Professional Documents

Culture Documents

Evaluating Risk and Return - Chapter 8

Evaluating Risk and Return - Chapter 8

Uploaded by

ikycazmajCopyright:

Available Formats

You might also like

- Chapter 6 - Build A Model SpreadsheetDocument6 pagesChapter 6 - Build A Model SpreadsheetShahmir Hamza AhmedNo ratings yet

- Chapter 7. Solution To End-of-Chapter Comprehensive/Spreadsheet ProblemDocument5 pagesChapter 7. Solution To End-of-Chapter Comprehensive/Spreadsheet ProblemBen HarrisNo ratings yet

- MGT 2281 Fall 2019 Assignment Solution Outline: Page 1 of 13Document13 pagesMGT 2281 Fall 2019 Assignment Solution Outline: Page 1 of 13BessieDuNo ratings yet

- (Solved) Chapter 14, Problem 14-9 - Fundamentals of Financial Management (15th Edition) - ADocument2 pages(Solved) Chapter 14, Problem 14-9 - Fundamentals of Financial Management (15th Edition) - AAli Hussain Al SalmawiNo ratings yet

- Case 6-26 Solution ExpertyDocument6 pagesCase 6-26 Solution ExpertyDevianna AzzahraNo ratings yet

- CH 06 P14 Build A ModelDocument3 pagesCH 06 P14 Build A ModelJessica Smith83% (6)

- Tut Lec 5 - Chap 80Document6 pagesTut Lec 5 - Chap 80Bella SeahNo ratings yet

- LopDocument3 pagesLopWidia Irma Yunita0% (2)

- Problem 5-19 Basic CVP Analysis Graphing (LO1, LO2, LO4, LO6)Document16 pagesProblem 5-19 Basic CVP Analysis Graphing (LO1, LO2, LO4, LO6)Chamrith SophearaNo ratings yet

- Tugas 1 - Problem 1-12Document2 pagesTugas 1 - Problem 1-12cemkudaNo ratings yet

- Case 01 CompleteDocument12 pagesCase 01 Completeertizashuvo100% (1)

- Mississippi River Shipyards Is Considering The Replacement of An - Appendix 11B-3 Replacement Project AnalysisDocument1 pageMississippi River Shipyards Is Considering The Replacement of An - Appendix 11B-3 Replacement Project AnalysisRajib DahalNo ratings yet

- (SAPP) F3 Mock Exam With Answer PDFDocument24 pages(SAPP) F3 Mock Exam With Answer PDFLong NgoNo ratings yet

- Chapter 3: Working With Financial StatementsDocument10 pagesChapter 3: Working With Financial StatementsNafeun AlamNo ratings yet

- Using The Gordon Dividend Model. Compare The Cost of Equity Computed On The BasisDocument2 pagesUsing The Gordon Dividend Model. Compare The Cost of Equity Computed On The BasisONASHI DEVNANI BBANo ratings yet

- BE4-1. The Adjusted Trial Balance of Pacific Scientific Corporation OnDocument10 pagesBE4-1. The Adjusted Trial Balance of Pacific Scientific Corporation OnNguyễn Linh NhiNo ratings yet

- Chương 4Document3 pagesChương 4Trần Khánh VyNo ratings yet

- Corporate Finance Solution Chapter 6Document9 pagesCorporate Finance Solution Chapter 6Kunal KumarNo ratings yet

- Credit Risk Management of Commercial Banks in Vietnam: Facts and IssuesDocument15 pagesCredit Risk Management of Commercial Banks in Vietnam: Facts and IssuesKhánh LinhNo ratings yet

- 3, Fa1 Question Book 2021 (Gen 5) - G I Cho Sinh ViênDocument76 pages3, Fa1 Question Book 2021 (Gen 5) - G I Cho Sinh ViênHoàng Vũ HuyNo ratings yet

- Thực Hành 2020Document17 pagesThực Hành 2020Sún HítNo ratings yet

- Exercise Stock ValuationDocument2 pagesExercise Stock ValuationUmair ShekhaniNo ratings yet

- Chapter 11Document8 pagesChapter 11yousufmeahNo ratings yet

- 1-3-Ulo D ExerciseDocument5 pages1-3-Ulo D ExerciseJames Darwin TehNo ratings yet

- SHY Week 1 Assignment SolutionDocument2 pagesSHY Week 1 Assignment Solutionhy_saingheng_7602609No ratings yet

- CHAPTER 3 Activity Cost BehaviorDocument28 pagesCHAPTER 3 Activity Cost BehaviorMudassar Hassan100% (1)

- Newman Hardware Store Completed The Following Merchandising Tran PDFDocument1 pageNewman Hardware Store Completed The Following Merchandising Tran PDFAnbu jaromiaNo ratings yet

- BÀI TẬP F2 2 CHƯƠNG 5 NHÓM 4Document9 pagesBÀI TẬP F2 2 CHƯƠNG 5 NHÓM 4Lúa PhạmNo ratings yet

- Chapter 21Document4 pagesChapter 21Rahila RafiqNo ratings yet

- Ventura, Mary Mickaella R - Chapter8p.256-258Document3 pagesVentura, Mary Mickaella R - Chapter8p.256-258Mary VenturaNo ratings yet

- Time Value of Money General Instructions:: Activity 4 MfcapistranoDocument2 pagesTime Value of Money General Instructions:: Activity 4 MfcapistranoAstrid BuenacosaNo ratings yet

- Bài tập tuần 4 - Case Study SOCADocument2 pagesBài tập tuần 4 - Case Study SOCAThảo HuỳnhNo ratings yet

- Rizq Aly Afif - 1181002057 - Audit 6 - AKT 52Document5 pagesRizq Aly Afif - 1181002057 - Audit 6 - AKT 52Rizq Aly AfifNo ratings yet

- CH 10Document74 pagesCH 10Chi NguyễnNo ratings yet

- Financial AccountingDocument22 pagesFinancial AccountingHoàng Minh Nguyễn100% (2)

- Exercise Chapter 4Document5 pagesExercise Chapter 4nguyễnthùy dươngNo ratings yet

- Chap 5 All DoneDocument3 pagesChap 5 All DoneDavid100% (1)

- Acc3 5Document4 pagesAcc3 5dinda ardiyaniNo ratings yet

- 21 Problems For CB NewDocument31 pages21 Problems For CB NewNguyễn Thảo MyNo ratings yet

- 202-0101-001 - ARIF HOSEN - Management Accounting Assignment 1Document11 pages202-0101-001 - ARIF HOSEN - Management Accounting Assignment 1Sayhan Hosen Arif100% (1)

- Economic Analysis FOR Business and Strategic Decisions: Delta Publishing CompanyDocument243 pagesEconomic Analysis FOR Business and Strategic Decisions: Delta Publishing CompanyLưu Thị Quế XuânNo ratings yet

- What-If Analysis For Linear Programming Solution To Solved ProblemsDocument4 pagesWhat-If Analysis For Linear Programming Solution To Solved ProblemsRamya KosarajuNo ratings yet

- CB Chapter 15 AnswerDocument5 pagesCB Chapter 15 AnswerSim Pei YingNo ratings yet

- MGMT AssignmentDocument79 pagesMGMT AssignmentLuleseged Gebre100% (1)

- FM - Assignment I - Kubra FatimaDocument15 pagesFM - Assignment I - Kubra FatimaFaryal MughalNo ratings yet

- Solved - Excerpts From The Annual Report of Lands' End Follow ($...Document2 pagesSolved - Excerpts From The Annual Report of Lands' End Follow ($...Iman naufalNo ratings yet

- Working 6Document7 pagesWorking 6Hà Lê DuyNo ratings yet

- Assign-01 (Math341) Fall 2016-17Document4 pagesAssign-01 (Math341) Fall 2016-17Rida Shah0% (1)

- Banking Academy: Assignment Financial Statement AnalysisDocument25 pagesBanking Academy: Assignment Financial Statement AnalysisDiệp NguyễnNo ratings yet

- F6 PIT AnswersDocument18 pagesF6 PIT AnswersHuỳnh TrungNo ratings yet

- Week 1 ICA - 2019 - Time Value of MoneyDocument2 pagesWeek 1 ICA - 2019 - Time Value of MoneyMira0% (1)

- CH 13#6Document13 pagesCH 13#6jjmaducdoc100% (1)

- Tugas 5. Siklus Akuntansi-Ricky Andrian K. RumereDocument66 pagesTugas 5. Siklus Akuntansi-Ricky Andrian K. RumererickyNo ratings yet

- Ch6 Que WsDocument7 pagesCh6 Que WsFoong Chan PingNo ratings yet

- Assignment On Segment Reporting, Jonas Albert AtasDocument2 pagesAssignment On Segment Reporting, Jonas Albert AtasJonasAlbertAtasNo ratings yet

- Ch06 P14 Build A ModelDocument6 pagesCh06 P14 Build A ModelKhurram KhanNo ratings yet

- #4 - Soluition To Essay Question #5 (Bonus Question)Document2 pages#4 - Soluition To Essay Question #5 (Bonus Question)DionizioNo ratings yet

- Bartman Industries and Reynolds Inc S Stock Prices and PDFDocument1 pageBartman Industries and Reynolds Inc S Stock Prices and PDFAnbu jaromiaNo ratings yet

- HW3 Managerial FinanceDocument13 pagesHW3 Managerial FinanceAndrew HawkinsNo ratings yet

- Assign 2 CLO 3Document3 pagesAssign 2 CLO 3DIVA RTHININo ratings yet

- Introduction To CommerceDocument12 pagesIntroduction To CommerceYagnik Mhatre100% (2)

- Day Trading PEG Red To Green SetupsDocument5 pagesDay Trading PEG Red To Green Setupsarenaman0528No ratings yet

- YFC Projects Private Limited (YPPL) : Rating RationaleDocument2 pagesYFC Projects Private Limited (YPPL) : Rating Rationalelalit rawatNo ratings yet

- Unit 2: General Concepts and Principles of AccountingDocument12 pagesUnit 2: General Concepts and Principles of AccountingChen HaoNo ratings yet

- Categories: NFPA 51B: Standard For Fire Prevention During Welding, Cutting, and Other Hot WorkDocument2 pagesCategories: NFPA 51B: Standard For Fire Prevention During Welding, Cutting, and Other Hot WorkThanakit SrisaengNo ratings yet

- Customer AnalyticsDocument38 pagesCustomer AnalyticsAbhie Ghail100% (5)

- Ent530bp Guideline and Template Oct2022Document15 pagesEnt530bp Guideline and Template Oct2022MOHD NOOR TAUFIQ JALALUDINNo ratings yet

- Hays GCC Salary Guide 2023 PDFDocument116 pagesHays GCC Salary Guide 2023 PDFmoony30No ratings yet

- A Level Entrepreneurship Revision Questions Based On Syllabus Phase 2Document18 pagesA Level Entrepreneurship Revision Questions Based On Syllabus Phase 2humpho45No ratings yet

- 11 - Chapter 4 The Valuation of Long-Term SecuritiesDocument53 pages11 - Chapter 4 The Valuation of Long-Term SecuritiesIni Ichiii100% (1)

- Entirety of Pittsburgh's Right-to-Know Response For Emails Sent Between Mayor's Office and UberDocument333 pagesEntirety of Pittsburgh's Right-to-Know Response For Emails Sent Between Mayor's Office and UberPennLiveNo ratings yet

- Exchange Rate "War Currencies".EditedDocument12 pagesExchange Rate "War Currencies".Edited2h rxNo ratings yet

- ACCT604 Week 5 Lecture SlidesDocument27 pagesACCT604 Week 5 Lecture SlidesBuddika PrasannaNo ratings yet

- 2023notices - 2023!07!06 - Order To Register With CIC VersionDocument9 pages2023notices - 2023!07!06 - Order To Register With CIC Versionalberiolerma827No ratings yet

- MSE 617 - Team B - Final ReportDocument17 pagesMSE 617 - Team B - Final ReporthshNo ratings yet

- Pengaruh Revolusi Industri RevisiDocument3 pagesPengaruh Revolusi Industri RevisiMuhammad Aris MunandarNo ratings yet

- Take Home ExamDocument12 pagesTake Home ExamShar KhanNo ratings yet

- Chapter 2Document4 pagesChapter 2Roselie Cuenca94% (16)

- CCeStatement 2022 10Document4 pagesCCeStatement 2022 10KAKI BELANGNo ratings yet

- UCO Reporter 2022, June Edition, May 26, 2022Document40 pagesUCO Reporter 2022, June Edition, May 26, 2022ucopresident100% (1)

- Tncs Signature Clean VersionDocument14 pagesTncs Signature Clean VersionQqwtryNo ratings yet

- Fcbo Jury Heenaagrima Sem 1Document30 pagesFcbo Jury Heenaagrima Sem 1Irene LalngaihzualiNo ratings yet

- Chapter1-Focusondecisionmaking Man. Acc.Document188 pagesChapter1-Focusondecisionmaking Man. Acc.eltonNo ratings yet

- Sea SH Action Plan Sadc GmiDocument7 pagesSea SH Action Plan Sadc GmiKaleab TadesseNo ratings yet

- Pooja 2023 CVDocument6 pagesPooja 2023 CVVipinNo ratings yet

- DasfasfaDocument2 pagesDasfasfarizkipamulaNo ratings yet

- Value Equivalence LineDocument5 pagesValue Equivalence LineExoYelzy yueNo ratings yet

- Signature of Student: Date: Signature of Guide/ Supervisor Date: Seal: Name: Name: Email ID: DesignationDocument1 pageSignature of Student: Date: Signature of Guide/ Supervisor Date: Seal: Name: Name: Email ID: DesignationzahooorbhatNo ratings yet

- Muhs Nashik Thesis Acceptance 2016Document4 pagesMuhs Nashik Thesis Acceptance 2016afkofvidg100% (1)

- A Study On Resource Allocation - SMDocument63 pagesA Study On Resource Allocation - SMbina100% (3)

Evaluating Risk and Return - Chapter 8

Evaluating Risk and Return - Chapter 8

Uploaded by

ikycazmajOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Evaluating Risk and Return - Chapter 8

Evaluating Risk and Return - Chapter 8

Uploaded by

ikycazmajCopyright:

Available Formats

EVALUATING RISK AND RETURN

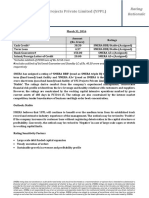

Bartman Industries ’ and Reynolds Inc.’s stock prices and dividends, along with the

Winslow 5000 Index, are shown here for the period 2006–2011. The Winslow 5000

data are adjusted to include dividends.

Bartman Industries Reynolds Inc. Winslow 5000

Year Stock Price Dividend Stock Price Dividend Includes Dividends

2011 $17.250 $1.15 $48.750 $3.00 $11,663.98

2010 14.750 1.06 52.300 2.90 8,785.70

2009 16.500 1.00 48.750 2.75 8,679.98

2008 10.750 0.95 57.250 2.50 6,434.03

2007 11.375 0.90 60.000 2.25 5,602.28

2006 7.625 0.85 55.750 2.00 4,705.97

a. Use the data to calculate annual rates of return for Bartman, Reynolds, and the

Winslow 5000 Index. Then calculate each entity’s average return over the 5-year

period.

(Hint: Remember, returns are calculated by subtracting the beginning price from the

ending price to get the capital gain or loss, adding the dividend to the capital gain or

loss, and dividing the result by the beginning price. Assume that dividends are

already included in the index. Also, you cannot calculate the rate of return for 2006

because you do not have 2005 data.)

Example using Bartman data: Rate of Return2007 = [(11.375 – 7.625) + .90]/7.625 =

60.98%

Calculate in the same way rates of return for 2008 through 2011. Finally calculate

the average annual rate of return by adding the 5 calculated rates of return and

dividing the sum by 5. Similarly calculate the average annual rate of return for

Reynolds and the Winslow 5ooo Index.

Note that for the Index, the rate of return for 2007 is simply the % ∆ in the index

from 2006 to 2007. The same is true for 2008 through 2011 annual rates of return.

In Excel, calculate average rate of return with =average command

b. Calculate the standard deviations of the returns for Bartman, Reynolds, and the

Winslow 5000. (Hint: Use the sample standard deviation formula, Equation 8-2a in

this chapter, which corresponds to the STDEV function in Excel.)

In Excel calculate standard deviation with =stdev command

5

( rate of return−average rate of return )2

σ =∑

i=1 √ n−1

c. Calculate the coefficients of variation for Bartman, Reynolds, and the Winslow

5000.

C.V. = σ /average rate of r eturn

d. Construct a scatter diagram that shows Bartman’s and Reynolds ’ returns on the

vertical axis and the Winslow 5000 Index’s returns on the horizontal axis.

Use Insert Scatter Diagram command in Excel

e. Estimate Bartman’s and Reynolds’ betas by running regressions of their returns

against the index’s returns. (Hint: Refer to Web Appendix 8A.) Are these betas

consistent with your graph?

Use =linest command in Excel to calculate each slope or beta

f. Assume that the risk-free rate on long-term Treasury bonds is 6.04%. Assume

also that the average annual return on the Winslow 5000 is not a good estimate of

the market’s required return —it is too high. So use 11% as the expected return on

the market. Use the SML equation to calculate the two companies’ required returns.

Use CAPM ri = rrf + (rm - rrf) bi to calculate required returns

g. If you formed a portfolio that consisted of 50% Bartman and 50% Reynolds, what

would the portfolio’s beta and required return be?

Use bp = (%a)ba + (%b)bb

h. Suppose an investor wants to include Bartman Industries ’ stock in his portfolio.

Stocks A, B, and C are currently in the portfolio; and their betas are 0.769, 0.985, and

1.423, respectively. Calculate the new portfolio required return if it consists of 25%

of Bartman, 15% of Stock A, 40% of Stock B, and 20% of Stock C.

Use CAPM to get r’s as needed.

Use rp = (%a)ra + (%b)rb + (%c)rc + (%d)rd

You might also like

- Chapter 6 - Build A Model SpreadsheetDocument6 pagesChapter 6 - Build A Model SpreadsheetShahmir Hamza AhmedNo ratings yet

- Chapter 7. Solution To End-of-Chapter Comprehensive/Spreadsheet ProblemDocument5 pagesChapter 7. Solution To End-of-Chapter Comprehensive/Spreadsheet ProblemBen HarrisNo ratings yet

- MGT 2281 Fall 2019 Assignment Solution Outline: Page 1 of 13Document13 pagesMGT 2281 Fall 2019 Assignment Solution Outline: Page 1 of 13BessieDuNo ratings yet

- (Solved) Chapter 14, Problem 14-9 - Fundamentals of Financial Management (15th Edition) - ADocument2 pages(Solved) Chapter 14, Problem 14-9 - Fundamentals of Financial Management (15th Edition) - AAli Hussain Al SalmawiNo ratings yet

- Case 6-26 Solution ExpertyDocument6 pagesCase 6-26 Solution ExpertyDevianna AzzahraNo ratings yet

- CH 06 P14 Build A ModelDocument3 pagesCH 06 P14 Build A ModelJessica Smith83% (6)

- Tut Lec 5 - Chap 80Document6 pagesTut Lec 5 - Chap 80Bella SeahNo ratings yet

- LopDocument3 pagesLopWidia Irma Yunita0% (2)

- Problem 5-19 Basic CVP Analysis Graphing (LO1, LO2, LO4, LO6)Document16 pagesProblem 5-19 Basic CVP Analysis Graphing (LO1, LO2, LO4, LO6)Chamrith SophearaNo ratings yet

- Tugas 1 - Problem 1-12Document2 pagesTugas 1 - Problem 1-12cemkudaNo ratings yet

- Case 01 CompleteDocument12 pagesCase 01 Completeertizashuvo100% (1)

- Mississippi River Shipyards Is Considering The Replacement of An - Appendix 11B-3 Replacement Project AnalysisDocument1 pageMississippi River Shipyards Is Considering The Replacement of An - Appendix 11B-3 Replacement Project AnalysisRajib DahalNo ratings yet

- (SAPP) F3 Mock Exam With Answer PDFDocument24 pages(SAPP) F3 Mock Exam With Answer PDFLong NgoNo ratings yet

- Chapter 3: Working With Financial StatementsDocument10 pagesChapter 3: Working With Financial StatementsNafeun AlamNo ratings yet

- Using The Gordon Dividend Model. Compare The Cost of Equity Computed On The BasisDocument2 pagesUsing The Gordon Dividend Model. Compare The Cost of Equity Computed On The BasisONASHI DEVNANI BBANo ratings yet

- BE4-1. The Adjusted Trial Balance of Pacific Scientific Corporation OnDocument10 pagesBE4-1. The Adjusted Trial Balance of Pacific Scientific Corporation OnNguyễn Linh NhiNo ratings yet

- Chương 4Document3 pagesChương 4Trần Khánh VyNo ratings yet

- Corporate Finance Solution Chapter 6Document9 pagesCorporate Finance Solution Chapter 6Kunal KumarNo ratings yet

- Credit Risk Management of Commercial Banks in Vietnam: Facts and IssuesDocument15 pagesCredit Risk Management of Commercial Banks in Vietnam: Facts and IssuesKhánh LinhNo ratings yet

- 3, Fa1 Question Book 2021 (Gen 5) - G I Cho Sinh ViênDocument76 pages3, Fa1 Question Book 2021 (Gen 5) - G I Cho Sinh ViênHoàng Vũ HuyNo ratings yet

- Thực Hành 2020Document17 pagesThực Hành 2020Sún HítNo ratings yet

- Exercise Stock ValuationDocument2 pagesExercise Stock ValuationUmair ShekhaniNo ratings yet

- Chapter 11Document8 pagesChapter 11yousufmeahNo ratings yet

- 1-3-Ulo D ExerciseDocument5 pages1-3-Ulo D ExerciseJames Darwin TehNo ratings yet

- SHY Week 1 Assignment SolutionDocument2 pagesSHY Week 1 Assignment Solutionhy_saingheng_7602609No ratings yet

- CHAPTER 3 Activity Cost BehaviorDocument28 pagesCHAPTER 3 Activity Cost BehaviorMudassar Hassan100% (1)

- Newman Hardware Store Completed The Following Merchandising Tran PDFDocument1 pageNewman Hardware Store Completed The Following Merchandising Tran PDFAnbu jaromiaNo ratings yet

- BÀI TẬP F2 2 CHƯƠNG 5 NHÓM 4Document9 pagesBÀI TẬP F2 2 CHƯƠNG 5 NHÓM 4Lúa PhạmNo ratings yet

- Chapter 21Document4 pagesChapter 21Rahila RafiqNo ratings yet

- Ventura, Mary Mickaella R - Chapter8p.256-258Document3 pagesVentura, Mary Mickaella R - Chapter8p.256-258Mary VenturaNo ratings yet

- Time Value of Money General Instructions:: Activity 4 MfcapistranoDocument2 pagesTime Value of Money General Instructions:: Activity 4 MfcapistranoAstrid BuenacosaNo ratings yet

- Bài tập tuần 4 - Case Study SOCADocument2 pagesBài tập tuần 4 - Case Study SOCAThảo HuỳnhNo ratings yet

- Rizq Aly Afif - 1181002057 - Audit 6 - AKT 52Document5 pagesRizq Aly Afif - 1181002057 - Audit 6 - AKT 52Rizq Aly AfifNo ratings yet

- CH 10Document74 pagesCH 10Chi NguyễnNo ratings yet

- Financial AccountingDocument22 pagesFinancial AccountingHoàng Minh Nguyễn100% (2)

- Exercise Chapter 4Document5 pagesExercise Chapter 4nguyễnthùy dươngNo ratings yet

- Chap 5 All DoneDocument3 pagesChap 5 All DoneDavid100% (1)

- Acc3 5Document4 pagesAcc3 5dinda ardiyaniNo ratings yet

- 21 Problems For CB NewDocument31 pages21 Problems For CB NewNguyễn Thảo MyNo ratings yet

- 202-0101-001 - ARIF HOSEN - Management Accounting Assignment 1Document11 pages202-0101-001 - ARIF HOSEN - Management Accounting Assignment 1Sayhan Hosen Arif100% (1)

- Economic Analysis FOR Business and Strategic Decisions: Delta Publishing CompanyDocument243 pagesEconomic Analysis FOR Business and Strategic Decisions: Delta Publishing CompanyLưu Thị Quế XuânNo ratings yet

- What-If Analysis For Linear Programming Solution To Solved ProblemsDocument4 pagesWhat-If Analysis For Linear Programming Solution To Solved ProblemsRamya KosarajuNo ratings yet

- CB Chapter 15 AnswerDocument5 pagesCB Chapter 15 AnswerSim Pei YingNo ratings yet

- MGMT AssignmentDocument79 pagesMGMT AssignmentLuleseged Gebre100% (1)

- FM - Assignment I - Kubra FatimaDocument15 pagesFM - Assignment I - Kubra FatimaFaryal MughalNo ratings yet

- Solved - Excerpts From The Annual Report of Lands' End Follow ($...Document2 pagesSolved - Excerpts From The Annual Report of Lands' End Follow ($...Iman naufalNo ratings yet

- Working 6Document7 pagesWorking 6Hà Lê DuyNo ratings yet

- Assign-01 (Math341) Fall 2016-17Document4 pagesAssign-01 (Math341) Fall 2016-17Rida Shah0% (1)

- Banking Academy: Assignment Financial Statement AnalysisDocument25 pagesBanking Academy: Assignment Financial Statement AnalysisDiệp NguyễnNo ratings yet

- F6 PIT AnswersDocument18 pagesF6 PIT AnswersHuỳnh TrungNo ratings yet

- Week 1 ICA - 2019 - Time Value of MoneyDocument2 pagesWeek 1 ICA - 2019 - Time Value of MoneyMira0% (1)

- CH 13#6Document13 pagesCH 13#6jjmaducdoc100% (1)

- Tugas 5. Siklus Akuntansi-Ricky Andrian K. RumereDocument66 pagesTugas 5. Siklus Akuntansi-Ricky Andrian K. RumererickyNo ratings yet

- Ch6 Que WsDocument7 pagesCh6 Que WsFoong Chan PingNo ratings yet

- Assignment On Segment Reporting, Jonas Albert AtasDocument2 pagesAssignment On Segment Reporting, Jonas Albert AtasJonasAlbertAtasNo ratings yet

- Ch06 P14 Build A ModelDocument6 pagesCh06 P14 Build A ModelKhurram KhanNo ratings yet

- #4 - Soluition To Essay Question #5 (Bonus Question)Document2 pages#4 - Soluition To Essay Question #5 (Bonus Question)DionizioNo ratings yet

- Bartman Industries and Reynolds Inc S Stock Prices and PDFDocument1 pageBartman Industries and Reynolds Inc S Stock Prices and PDFAnbu jaromiaNo ratings yet

- HW3 Managerial FinanceDocument13 pagesHW3 Managerial FinanceAndrew HawkinsNo ratings yet

- Assign 2 CLO 3Document3 pagesAssign 2 CLO 3DIVA RTHININo ratings yet

- Introduction To CommerceDocument12 pagesIntroduction To CommerceYagnik Mhatre100% (2)

- Day Trading PEG Red To Green SetupsDocument5 pagesDay Trading PEG Red To Green Setupsarenaman0528No ratings yet

- YFC Projects Private Limited (YPPL) : Rating RationaleDocument2 pagesYFC Projects Private Limited (YPPL) : Rating Rationalelalit rawatNo ratings yet

- Unit 2: General Concepts and Principles of AccountingDocument12 pagesUnit 2: General Concepts and Principles of AccountingChen HaoNo ratings yet

- Categories: NFPA 51B: Standard For Fire Prevention During Welding, Cutting, and Other Hot WorkDocument2 pagesCategories: NFPA 51B: Standard For Fire Prevention During Welding, Cutting, and Other Hot WorkThanakit SrisaengNo ratings yet

- Customer AnalyticsDocument38 pagesCustomer AnalyticsAbhie Ghail100% (5)

- Ent530bp Guideline and Template Oct2022Document15 pagesEnt530bp Guideline and Template Oct2022MOHD NOOR TAUFIQ JALALUDINNo ratings yet

- Hays GCC Salary Guide 2023 PDFDocument116 pagesHays GCC Salary Guide 2023 PDFmoony30No ratings yet

- A Level Entrepreneurship Revision Questions Based On Syllabus Phase 2Document18 pagesA Level Entrepreneurship Revision Questions Based On Syllabus Phase 2humpho45No ratings yet

- 11 - Chapter 4 The Valuation of Long-Term SecuritiesDocument53 pages11 - Chapter 4 The Valuation of Long-Term SecuritiesIni Ichiii100% (1)

- Entirety of Pittsburgh's Right-to-Know Response For Emails Sent Between Mayor's Office and UberDocument333 pagesEntirety of Pittsburgh's Right-to-Know Response For Emails Sent Between Mayor's Office and UberPennLiveNo ratings yet

- Exchange Rate "War Currencies".EditedDocument12 pagesExchange Rate "War Currencies".Edited2h rxNo ratings yet

- ACCT604 Week 5 Lecture SlidesDocument27 pagesACCT604 Week 5 Lecture SlidesBuddika PrasannaNo ratings yet

- 2023notices - 2023!07!06 - Order To Register With CIC VersionDocument9 pages2023notices - 2023!07!06 - Order To Register With CIC Versionalberiolerma827No ratings yet

- MSE 617 - Team B - Final ReportDocument17 pagesMSE 617 - Team B - Final ReporthshNo ratings yet

- Pengaruh Revolusi Industri RevisiDocument3 pagesPengaruh Revolusi Industri RevisiMuhammad Aris MunandarNo ratings yet

- Take Home ExamDocument12 pagesTake Home ExamShar KhanNo ratings yet

- Chapter 2Document4 pagesChapter 2Roselie Cuenca94% (16)

- CCeStatement 2022 10Document4 pagesCCeStatement 2022 10KAKI BELANGNo ratings yet

- UCO Reporter 2022, June Edition, May 26, 2022Document40 pagesUCO Reporter 2022, June Edition, May 26, 2022ucopresident100% (1)

- Tncs Signature Clean VersionDocument14 pagesTncs Signature Clean VersionQqwtryNo ratings yet

- Fcbo Jury Heenaagrima Sem 1Document30 pagesFcbo Jury Heenaagrima Sem 1Irene LalngaihzualiNo ratings yet

- Chapter1-Focusondecisionmaking Man. Acc.Document188 pagesChapter1-Focusondecisionmaking Man. Acc.eltonNo ratings yet

- Sea SH Action Plan Sadc GmiDocument7 pagesSea SH Action Plan Sadc GmiKaleab TadesseNo ratings yet

- Pooja 2023 CVDocument6 pagesPooja 2023 CVVipinNo ratings yet

- DasfasfaDocument2 pagesDasfasfarizkipamulaNo ratings yet

- Value Equivalence LineDocument5 pagesValue Equivalence LineExoYelzy yueNo ratings yet

- Signature of Student: Date: Signature of Guide/ Supervisor Date: Seal: Name: Name: Email ID: DesignationDocument1 pageSignature of Student: Date: Signature of Guide/ Supervisor Date: Seal: Name: Name: Email ID: DesignationzahooorbhatNo ratings yet

- Muhs Nashik Thesis Acceptance 2016Document4 pagesMuhs Nashik Thesis Acceptance 2016afkofvidg100% (1)

- A Study On Resource Allocation - SMDocument63 pagesA Study On Resource Allocation - SMbina100% (3)