Professional Documents

Culture Documents

TOA - Mock Exam and Lecture Notes

TOA - Mock Exam and Lecture Notes

Uploaded by

sunflower0 ratings0% found this document useful (0 votes)

63 views46 pagesaaa

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentaaa

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

Download as pdf

0 ratings0% found this document useful (0 votes)

63 views46 pagesTOA - Mock Exam and Lecture Notes

TOA - Mock Exam and Lecture Notes

Uploaded by

sunfloweraaa

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

Download as pdf

You are on page 1of 46

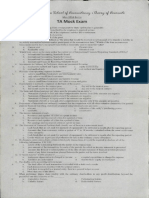

e ReSA.- The Review School of Uccourtanrcy. «Theorg of Accourte

May 2016 Barc

TA Mock Exam

1. Compensation expense resulting from a'compensatory share option plan is generally:

A «4, allocated to the periods benefited by the employee's required service

bb. allocated over the periods of the employee's service life to retirement

©. recognized in the period of exercise

4. recognized in the period of the grant

2. Under PERS 13, fair value is defined as “the price that would be received to sell an asset or to transfer a liability in

‘an orderly transaction between market participants at the measurement date.” Which of the Four measurement

thases mentioned in the Conceptual Framework is essentially used fo mean fair value?

B a, Current cost Present val

b. Realizable value 4. Historical cost

3. Which body serves as the main author the current set of International Financial Reporting Standards (IFRSs)?

A ‘4. Intemational Accounting Standards Board

. International Accounting Standards Council

Intemational Accounting Standards Committee

4. International Financial Reporting, Standards Board

4. Investments in Ordinary & Preference shares are accounted for using,

B a, revaluation method and Equity method c. equity method only

b. cast method only d. cost method and Equity method

5. Revenve of an operating segment includes

A ‘sales to unaffiliated customers and intersezment sales

>. only sales to unaffiliated eustomers

©. sales to unaflifiated customers and interest revenue

sales to unafftiated customers and other revenue and gains

6. Depreciation is normally computed on the basis of the nearest

A 11, full month and to the nearest peso. day and o the nearest peso.

b. full month and to the nearest eentavo. 4. day and to the nearest centavo.

7. ‘The basic and diluted earnings per share must be presented in an entity's:

A ‘4. Statement of profit or loss and other comprehensive income even if the amounts are negative

b. Statement of financial position even if the amounts are ne;

©. Statement of changes in equity even ifthe amounts are negat

4. Statement of profit or loss and other comprehensive ineome only ifthe amounts are positive

8. Proponents of historical cost ordinarily maintain that in comparison with all other valuation alternatives for general

‘purpose financial reporting, statements prepared using historical costs are more

DB relevant © ve of the ent ing power.

b. verifiable. 4 ative

9. The income statement reveals —__

B 44, Resources and equities of a firm at a point in tims

bb. Net earings (net income) ofa firm for a period of time,

. Resourees and equ

Net earnings (net income) ofa firm at « point in ime,

10, The Statement of Financial Position shall classify one of these as a non-current asset.

ic 4 Cash funds that are set aside for payment of equipment to be delivered a month after the reporting period

b. Amounts due from customers within a period of 12 to 18 months, extended within the usual credit terms

ofthe enterprise

fe. Cash funds that are set aside for payment of equipment to be delivered a month after the reporting period

4. Goods which are in process of production for sale in the ordinary course of business

11, Ifa business entity entered into certain related party transactions, it would be required to disclose all of the

{following information, EXCEPT:

D ‘nature ofthe relationship between the parties to the transactions.

. peso amount ofthe transactions for each of the periods For which an income statement is presented

©. amounts due from orto related partes as ofthe date of each statement of financial postion presente

nature of any future transactions planned between the parties and the tennis involved

12. A *seoret reserve” will be ereated if

c ‘a. inadequate depreciation is charged ( income ¢. a eapital expenditure is charged to expense

. liabilities are understated d. shareholders’ equity is overstated

13. The double-entry accounting system means

A fa. ‘The dual effect of each transaction is recorded with a debit and a credit

}b. Each transaction is recorded with two journal entries.

Fach item is recorded in 1 journal entry, then in a general ledger account

4d. More than one of the above.

14. When preference shares share ritably with the ordinary shareholders in any profit distributions

prescribed rate this is known as the _

© a. Cumulative feature, c. Participating feature

b.Callable feature d. Redeemable feature

ReSlh. The Review School of Cccountoney, TA Mock Exam

PREWEEK MATERIALS in THEORY of ACCOUNTS (May 2016 Batch) Page 2

D

18. When a company has acquired a "passive interest”

for the investment

a. by using the equity method €. by consolidation

'. by using the effective interest method 4. by using the fair value method

16. The accounting equation must remain in balance io

‘Only when formal financial statements are prepared.

bb. Throughout each step inthe accounting eyele

Only when journal entries are recorded

{Only al the time the trial balance is prepared.

17. When treasury shares are purchased for more than the par value of the shares and the eost method is used to

‘account for treasury shares, what aecount(s) should be debited?

ah Treasury shares for the par value and share premium for th

‘another corporation, the acquiring company should account

excess of the purchase price over the

par vale

bb. Treasury shares for the purchase price.

fc. Share premium for the purchase price.

Treasury shares for the par valve and retained earnings for the excess of the purchase price over the

par value.

18, Long-terin debt that matures wit

jn one year and is to be converted into shares shoukd be reported

‘2, as non-current ifthe refinancing agreement is completed by the end of the year.

b. asa.current liability.

c. ina special section hetween liabilities and equity

das part current and part non-current.

19, The amount of time that is expected to clapse until an asset is realized or converted into cash i referred to as

a, solvency liquidity

b. financial lexibili 4d. exchangeability

20, A segment ofa business enterprise ist be reported separately when the revenues of the segment exceed 109% of

the

‘4, total combined revenues of all segments reporting profits

b, total export and foreign sales

© €._ combined net income ofall segments reporting profits

PQ. total revenues of all the enterprise's industry segments

231. Anacounting system thot collects financial data on the basis ofthe underlying nature and extent of cost drivers is:

a. Cycle-time costing Activity-based costing

b. Variable costing d, Target costing

D

22, The date on Which to measure the compensati

rily is the date on which the employee _

‘a. is granted the option

bb. has performed all conditions precedent to exereising the option

may first exereise the option

dd, exereises the option

23, General-purpose financial reports

Mh Are largely based on estimates and judgments rather than exact depiction

bh. Are intended to provide information to a specifte group of users

Are designed to show the value of the reporting entity

‘d, Can provide all the information that primary users need

24, Based on the Implementing Rules & Regulations of Republic Act 9298 (|

element in q share option granted to a corporate employee

ine Accountancy Act of 2004),

how long is the renewable term of the chairman and members of Financial Reporting Standards Council (FRSC)?

a. 6 years years

b. Syears 4 3 years

25, Financial siatement of not-for-profit organization (NPO) focuses on _

‘i Standardization of funds nomenclature

Basic information for the organization as a whole

©. Inherent differences of notforsprfit organization that impact reporting presentations

{L__Distnetions between current fund and noncurrent Fund

26. Which ofthe following should be disclosed i a "Summary of

{t. Depreciation method followed

b._‘Types of exceutdry contracts

Claims of equity holders

4. Amount for eummulative effect of change in accounting policy

27. Which ofthe following steps inthe accounting eyele may be omitted?

‘Certain udjusting entries ae reversed ©. Entries

1. Financial statements are prepared Adjusting entries are jourmalized

28. Which of the following evenis occurring after the reporting period (ie. subsequent events) would require

adjustments in the financial statements?

‘a. Purchase of an existing business

‘b. Dectine in net realizable vahie of inventory as result of fire

4

jean Accounting Policies?”

Sale of a bond or share capital planned before the balance sheet dat

Toss on an uncollectible trade receivable as a result of a customer's deteriorating financial condition

Jeading to customer's bankruptcy subsequent to balance sheet date

Re SO. the Review School of Cecowmtomer TA Mock Exam

PREWEEK MATERIALS in THEORY of ACCOUNTS (May 2016 Batch) - Page 3

29. ‘The quality of information that means the numbers and descriptions match what really existed or happened is:

D Neutrality €. Relevance,

hb. Faithful representation a Compl

30. ‘The journal entry debiting accounts receivable and crediting allowance for doubtful aceounts would be made when

c ‘4 customer pays its account balance

'b. customer delitults on its aecount

©. previously defaulted customer pays its outstanding balance

d, estimated uncollectible receivables are too low

31. A company uses a two-way analysis for overhead variance: budget (controllable) and volume, The volume

variance is based on the:

D ‘a, Total overhead application rate ©. Variable or fixed overhead app!

b. Variable overhead application rate Fixed overhead application rate

32. A corporation issues bonds with detachable warrants. The amount to be recorded as share premium is preferably

B a.” zero

bb. calculated as the excess of the proceeds over the fair value of the bonds

c. ealeulated as the excess of the proceeds over the face value of the bonds

d, equal to the market value of the warrants

33. When an intangible asset is acquired by an exchange of assets, which of the following measures will need to be

considered in the determination of the cost

A i. Fair value ofthe asst given up . _Carying amount of the asset received

bb. Initial cost ofthe asset given up 4. Replacement cost ofthe aset received

34. The purpose of the Intemational Accounting Standards Board (IASB) isto

A a. Develop a single set of high-quality Intemational Financial Reporting Standards,

by. Issue enforecable standards which regulate the financial reporting of multinat

©. Arbitrate accounting disputes between auditors and international companies.

4 Develop a uniform currency in which the financial transactions of companies through-out the world would

tl corporations.

be measured.

35, What are consigned inventories?

A ‘a, Goods that are shipped, but title remains with the shipper.

+b, Goods that are sold, but payment is not required until the goods are sol.

‘c. Goods that have been segregated for shipment (0 4 customer.

‘d, Goods that are shipped, but title transfers to the receiver.

36. In an ABC system, what should be used 10 assign a department’s manufacturing overhead costs to products

produced in varying lot sizes?

© ‘a, Asingle cause-and-effect relationship Multiple cause-and-cflect relationships

b les values of the products 4, A product's ability to bear cost allocations

37, The earnings per share computation is NOTrequired for:

c a, Net income.

, Gain on disposal of discan

©. Income from operations.

d.__ Income from continuing operations.

38. One ofthe Follo NOT required to be measured at fair value plus transaction cost

c ‘4. Available for sale financial assets © assets held for trading

. Held-to-maturity securities a 1s and receivable

39. ‘The declaration and issuance of a share dividend:

increases ordinary shares outstanding and increases total equity

bb. decreases retained earnings but does not change total equity

e. “may increase share premium but does not change total equity

4d, increases retained earnings and increases total equity

40. LENRV of inventory

D should always be equal to net realizable value

'b. may sometimes be less than net realizable value

should always be equal o net realizable valuc less costs 10 complete

4, is always either the net realizable value or its cost

4k. ‘The statement of financial position of NPO shall report separately 3 classes of net assets that EXCLUDE

A a. Donated net assets €. Temporarily restricted net assets

b, Unrestricted net assets 4. Permanently restricted net assets

42. When the cash proceeds from bonds issued with detachable share warrants execed the fair.value of the bonds

without the warrants, the excess should be eredited t0

B ‘8, Share Premium —Ordinary Retained Famings

b. Share Premium-Share Warrants d, A share liability account

43, The statement of financial position:

Makes very limited use of judgments and estimates

Uses fair Value for most assets and liabilit

many items that are of financial value,

All ofthe choices are correct regarding the statement of financial position

jch of the following measurements is NOT a required disclosure for inventories?

‘a. The circumstances or events that lead to the reversal of write-downs.

'b. The circumstances or events that lead to the write-downs,

a,

ied operation, net of tax

44, Whi

B

rentories carried at fair value less costs to sel

ReSlh The Review School of lccourtoney, TA Mock Exam

PREWEEK MATERIALS in THEORY of ACCOUNTS (May 2016 Batch) -Page 4

TS. Which of the following subsequent events would generally require disclosure, but NO adjustment of the financial

fatements?

Dd a. Retirement ofthe eompany president

fh Settlement of litigation when the event that gave rise tothe litigation oceurred prior to the statement of

Sinancial postion date

Employee strikes

Dividend preferences ¢, Conversion oF exereise prices

b. Call prices <4. Liquidation preferences,

Si. Under PAS 2 the fixed production overhead is allocated to the inventory units on the basis of the production

facility's

c ‘Weal eapacity Normal capacity

be Actual capa 4. Theoretical capa

52, Dividends are NOTpaid on

c ‘4. noncumulative preference shares &. treasury

_nonparticipating preference shares all otthe choices

53. PAS Lidentfes its all changes in equity other than introduction and return of capital fo owners

b a. Profi ce. Net income

b. Total comprehensive income Other comprehensive income

54, Ofthe methods to reeord cash discounts related to aecounts receivable, whieh fs more theoretically corcet?

A a. Netmethod c. Gross method

bh Direct write-off method Allowance method

55, Joint eosts are used for

Dd ‘4 ‘comtolling costs

>, setting the selling price ofa product

¢. determining whether to continue producing an item

4. determining inventory costs for accounting purposes

456. Statement of financial postion information is useful for ull ofthe following, EXCEPT

Dd a. assessing a company’ risk ‘_cvalating a company’s financial Mexiility

b. evaluating company’s liquidity determining free cash flows

57. Which ofthe following is NOT a condition necessary t exclude a short-term obligation fram current Vibilities?

c ‘4. Intend to refinance the obligation on a longsterm basis

Obligation must be due within one year

€. Subsequently refinance the obligation on a long-term basis

Unconditional right to deer settlement of the liability for atleast 12 months.

58. Which of the following is NO necessarily reganded as onproft organizations?

D Cooperatives ¥ ©. Labor unions

b. Country clubs 4

59, ‘The balance in Ordinary Share Dividend Distributable should be reported as a(n)

c “a deduction from share capital-—ordinary —-c:_-addifion to share eaptal—ordinary

b. current lability «contra current asset

60. Which of the following adjusting entries will NOT affect both the balance sheet and income statement?

© a Acerved income

'. Uneamed income using the fabiity method

©. Nonvof the choices, bih statements are affected by adjusting journal entries

4. Prepayments using the expense metho!

61, Ifparmers dd not agree on any profit sharing scheme, the partnership profit shall be divided among them based on

B ‘2. Equal sharing Follow-up investment

Initial investment &. Existing capital

62. When a customer returns merchandise for cash refund, the seller enters the transaction in the

b a. General jouimal 6 Cash receipts journal

bb. Cash payments journal Salles journal

oe ee Pe, a Ce ee ee

© RSA. the Review School of lecorndemey TA Mock Exam

PREWEEK MATERIALS in THEORY of ACCOUNTS (May 2016 Batch) -Poge 5

63. For non-monetary exehange of plant assets, aecounting recognition should NOT be given to

Dd 4 Alloss when the exchange has commercial substance

. A gain when the exchange has commercial suhstance

€ loss when the exchange has no commercial substance.

4. A gain when the exchange has no commercial substance.

64. An entry is NOTmade on the

D a date of declaration ©. dates of declaration, record and paym

b. date of payment d. date of record

65. Which of the following is NOT an example ofa risk of ownership of an asset

A Gains on the eventual sale of the asse €. Idle capacity

b. Technical obsolescence 4. Uninstired damage

66, According to PAS 1, which of the following are NOT commonly required disclosures of accounting policies?

B a, The measurement basis or bases used in the financial statem

b. Personnel involved in drafting the summary of signifi

‘made the judgrments and estimations

©The nature of « company's operations and the policies that the users oF its financial statements would

expect to be disclosed for that type of entity

4. Disclosures required by other IFRSs, like the reasons why the entity's ownership interest does not

constitute control

67. What is the relationship between current li

A 4, Liquidation of current liabilities is reasonably expecte:

year if more).

b. Current liabilities are the result of operating transactions

Current liabitities can't exceed the amount incurred in one operating eyele.

d. ‘There is no relationship between the two,

68. What is a purpose of having « Conceptual Framework?

D To provide comparable information for different companies

b. To segregate activities among competing companies,

© To make sure that economic activity ean be identified with a particular legal entity.

4, To enable the profession to more quickly solve emerging practical problems and to provide a foundation

from which to build more useful standards,

69, ment information would help in which of the following tasks?

D a, Evaluate the solvency of « company, ‘¢. Evaluate the liquidity of a company.

b, _ Bstimate future financial flexibility 4. Estimate future cash flows,

70. In considering interim financial reporting. how does PF'RS conclude that such reporting should be viewed”?

B 4 Asa "special" type of reporting that need not follow international financial reporting standards

b, Asreporting fora separate accounting period

© Asuseful only ifactivity is evenly spread throughout the year so that estimates are unnecessary

As reporting for an integral part of an annual peri

71. Activity-based costing (ABC) frst assigns costs to

if accounting policies or, including those who

within the company’s operating eyele (or one

B a. Departments © Prod

Activities 4 Overhead

72. Preparing the statement of cash flows, using the indireet method, involves all of the following, EXCEPT

« cash provided by operat

b. change in cash during the period

©. cash collections from customers during the period

4. cash provided by or used in investing and financing activities

73. Accounting for nonprofit organizations is essentially:

dD a. State accounting Managerial accountin

b. Commercial accounting d. Fund accounting

74. ‘The date on which tofal compensation expense is computed in a share option plan isthe date

A a. of grant that the market price the option price

b, of exercise 4, that the market price exceeds the option price

75. Joint product costs are generally allocated using the

c Additional costs after split-off © Relative sales value

b. _ Relative profitability 4. Direet labor hours

76, ‘The major difference between convertible debt snd share warrants is that upon exercise of the warrants:

B ‘a2 the shares are held by the company for a defined period of time before they are isstied to the warrant

+ holder.

b. the holder has to pay 4

nowt oF eash to obtain the

volved ate restricted and ean only be sold by the recipient after a s

be a part of the transaction.

ted with preference shares include all of the following, EXCEPT

©. the shares i period of time

no share premium e

77. The features most frequently ass

A a. Callable at the option of the sharcholder. ©. Non-voting,

b. Convertible into ordinary shares, 4. Preference as 10 assets in the event of liquidation

inling to PAS 1, a required format for the presentation ofthe income statement is

B a. not prescribed and nce is provided in the standard

od in the standard for suitable format

prescribed but guidance is prov

€. __preseribed by the standard

4. not prescribed by the standard but details are found in the Corporations Act

ReSU. the Review School of lecomtaney TA Mock Exam

PREWEEK MATERIALS in THEORY of ACCOUNTS (May 2016 Batch) Page 6

79. Stundard cost variances are not closed (0 a

B a, Work-in-process c. Finished goods

b, — Dirwet materials d. Costs of goods sold

80, Under NGAS, itis the allotment by the Central office o its Regional offic

Regular allotment .Subalfotment

b. Ordinary Allotment Secondary’ Allotn

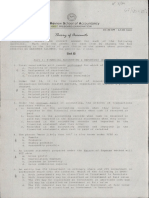

SECOND SEt

|. Liabilities which fai the reco,

on criteria and where the possibilty of an outflow is remote should

c 1. Be recognized as 1 contingent liability ‘e, Not he recognized in the financial statement

b. * Be recognized as an acerual d. Be recognized as a provision

2. Its function is to assist the Financial Reporting Standards Council (FRSC) in establishing and improving financial

reporting standards in the Philippines as it issues implementation guidance on existing Philippine Financial

dards.

B Education Task Foree Professional Regulations Commission

Philippine Interpretations Committee 4, Board of Accountancy

3 vent of eash flows typi lose the effects of a.

© 4, Ordinary shares issued at an amount gre

Share dividends declared.

Cash dividends paid,

4. In hyperinflationary: economy, balance sheet amounts not expressed in the

date are restated by appl

‘Consumer pric

string unit current at balance sheet

‘¢. Manulacturer price index

b. Suggested retail pri General price index

5. The disclosure of accounting policies, is important to financial statement readers in determi

B a. Net income for the year

bh. Whether accounting policies are consistently applied trom year to year

& The value oF obsote

4. Whether the working capital position is adequate for future operations.

6. Which of the following isa benefit of providing financial information?

Diselosure to competition. ‘c. _ Iinproved allocation of resources

b. Aad 4. Potential litigation.

ing inventory

7. When accounting for a biological asset oF an agricultural produce, which of the following is NOT w cost to sell?

c a. Commission to brokers Transfer costs to get assets to a market

bh. Transter taxes ame! dies d._- Lovies by regulatory agen

8. PFRS for SMEs strictly requites disclosure of information abo

Related party transactions €. Seginent inform

4. tnterim financial reports

B Atter the statement of finane

b. After the statement of finane

Before the statement of financial post ted after that date

Define the statement of financial position date, but dated as of that date

10. Which of the following is NOT related to profit distributions by a corporation?

B ‘a. The amount distributed to owners must be in compliance with the laws governing corporations.

'b. The amount distributed in any one year can never exceed the net income reported for that year

Profit distributions must be formally approved by the board of directors.

Dividends must he in full agreement with the capital contracts as to preter

11. Which of the following is NOT considered an agricultural activity”

restricto

A ‘Ovean fishing Peart tn

b, Fish farming Oyster &

12, Retained earnings are a component of:

B a. Other equity, © Comtribu

bh. Reserves 4. Comprehes

13, ‘The trial balance:

A ‘a, Can be used to uncover errors in journalizing and postin,

b, Is used to prepare the statement of fi

income statement

©. Isa listing of all the accounts and their balances in the order the accounts appear on the st

Finaneial position

d. Has as its primary purpose to prove (check) that ull journal

ncial position while the general ledger is used to prepare the

sment of

ries were made for the period.

14. At what amount per share should retained earnings be reduced for 8 20% share dividend’?

c a. Zero Par value

b, | Market value atthe date of declaration ‘d.— Market value at the date of issuance

that most likely would have no ef¥eet on 2015 profit is the:

2001 deemed worthless in 2015

building contributed by 3 sh

Colleetion in 2015 of a dividend fox

d. Correction of a prior period error discovered in 2015 subsequent (0

15. The oceurrenes

olde

ssuance of the statements

ReSA. the Review School of CecourFanen TA Mock Exam

PREWEEK MATERIALS in THEORY of ACCOUNTS (May 2016 Gatch) Page 7

a

16,

19,

20,

30.

1. Accounting for Build-Operate-Transfer (“BOT”) t

The major problem of accounting, for intangibles is determining

a. wefutlife separability

b. fair value d. salvage value

ment of cash flows, Sale of treasury stock at an umount greater than cust would be classified as

©. extraordinary a

@. investing activity

pensation expense is generally

vie

®. not recognized because no excess of market price over the option price exists atthe date of

b. allocated over the service period of the employees

¢. recognized in the period of the grant

ized in the period of exercise

Which of the following is iple of managing earnings u

a ating warranty elaims.

By facet crest WEE Bx tl cing lel

i Decreacing ctloted aalvage value of equipment,

and gross prof income and pretax income

b. income from continuing operations d. discontinued operations & prior period errors

Under the equity method of accounting for investments, an investor recognizes its share of the earnings in the

period in which the

investor sells the investment

investor declares dividends

¢. earnings are reported by the investee in its fi

4. _investee pays dividends

An entity is requ

relevant and provide more rel

unless it is considered more

ed 10 classify its assets and Tiabilities as current or non-currer

able information to present them according to their:

Age eV

b. Liquidity Physical nature

The statement of figancial position of nonprofit organization (NPO) displays the organization's 2

? cc. Excess of assets over liabilities

b. Assets, 4 Assets, liabilities and net assets

Jn sesso hs sage elipoG.9 foe tc tex cnipcchgne cui ofan eat PAS 1 prescribes

cms that are censier to hea sliien importance to warrant present

ea fixed format for the pre

4d. the presentation of fine items comprising total expense ms comprising total revenue

11s an authorization issued by the DBM to government agencies to withdraw cash from the National Treasury

through the issuance of Modified Disbursement System checks,

a. Notice of Cash Allocation ©

b. Allotment 4

In comparison with firms that use plant-wide overhead rates a

adopted activity-hased costing, will typically use:

sntal overhead rates, companies that have

4. More cost pools and more éost drivers © Fewer cost pools and more cost drivers

b, More cost pools and fewer cost drivers d. Fewer cast pools and fewer cost drivers

‘The “contractual adjustment account” of a nonprofit hospital is-a (an):

‘a. Expense account ©. Loss account

b. Contra-revenue account Asset nccount

A journal entry to record expenses out of the petty cash fund shall be done:

2, Upon disbursement ¢. - Upon replenishm

b. Whenever the entity wishes d.Atthe end of the period

nsactions is mostly covered by the eurre

Philippine

Reporting Standards based on:

a IFRIC 12 (Service Concession Arrangements)

b.- Exposure Draft on Turnkey Project Arrangements

©. PAS 11 (Construction Contracts)

dd. TERIC LS (Agr

Which of the following is an example of managing eamings down?

‘Changing estimated bad debts from 3% to 2.5% of sales.

b, Not writing off obsolete inventory

Revising the estimated life of equipms

4. Reducing research and development exy

Direct material costs are:

a. Prime a

'b. Prime and manufacturing costs 4

J conversion costs ©

Redeemable preference shares should be 3

4. included with ordinary s

b, excluded from the sta

position

© included as a liability

4d. included as a contra item in sharcholders’ equity

ReSlh. the Review School of Cccormony, TA Mock Exam

PREWEEK MATERIALS in THEORY of ACCOUNTS (May 2036 Batch) - Page 8

33, PFS 5 requires that a single

D 1 the post-tax profivoss. on discontinued operations and. the pre-tax

od operational wssets

protividss om disco

discontinued operational assets.

the pre-tax profivloss on diseon

al assets

mount be disclosed within the income statement for _

nued operations and the posttax ga

ved operations andl the pre-tax g

‘operatio

the posttax profivloss. on discontinued. operat

discontinued operational assets

ler the revised PERS 9, the cumulative balance of unrealized gain of Invest

‘Comprehensive Income shall be transferred to what equity account upon disposal

Dd a Revaluation surplus

bb. Share pret 4, Accumulated prof

35. The fll disclosure principle, as adopted by the account

A 8. Disclosure of any

ns and the post

neial facts significant enough to influ informed reader.

ice the judgment of

uded.

b. Information about each account by

faotes to the: Financial ta

© Enough information should be disclosed in the

profitable decision

business and operating objectives is required to be disc

ice appearing in the financial statements is to be

ris.

ed

36, What would be an adv

D a. Consistency ©. Lower preparation costs

bh. Comparability 4, Comparability and lower pre

37. PAS 1 requires the following. items 10 appear vin the tace of the Statement of Changes in Equity

1: The net amount of eash from the issue of any securities daring the period

Ti The cumulative effect of changes in avcounting policy and the correction of errors

Ml: Total comprchensive income for the period

tage of having all countries adopt and follow the same-accounting standards?

TV: Profit or loss for the perioa!

B a. Mand IV only e Lland Vv

bo U,Mand 1V d.LOLIH and 1V

38. ‘The objective of financial reporting in the Conceptual Fr

‘4. Is the foundation for the Framework

fs found on the thin level of

Lower of cost or NRV © Biological asset > Fair value less costs

b, _ Receivables > Cost 4, Inventories > Estimated amount collect

77, Under PAS 24, which of the following does NOY belong to the category “NOT nevessarily related parties”of the

reporting entity?

A ‘4, Post-employment benefit plans Public utilities

b. Providers of finance d. Trade unions

78. ltems that are dissimilar in nature must be presented separately in financial statements, UNLESS:

B ‘a. They are financial items in which ease they can be off-set

b. They are immaterial

The directors approve of an aggregation of the item

d, The auditors approval to aggregate the items is obtained

79. PERS requires that a company report all to the following, EXCEPT

c a, major customers ©. liquidity ratios

segment assets and liabilities d. segment profits and loss and related information

80, To be consistent with the historical cost principle, overhead costs incurred by an enterprise constructing its own

should be

allocated on the basis of lost production,

climinated completely from the cost of the asset

‘allocated on a pro rata basis between the asset and normal operations.

4d. allocated on an opportunity cost basis.

‘A contingent liability usually exists when a customer note receivable is

a Pledged c. Assigned

b. Discounted with recourse 4d, Discounted without recourse

2. In hyperinflationary economy, balance sheet amounts not expressed in the measuring unit current at balance sheet

date are restated by applying the:

D ‘a, Constimer price index © Manufacturer price index.

b. Suggested retail price index a

3, The following statements pertain to the Capital and Capital Maintenance Concepts under the Conceptual

Framework:

Statement I. The principal diference between two concepts of capital maintenance isthe treatment of the effects

‘of changes in the prices of assets and liability ofthe entity.

ratement I. The selection of the appropriate concept of capital by an entity should be based on the needs of the

‘users ofits financial statements.

Statement IIT. The concept of capital maintenance chosen by an entity shall determine the acco

inthe preparation of its financial statements

1g moxdel used

c a, Only statement i false €. None of the foregoing statements is false

'b, Only statement I is false dd. Only statement I is false

4. Cash dividends received by the investor shall be treated as

c ‘4. return on investment (cost method); return on inve' ~quily method)

bb. _retum of investment (cost method): retumn on investment (equity method)

. _retum on invesiment (cost method); return of investment (equity method)

4. return of investinent (cost method); retum of investment (equity method)

5. Which isan argument against using historical cost in accounting?

A ‘4, Fair values are more relevant

1b. Historical costs are reliable.

¢, Fair values are subjective:

4. Historical costs are based on an exchange transaction.

Information that is able to confirm or correct past evaluations that have been made by users of

formation is an example of information that satisfies which of the following characteristics of

information identified in The Framework?

D a. Understandability Comparability

b, Faithful representation ad. Relevance

7. A-company doing a bank reconciliation shall record a customer check marked as “NSF” by

A 4. Debiting Accounts Receivable . Crediting Accounts Receivable

b. Crediting Cash on Hand d.Debiting Cash in Bank

8 The accountant of John Company is preparing the Statement of Comprehensive Income and Statement of Financial

Position at December 31, 2014. The January 1, 2014 merchandise inventory balance will appear:

iG 1. Only as.an asset on the statement of financial post

Asan addition in the cost of goods sold scetion of the statement of comprehensi

. ‘current asset on the statement of financial position

‘é. Only in the cost of goods sold section of the statement of comprehensive ineome

4. As a deduction in the cost of goods sold scetion of the statement of comprehensive income and as a

‘current asset on the statement of financial position

9. Under NGAS, allotments by DBM are recorded in the registries

A ‘a. Quarterly © Atthe beginning of the period

b. Monthly di. Atthe end ofthe period

ReSU. The Review School of ecowetoney, TA Mock Exam

tch)-Page 12

jeal assets and there is no market price for that asset in its present

‘PREWEEK MATERIALS in THEORY of ACCOUNTS (May 2016

the fair value of biolo

condition, PAS 41 requires that:

© a ‘measure the asset at cost

b. The entity uses the contract prices for recent sales of similar assets adjusted for the effects of

biological transformation

« lity uses the present value of expected net cash flows from the asset discounted at» current

od pre-tax rate

uses sector benchmarks

the cost assoctated with the Hiability is:

n

are cormeet

srying amount of the related long-lived asset

12, Under PERS §, which of the following eriteria do not have to be mv

discontinued”?

c a. The operation should represent a separate line of business or geographical arca

b. The operation is a subsidiary acquired exclusively with a view to resale

© The operation mast be sold within three months after the balance sheet date

d. The operation is part ofa single plan to dispose ofa separate major line of business or geographical area

13. Property developer must classify properties that it held for sale in the ordinary course of business as

‘onder for an operation to be classified as

B & property, plant and equipment ©. finaneial assets

bi inventory investment property

4. The journal entry to record the factoring of a customer receivable normally inchudes.

D ‘4. Cash (debit) and Receivable from Factor (eredit)

b. Receivable from Factor (debit) and Cash (cred

© Accounts Receivable (debit) and Cash (ered

d. Cash (debit) and Accounts Receivable (credit)

15. A retail store received cash and issued a gill certifi

certificate was issued

dD ‘a, Revenue account should be decreased Deferred revenue account should be decreased

Revenue account should he increased Deferred revenue account should be increased

that is redeemable in merchandise. When the

16, What might a manager do during the last quartér of a sco! var if she wanted to improve eu

income?

c 4. Delay shipments to customers until afer the end of the fiseal yeur

bb. Delay purchases from supplicrs until after the end of the fiscal year.

©. Relax credit policies for customers,

4. Inerease research and development setivii

17. ‘The non-controlling interest section of the income statement is shown

D a, below income from operations. above income tax.

b. above other income and expenses 4d. below net income.

18, PAS 1 presents two alternative methods of classifying expenses in the income statement

‘Comprehensive Income. Which of these statements ivare correct?

Statement I- Additional disclosure is required for the function of expense when the nature of expens.

Statement Tk Additional disclosure is required for the nature ‘of expense when the function” of expense

classification is used,

B a Tony © Both Tand

b. Monly 4. Neither Ener f

19, How frequent shall « government unit covered by NGAS prepare financial reports?

A a. Quarterly ¢ Semiannually

b. Monthly Annually

turrent asset classified as held for sale under PFRS $ is lower than its fair

When the carrying amount of 2 1

value less costs to sell, then

A a, no impairment loss occurs

1b. _ impairment loss shall be recognized in prot

‘c. impairment Joss shall be recognized in other compre

4d. _ impairment gain shall be disclosed in the notes to the financial statements

21. Limitations of the income statenient include all of the following, EXCEPT

A a. Only actual amounts are reported in determining. net incom.

b. Income measurement involves judgment,

€. Income numbers are affected by the uecounting methods employed.

4. Items thot cannot be measured reliably are not reported.

22, allocates depreciation to the separate pans ofan asset and each part is accounted for separately, the

D on cost depreciation

Segment depreciation d. Components depreciation

23. Whether a dividend is paid by a company depends on the decisions made by the:

B a. Auditors of the company Creditors of the company

b. Directors of the company 4. Shareholders of the company

DP ReSOs The Rim School of Hccowectancy TA Mock Exam

PREWEEK MATERIALS in THEORY of ACCOUNTS (May 2016 Batch) -Page 23

D

24,

26.

30.

3

33

34.

35,

36,

37.

38

39.

2. PERS 8 on Operating Segments requ

wntal axis.

depreciation,

expense" on the vertical axis and "vim" gn the hi

A graph is set up with "yearly depreci

‘and sum-of-the-years-digi

‘Assuming linear relationships, how would the graphs for straight

respectively, be drawn’?

‘Vertically and sloping down tothe right ——¢. “Horizontally and sloping up to the right

b. Horizontally and sloping down to the right d. Vertically and sloping up 16 the right

Unie a build-operate-transter (BOT) scheme covered by IFRIC 12, any borrowing costs incurred by the private

‘operator for infrastructure projects shall be

&. Expensedl (Financial Asset model); Capitalized (Intangible Asset mode!)

b. Pxpensed (Financial Asset model); Expensed (Intangible Asset model)

© Capitalized (Financial Asset model); Expensed (Intangible Asset mode!)

«Capitalized (Financial Asset model}: Capitalized (Intangible Asset model)

Undeclared dividends are deducted from net income in the earnings per share computation for which type of

preference shares?

4. Non-cunulative only. © Cumulative only:

. Neither non-cumulative nor cumulative 4 Both non-cumulative and cumulative.

Which of the following items, if it exists, does NOT have to be presented asa line item on the face of a statement

‘of profit oF loss and other comprehensive income?

a. Closing inventory €.Posttax profit or loss of discontinued operations.

b. Reve 4. Profitor loss attributable to non-controlling interests

red by # corporation which are accounted for by recognizing unrealized holding gains or

ent of equity are __

Equity investments ac

losses as other comprehensive income and ss a separate com

4, trading investments where a company has holdings of less than 20%

b. investments where a company has holdings of between 20% and 50%

€ fing where a company has holdings of less than 20%

dd. investments where a company has holdings of more than 50%

The application of Philippine Financial Reporting Standards with additional disclosure where necessary is

presumed to result in financial statements th

4. Contain only material items ©. Are free from error and misstatement

bb. Will result in fair presentation Are unbiased

‘A-company is legally obligated for the costs associated with the retirement of a long-lived asset

only when it hires another party to perform the retirement act

b. only ifit performs the activi

. whether it hires another party to perform the retireme: activities or performs the activities itself

4. only. when the obligation arises atthe outset of the asset's use

Shares that have a fixed per-share amount printed on each share certificate are called

a.) par value shares fixed value shares

b. stated value shares , where did the cash come from during the period?

© what was the cash used for during the period’?

d. what was the change in the eash balance during the period?

66, Which ofthe following is correct regarding Investment in trading equity securities?

4. Cash dividends received should be recognized as income and presented in the statement of comprehensive

b. Gain on sale isthe excess of net selling price over the cost of the securities sold

cc. The initial carrying value of investment is always the total amount paid related to the acquisition of

investment

d. Any changes in fair value of investment during. the current ‘period are reported in the statement of

financial position

(67. events that occur aller the December 31, 201Sstatement of financial postion date (but before the statement of

Financial poston is authorized to be issusd) and provide aitional evidence about conditions that existed atthe

statment of Financial position date and affet the realizability of accounts receivable should he

a diveussed ony in the Management commentary section of the annual report

1. disclosed only in the Notes to the Financial Statemen

©. used to record an adjustment to Accounts Reveivsble wt De

{1 used to record an adjustment dieetly to the Retained Faring

68, Under NGAS, the standard residual value of depreciable assets is equal to

& Wot Cost © P1000

b. Zero a» 5000

69, Application ofthe Tul detosure principle

fi is demonstrated by the wse of sipplcrentary information explaining the effects of financing arangements.

b is by comsisictt std comparable

©. istheorctcally desirable but not pretical hecauss the costs of complete disclosure exceed the bene

{is violated when important inane information shied i the noes tothe nancial sate

10, PERS 13 “Fair Value Measurements reauited o be applied

‘4 Prospectvely rom the date ofits initial application

b ‘ofthe annual reporting period of its initial application

vely from the date ofits initial application

4 Retrospestively from the beginning ofthe sual reporting period of i

71, PERS 13 does NOT

a. Define fi value

Identity accounts toe measured ut air vali

©. Regie diselosures about fair ve

al Set out ina single PERS a framework for measuring far value

72, PERS 13 nga “fair value” as

tial application

An exit price ©. A bargain price

b. ” Anentry price dA negotiated price

73. Under PFRS 13, which is NOT an allowed valuation technique to measure fair value?

a. Cost approach © Income approach

b. Market approach Expense approach

74, Under PPRS 13, “Level I inputs” in the fair hy refers to

‘a, Quoted price in an active market for identical assets or liabil

1b, Quoted price in an active market for similar assets or liabilities (Level 1)

‘6. Quoted price in an inactive market for identical assets or liabilities (Level 11)

4d. -Unobservable inputs available under the circumstance (Level IH)

75. Which of the following is NOT considered as a countertrade.?

a. Barter ec. Buyback

b. Switch trading dd Leasehack

COUNTERTRADE (bilateral trade") means exchanging goods which are paid for with ther goods, rather than with money. monetary

valuation can however he use in eounter trade for aecounting purposes There ae six main variants of eountertade

Barter - Exchange of goods directly for other goods without the use of money as means of purehase or pay

Switch trading = Practice in which one company sells another its obligation to make a purchase ina given country

Counter purchase = Sale of goods to one company in enother country by a company that promises to make a future purchase of @

specific product ftom the same company in tht eountry

Buyback = Oceurs when a firm builds » plant in » country and

payment forthe contract,

Diset = Agreement by one nation to buy 8 produet trom another. subjest 0 the pl

‘materials from the bayer othe finished prosoc, of the assembly of such preduc in the buyer nation

‘Compensation trade -A form of barter in which one ofthe Hows i= party goods and partly in hard currency:

ENDO

ros take certain percentage of the plant’ cups as paral

hase of som

all ofthe components sd rave

KeS0- the Keriew School of Gacourdtamey » Theory of Gccourts

@) 1 QBoanvial , 2) Mrcal

FicQr7U0} Foxton Content me

i pa Theory of Accounts easel gute

en CegeeGSbECTURE NOTES > teeming“

e

nena gl? hy) ) Ace ;Metroh ,congieene nt

6 ei Brett ehiton® 04° Feed, Prudence sConpieen en

(=) THE CONci RK CF eraeet 7 ‘a pars aaraman Dern

; The Conceptual Framewor Se Gut the concepts used ifthe preparation and presentation of nancial

be ad statements (FS) for external users,

fy 2. The Conceptual Framework 's not a PFRS! -- it does not define standards for any particular

Pe Reeet ECE" aeasurement or dsclosure issue; nothing in the Concentsal Hamewees ce ‘any specific PERS. Th

auvtret F607 25° case of conic, the requirements of PERS prevail over the Conceptual Framework.

3, The purposes of the Conceptual Framework are.

AA) Assist FRSC’ in developing PFRS and its review and adoption of existing International Financial

ees Reporting Standards (IFRS) *

Treats gt ©) ASsist preparers of FS In applying PFRS and in dealing with topice that have yet to form the

ends pt ©) A pone

Lee © ©) Assist auditors in forming an opinion on whether FS comply with PFRS

? ) Assist users in interpreting Information contained in the FS: ;

Werth (we) E) Provide interested parties with information about formulation of PFRS by FRSC he

Feet 4s 94 OES. The following are some of the major diferences between the eld and new wersicas of the Conceptual

a Framework

| Official Titles @):

OLD version oan a “ONCEPIWAL FRAMEWORK "NEW version

La ets, *haey | 1) “Conceptual Framework uf Aecouning Y)Conceptual Framework for Financial Reporting’

2) Faith! Representation (FUNDAMENTAL )

¥ Freedom from Error

¥ Neutrality

¥ Complet

2 “Framework for Preparation & Presentation uf 8" | _2)The PELRSIERS Framework |

| weit Scape ap eee ee = |

santeurt MECEF 1) Objective uf Financial Statements |. 1) Objectives of Financial Reporting j

wee oe ive Characteristics of Financial Statements | 2) Qualitative Chamstersies ott

Rod sof Financial Statements |. 3) Flemonts of nancial Statcments

Lares | 4) Concepts oF Capital and Capita Maint

Yate i | _s) TheSeporting Entity (NOTE: deta not yr alae

guns ae een : } : tc of Veit Finca nora

sla et sWHHFE 1) Reeve dea wth CONTENT) 1) Relevance (PUNDAMENEAE carters)

: “Timeliness protictive Palos | chet

i

Pradence | 3)Comparability (ENHANCING characteristic)

Y Neutrality 4) Understandability (ENHANCING)

¥ Completeness 5) Timeliness (ENIANCINC

3) Comparability (deals with PRESENTATION), (6) Meritiabifity (ENLANCING)

|__4) Understundabitity (deals with PRESEN VATION)

|

— a |

iying Assumptions (2) ve Underiving Assumption; Going concen

1) Accrual basis | (NOTE: decrual hasis of accounting is. mentioned |

2) Going concer [ ander the section *ob |

ves of financial report")

5. ‘The OBJECTIVE of financial reporting forms the foundation of the Conceptual Framework

+ Overall objective: to provide financial information about the reporting entity that is useful to

existing and potential investors, lenders and other creditors in making decisions about providing

resources to the entity.

+ Specific objectives: to provide information about entity resources, claims and changes in resources

and claims useful in making decisions about providing resources to the entity and in assessing the

Prospects of future net cash flows to the entity.

6. Financial Position refers to information about the entity's economic resources and claims against the

Feporting entity (e.9,, liquidity, solvency, need for financing) while changes in these economic resources

and claims result from the entity's Financial Performance! and fron other transactions

Based on PAS 1. paragraph 7; the erm *PERS' (Philippine Financial Reporting Stindards) shall be conposed of (a) PE:

(b) Philippine Accounting Standards (PAS), and (©) Interpretations of PAS und PERS; PERS is presently the 1

of Generally Accepted Accounting Principles (GAAP) in the Philippines. (See paige 10 for further detailss

FRSC (Financial Reporting Standards Council). which replaces the ASC (Accouimtine Standards, Council), is the

‘uecounting standant-setting body in the Philippines; FRSC issues ‘PERS" while ASC in the past issued what used to bs

called as *SFAS" (Statements of Financial Accounting Standards); SFAS. was previously superseded by PAS. whichy

eventually cvalved into PFRS. (See page 10 for further details)

Under the Conceptual Framework, financial performance is reflected by (1) accrual accounting (2) past cash flows

ACCRUAL accounting depicts the effeets of transactions on a reporting entity's economie resources shad clans fi th?

periods in which those effects occuif even if the n

De gti ts i ha Nee ee em ReMi TCE icc MiaDEN CNS C

RS - the Review School of Gecomnitanen, Page 2

LECTURE NOTES in THEORY of ACCOUNTS

7. Users of financial information:

+ Primary Users: existing and potential investors lenders and other creditors

+ Other Users: employees, customers, governments and their agencies and the public.

8. The Conceptual Framework is concerned with general-purpose financial statements, including

consolidated financial statements of all commercial, industrial and business entities ---- public or

private; not-for-profit entities and special purpose financial reports are outside the scope of the

Conceptual Framework.

9. General purpose financial reports cannot provide all of the information that users need; they are not

designed to show the value of entity but they provide information to help the primary users estimate

the value of the entity; these reports are, to a large extent, based on estimates and judgment rather

than exact depiction

10. Information is material if its omission or misstatement could influence economic decisions of users

taken on the basis of the financial statements; it is an entity-specific aspect of relevance based on the

nature or magnitude, or both, of the items to which the information relates in the context of an

individual entity’s financial report.

11. COST is a pervasive constraint on the information that can be provided by financial reporting; reporting

financial information imposes costs, and it is important that those costs are justified by the benefits of

reporting that formation.

12, The ELEMENTS of financial statements:

+ Financial position: (1) Assets (2) Liabilities (3) Equity

+ Performance: (4) Income (includes revenue and gains) (5) Expenses (include losses)

13. An item that meets the definition of an element should be recognized if

A) PROBABLE: it is probable that any future economic benefit associated with the item will flow to

or from the entity, and

B) MEASURABLE: the item has a cost or value that can be measured with reliability. Four different

measurement bases are used to measure the elements of FS: (1) Historical cost (2) Current

cost (3) Realizable value (4) Present value

14, Two CAPITAL CONCEPTS: 1) Financial concept (most common) and 2) Physical concept (uses “current

cost’ basis). The concept of CAPITAL MAINTENANCE provides the linkage between the concepts of *

capital and concepts of profit since it provides the point of reference by which profit is measured.

PAS 1; PRESENTATION OF FINANCIAL STATEMENTS:

1. COMPONENTS OF FINANCIAL STATEMENTS (FS). A complete set of FS is composed of,

{A)_ Statement of financial position (balance sheet) - as at the end of the period

8B) Statement of comprehensive income* ~ for the period

©) Statement of cash flows - for the period

D) Statement of changes in equity ~ for the period

E) Notes, comprising a summary of significant accounting policies & other explanatory information

F). Statement of financial position ~ as at the beginning of the earliest comparative period when an

entity applies an accounting policy retrospectively” or makes a retrospective restatement of

items in its FS.

The term “Comprehensive Income” refers to all changes in equity, except those resulting from contributions from and

distribution to owners; hence, the Statement of Comprehensive Income shall include two (2) major categories:

1. Components of profit or fass~ these are income and expense accov ly found inthe traditional income

statement. As # minimum requirement, the line tems to be presented are: (PAS 1, par. 82)

> Revenue

> Finance costs

> Share in the income oF los of associates und joint venture accounted for using the equity method

> Tax expense

> Postax profit or loss on discontimied operations

> Profit or loss

2. Components of other comprehensive income ~ ese are income and expense aecounts not recapatized in profi or Toss

and are usually required by PFRS to be recognized dineetly in the equity section ofthe statement of financial position

{balance sheet). Examples include: (PAS 1. par; 7)

> Unrealized gain or loss 0 (PAS 39)

Gain or loss from translating the financial statements of « foreign operation (PAS 21)

‘Change in revaluation surplus (PAS 16 and 38)

Unrealized gain or foss on trom derivative contracts designated as cash flow hedge (PAS 39)

‘Actuarial gain of loss on defined benefit pension plans (PAS 19. par. 93)

“An entity has two options of presenting comprehensive income: (PAS 1. par. 81)

‘Option I: SINGLE STATEMENT

The components of profit or Joss and components of other comprehensive income are show it

comprehensive income.

Option 2: TWO STATEMENTS.

> Am income statement sho

> A-statement of comprehensive income beginning with profit or loss as shown in the income statement plus oF

minus the componenis of other compred

>

ngle statement of

comporients of profit or loss

KeS the Review School of becountamey Page 3

LECTURE NOTES in THEORY of ACCOUNTS

2, HEADINGS AND TITLES. An entity may use other tities for the statements other than those used in

PFRS and shall present with equal prominence all of the FS and distinguish them from other information

in the same published document. Ip addition, the following information shall be displayed prominently:

A) The name of reporting entity

8) Whether the financial statements cover the individual entity or @ group of entities

The date at the end of reporting period or the period covered by the set of financial statements

1} The presentation currency (as defined in PAS 21)

) The level of rounding (also known as ‘truncation’) used in presenting amounts in the FS

3. GENERAL FEATURES in presenting FS.

+ FAIR PRESENTATION, Financial statements shall present fairly the financial position, financial

performance and cash flows of an entity. The application of PFRS is presumed to result in FS that

achieve a fair presentation, FS that comply with PFRS should include in the notes to FS an explicit

and unreserved statement of such compliance.

‘+ GOING CONCERN. An entity shail prepare FS on a going concern basis unless management either

Intends to liquidate the entity or to cease trading, or has no realistic alternative but to do So.

+ ACCRUAL BASIS OF ACCOUNTING. Aj entity shall prepare its FS, except for cash flow information,

using the accrual basis of accounting,

+ MATERIALITY and AGGREGATION. An entity shall present separately each material class of similar

items and shall present separately items of dissimilar nature or function unless they are immaterial,

+ OFFSETTING. An entity shall not offset assets and liabilities or income and expenses, unless

offsetting is required or permitted by PFRS.

+ COMPARATIVE INFORMATION. An entity shall disclose comparative’ information in respect of the

previous period for all amounts reported in the current period's FS and shall include comparative

information for narrative and descriptive information when it is relevant to an understanding the

current period FS.

+ FREQUENCY OF REPORTING. An entity shall present a complete set of FS at least annually. When

an entity presents FS for a period longer or shorter than one year, an entity shall disclose

: (A) the period covered by the FS

(8) the reasons for using a longer or shorter period, an¢

(C) the fact that comparative amounts for FS are not entirely comparable.

i + CONSISTENCY OF PRESENTATION. An entity shall retain the presentation and classification of items

in the FS from one: period to the next unless:

(A) it is apparent, following a change in the nature of the entity's operations or a review of its

FS, that another presentation or classification would be more appropriate; or

(B) a specific PFRS requires a change in presentation.»

4, INCOME STATEMENT PRESENTATION. When items of income and expense are material, an entity shall

disclose their nature and amount separately. in addition, an entity. shall present’ an. analysis. of

expenses using a classification based on either (1) nature of expense method or (2) function of

expense” method, whichever provides, more reliable and relevant information

5. EXTRAORDINARY ITEMS. An entity shall not present any income or expense 8s extraordinary items, in

the statement of comprehensive. income, or separate income statement (if presented), or in the notes

,to the financial statements,

6. BALANCE SHEET (BS) PRESENTATION. An entity shall present current and non-current assets, and

current and non-current liabilities, except when a presentation based on liquidity provides more reliable

and relevant information. When this exception applies, all assets and liabilities shall be presented

broadly in order of liquidity.

2. CURRENT vs. NONCURRENT ASSETS. An entity shail classify an asset as current when

A) The asset is a cash or cash equivalent (unless restricted for at least 12 months after 8S date)

8) It holds the asset primarily for the purpose of trading

©) Ik expects to realize the asset within 12 months after the reporting period (BS date)

1) _It expects or intends to realize or consume it within the entity's normal operating cycle"

‘An entity shall classify all other assets as'non-current.

8. CURRENT vs. NONCURRENT LIABILITIES. An entity shall classify a liability as current when:

‘A) The liability 's due to be settled within 12 months after the reporting period (BS date)

B) It holds the liability primarily for the purpose of trading

©). It expects to settle the liability within the entity's normal operating cycle

DY The entity does not have an unconditional right to defer settlement of the liability for at least

twelve months after the reporting period (BS date) x

An entity shall classify all other liabilities as non-current

Retrospective application ofa change in accounting policy. is coveréd by PAS 8, (See pate 6 for mone details)

Inappropriate accounting policies are wot rectified either by disclosure of the accounting policies used or by

explanatory notes. (PAS 1, par. 18)

‘An entity that uses the fimetion of expense method (a.k-. “cost of sales” method) shall disclose pdivional information on

the nature of expenses, including depreciation and amortization expense and emplovee benefits expwnse. (PAS |, par 14)

® The eperating cycle of an entity isthe time between the acquisition of assets for processine and theit realization jn cash or

ble, its

‘cash equivalents. When the on i assumed to he twelve

‘months. (PAS 1, par. 68)

ity’s normal operating eye js not clearly ide

ReSU - the Kevrew School of lcconmioney Page 4

LECTURE NOTES in THEORY of ACCOUNTS

9) BALANCE SHEET LINE ITEMS. As a minimum requirement, the face of the statement of financial position

“shall include line items that present the following amounts

A). Property, plant and equipment

B) Investment property?

€) Intangible assets

D) Financial assets” (excluding amounts shown under E, H and 1)

£) Investments accounted for using the equity method

F) Biological assets (defined as “living animals or plants” under PAS 42)

G) Inventories

H) Trade and other receivables

1). Cash and cash equivalents

3} Total assets held for sale (Including assets of disposal groups held for sale under PERS 5)

K). Trade and other payables f

Provisions (defined as “habilites of uncertain timing or Amount” under PAS 37)

M) Financial liabilities” (excluding amounts showri under K and L)

NN) abilities and assets for current tax

0) Deferred tax liabilities and deferred tax assets, not to be presented as current (PAS 1, par. 56)

P) Noti-controlling (minority) interest, presented within equity’

)_ Issued capital and reserves attributable to equity holders of the parent

10, FINANCIAL LIABILITIES, An entity classifies its financial liabilities as current when they are due to be

settled within twelve months after the balance sheet date, even if

‘A)_ The original term was for a period longer than twelve months; and

8) An agreement to refinance, or to reschedule payments, on a long-term basis is completed after

the reporting period (BS date) and before the FS are authorized for issue”.

11 EFFECTS OF BREACHES. When an’entity breaches a provision of a long-term loan agreement on or

before the end of reporting period (BS date) with the effect that the liability becomes payable on

demand, the liability is classified as current, even if the lender has agreed not to demand payment as @

consequence of'the breach’

12. STATEMENT OF CHANGES IN EQUITY (SCE). An entity shall present a SCE showing:

'A) Total comprehensive income for the period, showing separately the total amounts attributed to

‘owners of the parent and to non-controlling (minority) interest

8) For each component of equity, the effects of retrospective application/restatement under PAS 8,

©) The amount of transactions with owners in their capacity as oviners, showing separately

contributions by end distributions to owners.

‘2)-Foreach-component-of equity, a reconcihation of the between the carrying amount at the

beginning and the end of the period, disclosing each change separately.

13. DIVIDENDS, An entity shall present either in the statement of changes in equity or in the notes, the

amount of dividends recognized as distributions to owners and the related amount per share

14, NOTES TO THE FS. The notes are normally presented in the following order, which assists users in

Understanding the FS and comparing them with FS of other entities:

‘A) Astatement of compliance with PFRS

8) A-summary of significant accounting policies applied", which shall include: :

>The measurement bases used in preparing FS

| & The other accounting policies used that are relevant to an understanding of the FS

6). Supporting information for items shown on the face of each FS, in the order in which each

statement and each line item \s presented

D) Other disclosures, including

> Contingent liabilities and un-ecognized contractual commitments

> Non-financial disclosures (e.9., the entity's financial risk under PFRS 7)

‘An investment property is @ property (land or building) held by the owner or by the fessew under finance ease to

rentals or for capital appreciation of both, rather than for use orale (PAS 40)

19 A financial asset iy any asset that is cash, an equity instrument of another entity, a contractual right to receive cash ot

‘another financial asset from another entity. (PAS 32)

11 Ginaneiat liability is any liability thet is a contractual obligation 4 deliver cash or unother financial asset to another

entity. (PAS 32)

42 Non-controlling inferests (previously known as minority interest) shall be presented in the consolidated! balance sheet

‘within equity, separately from the parent shareholders’ equity. (PAS 27. par. 27)

"han entity expects, and has the diseretion, to. refinange or roll ever an. obligation for at least twelve months alter the

balance sheet date tinder an existing, loan facility, it classifies the obfigution as non-current, even iC it would otlierwise be

ddue within « shorter period. (PAS 1: pur. 73)

14 The liability i classified as non-current ifthe lender agreed by ihe balance sheet date-to provide grace period ending at

least {2 months after the balunce sheet date, within which the enlty can rectify the breaeh-aind duting which the lender

‘cannot demand immediate payment. (PAS 1, par, 75)

15 ‘An entity is required 10 diselove the jisdemems: that management has made in the process of applying the entity's

‘accounting policies and that have the most significant efleet on the amounts recognized in the PS. (PAS 1. par. 122)

In addition, the notes shall contain ey assumptions concerning the future and other key sources of estimation that will

pose u significant risk of causing a material adjustment to the amount of assets and liabilities within the next period. In

he uotes shall inchude nature, amount snd other details of yueh assets und liabilities. (PAS 1, par. 125)

, ‘

ReSU - The Rerrew School of Cccounamey Page 5

LECTURE NOTES in THEORY of ACCOUNTS

PAS 8: ACCOUNTING POLICIES, CHANGES IN ACCOUNTING ESTIMATES & ERRORS

+ OBJECTIVE: The objective of PAS 8 is to prescribe the criteria for selecting and changing ACCOUNTING

POLICIES,"* changes in ACCOUNTING ESTIMATES and CORRECTION OF ERRORS to enhance relevance,

reliability and comparability of FS of an entity over time as well as with FS of other entitice.

+ SELECTION OF ACCOUNTING POLICIES. When a standard specifically applies to a transaction, the

accounting policy applied to an affected account shall be determined by applying the sendad ti ‘ne

absence of a standard that applies to a transaction, management shall use its judgment’ in developing ard

applying accounting policy that is relevant and reliable.

+ CONSISTENCY OF ACCOUNTING POLICIES. Once selected, accounting policies must be applied consistently

for similar transactions, unless a standard specticaly ‘requires otherwise. An entity’ shall chore, oy

accounting policy if the change (1) is required by a standard, or (2) resuits in the FS providig race

relevant and reliable financial information.

+ CHANGES IN ACCOUNTING POLICIES. A change in accounting policy that is required by a standard shall be

applied in accordance with the transitional provisions therein, if a standard contains no taremorn

Provisions or if an accounting policy is changed voluntarily, the change shall be applied retrospectively (as if

the policy hed always been applied) as adjustment to the opening balance of each affected component of

‘equity (e.g., retained earnings) for the earliest prior period presented

For purposes of PAS 8, the following are NOT considered as changes in accounting policies:

1. Application of accounting polices for events that differ in substance from those previously occurring.

2. Application of a new accounting policy for transactions that did not occur previously or were immaterial,

+ EXCEPTION to the RULE. When it is impracticable" for an entity to apply a new sccounting policy

retrospectively (Le. it cannot determine the cumulative effect of applying the policy to all prior periods),

the entity applies the new policy prospectively from the start of the earliest period prectreable:

+ APPLICATION of NEW STANDARDS. When an entity has not applied @ new standard thot hos been Issued

but ls not yet effective, the entity shall disclose this fact, and the reasonably estimable lntormaten ean

to assessing the possible impact that application of the new standard will have on the entitr’s Fe ie ohe

period of initial application.

+ GHANGES in ESTIMATES'®. The effect of a change in an accounting estimate shall be recognized

prospectively by Including it in the profit or loss during the period of the change {if the change affeck, thot

period only) or the period of the change and future periods (if the change affects both),

+ EXAMPLES of CHANGES in ESTIMATES. Due to uncertainties inherent in business activities, many items in

FS cannot be measured with precision but can only be estimated. Estimation involves judgments brece oe

the latest available, reliable information. Common examples of accounting estimates maine

4. Bad debts and inventory obsolescence

2. Fair value of financial assets or financial liabilities

3. Useful lives of depreciable assets; and

4. Provision for warranty obligations

A change in the measurement basis applied is a change in an accounting policy, and is not a change in an

accounting estimate. When it is difficult to distinguish a change in an accounting policy from # charge in an

accounting estimate, the change is treated as a change in accounting estimate.

+ CORRECTION OF ERRORS.”” An entity shall correct material prior period errors retrospectively as an

adjustment to the opening balances of retained earnings and affected assets and lablitics’ if corparsticc

statements are presented, the FS of prior period shall be restated to reflect the retrospective apoligation of

the ptlor period errors. If the error occurred before the earliest period presented, ‘he openine balances of

assets, liabilities and equity for the earliest period presented shall be restated

+ MATERIALITY”, In applying the concept of materiality:

1. Accounting policies in the PFRSs need not be applied when the effect of applying them is immaterial

2. FS do not comply with PFRSs if they contain material errors, whether due to omissions or

misstatements.

3. Material prior period errors should be corrected retrospectively in the first set of FS authorized for issue

after thelr discovery

18 Accounting policies are the specific principles, bases, conv

‘resenting financial statements.

In making judgments, management shall refer to the following sources in descending ord:

1). The requirements and guidance in standards dealing with similar and related issues

2) The definition, recognition criteria and measurement concepts sct forth in the Conceptual Framework

{In making the judgment, management may also consider the most recent pronounéements of other standand-scting bodies

that use similar conceptual framework to develop accounting standards, other accounting literature and accepted txlosty

practices, to the extent that these do not conflict with PERS and the Conceptual Framework,

Applying a requirement is impracticable when the enity cannot appli alter making every reasonable effort to do so.

‘A change in accounting estimates results from new information of developments and, hence, are not cornections of errs,

The concept of “fundamental erro’ has been eliminated, Instead. PAS & uses and defines term “prior period ever” Price

Petiod errors are omissions and misstatements inthe FS for one or more periods; they are commie th peor pesiods bot

ane discovered only inthe current period