Professional Documents

Culture Documents

Mitch T. Minglana BSA 301

Mitch T. Minglana BSA 301

Uploaded by

Mitch Tokong MinglanaCopyright:

Available Formats

You might also like

- LQ 1 - Set A SolutionDocument14 pagesLQ 1 - Set A SolutionChristina Jazareno64% (11)

- Audprob Answer 1Document1 pageAudprob Answer 1venice cambryNo ratings yet

- Intermediate Accounting 2Document27 pagesIntermediate Accounting 2CARMINA SANCHEZNo ratings yet

- Audit of Long Term Liabilities 2Document5 pagesAudit of Long Term Liabilities 2Cesar EsguerraNo ratings yet

- Note Receivable Part 2Document7 pagesNote Receivable Part 2Carlo VillanNo ratings yet

- Note Payable Practice ExerciseFDocument8 pagesNote Payable Practice ExerciseFJane Gavino0% (1)

- Notes Payable: By: Jumalon, Reicci and Gepiga, Kyle Opel ACC 211-2902Document23 pagesNotes Payable: By: Jumalon, Reicci and Gepiga, Kyle Opel ACC 211-2902idontcaree12331267% (3)

- Nepomuceno, Henry James B. - Ast Quiz 5Document2 pagesNepomuceno, Henry James B. - Ast Quiz 5Mitch Tokong MinglanaNo ratings yet

- Modules 2 4 Group Act. CompilationDocument2 pagesModules 2 4 Group Act. CompilationMitch Tokong MinglanaNo ratings yet

- BAICC2X-Solution Supplementary - Week 1docxDocument7 pagesBAICC2X-Solution Supplementary - Week 1docxMitchie FaustinoNo ratings yet

- Chapter 1 Liabilities ExercisesDocument3 pagesChapter 1 Liabilities ExercisesAwish FernNo ratings yet

- Chapter 1 None CompressDocument9 pagesChapter 1 None CompressiadcNo ratings yet

- Notes Payable and Debt Restructuring (Ruma, Jamaica)Document14 pagesNotes Payable and Debt Restructuring (Ruma, Jamaica)Jamaica RumaNo ratings yet

- Garcia Unit3 AssessmentTopic1Document5 pagesGarcia Unit3 AssessmentTopic1jaychristiangarcia18No ratings yet

- Module - IA Chapter 6Document10 pagesModule - IA Chapter 6Kathleen EbuenNo ratings yet

- Note Receivable Part 2Document7 pagesNote Receivable Part 2Carlo VillanNo ratings yet

- 5 27 LoansDocument9 pages5 27 LoansRengeline LucasNo ratings yet

- Hand Out 1 Practice SetDocument6 pagesHand Out 1 Practice SetLayka ResorezNo ratings yet

- FAR-07 Trade & Other PayableDocument3 pagesFAR-07 Trade & Other PayableKim Cristian MaañoNo ratings yet

- Chapter 14Document4 pagesChapter 14ks1043210No ratings yet

- 6011ASSIGNMENTDocument8 pages6011ASSIGNMENTpathiranapremabanduNo ratings yet

- Financial Accounting & Reporting 2: Sec - 7 - Short Quiz 1 SolutionDocument4 pagesFinancial Accounting & Reporting 2: Sec - 7 - Short Quiz 1 SolutionDump DumpNo ratings yet

- Working 5Document6 pagesWorking 5Hà Lê DuyNo ratings yet

- Alom Ia FoDocument18 pagesAlom Ia FoLea Yvette SaladinoNo ratings yet

- Problem 3Document11 pagesProblem 3Charmaine Kaye OndoyNo ratings yet

- 2020 Black Dwarf Company: Problem 7 Bonds Payable - Straight Line Method Journal Entries Date Account Title & ExplanationDocument7 pages2020 Black Dwarf Company: Problem 7 Bonds Payable - Straight Line Method Journal Entries Date Account Title & ExplanationLovely Anne Dela CruzNo ratings yet

- Boslon Audit3 Quiz 2Document6 pagesBoslon Audit3 Quiz 2Ra Dela RamaNo ratings yet

- A9 Audit of LiabilitiesDocument7 pagesA9 Audit of LiabilitiesKezNo ratings yet

- Chapter 2 Problems - IADocument8 pagesChapter 2 Problems - IAKimochi SenpaiiNo ratings yet

- LQ 1 - Set A Solution PDF Bonds (Finance) ADocument2 pagesLQ 1 - Set A Solution PDF Bonds (Finance) AeaeNo ratings yet

- FinLiab QuizDocument8 pagesFinLiab QuizAeris StrongNo ratings yet

- 8 Audit of LiabilitiesDocument4 pages8 Audit of LiabilitiesCarieza CardenasNo ratings yet

- IntAcc Reviewer - Module 2 (Problems)Document26 pagesIntAcc Reviewer - Module 2 (Problems)Lizette Janiya SumantingNo ratings yet

- Accounting 1Document10 pagesAccounting 1Jay EbuenNo ratings yet

- Lobrigas Unit3 Topic1 AssessmentDocument9 pagesLobrigas Unit3 Topic1 AssessmentClaudine LobrigasNo ratings yet

- Chapter 20 - Effective Interest Method (Amortized Cost, FVOCI, FVPL)Document66 pagesChapter 20 - Effective Interest Method (Amortized Cost, FVOCI, FVPL)Never Letting GoNo ratings yet

- FAR-01 Trade & Other PayableDocument3 pagesFAR-01 Trade & Other PayablehIgh QuaLIty SVT100% (1)

- Classroom Exercises On Sinking FundDocument3 pagesClassroom Exercises On Sinking Fundjay1ar1guyenaNo ratings yet

- 12 Redemption of DebenturesDocument13 pages12 Redemption of DebenturesRohith KumarNo ratings yet

- Chapter 15 Review ProblemsDocument4 pagesChapter 15 Review ProblemsMaya HamdyNo ratings yet

- Ans: A) Journal Entry On Date of Issue Date Account DR CRDocument4 pagesAns: A) Journal Entry On Date of Issue Date Account DR CRHumera AkbarNo ratings yet

- Problem 6-8 Answer A Savage CompanyDocument6 pagesProblem 6-8 Answer A Savage CompanyJurie BalandacaNo ratings yet

- Far Review - Notes and Receivable AssessmentDocument6 pagesFar Review - Notes and Receivable AssessmentLuisa Janelle BoquirenNo ratings yet

- Problem 5 On Loan ReceivableDocument6 pagesProblem 5 On Loan Receivablebm1ma.allysaamorNo ratings yet

- Renton Effective Am21Document5 pagesRenton Effective Am21Kris Hazel RentonNo ratings yet

- Me AnswersDocument9 pagesMe Answersgabprems11No ratings yet

- Cpa Review School of The Philippines ManilaDocument14 pagesCpa Review School of The Philippines ManilaVanessa Anne Acuña DavisNo ratings yet

- Q & A IntaccDocument9 pagesQ & A IntaccAramina Cabigting BocNo ratings yet

- Note Payable Practice Exercise FDocument9 pagesNote Payable Practice Exercise Flana del reyNo ratings yet

- Liabilities - ManuDocument7 pagesLiabilities - ManuClara MacallingNo ratings yet

- Chapter 20 CompilationDocument41 pagesChapter 20 CompilationMaria Licuanan0% (1)

- Acc 201 CH 10Document16 pagesAcc 201 CH 10Trickster TwelveNo ratings yet

- Chapter 9 - Discounting of Note ReceivableDocument5 pagesChapter 9 - Discounting of Note ReceivableLorence IbañezNo ratings yet

- Lobrigas Unit3 Topic2 AssessmentDocument6 pagesLobrigas Unit3 Topic2 AssessmentClaudine LobrigasNo ratings yet

- Financial Accounting - Tugas 5 - 18 Sep - REVISI 123Document3 pagesFinancial Accounting - Tugas 5 - 18 Sep - REVISI 123AlfiyanNo ratings yet

- Financial Accounting 2 - Liabilities (Solving) Multiple ChoiceDocument16 pagesFinancial Accounting 2 - Liabilities (Solving) Multiple ChoiceNicole Andrea TuazonNo ratings yet

- 19 Notes PayableDocument3 pages19 Notes Payableangelienacion8No ratings yet

- Receivable Financing Receivable FinancingDocument10 pagesReceivable Financing Receivable FinancingMarjorie PalmaNo ratings yet

- Bond Payable Problems - CompressDocument23 pagesBond Payable Problems - CompressJoan Ashley ViernesNo ratings yet

- Exercise LiabilitiesDocument2 pagesExercise LiabilitiesAlaine Milka GosycoNo ratings yet

- Asian Development Bank Trust Funds Report 2020: Includes Global and Special FundsFrom EverandAsian Development Bank Trust Funds Report 2020: Includes Global and Special FundsNo ratings yet

- One Year of Living with COVID-19: An Assessment of How ADB Members Fought the Pandemic in 2020From EverandOne Year of Living with COVID-19: An Assessment of How ADB Members Fought the Pandemic in 2020No ratings yet

- Prob 5Document1 pageProb 5Mitch Tokong MinglanaNo ratings yet

- Manlimos Lyka AssignmentDocument7 pagesManlimos Lyka AssignmentMitch Tokong MinglanaNo ratings yet

- Long Assignment - MinglanaDocument1 pageLong Assignment - MinglanaMitch Tokong MinglanaNo ratings yet

- Prob 2Document1 pageProb 2Mitch Tokong MinglanaNo ratings yet

- Quiz 5Document3 pagesQuiz 5Mitch Tokong MinglanaNo ratings yet

- Quiz 2 Problem 1Document4 pagesQuiz 2 Problem 1Mitch Tokong MinglanaNo ratings yet

- PROBLEM 1: How Should The 100,000 Be Distributed To The Following CreditorsDocument2 pagesPROBLEM 1: How Should The 100,000 Be Distributed To The Following CreditorsMitch Tokong MinglanaNo ratings yet

- Minglana, Mitch T. (Quiz 1)Document6 pagesMinglana, Mitch T. (Quiz 1)Mitch Tokong MinglanaNo ratings yet

- Long QuizDocument5 pagesLong QuizMitch Tokong MinglanaNo ratings yet

- Larong Aihzel G. Ast Long Quiz 1Document5 pagesLarong Aihzel G. Ast Long Quiz 1Mitch Tokong MinglanaNo ratings yet

- Problem 1: Answer and SolutionDocument2 pagesProblem 1: Answer and SolutionMitch Tokong MinglanaNo ratings yet

- Problem 1:: Cash Avail For First Distribution: P65, 000 Less: Priority Creditors 50,000 Payment To Partners P15,000Document3 pagesProblem 1:: Cash Avail For First Distribution: P65, 000 Less: Priority Creditors 50,000 Payment To Partners P15,000Mitch Tokong MinglanaNo ratings yet

- Module 4 (Lesson 1-3) MinglanaDocument16 pagesModule 4 (Lesson 1-3) MinglanaMitch Tokong Minglana100% (1)

- 5TH Requirement-Management Reports As of December 31, 2020 (Minglana - Surf - Resort - )Document1 page5TH Requirement-Management Reports As of December 31, 2020 (Minglana - Surf - Resort - )Mitch Tokong MinglanaNo ratings yet

- Exit Feedback Form Rev 7.2020 HeheDocument2 pagesExit Feedback Form Rev 7.2020 HeheMitch Tokong MinglanaNo ratings yet

- Answers To Final ExamsDocument42 pagesAnswers To Final ExamsMitch Tokong MinglanaNo ratings yet

- Resignation Letter Reanette T. MinglanaDocument1 pageResignation Letter Reanette T. MinglanaMitch Tokong MinglanaNo ratings yet

- Reflection - Commandments and Beatitudes (Minglana)Document1 pageReflection - Commandments and Beatitudes (Minglana)Mitch Tokong MinglanaNo ratings yet

- Group 5: Statistical Analysis With Software ApplicationDocument6 pagesGroup 5: Statistical Analysis With Software ApplicationMitch Tokong MinglanaNo ratings yet

- Module-1 (Lesson 1-3) Minglana-Mitch-T.Document16 pagesModule-1 (Lesson 1-3) Minglana-Mitch-T.Mitch Tokong MinglanaNo ratings yet

Mitch T. Minglana BSA 301

Mitch T. Minglana BSA 301

Uploaded by

Mitch Tokong MinglanaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Mitch T. Minglana BSA 301

Mitch T. Minglana BSA 301

Uploaded by

Mitch Tokong MinglanaCopyright:

Available Formats

Mitch T.

Minglana

BSA 301

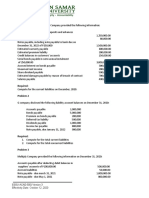

Problem 1:

Yellow Company received permission on January 1, 2020 to issue10% bonds

with face amount of P6, 000,000 maturing on January 1, 2030. Interest is

payable annually on December 31. The bonds are callable at 104 plus accrued

interest. On January 1, 2020, the entity issued the bonds for P6, 700,000 with

an effective yield of 12%. The fiscal year of the entity ends December 31. The

effective interest amortization is used.

Required:

1. Prepare journal entries relating to the bonds payable for 2020.

2020

Jan.1 Cash 6,700,000

Bonds Payable 6,000,000

Premium on bonds payable 700,000

Dec.1 Interest Expense (6,000,000x10%) 600,000

Cash 600,000

31 Premium on bonds payable 204,000

Interest expense 204,000

Interest paid 600,000

Interest expense (12%x6, 700,000) 804,000

Premium Amortization 204,000

2. Present the bonds payable on December 31, 2020.

ANSWER:

Noncurrent liabilities:

Bonds payable 6,000,000

Premium on bonds payable

(700,000-204,000) 496,000

Carrying Amount 6,496,000

You might also like

- LQ 1 - Set A SolutionDocument14 pagesLQ 1 - Set A SolutionChristina Jazareno64% (11)

- Audprob Answer 1Document1 pageAudprob Answer 1venice cambryNo ratings yet

- Intermediate Accounting 2Document27 pagesIntermediate Accounting 2CARMINA SANCHEZNo ratings yet

- Audit of Long Term Liabilities 2Document5 pagesAudit of Long Term Liabilities 2Cesar EsguerraNo ratings yet

- Note Receivable Part 2Document7 pagesNote Receivable Part 2Carlo VillanNo ratings yet

- Note Payable Practice ExerciseFDocument8 pagesNote Payable Practice ExerciseFJane Gavino0% (1)

- Notes Payable: By: Jumalon, Reicci and Gepiga, Kyle Opel ACC 211-2902Document23 pagesNotes Payable: By: Jumalon, Reicci and Gepiga, Kyle Opel ACC 211-2902idontcaree12331267% (3)

- Nepomuceno, Henry James B. - Ast Quiz 5Document2 pagesNepomuceno, Henry James B. - Ast Quiz 5Mitch Tokong MinglanaNo ratings yet

- Modules 2 4 Group Act. CompilationDocument2 pagesModules 2 4 Group Act. CompilationMitch Tokong MinglanaNo ratings yet

- BAICC2X-Solution Supplementary - Week 1docxDocument7 pagesBAICC2X-Solution Supplementary - Week 1docxMitchie FaustinoNo ratings yet

- Chapter 1 Liabilities ExercisesDocument3 pagesChapter 1 Liabilities ExercisesAwish FernNo ratings yet

- Chapter 1 None CompressDocument9 pagesChapter 1 None CompressiadcNo ratings yet

- Notes Payable and Debt Restructuring (Ruma, Jamaica)Document14 pagesNotes Payable and Debt Restructuring (Ruma, Jamaica)Jamaica RumaNo ratings yet

- Garcia Unit3 AssessmentTopic1Document5 pagesGarcia Unit3 AssessmentTopic1jaychristiangarcia18No ratings yet

- Module - IA Chapter 6Document10 pagesModule - IA Chapter 6Kathleen EbuenNo ratings yet

- Note Receivable Part 2Document7 pagesNote Receivable Part 2Carlo VillanNo ratings yet

- 5 27 LoansDocument9 pages5 27 LoansRengeline LucasNo ratings yet

- Hand Out 1 Practice SetDocument6 pagesHand Out 1 Practice SetLayka ResorezNo ratings yet

- FAR-07 Trade & Other PayableDocument3 pagesFAR-07 Trade & Other PayableKim Cristian MaañoNo ratings yet

- Chapter 14Document4 pagesChapter 14ks1043210No ratings yet

- 6011ASSIGNMENTDocument8 pages6011ASSIGNMENTpathiranapremabanduNo ratings yet

- Financial Accounting & Reporting 2: Sec - 7 - Short Quiz 1 SolutionDocument4 pagesFinancial Accounting & Reporting 2: Sec - 7 - Short Quiz 1 SolutionDump DumpNo ratings yet

- Working 5Document6 pagesWorking 5Hà Lê DuyNo ratings yet

- Alom Ia FoDocument18 pagesAlom Ia FoLea Yvette SaladinoNo ratings yet

- Problem 3Document11 pagesProblem 3Charmaine Kaye OndoyNo ratings yet

- 2020 Black Dwarf Company: Problem 7 Bonds Payable - Straight Line Method Journal Entries Date Account Title & ExplanationDocument7 pages2020 Black Dwarf Company: Problem 7 Bonds Payable - Straight Line Method Journal Entries Date Account Title & ExplanationLovely Anne Dela CruzNo ratings yet

- Boslon Audit3 Quiz 2Document6 pagesBoslon Audit3 Quiz 2Ra Dela RamaNo ratings yet

- A9 Audit of LiabilitiesDocument7 pagesA9 Audit of LiabilitiesKezNo ratings yet

- Chapter 2 Problems - IADocument8 pagesChapter 2 Problems - IAKimochi SenpaiiNo ratings yet

- LQ 1 - Set A Solution PDF Bonds (Finance) ADocument2 pagesLQ 1 - Set A Solution PDF Bonds (Finance) AeaeNo ratings yet

- FinLiab QuizDocument8 pagesFinLiab QuizAeris StrongNo ratings yet

- 8 Audit of LiabilitiesDocument4 pages8 Audit of LiabilitiesCarieza CardenasNo ratings yet

- IntAcc Reviewer - Module 2 (Problems)Document26 pagesIntAcc Reviewer - Module 2 (Problems)Lizette Janiya SumantingNo ratings yet

- Accounting 1Document10 pagesAccounting 1Jay EbuenNo ratings yet

- Lobrigas Unit3 Topic1 AssessmentDocument9 pagesLobrigas Unit3 Topic1 AssessmentClaudine LobrigasNo ratings yet

- Chapter 20 - Effective Interest Method (Amortized Cost, FVOCI, FVPL)Document66 pagesChapter 20 - Effective Interest Method (Amortized Cost, FVOCI, FVPL)Never Letting GoNo ratings yet

- FAR-01 Trade & Other PayableDocument3 pagesFAR-01 Trade & Other PayablehIgh QuaLIty SVT100% (1)

- Classroom Exercises On Sinking FundDocument3 pagesClassroom Exercises On Sinking Fundjay1ar1guyenaNo ratings yet

- 12 Redemption of DebenturesDocument13 pages12 Redemption of DebenturesRohith KumarNo ratings yet

- Chapter 15 Review ProblemsDocument4 pagesChapter 15 Review ProblemsMaya HamdyNo ratings yet

- Ans: A) Journal Entry On Date of Issue Date Account DR CRDocument4 pagesAns: A) Journal Entry On Date of Issue Date Account DR CRHumera AkbarNo ratings yet

- Problem 6-8 Answer A Savage CompanyDocument6 pagesProblem 6-8 Answer A Savage CompanyJurie BalandacaNo ratings yet

- Far Review - Notes and Receivable AssessmentDocument6 pagesFar Review - Notes and Receivable AssessmentLuisa Janelle BoquirenNo ratings yet

- Problem 5 On Loan ReceivableDocument6 pagesProblem 5 On Loan Receivablebm1ma.allysaamorNo ratings yet

- Renton Effective Am21Document5 pagesRenton Effective Am21Kris Hazel RentonNo ratings yet

- Me AnswersDocument9 pagesMe Answersgabprems11No ratings yet

- Cpa Review School of The Philippines ManilaDocument14 pagesCpa Review School of The Philippines ManilaVanessa Anne Acuña DavisNo ratings yet

- Q & A IntaccDocument9 pagesQ & A IntaccAramina Cabigting BocNo ratings yet

- Note Payable Practice Exercise FDocument9 pagesNote Payable Practice Exercise Flana del reyNo ratings yet

- Liabilities - ManuDocument7 pagesLiabilities - ManuClara MacallingNo ratings yet

- Chapter 20 CompilationDocument41 pagesChapter 20 CompilationMaria Licuanan0% (1)

- Acc 201 CH 10Document16 pagesAcc 201 CH 10Trickster TwelveNo ratings yet

- Chapter 9 - Discounting of Note ReceivableDocument5 pagesChapter 9 - Discounting of Note ReceivableLorence IbañezNo ratings yet

- Lobrigas Unit3 Topic2 AssessmentDocument6 pagesLobrigas Unit3 Topic2 AssessmentClaudine LobrigasNo ratings yet

- Financial Accounting - Tugas 5 - 18 Sep - REVISI 123Document3 pagesFinancial Accounting - Tugas 5 - 18 Sep - REVISI 123AlfiyanNo ratings yet

- Financial Accounting 2 - Liabilities (Solving) Multiple ChoiceDocument16 pagesFinancial Accounting 2 - Liabilities (Solving) Multiple ChoiceNicole Andrea TuazonNo ratings yet

- 19 Notes PayableDocument3 pages19 Notes Payableangelienacion8No ratings yet

- Receivable Financing Receivable FinancingDocument10 pagesReceivable Financing Receivable FinancingMarjorie PalmaNo ratings yet

- Bond Payable Problems - CompressDocument23 pagesBond Payable Problems - CompressJoan Ashley ViernesNo ratings yet

- Exercise LiabilitiesDocument2 pagesExercise LiabilitiesAlaine Milka GosycoNo ratings yet

- Asian Development Bank Trust Funds Report 2020: Includes Global and Special FundsFrom EverandAsian Development Bank Trust Funds Report 2020: Includes Global and Special FundsNo ratings yet

- One Year of Living with COVID-19: An Assessment of How ADB Members Fought the Pandemic in 2020From EverandOne Year of Living with COVID-19: An Assessment of How ADB Members Fought the Pandemic in 2020No ratings yet

- Prob 5Document1 pageProb 5Mitch Tokong MinglanaNo ratings yet

- Manlimos Lyka AssignmentDocument7 pagesManlimos Lyka AssignmentMitch Tokong MinglanaNo ratings yet

- Long Assignment - MinglanaDocument1 pageLong Assignment - MinglanaMitch Tokong MinglanaNo ratings yet

- Prob 2Document1 pageProb 2Mitch Tokong MinglanaNo ratings yet

- Quiz 5Document3 pagesQuiz 5Mitch Tokong MinglanaNo ratings yet

- Quiz 2 Problem 1Document4 pagesQuiz 2 Problem 1Mitch Tokong MinglanaNo ratings yet

- PROBLEM 1: How Should The 100,000 Be Distributed To The Following CreditorsDocument2 pagesPROBLEM 1: How Should The 100,000 Be Distributed To The Following CreditorsMitch Tokong MinglanaNo ratings yet

- Minglana, Mitch T. (Quiz 1)Document6 pagesMinglana, Mitch T. (Quiz 1)Mitch Tokong MinglanaNo ratings yet

- Long QuizDocument5 pagesLong QuizMitch Tokong MinglanaNo ratings yet

- Larong Aihzel G. Ast Long Quiz 1Document5 pagesLarong Aihzel G. Ast Long Quiz 1Mitch Tokong MinglanaNo ratings yet

- Problem 1: Answer and SolutionDocument2 pagesProblem 1: Answer and SolutionMitch Tokong MinglanaNo ratings yet

- Problem 1:: Cash Avail For First Distribution: P65, 000 Less: Priority Creditors 50,000 Payment To Partners P15,000Document3 pagesProblem 1:: Cash Avail For First Distribution: P65, 000 Less: Priority Creditors 50,000 Payment To Partners P15,000Mitch Tokong MinglanaNo ratings yet

- Module 4 (Lesson 1-3) MinglanaDocument16 pagesModule 4 (Lesson 1-3) MinglanaMitch Tokong Minglana100% (1)

- 5TH Requirement-Management Reports As of December 31, 2020 (Minglana - Surf - Resort - )Document1 page5TH Requirement-Management Reports As of December 31, 2020 (Minglana - Surf - Resort - )Mitch Tokong MinglanaNo ratings yet

- Exit Feedback Form Rev 7.2020 HeheDocument2 pagesExit Feedback Form Rev 7.2020 HeheMitch Tokong MinglanaNo ratings yet

- Answers To Final ExamsDocument42 pagesAnswers To Final ExamsMitch Tokong MinglanaNo ratings yet

- Resignation Letter Reanette T. MinglanaDocument1 pageResignation Letter Reanette T. MinglanaMitch Tokong MinglanaNo ratings yet

- Reflection - Commandments and Beatitudes (Minglana)Document1 pageReflection - Commandments and Beatitudes (Minglana)Mitch Tokong MinglanaNo ratings yet

- Group 5: Statistical Analysis With Software ApplicationDocument6 pagesGroup 5: Statistical Analysis With Software ApplicationMitch Tokong MinglanaNo ratings yet

- Module-1 (Lesson 1-3) Minglana-Mitch-T.Document16 pagesModule-1 (Lesson 1-3) Minglana-Mitch-T.Mitch Tokong MinglanaNo ratings yet