Professional Documents

Culture Documents

Fin Man Finals

Fin Man Finals

Uploaded by

Meidrick Rheeyonie Gialogo AlbaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Fin Man Finals

Fin Man Finals

Uploaded by

Meidrick Rheeyonie Gialogo AlbaCopyright:

Available Formats

GIALOGO, JESSIE LYN

TEST I

1. Operational Inventory level

2. Abc Method

3. Float

4. Working capital management

5. Temporary current asset

6. Capital Budgeting

7. Mutually Exclusive Projects

8. Initial investment

9. Payback period

10. Net Present Value

TEST II

1. Proposal Generation

2. Review and Analysis

3. Decision Making

4. Implementation

5. Follow-up

6. Turnover Inventory as quickly as possible without stock outs that result in lost sales

7. Collect receivables as quickly as possible without losing sales from high pressure techniques

8. Pay accounts as slowly as possible without damaging the firm’s credit rating

9. Manage mail, processing and clearing time to reduce them with collecting from customers and

increase them with paying vendors

10. Average payment period

11. Average collection period

12. Average age of inventory

13. To expand

14. To replace

15. To renew fixed assets

TEST III

1. Operating cycle = AAI + ACP = 120 days + 60 days = 180 days

2. Cash conversion cycle= 180 days – 45 days = 135 days

3. Total resources in CCC

Inventory Turnover=

30000000 * 60% = 18,000,00

18,000,000/ 360 = 50,000

50,000 * 120 = 6,000,000

Accounts Receivable=

30,000,000/ 360 = 83,333 * 60 = 4,999,980

Accounts Payable=

35, 000,000 * 60% * 50% * 4/360 = 2, 125, 000

Total Resources in CCC= 6,000,000 + 5,000,000 – 1, 125,000

= 9,875,000

4. INVENTORY =120 – 20 = 100 days inventory

=50,000,000 * 100

= 5,000,000

RECEIVABLE= 60-5 = 55 days receivable

= 83,333 * 55

= 4,583,315

TEST IV

a. For project A, (Annuity cashflows)

Pay back period = 550000/178000 = 3.0 years

For project B

Payback period= 154,000 + 132,000=286,000

358,000 – 286,000= 72,000

72,000/105,000= .68

.68 + 2 = 2.68 years

b. Project A is only acceptable since it is positive. Project A is preferable to project B as it

has a higher NPV of 45 656 comparing to B of 10 000 negative. Having a positive net

present value means the project promises a rate of return that is higher than the

minimum rate of return required by management . The net present value method is

used not only to evaluate investment projects that generate cash inflow but also to

evaluate investment projects that reduce costs.

You might also like

- Ushtrime Seminar Te Zgjidhura 4 5 6Document4 pagesUshtrime Seminar Te Zgjidhura 4 5 6Sherri BonquinNo ratings yet

- Respuestas Primer Examen PDFDocument4 pagesRespuestas Primer Examen PDFpcostagi750% (2)

- Khan Hildreth Case Study BookDocument4 pagesKhan Hildreth Case Study BookGrand OverallNo ratings yet

- Adv Business Calculations L3 Model Answers Series 4 2013 PDFDocument10 pagesAdv Business Calculations L3 Model Answers Series 4 2013 PDFKhin Zaw HtweNo ratings yet

- Chapter 9 - Working Capital ManagementDocument21 pagesChapter 9 - Working Capital Managementnurfatimah473No ratings yet

- MAF253 SS Common Test May 2022Document7 pagesMAF253 SS Common Test May 2022Nurfatihah JohariNo ratings yet

- Capital BudgetingDocument27 pagesCapital BudgetingColeen OrbegosoNo ratings yet

- Cash ManagementDocument5 pagesCash ManagementVote btsNo ratings yet

- FM-MBA-FM-BI-BE - Unit-3Document46 pagesFM-MBA-FM-BI-BE - Unit-3maheshgutam8756No ratings yet

- 3 Capital BudgetingDocument58 pages3 Capital BudgetingKristel Aira SacedaNo ratings yet

- Tutorial 6-Investment Appraisal - SolutionsDocument11 pagesTutorial 6-Investment Appraisal - SolutionsJunaid Ali IslamianNo ratings yet

- Unit 7 Working Capital ManagementDocument36 pagesUnit 7 Working Capital ManagementNabin JoshiNo ratings yet

- Capital Budgeting or Capital ExpenditureDocument18 pagesCapital Budgeting or Capital ExpenditurePooja VaidyaNo ratings yet

- Lecture 3: Capital Investment Decisions: Investment MethodsDocument44 pagesLecture 3: Capital Investment Decisions: Investment MethodsWinston 葉永隆 DiepNo ratings yet

- UNIT-4 Working Capital ManagementDocument13 pagesUNIT-4 Working Capital ManagementChandanN81No ratings yet

- Quiz No 4 A222 - BWFF2033Document6 pagesQuiz No 4 A222 - BWFF2033corinnatsyNo ratings yet

- FANFE File-2Document12 pagesFANFE File-2Asad NaveedNo ratings yet

- 30 JuneDocument31 pages30 JuneYandex PrithuNo ratings yet

- Management Advisory Services-Elimination RoundDocument18 pagesManagement Advisory Services-Elimination RoundRyan Christian M. Coral0% (1)

- UNIT 3 Tutorial Q & ADocument14 pagesUNIT 3 Tutorial Q & AAlicia AbsolamNo ratings yet

- Capital Budgeting TechniquesDocument16 pagesCapital Budgeting TechniquesAmirah RahmanNo ratings yet

- Unit Iv: Capital BudgetingDocument32 pagesUnit Iv: Capital BudgetingDevyansh GuptaNo ratings yet

- Corporate FinanceDocument9 pagesCorporate FinanceMayur AgarwalNo ratings yet

- Corporate Finance (Lecture-3)Document72 pagesCorporate Finance (Lecture-3)meahearun nesa mouNo ratings yet

- Managerial Finance GitmanDocument3 pagesManagerial Finance GitmanjessicaNo ratings yet

- MAC Material 2Document33 pagesMAC Material 2Blessy Zedlav LacbainNo ratings yet

- Auditing Simulated QBDocument25 pagesAuditing Simulated QBSarah BalisacanNo ratings yet

- Army Institute of Business Administration Savar Cantonment, SavarDocument5 pagesArmy Institute of Business Administration Savar Cantonment, Savarmahabub raselNo ratings yet

- Module - Business Finance Week 4Document7 pagesModule - Business Finance Week 4dorothytorino8No ratings yet

- ACC2101 Midterm ReviewDocument3 pagesACC2101 Midterm Reviewalbert100% (1)

- Quiz-Seatwork On ReportDocument5 pagesQuiz-Seatwork On ReportJomel BaptistaNo ratings yet

- CAPITAL PROJECT EVALUATION TECHNIQUES CompleteDocument7 pagesCAPITAL PROJECT EVALUATION TECHNIQUES CompleteHarusiNo ratings yet

- RATIO Practice QuestionsDocument14 pagesRATIO Practice Questionspranay raj rathoreNo ratings yet

- Working CapitalDocument16 pagesWorking CapitalAlkhair SangcopanNo ratings yet

- Question 1-: A. Calculation of Eoq For Hard PlasticDocument6 pagesQuestion 1-: A. Calculation of Eoq For Hard PlasticAdesina OlufemiNo ratings yet

- Chapter 6 Homework QuestionsDocument3 pagesChapter 6 Homework QuestionsLovepreet malhiNo ratings yet

- CH 05 Cash ManagementDocument14 pagesCH 05 Cash ManagementMichelle Davinna Michael HerryNo ratings yet

- Chapter 4 - Receivables ManagementDocument17 pagesChapter 4 - Receivables Managementbereket nigussieNo ratings yet

- Capital BudgetingDocument3 pagesCapital BudgetingKrNo ratings yet

- CH-4 - FM 1Document9 pagesCH-4 - FM 1ጌታ እኮ ነውNo ratings yet

- OC and CCC - AsynchronousDocument29 pagesOC and CCC - AsynchronousChristoper SalvinoNo ratings yet

- Chapter 14working Capital and Current Assets ManagementDocument1 pageChapter 14working Capital and Current Assets ManagementMaricris RellinNo ratings yet

- 085 - 106 Chapter 8 Capital BudgetingDocument22 pages085 - 106 Chapter 8 Capital BudgetingZayna Zen100% (2)

- FM Midterm Chapter4Document13 pagesFM Midterm Chapter4Mayet RoseteNo ratings yet

- Cash Management CaseDocument10 pagesCash Management CaseKim CustodioNo ratings yet

- 4working Capital ManagementDocument54 pages4working Capital ManagementErrol LuceroNo ratings yet

- Assignment CHPT 10Document3 pagesAssignment CHPT 10Alexander Steven ThemasNo ratings yet

- CH 6Document29 pagesCH 6Kasahun MekonnenNo ratings yet

- Tutorial Solutions - Week 10Document5 pagesTutorial Solutions - Week 10Finn WilsonNo ratings yet

- Working Capital Management PDFDocument46 pagesWorking Capital Management PDFNizar AhamedNo ratings yet

- Module 5 AnswerDocument2 pagesModule 5 AnswerSinclair faith galarioNo ratings yet

- Chapter 16 - Management of Current AssetsDocument7 pagesChapter 16 - Management of Current Assetslou-924No ratings yet

- Topic 6 - WCM 1 Ans 2019-20Document5 pagesTopic 6 - WCM 1 Ans 2019-20Gaba RieleNo ratings yet

- Module-3 Capital BudgetingDocument47 pagesModule-3 Capital Budgetingvinit PatidarNo ratings yet

- Activity RatiosDocument30 pagesActivity RatiosSURAJ KUMARNo ratings yet

- Null PDFDocument19 pagesNull PDFMarwa MohNo ratings yet

- Null PDFDocument19 pagesNull PDFMarwa MohNo ratings yet

- Learning Activity Sheet Business FinanceDocument9 pagesLearning Activity Sheet Business FinanceVon Violo BuenavidesNo ratings yet

- Working Capital Management: Department of Finance and Accountancy Vavuniya Campus FIN2213 Financial ManagementDocument22 pagesWorking Capital Management: Department of Finance and Accountancy Vavuniya Campus FIN2213 Financial ManagementWathz NawarathnaNo ratings yet

- Capital Budgeting TechniquesDocument96 pagesCapital Budgeting TechniquesAarushi ManchandaNo ratings yet

- Working Capital Management - 131218Document39 pagesWorking Capital Management - 131218bhumika manwaniNo ratings yet

- Working Capital ManagementDocument6 pagesWorking Capital ManagementJoshua BrazalNo ratings yet

- Organized Type ScriptDocument2 pagesOrganized Type ScriptMeidrick Rheeyonie Gialogo AlbaNo ratings yet

- Compound Financial LiabilityDocument3 pagesCompound Financial LiabilityMeidrick Rheeyonie Gialogo AlbaNo ratings yet

- Importance of GardeningDocument12 pagesImportance of GardeningMeidrick Rheeyonie Gialogo AlbaNo ratings yet

- Gialogo, Jessie LynDocument2 pagesGialogo, Jessie LynMeidrick Rheeyonie Gialogo AlbaNo ratings yet

- Gialogo, Jessie Lyn San Sebastian College - Recoletos Quiz: Required: Answer The FollowingDocument12 pagesGialogo, Jessie Lyn San Sebastian College - Recoletos Quiz: Required: Answer The FollowingMeidrick Rheeyonie Gialogo AlbaNo ratings yet

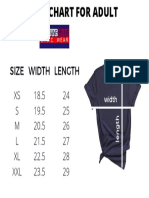

- Size Chart For AdultDocument1 pageSize Chart For AdultMeidrick Rheeyonie Gialogo AlbaNo ratings yet

- Mary Model of Church in Prayer: Lesson ViDocument1 pageMary Model of Church in Prayer: Lesson ViMeidrick Rheeyonie Gialogo AlbaNo ratings yet

- Financial Statements & Cash Flow AnalysisDocument15 pagesFinancial Statements & Cash Flow AnalysisMeidrick Rheeyonie Gialogo AlbaNo ratings yet

- Lesson Vi - PDFDocument1 pageLesson Vi - PDFMeidrick Rheeyonie Gialogo AlbaNo ratings yet

- Statement of Financial Position (Balance Sheet)Document11 pagesStatement of Financial Position (Balance Sheet)Rance Gerwyn OpialaNo ratings yet

- Problem No. 1: Practice Set Property Plant and EquipmentDocument4 pagesProblem No. 1: Practice Set Property Plant and EquipmentFiona MoralesNo ratings yet

- JHT'S Supermud: The Original Equipment Manufacturer (Oem) MarketDocument1 pageJHT'S Supermud: The Original Equipment Manufacturer (Oem) MarketNavya AgrawalNo ratings yet

- Recognition and Measurement of The Elements of Financial StatementsDocument17 pagesRecognition and Measurement of The Elements of Financial StatementsRudraksh WaliaNo ratings yet

- Irr, Pi, NPV, TemplatesDocument1 pageIrr, Pi, NPV, TemplatesBobbyNicholsNo ratings yet

- Fixed Income Securities: Bond Basics: CRICOS Code 00025BDocument43 pagesFixed Income Securities: Bond Basics: CRICOS Code 00025BNurhastuty WardhanyNo ratings yet

- COGS Split SAP S4 HANADocument9 pagesCOGS Split SAP S4 HANASubhra Narayan ChakrabortyNo ratings yet

- 1466060173976Document370 pages1466060173976ChittaNo ratings yet

- Insider Vs Outsider SystemDocument6 pagesInsider Vs Outsider Systemr e s tNo ratings yet

- An Introduction To Financial ManagementDocument17 pagesAn Introduction To Financial Managementariel mahardikaNo ratings yet

- Acca f3 NotesDocument71 pagesAcca f3 Notesbisma aslamNo ratings yet

- 0 InstructionsVivendi Lagardere v1Document2 pages0 InstructionsVivendi Lagardere v1Akshay SharmaNo ratings yet

- March 23 2021-Stocks QUESTION AND SOLUTION (Preffered Stock Notes & Dividends Notes)Document7 pagesMarch 23 2021-Stocks QUESTION AND SOLUTION (Preffered Stock Notes & Dividends Notes)Britania RanqueNo ratings yet

- ReportDocument3 pagesReportabdukarimu abdallahNo ratings yet

- BUSI 2093 Exam Cover Sheet (Set C) : Professor Use OnlyDocument6 pagesBUSI 2093 Exam Cover Sheet (Set C) : Professor Use OnlySimranjeet KaurNo ratings yet

- Solution 20 MarksDocument17 pagesSolution 20 Marksneha MistryNo ratings yet

- The Magic Formula and Value Traps - AmbitDocument60 pagesThe Magic Formula and Value Traps - AmbitSaeed JafferyNo ratings yet

- Statement: Your Current Details Period 30 Dec 2022 To 27 Jan 2023Document4 pagesStatement: Your Current Details Period 30 Dec 2022 To 27 Jan 2023tevisthomas205No ratings yet

- Module 6 Business Transaction Analysis FinalNOANSDocument31 pagesModule 6 Business Transaction Analysis FinalNOANSAlyssa AngananganNo ratings yet

- Reading 19: Introduction To Financial Statement AnalysisDocument43 pagesReading 19: Introduction To Financial Statement AnalysisAlex PaulNo ratings yet

- Ap02-01 Audit of SheDocument6 pagesAp02-01 Audit of SheRenato OrosaNo ratings yet

- Chandrasekaran.M Rebaccal.A ,: A Study On Capital BudgetingDocument11 pagesChandrasekaran.M Rebaccal.A ,: A Study On Capital Budgetingharisshaikh7070No ratings yet

- Corporate Finance ProjectDocument7 pagesCorporate Finance ProjectAbhinav Akash SinghNo ratings yet

- BKSLDocument3 pagesBKSLPrasetyo Indra SuronoNo ratings yet

- Study On Fundamental and Technical Analysis of SBI NDocument11 pagesStudy On Fundamental and Technical Analysis of SBI NMaruti LawandNo ratings yet

- Quiz - Partnership CompanyDocument4 pagesQuiz - Partnership Companyzinsike444No ratings yet

- Value Based MGTDocument75 pagesValue Based MGTNoorunnishaNo ratings yet