Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

447 viewsPartnership Dissolution and Change in Capital Structure PDF

Partnership Dissolution and Change in Capital Structure PDF

Uploaded by

chelsea kayle licomes fuentesCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5820)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (898)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Top 6 Best Accounting and Auditing Firms in The PhilippinesDocument4 pagesTop 6 Best Accounting and Auditing Firms in The Philippineschelsea kayle licomes fuentesNo ratings yet

- EthicsDocument5 pagesEthicschelsea kayle licomes fuentesNo ratings yet

- EthicsDocument4 pagesEthicschelsea kayle licomes fuentesNo ratings yet

- Clearance Form: 1. Administration SectorDocument3 pagesClearance Form: 1. Administration Sectorchelsea kayle licomes fuentesNo ratings yet

- Crepe Paper As An Alternative Ink For Ballpoint PenDocument5 pagesCrepe Paper As An Alternative Ink For Ballpoint Penchelsea kayle licomes fuentesNo ratings yet

- Tle 10 1ST QTR ExamDocument4 pagesTle 10 1ST QTR Examchelsea kayle licomes fuentesNo ratings yet

- What Is The Relevance of Bretton Woods Institution Such As The IMF and The World Bank in Todays Globalization WorldDocument3 pagesWhat Is The Relevance of Bretton Woods Institution Such As The IMF and The World Bank in Todays Globalization Worldchelsea kayle licomes fuentesNo ratings yet

- Powerpoint Presentation-Final DemoDocument22 pagesPowerpoint Presentation-Final Demochelsea kayle licomes fuentesNo ratings yet

- Problem Set (Statistics) - AssignmentDocument1 pageProblem Set (Statistics) - Assignmentchelsea kayle licomes fuentes100% (1)

- Jeric PoemDocument36 pagesJeric Poemchelsea kayle licomes fuentesNo ratings yet

- Wmsu NSTP Front Page CoverDocument1 pageWmsu NSTP Front Page Coverchelsea kayle licomes fuentesNo ratings yet

- Ca A3 FDocument1 pageCa A3 Fchelsea kayle licomes fuentesNo ratings yet

- Chapter 4 - Job Order and Process CostingDocument12 pagesChapter 4 - Job Order and Process Costingchelsea kayle licomes fuentesNo ratings yet

- My Experience BookDocument45 pagesMy Experience Bookchelsea kayle licomes fuentesNo ratings yet

- Ascendra: Study Buddy Program 2021 Accountancy DepartmentDocument3 pagesAscendra: Study Buddy Program 2021 Accountancy Departmentchelsea kayle licomes fuentesNo ratings yet

- Obligation Questions and AnswersDocument19 pagesObligation Questions and Answerschelsea kayle licomes fuentesNo ratings yet

- Chapter 1 - MAS IntroductionDocument9 pagesChapter 1 - MAS Introductionchelsea kayle licomes fuentesNo ratings yet

- Chapter 2 - ABC System PDFDocument5 pagesChapter 2 - ABC System PDFchelsea kayle licomes fuentesNo ratings yet

- Chapter 3 - Product CostingDocument6 pagesChapter 3 - Product Costingchelsea kayle licomes fuentesNo ratings yet

- The Concept Paper: Automatic ZoomDocument4 pagesThe Concept Paper: Automatic Zoomchelsea kayle licomes fuentesNo ratings yet

Partnership Dissolution and Change in Capital Structure PDF

Partnership Dissolution and Change in Capital Structure PDF

Uploaded by

chelsea kayle licomes fuentes0 ratings0% found this document useful (0 votes)

447 views33 pagesOriginal Title

partnership-Dissolution-and-change-in-capital-structure.pdf

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

Download as pdf

0 ratings0% found this document useful (0 votes)

447 views33 pagesPartnership Dissolution and Change in Capital Structure PDF

Partnership Dissolution and Change in Capital Structure PDF

Uploaded by

chelsea kayle licomes fuentesCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

Download as pdf

You are on page 1of 33

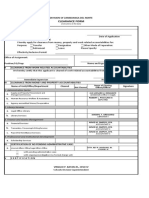

CHAPTER 4

PARTNERSHIP DISSOLUTION

LEARNING OBJECTIVES

1. Define parmership dissolution and identify the conditions giving rise to it.

2. Understand the accounting procedures to record the admission of a new partner by

purchase.

3. Understand the accounting procedures to record the admission of a new partner by

investment.

PREVIEW OF THE CHAPTER

PARTNERSHIP

DISSOLUTION

I

Causes of Admission by Admission by

Dissolution Purchase Investment

Admission of a new * Sale of interest at = Capital credit equal

partner book value to capital

Retirement of a = Sale of interest at contribution

partner less than book value * Capital credit not

Death, incapacity, or | | * Sale of interest at equal to capital

bankruptcy of a more than book contribution

partner value * Bonus method

Incorporation of a = Asset revaluation

partnership method

PARTNERSHIP DISSOLUTION

Dissolution is defined in Article 1825 of the Civil Code of the Philippines as the change

in the relation of the partners caused by any partner ceasing to be associated in the

carrying out of the business.

eter ene Dissolution

Dissolution refers to the teminstion of the lie of a” eXstnE PATMESNP. Thy

dissolution of an old partnership may be followed by

own as dissolution by change jy

lL. Th ic i

¢ formation of a new partnership. This is KNOWN Mines activities of thy

ownership structure. The new partnership continues the

dissolved partnership without interruption.

ness activities carried on by

2. Liquidation. This the bust

iqi This refers to the termination of ratory to going oy,

the partnership and the winding up of partnership affairs PreP:

of business.

Dissolution, therfore, doesnot always result to lguidation although liquidation is alway,

preceded by dissolution,

CONDITIONS RESULTING TO PARTNERSHIP DISSOLUTION

The following conditions will result to partnership dissolution by a change in ownership

‘structure:

. Admission of a new partner

. Retirement or withdrawal of a partner

. Death, incapacity or bankruptcy of a partner

Incorporation of a partnership

Ree

Accounting for admission of a new partner is discussed in this chapter. Accounting for

retirement, withdrawal, incapacity or bankruptcy and death of a partner is discussed in

the next chapter.

ADMISSION OF A NEW PARTNER

‘A new partner, with the consent of all the partners, may be admitted in an existing

partnership. Upon admission of a new partner, the firm is automatically dissolved and a

new partnership is formed. All the partners draw a new contract, Articles of Co-

Partnership. The admission of a new partner gives rise to the following accounting

problems:

1, Determination of the profit or loss from the beginning of the accounting period 0

the date of admission of a new partner and the distribution of such profit or loss to

the old partners.

2. Correction of accounting errors in prior periods like overstatement of

understatement of inventories, excessive depreciation charges and failure to

provide adequately for doubtful accounts

Chapter 4 ~ Parmership Dissolution 139

Parmership Disoluion

3. Revaluation of accounts which may call for the restatement of the existing assets

Of the partnership to appraised or fair market values and recognition of

unrecorded liabilities of the firm. All adjustments to the accounts give rise to

Profit or loss; such adjustments are recorded in the partnership books as increase

or decrease in capital shared according to partners’ profit and loss ratio.

4. Closing of the partnership books.

TYPES OF ADMISSION OF A NEW PARTNER

A new partner may be admitted into a partnership by:

1. Purchase of interest from one or more of the original (old) partners; or

2. Investment or asset contributions to the partnership

ADMISSION BY PURCHASE

With the consent of all the partners, a new partner may be admitted in an existing

partnership by purchasing a capital equity interest directly from one or more of the old

partners. Terms such as purchases, sells, pays, bought, sold and transferred indicate

admission by purchase.

The sale to a new partner of an old partner's interest in an existing partnership is a

personal transaction between the selling partner and the buying partner. The amount paid

by the partner who purchases an interest goes personally to the partner who sells his or

her interest; the amount paid does not go to the partnership,

The only entry required on the partnership books is the recording of the transfer of

capital from the capital account of the selling partner to that of the buying partner. The

amount of capital transferred will be equal to the book value of the interest sold

regardless of the amount paid. The pro-form entry is:

(Name of seller), Capital XXX

(Name of buyer), Capital Xxx

The purchase price of the interest sold to the new partner may be:

1. equal to the book value of interest sold

* 2. less than the book value of interest sold

3. more than the book value of interest sold

“The new partner may pay more than or less than the book value of the interest sold by the

old partner resulting in a gain or loss in the transaction. This gain or loss, however, is a

winership Dissolution

Chapter

Personal gain or loss of the selling partner and not of the partnership ee

oF loss is recognized in the partnership books.

Ilustrative Problem A: Coloma and Claudio are partners with capital ce 4

100,000 and P50,000, respectively. ‘They share profits and losses equally. Cordero isa

new partner,

Case 1a — Purchase at book value from one partner only. Cordero purchases l/s

interest from Coloma by paying P20,000.

Coloma, Capital 20,000

Cordero, Capital eats

P100,000 x 1/5 = P20,000

The P20,000 paid by the new partner Cordero to the old partner Coloma should not be

reflected in the partnership books because the said amount goes directly to Coloma. What

is recorded in the partnership books is the transfer of 1/5 of the capital of Coloma to

Cordero. The amount paid in the purchase is equal to the book value of the acquired 1/5

interest; hence, the sale of interest does not give rise to gain or loss to Coloma.

Case 1b — Purchase at book value from more than one partner. Cordero purchases

1/5 interest from the old partners by paying P30,000.

Coloma, Capital 20,000

Claudio, Capital 10,000

Cordero, Capital 30,000

P100,000 x 1/5 = P20,000

P 50,000 x 1/5 = P10,000

The P30,000 paid by Cordero to Coloma and Claudio should not be reflected in the

partnership books because the said amount goes directly to Coloma and Claudio. What is

recorded in the partnership books is the transfer of 1/5 of the capital of the old partners

Coloma and Claudio (P20,000 and P10,000, respectively) to the new partner Cordero.

The admission of the new partner, by purchasing a 1/5 interest from the old partners at

book value, does not result in a gain or loss to the old partners.

Case 2 Purchase at less than book value. Cordero purchases 1/5 interest from the old

partners by paying P25,000.

Coloma, Capital 20,000

Claudio, Capital 10,000 .

Cordero, Capital 30,000

P100,000 x 1/5 = P20,000

P 50,000 x 1/:

uw

Chapter 4 Partnership Dissolution

The P25,000 paid by Cordero to Coloma and Claudio should not be reflected in the

partnership books because the said amount was paid directly to the partners. What is

recorded in the partnership books is the transfer of 1/5 of the capital of the old partners

(P20,000 and P10,000, respectively) to the new partner. ‘The difference of P5.000 is

personal loss of the selling (old) partners.

Case 3 - Purchase at more than book value, Cordero pays R40,000 for a 1/5 interest of

the old partners.

Coloma, Capital 20,000

Claudio, Capital 10,000

Cordero, Capital 30,000

The P40,000 payment made by Cordero to Coloma and Claudio should not be reflected

in the partnership books. What is recorded in the books of the partnership is the transfer

of 1/5 of the capital of the old partners to the new partner. The P10,000 excess payment

is a personal gain of Coloma and Claudio

Key Points. In the preceding four cases, 1a, 1b, 2 and 3, the transfer of capital from the

old partners to the new partner is recorded at book value regardless of the amount paid.

Payments at less than book value and at more than book value are recorded as if they

were made at book value.

In addition, the four cases show that the total partnership capital before and after the

admission of the new partner are the same. Thus, the total partnership capital of

150,000 before the admission of Cordero is also the total partnership capital after his,

admission. Therefore, the admission of a new partner by purchase will not affect the total

assets and the total capital of the partnership.

ASSET REVALUATION UPON ADMISSION OF A NEW PARTNER BY PURCHASE

Revaluation of assets of the old partnership, however, is generally undertaken prior to the

admission of a new partner. The effect of the asset revaluation is carried to the capital

accounts of the old partners. The adjusted capital of the old partners becomes the basis.

for the interest transferred to the new partner.

The procedures under this approach are as follows

Step 1- Compute the new partnership capital using as basis the amount to be paid by

the incoming partner and his fraction of interest.

Step2- Deduct the capital of the old partnership from the capital of the new

partnership. The difference is the asset revaluation.

Step 3- Allocate the asset revaluation among the old partners in accordance with their

residual profit and loss sharing agreement.

1a per rma Dissolution

Ch

Step 4~ Add the share ofeach partner on the asset revaluation 10 ht capital balances

to get the capital balances after the asset revaluation.

Step 5- Compute the amount of interest transferred by the old Pareers 1° the! ney

partner based on their capital after the asset revaluation.

Step 6- Prepare the entry to record the admission of the new partner

‘A where Coloma and Claudio

To illustrate, assume the sami :

¢ data in Illustrative Problem tly. They share

are partners with capital balances of P100,000 and P50,000, respect¥

profits and losses equally. Cordero is a new partner who purchases @ 1/5 interest from

Coloma and Claudio paying P4000. However, before the admission of Cordero,

partnership assets are to be revalued using as basis the amount tobe paid PY Cordero.

Solution:

Step 1- The new partnership capital is equal to the amount paid by the incomng

partner divided by his fraction of interest

New partnership capital = P40,000 + 1/5 = P200,000

Step 2- The amount of asset revaluation is equal to the new partnership capital less old

partnership capital.

‘Asset revaluation = P200,000 — P150,000 = P50,000

Step 3- The allocation of the amount of the asset revaluation among the old partners is

as follows: P50,000 / 2 = P25,000 per partner.

Step 4- The capital balances of the old partners after asset revaluation 1s equal to their

old capital balances plus their share on asset revaluation.

Coloma Claudio

Capital balances before revaluation P100,000 50,000

Share on asset revaluation __25,000 _25,000

Capital balances after revaluation 125,000 75,000

step 5- The amount of interest transfered by the old partners fo the new partner is

based on the new capital balances (capital balances after asset revaluation).

Coloma Claudio

Capital balances after revaluation 125,000 P75,000

Interest transferred us 15

Capital transferred to Cordero P.25,000 15,000

Chapter 4 Partership Dissolution 143

Step6- The journal entries to record the revaluation of asset and the admission of

Cordero are as follows:

Other Assets 50,000

Coloma, Capital 25,000

Claudio, Capital 25,000 pecs Se

Coloma, Capital 25,000 L C

Claudio, Capital 15,000

Cordero, Capital 40,000

Moen

Capital balances after the admission of Cordero shall be:

Coloma P100,000 + P25,000 — P25,000 P100,000 x

Claudio P50,000 + P25,000 - P15,000 60,000

Cordero 40,000

ADMISSION BY INVESTMENT

‘The admission of a new partner by investment is a transaction between the original

partnership and the new partner. The use of the terms like invests and contributes

represent admission of a new partner by investment. The investment of the new partner

increases the total assets and the total capital of the partnership. The entry to record the

admission of the new partner depends upon the capital interest credited to the partners”

accounts.

DEFINITION OF TERMS

Agreed Capital (AC) ~ it is the amount of new capital set by the partners for the

partnership. It may be equal to, more than, or less than the total contributions of the

partners. Other terms used for agreed capital are: new firm capital, total capital and

agreed capitalization. The terms of the admission of a new partner may indicate the

agreed capital. If agreed capital is not indicated, it can be computed in either of two ways:

1, Investment of the new partner divided by the new partner’s fraction of

interest; or

2. Investment of the old partners (equal to the net assets or capital of the

partnership) divided by the old partners’ fraction of interest.

Example: Corpus and Carlos are partners with capital balances of 150,000 each.

Cabral invests P100,000 for a 2/5 interest in the new partnership. The agreed capital of

the new partnership is determined as follows:

Computation | - The new partner's investment used as a basis,

100,000 = 2/5 = P250,000

Computation 2 - The old partners’ investment used as a basis

300,000 = 3/5 = P500,000

rinership Dissolution

a nate tart SET

Total Contributed Capital (CC) - it is the investment of all the partners, both old and

the capital balances of the old partners (net asset

new, to the partnership. It is the sum of tl

investment) and the contribution of the new partner.

apital is P400,000, the

sn, the total contributed ¢ 0,006

rtner’s contribution of

Using the information in the example give

(00,000 and the new pat

sum of the old partners’ contribution of P3

100,000.

Bonus ~ it isthe transfer of capital ffom one partner 9 anothes ‘A bonus to the old

partners is given by the new partner. It isa reduction 9 the capital of the new partner and

aanrvrease inthe capital ofthe old partners. The capital accounts of the old partners are

credited according to their profit and loss ratio. “A bonus to the new partner is given by

the old partners It isa reduction inthe capital ofthe old partners and an increase in the

capital of the new partner. The capital aocount of the new partner is credited and the

capital accounts of the old partners are debited according to their profit and loss ratio.

‘The following procedures will be helpful in the computation and determination of the

ownership of bonus:

1. Multiply agreed capital (AC) by the faction of interest of the new partner. The

result isthe capital credit of the new partner in the new partnership

2, Compare the capital credit with the investment of the new parinr.

a. If the capital coedit is more than the investment of the new parine®, the

difference is bonus to the new partner.

b. Ifthe capital credit i less than the investment of the new partner, the difference

is bonus to the old partners

Asset Revaluation necessary adjustment in asset values upon admission of a new

partner. The adjustment in assets may be determined as the difference between the

oreed capital and the total contributed capital, Generally, asset revaluations upon

parinership formation relate only to the partners ofthe old partnership.

Capital Credit ~ iti the interest oF equity of parmer in the firm. Its computed by

multiplying agreed capital by te faction of interest ofa partner.

Chapter 4 ~ Partnership Dissolution “

PROBLEMS RELATING TO

: ADMISSION OF A

NEW PARTNER BY INVESTMENT

fitations relating to admission ofa new partner by investment may fall under any ofthe

ing

1

wv

4

&

Agreed capital is given. When agreed capital is given, the admission of a new

Partner by investment will give rise to any of the following cases:

4 No Bonus, no Asset Revaluation

b. Bonus to old partners, no Asset Revaluation

¢. Bonus to new partner, no Asset Revaluation

Asset Revaluation, no Bonus

Agreed capital is not given. When agreed capital is not given, the problem calls

for two altemative solutions.

a. Bonus method

b. Asset revaluation method

Agreed capital is not given but the basis for its computation is indicated in the

terms of admission.

The amount of contribution of the new partner is not given.

No fraction of interest for either the new or old partners is given.

The following are the illustrations of the various problems involving admission of a new

partner by investment.

AGREED CAPITAL IS GIVEN

Illustrative Problem B; Calma and Castro are partners with capital balances of

200,000 and P100,000, respectively. They share profits and losses equally. Conde is to

be admitted in the partnership

Case 1 -

Yo Bonus, no Asset Revaluation. Conde invests P100,000 for a % interest in

the agreed capital of P400,000.

Cash 100,000

Conde, Capital 100,000

srmership Disolu

tt

Solution:

Step 1 Fill in the given data in the table.

a. Partners, old and new

b. AC column, with the total written fist

ec. CCcolumn

cc

ac p 300,000

Me Sea 00,000

ew __

range, PH.

—P400,000-

Step2 Compare AC and CC. In this ease, AC = CC uation

{P400,000 = P400,000), therefore, there is no asset evaluat

Step3 Determine if there is bonus.

a. Compute for the capital credit

‘AC x fraction of interest;

b. Write this amount in the AC column

cc. Compare the new partner's AC with

are the same, therefore, there is no bonus:

of the new partner

400,000 x Y= P100,000

of the new partner

his CC. In this case, AC and CC

Step 4 The above table will be completed as follows

a, ACor capital credit ofthe old partners

‘AC x fraction of interest (4/4—1/4= 74)

400,000 x % = P300,000

b. Acompleted table appears as follows:

AC

cc

Old P 300,000 P 300,000

New 100,000

P__ 400,000,

¢. Conclusion based on the table:

(i) AC=CC, therefore, there is no asset revaluation

(ii) New partner: AC = CC, therefore, there is no bonus

(iii) Old partners: AC = CC, therefore, there is no bonus either.

In actual problem solving, only one table is prepared. The missing items are filled as

they are needed.

uw

Chapter 4 ~ Partnership Dissolution

Case 2 ~ Bonus to the old partners, no Asset Revaluation. Conde invests P100,000

for a 1/5 interest in the new firm capitalization of P400,000.

Cash 100,000

Conde, Capital 100,000

Conde, Capital 20,000

Calma, Capital 10,000

Castro, Capital 10,000

‘These entries were made to show clearly the transfer of capital from the new partner to

the old partners. However, a compound entry may also be prepared as follows:

Cash 100,000

Conde, Capital 80,000

Calma, Capital 10,000

Castro, Capital 10,000

Solution:

Step 1 Fill in the table as in Case 1. The completed table after Steps 1 to 4 is

shown below:

AC cc Bonus

Old P 320,000 P 300,000 P 20,000

New 80,000 100,000. (20,000)

P_ 400,000, P__ 400,000 :

Step 2 Compare AC and CC. Ini this case, AC = CC (P400,000 = P400,000).

‘Therefore, there is no asset revaluation but there may be bonus.

Step3 Determine if there is bonus.

a. Compute for the capital credit of the new partner.

‘AC x fraction of interest, P400,000 x 1/5 = P80,000.

b. Write this amount in the AC column of the new partner.

¢. Compare the new partner's AC with his CC. In this case, his

‘AC CC, therefore, they receive the bonus

shared according to their profit and loss ratio.

Case 3 — Bonus to new partner, no Asset Revaluation. Conde invests P60,000 for a

1/4 interest in the total capitalization of P360,000.

Cash 60,000

Calma, Capital 15,000

Castro, Capital 15,000

Conde, Capital 90,000

Solution:

Step Fill in the table as in Cases 1 and 2, The completed table after Steps I to 4

is shown below:

AC cc Bonus

old P 270,000 P- 300,000 P- (30,000)

New 90,000 60,000 30,000

P_360,000. _P 360,000 =

Step2 Compare AC and CC. In this case, AC = CC (P360,000 = P360,000).

Therefore, there is no asset revaluation but there may be bonus,

Step3 Determine if there is bonus.

‘Compute for the capital credit of the new partner.

‘AC x fraction of interest; P360,000 x 1/4 = P90, 000.

b. Write this amount in the AC column of the new partner.

Compare the new partner’s AC with his CC. In this case, his

AC > CC (P90,000 ~ P60,000); therefore, the increase in his

contributed capital represents bonus from the old partners

a.

¢

Step4 Complete the table by filling in the missing figures.

a. AC or capital credit of the old partners

‘AC x fraction of interest

360,000 x 3/4 = P270,000 or

CC - Bonus to old partners

300,000 — P30,000 = P270,000

The bonus given to the new partner is shared by the old partners

according to their profit and loss sharing ratio.

b. A completed table is shown in Step 1

Chapter 4~ Partership Dissolution 19

Conclusion based on the table:

(i) AC=CC, therefore, there is no asset revaluation.

(ii) New partner: AC> CC, therefore, he receives the bonus.

(iii) Old partners: AC < CC, therefore, they give the bonus shared

according to their profit and loss ratio.

Case 4 ~ Positive Asset Revaluation, no Bonus. Conde invests P100.000 for a 1/5

interest in the agreed capital of P500,000,

Other Assets 100,000

Calma, Capital 50,000

Castro, Capital 50,000

e 100,000

Conde, Capital 100,000

Solution:

Step | Fill in the table as in Cases | to 3. The completed table after Steps 1 to 4 is

shown below:

Asset

AC cc Revaluation

Old P 400,000 P 300,000 P 100,000

New 100,000. 100,000 “

P 4 P 100,000

Step2 Compare AC and CC. In this case, AC > CC (P500,000 > 400,000),

Therefore, there is a positive asset revaluation.

Step3 Determine if there is bonus.

a. Compute for the capital credit of the new partner.

‘AC x fraction of interest; P500,000 x 1/5 = P100,000,

b. Write this amount in the AC column of the new partner.

c. Compare the new partner’s AC with his CC. In this case, his

‘AC = CC (P100,000 = P100,000); therefore, there is no bonus

Step4 Complete the table by filling inthe missing figures

a, AC or capital credit of the old partners.

‘AC x fraction of interest

500,000 x 4/5 = P400,000 or

CC + Asset Revaluation

300,000 + P100,000 = P400,000

b. Acompleted table is shown in Step 1

c. Conclusion based on the table:

(i) AC>CC, therefore, there is a positive asset revaluation

(ii) New partner: AC = CC, therefore, there is no bonus.

(iii) Old partners: AC > CC, therefore, they are credited for the

asset revaluation shared according to their profit and loss ratio.

1 Dissolut

Chapter 4 Porters "

Case 5 ~ Negative

interest in the agreed

Calma, Capital

Asset Revaluation, No bonus, Conde invests POO!

capital of P300,000.

000 for a 1/5

° 000

Case. Capa 30400

Other Assets ° 60,000

Cash

60,000

Conde, Capital 60,000

Solution:

Step 1 Fill in the table as in Cases 1 to 4, The completed table after Steps | t0 4 is

shown below:

Asset

AC cc Revaluation

Old P 240,000 P 300,000 (P 60,000)

New ____60,000_ 60,000 =

P_ 300,000 P_ 360,000 P 60,000)

Step2 Compare AC and CC. In this case, AC < CC (P300,000 < P360,000).

Therefore, there is a negative asset revaluation.

Step3 Determine if there is bonus.

a. Compute for the capital credit of the new partner.

AC x fraction of interest; P300,000 x 1/5 = P60,000.

b. Write this amount in the AC column of the new partner.

c. Compare the new partner’s AC with his CC. In this ease, his

AC = CC (P60,000 = P60,000); therefore, there is no bonus.

Step4 Complete the table by filling in the missing figures.

a. AC or capital credit of the old partners.

‘AC x fraction of interest

300,000 x 4/5 = P240,000 or

CC - Asset Revaluation

300,000 ~ P60,000 = P240,000

b. A completed table is shown in Step |

¢. Conclusion based on the table:

(i) AC CC)

A positive asset revaluation increases the old partnership assets and the capital accounts

of the old partners. The increase is shared by the old partners based on their profit and

loss sharing ratio. Here, the agreed capitalization of the new partnership is more than the

total amount of contribution of both the old and new partners.

Under this method, the agreed capitalization is computed as follows:

‘AC = New partner's CC + new partner’s fraction of interest

NEGATIVE ASSET REVALUATION METHOD (AC

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5820)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (898)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Top 6 Best Accounting and Auditing Firms in The PhilippinesDocument4 pagesTop 6 Best Accounting and Auditing Firms in The Philippineschelsea kayle licomes fuentesNo ratings yet

- EthicsDocument5 pagesEthicschelsea kayle licomes fuentesNo ratings yet

- EthicsDocument4 pagesEthicschelsea kayle licomes fuentesNo ratings yet

- Clearance Form: 1. Administration SectorDocument3 pagesClearance Form: 1. Administration Sectorchelsea kayle licomes fuentesNo ratings yet

- Crepe Paper As An Alternative Ink For Ballpoint PenDocument5 pagesCrepe Paper As An Alternative Ink For Ballpoint Penchelsea kayle licomes fuentesNo ratings yet

- Tle 10 1ST QTR ExamDocument4 pagesTle 10 1ST QTR Examchelsea kayle licomes fuentesNo ratings yet

- What Is The Relevance of Bretton Woods Institution Such As The IMF and The World Bank in Todays Globalization WorldDocument3 pagesWhat Is The Relevance of Bretton Woods Institution Such As The IMF and The World Bank in Todays Globalization Worldchelsea kayle licomes fuentesNo ratings yet

- Powerpoint Presentation-Final DemoDocument22 pagesPowerpoint Presentation-Final Demochelsea kayle licomes fuentesNo ratings yet

- Problem Set (Statistics) - AssignmentDocument1 pageProblem Set (Statistics) - Assignmentchelsea kayle licomes fuentes100% (1)

- Jeric PoemDocument36 pagesJeric Poemchelsea kayle licomes fuentesNo ratings yet

- Wmsu NSTP Front Page CoverDocument1 pageWmsu NSTP Front Page Coverchelsea kayle licomes fuentesNo ratings yet

- Ca A3 FDocument1 pageCa A3 Fchelsea kayle licomes fuentesNo ratings yet

- Chapter 4 - Job Order and Process CostingDocument12 pagesChapter 4 - Job Order and Process Costingchelsea kayle licomes fuentesNo ratings yet

- My Experience BookDocument45 pagesMy Experience Bookchelsea kayle licomes fuentesNo ratings yet

- Ascendra: Study Buddy Program 2021 Accountancy DepartmentDocument3 pagesAscendra: Study Buddy Program 2021 Accountancy Departmentchelsea kayle licomes fuentesNo ratings yet

- Obligation Questions and AnswersDocument19 pagesObligation Questions and Answerschelsea kayle licomes fuentesNo ratings yet

- Chapter 1 - MAS IntroductionDocument9 pagesChapter 1 - MAS Introductionchelsea kayle licomes fuentesNo ratings yet

- Chapter 2 - ABC System PDFDocument5 pagesChapter 2 - ABC System PDFchelsea kayle licomes fuentesNo ratings yet

- Chapter 3 - Product CostingDocument6 pagesChapter 3 - Product Costingchelsea kayle licomes fuentesNo ratings yet

- The Concept Paper: Automatic ZoomDocument4 pagesThe Concept Paper: Automatic Zoomchelsea kayle licomes fuentesNo ratings yet