Professional Documents

Culture Documents

Census Horticulture

Census Horticulture

Uploaded by

Morgan IngramCopyright:

Available Formats

You might also like

- Growing Catha EdulisDocument2 pagesGrowing Catha EdulisLuis Portugal100% (1)

- Landscaping Business PlanDocument32 pagesLandscaping Business PlanGerald100% (1)

- Lawnranger Landscaping ServiceDocument47 pagesLawnranger Landscaping ServiceKailash Kumar100% (1)

- Prison Labor and The Fair Labor Standards ActDocument27 pagesPrison Labor and The Fair Labor Standards ActbeuchardNo ratings yet

- LandscapingDocument47 pagesLandscapingKarim Azad100% (3)

- 2015 Yukon Sales Reference Guide BrochureDocument15 pages2015 Yukon Sales Reference Guide BrochureBecker Buick GmcNo ratings yet

- Broadleaf Trees Student SheetDocument1 pageBroadleaf Trees Student SheetNit EshNo ratings yet

- Agriculture S.B.a. 2Document25 pagesAgriculture S.B.a. 2Kern Grant43% (7)

- Plant Nursery Management Manual - UpdatedDocument22 pagesPlant Nursery Management Manual - UpdatedMilanie Joy BaradiNo ratings yet

- Impressions Services (P) LTD - Company CatalogDocument33 pagesImpressions Services (P) LTD - Company CatalogimadNo ratings yet

- Josie's Garden Business PlanDocument14 pagesJosie's Garden Business Planleah_may6No ratings yet

- Hard N Soft LandscapeDocument5 pagesHard N Soft Landscapeprazol11223350% (2)

- Landscape DesignDocument4 pagesLandscape DesignzoliNo ratings yet

- GreenMyLife Portfolio 2017 Mailer - CompressedDocument34 pagesGreenMyLife Portfolio 2017 Mailer - CompressedAbhijit NathNo ratings yet

- GardeningDocument44 pagesGardeningslixster100% (1)

- 430-104 PDFDocument14 pages430-104 PDFrick785No ratings yet

- Shade House ManualDocument25 pagesShade House ManualStephen FrancisNo ratings yet

- Optimal AgricultureDocument9 pagesOptimal AgriculturesamNo ratings yet

- The Cost of Producing Potted Orchids Hawaiian Agricultural ProductsDocument4 pagesThe Cost of Producing Potted Orchids Hawaiian Agricultural ProductsStefana LnNo ratings yet

- Dryland Technologies in Crop ProductionDocument11 pagesDryland Technologies in Crop Production62 Renuga SNo ratings yet

- Landscaping Estimate: Plants LaborDocument1 pageLandscaping Estimate: Plants LaborMathiTwadCNo ratings yet

- Landscape & DesignDocument84 pagesLandscape & DesignÎsmaîl Îbrahîm SilêmanNo ratings yet

- Crop BudgetDocument10 pagesCrop BudgetBiz2BizNo ratings yet

- Planting and Care - Saffron CrocusDocument1 pagePlanting and Care - Saffron CrocusBrandia Ta'amuNo ratings yet

- Planting The Landscape: Jose B. Juson, JRDocument34 pagesPlanting The Landscape: Jose B. Juson, JRpatNo ratings yet

- Tress and TurfDocument2 pagesTress and Turflahsivlahsiv684No ratings yet

- Horticulture Fact Sheets PDFDocument15 pagesHorticulture Fact Sheets PDFmasumbuko mussaNo ratings yet

- Pennsylvania Creating Sustainable Community ParksDocument76 pagesPennsylvania Creating Sustainable Community ParksFree Rain Garden ManualsNo ratings yet

- Design & Implementation of Web Based Application For Plant NurseryDocument15 pagesDesign & Implementation of Web Based Application For Plant Nurseryqqwqwa100% (1)

- Home Design IdeasDocument19 pagesHome Design IdeasrnkaushalNo ratings yet

- Crop Profitability CalculatorDocument12 pagesCrop Profitability CalculatorAnupam BaliNo ratings yet

- ARBICO Garden Journal 2018Document25 pagesARBICO Garden Journal 2018А.ЈМитревскиNo ratings yet

- Principles of LandscapingDocument96 pagesPrinciples of Landscapingshivpal singh100% (1)

- Garden Journal 2011: Natural Products For Your Organic Home, Lawn, Garden, Farm and PetsDocument25 pagesGarden Journal 2011: Natural Products For Your Organic Home, Lawn, Garden, Farm and PetsAnne Marie DuBois Cullon100% (1)

- Landscape Plants CG Sections 1-3Document154 pagesLandscape Plants CG Sections 1-3Jeffrey PeekoNo ratings yet

- Agriculture Waste To Wealth NewDocument7 pagesAgriculture Waste To Wealth NewMadev RathodNo ratings yet

- Cost Estimating Worksheet The RestorationDocument4 pagesCost Estimating Worksheet The RestorationMay Myoe KhinNo ratings yet

- 09 Irrigation MDocument28 pages09 Irrigation MSaleemNo ratings yet

- Elite - Pre QualificationDocument24 pagesElite - Pre QualificationitechemiratesNo ratings yet

- Fragrant BookDocument28 pagesFragrant BookHO YOKE YENG MoeNo ratings yet

- 21stCentGreens FullBookDocument269 pages21stCentGreens FullBookg_spadolini6156100% (1)

- Market GardeningDocument14 pagesMarket GardeningBasit100% (1)

- Dayananda Sagar School of Architecture: 09 Arc 7.7 Landscape Architecture NotesDocument4 pagesDayananda Sagar School of Architecture: 09 Arc 7.7 Landscape Architecture NotesPrajwal PrakashNo ratings yet

- Mycorrhizal Production by HydroponicDocument16 pagesMycorrhizal Production by HydroponicMohamed Mohamed AbdulhayNo ratings yet

- Spring/Summer 2017: Create A Pollinator Garden Must Have Oh Deer!Document36 pagesSpring/Summer 2017: Create A Pollinator Garden Must Have Oh Deer!Sunita JadhavNo ratings yet

- Climbers and Trees For Villa LandscapingDocument11 pagesClimbers and Trees For Villa LandscapingMonisha100% (1)

- Job CostingDocument16 pagesJob CostingipeeterNo ratings yet

- Water Wise Landscape Handbook PDFDocument20 pagesWater Wise Landscape Handbook PDFmendes62No ratings yet

- Watermelon Fertilizer Schedule - Tips For Watermelon Feeding in The GardenDocument5 pagesWatermelon Fertilizer Schedule - Tips For Watermelon Feeding in The GardenNovancyNo ratings yet

- Andscape Lement: Jepson Parkway Concept Plan 27Document19 pagesAndscape Lement: Jepson Parkway Concept Plan 27Ayesha SheikhNo ratings yet

- Landscaping PDFDocument45 pagesLandscaping PDFDianaMocodeanNo ratings yet

- CarnationDocument54 pagesCarnationDR V S PATIL100% (1)

- Ridge Farms Manuel of Design Standards and Development GuidelinesDocument20 pagesRidge Farms Manuel of Design Standards and Development GuidelineslehighvalleynewsNo ratings yet

- GARDENDocument14 pagesGARDENMauriel MarzanNo ratings yet

- Nitrogen Fixers For Temperate Climate Permaculture Forest GardensDocument9 pagesNitrogen Fixers For Temperate Climate Permaculture Forest GardensformlessFlowerNo ratings yet

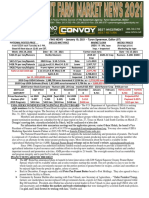

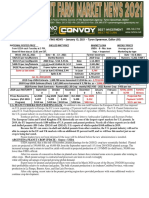

- Floriculture 2021Document2 pagesFloriculture 2021Morgan IngramNo ratings yet

- Niagara Agriculture Profile Dec 2022Document34 pagesNiagara Agriculture Profile Dec 2022samsinghania54321No ratings yet

- Griculture: Virginia Farm Facts Virginia's Top 20 Agricultural CommoditiesDocument2 pagesGriculture: Virginia Farm Facts Virginia's Top 20 Agricultural CommoditiesfdgfdsNo ratings yet

- NY Comptroller: Economic Impact of Agriculture in NYSDocument4 pagesNY Comptroller: Economic Impact of Agriculture in NYSAndy ArthurNo ratings yet

- Cotton Marketing NewsDocument1 pageCotton Marketing NewsBrittany EtheridgeNo ratings yet

- Leafly Cannabis Harvest Report 2021: Meet America's 5th Most Valuable CropDocument27 pagesLeafly Cannabis Harvest Report 2021: Meet America's 5th Most Valuable CropTrevor DrewNo ratings yet

- Calfacts Economy 2006Document10 pagesCalfacts Economy 2006FortuneNo ratings yet

- Florida Crop Progress and Condition ReportDocument2 pagesFlorida Crop Progress and Condition ReportMorgan IngramNo ratings yet

- Market Loan Weekly Prices: Shelled MKT PriceDocument1 pageMarket Loan Weekly Prices: Shelled MKT PriceMorgan IngramNo ratings yet

- Export Raw-Shelled Peanuts (MT) In-Shell Peanuts (MT) UP + 87.3%Document1 pageExport Raw-Shelled Peanuts (MT) In-Shell Peanuts (MT) UP + 87.3%Morgan IngramNo ratings yet

- Shelled MKT Price: Market Loan Weekly PricesDocument1 pageShelled MKT Price: Market Loan Weekly PricesMorgan IngramNo ratings yet

- Export Raw-Shelled Peanuts (MT) In-Shell Peanuts (MT) UP + 67.4%Document1 pageExport Raw-Shelled Peanuts (MT) In-Shell Peanuts (MT) UP + 67.4%Morgan IngramNo ratings yet

- Peanut Marketing News - January 22, 2021 - Tyron Spearman, EditorDocument1 pagePeanut Marketing News - January 22, 2021 - Tyron Spearman, EditorMorgan IngramNo ratings yet

- Florida Crop Progress and Condition ReportDocument2 pagesFlorida Crop Progress and Condition ReportMorgan IngramNo ratings yet

- Market Loan Weekly Prices: Shelled MKT PriceDocument1 pageMarket Loan Weekly Prices: Shelled MKT PriceMorgan IngramNo ratings yet

- Cotton Marketing NewsDocument1 pageCotton Marketing NewsMorgan IngramNo ratings yet

- Shelled MKT Price: Market Loan Weekly PricesDocument1 pageShelled MKT Price: Market Loan Weekly PricesMorgan IngramNo ratings yet

- Florida Crop Progress and Condition ReportDocument2 pagesFlorida Crop Progress and Condition ReportMorgan IngramNo ratings yet

- Crop Production and Peanut Stocks and Processing, NASS, USDA, Census Bureau and U.S. Department of Commerce Harvest Lbs/ac Begin Stocks Imports Seed & ResidualDocument2 pagesCrop Production and Peanut Stocks and Processing, NASS, USDA, Census Bureau and U.S. Department of Commerce Harvest Lbs/ac Begin Stocks Imports Seed & ResidualMorgan IngramNo ratings yet

- Cit 0121Document4 pagesCit 0121Morgan IngramNo ratings yet

- PEANUT MARKETING NEWS - December 17, 2020 - Tyron Spearman, EditorDocument1 pagePEANUT MARKETING NEWS - December 17, 2020 - Tyron Spearman, EditorMorgan IngramNo ratings yet

- 1,000 Acres Pounds/Acre TonsDocument1 page1,000 Acres Pounds/Acre TonsMorgan IngramNo ratings yet

- Broiler Hatchery 01-06-21Document2 pagesBroiler Hatchery 01-06-21Morgan IngramNo ratings yet

- Florida Crop Progress and Condition ReportDocument2 pagesFlorida Crop Progress and Condition ReportMorgan IngramNo ratings yet

- Edible Flowers: Allium Species. The Flowers of TheDocument8 pagesEdible Flowers: Allium Species. The Flowers of TheAdrian StanNo ratings yet

- Seed, Nursery Practice and EstablishmentDocument29 pagesSeed, Nursery Practice and EstablishmentAldrich Roswell OnaNo ratings yet

- RAPE NurseryDocument4 pagesRAPE NurseryWellington KubaraNo ratings yet

- Cropping (Pilas-Tanim) Refers The: Second Planted The ToDocument7 pagesCropping (Pilas-Tanim) Refers The: Second Planted The ToWaren LlorenNo ratings yet

- Mandevilla: This Plants GrowzoneDocument7 pagesMandevilla: This Plants GrowzoneLWNo ratings yet

- Chapter 3 Ali Abu AleidDocument3 pagesChapter 3 Ali Abu AleidAliAbulgasimNo ratings yet

- Geep 117Document4 pagesGeep 117friendkwtNo ratings yet

- Gladiolus - Importance: Gladiolus Is Always in Demand Both in Domestic and Export Market. During WinterDocument8 pagesGladiolus - Importance: Gladiolus Is Always in Demand Both in Domestic and Export Market. During WinterG.M.Tasnimul KarimNo ratings yet

- Methods of Plant PropagationDocument7 pagesMethods of Plant PropagationMaria Carmela Oriel MaligayaNo ratings yet

- How To Grow A Redwood Tree From Seed: 1) Collecting SeedsDocument3 pagesHow To Grow A Redwood Tree From Seed: 1) Collecting SeedsRob ZNo ratings yet

- Garden Inspiration 2010Document29 pagesGarden Inspiration 2010Schneider F. IstvánNo ratings yet

- Floriculture - I XI PDFDocument144 pagesFloriculture - I XI PDFGkNo ratings yet

- Nyanatusita Bhikkhu: What Is The Real Sal Tree?Document4 pagesNyanatusita Bhikkhu: What Is The Real Sal Tree?Nyanatusita Bhikkhu100% (3)

- Italian GardensDocument37 pagesItalian GardensradhikaNo ratings yet

- Ecological SuccessionDocument5 pagesEcological SuccessionSigfreed Angeles100% (1)

- Soil Cohesion: Typical Values of Soil Cohesion For Different SoilsDocument3 pagesSoil Cohesion: Typical Values of Soil Cohesion For Different SoilsJerome BalanoyosNo ratings yet

- 1 PBDocument10 pages1 PBFadiyaNo ratings yet

- Gardens of PlentyDocument159 pagesGardens of PlentyFrancisco Vargas100% (2)

- Altoire Nuc Pe Portaltoi Tanar-EngDocument4 pagesAltoire Nuc Pe Portaltoi Tanar-Engmarius1979No ratings yet

- 19 HTMDocument6 pages19 HTMSha-ReeNo ratings yet

- Grade 5 Plant AdaptationsDocument3 pagesGrade 5 Plant AdaptationsStevo JobosNo ratings yet

- Adaptations of PlantsDocument17 pagesAdaptations of Plantssandip patil100% (11)

- SUMMER Issue of The Dirt 2018Document28 pagesSUMMER Issue of The Dirt 2018Vermont Nursery & Landscape AssociationNo ratings yet

- GardenDocument11 pagesGardensakti_badalaNo ratings yet

- Hallie Morrison Portfolio 2017Document25 pagesHallie Morrison Portfolio 2017Hallie MorrisonNo ratings yet

- Drilling Log: Ded Pembangunan Jalan TolDocument2 pagesDrilling Log: Ded Pembangunan Jalan TolRizalPurnamaNo ratings yet

- Old Farmers AlmanacDocument5 pagesOld Farmers AlmanacAndreia MihailaNo ratings yet

- Technology and Livelihood EducationDocument40 pagesTechnology and Livelihood EducationMichael AnoraNo ratings yet

Census Horticulture

Census Horticulture

Uploaded by

Morgan IngramOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Census Horticulture

Census Horticulture

Uploaded by

Morgan IngramCopyright:

Available Formats

Horticulture

Highlights Results from the 2019 Census of Horticultural Specialties

ACH17-25/December 2020

The number of operations producing horticulture products in 2019 20,655

decreased 11% from 2014. Sales of horticulture products decreased slightly operations

(by $10.1 million), while expenses increased 6%. Five states accounted

$13.8 billion

for 50% of horticulture sales and 28% of horticulture operations. Nursery

horticulture sales

stock, annual bedding plants, and sod were the largest sectors in 2019, with

combined sales of over $8 billion. $11.9 billion

sold wholesale

Top States

Horticulture Sales U.S. Horticulture Sales, 1929-2019 ($ billion)

Horticulture Sales, 2019 ($ mil)

13.8 13.8

California, the top state in horticulture California 2,629

sales, sold $2.6 billion in horticulture 11.7 Florida 1,932

products in 2019, down 9% from 2014. 10.6 Oregon 1,016

Unlike California, many of the other Michigan 695

top producing states had increases in Texas 599

sales, yet experienced a decrease in the North Carolina 556

number of operations. Florida, the state New Jersey 505

with the most horticulture operations, 4.8 Ohio 469

had an 18% decrease in the number 3.2 Georgia 354

of operations. Horticulture products Pennsylvania 310

were primarily marketed wholesale, 1.0 New York 310

0.2 0.3 0.5

accounting for 86% of the value in sales Washington 300

compared to 14% retail. 1929 1949 1959 1970 1979 1988 1998 2009 2014 2019

2019 Sales % Change

Top States

($ million) Since 2014 Horticulture Production Horticulture Operations, 2019

Nursery stock 4,545 7

Annual bedding 2,244 -13 Land Area Used for Production, 2014 and 2019

2014 2019 % Change Florida 1,689

Sod 1,272 12 Pennsylvania 1,365

Potted flowering 1,200 11 Acres in production California 1,331

Potted herbaceous 923 -2 In the open, excluding Oregon 1,124

Food crops grown under under shade structures 497,339 549,063 10% Michigan 1,092

protection 703 -12 Sod 320,566 334,206 4% New York 978

Propagative materials 720 4 Cultivated Christmas trees 178,000 172,000 -3% North Carolina 885

Foliage 691 -4 Natural shade 5,404 6,729 25% Ohio 854

Cut flowers and cut lei Million square feet Wisconsin 789

flowers 386 -17 under protection Washington 699

Transplants for Greenhouses 895 885 -1% Texas 614

vegetables and Plastic film 640 666 4% New Jersey 555

strawberries 370 -1 Glass covered 123 109 -11%

Cultivated Christmas Rigid plastic 132 111 -16%

trees 357 -3 Shade structures 430 392 -9%

United States Department of Agriculture

National Agricultural Statistics Service www.nass.usda.gov/AgCensus

Operation Characteristics Nursery Stock Sales, 2019

% Change

Snapshot: Horticulture, 2014 and 2019 $ Million Since 2014

2014 2019 % Change Broadleaf evergreens 853 6

No. of operations 23,221 20,655 -11 Fruit and nut plants 735 -3

Total sales ($ billion) 13.8 13.8 0 Deciduous shade trees 711 26

Avg. sales per operation ($ thousands) 594 667 12 Deciduous shrubs 674 0

Wholesale (as percent of total sales) 86.0 86.0 0 Coniferous evergreens 652 15

Corporations (as % of total operations) 37.6 37.0 -1 Deciduous flowering trees 377 1

Production expenses ($ billion) 11.0 11.6 6 Ornamental grasses 179 13

No. of operations with hired workers 17,086 14,861 -13 Woody ornamentals

No. of hired workers 274,759 242,695 -12 and vines 141 -9

Landscaping palms 133 -13

Cacti and succulents 79 92

Bareroot herbaceous

Marketing Channels Used, 2019 ($ million) perennials 11 -36

Total Nursery Stock Sales 4,545 7

Landscape contractors 2,481

Retail garden centers/nurseries 2,377 Nursery stock was the largest horticultural

category by value of sales and accounted

Other mass marketers 2,342 for 33% of all horticultural sales. Broadleaf

Consumers (direct sales) 1,965 evergreens was the largest category of

nursery stock sales and accounted for 6%

Other 1,707 of total horticultural sales.

Supermarkets 1,110

Sales to landscape Expenditures, 2019

Landscape redistribution yards 909

contractors was the % Change

Wholesale florists 497 largest marketing $ Million Since 2014

channel by volume of

Retail florists 206 Labor 4,878 10

sales, accounting for

Seeds, growing media,

Non-profit groups 100 18% of total sales. Retail

containers 2,902 5

garden centers and

Interiorscapers 86 Fuel, utilities, supplies,

other mass marketers

repairs 1,369 -8

accounted for 17% each.

Rent, interest, taxes 759 9

Other 751 38

Fertilizer and chemicals 675 -9

66%

The share of horticultural operations that sold directly to consumers.

Marketing and packaging

Total

302

11,636

-1

6

Retail sales accounted for only 14% of all sales of horticultural products. Horticultural operations reported

$11.6 billion in production expenses in 2019.

About the Survey Operation Characteristics by Sales Class, 2019 (percent of total)

Wholesale Retail Hired

The 2019 Census of Horticultural Operations Sales Sales Sales Expenses Workers

Specialties is a Census of Agriculture

special study. It includes any operation $10,000 to $99,999 58 1 15 3 5 12

that produced and sold $10,000 or more $100,000 to $499,999 24 6 25 8 10 16

in horticultural specialty products in 2019. $500,000 to $999,999 7 6 13 7 8 10

$1,000,000 to

The 2019 data as well as results of

previous NASS horticultural surveys are

$2,499,999 6 14 17 15 15 15

available in the NASS Quick Stats database $2,500,000 + 5 73 30 67 62 47

at quickstats.nass.usda.gov, and as a PDF

file publication at www.nass.usda.gov/ Operations with $2.5 million or more in sales accounted for only 5% of total

go/hort. operations but the majority of wholesale sales (73%), total sales (67%), and

expenses (62%). Operations with $10,000 to $99,999 in sales accounted for 58%

of total operations.

Source: USDA NASS, 2019 Census of Horticultural Specialties. USDA is an equal opportunity provider, employer, and lender.

You might also like

- Growing Catha EdulisDocument2 pagesGrowing Catha EdulisLuis Portugal100% (1)

- Landscaping Business PlanDocument32 pagesLandscaping Business PlanGerald100% (1)

- Lawnranger Landscaping ServiceDocument47 pagesLawnranger Landscaping ServiceKailash Kumar100% (1)

- Prison Labor and The Fair Labor Standards ActDocument27 pagesPrison Labor and The Fair Labor Standards ActbeuchardNo ratings yet

- LandscapingDocument47 pagesLandscapingKarim Azad100% (3)

- 2015 Yukon Sales Reference Guide BrochureDocument15 pages2015 Yukon Sales Reference Guide BrochureBecker Buick GmcNo ratings yet

- Broadleaf Trees Student SheetDocument1 pageBroadleaf Trees Student SheetNit EshNo ratings yet

- Agriculture S.B.a. 2Document25 pagesAgriculture S.B.a. 2Kern Grant43% (7)

- Plant Nursery Management Manual - UpdatedDocument22 pagesPlant Nursery Management Manual - UpdatedMilanie Joy BaradiNo ratings yet

- Impressions Services (P) LTD - Company CatalogDocument33 pagesImpressions Services (P) LTD - Company CatalogimadNo ratings yet

- Josie's Garden Business PlanDocument14 pagesJosie's Garden Business Planleah_may6No ratings yet

- Hard N Soft LandscapeDocument5 pagesHard N Soft Landscapeprazol11223350% (2)

- Landscape DesignDocument4 pagesLandscape DesignzoliNo ratings yet

- GreenMyLife Portfolio 2017 Mailer - CompressedDocument34 pagesGreenMyLife Portfolio 2017 Mailer - CompressedAbhijit NathNo ratings yet

- GardeningDocument44 pagesGardeningslixster100% (1)

- 430-104 PDFDocument14 pages430-104 PDFrick785No ratings yet

- Shade House ManualDocument25 pagesShade House ManualStephen FrancisNo ratings yet

- Optimal AgricultureDocument9 pagesOptimal AgriculturesamNo ratings yet

- The Cost of Producing Potted Orchids Hawaiian Agricultural ProductsDocument4 pagesThe Cost of Producing Potted Orchids Hawaiian Agricultural ProductsStefana LnNo ratings yet

- Dryland Technologies in Crop ProductionDocument11 pagesDryland Technologies in Crop Production62 Renuga SNo ratings yet

- Landscaping Estimate: Plants LaborDocument1 pageLandscaping Estimate: Plants LaborMathiTwadCNo ratings yet

- Landscape & DesignDocument84 pagesLandscape & DesignÎsmaîl Îbrahîm SilêmanNo ratings yet

- Crop BudgetDocument10 pagesCrop BudgetBiz2BizNo ratings yet

- Planting and Care - Saffron CrocusDocument1 pagePlanting and Care - Saffron CrocusBrandia Ta'amuNo ratings yet

- Planting The Landscape: Jose B. Juson, JRDocument34 pagesPlanting The Landscape: Jose B. Juson, JRpatNo ratings yet

- Tress and TurfDocument2 pagesTress and Turflahsivlahsiv684No ratings yet

- Horticulture Fact Sheets PDFDocument15 pagesHorticulture Fact Sheets PDFmasumbuko mussaNo ratings yet

- Pennsylvania Creating Sustainable Community ParksDocument76 pagesPennsylvania Creating Sustainable Community ParksFree Rain Garden ManualsNo ratings yet

- Design & Implementation of Web Based Application For Plant NurseryDocument15 pagesDesign & Implementation of Web Based Application For Plant Nurseryqqwqwa100% (1)

- Home Design IdeasDocument19 pagesHome Design IdeasrnkaushalNo ratings yet

- Crop Profitability CalculatorDocument12 pagesCrop Profitability CalculatorAnupam BaliNo ratings yet

- ARBICO Garden Journal 2018Document25 pagesARBICO Garden Journal 2018А.ЈМитревскиNo ratings yet

- Principles of LandscapingDocument96 pagesPrinciples of Landscapingshivpal singh100% (1)

- Garden Journal 2011: Natural Products For Your Organic Home, Lawn, Garden, Farm and PetsDocument25 pagesGarden Journal 2011: Natural Products For Your Organic Home, Lawn, Garden, Farm and PetsAnne Marie DuBois Cullon100% (1)

- Landscape Plants CG Sections 1-3Document154 pagesLandscape Plants CG Sections 1-3Jeffrey PeekoNo ratings yet

- Agriculture Waste To Wealth NewDocument7 pagesAgriculture Waste To Wealth NewMadev RathodNo ratings yet

- Cost Estimating Worksheet The RestorationDocument4 pagesCost Estimating Worksheet The RestorationMay Myoe KhinNo ratings yet

- 09 Irrigation MDocument28 pages09 Irrigation MSaleemNo ratings yet

- Elite - Pre QualificationDocument24 pagesElite - Pre QualificationitechemiratesNo ratings yet

- Fragrant BookDocument28 pagesFragrant BookHO YOKE YENG MoeNo ratings yet

- 21stCentGreens FullBookDocument269 pages21stCentGreens FullBookg_spadolini6156100% (1)

- Market GardeningDocument14 pagesMarket GardeningBasit100% (1)

- Dayananda Sagar School of Architecture: 09 Arc 7.7 Landscape Architecture NotesDocument4 pagesDayananda Sagar School of Architecture: 09 Arc 7.7 Landscape Architecture NotesPrajwal PrakashNo ratings yet

- Mycorrhizal Production by HydroponicDocument16 pagesMycorrhizal Production by HydroponicMohamed Mohamed AbdulhayNo ratings yet

- Spring/Summer 2017: Create A Pollinator Garden Must Have Oh Deer!Document36 pagesSpring/Summer 2017: Create A Pollinator Garden Must Have Oh Deer!Sunita JadhavNo ratings yet

- Climbers and Trees For Villa LandscapingDocument11 pagesClimbers and Trees For Villa LandscapingMonisha100% (1)

- Job CostingDocument16 pagesJob CostingipeeterNo ratings yet

- Water Wise Landscape Handbook PDFDocument20 pagesWater Wise Landscape Handbook PDFmendes62No ratings yet

- Watermelon Fertilizer Schedule - Tips For Watermelon Feeding in The GardenDocument5 pagesWatermelon Fertilizer Schedule - Tips For Watermelon Feeding in The GardenNovancyNo ratings yet

- Andscape Lement: Jepson Parkway Concept Plan 27Document19 pagesAndscape Lement: Jepson Parkway Concept Plan 27Ayesha SheikhNo ratings yet

- Landscaping PDFDocument45 pagesLandscaping PDFDianaMocodeanNo ratings yet

- CarnationDocument54 pagesCarnationDR V S PATIL100% (1)

- Ridge Farms Manuel of Design Standards and Development GuidelinesDocument20 pagesRidge Farms Manuel of Design Standards and Development GuidelineslehighvalleynewsNo ratings yet

- GARDENDocument14 pagesGARDENMauriel MarzanNo ratings yet

- Nitrogen Fixers For Temperate Climate Permaculture Forest GardensDocument9 pagesNitrogen Fixers For Temperate Climate Permaculture Forest GardensformlessFlowerNo ratings yet

- Floriculture 2021Document2 pagesFloriculture 2021Morgan IngramNo ratings yet

- Niagara Agriculture Profile Dec 2022Document34 pagesNiagara Agriculture Profile Dec 2022samsinghania54321No ratings yet

- Griculture: Virginia Farm Facts Virginia's Top 20 Agricultural CommoditiesDocument2 pagesGriculture: Virginia Farm Facts Virginia's Top 20 Agricultural CommoditiesfdgfdsNo ratings yet

- NY Comptroller: Economic Impact of Agriculture in NYSDocument4 pagesNY Comptroller: Economic Impact of Agriculture in NYSAndy ArthurNo ratings yet

- Cotton Marketing NewsDocument1 pageCotton Marketing NewsBrittany EtheridgeNo ratings yet

- Leafly Cannabis Harvest Report 2021: Meet America's 5th Most Valuable CropDocument27 pagesLeafly Cannabis Harvest Report 2021: Meet America's 5th Most Valuable CropTrevor DrewNo ratings yet

- Calfacts Economy 2006Document10 pagesCalfacts Economy 2006FortuneNo ratings yet

- Florida Crop Progress and Condition ReportDocument2 pagesFlorida Crop Progress and Condition ReportMorgan IngramNo ratings yet

- Market Loan Weekly Prices: Shelled MKT PriceDocument1 pageMarket Loan Weekly Prices: Shelled MKT PriceMorgan IngramNo ratings yet

- Export Raw-Shelled Peanuts (MT) In-Shell Peanuts (MT) UP + 87.3%Document1 pageExport Raw-Shelled Peanuts (MT) In-Shell Peanuts (MT) UP + 87.3%Morgan IngramNo ratings yet

- Shelled MKT Price: Market Loan Weekly PricesDocument1 pageShelled MKT Price: Market Loan Weekly PricesMorgan IngramNo ratings yet

- Export Raw-Shelled Peanuts (MT) In-Shell Peanuts (MT) UP + 67.4%Document1 pageExport Raw-Shelled Peanuts (MT) In-Shell Peanuts (MT) UP + 67.4%Morgan IngramNo ratings yet

- Peanut Marketing News - January 22, 2021 - Tyron Spearman, EditorDocument1 pagePeanut Marketing News - January 22, 2021 - Tyron Spearman, EditorMorgan IngramNo ratings yet

- Florida Crop Progress and Condition ReportDocument2 pagesFlorida Crop Progress and Condition ReportMorgan IngramNo ratings yet

- Market Loan Weekly Prices: Shelled MKT PriceDocument1 pageMarket Loan Weekly Prices: Shelled MKT PriceMorgan IngramNo ratings yet

- Cotton Marketing NewsDocument1 pageCotton Marketing NewsMorgan IngramNo ratings yet

- Shelled MKT Price: Market Loan Weekly PricesDocument1 pageShelled MKT Price: Market Loan Weekly PricesMorgan IngramNo ratings yet

- Florida Crop Progress and Condition ReportDocument2 pagesFlorida Crop Progress and Condition ReportMorgan IngramNo ratings yet

- Crop Production and Peanut Stocks and Processing, NASS, USDA, Census Bureau and U.S. Department of Commerce Harvest Lbs/ac Begin Stocks Imports Seed & ResidualDocument2 pagesCrop Production and Peanut Stocks and Processing, NASS, USDA, Census Bureau and U.S. Department of Commerce Harvest Lbs/ac Begin Stocks Imports Seed & ResidualMorgan IngramNo ratings yet

- Cit 0121Document4 pagesCit 0121Morgan IngramNo ratings yet

- PEANUT MARKETING NEWS - December 17, 2020 - Tyron Spearman, EditorDocument1 pagePEANUT MARKETING NEWS - December 17, 2020 - Tyron Spearman, EditorMorgan IngramNo ratings yet

- 1,000 Acres Pounds/Acre TonsDocument1 page1,000 Acres Pounds/Acre TonsMorgan IngramNo ratings yet

- Broiler Hatchery 01-06-21Document2 pagesBroiler Hatchery 01-06-21Morgan IngramNo ratings yet

- Florida Crop Progress and Condition ReportDocument2 pagesFlorida Crop Progress and Condition ReportMorgan IngramNo ratings yet

- Edible Flowers: Allium Species. The Flowers of TheDocument8 pagesEdible Flowers: Allium Species. The Flowers of TheAdrian StanNo ratings yet

- Seed, Nursery Practice and EstablishmentDocument29 pagesSeed, Nursery Practice and EstablishmentAldrich Roswell OnaNo ratings yet

- RAPE NurseryDocument4 pagesRAPE NurseryWellington KubaraNo ratings yet

- Cropping (Pilas-Tanim) Refers The: Second Planted The ToDocument7 pagesCropping (Pilas-Tanim) Refers The: Second Planted The ToWaren LlorenNo ratings yet

- Mandevilla: This Plants GrowzoneDocument7 pagesMandevilla: This Plants GrowzoneLWNo ratings yet

- Chapter 3 Ali Abu AleidDocument3 pagesChapter 3 Ali Abu AleidAliAbulgasimNo ratings yet

- Geep 117Document4 pagesGeep 117friendkwtNo ratings yet

- Gladiolus - Importance: Gladiolus Is Always in Demand Both in Domestic and Export Market. During WinterDocument8 pagesGladiolus - Importance: Gladiolus Is Always in Demand Both in Domestic and Export Market. During WinterG.M.Tasnimul KarimNo ratings yet

- Methods of Plant PropagationDocument7 pagesMethods of Plant PropagationMaria Carmela Oriel MaligayaNo ratings yet

- How To Grow A Redwood Tree From Seed: 1) Collecting SeedsDocument3 pagesHow To Grow A Redwood Tree From Seed: 1) Collecting SeedsRob ZNo ratings yet

- Garden Inspiration 2010Document29 pagesGarden Inspiration 2010Schneider F. IstvánNo ratings yet

- Floriculture - I XI PDFDocument144 pagesFloriculture - I XI PDFGkNo ratings yet

- Nyanatusita Bhikkhu: What Is The Real Sal Tree?Document4 pagesNyanatusita Bhikkhu: What Is The Real Sal Tree?Nyanatusita Bhikkhu100% (3)

- Italian GardensDocument37 pagesItalian GardensradhikaNo ratings yet

- Ecological SuccessionDocument5 pagesEcological SuccessionSigfreed Angeles100% (1)

- Soil Cohesion: Typical Values of Soil Cohesion For Different SoilsDocument3 pagesSoil Cohesion: Typical Values of Soil Cohesion For Different SoilsJerome BalanoyosNo ratings yet

- 1 PBDocument10 pages1 PBFadiyaNo ratings yet

- Gardens of PlentyDocument159 pagesGardens of PlentyFrancisco Vargas100% (2)

- Altoire Nuc Pe Portaltoi Tanar-EngDocument4 pagesAltoire Nuc Pe Portaltoi Tanar-Engmarius1979No ratings yet

- 19 HTMDocument6 pages19 HTMSha-ReeNo ratings yet

- Grade 5 Plant AdaptationsDocument3 pagesGrade 5 Plant AdaptationsStevo JobosNo ratings yet

- Adaptations of PlantsDocument17 pagesAdaptations of Plantssandip patil100% (11)

- SUMMER Issue of The Dirt 2018Document28 pagesSUMMER Issue of The Dirt 2018Vermont Nursery & Landscape AssociationNo ratings yet

- GardenDocument11 pagesGardensakti_badalaNo ratings yet

- Hallie Morrison Portfolio 2017Document25 pagesHallie Morrison Portfolio 2017Hallie MorrisonNo ratings yet

- Drilling Log: Ded Pembangunan Jalan TolDocument2 pagesDrilling Log: Ded Pembangunan Jalan TolRizalPurnamaNo ratings yet

- Old Farmers AlmanacDocument5 pagesOld Farmers AlmanacAndreia MihailaNo ratings yet

- Technology and Livelihood EducationDocument40 pagesTechnology and Livelihood EducationMichael AnoraNo ratings yet