Professional Documents

Culture Documents

Presentation List of Student Fep

Presentation List of Student Fep

Uploaded by

Hera Arasu0 ratings0% found this document useful (0 votes)

52 views3 pagesThe document outlines the presentation schedule for the EPPA6524 course. It includes the course contents and presenting student for each of the 7 weeks. Week 1 covers tax administration principles and the Malaysian tax system. Week 2 discusses the history and development of tax administration in Malaysia. Week 3 focuses on the role and achievements of the Malaysian tax authority. Week 4 analyzes the federal budget, tax policies, and Malaysia's economic development. Week 5 examines policies on tax collection versus expenditure. Week 6 evaluates the current tax administration system. Week 7 includes a student presentation on suggestions for the tax administration structure and policies.

Original Description:

Original Title

PRESENTATION LIST OF STUDENT FEP.doc

Copyright

© © All Rights Reserved

Available Formats

DOC, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document outlines the presentation schedule for the EPPA6524 course. It includes the course contents and presenting student for each of the 7 weeks. Week 1 covers tax administration principles and the Malaysian tax system. Week 2 discusses the history and development of tax administration in Malaysia. Week 3 focuses on the role and achievements of the Malaysian tax authority. Week 4 analyzes the federal budget, tax policies, and Malaysia's economic development. Week 5 examines policies on tax collection versus expenditure. Week 6 evaluates the current tax administration system. Week 7 includes a student presentation on suggestions for the tax administration structure and policies.

Copyright:

© All Rights Reserved

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

Download as doc, pdf, or txt

0 ratings0% found this document useful (0 votes)

52 views3 pagesPresentation List of Student Fep

Presentation List of Student Fep

Uploaded by

Hera ArasuThe document outlines the presentation schedule for the EPPA6524 course. It includes the course contents and presenting student for each of the 7 weeks. Week 1 covers tax administration principles and the Malaysian tax system. Week 2 discusses the history and development of tax administration in Malaysia. Week 3 focuses on the role and achievements of the Malaysian tax authority. Week 4 analyzes the federal budget, tax policies, and Malaysia's economic development. Week 5 examines policies on tax collection versus expenditure. Week 6 evaluates the current tax administration system. Week 7 includes a student presentation on suggestions for the tax administration structure and policies.

Copyright:

© All Rights Reserved

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

Download as doc, pdf, or txt

You are on page 1of 3

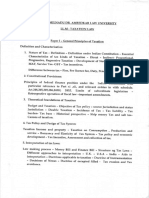

PRESENTATION LIST SCHEDULE – EPPA6524 - FEP

Date of Kandungan Kursus / Course Contents Student

Presenta

tion

Week 1 Prinsip Pentadbiran Cukai Norjihah Mohamad

- Pengenalan sistem cukai di Malaysia Yusof

- Fungsi LHDN dan KDRM

- Pentadbiran cukai langsung dan tidak

langsung

- Asas dan skop pengenaaan cukai

The Principle of Tax Administration

- Introduction to Malaysian tax system

- Function of LHDN and KDRM

- Administration of direct and indirect tax

- Basis and scope of charge

Week 2 Sejarah dan Perkembangan Pentadbiran Cukai di SUHAILIZA MOHD

Malaysia SUMIAR

- Sejarah cukai di Malaysia

- Sistem taksiran Formal

- Sistem taksiran sendiri

- E-filing

- Dividen - Input sistem dan single tier

- Cukai barangan dan perkhidmatan

- Cukai Jualan dan perkhidmatan 1.0 dan

2.0

The History and Development of Tax

Administration in Malaysia

- Tax history in Malaysia

- Formal tax system

- Self-assessment system

- E-filing

- Dividend-inputation system and sigle tier

- Goods and services tax

- Sales tax and services tax 1.0 and 2.0

Week 3 Peranan dan Pencapaian LHDNM sebagai Mohd Zaidilharis

Pentadbir Cukai Mohamad Yusuf

- Peranan utama LHDN

- Tadbir urus LHDN dan kekuatan kaki

tangan

- Jenis-jenis kutipan cukai

- Jumlah kutipan cukai tahunan mengikut

jenis

- Pematuhan cukai dan pendidikan cukai

The Role and Achievement of IRBM as the Tax

Administrator

- Main role of LHDN

- LHDN governance and capasity of staff

- Types of collected taxes

- Collection based on types of taxes

- Tax compliance and education

Week 4 Bajet Federal , Polisi Cukai dan Perkembangan Munawarah

Ekonomi Malaysia Mahran

- Analisis bajet tahunan

- Kesan bajet tahunan kepada sektor

tertentu

- Polisis cukai semasa (levi pelepasan,

Covid-19 insentif cukai)

- Perkembangan ekonomi semasa (laporan

tahunan Bank Negara)

The Federal Budget, Tax Policies and Malaysia

Economic Development

- Yearly baudget analysis

- The effect of yearly budget on certain

industries

- Current tax policy (departure levu, Covid-

19 tax incentives)

- Current economic situation (Bank Negara

annual report)

Week 5 Polisi ke atas Kutipan Cukai vs Perbelanjaan ARYA ZULFIKAR

Cukai AKBAR

- Perlaksanaan kutipan cukai langsung dan

tidak langsung yang efektif

- Kos kutipan cukai

- Denda dan penalti cukai

- Kos pematuhan individu dan syarikat

The Policies on Tax Collection vs Tax Expenditure

- Effective collection on direct and indirect

taxes

- Tax collection cost

- Tax penalties

- Company and individual compliance costs

Week 6 Penilaian ke atas Pentadbiran Cukai Semasa XUE QIYUN

- Cukai individu

- Cukai korporat

- Cukai keuntungan hartanah

- Cukai jualan dan perkhidmatan

The Evaluation on the Current Tax Administration

- Individual tax

- Corporate tax

- Real property gain tax

- Sales and services tax

Week 7 Pembentangan: Cadangan Struktur Pentadbiran FATIN NABILAH

dan Polisi Cukai BINTI NORZIHAD

- Potensi cukai baru seperti cukai alam

sekitar, cukai gula, cukai rokok. NUR ATHIRAH

- Penambah baikan sistem cukai sedia ada BINTI

BADLIHISHAM

Presentation: Suggested Structure of Tax

Administration and Policies

- Potential taxes i.e environment tax, sugar

tax and cigarette tax

- Improvement of current tax systems

You might also like

- Sap Logistics Execution - Transportation ManagementDocument37 pagesSap Logistics Execution - Transportation Managementrajasekeranmad88% (8)

- Banking: What You Should Know About..Document16 pagesBanking: What You Should Know About..Muhammad Fahad AkhterNo ratings yet

- Spectrum News: Enroll in Auto Pay Today!Document2 pagesSpectrum News: Enroll in Auto Pay Today!BrunaJamillyNo ratings yet

- Diploma in Taxation: Pakistan Tax Bar AssociationDocument6 pagesDiploma in Taxation: Pakistan Tax Bar AssociationAbdul wahabNo ratings yet

- Topics On Income TaxationDocument4 pagesTopics On Income TaxationJessa Lopez GarciaNo ratings yet

- Mba Finance and Accounting Outlines For 5 UnitsDocument19 pagesMba Finance and Accounting Outlines For 5 UnitsMWANJE FAHADNo ratings yet

- Atd TaxDocument4 pagesAtd TaxKafonyi JohnNo ratings yet

- Indian Direct of Vat,: PaperDocument8 pagesIndian Direct of Vat,: PaperNikhil KalyanNo ratings yet

- TaxationDocument1 pageTaxationmostafaali123No ratings yet

- Assignment Public Finance and Taxation - 2022-ExtensionDocument3 pagesAssignment Public Finance and Taxation - 2022-ExtensionMesfin YohannesNo ratings yet

- Ch03 - SL Tax Administration - 2024 - UoHDocument24 pagesCh03 - SL Tax Administration - 2024 - UoHMustafe MohamedNo ratings yet

- Taxation PlanDocument2 pagesTaxation PlanNguyễn Anh RuanNo ratings yet

- Taxation CourseDocument170 pagesTaxation CourseNaseef Us SakibNo ratings yet

- Tax SolnDocument315 pagesTax SolnmohedNo ratings yet

- Sep Final ReportDocument14 pagesSep Final ReportDanial ShadNo ratings yet

- Mo1. Tax 100Document2 pagesMo1. Tax 100Marife PangesbanNo ratings yet

- MGT 503 Lec 01Document16 pagesMGT 503 Lec 01bc180202357 BADAR FARIDNo ratings yet

- Public Finance and TaxationDocument315 pagesPublic Finance and TaxationB K100% (1)

- Module 9 Ethical Principles in Business PDFDocument22 pagesModule 9 Ethical Principles in Business PDFRomulo MarquezNo ratings yet

- ICGAB New Tax Syllabus (Sep-19)Document9 pagesICGAB New Tax Syllabus (Sep-19)Aminul HaqNo ratings yet

- PunjabDocument5 pagesPunjabUsaid KhanNo ratings yet

- Navigating The Complexities of Tax LawDocument2 pagesNavigating The Complexities of Tax LawReign Dela CruzNo ratings yet

- PGD in Customs VAT and Income Tax ManagementDocument6 pagesPGD in Customs VAT and Income Tax ManagementMd SujanNo ratings yet

- Public Finance and TaxationDocument317 pagesPublic Finance and TaxationDennisNo ratings yet

- Taxation Management Notes Tax Year 2020Document61 pagesTaxation Management Notes Tax Year 2020Ramsha ZahidNo ratings yet

- Chapter 1. OverviewDocument38 pagesChapter 1. OverviewKhuất Thanh HuếNo ratings yet

- South Sudan Taxation SystemDocument16 pagesSouth Sudan Taxation SystemNoahIssa0% (1)

- Taxation - Updated MaterialDocument125 pagesTaxation - Updated Materialtrishul poovaiahNo ratings yet

- Slide C1-C4Document229 pagesSlide C1-C4Lê Hồng ThuỷNo ratings yet

- Practical Income Tax & VAT Management: WWW - Bim.gov - BDDocument2 pagesPractical Income Tax & VAT Management: WWW - Bim.gov - BDrumon hossain100% (2)

- Public Finance and TaxationDocument314 pagesPublic Finance and TaxationCollins KiprotichNo ratings yet

- Corporate Taxation For Managers 5.12.23Document2 pagesCorporate Taxation For Managers 5.12.23Vani BalajiNo ratings yet

- Final Project of Taxation: Arsalan Haider Afzal Ahmed Shahid Iqbal Amir Shahzad M.TayyabDocument26 pagesFinal Project of Taxation: Arsalan Haider Afzal Ahmed Shahid Iqbal Amir Shahzad M.TayyabGul ShairNo ratings yet

- Why This Training Is ImportantDocument3 pagesWhy This Training Is ImportantAbu NaserNo ratings yet

- Topic 1 IntroductionDocument23 pagesTopic 1 IntroductionBaby KhorNo ratings yet

- Sohail Afridi IRPDocument17 pagesSohail Afridi IRPppsa.trgNo ratings yet

- Malaysian Indirect Tax Administration SyDocument22 pagesMalaysian Indirect Tax Administration SyAnesuishe MasawiNo ratings yet

- Basics of TaxationDocument23 pagesBasics of TaxationZenaida SolomonNo ratings yet

- ACC212 Student Notes 2019Document62 pagesACC212 Student Notes 2019preciousgomorNo ratings yet

- Taxpayer Attitudes Vis-À-Vis The Tax Administration: Differentiate and Classify Taxpayer Behaviors Maria Helena CardozoDocument20 pagesTaxpayer Attitudes Vis-À-Vis The Tax Administration: Differentiate and Classify Taxpayer Behaviors Maria Helena CardozoHosh shNo ratings yet

- In The Name of Allah, The Most Beneficent, The Most MercifulDocument40 pagesIn The Name of Allah, The Most Beneficent, The Most MercifulAmna ShoukatNo ratings yet

- Cours PDF Fiscalite Des Transports Master Prof. (FSJP LF 2020) Nvo Tarif Synthese TransmissionDocument81 pagesCours PDF Fiscalite Des Transports Master Prof. (FSJP LF 2020) Nvo Tarif Synthese Transmissionmbenlock14No ratings yet

- 2006 - TAX101 - Phil Tax System & Income TaxDocument7 pages2006 - TAX101 - Phil Tax System & Income Taxhappiness12340% (1)

- Tax EvasionDocument21 pagesTax EvasionChelsea BorbonNo ratings yet

- Income Tax Procedure PracticeU 12345 RB PDFDocument41 pagesIncome Tax Procedure PracticeU 12345 RB PDFBrindha BabuNo ratings yet

- WK 1 Lecture 1 - Intro M'Sia Taxation and Residence Status Student 53 2033Document27 pagesWK 1 Lecture 1 - Intro M'Sia Taxation and Residence Status Student 53 2033Haananth SubramaniamNo ratings yet

- Lecture 1-Tax Structure of PakistanDocument17 pagesLecture 1-Tax Structure of PakistanUsman Shaukat KhanNo ratings yet

- 1.concepts of Taxation & Tax Structure in PakistanDocument24 pages1.concepts of Taxation & Tax Structure in Pakistanuzma batool93% (14)

- Le SFMDocument30 pagesLe SFMOthman TakiNo ratings yet

- Work Book Paper18Document128 pagesWork Book Paper18vaishnavidixit724No ratings yet

- MPA605 Taxation Course Outline-1Document2 pagesMPA605 Taxation Course Outline-1Aminul Islam Rubel100% (1)

- Corporate Tax Management EDU MBA Summer 2020Document100 pagesCorporate Tax Management EDU MBA Summer 2020Foyez HafizNo ratings yet

- Business Taxation-1Document27 pagesBusiness Taxation-1Pranjal pandeyNo ratings yet

- Intax RevviwrDocument3 pagesIntax Revviwrbshark784No ratings yet

- Brochure PGD Customs VAT Income Tax ManagementDocument5 pagesBrochure PGD Customs VAT Income Tax Managementmd.belal1122No ratings yet

- Dcom308 Dcom502 Indirect Tax LawsDocument260 pagesDcom308 Dcom502 Indirect Tax LawsLopa NayakNo ratings yet

- Tax101 Module 02 - Taxes, Tax Laws and Tax Administration V 1.0Document10 pagesTax101 Module 02 - Taxes, Tax Laws and Tax Administration V 1.0Genevieve AnoreNo ratings yet

- Tax and MSMEs in the Digital Age: Why Do We Need To Pay Taxes And What Are The Benefits For Us As MSME Entrepreneurs And How To Build Regulations That Are Empathetic And Proven To Encourage Tax Revenue In The Informal SectorFrom EverandTax and MSMEs in the Digital Age: Why Do We Need To Pay Taxes And What Are The Benefits For Us As MSME Entrepreneurs And How To Build Regulations That Are Empathetic And Proven To Encourage Tax Revenue In The Informal SectorNo ratings yet

- Tax Savings Strategies for Small Businesses: A Comprehensive Guide For 2024From EverandTax Savings Strategies for Small Businesses: A Comprehensive Guide For 2024No ratings yet

- Tool Kit for Tax Administration Management Information SystemFrom EverandTool Kit for Tax Administration Management Information SystemRating: 1 out of 5 stars1/5 (1)

- Corporate Annual Income Tax ReturnDocument33 pagesCorporate Annual Income Tax ReturnHafiedz SNo ratings yet

- (Sesi 2) Latihan SoalDocument8 pages(Sesi 2) Latihan SoalRhezkyChiaraVeronicaNo ratings yet

- Mobile Payments Are Used by More Than Two Billion People WorldwideDocument2 pagesMobile Payments Are Used by More Than Two Billion People Worldwide67SYBMORE SHUBHAMNo ratings yet

- Application SMS Banking PULLDocument2 pagesApplication SMS Banking PULLNitendra SolankiNo ratings yet

- Fillable Bir Form 1701 2013 Version FillableDocument12 pagesFillable Bir Form 1701 2013 Version FillableCJNo ratings yet

- Parashar LakeDocument17 pagesParashar LakeAyushNo ratings yet

- Domestic: Nitai CH BasakDocument2 pagesDomestic: Nitai CH BasakArighna BasakNo ratings yet

- Taxes in IndiaDocument26 pagesTaxes in IndiaGyaneshwariNo ratings yet

- Tax Ii: Syllabus - Value-Added Tax Atty. Ma. Victoria A. Villaluz I. Nature of The VAT and Underlying LawsDocument12 pagesTax Ii: Syllabus - Value-Added Tax Atty. Ma. Victoria A. Villaluz I. Nature of The VAT and Underlying LawsChaNo ratings yet

- Ap TRMDocument11 pagesAp TRManishokm2992No ratings yet

- Week 3 Tax 2 - Assignment - MIPRANUM, RJAYDocument2 pagesWeek 3 Tax 2 - Assignment - MIPRANUM, RJAYAileen Mifranum IINo ratings yet

- Qaisar Khan: Account StatementDocument1 pageQaisar Khan: Account StatementTHE MoonlightNo ratings yet

- Fee Structure 2022Document3 pagesFee Structure 2022Ealaf AliNo ratings yet

- Cash BookDocument26 pagesCash Booksagiinfo1100% (1)

- Bank Reconciliation Statements 5: This Chapter Covers..Document18 pagesBank Reconciliation Statements 5: This Chapter Covers..amal joy0% (1)

- EBS PresentationDocument24 pagesEBS PresentationJacob PruittNo ratings yet

- Control Risk MatrixDocument7 pagesControl Risk Matrixmuhammad andri lowe100% (1)

- Company Logo & Template: Glorius Dexa Mandaya Unit W702 Tektite Towers Ortigas PasigDocument1 pageCompany Logo & Template: Glorius Dexa Mandaya Unit W702 Tektite Towers Ortigas PasigGrace ArinezNo ratings yet

- Data SheetDocument48 pagesData SheetLost HumeraNo ratings yet

- Accounting CH 4Document26 pagesAccounting CH 4Fam Sin YunNo ratings yet

- Ebill 12 19 2018Document1 pageEbill 12 19 2018Ace MereriaNo ratings yet

- Transactions Download 25-Apr-2024 165608941Document5 pagesTransactions Download 25-Apr-2024 165608941pinkrawpineappleNo ratings yet

- WTS4000 Refund Payoff RM79.45 PDFDocument2 pagesWTS4000 Refund Payoff RM79.45 PDFAmirul FirdausNo ratings yet

- Healthy Apps Us New VarDocument9 pagesHealthy Apps Us New VarJESUS DELGADONo ratings yet

- E-Purse enDocument39 pagesE-Purse enTayran PrashadNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruAadityaa PawarNo ratings yet

- Electronic Ticket Receipt, April 05 For MR JEMUEL LABRADORDocument2 pagesElectronic Ticket Receipt, April 05 For MR JEMUEL LABRADORJemuel LabradorNo ratings yet