Professional Documents

Culture Documents

Lab Iii Audit of Sales and Collection Cycle: I. Tujuan

Lab Iii Audit of Sales and Collection Cycle: I. Tujuan

Uploaded by

yenitaCopyright:

Available Formats

You might also like

- PDFDocument2 pagesPDFLIMNo ratings yet

- Audit Programme Trade Payables Name of Client Sheridan AV Year-End Name of Auditor (S)Document5 pagesAudit Programme Trade Payables Name of Client Sheridan AV Year-End Name of Auditor (S)Miljane PerdizoNo ratings yet

- Understanding The Flow - ReceiptsDocument3 pagesUnderstanding The Flow - ReceiptsPhilip CastroNo ratings yet

- Transaction Cycle Notes PDFDocument8 pagesTransaction Cycle Notes PDFPatrick Joshua BreisNo ratings yet

- Jawaban Chapter 18Document34 pagesJawaban Chapter 18Heltiana Nufriyanti75% (4)

- Lab 3Document10 pagesLab 3valen martaNo ratings yet

- Lab 4Document8 pagesLab 4valen martaNo ratings yet

- Sol18 Sebagian2Document11 pagesSol18 Sebagian2Chotimatul ChusnaaNo ratings yet

- Workshop 8 SolutionsDocument8 pagesWorkshop 8 SolutionsAssessment Help SolutionsNo ratings yet

- Lecture 2 Audit of The Sales and Collection Cycle Tests of ControlsDocument46 pagesLecture 2 Audit of The Sales and Collection Cycle Tests of ControlsShiaab Aladeemi100% (1)

- Nadiatul - Summary Week 5Document4 pagesNadiatul - Summary Week 5nadxco 1711No ratings yet

- 2.1 Audit of Sales and ReceivablesDocument2 pages2.1 Audit of Sales and ReceivablesNavsNo ratings yet

- Lab Iii Audit of Sales and Collection Cycle: I. TujuanDocument5 pagesLab Iii Audit of Sales and Collection Cycle: I. TujuanAna NurfaizahNo ratings yet

- Specific Further Audit ProceduresDocument4 pagesSpecific Further Audit ProceduresCattleyaNo ratings yet

- CH 14 Audit of Sales and Collection Cycle Tests of Controls and Substantive Tests of TransactionsDocument11 pagesCH 14 Audit of Sales and Collection Cycle Tests of Controls and Substantive Tests of TransactionsAldwin CalambaNo ratings yet

- Substantive Audit Receivables PDFDocument23 pagesSubstantive Audit Receivables PDFnanabaNo ratings yet

- Substantive ProcedureDocument8 pagesSubstantive ProcedureGoldaNo ratings yet

- A. Key Internal Control B. Transaction Related Audit Objectives C. Test of Control D. Substantive Test of TransactionDocument5 pagesA. Key Internal Control B. Transaction Related Audit Objectives C. Test of Control D. Substantive Test of TransactionRosanaDíazNo ratings yet

- Applicable To Accounts Receivables Assertion Category (CREV) Audit Objectives Audit ProceduresDocument3 pagesApplicable To Accounts Receivables Assertion Category (CREV) Audit Objectives Audit ProceduresRosept ParnesNo ratings yet

- SVFC BS Accountancy1Document29 pagesSVFC BS Accountancy1Lorraine TomasNo ratings yet

- Auditing The Expenditure Cycle: Chapter 15 (Tutor Financial Audit)Document15 pagesAuditing The Expenditure Cycle: Chapter 15 (Tutor Financial Audit)Himawan TanNo ratings yet

- Revenue CycleDocument10 pagesRevenue CycleMart BanaresNo ratings yet

- AUD02 - 02 Transaction CyclesDocument54 pagesAUD02 - 02 Transaction CyclesMark BajacanNo ratings yet

- Presentation Audit of Acquisition and Payment CycleDocument38 pagesPresentation Audit of Acquisition and Payment CycleSyaffiq UbaidillahNo ratings yet

- Audit of The Acquisition and Payment Cycle: Tests of Controls, Substantive Tests of Transactions, and Accounts PayableDocument33 pagesAudit of The Acquisition and Payment Cycle: Tests of Controls, Substantive Tests of Transactions, and Accounts Payable김현중No ratings yet

- KELOMPOK 04 PPT AUDIT Siklus Perolehan Dan Pembayaran EditDocument39 pagesKELOMPOK 04 PPT AUDIT Siklus Perolehan Dan Pembayaran EditAkuntansi 6511No ratings yet

- Vouching Summary PDFDocument7 pagesVouching Summary PDFAjay GiriNo ratings yet

- Vouching Summary NotesDocument6 pagesVouching Summary NotesVikram KumarNo ratings yet

- Audit Procedur ES Cash Accounts Receivable Accounts Payable InventoryDocument2 pagesAudit Procedur ES Cash Accounts Receivable Accounts Payable InventoryRoseyy GalitNo ratings yet

- Auditing Business Processes - Operations Auditing (1)Document68 pagesAuditing Business Processes - Operations Auditing (1)adulusman501No ratings yet

- Revenue Cycle (Part I)Document34 pagesRevenue Cycle (Part I)Rosario TaguinotNo ratings yet

- AT 06-06 Transaction Cycles Part 1Document9 pagesAT 06-06 Transaction Cycles Part 1Eeuh100% (1)

- AEB15 SM C18 v3Document33 pagesAEB15 SM C18 v3Aaqib Hossain100% (1)

- Chapter 4 PDFDocument5 pagesChapter 4 PDFNur-aima MortabaNo ratings yet

- Audit II - CH 2-Student Notes, April, 2022Document16 pagesAudit II - CH 2-Student Notes, April, 2022Abel ZewdeNo ratings yet

- Audit ObjectivesDocument22 pagesAudit ObjectivesLils LeeNo ratings yet

- AUDIT PROGRAM For Cash Disbursements 2Document5 pagesAUDIT PROGRAM For Cash Disbursements 2jezreel dela mercedNo ratings yet

- Jan Marie Valencia Kharla Baladjay Recca Anna Laranan Rex Martin GuceDocument46 pagesJan Marie Valencia Kharla Baladjay Recca Anna Laranan Rex Martin GuceElsie AdornaNo ratings yet

- Chapter 13 Audit of The Sales and Collection CycleDocument39 pagesChapter 13 Audit of The Sales and Collection CycleFenniLimNo ratings yet

- Chapter 2Document23 pagesChapter 2Genanew AbebeNo ratings yet

- Possible MistatementDocument4 pagesPossible MistatementQuỳnh Anh NguyễnNo ratings yet

- Audit Sales and Collection Cycle1Document43 pagesAudit Sales and Collection Cycle1Tariku Tufa GaredewNo ratings yet

- MBP-L1 and L2 Process DescriptionsDocument3 pagesMBP-L1 and L2 Process Descriptionssaivenkat76No ratings yet

- Kimberly Nicole B. Ledona Bsa 2B: GUIDE QUESTIONS: Report On Revenue CycleDocument3 pagesKimberly Nicole B. Ledona Bsa 2B: GUIDE QUESTIONS: Report On Revenue CycleKimberly NicoleNo ratings yet

- Fusion Finance-SyllabusDocument8 pagesFusion Finance-SyllabusNaveen UttarkarNo ratings yet

- Control Activities Over Sales and ReceiptsDocument2 pagesControl Activities Over Sales and ReceiptsKhyam Ahmed QaziNo ratings yet

- Arens CH 14 Audit Siklus PenjualanDocument34 pagesArens CH 14 Audit Siklus PenjualanbrianpermanaNo ratings yet

- OJT Scope of WorkDocument4 pagesOJT Scope of WorkSheena Marie OuanoNo ratings yet

- Chapter Two Audit of Receivables and Sales: Page - 1Document20 pagesChapter Two Audit of Receivables and Sales: Page - 1mubarek oumer100% (1)

- Problem CH 6,7,8 - Amelia Zulaikha Pratiwi - MAKSI43BDocument4 pagesProblem CH 6,7,8 - Amelia Zulaikha Pratiwi - MAKSI43Bamelia zulaikhaNo ratings yet

- CH04 - Revenue CycleDocument45 pagesCH04 - Revenue CycleIan Vincent Lazaga MaribaoNo ratings yet

- 1A Sales TransactionsDocument2 pages1A Sales TransactionsCrest TineNo ratings yet

- Test of ControlDocument10 pagesTest of ControlShrividhyaNo ratings yet

- Final Requirement in Auditing in Csis Environment: 1. Create A Data Flow Diagram of The Current SystemDocument3 pagesFinal Requirement in Auditing in Csis Environment: 1. Create A Data Flow Diagram of The Current SystemmaiaaaaNo ratings yet

- Audit of Revenue CycleDocument39 pagesAudit of Revenue CyclejunaiddaNo ratings yet

- Revenue and Expenditure AuditDocument38 pagesRevenue and Expenditure AuditPavitra MohanNo ratings yet

- AIS Reviewer AIS Reviewer: Accountancy (The National Teachers College) Accountancy (The National Teachers College)Document13 pagesAIS Reviewer AIS Reviewer: Accountancy (The National Teachers College) Accountancy (The National Teachers College)Aldwin CalambaNo ratings yet

- Davita - Dewardani - 182321069 Tugas Pengauditan KeuanganDocument4 pagesDavita - Dewardani - 182321069 Tugas Pengauditan KeuanganHAHAHA HIHIHINo ratings yet

- WP Asset B - Trade ReceivablesDocument15 pagesWP Asset B - Trade ReceivablesDikdikNo ratings yet

- Accounts Payable: A Guide to Running an Efficient DepartmentFrom EverandAccounts Payable: A Guide to Running an Efficient DepartmentNo ratings yet

- Health Insurance Policy Certificate Section80DDocument1 pageHealth Insurance Policy Certificate Section80DDebosmita DasNo ratings yet

- RLLR SchemeDocument1 pageRLLR SchemeBhushan Singh BadgujjarNo ratings yet

- Merger ReportDocument9 pagesMerger ReportArisha KhanNo ratings yet

- Lesson1 PDFDocument12 pagesLesson1 PDFCharm BatiancilaNo ratings yet

- AFN Forecasting - Practice QuestionsDocument1 pageAFN Forecasting - Practice QuestionsMuhammad Ali Samar100% (3)

- FNSCRD301 Process Applications For CreditDocument5 pagesFNSCRD301 Process Applications For Creditpatrick wafulaNo ratings yet

- Unit2: Treatment of Goodwill in Partnership AccountsDocument27 pagesUnit2: Treatment of Goodwill in Partnership AccountsJavid QuadirNo ratings yet

- Vision PT 365 Economy 2019Document69 pagesVision PT 365 Economy 2019ajit yashwantraoNo ratings yet

- AAT 20603 - Group AssignmentDocument1 pageAAT 20603 - Group Assignmentchongjiale5597No ratings yet

- Null 20220614 231107Document4 pagesNull 20220614 231107FARMASI BEC BUBATNo ratings yet

- FAR.113 - INVESTMENT PROPERTY With Answer PDFDocument5 pagesFAR.113 - INVESTMENT PROPERTY With Answer PDFMaeNo ratings yet

- T7 - Interest Rate Futures - AnswerDocument4 pagesT7 - Interest Rate Futures - Answerkristin_kim_13No ratings yet

- Discharge For Death Claim Under Policy No.Document3 pagesDischarge For Death Claim Under Policy No.Jayabalaji RNo ratings yet

- Manufacturing AccountDocument50 pagesManufacturing AccountfarissaharNo ratings yet

- Guidelines TaxRelatedDeclarations2022 23 ENCOREDocument24 pagesGuidelines TaxRelatedDeclarations2022 23 ENCOREwishliyaNo ratings yet

- Module 3: Nominal and Effective Interest Rates: SI-4151 Ekonomi TeknikDocument21 pagesModule 3: Nominal and Effective Interest Rates: SI-4151 Ekonomi TeknikSanjika IlhamNo ratings yet

- Paytm Money Limited: Combined Margin Statement For The Day: Apr 22 2021Document1 pagePaytm Money Limited: Combined Margin Statement For The Day: Apr 22 2021Lekkalapudi SricharanNo ratings yet

- 5-10 Fa1Document10 pages5-10 Fa1Shahab ShafiNo ratings yet

- Account Receivable (A/R) : ReceivablesDocument12 pagesAccount Receivable (A/R) : ReceivablesAndiBrianatanAffandiNo ratings yet

- HLB Receipt-2023-03-08Document2 pagesHLB Receipt-2023-03-08zu hairyNo ratings yet

- Midterm Paper-FSP-Fall 2020Document4 pagesMidterm Paper-FSP-Fall 2020syed aliNo ratings yet

- Rs-Cfa: Tally Accounting NotesDocument8 pagesRs-Cfa: Tally Accounting NotesJakir HusainNo ratings yet

- HFAC130 1 JanJun2024 FA1 GC V.2 07022024Document9 pagesHFAC130 1 JanJun2024 FA1 GC V.2 07022024ICT ASSIGNMENTS MZANSINo ratings yet

- CFA LEVEL 1 - CFA Exam Core Video SeriesDocument2 pagesCFA LEVEL 1 - CFA Exam Core Video SeriesrajsalgyanNo ratings yet

- Balance Sheet - WikipediaDocument32 pagesBalance Sheet - WikipediaIrshad ShaikhNo ratings yet

- Ventura, Mary Mickaella R - Noncurrentassetsheldforsale (2) - Group 3Document5 pagesVentura, Mary Mickaella R - Noncurrentassetsheldforsale (2) - Group 3Mary VenturaNo ratings yet

- Chapter 3 FinmarDocument21 pagesChapter 3 FinmarJohn SecretNo ratings yet

- Savings and Loan CrisisDocument15 pagesSavings and Loan CrisisSiuMing ChanNo ratings yet

- Account Statement 020222 010822Document143 pagesAccount Statement 020222 010822KumarNo ratings yet

Lab Iii Audit of Sales and Collection Cycle: I. Tujuan

Lab Iii Audit of Sales and Collection Cycle: I. Tujuan

Uploaded by

yenitaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Lab Iii Audit of Sales and Collection Cycle: I. Tujuan

Lab Iii Audit of Sales and Collection Cycle: I. Tujuan

Uploaded by

yenitaCopyright:

Available Formats

LAB III

AUDIT OF SALES AND COLLECTION CYCLE

I. Tujuan

1. Mengetahui kelas transaksi pada sales and collection cycle

2. Mengetahui fungsi bisnis , dokumen terakit, dan pencatatan pada sales and collection cycle

3. Memahami TOC, STOT, dan TODB

4. Mengetahui risiko kecurangan

5. Mengetahui jenis konfirmasi

6. Memahami Key Internal Control

II. TinjauanTeori

1. Kelas transaksi:

a. Sales of goods and service

b. Cash receipt

c. Sales return and allowances and sales discounts

2. Fungsi bisnis, dokumen terkait, dan pencatatan:

Kelas Transaksi Akun Fungsi Bisnis Dokumen Terkait

Sales Sales Processing Customer Customer order

Order Sales order

Deliver goods and Shipping document

services

Account Receivable Recognizing the Sales Invoices

receivable Credit memo

Sales transaction file

Sales journal or

listing

Account receivable

master file

ANISA-MARVEL-SARAH-ZIDNA ATA 2020

Account receivable

trial balance

Monthly statement

Cash receipt Cash in bank (from Processing and Check and

cash receipt) recording cash remittance advice

Account receivable receipt Cash receipt

transaction file

Sales discount Cash receipt journal

or listing

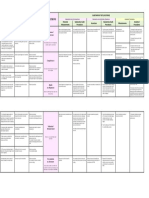

Methodology for Designing Tests of Controls and Substantive Tests of Transactions for

Sales:

Understand internal

control- sales

Assess planned control

risk-sales

Determine extent of tests

of controls

Design tests of controls Audit procedures

and substantive tests of

Sample size

transactions to meet

transaction-related audit Items to select

objectives

Timing

ANISA-MARVEL-SARAH-ZIDNA ATA 2020

3. Test of Control (TOC), Substantive Test of Transaction (STOT), dan Test of Details Balances (TODB)

Prosedur Asersi (TRAO)

Occurence Completeness Accuracy Posting and Classification Timing

summarization

Test of Control

1. Memeriksa dokumen pengiriman X

barang

2. Memeriksa indikasi persetujuan X X

3. Mencoba menginput transaksi X

dengan customer yang sah dan yang

tidak sah

4. Memeriksa indikasi adanya X

pembetulan penjualan

5. Memeriksa indikasi verifikasi X X X X X

internal

6. Membukukan sales order secara X

urut

7. Membukukan shipping document X

secara urut

8. Membukukan invoice secara urut X

ANISA-MARVEL-SARAH-ZIDNA ATA 2020

9. Membandingkan total dengan X

summary report

10. Memeriksa account receivable X

Masterfile dengan general ledger

untuk melihat apabila terdapat

perbedaan

11. Memeriksa prosedur manual dan X

chart of account

Substantive Test of Transaction

1. Review sales & cash receipt X

journal, general ledger dan account

receivable masterfile atas jumlah yang

besar atau yang tidak biasa

2. Memeriksa customer masterfile atas X

customer yang tidak biasa

3. Melakukan tracing terhadap check X

yang dibatalkan ke jurnal penjualan

terkait dan memeriksa nama customer

dan berapa jumlahnya

ANISA-MARVEL-SARAH-ZIDNA ATA 2020

4. Melakukan tracing terhadap X

shipping document atau invoice ke

sales journal

5.Membandingkan transaksi pada X

sales journal dengan invoices atau

shipping document

6. Menyiapkan prelisting of cash X

receipt

7. Melakukan footing jurnal dan X

tracing posting ke general ledger dan

account receivable

8. Membandingkan klasifikasi dengan X

chart of account yang ditujukan pada

sales invoice

9. Membandingkan tanggal pada X

cancelled check atau electronic bank

records dengan tanggal pada cash

receipt journal.

ANISA-MARVEL-SARAH-ZIDNA ATA 2020

Prosedur Asersi (BRAO)

Existence Completeness Accuracy Detail tie-in Classification Cutoff Obligations

Test of Details Balances

L Lakukan tracing account receivable X

masterfile ke general ledger

2. Konfirmasi account receivable X

3. Lakukan prosedur alternative X X

apabila konfirmasi positif tidak

mendapat respon

Periksa penerimaan kas yang

terjadi pada periode

selanjutnya

Periksa dokumen pengiriman

barang

4. Pengujian terhadap cutoff pada X

sales

ANISA-MARVEL-SARAH-ZIDNA ATA 2020

Analytical Procedure for the Sales and Collection Cycle:

Analytical Procedure Possible Misstatement

Compare gross margin percentage with Overstatement or understatement of sales

previous years (by product line). and accounts receivable.

Compare sales by month (by product line) Overstatement or understatement of sales

over time and accounts receivable.

Compare sales returns and allowances as a Overstatement or understatement of sales

percentage of gross sales with previous return and allowances and accounts

years (by product line). receivable.

Compare individual customer balances over Misstatements in accounts receivable and

a stated amount with previous years. related income statement accounts.

Compare bad debt expense as a percentage Uncollectible accounts receivable that have

of gross sales with previous years. not been provided for.

Compare number of days that accounts Overstatement or understatement of

receivable are outstanding with previous allowance for uncollectible accounts and

years and related turnover of accounts bad debt expense; also may indicate fictious

receivable. accounts receivable.

Compare aging categories as a percentage Overstatement or understatement of

of account receivable with previous years. allowance for uncollectible accounts and

bad debt expense.

Compare allowance for uncollectible Overstatement or understatement of

accounts as a percentage of accounts allowance for uncollectible accounts and

receivable with previous years. bad debt expense.

Compare write-off of uncollectible accounts Overstatement or understatement of

as a percentage of total account receivable allowance for uncollectible accounts and

with previous years. bad debt expense.

ANISA-MARVEL-SARAH-ZIDNA ATA 2020

4. Risiko Kecurangan pada sales and collection cycle adalah:

Penjualan Fiktif

Lapping (Penundaan pencatatan account receivable)

5. Jenis konfirmasi dalam siklus ini ada 2 yaitu:

a. Konfirmasi positif

Konfirmasi positif adalah konfirmasi yang membutuhkan jawaban dari pelanggan apakah saldo

piutang pelanggan tersebut sudah benar atau tidak. Konfirmasi positif terdiri dari:

Blank confirmation:

merupakan konfirmasi yang respondennya diminta untuk mengisikan saldo atau

informasi lain sebagai jawaban atas suatu hal yang dinyatakan.

Invoice confirmation:

merupakan bentuk lain konfirmasi positif yang merupakan konfirmasi individual,

bukan saldo keseluruhan piutang pelanggan.

b. Konfirmasi Negatif

Konfirmasi negatif adalah konfirmasi dimana pelanggan tidak perlu memberi respon jika saldo

piutang yang disajikan sudah benar.

.Jika konfirmasi positif tidak dijawab, maka dapat dilakukan prosedur alternatif yaitu :

subsequent cash receipt

duplicate sales imvoice

shipping document

6. Key Internal Control pada sales and collection cycle:

a. Segregation of duties

b. proper authorization

c. adequate document and record

d. prenumbered document

e. monthly statement

ANISA-MARVEL-SARAH-ZIDNA ATA 2020

You might also like

- PDFDocument2 pagesPDFLIMNo ratings yet

- Audit Programme Trade Payables Name of Client Sheridan AV Year-End Name of Auditor (S)Document5 pagesAudit Programme Trade Payables Name of Client Sheridan AV Year-End Name of Auditor (S)Miljane PerdizoNo ratings yet

- Understanding The Flow - ReceiptsDocument3 pagesUnderstanding The Flow - ReceiptsPhilip CastroNo ratings yet

- Transaction Cycle Notes PDFDocument8 pagesTransaction Cycle Notes PDFPatrick Joshua BreisNo ratings yet

- Jawaban Chapter 18Document34 pagesJawaban Chapter 18Heltiana Nufriyanti75% (4)

- Lab 3Document10 pagesLab 3valen martaNo ratings yet

- Lab 4Document8 pagesLab 4valen martaNo ratings yet

- Sol18 Sebagian2Document11 pagesSol18 Sebagian2Chotimatul ChusnaaNo ratings yet

- Workshop 8 SolutionsDocument8 pagesWorkshop 8 SolutionsAssessment Help SolutionsNo ratings yet

- Lecture 2 Audit of The Sales and Collection Cycle Tests of ControlsDocument46 pagesLecture 2 Audit of The Sales and Collection Cycle Tests of ControlsShiaab Aladeemi100% (1)

- Nadiatul - Summary Week 5Document4 pagesNadiatul - Summary Week 5nadxco 1711No ratings yet

- 2.1 Audit of Sales and ReceivablesDocument2 pages2.1 Audit of Sales and ReceivablesNavsNo ratings yet

- Lab Iii Audit of Sales and Collection Cycle: I. TujuanDocument5 pagesLab Iii Audit of Sales and Collection Cycle: I. TujuanAna NurfaizahNo ratings yet

- Specific Further Audit ProceduresDocument4 pagesSpecific Further Audit ProceduresCattleyaNo ratings yet

- CH 14 Audit of Sales and Collection Cycle Tests of Controls and Substantive Tests of TransactionsDocument11 pagesCH 14 Audit of Sales and Collection Cycle Tests of Controls and Substantive Tests of TransactionsAldwin CalambaNo ratings yet

- Substantive Audit Receivables PDFDocument23 pagesSubstantive Audit Receivables PDFnanabaNo ratings yet

- Substantive ProcedureDocument8 pagesSubstantive ProcedureGoldaNo ratings yet

- A. Key Internal Control B. Transaction Related Audit Objectives C. Test of Control D. Substantive Test of TransactionDocument5 pagesA. Key Internal Control B. Transaction Related Audit Objectives C. Test of Control D. Substantive Test of TransactionRosanaDíazNo ratings yet

- Applicable To Accounts Receivables Assertion Category (CREV) Audit Objectives Audit ProceduresDocument3 pagesApplicable To Accounts Receivables Assertion Category (CREV) Audit Objectives Audit ProceduresRosept ParnesNo ratings yet

- SVFC BS Accountancy1Document29 pagesSVFC BS Accountancy1Lorraine TomasNo ratings yet

- Auditing The Expenditure Cycle: Chapter 15 (Tutor Financial Audit)Document15 pagesAuditing The Expenditure Cycle: Chapter 15 (Tutor Financial Audit)Himawan TanNo ratings yet

- Revenue CycleDocument10 pagesRevenue CycleMart BanaresNo ratings yet

- AUD02 - 02 Transaction CyclesDocument54 pagesAUD02 - 02 Transaction CyclesMark BajacanNo ratings yet

- Presentation Audit of Acquisition and Payment CycleDocument38 pagesPresentation Audit of Acquisition and Payment CycleSyaffiq UbaidillahNo ratings yet

- Audit of The Acquisition and Payment Cycle: Tests of Controls, Substantive Tests of Transactions, and Accounts PayableDocument33 pagesAudit of The Acquisition and Payment Cycle: Tests of Controls, Substantive Tests of Transactions, and Accounts Payable김현중No ratings yet

- KELOMPOK 04 PPT AUDIT Siklus Perolehan Dan Pembayaran EditDocument39 pagesKELOMPOK 04 PPT AUDIT Siklus Perolehan Dan Pembayaran EditAkuntansi 6511No ratings yet

- Vouching Summary PDFDocument7 pagesVouching Summary PDFAjay GiriNo ratings yet

- Vouching Summary NotesDocument6 pagesVouching Summary NotesVikram KumarNo ratings yet

- Audit Procedur ES Cash Accounts Receivable Accounts Payable InventoryDocument2 pagesAudit Procedur ES Cash Accounts Receivable Accounts Payable InventoryRoseyy GalitNo ratings yet

- Auditing Business Processes - Operations Auditing (1)Document68 pagesAuditing Business Processes - Operations Auditing (1)adulusman501No ratings yet

- Revenue Cycle (Part I)Document34 pagesRevenue Cycle (Part I)Rosario TaguinotNo ratings yet

- AT 06-06 Transaction Cycles Part 1Document9 pagesAT 06-06 Transaction Cycles Part 1Eeuh100% (1)

- AEB15 SM C18 v3Document33 pagesAEB15 SM C18 v3Aaqib Hossain100% (1)

- Chapter 4 PDFDocument5 pagesChapter 4 PDFNur-aima MortabaNo ratings yet

- Audit II - CH 2-Student Notes, April, 2022Document16 pagesAudit II - CH 2-Student Notes, April, 2022Abel ZewdeNo ratings yet

- Audit ObjectivesDocument22 pagesAudit ObjectivesLils LeeNo ratings yet

- AUDIT PROGRAM For Cash Disbursements 2Document5 pagesAUDIT PROGRAM For Cash Disbursements 2jezreel dela mercedNo ratings yet

- Jan Marie Valencia Kharla Baladjay Recca Anna Laranan Rex Martin GuceDocument46 pagesJan Marie Valencia Kharla Baladjay Recca Anna Laranan Rex Martin GuceElsie AdornaNo ratings yet

- Chapter 13 Audit of The Sales and Collection CycleDocument39 pagesChapter 13 Audit of The Sales and Collection CycleFenniLimNo ratings yet

- Chapter 2Document23 pagesChapter 2Genanew AbebeNo ratings yet

- Possible MistatementDocument4 pagesPossible MistatementQuỳnh Anh NguyễnNo ratings yet

- Audit Sales and Collection Cycle1Document43 pagesAudit Sales and Collection Cycle1Tariku Tufa GaredewNo ratings yet

- MBP-L1 and L2 Process DescriptionsDocument3 pagesMBP-L1 and L2 Process Descriptionssaivenkat76No ratings yet

- Kimberly Nicole B. Ledona Bsa 2B: GUIDE QUESTIONS: Report On Revenue CycleDocument3 pagesKimberly Nicole B. Ledona Bsa 2B: GUIDE QUESTIONS: Report On Revenue CycleKimberly NicoleNo ratings yet

- Fusion Finance-SyllabusDocument8 pagesFusion Finance-SyllabusNaveen UttarkarNo ratings yet

- Control Activities Over Sales and ReceiptsDocument2 pagesControl Activities Over Sales and ReceiptsKhyam Ahmed QaziNo ratings yet

- Arens CH 14 Audit Siklus PenjualanDocument34 pagesArens CH 14 Audit Siklus PenjualanbrianpermanaNo ratings yet

- OJT Scope of WorkDocument4 pagesOJT Scope of WorkSheena Marie OuanoNo ratings yet

- Chapter Two Audit of Receivables and Sales: Page - 1Document20 pagesChapter Two Audit of Receivables and Sales: Page - 1mubarek oumer100% (1)

- Problem CH 6,7,8 - Amelia Zulaikha Pratiwi - MAKSI43BDocument4 pagesProblem CH 6,7,8 - Amelia Zulaikha Pratiwi - MAKSI43Bamelia zulaikhaNo ratings yet

- CH04 - Revenue CycleDocument45 pagesCH04 - Revenue CycleIan Vincent Lazaga MaribaoNo ratings yet

- 1A Sales TransactionsDocument2 pages1A Sales TransactionsCrest TineNo ratings yet

- Test of ControlDocument10 pagesTest of ControlShrividhyaNo ratings yet

- Final Requirement in Auditing in Csis Environment: 1. Create A Data Flow Diagram of The Current SystemDocument3 pagesFinal Requirement in Auditing in Csis Environment: 1. Create A Data Flow Diagram of The Current SystemmaiaaaaNo ratings yet

- Audit of Revenue CycleDocument39 pagesAudit of Revenue CyclejunaiddaNo ratings yet

- Revenue and Expenditure AuditDocument38 pagesRevenue and Expenditure AuditPavitra MohanNo ratings yet

- AIS Reviewer AIS Reviewer: Accountancy (The National Teachers College) Accountancy (The National Teachers College)Document13 pagesAIS Reviewer AIS Reviewer: Accountancy (The National Teachers College) Accountancy (The National Teachers College)Aldwin CalambaNo ratings yet

- Davita - Dewardani - 182321069 Tugas Pengauditan KeuanganDocument4 pagesDavita - Dewardani - 182321069 Tugas Pengauditan KeuanganHAHAHA HIHIHINo ratings yet

- WP Asset B - Trade ReceivablesDocument15 pagesWP Asset B - Trade ReceivablesDikdikNo ratings yet

- Accounts Payable: A Guide to Running an Efficient DepartmentFrom EverandAccounts Payable: A Guide to Running an Efficient DepartmentNo ratings yet

- Health Insurance Policy Certificate Section80DDocument1 pageHealth Insurance Policy Certificate Section80DDebosmita DasNo ratings yet

- RLLR SchemeDocument1 pageRLLR SchemeBhushan Singh BadgujjarNo ratings yet

- Merger ReportDocument9 pagesMerger ReportArisha KhanNo ratings yet

- Lesson1 PDFDocument12 pagesLesson1 PDFCharm BatiancilaNo ratings yet

- AFN Forecasting - Practice QuestionsDocument1 pageAFN Forecasting - Practice QuestionsMuhammad Ali Samar100% (3)

- FNSCRD301 Process Applications For CreditDocument5 pagesFNSCRD301 Process Applications For Creditpatrick wafulaNo ratings yet

- Unit2: Treatment of Goodwill in Partnership AccountsDocument27 pagesUnit2: Treatment of Goodwill in Partnership AccountsJavid QuadirNo ratings yet

- Vision PT 365 Economy 2019Document69 pagesVision PT 365 Economy 2019ajit yashwantraoNo ratings yet

- AAT 20603 - Group AssignmentDocument1 pageAAT 20603 - Group Assignmentchongjiale5597No ratings yet

- Null 20220614 231107Document4 pagesNull 20220614 231107FARMASI BEC BUBATNo ratings yet

- FAR.113 - INVESTMENT PROPERTY With Answer PDFDocument5 pagesFAR.113 - INVESTMENT PROPERTY With Answer PDFMaeNo ratings yet

- T7 - Interest Rate Futures - AnswerDocument4 pagesT7 - Interest Rate Futures - Answerkristin_kim_13No ratings yet

- Discharge For Death Claim Under Policy No.Document3 pagesDischarge For Death Claim Under Policy No.Jayabalaji RNo ratings yet

- Manufacturing AccountDocument50 pagesManufacturing AccountfarissaharNo ratings yet

- Guidelines TaxRelatedDeclarations2022 23 ENCOREDocument24 pagesGuidelines TaxRelatedDeclarations2022 23 ENCOREwishliyaNo ratings yet

- Module 3: Nominal and Effective Interest Rates: SI-4151 Ekonomi TeknikDocument21 pagesModule 3: Nominal and Effective Interest Rates: SI-4151 Ekonomi TeknikSanjika IlhamNo ratings yet

- Paytm Money Limited: Combined Margin Statement For The Day: Apr 22 2021Document1 pagePaytm Money Limited: Combined Margin Statement For The Day: Apr 22 2021Lekkalapudi SricharanNo ratings yet

- 5-10 Fa1Document10 pages5-10 Fa1Shahab ShafiNo ratings yet

- Account Receivable (A/R) : ReceivablesDocument12 pagesAccount Receivable (A/R) : ReceivablesAndiBrianatanAffandiNo ratings yet

- HLB Receipt-2023-03-08Document2 pagesHLB Receipt-2023-03-08zu hairyNo ratings yet

- Midterm Paper-FSP-Fall 2020Document4 pagesMidterm Paper-FSP-Fall 2020syed aliNo ratings yet

- Rs-Cfa: Tally Accounting NotesDocument8 pagesRs-Cfa: Tally Accounting NotesJakir HusainNo ratings yet

- HFAC130 1 JanJun2024 FA1 GC V.2 07022024Document9 pagesHFAC130 1 JanJun2024 FA1 GC V.2 07022024ICT ASSIGNMENTS MZANSINo ratings yet

- CFA LEVEL 1 - CFA Exam Core Video SeriesDocument2 pagesCFA LEVEL 1 - CFA Exam Core Video SeriesrajsalgyanNo ratings yet

- Balance Sheet - WikipediaDocument32 pagesBalance Sheet - WikipediaIrshad ShaikhNo ratings yet

- Ventura, Mary Mickaella R - Noncurrentassetsheldforsale (2) - Group 3Document5 pagesVentura, Mary Mickaella R - Noncurrentassetsheldforsale (2) - Group 3Mary VenturaNo ratings yet

- Chapter 3 FinmarDocument21 pagesChapter 3 FinmarJohn SecretNo ratings yet

- Savings and Loan CrisisDocument15 pagesSavings and Loan CrisisSiuMing ChanNo ratings yet

- Account Statement 020222 010822Document143 pagesAccount Statement 020222 010822KumarNo ratings yet