Professional Documents

Culture Documents

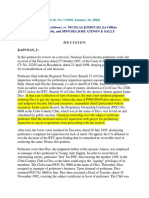

BIR Ruling DA-522-05

BIR Ruling DA-522-05

Uploaded by

Pam MarceloOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

BIR Ruling DA-522-05

BIR Ruling DA-522-05

Uploaded by

Pam MarceloCopyright:

Available Formats

3

December 23, 2005; BIR RULING [DA-522-05]; 24 (C); DA 567-04

Romulo Mabanta Buenaventura

Sayoc & De Los Angeles

30th Floor, Citibank Tower

8741 Paseo de Roxas

Makati City

Attention: Atty. Priscilla B. Valer and Atty. Jayson L. Fernandez

Gentlemen :

This refers to your letter dated October 10, 2005 stating that your client, Kraft Foods (Philippines), Inc.

(KRAFT) purchased one (1) share of Manila Polo Club, Inc. with a par value of P100,000.00 as evidenced

by Proprietary Certificate No. 4269; that the purchase was paid by KRAFT but in accordance with the

rules and regulations of Manila Polo Club, Inc., the share was not registered in the name of KRAFT but its

officer; that the cost of the share is still carried in the books of KRAFT as part of its assets, particularly,

under the heading Investments in Stocks; that the share is presently registered in the name of Mr.

Bienvenido Bautista (Mr. Bautista), the former President of KRAFT, who was the assignee of the share;

that the share is beneficially owned by KRAFT but was placed in the name of Mr. Bautista to make him

qualified to avail of and use of the various facilities of the Manila Polo Club; that Mr. Bautista retired from

KRAFT; that due to the severance of his employment, the share will be transferred to a new nominee-Ms.

Marivi Tiongson, KRAFT's incumbent President and General Manager so that she can avail of the

services and facilities of the Manila Polo Club; that the transfer of the share, being merely a transfer from

one nominee to another of KRAFT, is without any consideration; and that Ms. Marivic Tiongson has

executed a Declaration of Trust in favor of KRAFT to acknowledge that she is a mere nominee and the

share is beneficially owned by KRAFT.

Based on the foregoing representations, you now request confirmation of your opinion that the transfer of

the aforesaid share is not subject to capital gains tax or income tax imposed under Section 24(C) of the

Tax Code of 1997 and to the donor's tax imposed under Title II of the said Code.

In reply thereto, please be informed that since the transfer of the proprietary membership certificate

representing one (1) share of Manila Polo Club, Inc. beneficially owned by KRAFT from its present

nominee, Mr. Bautista, to a new nominee, Ms. Marivic Tiongson, does not involve any monetary

consideration or other material consideration, the same is not a taxable transaction and therefore, no

capital gains tax is due and payable on the aforementioned transaction.

Moreover, while the said transaction is considered a gift since it is a valid transfer of property from one

person to another without consideration or compensation therefor, the same is not subject to the gift tax.

This is so because although there is a direct gift, there is no donative intent under the above

circumstances. It has been held that in a direct gift, the element of donative intent must be present in the

transfer of property to be donated. (Perez vs. Commissioner, CTA Case No. 1707, February 10, 1969)

(BIR Ruling No. DA567-04 dated November 9, 2004)

Furthermore, the transfer of the said certificate is not subject to the documentary stamp tax imposed

under Section 176 of the Tax Code of 1997.

This ruling is being issued on the basis of the foregoing facts as represented. However, if upon

investigation, it will be disclosed that the facts are different, then this ruling shall be considered null and

void.

Very truly yours,

(SGD.) JOSE MARIO C. BUÑAG

Commissioner

Bureau of Internal Revenue

You might also like

- Phases of A ProjectDocument9 pagesPhases of A ProjectRaquel RsuNo ratings yet

- BIR Rulings On Nominee SharesDocument8 pagesBIR Rulings On Nominee SharesJenny Pasic LomibaoNo ratings yet

- General PsychologyDocument4 pagesGeneral PsychologyDaniel C. Dequiña100% (1)

- BOI Citizen's CharterDocument32 pagesBOI Citizen's CharterPam MarceloNo ratings yet

- 6 Makati Sports Club Inc. vs. Cecile Cheng and Ramon SabarreDocument16 pages6 Makati Sports Club Inc. vs. Cecile Cheng and Ramon SabarreTrebx Sanchez de GuzmanNo ratings yet

- Traders Royal Bank Vs CA Digest 1997Document2 pagesTraders Royal Bank Vs CA Digest 1997Wilfred MartinezNo ratings yet

- BIR Ruling OT-212-2022 - Transfer of Manila Polo Club Shares To Another Trustee Not Subject To CGT and DSTDocument6 pagesBIR Ruling OT-212-2022 - Transfer of Manila Polo Club Shares To Another Trustee Not Subject To CGT and DSTMark DomingoNo ratings yet

- Bir Ruling No. 039-97Document3 pagesBir Ruling No. 039-97MysajadeJaoMejicaNo ratings yet

- CASES 1-4 NegoDocument21 pagesCASES 1-4 NegoaudreyracelaNo ratings yet

- G.R. No. 93397Document6 pagesG.R. No. 93397Julian DubaNo ratings yet

- LTL Case Digest 9 13Document123 pagesLTL Case Digest 9 13Ray Joshua ValdezNo ratings yet

- BIR Ruling No. 039-97 Dated 03april1997 (STT, No Transfer of Beneficial Ownership)Document3 pagesBIR Ruling No. 039-97 Dated 03april1997 (STT, No Transfer of Beneficial Ownership)Hailin QuintosNo ratings yet

- Traders Royal Bank v. CADocument11 pagesTraders Royal Bank v. CARyan RapaconNo ratings yet

- SEC Opinions Re Nominee DirectorsDocument6 pagesSEC Opinions Re Nominee DirectorsJopet EstolasNo ratings yet

- 063-Traders Royal Bank vs. CA 269 Scra 601Document10 pages063-Traders Royal Bank vs. CA 269 Scra 601wewNo ratings yet

- Second Division G.R. No. 93397, March 03, 1997: Supreme Court of The PhilippinesDocument15 pagesSecond Division G.R. No. 93397, March 03, 1997: Supreme Court of The PhilippinesSocNo ratings yet

- Notice of Dispute of Alleged Debt2Document4 pagesNotice of Dispute of Alleged Debt2Armond TrakarianNo ratings yet

- Torres vs. PAGCOR, G.R. No. 193531, 14 December 2011: DigestDocument8 pagesTorres vs. PAGCOR, G.R. No. 193531, 14 December 2011: DigestNovember Lily OpledaNo ratings yet

- Antonio V. Bañez and Luisita Bañez Valera Nena Bañez Hojilla, and Edgardo B. HojillaDocument2 pagesAntonio V. Bañez and Luisita Bañez Valera Nena Bañez Hojilla, and Edgardo B. HojillaYeng AntonioNo ratings yet

- G.R. No. 164686Document9 pagesG.R. No. 164686Braian HitaNo ratings yet

- Republic of The Philippines Manila: CIR v. Filinvest Dev't. Corp. G.R. No. 163653Document18 pagesRepublic of The Philippines Manila: CIR v. Filinvest Dev't. Corp. G.R. No. 163653Jopan SJNo ratings yet

- Bachrach Motor Co. v. Lacson Ledesma 1937Document15 pagesBachrach Motor Co. v. Lacson Ledesma 1937Maricel Caranto FriasNo ratings yet

- Corp Law CasesDocument15 pagesCorp Law CasesNoel IV T. BorromeoNo ratings yet

- Traders Royal Bank vs. CA, 269 SCRA 16, March 3, 1997Document9 pagesTraders Royal Bank vs. CA, 269 SCRA 16, March 3, 1997XuagramellebasiNo ratings yet

- BIR Ruling 274-1987 September 9, 1987Document4 pagesBIR Ruling 274-1987 September 9, 1987Raiya Angela100% (1)

- 139754-1976-Nava v. Peers Marketing Corp.Document4 pages139754-1976-Nava v. Peers Marketing Corp.Kristine FayeNo ratings yet

- Bizradio Receiver MotionDocument26 pagesBizradio Receiver Motioneditorial.onlineNo ratings yet

- BIR Ruling No. 522-2017Document7 pagesBIR Ruling No. 522-2017liz kawiNo ratings yet

- Traders Royal Bank, Petitioner, vs. Court of Appeals, Filriters Guaranty Assurance Corporation and Central Bank of The Philippines, RespondentsDocument68 pagesTraders Royal Bank, Petitioner, vs. Court of Appeals, Filriters Guaranty Assurance Corporation and Central Bank of The Philippines, RespondentsElaizaNo ratings yet

- CORP GarciaDocument1 pageCORP GarciaCamille Maria CastoloNo ratings yet

- 20 Traders Royal Bank V CA 1997Document8 pages20 Traders Royal Bank V CA 1997Raiya AngelaNo ratings yet

- Cases in Obligations and ContractsDocument188 pagesCases in Obligations and ContractslaursNo ratings yet

- Magaso v. COA - Jan 2023 - Case Digest - 112923Document4 pagesMagaso v. COA - Jan 2023 - Case Digest - 112923Sam LeynesNo ratings yet

- Corp-Lipat V PAcific BankingDocument7 pagesCorp-Lipat V PAcific BankingAnonymous OVr4N9MsNo ratings yet

- Case Study For Obligations and ContractsDocument18 pagesCase Study For Obligations and ContractsJezreel Enad MaguindaNo ratings yet

- Bernardo v. CADocument9 pagesBernardo v. CAVeah CaabayNo ratings yet

- Traders Royal Bank V CA (DIGEST)Document2 pagesTraders Royal Bank V CA (DIGEST)Obin Tambasacan Baggayan100% (3)

- Traders Royal Bank Vs Court of Appeals Et AlDocument10 pagesTraders Royal Bank Vs Court of Appeals Et AlJunalyn BuesaNo ratings yet

- Ligon vs. RTC of Makati, Br. 56, 717 SCRSADocument15 pagesLigon vs. RTC of Makati, Br. 56, 717 SCRSAAlbert John RanocoNo ratings yet

- FT Garcia V JomouadDocument3 pagesFT Garcia V JomouadCinNo ratings yet

- PNB Vs CIRDocument4 pagesPNB Vs CIRRomielyn MacalinaoNo ratings yet

- Additional CasesDocument5 pagesAdditional CasesMorgana BlackhawkNo ratings yet

- Torres vs. Philippines Amusement and Gaming CorporationDocument13 pagesTorres vs. Philippines Amusement and Gaming Corporationpoiuytrewq9115No ratings yet

- Traders Royal Bank Vs CADocument8 pagesTraders Royal Bank Vs CAjeshemaNo ratings yet

- Traders Royal Bank Vs CA - G.R. No. 93397. March 3, 1997Document11 pagesTraders Royal Bank Vs CA - G.R. No. 93397. March 3, 1997Ebbe DyNo ratings yet

- Traders Royal Bank VDocument13 pagesTraders Royal Bank Vglenda e. calilaoNo ratings yet

- Cases TaxationDocument6 pagesCases TaxationEdel VillanuevaNo ratings yet

- Nego - TRB VS CaDocument3 pagesNego - TRB VS CaXing Keet LuNo ratings yet

- Reynoso vs. CADocument3 pagesReynoso vs. CAKaren Patricio LusticaNo ratings yet

- BIR Ruling 479-11Document2 pagesBIR Ruling 479-11RB BalanayNo ratings yet

- Digests 1 15Document12 pagesDigests 1 15KarlNo ratings yet

- CORPO Cases 1Document19 pagesCORPO Cases 1LoNo ratings yet

- Bir RulingDocument4 pagesBir Rulingdranreb ursabiaNo ratings yet

- Mercrev Stockholders DigestsDocument50 pagesMercrev Stockholders DigestsaugustofficialsNo ratings yet

- Traders v. CADocument8 pagesTraders v. CAJanine CastroNo ratings yet

- Traders Royal Bank v. Court of AppealsDocument13 pagesTraders Royal Bank v. Court of Appealslovekimsohyun89No ratings yet

- Lim Vs Lazaro G.R. No. 185734 HeldDocument14 pagesLim Vs Lazaro G.R. No. 185734 Heldrosario orda-caiseNo ratings yet

- COA DECISION NO. 1996-362: July 16, 1996Document2 pagesCOA DECISION NO. 1996-362: July 16, 1996Anj EboraNo ratings yet

- COA Decision No. 1996-362Document2 pagesCOA Decision No. 1996-362Fam MedinaNo ratings yet

- Corpo Case Digest FinalsDocument73 pagesCorpo Case Digest FinalsLouie SalazarNo ratings yet

- Com Rev - Garcia vs. Jomouad - CorpoDocument2 pagesCom Rev - Garcia vs. Jomouad - CorpoEly R. BarrettoNo ratings yet

- How to Do a 1031 Exchange of Real Estate: Using a 1031 Qualified Intermediary (Qi) 2Nd EditionFrom EverandHow to Do a 1031 Exchange of Real Estate: Using a 1031 Qualified Intermediary (Qi) 2Nd EditionNo ratings yet

- Crypto Taxation in USA: A Comprehensive Guide to Navigating Digital Assets and TaxationFrom EverandCrypto Taxation in USA: A Comprehensive Guide to Navigating Digital Assets and TaxationNo ratings yet

- Petitioner vs. vs. Respondent: Special First DivisionDocument3 pagesPetitioner vs. vs. Respondent: Special First DivisionPam MarceloNo ratings yet

- 124787-1997-Golangco v. Court of AppealsDocument8 pages124787-1997-Golangco v. Court of AppealsPam MarceloNo ratings yet

- Petitioners Vs Vs Respondents Daniel B. Valdez A.D. Corvera & AssociatesDocument10 pagesPetitioners Vs Vs Respondents Daniel B. Valdez A.D. Corvera & AssociatesPam MarceloNo ratings yet

- 1990Document29 pages1990Pam MarceloNo ratings yet

- Petitioner vs. vs. Respondent: Third DivisionDocument6 pagesPetitioner vs. vs. Respondent: Third DivisionPam MarceloNo ratings yet

- Checklist For Cancellation of ACR I-CardDocument1 pageChecklist For Cancellation of ACR I-CardPam MarceloNo ratings yet

- IAZ V CommissionDocument51 pagesIAZ V CommissionPam MarceloNo ratings yet

- ABS-CBN V Marlyn Nazareno Et G.R. No. 164156Document22 pagesABS-CBN V Marlyn Nazareno Et G.R. No. 164156Pam Marcelo100% (1)

- 1 Notes - Yashodhara-TheriDocument8 pages1 Notes - Yashodhara-TherisamskhangNo ratings yet

- HarperCollins Spanish-English College DictionaryDocument3,334 pagesHarperCollins Spanish-English College DictionaryMina Gomez100% (1)

- Court DiaryDocument16 pagesCourt DiaryJajju RaoNo ratings yet

- Chapter 4: Passive Voice : 4.1. General FormulaDocument6 pagesChapter 4: Passive Voice : 4.1. General FormulaAriSuandiNo ratings yet

- Materi 3 Materi 3 Rerangka Konseptual IASBDocument20 pagesMateri 3 Materi 3 Rerangka Konseptual IASBgadi3szzNo ratings yet

- Non Rigid Connector FPDDocument3 pagesNon Rigid Connector FPDIana RusuNo ratings yet

- Khajuraho - Group of Monuments - MP TourismDocument17 pagesKhajuraho - Group of Monuments - MP TourismMPTourismNo ratings yet

- Unit 3 Module 1 The Menstrual CycleDocument20 pagesUnit 3 Module 1 The Menstrual CycleMARIANNE SORIANO100% (2)

- SA Economy 4Document10 pagesSA Economy 4Manyanani KamangaNo ratings yet

- The Travels of Macarius, Patriarch of Antioch: Written by his Attendant Archdeacon, Paul of Aleppo, In Arabic. Volume I and II. Translated By F. C. Belfour London: Printed for the Oriental Translation Fund, 1837Document8 pagesThe Travels of Macarius, Patriarch of Antioch: Written by his Attendant Archdeacon, Paul of Aleppo, In Arabic. Volume I and II. Translated By F. C. Belfour London: Printed for the Oriental Translation Fund, 1837Nicholas PappasNo ratings yet

- Seminar Report On Ion PropulsionDocument6 pagesSeminar Report On Ion PropulsionMac TVNo ratings yet

- Bacarro Vs CastanoDocument2 pagesBacarro Vs CastanoMaiti LagosNo ratings yet

- Khanqah of Sarwari Qadri OrderDocument74 pagesKhanqah of Sarwari Qadri OrderSultan ul Faqr PublicationsNo ratings yet

- 3-Medical Gases Systems. The Third Lecture.Document17 pages3-Medical Gases Systems. The Third Lecture.Fireproof Sistemas ElectromecánicosNo ratings yet

- MemoDocument33 pagesMemoNeha GillNo ratings yet

- Astrological Chart Interpretation Astrological Chart InterpretationDocument10 pagesAstrological Chart Interpretation Astrological Chart InterpretationboraNo ratings yet

- The Prayer of Faith by Leonard Boase PDFDocument69 pagesThe Prayer of Faith by Leonard Boase PDF6luke3738No ratings yet

- General Instructions:: PRACTICE PAPER (2018-19) Class: Xii Max. Marks:70 Subject: Chemistry Time: 3 HoursDocument8 pagesGeneral Instructions:: PRACTICE PAPER (2018-19) Class: Xii Max. Marks:70 Subject: Chemistry Time: 3 HoursHINDI CARTOONSNo ratings yet

- HTML Lab FileDocument25 pagesHTML Lab FilegrvshrNo ratings yet

- Marketing Management: Group Members: Oasama Mahmood Batla Rameel Safwan Umm-e-Areeba MustafaDocument15 pagesMarketing Management: Group Members: Oasama Mahmood Batla Rameel Safwan Umm-e-Areeba MustafaOasama BatlaNo ratings yet

- Francisco v. MejiaDocument8 pagesFrancisco v. MejiaCari Mangalindan MacaalayNo ratings yet

- Christianity and The ArtsDocument11 pagesChristianity and The ArtsPaulo FernandesNo ratings yet

- MUSIC 9-Module 1: Schools Division of Pasig CityDocument3 pagesMUSIC 9-Module 1: Schools Division of Pasig CityEdeli Faith PatrocinioNo ratings yet

- Disagreeing PolitelylpDocument7 pagesDisagreeing PolitelylpRoseanne IkanNo ratings yet

- Quiz 2Document5 pagesQuiz 2Apples Ermida BanuelosNo ratings yet

- Components of TSMDocument2 pagesComponents of TSMsubhrajitm47No ratings yet

- Upper-Intermediate - When The Taxi Takes The Long Way: Visit The - C 2007 Praxis Language LTDDocument6 pagesUpper-Intermediate - When The Taxi Takes The Long Way: Visit The - C 2007 Praxis Language LTDhudixNo ratings yet

- Bullying: by Cathlyn de Dios and Mary Yochabel FrancoDocument31 pagesBullying: by Cathlyn de Dios and Mary Yochabel FrancoKDNo ratings yet