Professional Documents

Culture Documents

$RC2KGBT PDF

$RC2KGBT PDF

Uploaded by

Raphael LoreteOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

$RC2KGBT PDF

$RC2KGBT PDF

Uploaded by

Raphael LoreteCopyright:

Available Formats

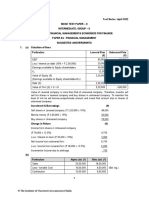

Russell Joseph L.

Lorete I

BSA 3A

Problem 1

Sales evenue 200000.00

Less: Cost of parts sold 125000.00

Gross Margin 75000.00

Less: Out of pocket costs 35000.00

Annual Net Cash Flow 40000.00

Years Cash Flows 20% Factor PV

Investment in Equipment now -60000.00 1.00 -60000.00

Working Capital Needed now -100000.00 1.00 -100000.00

Annual Net Cash Flow 1 to 5 40000.00 2.99 119640.00

Overhaul of Equipment 4.00 -5000.00 0.48 -2410.00

Salvage Value 5.00 10000.00 0.40 4020.00

Working Capital Released 5.00 100000.00 0.40 40200.00

Net Present Value 1450.00

Since the NPV has a positive I will recommend that the new product will be introduced.

Problem 2

Cost 169500.00

Divided by Labor Savings 30000.00

PV 5.65

1-(1+r)^-t

PV=

r Trial and error

5.65r= 1-(1+r)^-10

1-(1+r)^-10

5.65=

r 5.65 x 12% = 1-(1+ 12%)^-10

r= 0.12 0.678= 0.68

You might also like

- Magsino Hannah Florence Activity 5 Discounted Cash FlowsDocument36 pagesMagsino Hannah Florence Activity 5 Discounted Cash FlowsKathyrine Claire Edrolin100% (2)

- KKTiwari - 18214263 - Worldwide Paper Company-2016Document5 pagesKKTiwari - 18214263 - Worldwide Paper Company-2016KritikaPandeyNo ratings yet

- SampaSoln EXCELDocument4 pagesSampaSoln EXCELRasika Pawar-HaldankarNo ratings yet

- $RC2KGBT PDFDocument1 page$RC2KGBT PDFRaphael LoreteNo ratings yet

- $RC2KGBT PDFDocument1 page$RC2KGBT PDFRaphael LoreteNo ratings yet

- $RC2KGBT PDFDocument1 page$RC2KGBT PDFRaphael LoreteNo ratings yet

- $RC2KGBT PDFDocument1 page$RC2KGBT PDFRaphael LoreteNo ratings yet

- Suggested - FM Eco - Test 1Document8 pagesSuggested - FM Eco - Test 1Ritam chaturvediNo ratings yet

- FormulasDocument9 pagesFormulasYajZaragozaNo ratings yet

- AFM IBSB Leverages WordDocument16 pagesAFM IBSB Leverages WordSangeetha K SNo ratings yet

- Non-Current Assets: Hnda 3 Year - 2 Semester 2016 Advanced Financial Reporting Model AnswersDocument8 pagesNon-Current Assets: Hnda 3 Year - 2 Semester 2016 Advanced Financial Reporting Model Answersrwl s.r.lNo ratings yet

- Et Uts 031700012Document2 pagesEt Uts 031700012emilkwd199 KenwoodNo ratings yet

- MaDocument6 pagesMaAashayNo ratings yet

- 3.16 ContributionDocument8 pages3.16 ContributionVishal SairamNo ratings yet

- L19 RC Problems On ROI and EVADocument8 pagesL19 RC Problems On ROI and EVAapi-3820619100% (2)

- Management Accounting SchemeDocument8 pagesManagement Accounting SchemeSpandana Madhan SmrbNo ratings yet

- Chapter 1: Answers To Questions and Problems: Chapter 01 - The Fundamentals of Managerial EconomicsDocument7 pagesChapter 1: Answers To Questions and Problems: Chapter 01 - The Fundamentals of Managerial EconomicsNAASC Co.No ratings yet

- FM PracticalDocument18 pagesFM Practicalarpit200314No ratings yet

- Less: Interest On Debt (10% × ' 2,00,000) : © The Institute of Chartered Accountants of IndiaDocument16 pagesLess: Interest On Debt (10% × ' 2,00,000) : © The Institute of Chartered Accountants of IndiaGao YungNo ratings yet

- Final Summative Assessment - Ae112 (1St Sem 2020-2021) - Quiz 2 Suggested Key AnswerDocument3 pagesFinal Summative Assessment - Ae112 (1St Sem 2020-2021) - Quiz 2 Suggested Key AnswerDjunah ArellanoNo ratings yet

- FM WORKBOOkDocument21 pagesFM WORKBOOkAryan GuptaNo ratings yet

- JournalDocument8 pagesJournalAmelia AndrianiNo ratings yet

- Apr 18 Management Acc 2Document4 pagesApr 18 Management Acc 2Harish KapoorNo ratings yet

- 215Document4 pages215Rand AlqamNo ratings yet

- Class 3 - 28th March 2021Document9 pagesClass 3 - 28th March 2021Bhumika JainNo ratings yet

- FM Assignment1Document6 pagesFM Assignment1Rishi Kumar SainiNo ratings yet

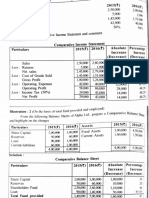

- Unit-2 SUM Comparative, Commonsize, Trend ExamplesDocument14 pagesUnit-2 SUM Comparative, Commonsize, Trend Examplesbhargav.bhut112007No ratings yet

- Tut 8 - Management AccountingDocument29 pagesTut 8 - Management AccountingTao LoheNo ratings yet

- Ma AssigmentDocument32 pagesMa AssigmentAashayNo ratings yet

- CAPITAL STRUCTURE Sums OnlinePGDMDocument6 pagesCAPITAL STRUCTURE Sums OnlinePGDMSoumendra RoyNo ratings yet

- Isna Wirda Lutfiyah - 17 - 4-17Document10 pagesIsna Wirda Lutfiyah - 17 - 4-17DewaSatriaNo ratings yet

- Marks Question No. 1Document6 pagesMarks Question No. 1kami0005No ratings yet

- Group Assesment Part B 1,2,3Document7 pagesGroup Assesment Part B 1,2,3YajZaragozaNo ratings yet

- Bank A Regulation ExDocument4 pagesBank A Regulation ExCarlos Diaz SanchezNo ratings yet

- Responsiblity Accounting IllustrationDocument14 pagesResponsiblity Accounting IllustrationRianne NavidadNo ratings yet

- BookDocument3 pagesBookmanalnasnkjfnsdkjndjknxNo ratings yet

- Sem IV CFA SolutionDocument10 pagesSem IV CFA SolutionFaheem KwtNo ratings yet

- Midterms MADocument10 pagesMidterms MAJustz LimNo ratings yet

- Book1 COST SHEETDocument3 pagesBook1 COST SHEETAshish KhandelwalNo ratings yet

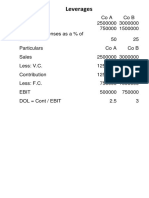

- Chapter 3 - LeveragesDocument9 pagesChapter 3 - LeveragesParth GargNo ratings yet

- Case 5 Ans - Charmingly YoursDocument4 pagesCase 5 Ans - Charmingly YoursVaness Grace Aniban100% (4)

- Quiz ManaSciDocument15 pagesQuiz ManaSciRocio Isabel LuzuriagaNo ratings yet

- CA Inter FM Super 50 Q by Sanjay Saraf SirDocument129 pagesCA Inter FM Super 50 Q by Sanjay Saraf SirSaroj AdhikariNo ratings yet

- Comparative Income StatementDocument12 pagesComparative Income StatementBISHAL ROYNo ratings yet

- UntitledDocument36 pagesUntitledCiana SacdalanNo ratings yet

- Cisb 243/cisb3433 - Is Project Management - Midterm ExaminationDocument5 pagesCisb 243/cisb3433 - Is Project Management - Midterm ExaminationNalesh AnanshaNo ratings yet

- Water Wonders, Inc., Ocean Adventures Makers of Custom-Made Jet Skis, TheDocument3 pagesWater Wonders, Inc., Ocean Adventures Makers of Custom-Made Jet Skis, Thelaale dijaanNo ratings yet

- Loan Loss Provision TaxDocument13 pagesLoan Loss Provision TaxSabin YadavNo ratings yet

- Ffa ADocument5 pagesFfa Aaccounts officerNo ratings yet

- DR Rachna Mahalwla - B.Com III Year Management Accounting Flexible BudgetingDocument6 pagesDR Rachna Mahalwla - B.Com III Year Management Accounting Flexible BudgetingSaumya JainNo ratings yet

- Tutorial 5 - Mini Case Study Correct SolutionDocument2 pagesTutorial 5 - Mini Case Study Correct Solutionapi-3708231No ratings yet

- Net Income ApprochDocument11 pagesNet Income ApprochMahedrz GavaliNo ratings yet

- AFA IIP.L III SolutionJune 2016Document4 pagesAFA IIP.L III SolutionJune 2016HossainNo ratings yet

- Business Risk:: Invesdted Capital Is Difference Between Total Assets and Working CapitalDocument5 pagesBusiness Risk:: Invesdted Capital Is Difference Between Total Assets and Working Capitaldua tanveerNo ratings yet

- OjoylanJenny - Charmingly (Case#5)Document5 pagesOjoylanJenny - Charmingly (Case#5)Jenny Ojoylan100% (1)

- LEVERAGESDocument4 pagesLEVERAGESdonadisamanta9No ratings yet

- Break-Even Occurs Between The Production Volume Interval of 20,000 To 30,000Document6 pagesBreak-Even Occurs Between The Production Volume Interval of 20,000 To 30,000kripsNo ratings yet

- Shri WCMDocument9 pagesShri WCMIrfan ShaikhNo ratings yet

- Cell Name Original Value Final ValueDocument13 pagesCell Name Original Value Final ValueAyman AlamNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- $RC2KGBT PDFDocument1 page$RC2KGBT PDFRaphael LoreteNo ratings yet

- $R0LP7DLDocument1 page$R0LP7DLRaphael LoreteNo ratings yet

- $RC2KGBT PDFDocument1 page$RC2KGBT PDFRaphael LoreteNo ratings yet

- Russell Joseph L. Lorete Bsa 3 A Quiz Problem 1Document4 pagesRussell Joseph L. Lorete Bsa 3 A Quiz Problem 1Raphael LoreteNo ratings yet

- Russell Joseph L. Lorete Bsa 3 A Quiz Problem 1Document4 pagesRussell Joseph L. Lorete Bsa 3 A Quiz Problem 1Raphael LoreteNo ratings yet

- $RC2KGBT PDFDocument1 page$RC2KGBT PDFRaphael LoreteNo ratings yet

- $RC2KGBT PDFDocument1 page$RC2KGBT PDFRaphael LoreteNo ratings yet

- Russell Joseph L. Lorete Bsa 3 A Quiz Problem 1Document4 pagesRussell Joseph L. Lorete Bsa 3 A Quiz Problem 1Raphael LoreteNo ratings yet

- Russell Joseph L. Lorete Bsa 3 A Quiz Problem 1Document4 pagesRussell Joseph L. Lorete Bsa 3 A Quiz Problem 1Raphael LoreteNo ratings yet