Professional Documents

Culture Documents

Note 8. Investments in Government-Sponsored Enterprises

Note 8. Investments in Government-Sponsored Enterprises

Uploaded by

LokiOriginal Description:

Original Title

Copyright

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Note 8. Investments in Government-Sponsored Enterprises

Note 8. Investments in Government-Sponsored Enterprises

Uploaded by

LokiCopyright:

NOTES TO THE FINANCIAL STATEMENTS 90

Note 8. Investments in Government-Sponsored Enterprises

Congress established Fannie Mae and Freddie Mac as GSEs to support mortgage lending. A key function of the GSEs is

to purchase mortgages, package those mortgages into securities, which are subsequently sold to investors, and guarantee the

timely payment of principal and interest on these securities.

Leading up to the financial crisis, increasingly difficult conditions in the housing market challenged the soundness and

profitability of the GSEs, thereby threatening to undermine the entire housing market. In response Congress passed the

Housing and Economic Recovery Act of 2008 (P.L.110-289) in July 2008. This act created FHFA, with enhanced regulatory

authority over the GSEs, and provided the Secretary of the Treasury with certain authorities intended to ensure the financial

stability of the GSEs, if necessary. In September 2008, FHFA placed the GSEs under conservatorship and Treasury invested

in the GSEs by entering into a SPSPA with each GSE. These actions were taken to preserve the GSEs’ assets, ensure a sound

and solvent financial condition, and mitigate systemic risks that contributed to market instability.

The purpose of such actions is to maintain the solvency of the GSEs so they can continue to fulfill their vital roles in the

home mortgage market while the Administration and Congress determine what structural changes should be made to the

housing finance system. Draws under the SPSPAs result in an increased investment in the GSEs as further discussed below.

Under SFFAS No. 47, Reporting Entity criteria Fannie Mae and Freddie Mac were owned or controlled by the federal

government only as a result of (a) regulatory actions (such as organizations in receivership or conservatorship) or (b) other

federal government intervention actions. Under the regulatory or other intervention actions, the relationship with the federal

government was and is not expected to be permanent. These entities are classified as disclosure entities based on their

characteristics as a whole. Accordingly, these entities are not consolidated into the U.S. government’s consolidated financial

statements; however, the value of the investments in these entities, changes in value, and related activity with these entities

are included in the U.S. government’s consolidated financial statements.

Senior Preferred Stock Purchase Agreements

Under the SPSPAs, Treasury initially received from each GSE: 1) 1,000,000 shares of non-voting variable liquidation

preference senior preferred stock with a liquidation preference value of $1,000 per share and 2) a non-transferable warrant for

the purchase, at a nominal cost, of 79.9 percent of common stock on a fully-diluted basis. The warrants expire on September

7, 2028. Under the amended SPSPAs, the quarterly dividend payment changed from a 10.0 percent per annum fixed rate

dividend on the total liquidation preference (as discussed below) to an amount equivalent to the GSE’s positive net worth

above a capital reserve amount. The capital reserve amount, which was initially set at $3.0 billion for calendar year 2013,

declined by $600 million at the beginning of each calendar year thereafter, and was scheduled to reach zero by calendar year

2018. On December 21, 2017, Treasury and the FHFA modified the SPSPAs between Treasury and the GSEs to increase the

capital reserve amount for each GSE back to $3 billion, effective with the December 2017 dividend payment. In exchange for

the increase in the capital reserve, Treasury’s liquidation preference in each GSE increased by $3 billion on December 31,

2017. On September 27, 2019, Treasury and the FHFA agreed to increase the capital reserve amounts of Fannie Mae and

Freddie Mac to $25 billion and $20 billion, representing an increase of $22 billion and $17 billion, respectively, over the

prior reserve amount of $3 billion each. In exchange, Treasury’s liquidation preference in each GSE will gradually increase

up to the adjusted capital reserve amounts based on the quarterly earnings of each GSE. For the fiscal year ended September

30, 2019, Treasury’s liquidation preference in Fannie Mae and Freddie Mac increased by $3.4 billion and $1.8 billion,

respectively. The GSEs will not pay a quarterly dividend if their positive net worth is below the required capital reserve

threshold. Cash dividends of $3.9 billion and $3.6 billion were received during fiscal years ended September 30, 2019, and

2018, respectively.

The SPSPAs, which have no expiration date, require that Treasury will disburse funds to the GSEs if at the end of any

quarter, the FHFA determines that the liabilities of either GSE exceed its assets. Draws from Treasury under the SPSPAs are

designed to ensure that the GSEs maintain positive net worth, with a fixed maximum amount available to each GSE under

this agreement established as of December 31, 2012 (refer to the “Contingent Liability to GSEs” section below and Note 18

—Contingencies). Draws against the funding commitment of the SPSPAs do not result in the issuance of additional shares of

senior preferred stock; instead, it increases the liquidation preference of the initial 1,000,000 shares by the amount of the

draw. The combined cumulative liquidation preference totaled $204 billion and $199 billion as of September 30, 2019 and

2018, respectively. There were no payments to the GSEs for the fiscal year ended September 30, 2019. Actual payments of

$4.0 billion were made to the GSEs for the fiscal year ended September 30, 2018.

91 NOTES TO THE FINANCIAL STATEMENTS

Senior Preferred Stock and Warrants for Common Stock

In determining the fair value of the senior preferred stock and warrants for common stock, Treasury relied on the GSEs’

public filings and press releases concerning their financial statements, as well as non-public, long-term financial forecasts,

monthly summaries, quarterly credit supplements, independent research regarding preferred stock trading, independent

research regarding the GSEs’ common stock trading on the OTC Bulletin Board, discussions with each of the GSEs and

FHFA, and other information pertinent to the valuations. Because the instruments are not publicly traded, there is no

comparable trading information available. The fair valuations rely on significant unobservable inputs that reflect assumptions

about the expectations that market participants would use in pricing.

The fair value of the senior preferred stock considers the amount of forecasted cash flows to equity. The fair valuations

assume that a hypothetical buyer would acquire the discounted dividend stream as of the transaction date. The fair value of

the senior preferred stock decreased as of September 30, 2019 when compared to September 30, 2018, mainly driven by the

increase in the market value of the GSEs’ other equity securities that comprise the GSEs’ total equity value. The effect of the

market value increase was partially offset by a lower discount rate, driven by a lower risk-free rate and reduced volatility

among comparable companies.

Factors impacting the fair value of the warrants include the nominal exercise price and the large number of potential

exercise shares, the market trading of the common stock that underlies the warrants as of September 30, the principal market,

and the market participants. Other factors impacting the fair value include, among other things, the holding period risk related

directly to the assumption of the amount of time that it will take to sell the exercised shares without depressing the market.

The fair value of the warrants increased at the end of fiscal year 2019, when compared to 2018, primarily due to increases in

the market price of the underlying common stock of each GSE.

Estimation Factors

Treasury’s forecasts concerning the GSEs may differ from actual experience. Estimated senior preferred values and

future draw amounts will depend on numerous factors that are difficult to predict including, but not limited to, changes in

government policy with respect to the GSEs, the business cycle, inflation, home prices, unemployment rates, interest rates,

changes in housing preferences, home financing alternatives, availability of debt financing, market rates of guarantee fees,

outcomes of loan refinancings and modifications, new housing programs, and other applicable factors.

Contingent Liability to GSEs

As part of the annual process undertaken by Treasury, a series of long-term financial forecasts are prepared to assess, as

of September 30, the likelihood and magnitude of future draws to be required by the GSEs under the SPSPAs within the

forecast time horizon. Treasury used 25-year financial forecasts prepared through years 2044 and 2043 in assessing if a

contingent liability was required as of September 30, 2019 and 2018, respectively. If future payments under the SPSPAs are

deemed to be probable within the forecast horizon, and Treasury can reasonably estimate such payment, Treasury will accrue

a contingent liability to the GSEs to reflect the forecasted equity deficits of the GSEs. This accrued contingent liability will

be undiscounted and will not take into account any of the offsetting dividends that could be received, as the dividends, if any,

would be owed directly to the General Fund. Treasury will adjust such recorded accruals in subsequent years as new

information develops or circumstances change. If future payments are reasonably possible, they are disclosed but not

recorded as an accrued contingent liability.

Based on the annual forecasts as of September 30, 2019 and 2018, Treasury estimated there was no probable future

funding draws. As of September 30, 2019, it is reasonably possible that market volatility or non-recurring events—for

instance, changes to accounting policies that impact credit loss provisions—could potentially cause the GSEs to generate

quarterly losses and, therefore, result in future funding draws against the funding commitment. Due to challenges quantifying

future market volatility or the timing, magnitude, and likelihood of non-recurring events, the total amount of this reasonably

possible future funding liability could not be estimated as of September 30, 2019. There were no payments to the GSEs for

fiscal year ended September 30, 2019. At September 30, 2019 and 2018, the maximum remaining funding commitment to the

GSEs for the remaining life of the SPSPAs was $254.1 billion. Subsequent funding draws will reduce the remaining

commitments. Refer to Note 19—Commitments for a full description of other commitments and risks.

In assessing the need for an estimated contingent liability, Treasury relied on the GSEs’ public filings and press releases

concerning their financial statements, monthly summaries, and quarterly credit supplements, as well as non-public, long-term

financial forecasts, the FHFA House Price Index, discussions with each of the GSEs and FHFA, and other information

pertinent to the liability estimates. The forecasts prepared in assessing the need for an estimated contingent liability as of

September 30, 2019 include three potential wind-down scenarios, with varying assumptions regarding the timing as to when

the GSEs would cease new business activities, including purchasing mortgage loans and issuing new guaranteed MBS. The

forecasts as of September 30, 2019, also assumed the maintenance of the GSEs’ retained mortgage portfolios (and

NOTES TO THE FINANCIAL STATEMENTS 92

corresponding net interest income) below the $250 billion maximum permitted under the SPSPAs. The maximum balance of

each GSE’s retained mortgage portfolio was initially set at $650 billion as of December 31, 2012, and the amended SPSPAs

required that the GSEs reduce this maximum balance to $250 billion by December 31, 2018, which was accomplished by

both GSEs.

Regulatory Environment

To date, Congress has not passed legislation nor has FHFA taken actions to end the conservatorships to address the

future of the GSEs. The GSEs continue to operate under the direction of their conservator, the FHFA. On March 27, 2019,

the President issued a Memorandum that directed the Secretary of the Treasury to develop a plan for administrative and

legislative reforms to achieve the following housing finance reform goals: (1) ending the conservatorships of the GSEs upon

completion of specified reforms; (2) facilitating competition in the housing finance market; (3) establishing regulation of the

GSEs that safeguards their safety and soundness and minimizes the risks they pose to the financial stability of the U.S.; and

(4) providing that the federal government is properly compensated for any explicit or implicit support it provides to the GSEs

or the secondary housing finance market. On September 5, 2019, Treasury released their Housing Reform Plan, which

included recommended legislative and administrative reforms to achieve each of these goals.

The Temporary Payroll Tax Cut Continuation Act of 2011 (P.L. 112-78) was funded by an increase of ten basis points in

the GSEs’ guarantee fees (referred to as “the incremental fees”) which began in April 2012 and is effective through

September 30, 2021. The incremental fees are remitted to Treasury and not retained by the GSEs and, thus, do not affect the

profitability of the GSEs. For fiscal years 2019 and 2018, the GSEs remitted to Treasury the incremental fees totaling $3.9

billion and $3.6 billion, respectively.

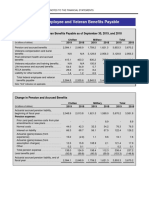

As of September 30, 2019, and 2018, GSEs investments consisted of the following:

Investments in GSEs as of September 30, 2019

Cumulative

Gross Valuation Fair

(In billions of dollars) Investments Gain/(Loss) Value

Fannie Mae senior preferred stock ................................. 127.0 (78.3) 48.7

Freddie Mac senior preferred stock ................................ 77.3 (38.5) 38.8

Fannie Mae warrants common stock .............................. 3.1 12.9 16.0

Freddie Mac warrants common stock ............................. 2.3 6.3 8.6

Total investments in GSEs ......................................... 209.7 (97.6) 112.1

Investments in GSEs as of September 30, 2018

Cumulative

Gross Valuation Fair

(In billions of dollars) Investments Gain/(Loss) Value

Fannie Mae senior preferred stock ................................. 123.7 (64.5) 59.2

Freddie Mac senior preferred stock ................................ 75.4 (31.2) 44.2

Fannie Mae warrants common stock .............................. 3.1 3.2 6.3

Freddie Mac warrants common stock ............................. 2.3 1.2 3.5

Total investments in GSEs .......................................... 204.5 (91.3) 113.2

You might also like

- Investments BKM - 9e SolutionsDocument246 pagesInvestments BKM - 9e SolutionsMichael Ong100% (3)

- Convertible Loan AgreementDocument7 pagesConvertible Loan AgreementPoonamNo ratings yet

- Housing & Government Sponsored Enterprises FY 2013 Congressional JustificationDocument13 pagesHousing & Government Sponsored Enterprises FY 2013 Congressional Justificationjoko-jacksNo ratings yet

- Case Study StockDocument3 pagesCase Study StockMatt INo ratings yet

- IAnthus Investor Presentation - October 2019 Investor DeckDocument29 pagesIAnthus Investor Presentation - October 2019 Investor DeckAnonymous fJAvrhj80JNo ratings yet

- Philippine Deposit Insurance Corporation Notes To Financial StatementsDocument31 pagesPhilippine Deposit Insurance Corporation Notes To Financial Statementsarellano lawschoolNo ratings yet

- Blackstone BREIT Notice To StockholdersDocument3 pagesBlackstone BREIT Notice To StockholdersZerohedgeNo ratings yet

- Notes To Financial Statements 2019Document103 pagesNotes To Financial Statements 2019LokiNo ratings yet

- NewMethodForGSE RiskTransfer-MalayBansalDocument10 pagesNewMethodForGSE RiskTransfer-MalayBansaldocs22No ratings yet

- Blueprint For Restoring Safety and Soundness To The GSEs November 2018Document32 pagesBlueprint For Restoring Safety and Soundness To The GSEs November 2018GSE Safety and SoundnessNo ratings yet

- 2007-08-07 COMMENTS ON RECENT MARKET SPECULATION REGARDING THE GSEs - Weekly Aug 7 2007Document4 pages2007-08-07 COMMENTS ON RECENT MARKET SPECULATION REGARDING THE GSEs - Weekly Aug 7 2007Joshua RosnerNo ratings yet

- Fy 2018 Midyear UpdateDocument388 pagesFy 2018 Midyear UpdateNick ReismanNo ratings yet

- The Cost of Government Financial Interventions, Past and PresentDocument6 pagesThe Cost of Government Financial Interventions, Past and Presentalex1521dfNo ratings yet

- Fy 19 Enac FPDocument440 pagesFy 19 Enac FPThe Capitol PressroomNo ratings yet

- Tab C (2 of 2) - Notes To Financial StatementsDocument29 pagesTab C (2 of 2) - Notes To Financial Statementsarellano lawschoolNo ratings yet

- Fourth Quarter 2019 Earnings PresentationDocument26 pagesFourth Quarter 2019 Earnings PresentationShambavaNo ratings yet

- United States Government Notes To The Financial Statements For The Fiscal Years Ended September 30, 2019, and 2018Document13 pagesUnited States Government Notes To The Financial Statements For The Fiscal Years Ended September 30, 2019, and 2018LokiNo ratings yet

- Qau 1203Document15 pagesQau 1203TBP_Think_TankNo ratings yet

- Portfolio Disposition FAQs Update 05-02-11 - FinalDocument7 pagesPortfolio Disposition FAQs Update 05-02-11 - Finaleav206No ratings yet

- 2013 q2 Crescent Commentary Steve RomickDocument16 pages2013 q2 Crescent Commentary Steve RomickCanadianValueNo ratings yet

- ALI 05-25 R23 ALI-Bonds-due-2025-Amended-Offer-Supplement-04212021Document320 pagesALI 05-25 R23 ALI-Bonds-due-2025-Amended-Offer-Supplement-04212021Ram CervantesNo ratings yet

- Note 23. Long-Term Fiscal ProjectionsDocument6 pagesNote 23. Long-Term Fiscal ProjectionsLokiNo ratings yet

- Carson Senate Banking Testimony 9-10-19Document8 pagesCarson Senate Banking Testimony 9-10-19Stephen LoiaconiNo ratings yet

- Accounting Standard 12Document11 pagesAccounting Standard 12api-3828505100% (1)

- Strengths, Credit Rating'Document7 pagesStrengths, Credit Rating'sammitNo ratings yet

- Financial - Accounting Assig 1bDocument10 pagesFinancial - Accounting Assig 1btumonekongo02No ratings yet

- Note 25. Disclosure Entities and Related PartiesDocument5 pagesNote 25. Disclosure Entities and Related PartiesLokiNo ratings yet

- FitchDocument9 pagesFitchTiso Blackstar Group100% (1)

- Finance Report - AusiDocument6 pagesFinance Report - AusiMichael NguriNo ratings yet

- GSAM Municipal Fixed Income SarDocument156 pagesGSAM Municipal Fixed Income Sarjoe1lee_1No ratings yet

- MODULE 2: Government Grants & Government AssistanceDocument2 pagesMODULE 2: Government Grants & Government AssistancePauline Joy GenalagonNo ratings yet

- 69240asb55316 As12Document9 pages69240asb55316 As12cheyam222No ratings yet

- (LGT) 20210316 - DRU - Sector RotationDocument3 pages(LGT) 20210316 - DRU - Sector RotationRuehYinn YapNo ratings yet

- 2008-10-08 TARP - Capital InfusionDocument6 pages2008-10-08 TARP - Capital InfusionJoshua RosnerNo ratings yet

- FINAL Joy Global Presentation For Investors 00793403xA26CA FinalDocument9 pagesFINAL Joy Global Presentation For Investors 00793403xA26CA FinalEdson MirandaNo ratings yet

- Background On: Insurance AccountingDocument5 pagesBackground On: Insurance AccountingSheena Doria de VeraNo ratings yet

- U.S. Mortgage Finance Reform Efforts and The Potential Credit ImplicationsDocument8 pagesU.S. Mortgage Finance Reform Efforts and The Potential Credit Implicationsapi-227433089No ratings yet

- Government SubsidiesDocument6 pagesGovernment Subsidiessamy7541No ratings yet

- Financial Supplement Q2 2011Document30 pagesFinancial Supplement Q2 2011Patricia bNo ratings yet

- Note 21. Fiduciary Activities: Thrift Savings PlanDocument2 pagesNote 21. Fiduciary Activities: Thrift Savings PlanLokiNo ratings yet

- Notes To The Financial Statements9Document1 pageNotes To The Financial Statements9LokiNo ratings yet

- Sensitive/Pre-Decisional: Department of The Treasury WASHINGTON, D.C. 20220Document8 pagesSensitive/Pre-Decisional: Department of The Treasury WASHINGTON, D.C. 20220api-261468864No ratings yet

- Accounting For Borrowing Cost and Government GrantDocument4 pagesAccounting For Borrowing Cost and Government GrantMaureen Derial PantaNo ratings yet

- Fair Valuation of Residential Whole Loans: Jay Guo, PH.D Interactive Data Corporation May 2011Document4 pagesFair Valuation of Residential Whole Loans: Jay Guo, PH.D Interactive Data Corporation May 2011bigposerNo ratings yet

- Accounting For Govt GrantsDocument20 pagesAccounting For Govt GrantsSaisanthosh Kumar SharmaNo ratings yet

- Muni Rally May Continue, But Must Navigate Policy RisksDocument3 pagesMuni Rally May Continue, But Must Navigate Policy RisksPutnam InvestmentsNo ratings yet

- Government Securities MarketDocument47 pagesGovernment Securities MarketArjit AgrawalNo ratings yet

- Investment and Financing Constrainst:: 1 CommentsDocument6 pagesInvestment and Financing Constrainst:: 1 CommentsCristina TessariNo ratings yet

- Moody's On ChinaDocument9 pagesMoody's On ChinaTim MooreNo ratings yet

- GT Capital: Up To P12B Bond IssueDocument457 pagesGT Capital: Up To P12B Bond IssueBusinessWorldNo ratings yet

- The Impact of COVID-19 On Alternative Assets: Investment ImplicationsDocument6 pagesThe Impact of COVID-19 On Alternative Assets: Investment ImplicationsAndres Torres0% (1)

- Unit 3 NFPDocument15 pagesUnit 3 NFPAbdii DhufeeraNo ratings yet

- Global Financial Crisis ReportDocument11 pagesGlobal Financial Crisis ReportRONNY WINGANo ratings yet

- International Accounting Standard 20 Accounting For Government Grants and Disclosure of Government AssistanceDocument7 pagesInternational Accounting Standard 20 Accounting For Government Grants and Disclosure of Government AssistanceParisNo ratings yet

- The $5 Trillion Question: What Should We Do With Fannie Mae and Freddie Mac?Document6 pagesThe $5 Trillion Question: What Should We Do With Fannie Mae and Freddie Mac?Lani RosalesNo ratings yet

- Housing Finance 0Document67 pagesHousing Finance 0AdminAliNo ratings yet

- RRMS Market Insights: Editor's NoteDocument5 pagesRRMS Market Insights: Editor's NoteRobert PardesNo ratings yet

- Policyholder Information Statement On Shenandoah Life Insurance Co.Document42 pagesPolicyholder Information Statement On Shenandoah Life Insurance Co.The Roanoke Times100% (1)

- Rating Action Moodys Downgrades Surinames Rating To Caa3 Maintains Negative Outlook 07jul20Document6 pagesRating Action Moodys Downgrades Surinames Rating To Caa3 Maintains Negative Outlook 07jul20Suriname MirrorNo ratings yet

- Government SecuritiesDocument31 pagesGovernment Securitiesshranil-k-shah-7086100% (1)

- Budget of the U.S. Government: A New Foundation for American Greatness: Fiscal Year 2018From EverandBudget of the U.S. Government: A New Foundation for American Greatness: Fiscal Year 2018No ratings yet

- The effects of investment regulations on pension funds performance in BrazilFrom EverandThe effects of investment regulations on pension funds performance in BrazilNo ratings yet

- Scs 3Document8 pagesScs 3LokiNo ratings yet

- Food - The GuardianDocument7 pagesFood - The GuardianLoki100% (1)

- Culture - The GuardianDocument8 pagesCulture - The GuardianLokiNo ratings yet

- Language Learning With Free PodcastsDocument3 pagesLanguage Learning With Free PodcastsLokiNo ratings yet

- Unmatched Transactions and Balances: Restated Fiscal Year Fiscal Year 2019 2018Document1 pageUnmatched Transactions and Balances: Restated Fiscal Year Fiscal Year 2019 2018LokiNo ratings yet

- Notes To The Financial Statements27Document1 pageNotes To The Financial Statements27LokiNo ratings yet

- 2019 Country Reports On Human Rights Practices - United States Department of StateDocument10 pages2019 Country Reports On Human Rights Practices - United States Department of StateLokiNo ratings yet

- United States Government Other Information (Unaudited) For The Years Ended September 30, 2019, and 2018Document2 pagesUnited States Government Other Information (Unaudited) For The Years Ended September 30, 2019, and 2018LokiNo ratings yet

- Largest Income Tax Expenditures As of September 30, 2019Document2 pagesLargest Income Tax Expenditures As of September 30, 2019LokiNo ratings yet

- Tax Gap: Corporate Income Tax Liability For Tax Year 2016Document1 pageTax Gap: Corporate Income Tax Liability For Tax Year 2016LokiNo ratings yet

- Social Insurance: Social Security and MedicareDocument26 pagesSocial Insurance: Social Security and MedicareLokiNo ratings yet

- Sustainability of Fiscal PolicyDocument11 pagesSustainability of Fiscal PolicyLokiNo ratings yet

- Tax Assessments: Required Supplementary Information (Unaudited) 208Document1 pageTax Assessments: Required Supplementary Information (Unaudited) 208LokiNo ratings yet

- Note 25. Disclosure Entities and Related PartiesDocument5 pagesNote 25. Disclosure Entities and Related PartiesLokiNo ratings yet

- Note 21. Fiduciary Activities: Thrift Savings PlanDocument2 pagesNote 21. Fiduciary Activities: Thrift Savings PlanLokiNo ratings yet

- Deferred Maintenance and RepairsDocument1 pageDeferred Maintenance and RepairsLokiNo ratings yet

- Notes To The Financial Statements26 PDFDocument1 pageNotes To The Financial Statements26 PDFLokiNo ratings yet

- Note 23. Long-Term Fiscal ProjectionsDocument6 pagesNote 23. Long-Term Fiscal ProjectionsLokiNo ratings yet

- Note 24. Stewardship Land and Heritage Assets: 161 Notes To The Financial StatementsDocument1 pageNote 24. Stewardship Land and Heritage Assets: 161 Notes To The Financial StatementsLokiNo ratings yet

- Note 17. Collections and Refunds of Federal RevenueDocument3 pagesNote 17. Collections and Refunds of Federal RevenueLokiNo ratings yet

- Notes To The Financial Statements20Document6 pagesNotes To The Financial Statements20LokiNo ratings yet

- Note 22. Social Insurance: 137 Notes To The Financial StatementsDocument18 pagesNote 22. Social Insurance: 137 Notes To The Financial StatementsLokiNo ratings yet

- Notes To The Financial Statements18Document7 pagesNotes To The Financial Statements18LokiNo ratings yet

- Notes To The Financial Statements16Document2 pagesNotes To The Financial Statements16LokiNo ratings yet

- Note 19. Commitments: Long-Term Operating Leases As of September 30, 2019, and 2018Document3 pagesNote 19. Commitments: Long-Term Operating Leases As of September 30, 2019, and 2018LokiNo ratings yet

- Note 15. Insurance and Guarantee Program LiabilitiesDocument2 pagesNote 15. Insurance and Guarantee Program LiabilitiesLokiNo ratings yet

- Notes To The Financial Statements14Document1 pageNotes To The Financial Statements14LokiNo ratings yet

- Note 13. Environmental and Disposal LiabilitiesDocument2 pagesNote 13. Environmental and Disposal LiabilitiesLokiNo ratings yet

- Note 12. Federal Employee and Veteran Benefits PayableDocument10 pagesNote 12. Federal Employee and Veteran Benefits PayableLokiNo ratings yet

- Note 11. Federal Debt Securities Held by The Public and Accrued InterestDocument4 pagesNote 11. Federal Debt Securities Held by The Public and Accrued InterestLokiNo ratings yet

- Unit-Iii Fundamental AnalysisDocument36 pagesUnit-Iii Fundamental Analysisharesh KNo ratings yet

- Mba 4 Sem (Umang Rajput)Document20 pagesMba 4 Sem (Umang Rajput)Umang RajputNo ratings yet

- Black BookDocument43 pagesBlack Booknedexed404No ratings yet

- PercentDocument24 pagesPercentmidas66No ratings yet

- 2,3,4 Ir Uzd PDFDocument31 pages2,3,4 Ir Uzd PDFLeonid LeoNo ratings yet

- 03 04 Analysis Financial StatementDocument216 pages03 04 Analysis Financial StatementShanique Y. Harnett100% (1)

- Security Analysis & Portfolio Management - 1Document4 pagesSecurity Analysis & Portfolio Management - 1api-3745584No ratings yet

- DP 25537Document293 pagesDP 25537Antonio LopezNo ratings yet

- Capital MarketDocument14 pagesCapital MarketAnmol GuptaNo ratings yet

- Debre Markos Universty College of Post-Graduate Studies Department of Accounting and FinanceDocument14 pagesDebre Markos Universty College of Post-Graduate Studies Department of Accounting and FinanceMikias DegwaleNo ratings yet

- Phillip Nova 2H2023 Market OutlookDocument29 pagesPhillip Nova 2H2023 Market OutlookSteven TimNo ratings yet

- Chapter 7Document21 pagesChapter 7TACIPIT, Rowena Marie DizonNo ratings yet

- Chapter 1: The Investment Environment: Problem SetsDocument5 pagesChapter 1: The Investment Environment: Problem SetsGrant LiNo ratings yet

- Iaet and Tax-Exempt CorporationsDocument12 pagesIaet and Tax-Exempt Corporationsandrea ibanezNo ratings yet

- 9QDEHY - 2019 Tesla Inc Press Release Annual Report - JGVR0PDocument232 pages9QDEHY - 2019 Tesla Inc Press Release Annual Report - JGVR0PHarshNo ratings yet

- Lesson 7 Bull Call SpreadDocument14 pagesLesson 7 Bull Call Spreadadms100% (3)

- Certificate of Final Tax Withheld at Source: Faye and Sam General MerchandiseDocument4 pagesCertificate of Final Tax Withheld at Source: Faye and Sam General MerchandiseMay MayNo ratings yet

- Crescent Star Insurance LimitedDocument5 pagesCrescent Star Insurance LimitedlordraiNo ratings yet

- DuPont Public WP 2015 - 02.11.15Document78 pagesDuPont Public WP 2015 - 02.11.15marketfolly.comNo ratings yet

- Annual Report FinalDocument192 pagesAnnual Report Finalprashanthfeb90No ratings yet

- Bonus IssueDocument11 pagesBonus IssueRiya NitharwalNo ratings yet

- EFAMA AssetManagementReport2019Document15 pagesEFAMA AssetManagementReport2019CHUMBNo ratings yet

- Canadian Preferred Shares Yield TablesDocument29 pagesCanadian Preferred Shares Yield TablesrblaisNo ratings yet

- IDirect GladiatorStocks LIC March24Document9 pagesIDirect GladiatorStocks LIC March24ptus nayakNo ratings yet

- A Comparative Analysis On The Shareholder Value of Saint and Sin StocksDocument43 pagesA Comparative Analysis On The Shareholder Value of Saint and Sin StocksKarla Eunice Aquino ChanNo ratings yet

- Diglog07 15Document15 pagesDiglog07 15iftiniaziNo ratings yet

- Managerial Economics: Applications, Strategy, and Tactics, 10 EditionDocument18 pagesManagerial Economics: Applications, Strategy, and Tactics, 10 EditionMoshNo ratings yet

- CA IPCC New Accounts Question Paper Nov 2018 StudycafeDocument12 pagesCA IPCC New Accounts Question Paper Nov 2018 Studycafeshrey goelNo ratings yet