Professional Documents

Culture Documents

To Recognize Transfer of Funds To IA-National Government Agency.

To Recognize Transfer of Funds To IA-National Government Agency.

Uploaded by

Ranie Monteclaro0 ratings0% found this document useful (0 votes)

10 views3 pagesOriginal Title

GAM_A31_Entries

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

10 views3 pagesTo Recognize Transfer of Funds To IA-National Government Agency.

To Recognize Transfer of Funds To IA-National Government Agency.

Uploaded by

Ranie MonteclaroCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 3

1.

In relation to the previous assessment, prepare journal Entries for disbursements assuming that you are the

accountant of the Bureau of the Treasury (BTr).

DATE ACCOUNT TITLE RCA CODE DEBIT CREDIT

Oct. 1, 2018 BIR – Regular Agency Fund

Subsidy to NGAs 50214010 40,000,000

Cash in Bank Local Currency, Savings Account 10102020 40,000,000 40,000,000

Cash in Bank Local Currency, Savings Account 10102030 40,000,000

(To recognize transfer of funds to

IA-National Government Agency.)

Oct. 5, 2018 No Entry.

Oct. 7, 2018 Subsidy to NGAs 50214010 17,500

Cash in Bank Local Currency, Current Account 10102020 17,500 17,500

Cash in Bank Local Currency, Savings Account 10102030 17,500

(To recognize MDS checks negotiated.)

Oct. 10, 2018 No Entry

Oct. 15, 2018 Subsidy to NGAs 50214010 911,094.38

Cash in Bank Local Currency, Current Account 10102020 911,094.38 911,094.38

Cash in Bank Local Currency, Savings Account 10102030 911,094.38

(To recognize MDS checks negotiated.)

Oct. 15, 2018 No Entry

Oct. 18, 2018 No Entry

Oct. 20, 2018 Subsidy to NGAs 50214010 177,539.44

Cash-Tax Remittance Advice 10104070 177,539.44

(To recognize remittance of taxes withheld.)

2. Give examples of journal Entries for disbursement transaction for foreign posts of the government.

The following are the given info. :

Passport and VISA fee collected 500,000

Cash Disbursement Ceiling (CDC) received 300,000

Expenses Paid: Allowances – Civilian Employees 100,000

Rent 50,000 150,000

The accounting entries for the collection of revenue and the constructive receipt of disbursement authority to

Foreign Service Post of DFA and DOLE.

DFA and DOLE’s Book:

DATE ACCOUNT TITLE DEBIT CREDIT

Nov. 18, 2020 Cash – Collecting Officers 500,000

Passport and VISA fees 500,000

(To recognize collection of FSPs.)

Nov. 18, 2020 CIB – Foreign Currency, Current Account 500,000

Cash 500,000

(To recognize deposit of collections to authorized

servicing bank of the FSPs)

Nov. 18, 2020 Cash – Constructive Income Remittance 300,000

Subsidy from National Government 300,000

(To recognize receipt of CDC from DBM)

Nov. 18, 2020 Quarters Allowance – Civilian 100,000

Rents – Building and Structures 50,000

CIB – Foreign Currency, Current Account 150,000

(To recognize payment of expenses charged to CDC)

BTr Book:

DATE ACCOUNT TITLE DEBIT CREDIT

Nov. 18, 2020 Subsidy to NGAs 150,000

Cash – Constructive Income Remittance 150,000

( To recognized constructive receipt of remitted

Collections by FSPs and disbursements charged

to the issued CDCs to FSPs)

You might also like

- 1304亞聚 (N) 凱基05242023Document4 pages1304亞聚 (N) 凱基05242023風雲造天No ratings yet

- Adjustments Unreleased Check: SM Investments Corporation Had The Following Account Balances at December 31, 2019Document3 pagesAdjustments Unreleased Check: SM Investments Corporation Had The Following Account Balances at December 31, 2019Regina Mae CatamponganNo ratings yet

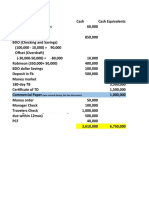

- Far Eastern University: Post-Test1-Cash and Cash EquivalentsDocument9 pagesFar Eastern University: Post-Test1-Cash and Cash EquivalentschristineNo ratings yet

- Answers of Cash and Cash Equivalents AssignmentDocument4 pagesAnswers of Cash and Cash Equivalents AssignmentGee Lysa Pascua Vilbar50% (2)

- Cash and Cash Equivalents - ProblemsDocument47 pagesCash and Cash Equivalents - Problemscommissioned homeworkNo ratings yet

- MODULE 5 - Audit of Cash and Related AccountsDocument176 pagesMODULE 5 - Audit of Cash and Related AccountsAngelo TipaneroNo ratings yet

- Undeposited Receipts. 50,000 Postal Money Orders 90,000 Traveler's Checks On Hand 120,000 Money Market Fund 400,000 Utility Deposit Receipt 100,000Document5 pagesUndeposited Receipts. 50,000 Postal Money Orders 90,000 Traveler's Checks On Hand 120,000 Money Market Fund 400,000 Utility Deposit Receipt 100,000Jeric Lagyaban AstrologioNo ratings yet

- Cash and Cash EquivDocument8 pagesCash and Cash EquivMonina Cabalag0% (1)

- Cash and Cash Equivalents AssignmentDocument15 pagesCash and Cash Equivalents AssignmentJonathan Peter Del Rosario100% (1)

- Your Bill $171.72: Payment SlipDocument2 pagesYour Bill $171.72: Payment SlipKarthik KurapatiNo ratings yet

- 1 Cash and Cash EquivalentsDocument3 pages1 Cash and Cash EquivalentsJohn Aries Reyes100% (1)

- Problem 1 - 1 (IAA) : RequiredDocument11 pagesProblem 1 - 1 (IAA) : RequiredMareah Evanne Bahan50% (2)

- Bsa1acash and Cash Equivalents For Discussion PurposesDocument12 pagesBsa1acash and Cash Equivalents For Discussion PurposesSafe PlaceNo ratings yet

- 3.1 - Audit of Cash ProblemsDocument4 pages3.1 - Audit of Cash ProblemsLorraineMartinNo ratings yet

- La Consolacion College-Manila: School of Business and AccountancyDocument20 pagesLa Consolacion College-Manila: School of Business and AccountancyKasey PastorNo ratings yet

- Composition of Cash Petty CashDocument7 pagesComposition of Cash Petty CashRyou ShinodaNo ratings yet

- Quiz 1 Cash and Cash Equivalent (A)Document2 pagesQuiz 1 Cash and Cash Equivalent (A)JHERRY MIG SEVILLANo ratings yet

- Cash and Cash Equivalents Problem SetDocument3 pagesCash and Cash Equivalents Problem Setmarinel pioquidNo ratings yet

- Quiz-on-Cash-and-Cash-Equivalent-to-Proof-of-CashDocument4 pagesQuiz-on-Cash-and-Cash-Equivalent-to-Proof-of-CashLyanna PinedaNo ratings yet

- ACC 140 1 Period - Quiz 2Document7 pagesACC 140 1 Period - Quiz 2Rica Mille MartinNo ratings yet

- Dumasig - Unit 1 - Cash and Cash EquivalentsDocument7 pagesDumasig - Unit 1 - Cash and Cash Equivalentscherryzza bation100% (1)

- IA Activity 1Document13 pagesIA Activity 1Sunghoon SsiNo ratings yet

- Cash and Cash Equivalents: Intermediate Accounting 1Document3 pagesCash and Cash Equivalents: Intermediate Accounting 1Hershey GalvezNo ratings yet

- Answer To Problems On Cash & Cash Equivalents - Reinforcement DiscussionDocument8 pagesAnswer To Problems On Cash & Cash Equivalents - Reinforcement DiscussionAnnie RapanutNo ratings yet

- Final inDocument7 pagesFinal inSofia GadoyNo ratings yet

- FAR 0 Drill Problem CCEDocument4 pagesFAR 0 Drill Problem CCEyeeaahh56No ratings yet

- FAR103 - FAR - 203 (A) - Cash and Cash EquivalentsDocument3 pagesFAR103 - FAR - 203 (A) - Cash and Cash EquivalentsDan Andrei BongoNo ratings yet

- POCDocument4 pagesPOCAlvin John San Juan100% (1)

- MOD 01 - Cash and Cash EquivalentsDocument3 pagesMOD 01 - Cash and Cash EquivalentsIrish VargasNo ratings yet

- 2022 - 10 - 22 2 - 32 PM Office LensDocument5 pages2022 - 10 - 22 2 - 32 PM Office LensRizalito SisonNo ratings yet

- Cash and Cash EquivalentsDocument3 pagesCash and Cash EquivalentsJessica JamonNo ratings yet

- Cash and Cash Equivalents: Problem 1Document4 pagesCash and Cash Equivalents: Problem 1Hannah SalcedoNo ratings yet

- Sample Probs Cashcash Equiv Bank ReconDocument3 pagesSample Probs Cashcash Equiv Bank ReconKitty CatNo ratings yet

- Gdhsjsiidbebrvrkld PDFDocument19 pagesGdhsjsiidbebrvrkld PDFNuarin JJNo ratings yet

- Ac20 Quiz 1 - DGCDocument10 pagesAc20 Quiz 1 - DGCMaricar PinedaNo ratings yet

- Ia1 Posttest1 - Cash Composition (Key)Document9 pagesIa1 Posttest1 - Cash Composition (Key)Chris JacksonNo ratings yet

- INTACC1Document2 pagesINTACC1Ronalyn LajomNo ratings yet

- AP - Quiz 01 (UCP)Document8 pagesAP - Quiz 01 (UCP)CrestinaNo ratings yet

- 3-Cash and Cash Equiv ExercisesDocument8 pages3-Cash and Cash Equiv ExercisesAngelica CastilloNo ratings yet

- Cash and Cash Equivalents-StudentDocument2 pagesCash and Cash Equivalents-StudentJerome_JadeNo ratings yet

- This Study Resource Was: Homework On CashDocument6 pagesThis Study Resource Was: Homework On CashYukiNo ratings yet

- Practical Auditing Empleo Sol Man Chapter 3Document6 pagesPractical Auditing Empleo Sol Man Chapter 3Elaine AntonioNo ratings yet

- Acctg 205A Cash & Receivables Quiz 10-10-20Document3 pagesAcctg 205A Cash & Receivables Quiz 10-10-20Darynn LinggonNo ratings yet

- Annex M - Trust Receipts-IATF-BtrDocument4 pagesAnnex M - Trust Receipts-IATF-BtrMark Ronnier VedañaNo ratings yet

- Cash and CashDocument13 pagesCash and CashAnonymous WmvilCEFNo ratings yet

- 001 Cash Cash Equi Bank Recon and PocDocument5 pages001 Cash Cash Equi Bank Recon and PocArsenio N. RojoNo ratings yet

- PRACTICAL ACCOUNTING 1 - ReviewDocument21 pagesPRACTICAL ACCOUNTING 1 - ReviewMaria BeatriceNo ratings yet

- EmeDocument12 pagesEmeangelicamadscNo ratings yet

- Government Accounting Quiz 7 Write The Letter Pertaining To Best AnswerDocument5 pagesGovernment Accounting Quiz 7 Write The Letter Pertaining To Best AnswerWilliam DC RiveraNo ratings yet

- 1 Cash and ReceivablesDocument8 pages1 Cash and ReceivablesSamantha Suan CatambingNo ratings yet

- Chapter 2 Cash and Cash EquivalentsDocument10 pagesChapter 2 Cash and Cash EquivalentsShe SalazarNo ratings yet

- Quizzer Cash and Cash EquivalentsDocument10 pagesQuizzer Cash and Cash EquivalentsJoshua TorillaNo ratings yet

- Cannon Ball Review With Exercises Part 2 PDFDocument30 pagesCannon Ball Review With Exercises Part 2 PDFLayNo ratings yet

- One Year of Living with COVID-19: An Assessment of How ADB Members Fought the Pandemic in 2020From EverandOne Year of Living with COVID-19: An Assessment of How ADB Members Fought the Pandemic in 2020No ratings yet

- Strengthening Fiscal Decentralization in Nepal’s Transition to FederalismFrom EverandStrengthening Fiscal Decentralization in Nepal’s Transition to FederalismNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionNo ratings yet

- Public Financial Management Systems—Indonesia: Key Elements from a Financial Management PerspectiveFrom EverandPublic Financial Management Systems—Indonesia: Key Elements from a Financial Management PerspectiveRating: 5 out of 5 stars5/5 (1)

- Finding Balance 2019: Benchmarking the Performance of State-Owned Banks in the PacificFrom EverandFinding Balance 2019: Benchmarking the Performance of State-Owned Banks in the PacificNo ratings yet

- Mas Part3Document74 pagesMas Part3Ranie MonteclaroNo ratings yet

- Finman Written ReportDocument9 pagesFinman Written ReportRanie MonteclaroNo ratings yet

- Innovation and QualityDocument7 pagesInnovation and QualityRanie MonteclaroNo ratings yet

- Ranie B. Monteclaro TAX 311 - Income Taxation Case Study No.1Document2 pagesRanie B. Monteclaro TAX 311 - Income Taxation Case Study No.1Ranie MonteclaroNo ratings yet

- To Be Prepared To Meet The New Challenge Head On and Anticipate Existing and Future Problem Areas With Responsive SolutionsDocument2 pagesTo Be Prepared To Meet The New Challenge Head On and Anticipate Existing and Future Problem Areas With Responsive SolutionsRanie MonteclaroNo ratings yet

- Budgeting The Monthly Income of A Family in Butuan City Name: Date: Direction: Encircle Your AnswerDocument1 pageBudgeting The Monthly Income of A Family in Butuan City Name: Date: Direction: Encircle Your AnswerRanie MonteclaroNo ratings yet

- Variable Findings/DescriptionDocument3 pagesVariable Findings/DescriptionRanie MonteclaroNo ratings yet

- Business Plan Maxx DelightsDocument68 pagesBusiness Plan Maxx DelightsRanie MonteclaroNo ratings yet

- Section 14. Form of Articles of Incorporation. - Unless Otherwise Prescribed by Special Law, The ArticlesDocument2 pagesSection 14. Form of Articles of Incorporation. - Unless Otherwise Prescribed by Special Law, The ArticlesRanie MonteclaroNo ratings yet

- Form 1 Group 5Document2 pagesForm 1 Group 5Ranie MonteclaroNo ratings yet

- EFFECTIVENESS OF TOMATO (Solanum Lycopersicum) AND Molasses As An Alternative Fertilizer in Growing PECHAY PLANT (Brassica Napus L.)Document18 pagesEFFECTIVENESS OF TOMATO (Solanum Lycopersicum) AND Molasses As An Alternative Fertilizer in Growing PECHAY PLANT (Brassica Napus L.)Ranie MonteclaroNo ratings yet

- Ranie B. Monteclaro TAX 311 - Income Taxation Case Study No.1Document2 pagesRanie B. Monteclaro TAX 311 - Income Taxation Case Study No.1Ranie MonteclaroNo ratings yet

- Problems Encountered by Police Personnel in Conducting DrugDocument5 pagesProblems Encountered by Police Personnel in Conducting DrugRanie MonteclaroNo ratings yet

- Enron ReflectionDocument2 pagesEnron ReflectionRanie MonteclaroNo ratings yet

- To Provide Results That Will Help With Social, Professional, and Scientific ExpansionDocument1 pageTo Provide Results That Will Help With Social, Professional, and Scientific ExpansionRanie MonteclaroNo ratings yet

- Strategic Cost ManagementDocument4 pagesStrategic Cost ManagementRanie MonteclaroNo ratings yet

- Ranie B. Monteclaro TAX 311 - Income Taxation Case Study No.1Document2 pagesRanie B. Monteclaro TAX 311 - Income Taxation Case Study No.1Ranie MonteclaroNo ratings yet

- Differentiate Global Integration (Left) To Regional Integration (Right) - in The Middle, Write The Similarities of The TwoDocument5 pagesDifferentiate Global Integration (Left) To Regional Integration (Right) - in The Middle, Write The Similarities of The TwoRanie MonteclaroNo ratings yet

- Ranie B. Monteclaro IBT 311-International Business and Trade ExplainDocument11 pagesRanie B. Monteclaro IBT 311-International Business and Trade ExplainRanie MonteclaroNo ratings yet

- 1.what Is IMF and Why Should An Accounting Professional Become Literate About Foreign Exchange?Document2 pages1.what Is IMF and Why Should An Accounting Professional Become Literate About Foreign Exchange?Ranie MonteclaroNo ratings yet

- Link Entrepreneurship, Entrepreneurs, and Entrepreneurial Firms Using Any Graphical Representation Found in Microsoft Word Software. (Use Smartart)Document3 pagesLink Entrepreneurship, Entrepreneurs, and Entrepreneurial Firms Using Any Graphical Representation Found in Microsoft Word Software. (Use Smartart)Ranie MonteclaroNo ratings yet

- Jollibee Food Corporation Takes Full Control of Mang InasalDocument1 pageJollibee Food Corporation Takes Full Control of Mang InasalRanie MonteclaroNo ratings yet

- The Looking Glass Self BotanywaybootDocument1 pageThe Looking Glass Self BotanywaybootRanie MonteclaroNo ratings yet

- When I See A Barong BarongDocument11 pagesWhen I See A Barong BarongRanie Monteclaro100% (1)

- Investment in BondsDocument1 pageInvestment in BondsRanie MonteclaroNo ratings yet

- in A Venn Diagram, Differentiate FDI (Left) and FPI (Right) - in The Center, Write The Similarities of The TwoDocument2 pagesin A Venn Diagram, Differentiate FDI (Left) and FPI (Right) - in The Center, Write The Similarities of The TwoRanie MonteclaroNo ratings yet

- Law 28Document7 pagesLaw 28ram RedNo ratings yet

- Franklin Templeton Investment Funds Annual Report (Full)Document478 pagesFranklin Templeton Investment Funds Annual Report (Full)read allNo ratings yet

- Correigendum SolarDocument49 pagesCorreigendum SolarKetav PatelNo ratings yet

- Carbon Taxation in BangladeshDocument11 pagesCarbon Taxation in BangladeshOmar AkbarNo ratings yet

- Receipt From STC Pay: Transaction ID: 31910248 Amount 10000.00 INR MTCN 8342234688Document1 pageReceipt From STC Pay: Transaction ID: 31910248 Amount 10000.00 INR MTCN 8342234688Aejaz AhmedNo ratings yet

- Transunion Cibil ReportDocument39 pagesTransunion Cibil ReportSHREYAS KHANOLKARNo ratings yet

- LAS - Q1W1 - Intro To Accounting1Document4 pagesLAS - Q1W1 - Intro To Accounting1marissa casareno almueteNo ratings yet

- Atikah Beauty SalonDocument15 pagesAtikah Beauty SalonEko Firdausta TariganNo ratings yet

- Rizki Permana Eka PutraDocument32 pagesRizki Permana Eka Putrakhoirunnisa ramadhanNo ratings yet

- Applying Lean Construction Principles in Road Maintenance Planning and SchedulingDocument12 pagesApplying Lean Construction Principles in Road Maintenance Planning and Schedulingana majstNo ratings yet

- ACCA108 Problem 15-11 To 15-14Document3 pagesACCA108 Problem 15-11 To 15-14Dominic RomeroNo ratings yet

- Pandit Automotive Pvt. Ltd.Document6 pagesPandit Automotive Pvt. Ltd.JudicialNo ratings yet

- Cost Benefit Analysis Is Done To Determine How WellDocument5 pagesCost Benefit Analysis Is Done To Determine How WellShaikh JahirNo ratings yet

- Section 7 of Court Fee ActDocument15 pagesSection 7 of Court Fee Actzenab tayyab 86No ratings yet

- Ethiopia - Country Strategy Paper 2023-2027 and 2022 Country Portfolio Performance ReviewDocument83 pagesEthiopia - Country Strategy Paper 2023-2027 and 2022 Country Portfolio Performance ReviewgetupfrontNo ratings yet

- Ba 4055 Warehouse ManagementDocument40 pagesBa 4055 Warehouse ManagementDEAN RESEARCH AND DEVELOPMENT100% (1)

- IRCTC IPO Description - IRCTC Limited (Indian Railway Catering and Tourism CorporationDocument6 pagesIRCTC IPO Description - IRCTC Limited (Indian Railway Catering and Tourism CorporationVinay KalraNo ratings yet

- Chapter 1 - Marketing - Creating Customer Value and Engagement PDFDocument25 pagesChapter 1 - Marketing - Creating Customer Value and Engagement PDFmaalouf nicolasNo ratings yet

- INVENTORIES Refer To Assets That Are Held For SaleDocument3 pagesINVENTORIES Refer To Assets That Are Held For SaleNica MontevirgenNo ratings yet

- GST Vishal BhattDocument163 pagesGST Vishal BhattIS WING AP100% (1)

- Effects of Cash Management Practice On Financial Performance of Las Pinas Florita Trading 2Document82 pagesEffects of Cash Management Practice On Financial Performance of Las Pinas Florita Trading 2Rubie Grace ManaigNo ratings yet

- Ts Grewal Solutions For Class 11 Accountancy Chapter 3Document10 pagesTs Grewal Solutions For Class 11 Accountancy Chapter 3Karan SharmaNo ratings yet

- B01 - Financial ManagementDocument7 pagesB01 - Financial ManagementDAVID KIWIANo ratings yet

- Savings CalculatorDocument2 pagesSavings Calculatorjiguparmar1516No ratings yet

- Va Tax HolidayDocument23 pagesVa Tax HolidayWSLSNo ratings yet

- Liberty Insurance Berhad (16688-K) Customer Service Tollfree: 1-300-888-990Document5 pagesLiberty Insurance Berhad (16688-K) Customer Service Tollfree: 1-300-888-990Abdul Hady Abu BakarNo ratings yet

- 07 - Strategies For Competing in International MarketsDocument39 pages07 - Strategies For Competing in International MarketsJohnny RamonNo ratings yet

- Pricing Strategies: Marketing Starter: Chapter 11Document28 pagesPricing Strategies: Marketing Starter: Chapter 11muazNo ratings yet