Professional Documents

Culture Documents

Additional Financial Reporting Issues: Chapter Outline

Additional Financial Reporting Issues: Chapter Outline

Uploaded by

Fernando III PerezOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Additional Financial Reporting Issues: Chapter Outline

Additional Financial Reporting Issues: Chapter Outline

Uploaded by

Fernando III PerezCopyright:

Available Formats

CHAPTER 8

ADDITIONAL FINANCIAL REPORTING ISSUES

Chapter Outline

I. In addition to issues involving the accounting for foreign currency, three financial reporting

issues of international importance are: (a) accounting for changing prices (inflation

accounting), (b) accounting for business combinations and consolidated financial

statements, and (c) segment reporting.

II. Historical cost accounting in a period of inflation understates asset values (and related

expenses) and overstates income. Historical cost accounting also ignores the gains and

losses in purchasing power caused by inflation that arise from holding monetary assets

and liabilities.

III. Two methods of accounting for inflation have been used in different countries – general

purchasing power (GPP) accounting and current cost (CC) accounting.

A. Under GPP accounting, nonmonetary assets and stockholders’ equity accounts are

restated for changes in the general price level. Cost of goods sold and

depreciation/amortization are based on restated asset values and the net purchasing

power gain/loss on the net monetary liability/asset position is included in income. GPP

income is the amount that can be paid as a dividend while maintaining the purchasing

power of capital.

B. Under CC accounting, nonmonetary assets are revalued to current cost, and cost of

goods sold and depreciation/amortization are based on revalued amounts. CC

income is the amount that can be paid as a dividend while maintaining physical capital.

IV. IAS 29 requires the use of GPP accounting by firms that report in the currency of a

hyperinflationary economy. IAS 21 requires the financial statements of a foreign operation

located in a hyperinflationary economy to first be adjusted for inflation in accordance with

IAS 29 before translation into the parent company’s reporting currency.

V. Issues that must be resolved in accounting for a business combination relate to (a)

selection of an appropriate method, (b) recognition and measurement of goodwill, and (c)

measurement of minority interest.

A. IFRS 3 and US. GAAP both require the purchase method in accounting for business

combinations; the pooling of interests method is not allowed.

B. Goodwill is recognized on the consolidated balance sheet as an asset and tested

annually for impairment under both IFRS 3 and U.S. GAAP.

C. When less than 100% of a company is acquired, IFRS 3 requires the acquired assets

and liabilities to be recorded at full fair value and minority interest is initially measured

at the minority shareholders’ percentage ownership in the fair value of the acquired

company’s net assets. This is known as the economic unit or entity concept.

McGraw-Hill/Irwin © The McGraw-Hill Companies, Inc., 2007

Doupnik and Perera, International Accounting, 1/e 8-1

1. In addition to the economic unit or entity concept, U.S. GAAP also allows use of

the parent company concept in which the acquired assets and liabilities are initially

measured at book value plus the parent’s ownership percentage in the difference

between fair value and book value. Under this approach, minority interest is

initially measured at the minority shareholders’ percentage ownership in the book

value of the subsidiary’s net assets.

VI. IAS 28 and US. GAAP require use of the equity method when an investor has the ability to

exert significant influence over an investee; significant influence is presumed when the

investor owns 20% or more of the investee’s voting shares.

VII. In accounting for an investment in a joint venture, IAS 31 prefers the use of proportionate

consolidation, but also allows the equity method. The equity method is required under

U.S. GAAP.

VIII. Questions arise as to (a) when an investee should be considered a subsidiary and (b)

which subsidiaries should be consolidated when a parent company prepares consolidated

financial statements.

A. IAS 27 defines a subsidiary as an enterprise controlled by another enterprise known as

the parent. Control is defined as the power to govern the financial and operating

policies of an entity so as to obtain benefits from its activities. Control can exist

without owning a majority of shares of stock, for example, when one company has

power over more than half of the voting rights through agreements with other

shareholders.

1. Historically, U.S. companies have relied on majority stock ownership as evidence of

control.

B. IAS 27 requires a parent to consolidate all subsidiaries unless (a) the subsidiary was

acquired with the intent to dispose of it within 12 months and (b) management is

actively seeking a buyer.

1. U.S. GAAP requires all subsidiaries to be consolidated unless the parent has lost

control due to bankruptcy or severe restrictions imposed by a foreign government.

IX. The aggregation of all of a company’s activities into consolidated totals masks the

differences in risk and potential existing across different lines of business and in different

parts of the world. To provide information that can be used to evaluate these risks and

potentials, companies disaggregate consolidated totals and provide disclosures on a

segment basis. Segment reporting is an area in which considerable diversity exists

internationally.

McGraw-Hill/Irwin © The McGraw-Hill Companies, Inc., 2007

Doupnik and Perera, International Accounting, 1/e 8-2

X. IAS 14 requires companies to disclose disaggregated information by business segment

and geographic segment, one of which is designated as the primary reporting format.

A. A business segment or a geographic segment is reportable if a majority of its revenues

are generated from external customers and it meets one of three significance tests.

The segment must have: 10% or more of combined segment revenues, 10% or more

of combined segment profits, or 10% or more of combined segment assets.

B. A sufficient number of segments must be separately reported to disclose at least 75%

of consolidated revenues.

C. Disclosures to be provided for each primary reporting format reportable segment

include: revenue, profit or loss, assets, liabilities, capital expenditures, depreciation

and amortization, other significant noncash expenses, and equity method profit or loss.

D. Disclosures to be provided for each secondary reporting format reportable segment

include: revenue from external customers, assets, and capital expenditures.

XI. U.S. GAAP requires extensive disclosure to be made for operating segments, which can

be based either on product lines or geographic regions.

A. Disclosures should reflect what is reported internally to the chief operating officer, even

if this is on a non-GAAP basis.

B. If operating segments are not based on geography, revenues and long-lived assets

must be disclosed for (a) the domestic country, (b) all foreign countries in total, and (c)

for each foreign country in which a material amount of revenues or long-lived assets

are located. A quantitative threshold for determining materiality is not specified.

McGraw-Hill/Irwin © The McGraw-Hill Companies, Inc., 2007

Doupnik and Perera, International Accounting, 1/e 8-3

Answers to Questions

1. Historical cost accounting causes assets to be significantly understated in a country

experiencing high inflation. Understated assets, such as inventory and fixed assets, leads

to understated expenses, such as cost of goods sold and depreciation, which in turn leads

to overstated income and stockholders’ equity.

Understated asset values can have a negative impact on a company’s ability to borrow

because the collateral is understated. Understated asset values also can be an invitation for

a hostile takeover to the extent that the current market price of a company’s stock does not

reflect the current value of assets.

Overstated income results in more taxes being paid to the government than would otherwise

be paid, and could lead to stockholders demanding a higher level of dividend than would

otherwise be expected. Through the payment of taxes on inflated income and the payment

of dividends out of inflated net income, both of which result in cash outflows, a company

may find itself in a liquidity crisis.

To the extent that companies are exposed to different rates of inflation, the understatement

of assets and overstatement of income will differ across companies; this can distort

comparisons across companies. For example, a company with older fixed assets will report

a higher return on assets than a company with newer assets because income is more

overstated and assets are more understated than for the comparison company. Because

inflation rates tend to vary across countries, comparisons made by a parent company across

its subsidiaries located in different countries can be distorted.

2. Non-monetary assets and non-monetary liabilities are restated for changes in the general

purchasing power of the monetary unit. Most non-monetary items are carried at historical

cost. In these cases, the restated cost is determined by applying to the historical cost the

change in general price index from the date of acquisition to the balance sheet date. Some

non-monetary items are carried at revalued amounts, for example, property, plant and

equipment revalued according to the allowed alternative treatment in IAS 16, “Property,

Plant and Equipment.” These items are restated from the date of the revaluation.

All components of owners’ equity are restated by applying the change in the general price

index from the beginning of the period or the date of contribution, if later, to the balance

sheet date.

Monetary assets and monetary liabilities (cash, receivables, and payables) are not restated

because they are already expressed in terms of the monetary unit current at the balance

sheet date.

All income statement items are restated by applying the change in the general price index

from the dates when the items were originally recorded to the balance sheet date.

The gain or loss on net monetary position (purchasing power gain or loss) is included in net

income.

3. Monetary assets (cash and receivables) give rise to purchasing power losses and monetary

liabilities (payables) give rise to purchasing power gains.

McGraw-Hill/Irwin © The McGraw-Hill Companies, Inc., 2007

Doupnik and Perera, International Accounting, 1/e 8-4

4. Historical costs of nonmonetary assets (inventory, fixed assets, intangibles) are replaced

with current replacement cost and expenses (cost of goods sold, depreciation, amortization)

are based on these current costs. The amount by which nonmonetary assets are revalued

to replacement cost on the balance sheet is also reflected in stockholders’ equity as a

revaluation surplus (or reserve).

5. Current cost accounting generally results in a larger amount of nonmonetary assets, as well

as a larger amount of stockholders’ equity, being reported on the balance sheet. Expenses

based on the current cost of nonmonetary assets (carried at larger amounts) generally

results in a smaller amount of net income being reported under current cost accounting.

With smaller income and larger stockholders’ equity, return on equity measured under

current cost accounting is generally smaller than under historical cost accounting.

6. IAS 15, “Information Reflecting the Effects of Changing Prices,” required supplementary

disclosure of the following items reflecting the effects of changing prices:

1. the amount of adjustment to depreciation expense,

2. the amount of adjustment to cost of sales,

3. the amount of purchasing power gain or loss on monetary items,

4. the aggregate of all adjustments reflecting the effects of changing prices, and

5. if current cost accounting is used, the current cost of property, plant, and equipment.

The standard only applied to enterprises “whose levels of revenues, profits, assets or

employment are significant in the economic environment in which they operate,” and

allowed those enterprises to choose between making adjustments on a GPP or a CC basis.

Because of a lack of international support for inflation accounting disclosures, in 1989, the

IASC decided to make IAS 15 optional. However, the IASB encourages presentation of

inflation-adjusted information as required by IAS 15.

IAS 29, “Financial Reporting in Hyperinflationary Economies,” was issued in 1989 and

applies to the primary financial statements of any company that reports in a currency of a

hyperinflationary economy. IAS 29 requires the use of GPP accounting following

procedures outlined above in the answer to question 2.

IAS 21, “The Effects of Changes in Foreign Exchange Rates,” requires application of IAS 29

to restate the foreign operation’s financial statements to a GPP basis. The GPP adjusted

financial statements are then translated into the parent company’s reporting currency using

the current rate method of translation. This approach is referred to as the restate/translate

method.

7. IAS27, “Consolidated Financial Statements and Accounting for Investments in Subsidiaries,”

defines a group as a parent and all its subsidiaries, and requires parents to present

consolidated financial statements.

8. The concept of a group relates to a business combination in which one company obtains

control over another company but the acquired company continues its separate legal

existence.

McGraw-Hill/Irwin © The McGraw-Hill Companies, Inc., 2007

Doupnik and Perera, International Accounting, 1/e 8-5

9. IAS 27 states that control exists when the investor owns more than 50 of the stock of

another company. However, control also can exist for an investor owning less than 50% of

the stock of another company when the investor has power:

Over more than half of the voting rights through agreements with other shareholders,

To set the company’s financial and operating policies because of existing statutes or

agreements,

To appoint or remove majority of the members of the governing body (board of directors

or equivalent group), or

To cast the majority of votes at meetings of the company’s governing body.

10. Because of their extensive cross-ownership of companies, identifying the legal ownership

patterns of Japanese company groups (Keiretsu) can be extremely difficult.

11. IAS 27 requires a parent to consolidate all subsidiaries, foreign and domestic, unless (a)

control of the subsidiary is temporary because it is held with a view to its disposal in the near

future, or (b) the subsidiary operates under severe long-term restrictions that significantly

affect its ability to send funds to its parent. IAS 27 does not allow a subsidiary to be

excluded from consolidated financial statements solely because its operations are dissimilar

to those of the other companies that comprise the group. U.S. GAAP requires all

subsidiaries to be consolidated unless the parent has lost control due to bankruptcy or

severe restrictions imposed by a foreign government.

12. In some cases, two companies will jointly control another entity as a joint venture. IAS 31,

“Financial Reporting of Interests in Joint Ventures,” prefers proportional consolidation for

joint ventures (benchmark treatment), while equity accounting is allowed as an alternative.

The effect of the proportional consolidation method is to remove the “investment in joint

venture” account from the investor’s balance sheet and replace it with the proportion of all

the individual items that it represents. In contrast, the full consolidation method replaces the

“investment in subsidiary” account on the parent’s balance sheet with 100% of the value of

the subsidiary’s balance sheet items. If the parent owns less than 100% of the subsidiary, a

minority interest account is reflected on the parent’s consolidated balance sheet. There is

no minority interest reported under proportional consolidation.

Proportional consolidation is prohibited in the U.S. and the U.K., except for unincorporated

joint ventures. Instead, the equity method is used to account for investments in joint

ventures. In Germany, proportional consolidation was not allowed before the

implementation of the Seventh Directive, which permits its use for joint ventures. On the

other hand, proportional consolidation has been relatively common in both France and in the

Netherlands.

McGraw-Hill/Irwin © The McGraw-Hill Companies, Inc., 2007

Doupnik and Perera, International Accounting, 1/e 8-6

13. IAS 14 defines a business segment as a distinguishable component of a company that is

engaged in providing an individual product or service or groups of related products or

services and that is subject to risks and returns that are different from those of other

business segments. A geographical segment is a distinguishable component of a company

that is engaged in providing products or services within a particular economic environment

and is subject to risks and returns that differ from those of components operating in other

economic environments. Geographical segments can be a single country or groups of

countries. Factors to consider in identifying geographical segments include:

similarity of economic and political conditions,

geographical proximity,

special risk associated with operations in a particular area,

exchange control regulations, and

currency risks.

A business segment or a geographical segment is a reportable segment if (1) a majority of

its revenues are generated from external customers and (2) it meets any one of the

following three significance tests:

Revenue test. Segment revenues, both external and intersegment, are 10% or more of

the combined revenue, internal and external, of all segments.

Profit or loss test. Segment result (profit or loss) is 10% or more of the greater (in

absolute value terms) of the combined profit of segments with a profit or combined loss

of segments with a loss.

Asset test. Segment assets are 10% or more of the combined assets of all segments.

In applying these tests, segment result is defined as segment revenue less segment

expense. Segment revenue includes revenue directly attributable to a segment and a

portion of enterprise revenue that can be allocated on a reasonable basis to a segment.

Segment expense includes expenses directly attributable to a segment and a portion of

enterprise expense that can be allocated on a reasonable basis to a segment. IAS 14

defines segment assets as those operating assets that are employed by a segment in its

operating activities and that either are directly attributable to the segment or can be

allocated to the segment on a reasonable basis.

If total external revenue attributable to reportable segments constitutes less than 75% of the

total consolidated revenue, additional segments should be reported even if they do not meet

the 10% threshold. All segments that are neither separately reported nor combined should

be included in the segment reporting disclosures as an unallocated reconciliation item or in

an “all other” category.

McGraw-Hill/Irwin © The McGraw-Hill Companies, Inc., 2007

Doupnik and Perera, International Accounting, 1/e 8-7

14. The information required to be reported by geographic area under IAS 14 depends on

whether geographic segments represent the primary reporting format or the secondary

reporting format. The following information must be provided for each reportable primary

reporting format segment, whether business segment or geographic segment:

segment revenue,

segment profit or loss,

carrying amount of segment assets,

segment liabilities,

cost during the period to acquire property, plant, and equipment, and intangible assets

(capital expenditures),

depreciation and amortization,

significant noncash expenses, other than depreciation and amortization, and aggregate

share of profit or loss and aggregate investment in equity method associates and joint

ventures.

When business segments are the primary reporting format, the following geographical

segment information also should be provided:

revenue from external customers for each geographical segment whose revenue from

sales to external customers is 10% or more of total external revenue,

carrying amount of segment assets for each geographical segment whose assets are

10% or more of total assets of all geographical segments, and

capital expenditures for each geographical segment whose assets are 10% or more of

total assets of all geographical segments.

Under IAS 14, geographical segments can be a single country or groups of countries.

Under SFAS 131, companies must identify operating segments based on its internal

reporting system. Operating segments can be based on geography. Items disclosed by

operating segment under U.S. GAAP are the same as those items required to be disclosed

for the primary reporting format under IAS 14, with a few exceptions. U.S. GAAP does not

require disclosure of liabilities by segment, but does require disclosure of interest, taxes,

and unusual items (discontinued operations and extraordinary items). Whereas IAS 14

requires segment information to be presented in accordance with the company’s accounting

policies, SFAS 131 requires segment disclosures to be the same as what is reported

internally even if this is on a non-GAAP basis.

If operating segments are not based on geography, then companies must also

provide information about their foreign operations. Companies must disclose revenues and

long-lived assets for:

1. the domestic country,

2. all foreign countries in which the company derives revenues or holds assets, and

3. each foreign country in which a material amount of revenues is derived or long-lived

assets are held.

The SFAS 131 requirement to provide disclosures by individual foreign country is a

significant difference from IAS 14.

McGraw-Hill/Irwin © The McGraw-Hill Companies, Inc., 2007

Doupnik and Perera, International Accounting, 1/e 8-8

15. The major concern of some companies with respect to segment disclosures is that it could

provide information that competitors can use to better compete with the company.

Information about the revenues and profits earned in specific lines of business and/or

geographic areas that otherwise would be undisclosed, could be of interest to competing

firms as they are looking for lines of business and/or geographic areas in which to expand.

McGraw-Hill/Irwin © The McGraw-Hill Companies, Inc., 2007

Doupnik and Perera, International Accounting, 1/e 8-9

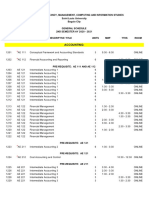

Solutions to Exercises and Problems

1. Sorocaba Company

December 31, Year 1

Original Restated

Purchase Historical Restatement Historical

Date Item Cost Ratio Cost

1/15/Y1 Machine X $ 20,000 140/100 $ 28,000

3/20/Y1 Machine Y 55,000 140/110 70,000

10/10/Y1 Machine Z 130,000 140/130 140,000

$205,000

$238,000

December 31, Year 2

Original Restated

Purchase Historical Restatement Historical

Date Item Cost Ratio Cost

3/20/Y1 Machine Y $ 55,000 180/110 $ 90,000

10/10/Y1 Machine Z 130,000 180/130 180,000

$185,000

$270,000

Alternatively, the restated historical cost at December 31, Year 2 could be determined as

follows:

December 31, Year 2

Restated Restated

Historical Historical

Purchase Cost Restatement Cost

Date Item (12/31/Y1) Ratio (12/31/Y2)

3/20/Y1 Machine Y $ 70,000 180/140 $ 90,000

10/10/Y1 Machine Z 140,000 180/140 180,000

$210,000

$270,000

Ignoring depreciation, machinery and equipment would be reported on the balance sheet at:

12/31/Y1 $238,000

12/31/Y2 $270,000

2. Antalya Company

McGraw-Hill/Irwin © The McGraw-Hill Companies, Inc., 2007

Doupnik and Perera, International Accounting, 1/e 8-10

a. The nominal interest expense is TL 600,000 (TL 1,000,000 x 60% x 1 year).

b. The purchasing power gain is TL 550,000 (TL 1,000,000 x 387.5/250 = TL 1,550,000 –

1,000,000).

c. The real interest expense is TL 5,000, which equates to a real interest rate of 0.5% (TL

5,000/ TL 1,000,000)

McGraw-Hill/Irwin © The McGraw-Hill Companies, Inc., 2007

Doupnik and Perera, International Accounting, 1/e 8-11

3. Doner Company

Calculation of Purchasing Power Loss

Net monetary assets, 1/1/Y1 $5,000 x 150/100 = $ 7,500

Plus: Increase in net monetary assets 15,000 x 150/120 = 18,750

Net monetary assts, 12/31/Y1 $20,000 $26,250

20,000

Purchasing power loss $ 6,250

GPP Income Statement

Year 1

Revenues $50,000 x 150/120 = $ 62,500

Depreciation (5,000) x 150/100 = (7,500)

Other expenses (incl. income taxes) (35,000) x 150/120 = (43,750)

Purchasing power loss (6,250)

Net income $ 5,000

McGraw-Hill/Irwin © The McGraw-Hill Companies, Inc., 2007

Doupnik and Perera, International Accounting, 1/e 8-12

4. Petrodat Company

Subsidiary in Mexico

GPI

1/1/Y1 100

Average 105

12/31/Y1 110

a.

Balance Sheet, 1/1/Y1 Historical Restatement Restated to

Cost Factor 12/31/Y1 GPP

Machinery and equipment 1,000,000.00 110/100 1,100,000.00

Total assets 1,000,000.00 1,100,000.00

Contributed capital 1,000,000.00 110/100 1,100,000.00

Total stockholders’ equity 1,000,000.00 1,100,000.00

Income Statement, Year 1

Historical Restatement Restated to

Cost Factor 12/31/Y1 GPP

Revenues 400,000.00 110/105 419,047.62

Depreciation expense (200,000.00) 110/100 (220,000.00)

Other expenses (150,000.00) 110/105 (157,142.86)

Purchasing power loss (11,904.76)

Income 50,000.00 30,000.00

Calculation of Purchasing Power Loss

Net monetary assets, 1/1 0.00 110/100 0.00

plus: Increase in NMA, Y1* 250,000.00 110/105 261,904.76

Net monetary assets, 12/31 250,000.00 261,904.76

250,000.00

Purchasing power loss (11,904.76)

* Revenues less other expenses

McGraw-Hill/Irwin © The McGraw-Hill Companies, Inc., 2007

Doupnik and Perera, International Accounting, 1/e 8-13

Balance Sheet, 12/31/Y1 Historical Restatement Restated to

Cost Factor 12/31/Y1 GPP

Cash 250,000.00 none 250,000.00

Machinery and equipment 1,000,000.00 110/100 1,100,000.00

Less: accumulated depreciation (200,000.00) 110/100 (220,000.00)

Total assets 1,050,000.00 1,130,000.00

Contributed capital 1,000,000.00 110/100 1,100,000.00

Retained earnings 50,000.00 above 30,000.00

Total stockholders' equity 1,050,000.00 1,130,000.00

Calculation of Average Stockholders' Equity

January 1, Year 1 (restated) 1,100,000.00

December 31, Year 1 1,130,000.00

2,230,000.00

Average stockholders’ equity 1,115,000.00

b. Calculation of profit margin and return on equity on an inflation-adjusted basis

Profit margin 30,000.00 7.16%

419,047.62

Return on Equity 30,000.00 2.69%

1,115,000.00

McGraw-Hill/Irwin © The McGraw-Hill Companies, Inc., 2007

Doupnik and Perera, International Accounting, 1/e 8-14

Subsidiary in Venezuela

GPI

1/1/Y1 100

Average 115

12/31/Y1 130

a.

Balance Sheet, 1/1/Y1 Historical Restatement Restated to

Cost Factor 12/31/Y1 GPP

Machinery and equipment 150,000,000.00 130/100 195,000,000.00

Total assets 150,000,000.00 195,000,000.00

Contributed capital 150,000,000.00 130/100 195,000,000.00

Total stockholders’ equity 150,000,000.00 195,000,000.00

Income Statement, Year 1

Historical Restatement Restated to

Cost Factor 12/31/Y1 GPP

Revenues 60,000,000.00 130/115 67,826,086.96

Depreciation expense (30,000,000.00) 130/100 (39,000,000.00)

Other expenses (22,500,000.00) 130/115 (25,434,782.61)

Purchasing power loss (4,891,304.35)

Income 7,500,000.00 (1,500,000.00)

Calculation of Purchasing Power Loss

Net monetary assets, 1/1 0.00 130/100 0.00

plus: Increase in NMA, Y1* 37,500,000.00 130/115 42,391,304.35

Net monetary assets, 12/31 37,500,000.00 42,391,304.35

37,500,000.00

Purchasing power loss (4,891,304.35)

* Revenues less other expenses

McGraw-Hill/Irwin © The McGraw-Hill Companies, Inc., 2007

Doupnik and Perera, International Accounting, 1/e 8-15

Balance Sheet, 12/31/Y1 Historical Restatement Restated to

Cost Factor 12/31/Y1 GPP

Cash 37,500,000.00 none 37,500,000.00

Machinery and equipment 150,000,000.00 130/100 195,000,000.00

Less: accumulated deprec (30,000,000.00) 130/100 (39,000,000.00)

Total assets 157,500,000.00 193,500,000.00

Contributed capital 150,000,000.00 130/100 195,000,000.00

Retained earnings 7,500,000.00 above (1,500,000.00)

Total stockholders' equity 157,500,000.00 193,500,000.00

Calculation of Average Stockholders' Equity

January 1, Year 1 (restated) 195,000,000.00

December 31, Year 1 193,500,000.00

388,500,000.00

Average stockholders’ equity 194,250,000.00

b. Calculation of profit margin and return on equity on an inflation-adjusted basis

Profit margin (1,500,000.00) -2.21%

67,826,086.96

Return on Equity (1,500,000.00) -0.77%

194,250,000.00

c. Both subsidiaries had the same profit margin and return on equity when these ratios were

calculated from unadjusted historical cost information. After adjusting for inflation, the

Mexican subsidiary appears to be substantially more profitable than the Venezuelan

subsidiary.

McGraw-Hill/Irwin © The McGraw-Hill Companies, Inc., 2007

Doupnik and Perera, International Accounting, 1/e 8-16

5. Auroral Company

Name of % Voting

Company Rights IFRSs U.S. GAAP

Accurcast 100% Full consolidation Full consolidation

Bonello 45% Equity method – unless there is Equity method

evidence that Auroral exercises

effective control

Cromos 30% Equity method Equity method

Fidelis 100% Do not consolidate – fair value Do not consolidate – fair

method value method

Jenna 100% Full consolidation Full consolidation

Marek 40% Full consolidation Equity method

Phenix 90% Full consolidation Full consolidation

Regulus 50% Proportional consolidation or Equity method

equity method

Synkron 15% Fair value method Fair value method

Tiksed 70% Full consolidation Full consolidation

Ypsilon 51% Full consolidation Full consolidation

McGraw-Hill/Irwin © The McGraw-Hill Companies, Inc., 2007

Doupnik and Perera, International Accounting, 1/e 8-17

6. Sandestino Company

a. Restated financial statements:

1. Proportionate Consolidation Method

Sandestino Company

Income Statement

Year 1

Revenues $840,000

Expenses 475,000

Income before tax 365,000

Tax expense 105,000

Net income $260,000

Sandestino Company

Balance Sheet

December 31, Year 1

Cash $150,000 Liabilities $280,000

Inventory 230,000 Common stock 600,000

Property, plant, & equipment (net) 810,000 Retained earnings 310,000

Total $1,190,000 Total $1,190,000

2. Equity Method

Sandestino Company

Income Statement

Year 1

Revenues $800,000

Expenses (450,000)

Equity in Grand Sand’s net income 10,000

Income before tax 360,000

Tax expense (100,000)

Net income $260,000

Sandestino Company

Balance Sheet

December 31, Year 1

Cash $130,000 Liabilities $250,000

Inventory 200,000 Common stock 600,000

Property, plant, & equipment (net) 650,000 Retained earnings 310,000

Investment in Grand Sand 180,000 Total $1,160,000

Total $1,160,000

McGraw-Hill/Irwin © The McGraw-Hill Companies, Inc., 2007

Doupnik and Perera, International Accounting, 1/e 8-18

b. Calculation of ratios:

Proportionate Consolidation Equity Method

Profit margin 260,000/840,000 = 0.3095 260,000/800,000 = 0.325

Debt/equity 280,000/910,000 = 0.3077 250,000/910,000 = 0.275

Sandestino’s profit margin would be higher and its debt-to-equity ratio would be lower if it used

the equity method to account for its investment in Grand Sand.

McGraw-Hill/Irwin © The McGraw-Hill Companies, Inc., 2007

Doupnik and Perera, International Accounting, 1/e 8-19

7. Horace Jones Company

The first step in determining which business segments must be reported separately is to

determine whether a majority of revenues are generated from external customers. As shown

below, this criterion is met by all segments other than C. Therefore, segment C will not be

reported separately.

Majority of Revenues Test A B C D E F

Revenues:

External sales revenue 1,030 350 20 140 130 120

Intersegment sales revenue 30 20 200 10 0 0

Total revenues 1,060 370 220 150 130 120

External revenues as % of

total revenues 97% 95% 9% 93% 100% 100%

The next step is to apply the three significance tests to determine whether the second criterion

for a reportable segment is met.

Revenue Test Total Percentage

Segment Revenues of Total

A 1,060 52% reportable

B 370 18% reportable

C 220 11%

D 150 7%

E 130 6%

F 120 6%

Total 2,050 100%

Profit or Loss Test Segment Segment Segment Result

Segment Revenues Expenses Profit Loss

A 1,060 824 236 reportable

B 370 560 (190) reportable

C 220 158 62

D 150 144 6

E 130 73 57 reportable

F 120 101 19

Total 2,050 1,860 380 (190)

McGraw-Hill/Irwin © The McGraw-Hill Companies, Inc., 2007

Doupnik and Perera, International Accounting, 1/e 8-20

Asset Test Total Percentage

Segment Assets of Total

A 1,650 47% reportable

B 650 19% reportable

C 500 14%

D 280 8%

E 300 9%

F 120 3%

Total 3,500 100%

Of the five business segments that meet the criterion of having a majority of revenues from

external sources, only three segments meet at least one of the significance tests. Segments A,

B, and E will be reported separately; segments C, D, and F will be combined into Other

Segments. However, if total external revenues attributable to separately reportable segments is

less than 75% of total consolidated revenue, additional segments must be reported even if they

do not meet any of the significance tests.

75% Test External Percentage of

Segment Revenues Consolidated Revenues

A 1,030 58%

B 350 20%

C 20 n/a

D 140 n/a

E 130 7%

F 120 n/a

Total consolidated

revenues 1,790 84%

Because A, B, and E collectively comprise more than 75% of total consolidated revenues,

segments C, D, and F will be combined.

McGraw-Hill/Irwin © The McGraw-Hill Companies, Inc., 2007

Doupnik and Perera, International Accounting, 1/e 8-21

The schedule below provides a suggestion for how the information items required to be

presented for primary format segments might be presented. A reconciliation is provided for the

amounts that appear in the consolidated income statement.

Segment Segment Segment Other Corp- Elimin- Consoli-

A B E Segments orate ations dated

Total revenues 1,060 370 130 490 - (260) 1,790

(200 1,06

Cost of goods sold 600 300 60 300 - ) 0

Depreciation and 1 23

amortization 80 100 5 35 0 0

Other operating 5 38

expenses 120 150 5 55 0 0

Allocated corporate (50

expense 24 10 3 13 - ) -

Segment profit or 12

loss 236 (190) 57 87 0

3

Interest expense 0

Income taxes 30

Net income 60

Other information:

10 3,60

Segment assets 1,650 650 300 900 0 0

1,70

Segment liabilities 750 300 140 510 - 0

Capital 1 38

expenditures 200 50 20 105 0 5

Depreciation and 8 1

amortization 0 100 5 35 0 230

McGraw-Hill/Irwin © The McGraw-Hill Companies, Inc., 2007

Doupnik and Perera, International Accounting, 1/e 8-22

8. Schering AG

Schering’s Primary Reporting Format is geographic. The following table indicates the heading

used by Schering to report information required by IAS 14 for each reportable primary reporting

format segment:

IAS 14 Requirement Schering heading

Segment revenue Segment net sales

Segment profit or loss Segment result

Carrying amount of segment assets Segment assets

Segment liabilities Segment liabilities

Cost during the period to acquire property, Investments in intangibles and property,

plant, and equipment, and intangible assets plant and equipment

Depreciation and amortization Depreciation

Significant noncash expenses, other than Other significant non-cash expenses

depreciation and amortization

Aggregate share of profit or loss and Not found, might not be applicable

aggregate investment in equity method

associates and joint ventures.

IAS 14 also requires a reconciliation between the information disclosed for primary segments

and the aggregate information in the consolidated financial statements. Schering provides this

reconciliation; consolidated amounts are referred to as “Schering AG Group.”

When the primary reporting format is geographical segments, three items of information as

shown below should be provided for each business segment whose external revenues are 10%

of total external revenues or whose segment assets are 10% or more of total segment assets.

IAS 14 Requirement Schering heading

Revenue from external customers External net sales

Carrying amount of segment assets Segment assets

Capital expenditures Investments in intangibles and property,

plant and equipment

Geographical segments can be determined on the basis of where assets are located or on the

basis of where customers are located. If the primary reporting format is geographical segments

based on location of assets and customer location is different from asset location, the company

should disclose revenues from external customers for each customer-based geographical

segment that has 10% or more of total external revenues. If the primary reporting format

instead is geographical segments based on customer location and assets are located in

geographical areas different from customers, the company should disclose:

the carrying amount of segment assets for each asset-based geographical segment that

has 10% or more of total external revenues, and

capital expenditures during the period for each asset-based geographical segment that

has 10% or more of total capital expenditures.

McGraw-Hill/Irwin © The McGraw-Hill Companies, Inc., 2007

Doupnik and Perera, International Accounting, 1/e 8-23

Schering’s geographic segments are based on customer location. The company complies with

the above requirements by reporting “Segment assets by geographic location” and “Investments

by geographic location.”

In conclusion, Schering AG complies fully with the primary and secondary reporting format

requirements of IAS 14.

McGraw-Hill/Irwin © The McGraw-Hill Companies, Inc., 2007

Doupnik and Perera, International Accounting, 1/e 8-24

9. IBM, Johnson & Johnson, and General Motors

a. A commonly used measure of multinationality is the percentage of total sales that are

generated in countries other than the United States: Foreign Sales/Total Sales. This

ratio can be calculated for each company by subtracting U.S. sales from total sales and

then dividing by total sales:

IBM ($96,293 - $35,637) / $96,293 = 63.0%

Johnson & Johnson ($47,348 - $27,770) / $47,348 = 41.3%

General Motors ($193,517 - $134,380) / $193,517 = 30.6%

Based on this measure, IBM is the most multinational company among the three in

Exhibit 8.8.

b. International diversification refers to the extent to which a company’s operations are

spread across different countries and regions of the world. General Motors appears to

be concentrated in a relatively small number of countries, and is therefore not very

diversified internationally. Almost 90% of GM’s sales are generated from operations in

only eight countries (U.S., Canada and Mexico, France, Germany, Spain, U.K., and

Brazil). From Johnson & Johnson’s segment disclosure, it is impossible to know the

number of countries in which the company has operations. For example, “Europe” could

imply operations in anywhere from one to 30+ countries. One can determine that about

50% of IBM’s revenues are generated in only two countries (U.S. and Japan), but it is

impossible to know where in the world the remaining 40% of its sales are generated.

We do know that there are no other countries in which IBM believes it has a material

amount of revenues, because it would be required to disclose this country separately.

This exercise demonstrates the difficulty in assessing international diversification given

current segment reporting practices.

McGraw-Hill/Irwin © The McGraw-Hill Companies, Inc., 2007

Doupnik and Perera, International Accounting, 1/e 8-25

10. BMW and Volkswagen

a. A commonly used measure of multinationality is the percentage of total sales that are

generated in countries other than the home country: Foreign Sales/Total Sales. This

ratio can be calculated for each company by subtracting sales in Germany from total

sales and then dividing by total sales:

BMW (€44,335 – €11,961) / €44,335 = 73.0%

Volkswagen (€88,963 – €24,504) / €88,963 = 72.5%

Based on this measure, BMW is slightly more multinational than Volkswagen. Both

companies rely very heavily on sales made outside of Germany.

Note that the internationality of the two companies can be directly compared by

collapsing VW’s North America and South America segments into one region – America

– and by collapsing its Africa and Asia/Oceania segments into one region – Africa, Asia,

Oceania.

b. One way to measure international diversification is the extent to which sales are spread

out over different regions of the world. Column B in the table below shows that BMW’s

sales are more evenly spread over the four segments than are VW’s. Whereas VW

generates 72% of its sales in Europe including Germany, BMW generates only 63% of

its sale in Europe.

External Sales Col. A Col. B Col. C Col. D Col. E

Year-to-year

BMW 2004 % 2003 % % change

Germany 11,961 27.0% 10,590 25.5% 12.9%

Rest of Europe 15,823 35.7% 13,389 32.2% 18.2%

America 10,648 24.0% 11,620 28.0% -8.4%

Africa, Asia, Oceania 5,903 13.3% 5,926 14.3% -0.4%

44,335 100.0% 41,525 100.0% 6.8%

Volkswagen

Germany 24,504 27.5% 23,298 27.5% 5.2%

Rest of Europe 39,755 44.7% 35,723 42.1% 11.3%

America 17,257 19.4% 18,084 21.3% -4.6%

Africa, Asia, Oceania 7,447 8.4% 7,708 9.1% -3.4%

88,963 100.0% 84,813 100.0% 4.9%

c. BMW experienced a growth in 2004 revenues of 6.8% (Col. E in table above).

Revenues grew in Germany and the Rest of Europe only. The greatest decrease in

revenues incurred in America.

Volkswagen experienced an overall increase in sales in 2004 of 4.9% (Col. E). The

pattern of revenue growth for Volkswagen is similar to that for BMW. Sales for VW also

grew in Germany and the Rest of Europe, with a decline in America and

Africa/Asia/Oceania. The largest year-to-year % decline was in America (Col. E).

McGraw-Hill/Irwin © The McGraw-Hill Companies, Inc., 2007

Doupnik and Perera, International Accounting, 1/e 8-26

You might also like

- Advanced Accounting 9th Edition Hoyle Solutions ManualDocument33 pagesAdvanced Accounting 9th Edition Hoyle Solutions Manualcemeteryliana.9afku100% (24)

- The Balance Sheet and Income StatementDocument3 pagesThe Balance Sheet and Income Statementdhanya1995No ratings yet

- Test BankDocument14 pagesTest BankJi YuNo ratings yet

- City BrandDocument27 pagesCity BrandCityNewsToronto100% (1)

- Chapter 08Document26 pagesChapter 08sdnm dnkNo ratings yet

- Chapter 4Document18 pagesChapter 4Shevon FortuneNo ratings yet

- Questions: Liabilities, and Equity. These ElementsDocument38 pagesQuestions: Liabilities, and Equity. These ElementssiaaswanNo ratings yet

- FSA 8e Ch05 SMDocument39 pagesFSA 8e Ch05 SMnufusNo ratings yet

- Hilton8e WYRNTK Ch03Document4 pagesHilton8e WYRNTK Ch03jakeNo ratings yet

- Summary of Important Us Gaap:: Under US GAAP, The Financial Statements Include TheDocument28 pagesSummary of Important Us Gaap:: Under US GAAP, The Financial Statements Include TheSangram PandaNo ratings yet

- Chapter 08 IMSMDocument31 pagesChapter 08 IMSMZachary Thomas Carney100% (1)

- Group 7 Stirling - Sir's EvalDocument4 pagesGroup 7 Stirling - Sir's EvalKenneth Jules GarolNo ratings yet

- Full Download Solution Manual For Advanced Accounting 7th by Jeter PDF Full ChapterDocument20 pagesFull Download Solution Manual For Advanced Accounting 7th by Jeter PDF Full Chaptermirific.sixtyuwre0b100% (25)

- Solution Manual For Advanced Accounting 7th by JeterDocument36 pagesSolution Manual For Advanced Accounting 7th by Jeterbraidscanty8unib100% (46)

- AssignmentDocument24 pagesAssignmentsanyogeeta sahooNo ratings yet

- FR & FasDocument195 pagesFR & FasPrerana SharmaNo ratings yet

- Chapter 31 - AnswerDocument15 pagesChapter 31 - AnswerEunice LigutanNo ratings yet

- 2009 F-7 Class NotesDocument3 pages2009 F-7 Class NotesChris Tian FlorendoNo ratings yet

- Fae3e SM Ch08Document17 pagesFae3e SM Ch08Jarkee100% (1)

- CFF20968-C6B4-49F5-BBD9-7396D104482EDocument10 pagesCFF20968-C6B4-49F5-BBD9-7396D104482EMuhammad Zaifan HakimNo ratings yet

- Chapter 3 Managerial-Finance Solutions PDFDocument24 pagesChapter 3 Managerial-Finance Solutions PDFMohammad Mamun UddinNo ratings yet

- Financial Statements and Analysis: ̈ Instructor's ResourcesDocument24 pagesFinancial Statements and Analysis: ̈ Instructor's ResourcesMohammad Mamun UddinNo ratings yet

- Pra 371Document3 pagesPra 371Nikesh SapkotaNo ratings yet

- Sheet 1Document5 pagesSheet 1Shruti MaheshwariNo ratings yet

- Disclosure A. Full Disclosure Principle: The Full Disclosure Principle Is A Concept That Requires A Business To Report AllDocument5 pagesDisclosure A. Full Disclosure Principle: The Full Disclosure Principle Is A Concept That Requires A Business To Report AllMichaela HartantoNo ratings yet

- Advanced Accounting Hoyle 12th Edition Solutions ManualDocument33 pagesAdvanced Accounting Hoyle 12th Edition Solutions ManualBrentBrowncgwzm100% (92)

- Acct Principles and Assumption - Week1Document10 pagesAcct Principles and Assumption - Week1Linh KhánhNo ratings yet

- Act-6j03 Comp1 1stsem05-06Document14 pagesAct-6j03 Comp1 1stsem05-06RegenLudeveseNo ratings yet

- Ans To Exercises Stice Chap 1 and Hall Chap 1234 5 11 All ProblemsDocument188 pagesAns To Exercises Stice Chap 1 and Hall Chap 1234 5 11 All ProblemsLouise GazaNo ratings yet

- Solution Manual For Advanced Accounting, 11th Edition - HoyleDocument27 pagesSolution Manual For Advanced Accounting, 11th Edition - HoyleAlmoosawi100% (1)

- Hall SolmanDocument188 pagesHall SolmanMariel SalangsangNo ratings yet

- Advanced Accounting 13th Edition Hoyle Solutions ManualDocument32 pagesAdvanced Accounting 13th Edition Hoyle Solutions ManualKatieElliswcze100% (37)

- Statement of Income, Changes in EquityDocument6 pagesStatement of Income, Changes in EquityAdrian CallanganNo ratings yet

- Answers To Review QuestionsDocument3 pagesAnswers To Review QuestionsRose Ann Moraga FrancoNo ratings yet

- Midterm Chapter1 2 3Document3 pagesMidterm Chapter1 2 3Mae Ann AvenidoNo ratings yet

- 1 Materiality: What Is "Material"?Document6 pages1 Materiality: What Is "Material"?Erentina Suarna NhsNo ratings yet

- AFA 716 Chap 2 SolutionsDocument40 pagesAFA 716 Chap 2 SolutionsMarc ColalilloNo ratings yet

- ACTG5100 Friedlan4e SM Ch11Document31 pagesACTG5100 Friedlan4e SM Ch11Sunrise ConsultingNo ratings yet

- Ebesa, Mary Grace P., Midterm Exam Chapter 1,2,3Document3 pagesEbesa, Mary Grace P., Midterm Exam Chapter 1,2,3Mae Ann AvenidoNo ratings yet

- Consolidated Financial Statements (Part 3)Document96 pagesConsolidated Financial Statements (Part 3)Justine Kate Ferrer BascoNo ratings yet

- Chapter 3Document23 pagesChapter 3Shevon FortuneNo ratings yet

- Kunci Jawaban Intermediate AccountingDocument41 pagesKunci Jawaban Intermediate AccountingsiaaswanNo ratings yet

- Summary of IND As 110 and IFRS 10 Consolidated Financial Statements - Taxguru - inDocument7 pagesSummary of IND As 110 and IFRS 10 Consolidated Financial Statements - Taxguru - inalok kumarNo ratings yet

- Advanced Accounting 10th Edition Hoyle Solutions ManualDocument29 pagesAdvanced Accounting 10th Edition Hoyle Solutions Manualcliniqueafraidgfk1o100% (23)

- Financial Statements, Cash Flows, and Taxes: Learning ObjectivesDocument12 pagesFinancial Statements, Cash Flows, and Taxes: Learning Objectivessarah_200285No ratings yet

- Important Notes For Consolidation and Business CombinationDocument10 pagesImportant Notes For Consolidation and Business CombinationSajib Kumar DasNo ratings yet

- FALL 2020: Course Title: Financial Statement Analysis Course Code: FIN4233Document4 pagesFALL 2020: Course Title: Financial Statement Analysis Course Code: FIN4233ھاشم عمران واھلہNo ratings yet

- Midterm ExamDocument3 pagesMidterm ExamMae Ann AvenidoNo ratings yet

- Additional Financial Reporting IssuesDocument35 pagesAdditional Financial Reporting IssuesStephanie SanchezNo ratings yet

- Balance SheetDocument32 pagesBalance SheetJanine padronesNo ratings yet

- Jeter Advanced Accounting 4eDocument14 pagesJeter Advanced Accounting 4eMinh NguyễnNo ratings yet

- Group Account Week 1Document8 pagesGroup Account Week 1Omolaja IbukunNo ratings yet

- 502 Final-2Document22 pages502 Final-2mrx255803No ratings yet

- TOA Test BankDocument15 pagesTOA Test BankRod100% (2)

- Week 2 TUTE Chapter 1 SolutionsDocument6 pagesWeek 2 TUTE Chapter 1 SolutionsDylan AdrianNo ratings yet

- "The Language of Business: How Accounting Tells Your Story" "A Comprehensive Guide to Understanding, Interpreting, and Leveraging Financial Statements for Personal and Professional Success"From Everand"The Language of Business: How Accounting Tells Your Story" "A Comprehensive Guide to Understanding, Interpreting, and Leveraging Financial Statements for Personal and Professional Success"No ratings yet

- CPA Financial Accounting and Reporting: Second EditionFrom EverandCPA Financial Accounting and Reporting: Second EditionNo ratings yet

- PDF Audit of Cash Roque 2018 1 Compress PDFDocument87 pagesPDF Audit of Cash Roque 2018 1 Compress PDFFernando III PerezNo ratings yet

- Block Section - BS HM TMDocument7 pagesBlock Section - BS HM TMFernando III PerezNo ratings yet

- Block Section - BS Ac MaDocument9 pagesBlock Section - BS Ac MaFernando III PerezNo ratings yet

- The Relationship Between Working CapitalDocument8 pagesThe Relationship Between Working CapitalFernando III PerezNo ratings yet

- AM Programs General ScheduleDocument20 pagesAM Programs General ScheduleFernando III PerezNo ratings yet

- Activity 1Document4 pagesActivity 1Fernando III PerezNo ratings yet

- Articles of PartnershipDocument4 pagesArticles of PartnershipFernando III PerezNo ratings yet

- Da Nang Identifies 7 Key Areas For Economic Development 2023Document4 pagesDa Nang Identifies 7 Key Areas For Economic Development 2023NHƯ THƯƠNGNo ratings yet

- Dualistic TheoriesDocument5 pagesDualistic Theoriessuji8161No ratings yet

- Business Plan (Fish Farming)Document9 pagesBusiness Plan (Fish Farming)ceo solaNo ratings yet

- Notice For Selected Results Main List Fall 2023 - 25 July 2023 - For Publication - v3Document202 pagesNotice For Selected Results Main List Fall 2023 - 25 July 2023 - For Publication - v3Amit baraiNo ratings yet

- Parul SinghDocument30 pagesParul SinghMayank jainNo ratings yet

- Nonprofit VsDocument3 pagesNonprofit VsRoschelle MiguelNo ratings yet

- Exercise in Manaco 2Document2 pagesExercise in Manaco 2Gracelle Mae Oraller100% (1)

- The Manufacturing Processes of StaplerSDocument9 pagesThe Manufacturing Processes of StaplerSMahendra DahiyaNo ratings yet

- IC Inventory Management Template Updated 8857Document31 pagesIC Inventory Management Template Updated 8857Dilnesa EjiguNo ratings yet

- More Than A Sex Crime: A Feminist Political Economy of The 2014 Icloud HackDocument17 pagesMore Than A Sex Crime: A Feminist Political Economy of The 2014 Icloud HackSo AppalledNo ratings yet

- 56 Brand Management at HCL (Vishal)Document77 pages56 Brand Management at HCL (Vishal)sheemankhanNo ratings yet

- Mr. Rohit Bajaj - 1 - Open AccessDocument38 pagesMr. Rohit Bajaj - 1 - Open Accessyatendra singhNo ratings yet

- Fire Safety RegulationsDocument84 pagesFire Safety RegulationsVandana GuptaNo ratings yet

- Medical Store Rs. 4.64 MillionDocument17 pagesMedical Store Rs. 4.64 MillionMohtashim SolankiNo ratings yet

- Unified Application For Certificate of Occupancy/Use: Office of The Building OfficialDocument1 pageUnified Application For Certificate of Occupancy/Use: Office of The Building OfficialThe MatrixNo ratings yet

- NEW Business and Society A Strategic Approach To Social ResponsibilityDocument606 pagesNEW Business and Society A Strategic Approach To Social ResponsibilitymkhimaniNo ratings yet

- Lacoste?Document4 pagesLacoste?LofiNo ratings yet

- Module 5Document5 pagesModule 5Noel S. De Juan Jr.No ratings yet

- Investment Management Interview QuestionsDocument6 pagesInvestment Management Interview Questionsfossil.tractor0sNo ratings yet

- New - Blockchain Legal & Regulatory GuidanceDocument236 pagesNew - Blockchain Legal & Regulatory GuidanceChristian M Nino-Moris FANo ratings yet

- Standards Development Centre (SDC), IT & ICT Division: Technical Committee Membership FormDocument1 pageStandards Development Centre (SDC), IT & ICT Division: Technical Committee Membership FormEngr Ishfaque TunioNo ratings yet

- Lecture Notes On ECO223 Labour Economics I TOPICSDocument25 pagesLecture Notes On ECO223 Labour Economics I TOPICSeldenpotNo ratings yet

- 8-Monthly Project Progress ReportDocument1 page8-Monthly Project Progress ReportHimanshu PawarNo ratings yet

- QUIZ 1 IN CE LAWS-WPS OfficeDocument4 pagesQUIZ 1 IN CE LAWS-WPS OfficeDarlene Mae VenturanzaNo ratings yet

- Knowledge and Human Capital As Sustainable Competitive Advantage in Human Resource Management2019Sustainability SwitzerlandDocument18 pagesKnowledge and Human Capital As Sustainable Competitive Advantage in Human Resource Management2019Sustainability SwitzerlandMary RodchenkoNo ratings yet

- FUSION - FS - Personnel Administration - E - HR1 - 004 - Custom object-IT0001 V1 0Document11 pagesFUSION - FS - Personnel Administration - E - HR1 - 004 - Custom object-IT0001 V1 0kavitasreeNo ratings yet

- Test Bank For Economics of Strategy 7th Edition by DranoveDocument14 pagesTest Bank For Economics of Strategy 7th Edition by Dranovewinry100% (1)

- Women Working in Unorganized Sector-A Conceptual Study: KeywordsDocument3 pagesWomen Working in Unorganized Sector-A Conceptual Study: KeywordsRam Kumar YadavNo ratings yet