Professional Documents

Culture Documents

CAED102-Activity 6 - Foreign Exchange

CAED102-Activity 6 - Foreign Exchange

Uploaded by

charlottevinsmokeCopyright:

Available Formats

You might also like

- FR & Fsa Sem-6 GKJ (Final File) - 02!03!24 (Final)Document72 pagesFR & Fsa Sem-6 GKJ (Final File) - 02!03!24 (Final)bharatipaul42No ratings yet

- Assignment 1Document3 pagesAssignment 1kannadhass0% (1)

- Simple Strategies To Boost Your Profits - Trading With RSI Power Zones - Hima ReddyDocument34 pagesSimple Strategies To Boost Your Profits - Trading With RSI Power Zones - Hima ReddyPhu Anh Nguyen100% (1)

- FNCE 249: Assignment 1: InstructionsDocument8 pagesFNCE 249: Assignment 1: Instructionsmicrobiology biotechnology0% (1)

- FX Deal ContingentDocument23 pagesFX Deal ContingentJustinNo ratings yet

- FRM Exam Questions Financial Markets and ProductsDocument4 pagesFRM Exam Questions Financial Markets and ProductsEmmanuelDasiNo ratings yet

- Investment Contract June 27 2019 3 PDFDocument8 pagesInvestment Contract June 27 2019 3 PDFMohammad RazNo ratings yet

- Investment in Associates - IntercompanyDocument13 pagesInvestment in Associates - IntercompanyAmé MoutonNo ratings yet

- Caed102: Financial MarketsDocument3 pagesCaed102: Financial MarketsXytusNo ratings yet

- FMDocument2 pagesFMLorie Anne ValleNo ratings yet

- Mid-Term ReviewDocument29 pagesMid-Term ReviewChou mỡNo ratings yet

- FIN3352 1st Test (With Answers)Document4 pagesFIN3352 1st Test (With Answers)p9vdp7d9fkNo ratings yet

- FL 03 - Module InvestingDocument4 pagesFL 03 - Module InvestingJoshuaFayeleNo ratings yet

- ADMS 3531 Midterm ReviewDocument13 pagesADMS 3531 Midterm Review1donovanblaNo ratings yet

- List of Attempted Questions and AnswersDocument3 pagesList of Attempted Questions and AnswersSudakkar BhooramoorthyNo ratings yet

- Full download GLOBAL 2nd Edition Mike Peng Solutions Manual all chapter 2024 pdfDocument36 pagesFull download GLOBAL 2nd Edition Mike Peng Solutions Manual all chapter 2024 pdfdrywatesefa100% (8)

- Instant Download PDF GLOBAL 2nd Edition Mike Peng Solutions Manual Full ChapterDocument36 pagesInstant Download PDF GLOBAL 2nd Edition Mike Peng Solutions Manual Full Chapteryaqbovpanait100% (6)

- Global 2nd Edition Mike Peng Solutions ManualDocument13 pagesGlobal 2nd Edition Mike Peng Solutions Manualtammywilkinspwsoymeibn100% (31)

- Download Multinational Financial Management 9th Edition Shapiro Solutions Manual all chaptersDocument35 pagesDownload Multinational Financial Management 9th Edition Shapiro Solutions Manual all chapterskattahmaksud100% (6)

- Multiple Choice Multiple Answer: List of Attempted Questions and AnswersDocument225 pagesMultiple Choice Multiple Answer: List of Attempted Questions and Answersapi-3798829No ratings yet

- Solved by Vuzs Team: Midterm Examination Spring 2009 Fin630-Investment Analysis & Portfolio Management (Session - 2)Document16 pagesSolved by Vuzs Team: Midterm Examination Spring 2009 Fin630-Investment Analysis & Portfolio Management (Session - 2)altamashrathoreNo ratings yet

- Chapter 3 International Financial MarketDocument11 pagesChapter 3 International Financial MarketTanvir Ahmed Chowdhury100% (1)

- IBF301 Ch005 2020Document40 pagesIBF301 Ch005 2020Giang PhanNo ratings yet

- International Financial Management Canadian Canadian 3rd Edition Brean Solutions Manual instant download all chapterDocument42 pagesInternational Financial Management Canadian Canadian 3rd Edition Brean Solutions Manual instant download all chapterculyaouardy100% (2)

- Instant Download PDF International Economics 6th Edition James Gerber Test Bank Full ChapterDocument35 pagesInstant Download PDF International Economics 6th Edition James Gerber Test Bank Full Chapterderiazpyaara100% (7)

- Due Date: Name of Student: Section: Financial Markets Worksheet GuideDocument8 pagesDue Date: Name of Student: Section: Financial Markets Worksheet GuideJane Clarisse SantosNo ratings yet

- 15980Document42 pages15980pyayoumana76No ratings yet

- Instant Download PDF International Financial Management Canadian Canadian 3rd Edition Brean Solutions Manual Full ChapterDocument42 pagesInstant Download PDF International Financial Management Canadian Canadian 3rd Edition Brean Solutions Manual Full Chapterrooiportio100% (5)

- Global 2Nd Edition Mike Peng Solutions Manual Full Chapter PDFDocument34 pagesGlobal 2Nd Edition Mike Peng Solutions Manual Full Chapter PDFChelseaHernandezbnjf100% (10)

- Etps: Exchange Traded Funds Etps: Exchange Traded Funds: The Hottest Game in Town The Hottest Game in TownDocument9 pagesEtps: Exchange Traded Funds Etps: Exchange Traded Funds: The Hottest Game in Town The Hottest Game in Towngl620054545No ratings yet

- Ge 10Document4 pagesGe 10Lisa LvqiuNo ratings yet

- Chapter 6 - TestbankDocument14 pagesChapter 6 - TestbankCharles MK ChanNo ratings yet

- English Learning Guide Competency 1 Unit 2: Maths Workshop 1 Centro de Servicios Financieros-CSFDocument5 pagesEnglish Learning Guide Competency 1 Unit 2: Maths Workshop 1 Centro de Servicios Financieros-CSFBraynner QuiñonezNo ratings yet

- Case Study Currency SwapsDocument2 pagesCase Study Currency SwapsSourav Maity100% (2)

- Ali Al Tareef-ACC1103 T S2 2021 (Version B) مهمDocument4 pagesAli Al Tareef-ACC1103 T S2 2021 (Version B) مهمFatima MacNo ratings yet

- 03 Workshop 1 - MathsDocument4 pages03 Workshop 1 - MathsOscar BernalNo ratings yet

- Lecture Outline Introduction1Document43 pagesLecture Outline Introduction1gghthtrhtNo ratings yet

- Case+Study+Solution-1+ 1Document14 pagesCase+Study+Solution-1+ 1Muhammad Usama WaqarNo ratings yet

- Test Bank For Foundations of Finance 8th Edition by Keown Petty ISBN 0132994879 9780132994873Document36 pagesTest Bank For Foundations of Finance 8th Edition by Keown Petty ISBN 0132994879 9780132994873melissamayfgdbsqxpyj100% (33)

- Fin122 Seminar 13Document4 pagesFin122 Seminar 13Нурбол АсылбекNo ratings yet

- Basic Math VocabularyDocument6 pagesBasic Math VocabularyDanna valentina Arevalo hernandezNo ratings yet

- Chapter 9Document13 pagesChapter 9queen hassaneenNo ratings yet

- IBF301 Ch005Document42 pagesIBF301 Ch005vanossman904No ratings yet

- International FinanceDocument14 pagesInternational Financecpsandeepgowda6828100% (1)

- Case QuestionsDocument6 pagesCase QuestionsRia MehtaNo ratings yet

- Jpmorgan Chase Quant Finance Mentorship Case Study 2024Document25 pagesJpmorgan Chase Quant Finance Mentorship Case Study 2024anshikamittal2626No ratings yet

- For Each of The Following Transactions: Portfolio. CopenhagenDocument18 pagesFor Each of The Following Transactions: Portfolio. CopenhagenHiền NguyễnNo ratings yet

- PDF 20230816 232044 0000Document26 pagesPDF 20230816 232044 0000dcbrown1240No ratings yet

- SIT Open Assessment 2023-4 30Document4 pagesSIT Open Assessment 2023-4 30ADNAN SHOAIBNo ratings yet

- FIN4218 Final 1701QA 2Document14 pagesFIN4218 Final 1701QA 2Ng ChunyeNo ratings yet

- How To DeFi AdvancedDocument275 pagesHow To DeFi AdvancedRahulDwivediNo ratings yet

- NISM Currency Notes July 2017Document19 pagesNISM Currency Notes July 2017my facebookNo ratings yet

- English Learning Guide Competency 1 Unit 2: Maths Workshop 1 Centro de Servicios Financieros-CSFDocument4 pagesEnglish Learning Guide Competency 1 Unit 2: Maths Workshop 1 Centro de Servicios Financieros-CSFFernanda C FuentesNo ratings yet

- 0 - Human Forex One Minute Strategy 11 11 1 1 2 2 1 1 2 3Document97 pages0 - Human Forex One Minute Strategy 11 11 1 1 2 2 1 1 2 3A Syed100% (2)

- International FinanceDocument24 pagesInternational FinanceAtasi SinghaniaNo ratings yet

- International Business The Challenge of Global Competition 13th Edition Ball Solutions Manual instant download all chapterDocument33 pagesInternational Business The Challenge of Global Competition 13th Edition Ball Solutions Manual instant download all chaptervelsonfauzul43100% (2)

- FINA3010 Session1Document42 pagesFINA3010 Session1eddy ngNo ratings yet

- Ieb gr9 Ems 2011Document13 pagesIeb gr9 Ems 2011WizardcyclopcNo ratings yet

- Capital Markets - Exercises 2024Document5 pagesCapital Markets - Exercises 2024A BNo ratings yet

- Bloomberg Aptitude TestDocument35 pagesBloomberg Aptitude TestShivgan Joshi100% (1)

- Reading The Market Using Key Reference Areas (Part 1) DrillsDocument5 pagesReading The Market Using Key Reference Areas (Part 1) DrillsCr HtNo ratings yet

- FINM8007 PS1 AnswerDocument4 pagesFINM8007 PS1 Answerqx62n6xxrkNo ratings yet

- Operational Expenses Sept. 1-15,2020 NewDocument20 pagesOperational Expenses Sept. 1-15,2020 NewcharlottevinsmokeNo ratings yet

- Cost Residual Value Dapriciable Amount Useful Life Building Machinery EquipmentDocument14 pagesCost Residual Value Dapriciable Amount Useful Life Building Machinery EquipmentcharlottevinsmokeNo ratings yet

- Jetti Ram/ NDM Insight SurveyDocument2 pagesJetti Ram/ NDM Insight SurveycharlottevinsmokeNo ratings yet

- Your Life, Your Decision, Your Goal: Marinelle B. AbarietnosDocument1 pageYour Life, Your Decision, Your Goal: Marinelle B. AbarietnoscharlottevinsmokeNo ratings yet

- Proposal To Lease Real Estate PropertyDocument1 pageProposal To Lease Real Estate PropertycharlottevinsmokeNo ratings yet

- Bello - Ngec1 ExamDocument7 pagesBello - Ngec1 ExamcharlottevinsmokeNo ratings yet

- Subject Sect Teacher Date TimeDocument2 pagesSubject Sect Teacher Date TimecharlottevinsmokeNo ratings yet

- The Deck Fittings: BSMT-1A8Document2 pagesThe Deck Fittings: BSMT-1A8charlottevinsmokeNo ratings yet

- CAED103 - ABARIETNOS - AC23 - Intro To Pivot Tables Part 2Document34 pagesCAED103 - ABARIETNOS - AC23 - Intro To Pivot Tables Part 2charlottevinsmokeNo ratings yet

- Pe1 ActivityDocument2 pagesPe1 ActivitycharlottevinsmokeNo ratings yet

- Empowering Teenagers The Harm That Peer Pressure Can Give and How It Can Affect Their LivesDocument3 pagesEmpowering Teenagers The Harm That Peer Pressure Can Give and How It Can Affect Their LivescharlottevinsmokeNo ratings yet

- History of Swinng TimelineDocument2 pagesHistory of Swinng TimelinecharlottevinsmokeNo ratings yet

- Week No. 2: Name: Nestor P. Bello Jr. Section: BSMT-1A8Document1 pageWeek No. 2: Name: Nestor P. Bello Jr. Section: BSMT-1A8charlottevinsmokeNo ratings yet

- Bello Week3 Bsmt-1a8Document1 pageBello Week3 Bsmt-1a8charlottevinsmokeNo ratings yet

- Purpocom ExamDocument4 pagesPurpocom ExamcharlottevinsmokeNo ratings yet

- Nestor P. Bello Jr. BSMT-1A8: Products of Sum and Difference of Two TermsDocument1 pageNestor P. Bello Jr. BSMT-1A8: Products of Sum and Difference of Two TermscharlottevinsmokeNo ratings yet

- Types of CommunicationDocument1 pageTypes of CommunicationcharlottevinsmokeNo ratings yet

- Multiplying and Dividng PolynomialsDocument1 pageMultiplying and Dividng PolynomialscharlottevinsmokeNo ratings yet

- Nestor P. Bello Jr. BSMT-1A8Document2 pagesNestor P. Bello Jr. BSMT-1A8charlottevinsmokeNo ratings yet

- Adding and Subtracting PolynomialsDocument1 pageAdding and Subtracting PolynomialscharlottevinsmokeNo ratings yet

- Activity 9 - CryptocurrenciesDocument2 pagesActivity 9 - CryptocurrenciescharlottevinsmokeNo ratings yet

- Stand Up India SchemeDocument3 pagesStand Up India SchemeDSP VarmaNo ratings yet

- AQR 2023 Alternative Thinking Capital Market AssumptionsDocument19 pagesAQR 2023 Alternative Thinking Capital Market AssumptionsABAD GERONIMO RAMOS CORDOVANo ratings yet

- Gains or Losses in Dealings in PropertyDocument6 pagesGains or Losses in Dealings in PropertyRussel RuizNo ratings yet

- Equity Research Report - AMN Healthcare-AMNDocument47 pagesEquity Research Report - AMN Healthcare-AMNTeboho QholoshaNo ratings yet

- Harrod Model of GrowthDocument6 pagesHarrod Model of Growthvikram inamdarNo ratings yet

- Managing RestructuringDocument140 pagesManaging RestructuringCollinson GrantNo ratings yet

- PDFDocument223 pagesPDFOsamaIbrahim100% (1)

- Time Value of MoneyDocument5 pagesTime Value of MoneyXytusNo ratings yet

- Advance Accounting Two Chapter One Part One: True or FalseDocument5 pagesAdvance Accounting Two Chapter One Part One: True or FalsetemedebereNo ratings yet

- Joint Venture Accounts Hr-6Document8 pagesJoint Venture Accounts Hr-6meenasarathaNo ratings yet

- Projects SolutionsDocument89 pagesProjects Solutionssrk523No ratings yet

- Project Report Mukesh DeshmukhDocument13 pagesProject Report Mukesh Deshmukharju gaikwadNo ratings yet

- Vijaya BankDocument0 pagesVijaya BankChethan GowdaNo ratings yet

- Gmail - India's Population Crosses China's, Tax On Crude Oil, & More - Groww Digest (Every Day)Document6 pagesGmail - India's Population Crosses China's, Tax On Crude Oil, & More - Groww Digest (Every Day)Pradeep TiwariNo ratings yet

- Chapter 5 BS 14 PGDocument15 pagesChapter 5 BS 14 PGzee abadillaNo ratings yet

- American Depositary ReceiptDocument7 pagesAmerican Depositary ReceiptarmailgmNo ratings yet

- Chapter 1 Why Study Financial Markets and InstitutionsDocument15 pagesChapter 1 Why Study Financial Markets and Institutionshmmms11100% (1)

- 1.1 Industry Profile: Mutual FundsDocument42 pages1.1 Industry Profile: Mutual FundsVanessa ThomasNo ratings yet

- Embassy ReitDocument412 pagesEmbassy ReitslohariNo ratings yet

- A Case Study of Financial Analysis of Nepal SDocument22 pagesA Case Study of Financial Analysis of Nepal SDiwesh Tamrakar100% (1)

- Related Literature About Haircut PolicyDocument11 pagesRelated Literature About Haircut Policyedob449No ratings yet

- Underwriters of Shares Lec No 1Document8 pagesUnderwriters of Shares Lec No 1Vikram JhaNo ratings yet

- Tgs Kelompok Ganda Kasus 3Document18 pagesTgs Kelompok Ganda Kasus 3GARTMiawNo ratings yet

- Project-Management-KPI-DashboardDocument11 pagesProject-Management-KPI-DashboardNeevinternational NeevNo ratings yet

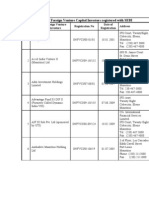

- A-List of Foreign Venture Capital Investors Registered With SEBIDocument24 pagesA-List of Foreign Venture Capital Investors Registered With SEBIVipul ParekhNo ratings yet

- Effect of Operating Cash Flow On Share Price of Listed Consumer Goods Firm in NigeriaDocument43 pagesEffect of Operating Cash Flow On Share Price of Listed Consumer Goods Firm in NigeriaISAH MUHAMMD SANINo ratings yet

CAED102-Activity 6 - Foreign Exchange

CAED102-Activity 6 - Foreign Exchange

Uploaded by

charlottevinsmokeOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

CAED102-Activity 6 - Foreign Exchange

CAED102-Activity 6 - Foreign Exchange

Uploaded by

charlottevinsmokeCopyright:

Available Formats

CAED102: FINANCIAL MARKETS

ACTIVITY #6: FOREIGN EXCHANGE

Name: ABARIENTOS, MAE LOU FRIA B. Section: AC24

INSTRUCTIONS:

Answer the following questions and cite your corresponding source/s.

1. What is forex? (1 pts)

Answer:

Forex stands for foreign exchange and is sometimes called the forex market. It is the

world largest financial markets that enable you to trade any two currencies in the world.

Source/s: (videos from the Google classroom)

2. What are the 2 key purposes of forex? (2 pts)

Answer: - MARGIN & FINANCING

Source/s: (videos from the Google classroom)

3. Differentiate spot, forward and future market? (3 pts)

Answer:

Spot FX is an immediate exchange of currencies at a current exchange rate. On the

hand, forward FX is an exchange in the future on a specific date and at a pre-specified

exchange rate. While, on the other hand, future FX was stipulating an exchange of one

currency for another at a future date and at a fixed purchase price.

Source/s: (topic in Intro to financial market)

4. Who trade forex (name atleast 5)? Note: Not individual name of persons. (5 pts)

Answer:

Market Participants

-Individual forex traders

-Companies

-Financial institutions (pension funds, hedge funds, brokers)

-Banks

-Retail forex participants

Source/s: (videos from the Google classroom)

5. How much is the volume of currencies traded in a single day? (1 pts)

Answer:

Volume of currencies at $5.1 trillion is traded on average every day.

Source/s: https://www.investopedia.com/articles/forex/11/who-trades-forex-and-why

5. Using the video as reference, what are the types of currency pairs? (3 pts)

Answer:

Currency pairs are classified into two types, the most often trade are called (1) major

currency pairs, other currency pairs are called (2) minor or emerging currency pairs.

Source/s: (videos from the Google classroom)

6. Name the 7 Majors? (7 pts)

Answer:

(1)The euro and US dollar: EUR/USD.

(2)The US dollar and Japanese yen: USD/JPY.

(3)The British pound sterling and US dollar: GBP/USD.

(4)The US dollar and Swiss franc: USD/CHF.

(5)The Australian dollar and US dollar: AUD/USD.

(6)The US dollar and Canadian dollar: USD/CAD.

(7)The New Zealand dollar and US dollar: NZD/USD.

Source/s: (videos from the Google classroom)

7. What is spread? How it is being measured? (2 points)

Answer:

Spread is the difference between the buy price and the sale price, it is not

measured in whole dollars or pounds but in so called PIPS smallest possible price charge on most

trading platforms. To most currency pairs, this is the fourth number after decimal point.

Source/s: (videos from the Google classroom)

8. Enumerate and discuss at least three (3) key factors that affect forex markets? (6 points)

Answer:

Factors Affecting Forex Markets

(1) Interest

(2) Economic announcement

(3) News and events

Source/s: (videos from the Google classroom)

9. Enumerate and discuss the two (2) components of a currency pair? (4 points)

Answer:

The first listed currency of a currency pair is called the base currency, and the

second currency is called the quote currency. The base currency is what you buy or sell,

and the quote currency pertains to how much you will pay or receive.

Source/s: (videos from the Google classroom)

10. Differentiate margin and leverage? (2 point)

Answer:

When you trade on margin, you only need to put up a percentage of the total

investment to enter into a position, this amount is known as the margin requirement. Trading on

margin typically means borrowing funds from your broker and it can be as small as 2% and as large

as 20%. While, on the other hand, leverage enables investors to control a large investments with

relatively small amount of money.

Source/s: (videos from the Google classroom)

You might also like

- FR & Fsa Sem-6 GKJ (Final File) - 02!03!24 (Final)Document72 pagesFR & Fsa Sem-6 GKJ (Final File) - 02!03!24 (Final)bharatipaul42No ratings yet

- Assignment 1Document3 pagesAssignment 1kannadhass0% (1)

- Simple Strategies To Boost Your Profits - Trading With RSI Power Zones - Hima ReddyDocument34 pagesSimple Strategies To Boost Your Profits - Trading With RSI Power Zones - Hima ReddyPhu Anh Nguyen100% (1)

- FNCE 249: Assignment 1: InstructionsDocument8 pagesFNCE 249: Assignment 1: Instructionsmicrobiology biotechnology0% (1)

- FX Deal ContingentDocument23 pagesFX Deal ContingentJustinNo ratings yet

- FRM Exam Questions Financial Markets and ProductsDocument4 pagesFRM Exam Questions Financial Markets and ProductsEmmanuelDasiNo ratings yet

- Investment Contract June 27 2019 3 PDFDocument8 pagesInvestment Contract June 27 2019 3 PDFMohammad RazNo ratings yet

- Investment in Associates - IntercompanyDocument13 pagesInvestment in Associates - IntercompanyAmé MoutonNo ratings yet

- Caed102: Financial MarketsDocument3 pagesCaed102: Financial MarketsXytusNo ratings yet

- FMDocument2 pagesFMLorie Anne ValleNo ratings yet

- Mid-Term ReviewDocument29 pagesMid-Term ReviewChou mỡNo ratings yet

- FIN3352 1st Test (With Answers)Document4 pagesFIN3352 1st Test (With Answers)p9vdp7d9fkNo ratings yet

- FL 03 - Module InvestingDocument4 pagesFL 03 - Module InvestingJoshuaFayeleNo ratings yet

- ADMS 3531 Midterm ReviewDocument13 pagesADMS 3531 Midterm Review1donovanblaNo ratings yet

- List of Attempted Questions and AnswersDocument3 pagesList of Attempted Questions and AnswersSudakkar BhooramoorthyNo ratings yet

- Full download GLOBAL 2nd Edition Mike Peng Solutions Manual all chapter 2024 pdfDocument36 pagesFull download GLOBAL 2nd Edition Mike Peng Solutions Manual all chapter 2024 pdfdrywatesefa100% (8)

- Instant Download PDF GLOBAL 2nd Edition Mike Peng Solutions Manual Full ChapterDocument36 pagesInstant Download PDF GLOBAL 2nd Edition Mike Peng Solutions Manual Full Chapteryaqbovpanait100% (6)

- Global 2nd Edition Mike Peng Solutions ManualDocument13 pagesGlobal 2nd Edition Mike Peng Solutions Manualtammywilkinspwsoymeibn100% (31)

- Download Multinational Financial Management 9th Edition Shapiro Solutions Manual all chaptersDocument35 pagesDownload Multinational Financial Management 9th Edition Shapiro Solutions Manual all chapterskattahmaksud100% (6)

- Multiple Choice Multiple Answer: List of Attempted Questions and AnswersDocument225 pagesMultiple Choice Multiple Answer: List of Attempted Questions and Answersapi-3798829No ratings yet

- Solved by Vuzs Team: Midterm Examination Spring 2009 Fin630-Investment Analysis & Portfolio Management (Session - 2)Document16 pagesSolved by Vuzs Team: Midterm Examination Spring 2009 Fin630-Investment Analysis & Portfolio Management (Session - 2)altamashrathoreNo ratings yet

- Chapter 3 International Financial MarketDocument11 pagesChapter 3 International Financial MarketTanvir Ahmed Chowdhury100% (1)

- IBF301 Ch005 2020Document40 pagesIBF301 Ch005 2020Giang PhanNo ratings yet

- International Financial Management Canadian Canadian 3rd Edition Brean Solutions Manual instant download all chapterDocument42 pagesInternational Financial Management Canadian Canadian 3rd Edition Brean Solutions Manual instant download all chapterculyaouardy100% (2)

- Instant Download PDF International Economics 6th Edition James Gerber Test Bank Full ChapterDocument35 pagesInstant Download PDF International Economics 6th Edition James Gerber Test Bank Full Chapterderiazpyaara100% (7)

- Due Date: Name of Student: Section: Financial Markets Worksheet GuideDocument8 pagesDue Date: Name of Student: Section: Financial Markets Worksheet GuideJane Clarisse SantosNo ratings yet

- 15980Document42 pages15980pyayoumana76No ratings yet

- Instant Download PDF International Financial Management Canadian Canadian 3rd Edition Brean Solutions Manual Full ChapterDocument42 pagesInstant Download PDF International Financial Management Canadian Canadian 3rd Edition Brean Solutions Manual Full Chapterrooiportio100% (5)

- Global 2Nd Edition Mike Peng Solutions Manual Full Chapter PDFDocument34 pagesGlobal 2Nd Edition Mike Peng Solutions Manual Full Chapter PDFChelseaHernandezbnjf100% (10)

- Etps: Exchange Traded Funds Etps: Exchange Traded Funds: The Hottest Game in Town The Hottest Game in TownDocument9 pagesEtps: Exchange Traded Funds Etps: Exchange Traded Funds: The Hottest Game in Town The Hottest Game in Towngl620054545No ratings yet

- Ge 10Document4 pagesGe 10Lisa LvqiuNo ratings yet

- Chapter 6 - TestbankDocument14 pagesChapter 6 - TestbankCharles MK ChanNo ratings yet

- English Learning Guide Competency 1 Unit 2: Maths Workshop 1 Centro de Servicios Financieros-CSFDocument5 pagesEnglish Learning Guide Competency 1 Unit 2: Maths Workshop 1 Centro de Servicios Financieros-CSFBraynner QuiñonezNo ratings yet

- Case Study Currency SwapsDocument2 pagesCase Study Currency SwapsSourav Maity100% (2)

- Ali Al Tareef-ACC1103 T S2 2021 (Version B) مهمDocument4 pagesAli Al Tareef-ACC1103 T S2 2021 (Version B) مهمFatima MacNo ratings yet

- 03 Workshop 1 - MathsDocument4 pages03 Workshop 1 - MathsOscar BernalNo ratings yet

- Lecture Outline Introduction1Document43 pagesLecture Outline Introduction1gghthtrhtNo ratings yet

- Case+Study+Solution-1+ 1Document14 pagesCase+Study+Solution-1+ 1Muhammad Usama WaqarNo ratings yet

- Test Bank For Foundations of Finance 8th Edition by Keown Petty ISBN 0132994879 9780132994873Document36 pagesTest Bank For Foundations of Finance 8th Edition by Keown Petty ISBN 0132994879 9780132994873melissamayfgdbsqxpyj100% (33)

- Fin122 Seminar 13Document4 pagesFin122 Seminar 13Нурбол АсылбекNo ratings yet

- Basic Math VocabularyDocument6 pagesBasic Math VocabularyDanna valentina Arevalo hernandezNo ratings yet

- Chapter 9Document13 pagesChapter 9queen hassaneenNo ratings yet

- IBF301 Ch005Document42 pagesIBF301 Ch005vanossman904No ratings yet

- International FinanceDocument14 pagesInternational Financecpsandeepgowda6828100% (1)

- Case QuestionsDocument6 pagesCase QuestionsRia MehtaNo ratings yet

- Jpmorgan Chase Quant Finance Mentorship Case Study 2024Document25 pagesJpmorgan Chase Quant Finance Mentorship Case Study 2024anshikamittal2626No ratings yet

- For Each of The Following Transactions: Portfolio. CopenhagenDocument18 pagesFor Each of The Following Transactions: Portfolio. CopenhagenHiền NguyễnNo ratings yet

- PDF 20230816 232044 0000Document26 pagesPDF 20230816 232044 0000dcbrown1240No ratings yet

- SIT Open Assessment 2023-4 30Document4 pagesSIT Open Assessment 2023-4 30ADNAN SHOAIBNo ratings yet

- FIN4218 Final 1701QA 2Document14 pagesFIN4218 Final 1701QA 2Ng ChunyeNo ratings yet

- How To DeFi AdvancedDocument275 pagesHow To DeFi AdvancedRahulDwivediNo ratings yet

- NISM Currency Notes July 2017Document19 pagesNISM Currency Notes July 2017my facebookNo ratings yet

- English Learning Guide Competency 1 Unit 2: Maths Workshop 1 Centro de Servicios Financieros-CSFDocument4 pagesEnglish Learning Guide Competency 1 Unit 2: Maths Workshop 1 Centro de Servicios Financieros-CSFFernanda C FuentesNo ratings yet

- 0 - Human Forex One Minute Strategy 11 11 1 1 2 2 1 1 2 3Document97 pages0 - Human Forex One Minute Strategy 11 11 1 1 2 2 1 1 2 3A Syed100% (2)

- International FinanceDocument24 pagesInternational FinanceAtasi SinghaniaNo ratings yet

- International Business The Challenge of Global Competition 13th Edition Ball Solutions Manual instant download all chapterDocument33 pagesInternational Business The Challenge of Global Competition 13th Edition Ball Solutions Manual instant download all chaptervelsonfauzul43100% (2)

- FINA3010 Session1Document42 pagesFINA3010 Session1eddy ngNo ratings yet

- Ieb gr9 Ems 2011Document13 pagesIeb gr9 Ems 2011WizardcyclopcNo ratings yet

- Capital Markets - Exercises 2024Document5 pagesCapital Markets - Exercises 2024A BNo ratings yet

- Bloomberg Aptitude TestDocument35 pagesBloomberg Aptitude TestShivgan Joshi100% (1)

- Reading The Market Using Key Reference Areas (Part 1) DrillsDocument5 pagesReading The Market Using Key Reference Areas (Part 1) DrillsCr HtNo ratings yet

- FINM8007 PS1 AnswerDocument4 pagesFINM8007 PS1 Answerqx62n6xxrkNo ratings yet

- Operational Expenses Sept. 1-15,2020 NewDocument20 pagesOperational Expenses Sept. 1-15,2020 NewcharlottevinsmokeNo ratings yet

- Cost Residual Value Dapriciable Amount Useful Life Building Machinery EquipmentDocument14 pagesCost Residual Value Dapriciable Amount Useful Life Building Machinery EquipmentcharlottevinsmokeNo ratings yet

- Jetti Ram/ NDM Insight SurveyDocument2 pagesJetti Ram/ NDM Insight SurveycharlottevinsmokeNo ratings yet

- Your Life, Your Decision, Your Goal: Marinelle B. AbarietnosDocument1 pageYour Life, Your Decision, Your Goal: Marinelle B. AbarietnoscharlottevinsmokeNo ratings yet

- Proposal To Lease Real Estate PropertyDocument1 pageProposal To Lease Real Estate PropertycharlottevinsmokeNo ratings yet

- Bello - Ngec1 ExamDocument7 pagesBello - Ngec1 ExamcharlottevinsmokeNo ratings yet

- Subject Sect Teacher Date TimeDocument2 pagesSubject Sect Teacher Date TimecharlottevinsmokeNo ratings yet

- The Deck Fittings: BSMT-1A8Document2 pagesThe Deck Fittings: BSMT-1A8charlottevinsmokeNo ratings yet

- CAED103 - ABARIETNOS - AC23 - Intro To Pivot Tables Part 2Document34 pagesCAED103 - ABARIETNOS - AC23 - Intro To Pivot Tables Part 2charlottevinsmokeNo ratings yet

- Pe1 ActivityDocument2 pagesPe1 ActivitycharlottevinsmokeNo ratings yet

- Empowering Teenagers The Harm That Peer Pressure Can Give and How It Can Affect Their LivesDocument3 pagesEmpowering Teenagers The Harm That Peer Pressure Can Give and How It Can Affect Their LivescharlottevinsmokeNo ratings yet

- History of Swinng TimelineDocument2 pagesHistory of Swinng TimelinecharlottevinsmokeNo ratings yet

- Week No. 2: Name: Nestor P. Bello Jr. Section: BSMT-1A8Document1 pageWeek No. 2: Name: Nestor P. Bello Jr. Section: BSMT-1A8charlottevinsmokeNo ratings yet

- Bello Week3 Bsmt-1a8Document1 pageBello Week3 Bsmt-1a8charlottevinsmokeNo ratings yet

- Purpocom ExamDocument4 pagesPurpocom ExamcharlottevinsmokeNo ratings yet

- Nestor P. Bello Jr. BSMT-1A8: Products of Sum and Difference of Two TermsDocument1 pageNestor P. Bello Jr. BSMT-1A8: Products of Sum and Difference of Two TermscharlottevinsmokeNo ratings yet

- Types of CommunicationDocument1 pageTypes of CommunicationcharlottevinsmokeNo ratings yet

- Multiplying and Dividng PolynomialsDocument1 pageMultiplying and Dividng PolynomialscharlottevinsmokeNo ratings yet

- Nestor P. Bello Jr. BSMT-1A8Document2 pagesNestor P. Bello Jr. BSMT-1A8charlottevinsmokeNo ratings yet

- Adding and Subtracting PolynomialsDocument1 pageAdding and Subtracting PolynomialscharlottevinsmokeNo ratings yet

- Activity 9 - CryptocurrenciesDocument2 pagesActivity 9 - CryptocurrenciescharlottevinsmokeNo ratings yet

- Stand Up India SchemeDocument3 pagesStand Up India SchemeDSP VarmaNo ratings yet

- AQR 2023 Alternative Thinking Capital Market AssumptionsDocument19 pagesAQR 2023 Alternative Thinking Capital Market AssumptionsABAD GERONIMO RAMOS CORDOVANo ratings yet

- Gains or Losses in Dealings in PropertyDocument6 pagesGains or Losses in Dealings in PropertyRussel RuizNo ratings yet

- Equity Research Report - AMN Healthcare-AMNDocument47 pagesEquity Research Report - AMN Healthcare-AMNTeboho QholoshaNo ratings yet

- Harrod Model of GrowthDocument6 pagesHarrod Model of Growthvikram inamdarNo ratings yet

- Managing RestructuringDocument140 pagesManaging RestructuringCollinson GrantNo ratings yet

- PDFDocument223 pagesPDFOsamaIbrahim100% (1)

- Time Value of MoneyDocument5 pagesTime Value of MoneyXytusNo ratings yet

- Advance Accounting Two Chapter One Part One: True or FalseDocument5 pagesAdvance Accounting Two Chapter One Part One: True or FalsetemedebereNo ratings yet

- Joint Venture Accounts Hr-6Document8 pagesJoint Venture Accounts Hr-6meenasarathaNo ratings yet

- Projects SolutionsDocument89 pagesProjects Solutionssrk523No ratings yet

- Project Report Mukesh DeshmukhDocument13 pagesProject Report Mukesh Deshmukharju gaikwadNo ratings yet

- Vijaya BankDocument0 pagesVijaya BankChethan GowdaNo ratings yet

- Gmail - India's Population Crosses China's, Tax On Crude Oil, & More - Groww Digest (Every Day)Document6 pagesGmail - India's Population Crosses China's, Tax On Crude Oil, & More - Groww Digest (Every Day)Pradeep TiwariNo ratings yet

- Chapter 5 BS 14 PGDocument15 pagesChapter 5 BS 14 PGzee abadillaNo ratings yet

- American Depositary ReceiptDocument7 pagesAmerican Depositary ReceiptarmailgmNo ratings yet

- Chapter 1 Why Study Financial Markets and InstitutionsDocument15 pagesChapter 1 Why Study Financial Markets and Institutionshmmms11100% (1)

- 1.1 Industry Profile: Mutual FundsDocument42 pages1.1 Industry Profile: Mutual FundsVanessa ThomasNo ratings yet

- Embassy ReitDocument412 pagesEmbassy ReitslohariNo ratings yet

- A Case Study of Financial Analysis of Nepal SDocument22 pagesA Case Study of Financial Analysis of Nepal SDiwesh Tamrakar100% (1)

- Related Literature About Haircut PolicyDocument11 pagesRelated Literature About Haircut Policyedob449No ratings yet

- Underwriters of Shares Lec No 1Document8 pagesUnderwriters of Shares Lec No 1Vikram JhaNo ratings yet

- Tgs Kelompok Ganda Kasus 3Document18 pagesTgs Kelompok Ganda Kasus 3GARTMiawNo ratings yet

- Project-Management-KPI-DashboardDocument11 pagesProject-Management-KPI-DashboardNeevinternational NeevNo ratings yet

- A-List of Foreign Venture Capital Investors Registered With SEBIDocument24 pagesA-List of Foreign Venture Capital Investors Registered With SEBIVipul ParekhNo ratings yet

- Effect of Operating Cash Flow On Share Price of Listed Consumer Goods Firm in NigeriaDocument43 pagesEffect of Operating Cash Flow On Share Price of Listed Consumer Goods Firm in NigeriaISAH MUHAMMD SANINo ratings yet