epi Update 156Document15 pagesWeekly Epi Update 156andres filipe rodriguez gelvesNo ratings yet

- BS20B004 BS20B029Document12 pagesBS20B004 BS20B029Ahire Ganesh Ravindra bs20b004No ratings yet

- JULY 2023 Printed TextDocument1 pageJULY 2023 Printed TextDr ChippeyNo ratings yet

- Money Challenge V2Document23 pagesMoney Challenge V2Gerlie Gamil Diarez Lpt100% (1)

- Cash PlanningDocument4 pagesCash PlanningAhmed Elkady2No ratings yet

- Uts Remedial StratopDocument3 pagesUts Remedial StratopvasqofootballNo ratings yet

- ChartsDocument32 pagesChartsasha peirisNo ratings yet

- Praktikum 2Document6 pagesPraktikum 2fgrehNo ratings yet

- Excel Chart BasicsDocument50 pagesExcel Chart BasicsAndreea GeorgianaNo ratings yet

- SQUACKERSDocument25 pagesSQUACKERSPhilip LarozaNo ratings yet

- Mizo Koshary BusinessDocument2 pagesMizo Koshary BusinesshatemNo ratings yet

- Sales ChartDocument2 pagesSales ChartOrcel GenesysNo ratings yet

- Cash BudgetDocument2 pagesCash BudgetJasmine ActaNo ratings yet

- Sales Chart-WPS OfficeDocument2 pagesSales Chart-WPS OfficeJINTALAN CARLO12 TVNo ratings yet

- ASNB 投资理财の记忆 CalculatorDocument2 pagesASNB 投资理财の记忆 CalculatorTan Lee PingNo ratings yet

- ASNB 投资理财の记忆 CalculatorDocument2 pagesASNB 投资理财の记忆 CalculatorTan Lee PingNo ratings yet

- Cash Flow 2020dosDocument9 pagesCash Flow 2020dosFercho MonroyNo ratings yet

- Week Dates Amount Total Week Dates AmountDocument2 pagesWeek Dates Amount Total Week Dates AmountConnor WalshNo ratings yet

- Junaid Javed Payment ScheduleDocument2 pagesJunaid Javed Payment ScheduleJunaid JavedNo ratings yet

- Rekap Selisih merchant OkkyDocument9 pagesRekap Selisih merchant Okkyp2pbudiNo ratings yet

- SIP+Lumpsum Worksheet (Scenarios)Document23 pagesSIP+Lumpsum Worksheet (Scenarios)narmathasabari123No ratings yet

- Control de AhorrosDocument11 pagesControl de AhorrosAntonio Santamaria CepedaNo ratings yet

- Monthly Sales ReportDocument2 pagesMonthly Sales ReportOgochukwuNo ratings yet

- Alvin ExcelDocument2 pagesAlvin ExcelLaylay, Divina C.No ratings yet

- Loan Payment DetailDocument8 pagesLoan Payment DetailGayan IndunilNo ratings yet

- Chittu: Loan 30000Document7 pagesChittu: Loan 30000Vijay KumarNo ratings yet

- Merchandising Business - Perpetual PeriodicDocument11 pagesMerchandising Business - Perpetual PeriodicMilrosePaulinePascuaGudaNo ratings yet

- SUSHUDocument1 pageSUSHUharshitbhajoi1502No ratings yet

- August 2023 Printed Text DecemberDocument1 pageAugust 2023 Printed Text DecemberDr ChippeyNo ratings yet

- 6 PKT 0003Document2 pages6 PKT 0003Yasir IftikharNo ratings yet

- Glass ChartDocument19 pagesGlass ChartMyo Tin Ko OoNo ratings yet

- Glory Glory Tottenham Hotspur: The True Story of Tottenham Hotspur's Silverware in the 21st CenturyFrom EverandGlory Glory Tottenham Hotspur: The True Story of Tottenham Hotspur's Silverware in the 21st CenturyNo ratings yet

- Contoso Potluck Form Name Extension Salad 1 Salad 2 Entrée 1 Entrée 2 Drink 1 Drink 2 Desserts 1 Desserts 2 Utensils Plates NapkinsDocument1 pageContoso Potluck Form Name Extension Salad 1 Salad 2 Entrée 1 Entrée 2 Drink 1 Drink 2 Desserts 1 Desserts 2 Utensils Plates NapkinsdimenmarkNo ratings yet

- Contoso Potluck Form Name Extension Salad 1 Salad 2 Entrée 1 Entrée 2 Drink 1 Drink 2 Desserts 1 Desserts 2 Utensils Plates NapkinsDocument1 pageContoso Potluck Form Name Extension Salad 1 Salad 2 Entrée 1 Entrée 2 Drink 1 Drink 2 Desserts 1 Desserts 2 Utensils Plates NapkinsdimenmarkNo ratings yet

- Graphic Organizer (The Gift of Magi)Document1 pageGraphic Organizer (The Gift of Magi)dimenmarkNo ratings yet

- Graphic Organizer (The Gift of Magi) PDFDocument1 pageGraphic Organizer (The Gift of Magi) PDFdimenmark0% (1)

- CPE For Technical Result Region I September 12-13, 2019Document3 pagesCPE For Technical Result Region I September 12-13, 2019dimenmarkNo ratings yet

- CPE For Clerical Result Central Office October 2019 PDFDocument1 pageCPE For Clerical Result Central Office October 2019 PDFdimenmarkNo ratings yet

- A Detailed Lesson Plan in English 4Document5 pagesA Detailed Lesson Plan in English 4dimenmark100% (2)

- Portfolio Theory Exam 2020 With SolutionDocument4 pagesPortfolio Theory Exam 2020 With SolutionFARAH BENDALINo ratings yet

- LJRC KDRoi RXBQ 83 UDocument1 pageLJRC KDRoi RXBQ 83 Ushobhit singhNo ratings yet

- Guaranty & SuretyshipDocument140 pagesGuaranty & SuretyshipLovely Potane-RobinNo ratings yet

- ENTRE2 ND GroupDocument66 pagesENTRE2 ND Groupit is meNo ratings yet

- TAX AssignmentDocument8 pagesTAX AssignmentJaydeep KumarNo ratings yet

- Management TrustDocument37 pagesManagement TrustLamario StillwellNo ratings yet

- Module - 1: Planning & Analysis Overview: PhasesDocument43 pagesModule - 1: Planning & Analysis Overview: Phaseslakshmipriya_mcNo ratings yet

- 2014 WFE Market HighlightsDocument10 pages2014 WFE Market HighlightsFocsa DorinNo ratings yet

- Twelve Key Elements of Practical Personal Finance: Common Sense EconomicsDocument65 pagesTwelve Key Elements of Practical Personal Finance: Common Sense EconomicssigmasundarNo ratings yet

- Finance Manager in Chicago Schaumburg IL Resume Anthony VolinDocument2 pagesFinance Manager in Chicago Schaumburg IL Resume Anthony VolinAnthonyVolinNo ratings yet

- Social and Financial LiteracyDocument9 pagesSocial and Financial LiteracyjaisymentarNo ratings yet

- 2019 Saln FormDocument2 pages2019 Saln Formchristine joy a. rola100% (1)

- JoS. A. Bank Investor Presentation Regarding Men's Wearhouse ProposalDocument16 pagesJoS. A. Bank Investor Presentation Regarding Men's Wearhouse ProposalTim ParryNo ratings yet

- 2nd Quarter Gen MathDocument2 pages2nd Quarter Gen MathLea Mae Vivo Gelera0% (1)

- FSRE 2022-23 Topic 4Document22 pagesFSRE 2022-23 Topic 4Ali Al RostamaniNo ratings yet

- Topic II - Statement of Comprehensive IncomeDocument8 pagesTopic II - Statement of Comprehensive IncomeJianne Ricci GalitNo ratings yet

- PMD Pro Guide PDFDocument163 pagesPMD Pro Guide PDFKaka SuleNo ratings yet

- Chipotle PPT FINAL RevisedDocument25 pagesChipotle PPT FINAL RevisedHeather MichaelsonNo ratings yet

- Week 2: Solutions To Homework Problems: BKM Chapter 3Document4 pagesWeek 2: Solutions To Homework Problems: BKM Chapter 3Dean PhamNo ratings yet

- Fed. Sec. L. Rep. P 93,309 Karen A. McVay v. Western Plains Service Corporation, 823 F.2d 1395, 10th Cir. (1987)Document10 pagesFed. Sec. L. Rep. P 93,309 Karen A. McVay v. Western Plains Service Corporation, 823 F.2d 1395, 10th Cir. (1987)Scribd Government DocsNo ratings yet

- I Love Monday S&P 500 Trading StrategyDocument9 pagesI Love Monday S&P 500 Trading StrategywjdtanNo ratings yet

- Icra PPTDocument17 pagesIcra PPTSandeep ReddyNo ratings yet

- The Eternal ZeroDocument4 pagesThe Eternal ZeroThuy NguyenNo ratings yet

- MidtermsE 94%Document17 pagesMidtermsE 94%jrence67% (3)

- Test-III: Quantitative Aptitude: in The Following Questions?Document5 pagesTest-III: Quantitative Aptitude: in The Following Questions?Rekha NairNo ratings yet

- Groveland Capital - Biglari Holdings Investor Presentation 03-13-2015 Final VersionDocument60 pagesGroveland Capital - Biglari Holdings Investor Presentation 03-13-2015 Final VersionCanadianValueNo ratings yet

- DESRI Associate FTEDocument2 pagesDESRI Associate FTEeverydimension123No ratings yet

- Sample Paper CAIIB BRBL by Dr. MuruganDocument94 pagesSample Paper CAIIB BRBL by Dr. MuruganMarshall MathersNo ratings yet

- Workbook Contents: Natural Gas Futures Prices (NYMEX)Document16 pagesWorkbook Contents: Natural Gas Futures Prices (NYMEX)Noman Abu-FarhaNo ratings yet