Professional Documents

Culture Documents

History: Peasants Non-Payment of Taxes Pyramid Age

History: Peasants Non-Payment of Taxes Pyramid Age

Uploaded by

Maika J. Pudadera0 ratings0% found this document useful (0 votes)

82 views1 pageThe earliest known system of taxation was in Ancient Egypt around 3000–2800 BC during the Old Kingdom. Taxes were collected in the form of corvée (forced labor) and tithes (a percentage of crops). Pharaohs would tour the kingdom every two years to collect tithes from the people. In Persia under Darius I in 500 BC, each satrapy (province) was assessed different taxes based on its productivity and economic potential. Egypt, known for its agriculture, was required to provide large amounts of grain and silver. Islamic rulers later imposed the Zakat tax on Muslims and the Jizya poll tax on non-Muslims.

Original Description:

dasdas

Original Title

139

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe earliest known system of taxation was in Ancient Egypt around 3000–2800 BC during the Old Kingdom. Taxes were collected in the form of corvée (forced labor) and tithes (a percentage of crops). Pharaohs would tour the kingdom every two years to collect tithes from the people. In Persia under Darius I in 500 BC, each satrapy (province) was assessed different taxes based on its productivity and economic potential. Egypt, known for its agriculture, was required to provide large amounts of grain and silver. Islamic rulers later imposed the Zakat tax on Muslims and the Jizya poll tax on non-Muslims.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

82 views1 pageHistory: Peasants Non-Payment of Taxes Pyramid Age

History: Peasants Non-Payment of Taxes Pyramid Age

Uploaded by

Maika J. PudaderaThe earliest known system of taxation was in Ancient Egypt around 3000–2800 BC during the Old Kingdom. Taxes were collected in the form of corvée (forced labor) and tithes (a percentage of crops). Pharaohs would tour the kingdom every two years to collect tithes from the people. In Persia under Darius I in 500 BC, each satrapy (province) was assessed different taxes based on its productivity and economic potential. Egypt, known for its agriculture, was required to provide large amounts of grain and silver. Islamic rulers later imposed the Zakat tax on Muslims and the Jizya poll tax on non-Muslims.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 1

History[edit]

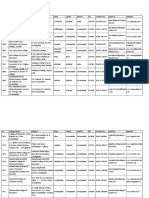

Egyptian peasants seized for non-payment of taxes. (Pyramid Age)

The first known system of taxation was in Ancient Egypt around 3000–2800 BC in the First Dynasty

of Egypt of the Old Kingdom of Egypt.[28] The earliest and most widespread form of taxation was

the corvée and tithe. The corvée was forced labour provided to the state by peasants too poor to pay

other forms of taxation (labour in ancient Egyptian is a synonym for taxes).[29] Records from the time

document that the Pharaoh would conduct a biennial tour of the kingdom, collecting tithes from the

people. Other records are granary receipts on limestone flakes and papyrus.[30] Early taxation is also

described in the Bible. In Genesis (chapter 47, verse 24 – the New International Version), it states

"But when the crop comes in, give a fifth of it to Pharaoh. The other four-fifths you may keep as seed

for the fields and as food for yourselves and your households and your children". Joseph was telling

the people of Egypt how to divide their crop, providing a portion to the Pharaoh. A share (20%) of the

crop was the tax (in this case, a special rather than an ordinary tax, as it was gathered against an

expected famine) The stock made by was returned and equally shared with the people of Egypt and

traded with the surrounding nations thus saving and elevating Egypt.[31] Samgharitr is the name

mentioned for the Tax collector in the Vedic texts.[32] In Hattusa, the capital of the Hittite Empire,

grains were collected as a tax from the surrounding lands, and stored in silos as a display of the

king's wealth.[33]

In the Persian Empire, a regulated and sustainable tax system was introduced by Darius I the

Great in 500 BC;[34] the Persian system of taxation was tailored to each Satrapy (the area ruled by a

Satrap or provincial governor). At differing times, there were between 20 and 30 Satrapies in the

Empire and each was assessed according to its supposed productivity. It was the responsibility of

the Satrap to collect the due amount and to send it to the treasury, after deducting his expenses (the

expenses and the power of deciding precisely how and from whom to raise the money in the

province, offer maximum opportunity for rich pickings). The quantities demanded from the various

provinces gave a vivid picture of their economic potential. For instance, Babylon was assessed for

the highest amount and for a startling mixture of commodities; 1,000 silver talents and four months

supply of food for the army. India, a province fabled for its gold, was to supply gold dust equal in

value to the very large amount of 4,680 silver talents. Egypt was known for the wealth of its crops; it

was to be the granary of the Persian Empire (and, later, of the Roman Empire) and was required to

provide 120,000 measures of grain in addition to 700 talents of silver.[35] This tax was exclusively

levied on Satrapies based on their lands, productive capacity and tribute levels.[36]

The Rosetta Stone, a tax concession issued by Ptolemy V in 196 BC and written in three languages

"led to the most famous decipherment in history—the cracking of hieroglyphics".[37]

Islamic rulers imposed Zakat (a tax on Muslims) and Jizya (a poll tax on conquered non-Muslims). In

India this practice began in the 11th century.

You might also like

- Investments (2023) 1 (01 50)Document50 pagesInvestments (2023) 1 (01 50)farzad naderi67% (12)

- Tax FarmingDocument13 pagesTax FarmingHussein RizkNo ratings yet

- Lista Great Wall PDFDocument125 pagesLista Great Wall PDFJermy Carrasco Pastenes67% (3)

- Tax - History: TextoDocument5 pagesTax - History: TextoRudimar PetterNo ratings yet

- Ancient Egypt: Jump To Navigationjump To SearchDocument4 pagesAncient Egypt: Jump To Navigationjump To SearchIyesusgetanewNo ratings yet

- Mesopotamia and EgyptDocument2 pagesMesopotamia and EgyptTypical SnakeNo ratings yet

- Introduction and Research MethodologyDocument305 pagesIntroduction and Research MethodologysanchitNo ratings yet

- ChapterDocument8 pagesChapterHsu Sandi AungNo ratings yet

- Ancient EgyptDocument49 pagesAncient EgyptJozsef MokulaNo ratings yet

- Prehistory (Pre-3100 BC) : Prehistoric Egypt Population History of EgyptDocument3 pagesPrehistory (Pre-3100 BC) : Prehistoric Egypt Population History of EgyptAlicia NhsNo ratings yet

- Ancient EgyptDocument3 pagesAncient Egyptapi-347951553No ratings yet

- Brief History Ancient EgyptDocument15 pagesBrief History Ancient EgyptPhil HomsNo ratings yet

- 01b - First River-Valley Civilizations, 3500 - 1500 B.C.E.Document5 pages01b - First River-Valley Civilizations, 3500 - 1500 B.C.E.shechtelNo ratings yet

- Name Dynasty YearsDocument6 pagesName Dynasty YearsMalik SufianNo ratings yet

- Chapter 1 Income TaxDocument34 pagesChapter 1 Income TaxGirlie Kaye Onongen PagtamaNo ratings yet

- Paleolithic: The Primary Socio-Economic Unit Was The Band (Small Kin Group)Document5 pagesPaleolithic: The Primary Socio-Economic Unit Was The Band (Small Kin Group)khinojidaNo ratings yet

- Egypt 2Document3 pagesEgypt 2EINSTEINNo ratings yet

- World History SlideDocument8 pagesWorld History Slideapi-327713634No ratings yet

- Egyptian Civilization: GeographyDocument9 pagesEgyptian Civilization: GeographySaima100% (1)

- Egyptian Civilization: The Nile Dynastic Egypt Religion WritingDocument56 pagesEgyptian Civilization: The Nile Dynastic Egypt Religion WritingLerma Luluquisen MejiaNo ratings yet

- Egyptian ChronologyDocument2 pagesEgyptian ChronologyMaria NilantaNo ratings yet

- Egyptian CivilizationDocument9 pagesEgyptian CivilizationKrisselle Kate Quitalig NeryNo ratings yet

- CivilisationDocument4 pagesCivilisationAANo ratings yet

- History of Inidan TaxationDocument1 pageHistory of Inidan TaxationJuhi TiwariNo ratings yet

- From Freedom To SalveryDocument40 pagesFrom Freedom To SalveryBill CreasyNo ratings yet

- Egyptian CivilisationDocument3 pagesEgyptian CivilisationKHUSHI SRIVASTAVANo ratings yet

- C. 2040 BC, Reaching A Peak During The Reign of PharaohDocument4 pagesC. 2040 BC, Reaching A Peak During The Reign of PharaohChad Lopez MaamoNo ratings yet

- Architectural History of Egyptian CivilisationDocument8 pagesArchitectural History of Egyptian CivilisationNameerah Tariq Tariq SaeedNo ratings yet

- AP World Western Asia and EgyptDocument22 pagesAP World Western Asia and EgyptJonathan Daniel KeckNo ratings yet

- Ancient Egypt - Civilization, Empire & Culture - HISTORYDocument8 pagesAncient Egypt - Civilization, Empire & Culture - HISTORYsamyfotoworksNo ratings yet

- Egypt 4Document3 pagesEgypt 4EINSTEINNo ratings yet

- History of EgyptDocument16 pagesHistory of EgyptelisiaNo ratings yet

- Ancient Middle East and EgyptDocument50 pagesAncient Middle East and EgyptDokter AnestesiNo ratings yet

- Egyptian CivilizationDocument24 pagesEgyptian Civilizationrosemelynbugto1No ratings yet

- Ancient Sumer and EgyptDocument84 pagesAncient Sumer and EgyptSrood TalibNo ratings yet

- Ancient CivilizationsDocument9 pagesAncient CivilizationsMarienne LaoNo ratings yet

- The Development of Accounting Through The History: Mohamud Ambashe, Hikmat A AlrawiDocument6 pagesThe Development of Accounting Through The History: Mohamud Ambashe, Hikmat A AlrawiRahimah ARNo ratings yet

- Social StructureDocument6 pagesSocial Structureapi-346645824No ratings yet

- Geo Graph y Final ShitDocument9 pagesGeo Graph y Final ShitRhod Uriel FabularNo ratings yet

- Giza Necropolis Ancient Wonders: The Is The Oldest of The and The Only One Still in ExistenceDocument1 pageGiza Necropolis Ancient Wonders: The Is The Oldest of The and The Only One Still in Existenceსო ფიაNo ratings yet

- Chapter Three The Ancient WorldDocument30 pagesChapter Three The Ancient WorldHaylemeskel HaylemariamNo ratings yet

- Rosetta StoneDocument11 pagesRosetta StoneSarah NixonNo ratings yet

- The History of EgyptDocument3 pagesThe History of EgyptlectorilloNo ratings yet

- 3AS Project - Unit 1 (Egypt, Land of History and CivilizatiDocument23 pages3AS Project - Unit 1 (Egypt, Land of History and CivilizatiKhadidja Belaskri100% (5)

- Smith's Bible Dictionary On EgyptDocument24 pagesSmith's Bible Dictionary On Egyptjld4444No ratings yet

- Egyptian Civilisation: Aryan Rathore BYDocument33 pagesEgyptian Civilisation: Aryan Rathore BYPankhuri Sinha100% (2)

- Egyptian CivilizationDocument7 pagesEgyptian CivilizationSHIKHA VERMANo ratings yet

- Unit-9 Bronze Age CivilizationsDocument14 pagesUnit-9 Bronze Age Civilizationsvrpatil1313No ratings yet

- Mesopotamian CivilizationDocument24 pagesMesopotamian CivilizationMd Nawas SharifNo ratings yet

- TheAncientWorldPart1 TRANSCRIPTDocument9 pagesTheAncientWorldPart1 TRANSCRIPTbababanana22No ratings yet

- Ancient Egypt & The Nile Valley: Chapter 3 NotesDocument23 pagesAncient Egypt & The Nile Valley: Chapter 3 Notesapi-296326751No ratings yet

- Ancient Civilizations of MankindDocument8 pagesAncient Civilizations of Mankindusama afzalNo ratings yet

- Lecture 2 - Ancient EgyptDocument3 pagesLecture 2 - Ancient EgyptKamalito El CaballeroNo ratings yet

- Ancient Egypt & The Nile Valley: Chapter 3 NotesDocument23 pagesAncient Egypt & The Nile Valley: Chapter 3 Notesapi-368031037No ratings yet

- Ancient Economic Thought - WikipediaDocument7 pagesAncient Economic Thought - WikipediaTreasureNo ratings yet

- Egyptian CivilizationDocument8 pagesEgyptian CivilizationCruz Jimmy Callizaya GirondaNo ratings yet

- Plant Exploration: From Queen Hatshepsut To Sir Joseph BanksDocument6 pagesPlant Exploration: From Queen Hatshepsut To Sir Joseph BanksAlexanderNo ratings yet

- Ilovepdf Merged (1) MergedDocument576 pagesIlovepdf Merged (1) MergedIoana FaurNo ratings yet

- Ancient Egypt, Rise and Fall: Ancient Worlds and Civilizations, #4From EverandAncient Egypt, Rise and Fall: Ancient Worlds and Civilizations, #4No ratings yet

- Ancient Egypt: A Concise Overview of the Egyptian History and Mythology Including the Egyptian Gods, Pyramids, Kings and QueensFrom EverandAncient Egypt: A Concise Overview of the Egyptian History and Mythology Including the Egyptian Gods, Pyramids, Kings and QueensNo ratings yet

- Tax LawDocument1 pageTax LawMaika J. PudaderaNo ratings yet

- Poll TaxDocument1 pagePoll TaxMaika J. PudaderaNo ratings yet

- Types: Compliance CostDocument1 pageTypes: Compliance CostMaika J. PudaderaNo ratings yet

- Branches of ScienceDocument2 pagesBranches of ScienceMaika J. PudaderaNo ratings yet

- History: Joint-Stock CompaniesDocument1 pageHistory: Joint-Stock CompaniesMaika J. PudaderaNo ratings yet

- Economic Effects: WealthDocument1 pageEconomic Effects: WealthMaika J. PudaderaNo ratings yet

- Angola Kenya Brazil MalaysiaDocument1 pageAngola Kenya Brazil MalaysiaMaika J. PudaderaNo ratings yet

- Real Estate Real Estate Window Tax Listed Buildings Stamp Duty Inheritance Tax Land-Value TaxDocument1 pageReal Estate Real Estate Window Tax Listed Buildings Stamp Duty Inheritance Tax Land-Value TaxMaika J. PudaderaNo ratings yet

- Fees and Effective: Direct Tax Indirect TaxDocument1 pageFees and Effective: Direct Tax Indirect TaxMaika J. PudaderaNo ratings yet

- Social-Security Contributions: Corporate TaxDocument1 pageSocial-Security Contributions: Corporate TaxMaika J. PudaderaNo ratings yet

- Income TaxDocument1 pageIncome TaxMaika J. PudaderaNo ratings yet

- Key Facts: Trade LiberalisationDocument1 pageKey Facts: Trade LiberalisationMaika J. PudaderaNo ratings yet

- The Financial System: Financial Services Financial Market Circular Flow of IncomeDocument1 pageThe Financial System: Financial Services Financial Market Circular Flow of IncomeMaika J. PudaderaNo ratings yet

- Financial Mathematics: Main ArticleDocument1 pageFinancial Mathematics: Main ArticleMaika J. PudaderaNo ratings yet

- Excise: Indirect TaxDocument1 pageExcise: Indirect TaxMaika J. PudaderaNo ratings yet

- Laffer Curve: When?Document1 pageLaffer Curve: When?Maika J. PudaderaNo ratings yet

- TariffDocument1 pageTariffMaika J. PudaderaNo ratings yet

- Reduced Economic WelfareDocument2 pagesReduced Economic WelfareMaika J. PudaderaNo ratings yet

- Role of MathematicsDocument2 pagesRole of MathematicsMaika J. PudaderaNo ratings yet

- Forms: SeigniorageDocument1 pageForms: SeigniorageMaika J. PudaderaNo ratings yet

- Payroll or WorkforceDocument1 pagePayroll or WorkforceMaika J. PudaderaNo ratings yet

- Sales Tax: Main ArticleDocument1 pageSales Tax: Main ArticleMaika J. PudaderaNo ratings yet

- Application: Stock Exchange Initial Public OfferingDocument1 pageApplication: Stock Exchange Initial Public OfferingMaika J. PudaderaNo ratings yet

- Descriptive Labels: Edit EditDocument1 pageDescriptive Labels: Edit EditMaika J. PudaderaNo ratings yet

- Normal Goods: Ad Valorem TaxDocument1 pageNormal Goods: Ad Valorem TaxMaika J. PudaderaNo ratings yet

- Types: Common Stock Preferred Stock Voting Rights Preferred Stock Dividend OptionDocument1 pageTypes: Common Stock Preferred Stock Voting Rights Preferred Stock Dividend OptionMaika J. PudaderaNo ratings yet

- Means of Financing: TradingDocument1 pageMeans of Financing: TradingMaika J. PudaderaNo ratings yet

- Stamp Duty Stamp Duty Reserve Tax Stamp Duty Land Tax United StatesDocument1 pageStamp Duty Stamp Duty Reserve Tax Stamp Duty Land Tax United StatesMaika J. PudaderaNo ratings yet

- SharesDocument1 pageSharesMaika J. PudaderaNo ratings yet

- Purposes and EffectsDocument1 pagePurposes and EffectsMaika J. PudaderaNo ratings yet

- Lecture 11, Lafarge Case StudyDocument4 pagesLecture 11, Lafarge Case StudyoceanevesinNo ratings yet

- Roof Truss QuoteDocument3 pagesRoof Truss QuoteMmamoraka Christopher MakhafolaNo ratings yet

- Shipping Corporation of India: Project Report OnDocument6 pagesShipping Corporation of India: Project Report OnAnuj BhagatNo ratings yet

- Free Villages HistoryDocument18 pagesFree Villages HistorySamantha JohnsonNo ratings yet

- Accounting Terminology: Servicio Nacional de Aprendizaje Sena Taller de Aprendizaje - BilingüismoDocument3 pagesAccounting Terminology: Servicio Nacional de Aprendizaje Sena Taller de Aprendizaje - BilingüismoMaleNo ratings yet

- Test Bank For International Economics 8Th Edition Appleyard Dennis Field 0078021677 978007802167 Full Chapter PDFDocument28 pagesTest Bank For International Economics 8Th Edition Appleyard Dennis Field 0078021677 978007802167 Full Chapter PDFrenee.garcia396100% (19)

- Metema Hospital, North Gondar Zone, AmharaDocument23 pagesMetema Hospital, North Gondar Zone, AmharadrkefyalewtayeNo ratings yet

- Cost Piping An Update 18 September 2017Document49 pagesCost Piping An Update 18 September 2017abi zihni100% (1)

- DepriciationDocument2 pagesDepriciationmeelas123No ratings yet

- Political Science Notes 2Document3 pagesPolitical Science Notes 2aaNo ratings yet

- Solved SSC CGL 24th August 2021 Shift-1 Paper With SolutionsDocument31 pagesSolved SSC CGL 24th August 2021 Shift-1 Paper With SolutionsabhiNo ratings yet

- Pitch 1stDocument11 pagesPitch 1stGoodluck KapingaNo ratings yet

- Chapter #3 National Differences in Economic DevelopmentDocument36 pagesChapter #3 National Differences in Economic DevelopmentLalo SalamancaNo ratings yet

- Public Borrowing and Debt Management by Mario RanceDocument47 pagesPublic Borrowing and Debt Management by Mario RanceWo Rance100% (2)

- Finding An Apartment ProjectDocument3 pagesFinding An Apartment Projectapi-288395661No ratings yet

- Installation Instructions: Decorative Bottle TrapDocument2 pagesInstallation Instructions: Decorative Bottle TrapAfzal FasehudeenNo ratings yet

- Chapter 9 - Discounting of Note ReceivableDocument5 pagesChapter 9 - Discounting of Note ReceivableLorence IbañezNo ratings yet

- Problem Faced by EntrepreneurDocument9 pagesProblem Faced by Entrepreneur428SHUBHASHEESH SAXENANo ratings yet

- Rajasthan Platform-Based Gig Workers (Registration and Welfare) Bill, 2023Document7 pagesRajasthan Platform-Based Gig Workers (Registration and Welfare) Bill, 2023awardanbhimawatNo ratings yet

- FY23 FD Re Willow (Morelle)Document1 pageFY23 FD Re Willow (Morelle)Rep. Joe MorelleNo ratings yet

- Magazine G20 Summit WWW - UpscportalDocument5 pagesMagazine G20 Summit WWW - UpscportalKishore PotnuruNo ratings yet

- International Business Development 1Document17 pagesInternational Business Development 1Emma DeprezNo ratings yet

- Iso 9001-2008Document36 pagesIso 9001-2008Muhammad Amjad MaroofNo ratings yet

- Affiliated Colleges Institutes Bamu AWBDocument64 pagesAffiliated Colleges Institutes Bamu AWBSachin KhadNo ratings yet

- Chapter 03 EconomicsDocument9 pagesChapter 03 Economicsloveza lodhiNo ratings yet

- Itr Simpal Kumari 23 24Document1 pageItr Simpal Kumari 23 24prateek gangwaniNo ratings yet

- Introducing Economic Development: A Global PerspectiveDocument34 pagesIntroducing Economic Development: A Global PerspectiveAprile Margareth HidalgoNo ratings yet

- Journal PDFDocument8 pagesJournal PDFEfaz AfnanNo ratings yet