Professional Documents

Culture Documents

Cost Accounting - 2019 Chapter 2 - Costs - Concepts and Classification

Cost Accounting - 2019 Chapter 2 - Costs - Concepts and Classification

Uploaded by

?????Copyright:

Available Formats

You might also like

- Relevant Information For Decision Making: Cost Accounting: Foundations and Evolutions, 8eDocument28 pagesRelevant Information For Decision Making: Cost Accounting: Foundations and Evolutions, 8eLau AngelNo ratings yet

- Master Budget ACCT 310Document14 pagesMaster Budget ACCT 310Yessica Leticia SanchezNo ratings yet

- Kinney8e PPT Ch06Document43 pagesKinney8e PPT Ch06Christian GoNo ratings yet

- Central Bank v. CA, 139 SCRA 46 (1985)Document5 pagesCentral Bank v. CA, 139 SCRA 46 (1985)Clive HendelsonNo ratings yet

- Activity No. 1 - Cost, Concepts and ClassificationsDocument4 pagesActivity No. 1 - Cost, Concepts and ClassificationsDan RyanNo ratings yet

- AGENCYDocument20 pagesAGENCYJoshua CabinasNo ratings yet

- Standard Cost and Components and Variance AnalysisDocument7 pagesStandard Cost and Components and Variance AnalysisNaveen RajputNo ratings yet

- Cost Concepts and ClassificationsDocument5 pagesCost Concepts and ClassificationsAbdulrahman M. MacacuaNo ratings yet

- Standard Costing and Variance Analysis: Cost Accounting: Foundations and Evolutions, 8eDocument46 pagesStandard Costing and Variance Analysis: Cost Accounting: Foundations and Evolutions, 8eBernard SalongaNo ratings yet

- Local Taxes, Preferential Taxation - QuestionnaireDocument7 pagesLocal Taxes, Preferential Taxation - Questionnaireacctg.files1231No ratings yet

- Chapter 3 Predetermined FOH RatesDocument37 pagesChapter 3 Predetermined FOH RatesAtif SaeedNo ratings yet

- Learning Packet (CAE19) BSA 3Document36 pagesLearning Packet (CAE19) BSA 3Judy Anne RamirezNo ratings yet

- Mixed Cost High-Low Method ProblemDocument1 pageMixed Cost High-Low Method ProblemAnj HwanNo ratings yet

- Omnibus Investment CodeDocument6 pagesOmnibus Investment CodeangelaaaxNo ratings yet

- Chapter 4Document20 pagesChapter 4Oskard MacoNo ratings yet

- Lesson 8: Deductions To Gross IncomeDocument28 pagesLesson 8: Deductions To Gross IncomeeuniNo ratings yet

- Job Order Costing HandoutsDocument8 pagesJob Order Costing HandoutsHannah Jane Arevalo LafuenteNo ratings yet

- Cost Concepts and Classification Quizzer 2 2Document13 pagesCost Concepts and Classification Quizzer 2 2BRYLL RODEL PONTINONo ratings yet

- Receivables ManagementDocument5 pagesReceivables ManagementInocencio TiburcioNo ratings yet

- Financial Management RiskDocument11 pagesFinancial Management RisknevadNo ratings yet

- Chapter 9 Process CostingDocument61 pagesChapter 9 Process CostingAlliahDataNo ratings yet

- Ch05-Job CostingDocument35 pagesCh05-Job Costingemanmaryum7No ratings yet

- Accounting For Income TaxDocument31 pagesAccounting For Income TaxJames Ryan AlzonaNo ratings yet

- ABC Costing Lecture NotesDocument12 pagesABC Costing Lecture NotesMickel AlexanderNo ratings yet

- ACCOUNTING 105 LESSON NO 1.doc1Document4 pagesACCOUNTING 105 LESSON NO 1.doc1Lee SuarezNo ratings yet

- Working Capital and Current Assets ManagementDocument66 pagesWorking Capital and Current Assets ManagementElmer KennethNo ratings yet

- Module 9 Reports On Audited Financial StatementsDocument53 pagesModule 9 Reports On Audited Financial StatementsDjunah ArellanoNo ratings yet

- LEC 5.2 Standard Costing and Variance AnalysisDocument32 pagesLEC 5.2 Standard Costing and Variance AnalysisKelvin Culajará100% (1)

- Process CostingDocument49 pagesProcess CostingAccounting Files100% (2)

- Managerial Accounting Hilton 6e Chapter 4 Solution PDFDocument68 pagesManagerial Accounting Hilton 6e Chapter 4 Solution PDFNoor QamarNo ratings yet

- Kinney8e PPT Ch07Document46 pagesKinney8e PPT Ch07Michelle RotairoNo ratings yet

- Gross Profit AnalysisDocument4 pagesGross Profit AnalysisLady Lhyn LalunioNo ratings yet

- ECODEV 18 Assignment No.2 Ten Lesson in Economics and Thinking Like An EconomistsDocument4 pagesECODEV 18 Assignment No.2 Ten Lesson in Economics and Thinking Like An EconomistsCassie LyeNo ratings yet

- BackFlush Costing2Document12 pagesBackFlush Costing2Venn Bacus RabadonNo ratings yet

- Instructions. Write Your Final Answers On The Answer Sheet Provided. For Problem Solving Items, Please Write Solutions On The Answer Sheet AlsoDocument8 pagesInstructions. Write Your Final Answers On The Answer Sheet Provided. For Problem Solving Items, Please Write Solutions On The Answer Sheet AlsoJozette TorinoNo ratings yet

- ACCCOB3Document87 pagesACCCOB3Lexy SungaNo ratings yet

- Easy Company Financial PositionDocument2 pagesEasy Company Financial PositionSheila May SantosNo ratings yet

- Chapter 6 Fundamentals of Assurance ServicesDocument28 pagesChapter 6 Fundamentals of Assurance ServicesJoyce Anne Garduque100% (1)

- Chapter 2. COST IDocument8 pagesChapter 2. COST Iyebegashet100% (1)

- Job Order, Operation and Life Cycle Costing Job Order CostingDocument19 pagesJob Order, Operation and Life Cycle Costing Job Order Costingjessa mae zerdaNo ratings yet

- Cost & Managerial Accounting Cost-Volume-Profit Analysis: Page 1 of 3Document3 pagesCost & Managerial Accounting Cost-Volume-Profit Analysis: Page 1 of 3mohammad bilal0% (1)

- JOB Order CostingDocument4 pagesJOB Order CostingWag NasabiNo ratings yet

- Intermediate Accounting 3 - Week 1 - Module 2Document6 pagesIntermediate Accounting 3 - Week 1 - Module 2LuisitoNo ratings yet

- Group 5: Cornejo, Sue Cleo Pedroza, Pia Loraine Rodrigo, Karla Angela Therese Yutico, Roxane Mae Imperial, SheenaDocument12 pagesGroup 5: Cornejo, Sue Cleo Pedroza, Pia Loraine Rodrigo, Karla Angela Therese Yutico, Roxane Mae Imperial, SheenaVenn Bacus RabadonNo ratings yet

- Absorption and Variable CostingDocument11 pagesAbsorption and Variable CostingalliahnahNo ratings yet

- Chapter 13a - Ordinary Allowable Itemized DeductionsDocument9 pagesChapter 13a - Ordinary Allowable Itemized DeductionsprestinejanepanganNo ratings yet

- Absorption and Variable CostingDocument13 pagesAbsorption and Variable CostingdarylNo ratings yet

- Required: 1. Predetermined Overhead Rate For The YearDocument3 pagesRequired: 1. Predetermined Overhead Rate For The YearEevan SalazarNo ratings yet

- ACCA Certified Accounting Technician Examination Paper T7 Planning, Control and Performance ManagementDocument9 pagesACCA Certified Accounting Technician Examination Paper T7 Planning, Control and Performance ManagementanonNo ratings yet

- ARTS CPA Review ARTS CPA ReviewDocument28 pagesARTS CPA Review ARTS CPA ReviewAG VenturesNo ratings yet

- 5Document46 pages5Navindra JaggernauthNo ratings yet

- Evaluating Firm Performance - ReportDocument5 pagesEvaluating Firm Performance - ReportJeane Mae BooNo ratings yet

- Contemporary Strategy Analysis Ch2 Study QuestionsDocument3 pagesContemporary Strategy Analysis Ch2 Study QuestionsBeta Acc100% (1)

- Acc 223a CH 5 AnswersDocument13 pagesAcc 223a CH 5 Answersjr centenoNo ratings yet

- Business & Transfer Taxation: Rex B. Banggawan, Cpa, MbaDocument38 pagesBusiness & Transfer Taxation: Rex B. Banggawan, Cpa, Mbajustine reine cornicoNo ratings yet

- Chap12 (Capital Budgeting and Estimating Cash Flows) VanHorne&Brigham, CabreaDocument4 pagesChap12 (Capital Budgeting and Estimating Cash Flows) VanHorne&Brigham, CabreaClaudine DuhapaNo ratings yet

- Taxation 2Document11 pagesTaxation 2MerEl Urbano De GuzmanNo ratings yet

- Fin 018 Problem SolvingDocument7 pagesFin 018 Problem SolvingVincenzo CassanoNo ratings yet

- Cost Accounting Answer Chapter 2 PDFDocument5 pagesCost Accounting Answer Chapter 2 PDFangel cruz0% (1)

- Cost Accounting 2014Document94 pagesCost Accounting 2014Juliet Leron MediloNo ratings yet

- ThatDocument4 pagesThat?????No ratings yet

- ThereforeDocument3 pagesTherefore?????No ratings yet

- I Like Sumireko SanshokuinDocument4 pagesI Like Sumireko Sanshokuin?????No ratings yet

- You 1Document3 pagesYou 1?????No ratings yet

- Different From Cosmos and HimawariDocument4 pagesDifferent From Cosmos and Himawari?????No ratings yet

- If Himawari Comes Then Cosmos Will Be MadDocument4 pagesIf Himawari Comes Then Cosmos Will Be Mad?????No ratings yet

- If You Run AwayDocument3 pagesIf You Run Away?????No ratings yet

- HMMDocument4 pagesHMM?????No ratings yet

- ItDocument3 pagesIt?????No ratings yet

- By The WayDocument3 pagesBy The Way?????No ratings yet

- Because Yesterday Was Such A Big FailureDocument4 pagesBecause Yesterday Was Such A Big Failure?????No ratings yet

- AnywaysDocument3 pagesAnyways?????No ratings yet

- MonsterDocument3 pagesMonster?????No ratings yet

- Munch, Munch. Munch, Munch, Munch, MunchDocument4 pagesMunch, Munch. Munch, Munch, Munch, Munch?????No ratings yet

- Guard DownDocument3 pagesGuard Down?????No ratings yet

Cost Accounting - 2019 Chapter 2 - Costs - Concepts and Classification

Cost Accounting - 2019 Chapter 2 - Costs - Concepts and Classification

Uploaded by

?????Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Cost Accounting - 2019 Chapter 2 - Costs - Concepts and Classification

Cost Accounting - 2019 Chapter 2 - Costs - Concepts and Classification

Uploaded by

?????Copyright:

Available Formats

Cost Accounting - 2019

Chapter 2 - Costs – Concepts and classification

Problem 1- Ram Corporation Problem 2

1. Direct materials 1. Fixed

2. Manufacturing overhead 2. Variable

3. Direct materials 3. Mixed

4. Direct labor 4. Fixed

5. Manufacturing overhead 5. Variable

6. Manufacturing overhead 6. Fixed

7. Direct materials 7. Fixed

8. Manufacturing overhead 8. Variable

9. Manufacturing overhead 9. Variable

10. Manufacturing overhead 10. Variable

Problem 3

1. Manufacturing 6. Manufacturing - Cost of machine breakdown

2. Selling 7. Manufacturing - Power to operate factory equipment

3. Manufacturing 8. Seling - Advertising

4. Manufacturing 9. Selling - Commission paid to sales personnel

5. Administrative 10.Administrative - Travel expenses of Chief Executive Officer

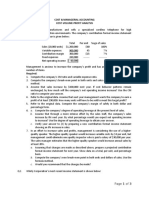

QUIZ Rocco Manufacturing Company reports the following costs and expenses in March of 2019:

Direct materials P220,000

Factory rent 50,000

Direct labor 180,000

Factory utilities 8,500

Factory supervisor’s salary 60,000

Depreciation – Factory equipment 20,000

Sales commission 57,000

Advertising 47,000

Depreciation – office equipment 10,000

Salary of the president 250,000

SOLUTION TO QUIZ Product Cost Period Cost

Direct mat. Direct laborMfg. OH Selling Adm

1. DM 220,000

2. Factory rent 50,000

3. Direct labor 180,000

4. Factory utilities 8,500

5. Supervision 60,000

6. Depreciation-FE 20,000

7. Sales Commission 57,000

8. Advertising 47,000

9. Depreciation-OE 10,000

10. Salary - pres. 250,000

1. TOTAL PRODUCT CST = 220,000 + 180,000 + 138,500 = p 538,500

2. TOTAL PERIOD COST = 57,000 + 307,000 = 364,000

3. COST PER UNIT = 538,500/ 40,000 = P 13.4625

Problem 4 – Bug Company

1. Variable Inventoriable (DM) 6. Variable Period (OE)

2. Variable Inventoriable (FO) 7. Variable Inventoriable (DM)

3. Fixed Inventoriable (FO) 8. Variable Period (OE)

4. Variable Inventoriable (DM) 9. Fixed Period (OE)

5. Variable Inventoriable (FO) 10. Variab;e Inventoriable (DL)

QUIZ Mighty Muffler, Inc. operates an automobile service facility, which specializes in replacing

mufflers on cars. The following table shows the costs incurred during a month when 500 mufflers

were replaced:

Number of muffler replacements

Total costs: 400 500 800

Fixed costs (a) P 50,000 (b)

Variable costs (c) 60,000 (d)

Total costs (e) P110,000 (f)

Cost per muffler replacement

Fixed cost (g) (h) (i)

Variable cost (j) (k) (l)

Total cost per unit replacement (m) (n) (o)

Required: Fill in the missing amounts.

ANSWERS FO QUIZ

a. P 50,000

b. P 50,000

c. P 60,000 = P120/muffler x 400 = P 48,000

500

d. P 120 x 800 = P 96,000

e. P 50,000 + P 48,000 = P 98,000

f. P 50,000 + P 96,000 = P 146,000

g. P 50,000/ 400 = P 125

h. P 50,000/500 = P 100

I, P 50,000/800 = P 62.50

j. P 48,000/400 = P 120

k. P 60,000/500 = P 120

l. P 96,000/800 = P 120

m. P 125 + P 120 = P 245

n. P 100 + P 120 = P 220

o. P 62.50 + P 120 = P 182.50

Problem 5

1. Prime cost (P65,000 - P15,000) + (P70,000 - P18,000) = P102,000

2. Conversion cost (P70,000 - P18,000) + (P95,000 - P33,000) = P114,000

3. Total product cost (P50,000 + P52,000 + P62,000*) = P164,000

4. Total period cost (P2,600 + P18,600) = P 21,200

Applied Overhead (P95,000 – P15,000 - P18,000)= P62,000.

Problem 6 – Mother Goose Company

1. Prime costs - 530,000

2. Conversion cost - 575,000

3 Inventoriable cost - 860,000

4. Total period costs - 305,000

Problem 7

1. Direct materials P 60.00

Direct labor 30.00

Variable manufacturing overhead 9.00

Total variable manufacturing cost per unit P 99.00

` 2. Total variable manufacturing cost per unit P 99.00

Variable marketing and administrative 6.00

Total variable costs per unit 105.00

3. Total variable manufacturing cost per unit P 99,00

Fixed manufacturing overhead (30,000/1,200) 25.00

Full manufacturing cost per unit 124.00

4. Full manufacturing cost per unit 124.00

Variable marketing and administrative 6.00

Fixed marketing and administrative 20.00

Full cost to make and sell per unit 150.00

Problem 8

1. P7 per machine hour

2. P18,000

3. P51,600

Problem 9 – Johnson Corporation

1. Variable cost per machine hour = 35,600 – 20,000

4,000 - 2,000

= 7.80 per machine hour

2. 4,000 hours 2000 hours

Total electricity expense 35,600 20,000

Less: Variable costs

( 4,000 x 7.80) 31,200

( 2000 x 7.80) ______ 15,600

Fixed cost 4,400 4,400

3. Fixed cost 4,400

Variable cost ( 4,500 x 7.50) 35,100

Totl manufacturing costs 39,500

Problem 10 – Valdez Motors Co.

1. Variable cost per machine hour = 5,475 – 3,975

210 - 145

= 23.08 per machine hour

2. 210 hours 145 hours

Total overhead costs 5,475 3,975

Less: Variable costs

( 210 x 23.08) 4,847

( 145 x 23.08) _____ 3,347

Fixed cost 628 628

Variable cost (200 mh x P23.08) P4,616

Fixed cost 628 P5,244

True/False Questions

1. False 6. True 11. False 16. True 21. True

2. False 7. False 12. False 17. False 22. True

3. True 8. True 13. True 18. True 23. False

4. False 9. False 14. False 19. False 24. False

5. False 10. True 15. False 20. True 25. True

Multiple Choice – Theoretical

1. D 6. A 11. C 16. B

2. C 7. D 12. D 17. B

3. B 8. D 13. C 18. A

4. C 9. B 14. B 19. D

5. D 10. C 15. A 20. B

Multiple choice - Computational

1. A 11. B

2. C 12. A

3. A 13. A

4. B 14. B

5. A 15. C

6. B 16. A

7. C 17. P34,000

8. B 18. C

9. B 19. D

10. A 20. D

You might also like

- Relevant Information For Decision Making: Cost Accounting: Foundations and Evolutions, 8eDocument28 pagesRelevant Information For Decision Making: Cost Accounting: Foundations and Evolutions, 8eLau AngelNo ratings yet

- Master Budget ACCT 310Document14 pagesMaster Budget ACCT 310Yessica Leticia SanchezNo ratings yet

- Kinney8e PPT Ch06Document43 pagesKinney8e PPT Ch06Christian GoNo ratings yet

- Central Bank v. CA, 139 SCRA 46 (1985)Document5 pagesCentral Bank v. CA, 139 SCRA 46 (1985)Clive HendelsonNo ratings yet

- Activity No. 1 - Cost, Concepts and ClassificationsDocument4 pagesActivity No. 1 - Cost, Concepts and ClassificationsDan RyanNo ratings yet

- AGENCYDocument20 pagesAGENCYJoshua CabinasNo ratings yet

- Standard Cost and Components and Variance AnalysisDocument7 pagesStandard Cost and Components and Variance AnalysisNaveen RajputNo ratings yet

- Cost Concepts and ClassificationsDocument5 pagesCost Concepts and ClassificationsAbdulrahman M. MacacuaNo ratings yet

- Standard Costing and Variance Analysis: Cost Accounting: Foundations and Evolutions, 8eDocument46 pagesStandard Costing and Variance Analysis: Cost Accounting: Foundations and Evolutions, 8eBernard SalongaNo ratings yet

- Local Taxes, Preferential Taxation - QuestionnaireDocument7 pagesLocal Taxes, Preferential Taxation - Questionnaireacctg.files1231No ratings yet

- Chapter 3 Predetermined FOH RatesDocument37 pagesChapter 3 Predetermined FOH RatesAtif SaeedNo ratings yet

- Learning Packet (CAE19) BSA 3Document36 pagesLearning Packet (CAE19) BSA 3Judy Anne RamirezNo ratings yet

- Mixed Cost High-Low Method ProblemDocument1 pageMixed Cost High-Low Method ProblemAnj HwanNo ratings yet

- Omnibus Investment CodeDocument6 pagesOmnibus Investment CodeangelaaaxNo ratings yet

- Chapter 4Document20 pagesChapter 4Oskard MacoNo ratings yet

- Lesson 8: Deductions To Gross IncomeDocument28 pagesLesson 8: Deductions To Gross IncomeeuniNo ratings yet

- Job Order Costing HandoutsDocument8 pagesJob Order Costing HandoutsHannah Jane Arevalo LafuenteNo ratings yet

- Cost Concepts and Classification Quizzer 2 2Document13 pagesCost Concepts and Classification Quizzer 2 2BRYLL RODEL PONTINONo ratings yet

- Receivables ManagementDocument5 pagesReceivables ManagementInocencio TiburcioNo ratings yet

- Financial Management RiskDocument11 pagesFinancial Management RisknevadNo ratings yet

- Chapter 9 Process CostingDocument61 pagesChapter 9 Process CostingAlliahDataNo ratings yet

- Ch05-Job CostingDocument35 pagesCh05-Job Costingemanmaryum7No ratings yet

- Accounting For Income TaxDocument31 pagesAccounting For Income TaxJames Ryan AlzonaNo ratings yet

- ABC Costing Lecture NotesDocument12 pagesABC Costing Lecture NotesMickel AlexanderNo ratings yet

- ACCOUNTING 105 LESSON NO 1.doc1Document4 pagesACCOUNTING 105 LESSON NO 1.doc1Lee SuarezNo ratings yet

- Working Capital and Current Assets ManagementDocument66 pagesWorking Capital and Current Assets ManagementElmer KennethNo ratings yet

- Module 9 Reports On Audited Financial StatementsDocument53 pagesModule 9 Reports On Audited Financial StatementsDjunah ArellanoNo ratings yet

- LEC 5.2 Standard Costing and Variance AnalysisDocument32 pagesLEC 5.2 Standard Costing and Variance AnalysisKelvin Culajará100% (1)

- Process CostingDocument49 pagesProcess CostingAccounting Files100% (2)

- Managerial Accounting Hilton 6e Chapter 4 Solution PDFDocument68 pagesManagerial Accounting Hilton 6e Chapter 4 Solution PDFNoor QamarNo ratings yet

- Kinney8e PPT Ch07Document46 pagesKinney8e PPT Ch07Michelle RotairoNo ratings yet

- Gross Profit AnalysisDocument4 pagesGross Profit AnalysisLady Lhyn LalunioNo ratings yet

- ECODEV 18 Assignment No.2 Ten Lesson in Economics and Thinking Like An EconomistsDocument4 pagesECODEV 18 Assignment No.2 Ten Lesson in Economics and Thinking Like An EconomistsCassie LyeNo ratings yet

- BackFlush Costing2Document12 pagesBackFlush Costing2Venn Bacus RabadonNo ratings yet

- Instructions. Write Your Final Answers On The Answer Sheet Provided. For Problem Solving Items, Please Write Solutions On The Answer Sheet AlsoDocument8 pagesInstructions. Write Your Final Answers On The Answer Sheet Provided. For Problem Solving Items, Please Write Solutions On The Answer Sheet AlsoJozette TorinoNo ratings yet

- ACCCOB3Document87 pagesACCCOB3Lexy SungaNo ratings yet

- Easy Company Financial PositionDocument2 pagesEasy Company Financial PositionSheila May SantosNo ratings yet

- Chapter 6 Fundamentals of Assurance ServicesDocument28 pagesChapter 6 Fundamentals of Assurance ServicesJoyce Anne Garduque100% (1)

- Chapter 2. COST IDocument8 pagesChapter 2. COST Iyebegashet100% (1)

- Job Order, Operation and Life Cycle Costing Job Order CostingDocument19 pagesJob Order, Operation and Life Cycle Costing Job Order Costingjessa mae zerdaNo ratings yet

- Cost & Managerial Accounting Cost-Volume-Profit Analysis: Page 1 of 3Document3 pagesCost & Managerial Accounting Cost-Volume-Profit Analysis: Page 1 of 3mohammad bilal0% (1)

- JOB Order CostingDocument4 pagesJOB Order CostingWag NasabiNo ratings yet

- Intermediate Accounting 3 - Week 1 - Module 2Document6 pagesIntermediate Accounting 3 - Week 1 - Module 2LuisitoNo ratings yet

- Group 5: Cornejo, Sue Cleo Pedroza, Pia Loraine Rodrigo, Karla Angela Therese Yutico, Roxane Mae Imperial, SheenaDocument12 pagesGroup 5: Cornejo, Sue Cleo Pedroza, Pia Loraine Rodrigo, Karla Angela Therese Yutico, Roxane Mae Imperial, SheenaVenn Bacus RabadonNo ratings yet

- Absorption and Variable CostingDocument11 pagesAbsorption and Variable CostingalliahnahNo ratings yet

- Chapter 13a - Ordinary Allowable Itemized DeductionsDocument9 pagesChapter 13a - Ordinary Allowable Itemized DeductionsprestinejanepanganNo ratings yet

- Absorption and Variable CostingDocument13 pagesAbsorption and Variable CostingdarylNo ratings yet

- Required: 1. Predetermined Overhead Rate For The YearDocument3 pagesRequired: 1. Predetermined Overhead Rate For The YearEevan SalazarNo ratings yet

- ACCA Certified Accounting Technician Examination Paper T7 Planning, Control and Performance ManagementDocument9 pagesACCA Certified Accounting Technician Examination Paper T7 Planning, Control and Performance ManagementanonNo ratings yet

- ARTS CPA Review ARTS CPA ReviewDocument28 pagesARTS CPA Review ARTS CPA ReviewAG VenturesNo ratings yet

- 5Document46 pages5Navindra JaggernauthNo ratings yet

- Evaluating Firm Performance - ReportDocument5 pagesEvaluating Firm Performance - ReportJeane Mae BooNo ratings yet

- Contemporary Strategy Analysis Ch2 Study QuestionsDocument3 pagesContemporary Strategy Analysis Ch2 Study QuestionsBeta Acc100% (1)

- Acc 223a CH 5 AnswersDocument13 pagesAcc 223a CH 5 Answersjr centenoNo ratings yet

- Business & Transfer Taxation: Rex B. Banggawan, Cpa, MbaDocument38 pagesBusiness & Transfer Taxation: Rex B. Banggawan, Cpa, Mbajustine reine cornicoNo ratings yet

- Chap12 (Capital Budgeting and Estimating Cash Flows) VanHorne&Brigham, CabreaDocument4 pagesChap12 (Capital Budgeting and Estimating Cash Flows) VanHorne&Brigham, CabreaClaudine DuhapaNo ratings yet

- Taxation 2Document11 pagesTaxation 2MerEl Urbano De GuzmanNo ratings yet

- Fin 018 Problem SolvingDocument7 pagesFin 018 Problem SolvingVincenzo CassanoNo ratings yet

- Cost Accounting Answer Chapter 2 PDFDocument5 pagesCost Accounting Answer Chapter 2 PDFangel cruz0% (1)

- Cost Accounting 2014Document94 pagesCost Accounting 2014Juliet Leron MediloNo ratings yet

- ThatDocument4 pagesThat?????No ratings yet

- ThereforeDocument3 pagesTherefore?????No ratings yet

- I Like Sumireko SanshokuinDocument4 pagesI Like Sumireko Sanshokuin?????No ratings yet

- You 1Document3 pagesYou 1?????No ratings yet

- Different From Cosmos and HimawariDocument4 pagesDifferent From Cosmos and Himawari?????No ratings yet

- If Himawari Comes Then Cosmos Will Be MadDocument4 pagesIf Himawari Comes Then Cosmos Will Be Mad?????No ratings yet

- If You Run AwayDocument3 pagesIf You Run Away?????No ratings yet

- HMMDocument4 pagesHMM?????No ratings yet

- ItDocument3 pagesIt?????No ratings yet

- By The WayDocument3 pagesBy The Way?????No ratings yet

- Because Yesterday Was Such A Big FailureDocument4 pagesBecause Yesterday Was Such A Big Failure?????No ratings yet

- AnywaysDocument3 pagesAnyways?????No ratings yet

- MonsterDocument3 pagesMonster?????No ratings yet

- Munch, Munch. Munch, Munch, Munch, MunchDocument4 pagesMunch, Munch. Munch, Munch, Munch, Munch?????No ratings yet

- Guard DownDocument3 pagesGuard Down?????No ratings yet