Professional Documents

Culture Documents

Activity No. 3 - Principles of Accounting: Answers

Activity No. 3 - Principles of Accounting: Answers

Uploaded by

Lagasca IrisOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Activity No. 3 - Principles of Accounting: Answers

Activity No. 3 - Principles of Accounting: Answers

Uploaded by

Lagasca IrisCopyright:

Available Formats

NAME: Score:

ACTIVITY NO. 3 – PRINCIPLES OF ACCOUNTING

Nine transactions are reflected in the October transaction worksheet of the K. Reyes Company presented

below. Describe each of the following transactions. The last transaction is the only transaction affecting the

capital account that does not affect the net income. Prepare the balance sheet for the month of October, 20XX.

Use the space provided below for your descriptions and at the back of the paper for the balance sheet.

K. Reyes Company

Financial Transaction Worksheet

October 31, 20XX

OWNER’S

ASSETS = LIABILITIES +

EQUITY

Cash + Accounts + Supplies + Office = Accounts + Reyes,

Receivable Equipment Payable Capital

B/ =

P 15,000 17,500 4,500 153,000 60,000 130,000

b

1 7,000 (7,000) =

2 (5,000) 5,000 =

3 25,000 = 25,000

4 24,500 = 24,500

5 = 16,000 (16,000)

6 (6,500) = (6,500)

7 3,700 = 3,700

8 (2,500) = (2,500)

9 (5,000) = (5,000)

P 3,000 35,000 13,200 178,000 = 98,200 131,000

Answers:

1. K. Reyes Company received 7,000 cash.

2. Purchased Supplies for Php 5,000 cash.

3. Purchased Office Equipment on account for Php 25,000.

4. Billed a customer 24,500 for services.

5. Withdraw on account for Php 16,000 and will pay.

6. Paid Php 6,500 cash

7. Purchased Office Equipment on account for 3,700.

8. Withdraw Php 2,500 from the business.

9. Withdraw Php 5,000 from the business.

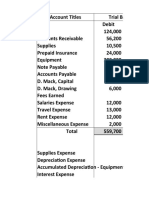

BALANCE SHEET

K. Reyes Company

Balance Sheet

As of 30, 20XX

ASSETS LIABILITIES AND OWNER’S EQUITY

Cash Php 3,000 Account Payable Php 98,200

Account Receivable 35,000

Office Supplies 13,200 Young’s Capital 131,000

Office Equipment 178,000

______________ ______________

TOTAL Php 229,200 TOTAL Php 229,200

You might also like

- Ruben Pater - CAPS LOCK-Valiz (2021)Document556 pagesRuben Pater - CAPS LOCK-Valiz (2021)Paulina Escobar AguirreNo ratings yet

- 3c - Chapter 4Document1 page3c - Chapter 4Lady Mae Dioquino33% (12)

- Introduction To Managerial EconomicsDocument48 pagesIntroduction To Managerial EconomicsSajid RehmanNo ratings yet

- Crispin Rosales JournalizingDocument5 pagesCrispin Rosales JournalizingNightmare WolfNo ratings yet

- Activity 24. in This Activity You Need To Identify The Adjusting Entry That Can BeDocument3 pagesActivity 24. in This Activity You Need To Identify The Adjusting Entry That Can BeTriquesha Marriette Romero RabiNo ratings yet

- Prob Basic AcctDocument3 pagesProb Basic AcctSamuel Ferolino50% (2)

- Group 6Document8 pagesGroup 6Parkiee JamsNo ratings yet

- Comprehensive Problem 2 Corrected 1Document2 pagesComprehensive Problem 2 Corrected 1Ellaine joy Daria100% (3)

- University of Caloocan City: Name: Score: Course/Year & Section: DateDocument3 pagesUniversity of Caloocan City: Name: Score: Course/Year & Section: DatePatricia Camille Austria0% (1)

- Ebin Belderol TB and WorksheetDocument11 pagesEbin Belderol TB and WorksheetMarielle Ebin100% (3)

- AICPA Newly Released MCQsDocument54 pagesAICPA Newly Released MCQsDaljeet SinghNo ratings yet

- Homework Chapter 4Document17 pagesHomework Chapter 4Trung Kiên Nguyễn100% (1)

- P4-1A Prepare A Worksheet, Financial Statements, and Adjusting and Closing EntriesDocument7 pagesP4-1A Prepare A Worksheet, Financial Statements, and Adjusting and Closing EntriesDidan EnricoNo ratings yet

- PDF Solution Manual Partnership Amp Corporation 2014 2015 PDFDocument91 pagesPDF Solution Manual Partnership Amp Corporation 2014 2015 PDFGarp BarrocaNo ratings yet

- Nelson Daganta CashDocument10 pagesNelson Daganta CashDan RioNo ratings yet

- PTAccountingDocument13 pagesPTAccountingLAN ONLINENo ratings yet

- Martinez, Althea E. Abm 12-1 (Accounting 2)Document13 pagesMartinez, Althea E. Abm 12-1 (Accounting 2)Althea Escarpe MartinezNo ratings yet

- Galatians 6: 9 "Let Us Not Become Weary in Doing Good, For at The Proper Time We Will Reap A Harvest If We Do Not Give Up."Document5 pagesGalatians 6: 9 "Let Us Not Become Weary in Doing Good, For at The Proper Time We Will Reap A Harvest If We Do Not Give Up."Kei Tsukishima100% (2)

- Exercise#1 Earlmathew VisarraDocument2 pagesExercise#1 Earlmathew VisarraMathew VisarraNo ratings yet

- Output Fabm1 Ladera, Rhealyn Patan-Ao Bsa-IDocument9 pagesOutput Fabm1 Ladera, Rhealyn Patan-Ao Bsa-IRhealyn Patan-ao LaderaNo ratings yet

- Sue Feria Travel AgencyDocument5 pagesSue Feria Travel AgencyMa Sophia Mikaela Erece100% (1)

- Accounting Assumptions: Introduction To Basic AccountingDocument6 pagesAccounting Assumptions: Introduction To Basic AccountingJon Nell Laguador Bernardo100% (1)

- Problem 6 1Document2 pagesProblem 6 1SerdenRoseNo ratings yet

- Activity 6 - Adjusting Entries - Depreciation (Ans)Document5 pagesActivity 6 - Adjusting Entries - Depreciation (Ans)angela flores100% (1)

- Activity 11: ExplanationDocument11 pagesActivity 11: ExplanationDonabelle Marimon0% (1)

- Seatwork 03 - DingcongDocument8 pagesSeatwork 03 - DingcongJheilson S. DingcongNo ratings yet

- Accounting 2Document4 pagesAccounting 2Jocelyn Delacruz50% (2)

- Application of Accounting Equation and Double Entry SystemDocument3 pagesApplication of Accounting Equation and Double Entry SystemMark Joseph CanoNo ratings yet

- General Journal Date Particulars Folio DebitDocument6 pagesGeneral Journal Date Particulars Folio DebitJelaina AlimansaNo ratings yet

- Accounting Problem 16Document1 pageAccounting Problem 16sabbyveraNo ratings yet

- AtelengDocument2 pagesAtelengGarp BarrocaNo ratings yet

- Chapter 8Document27 pagesChapter 8Francesz VirayNo ratings yet

- FAR1 ASN02 Financial Transaction WorksheetDocument2 pagesFAR1 ASN02 Financial Transaction WorksheetPatricia Camille AustriaNo ratings yet

- FSDocument44 pagesFSMaria Beatriz Aban Munda100% (2)

- Eto SagoDocument2 pagesEto SagoaleckNo ratings yet

- Acctgchap 2Document15 pagesAcctgchap 2Anjelika ViescaNo ratings yet

- Merchandising Problem AnswerDocument2 pagesMerchandising Problem AnswerBrian Gerome MercadoNo ratings yet

- Accounting 1 ValeDocument13 pagesAccounting 1 ValeAhmadnur JulNo ratings yet

- CHAPTER 3 (Accounting Equation)Document5 pagesCHAPTER 3 (Accounting Equation)lcNo ratings yet

- Module 1 JournalizingDocument6 pagesModule 1 JournalizingDianne CabilloNo ratings yet

- Sample Problem For Last MeetingDocument11 pagesSample Problem For Last MeetingLylanie Alcoran AnibNo ratings yet

- Journalizing To Adjusting Entries QuizDocument3 pagesJournalizing To Adjusting Entries QuizNemar Jay Capitania100% (1)

- Chap 7 Worksheet 01Document5 pagesChap 7 Worksheet 01Lady Zyanien DevarasNo ratings yet

- Chapter 4 - 5 ActivitiesDocument3 pagesChapter 4 - 5 ActivitiesJane Carla BorromeoNo ratings yet

- Moises Dondoyano Information Systems Company Trial Balance: Accounts Dr. CRDocument5 pagesMoises Dondoyano Information Systems Company Trial Balance: Accounts Dr. CR버니 모지코No ratings yet

- Recording Transactions in Financial Transaction WorksheetDocument4 pagesRecording Transactions in Financial Transaction WorksheetAngel MayNo ratings yet

- Basic Acco VariousDocument26 pagesBasic Acco VariousJasmine Acta100% (1)

- It FinalsDocument11 pagesIt FinalsHea Jennifer AyopNo ratings yet

- Answer Key To Fundamentals of Financial Accounting and Reporting CDCDocument3 pagesAnswer Key To Fundamentals of Financial Accounting and Reporting CDCAprile Margareth HidalgoNo ratings yet

- 600 Assembly Work: 2x + 6y 480Document5 pages600 Assembly Work: 2x + 6y 480John Louie DungcaNo ratings yet

- Worksheet 1Document8 pagesWorksheet 1Kevin Espiritu100% (1)

- Act 110 Bonus Activity (Dimalawang)Document10 pagesAct 110 Bonus Activity (Dimalawang)Kilwa DyNo ratings yet

- MerchandisingDocument11 pagesMerchandisingAIRA NHAIRE MECATE100% (1)

- Book 1Document4 pagesBook 1Sly BlueNo ratings yet

- Journal Entries Module 1Document7 pagesJournal Entries Module 1Jervin Maon Velasco100% (1)

- Adjusting and Closing Entries - Accruals Demonstration Problem 1 Anderson ArchitectsDocument31 pagesAdjusting and Closing Entries - Accruals Demonstration Problem 1 Anderson ArchitectsFlorenz AmbasNo ratings yet

- Acctg 1 - PrelimDocument1 pageAcctg 1 - PrelimRalph Christer Maderazo80% (5)

- Accounting For A Service CompanyDocument9 pagesAccounting For A Service CompanyAnnie RapanutNo ratings yet

- Mulles Data EncodersDocument4 pagesMulles Data EncodersMackenzie Heart ObienNo ratings yet

- Closing EntriesDocument2 pagesClosing EntriesTey-yah Malumbres100% (1)

- 6 AccountingDocument5 pages6 AccountingRenz MoralesNo ratings yet

- IA1 - Quiz#1 (Chapter 1 & 2 - CCE & Bank Recon) Theories and ProblemsDocument27 pagesIA1 - Quiz#1 (Chapter 1 & 2 - CCE & Bank Recon) Theories and ProblemsChristabel Lecita PuigNo ratings yet

- Statcalysis Homework AnswersDocument4 pagesStatcalysis Homework AnswersNicole Allyson Aguanta100% (1)

- Fundamental Accountancy, Business and Management II: Deparment of EducationDocument3 pagesFundamental Accountancy, Business and Management II: Deparment of Educationrose gabonNo ratings yet

- Answers To CH 2 - FTW ProblemsDocument14 pagesAnswers To CH 2 - FTW ProblemsJuanito Jr. LagnoNo ratings yet

- Pointers To Review ITPC109 11032020 PDFDocument1 pagePointers To Review ITPC109 11032020 PDFLagasca IrisNo ratings yet

- Test Instrument: Itpc 108 Fundamentals of Enterprise Data Management Midterm ExaminationDocument9 pagesTest Instrument: Itpc 108 Fundamentals of Enterprise Data Management Midterm ExaminationLagasca IrisNo ratings yet

- The Eggshell: Structure, Composition and Mineralization: Frontiers in Bioscience January 2012Document16 pagesThe Eggshell: Structure, Composition and Mineralization: Frontiers in Bioscience January 2012Lagasca IrisNo ratings yet

- Test Instrument: Itpc 108 Fundamentals of Enterprise Data Management Midterm ExaminationDocument9 pagesTest Instrument: Itpc 108 Fundamentals of Enterprise Data Management Midterm ExaminationLagasca IrisNo ratings yet

- TI ITTE 101c Mid Term Copy of Students PDFDocument3 pagesTI ITTE 101c Mid Term Copy of Students PDFLagasca IrisNo ratings yet

- Pointers To Review ITPC109 11032020 PDFDocument1 pagePointers To Review ITPC109 11032020 PDFLagasca IrisNo ratings yet

- Lean Canvas Model: Problem Solution Unique Value Proposition Unfair Advantage Customer SegmentsDocument2 pagesLean Canvas Model: Problem Solution Unique Value Proposition Unfair Advantage Customer SegmentsLagasca IrisNo ratings yet

- Rizal and Early EducationDocument20 pagesRizal and Early EducationLagasca Iris100% (1)

- 2020 Nodos - Creatio Deck v1 - CEMINDocument38 pages2020 Nodos - Creatio Deck v1 - CEMINJulio Falcón LuceroNo ratings yet

- Formulas Accounting RatiosDocument12 pagesFormulas Accounting RatiosMAHI LADNo ratings yet

- Presentation KazakhstanDocument16 pagesPresentation KazakhstanAnash RamazanovaNo ratings yet

- The FTS Orange Book (NGO & Related Contacts in Durban)Document21 pagesThe FTS Orange Book (NGO & Related Contacts in Durban)Feeding_the_SelfNo ratings yet

- Accounting What The Numbers Mean 11th Edition Marshall Solutions ManualDocument25 pagesAccounting What The Numbers Mean 11th Edition Marshall Solutions ManualElizabethBautistadazi100% (51)

- Shashi Dhiman - Cv.Document3 pagesShashi Dhiman - Cv.sdhiman79No ratings yet

- Tugas Bahasa Inggris MemoDocument5 pagesTugas Bahasa Inggris MemoNur AyuNo ratings yet

- Tutorial 6Document5 pagesTutorial 6mohamed ahmedNo ratings yet

- Sustaining The Means of Sustainability-The Need For Accepting Wakaf (Waqf) Assets in Malaysian Property MarketDocument17 pagesSustaining The Means of Sustainability-The Need For Accepting Wakaf (Waqf) Assets in Malaysian Property MarketDedy Ahmad WiryadiNo ratings yet

- Berita Dan Politik: Forum Jual Beli Groupee Kaskusradio Sign inDocument2 pagesBerita Dan Politik: Forum Jual Beli Groupee Kaskusradio Sign inBob YuNo ratings yet

- SG Chapter 5 Valuation Concepts and MethodologiesDocument11 pagesSG Chapter 5 Valuation Concepts and MethodologiesTACIPIT, Rowena Marie DizonNo ratings yet

- Franchise Tax Board JobsDocument24 pagesFranchise Tax Board JobsAbdullah KhanNo ratings yet

- Global Vacation Rental Report 2022Document60 pagesGlobal Vacation Rental Report 2022Walter HidalgoNo ratings yet

- Marketing ManagementDocument11 pagesMarketing ManagementAvijit DindaNo ratings yet

- Update Sheet For Upgrade Risk Mitigation Building-Bi-01409Document12 pagesUpdate Sheet For Upgrade Risk Mitigation Building-Bi-01409SARANGMUMBAINo ratings yet

- Midterm QuestionDocument10 pagesMidterm QuestionKultum Demie100% (1)

- Understanding Lump SumDocument2 pagesUnderstanding Lump SumYhamNo ratings yet

- TDS On Real Estate Transactions: Flow of DiscussionDocument32 pagesTDS On Real Estate Transactions: Flow of DiscussionANILNo ratings yet

- Advertisement No. 04 - 2024Document11 pagesAdvertisement No. 04 - 2024Madhu SrivastavaNo ratings yet

- List of Countries and Capitals With Currency and LanguageDocument36 pagesList of Countries and Capitals With Currency and LanguageGaby López MoguelNo ratings yet

- I The Concept and Characteristics of FDIDocument6 pagesI The Concept and Characteristics of FDIMinh TrinhhuyNo ratings yet

- AFMDocument213 pagesAFMAnkita SainiNo ratings yet

- CH 18 20 AKMDocument121 pagesCH 18 20 AKMDewanto Kusumo100% (1)

- CH 01Document49 pagesCH 01Rachmawati 123No ratings yet

- CPSPM 51119392 1715007813Document29 pagesCPSPM 51119392 1715007813Nittu SharmaNo ratings yet