Professional Documents

Culture Documents

The Weaknesses of The Companies

The Weaknesses of The Companies

Uploaded by

Liyana FarisyaCopyright:

Available Formats

You might also like

- Managing ExpectationsDocument400 pagesManaging Expectationsswaroopr8100% (10)

- Fin Man Case Problems Financial Ratio AnalysisDocument5 pagesFin Man Case Problems Financial Ratio AnalysisCoreen Andrade50% (2)

- Sears Case AnalysisDocument2 pagesSears Case AnalysisAakash Shaw83% (6)

- Anti-Dilution Calculation (English Version)Document12 pagesAnti-Dilution Calculation (English Version)api-3764496100% (3)

- Problem - PROFORMA BALANCE SHEET WITH CHOICE OF FINANCINGDocument6 pagesProblem - PROFORMA BALANCE SHEET WITH CHOICE OF FINANCINGJohn Richard Bonilla100% (4)

- Market Profile GuideDocument24 pagesMarket Profile GuideMahesh Dulani100% (2)

- Bachelor of Business Management (Hons) Finance: Universiti Teknologi MARA, Melaka City CampusDocument34 pagesBachelor of Business Management (Hons) Finance: Universiti Teknologi MARA, Melaka City CampusPuteri Nina100% (1)

- ADM 3351-Final With SolutionsDocument14 pagesADM 3351-Final With SolutionsGraeme RalphNo ratings yet

- Liabilities With Answer For StudentsDocument29 pagesLiabilities With Answer For StudentsDivine CuasayNo ratings yet

- Finman ProblemDocument16 pagesFinman ProblemKatrizia FauniNo ratings yet

- Manual For Finance QuestionsDocument56 pagesManual For Finance QuestionssamiraZehra85% (13)

- Elc501 - Forum Portfolio (Odl)Document23 pagesElc501 - Forum Portfolio (Odl)Liyana Farisya95% (19)

- SHE ReviewMaterial3 PDFDocument23 pagesSHE ReviewMaterial3 PDFYou're WelcomeNo ratings yet

- PG Auditing Credit Risk ManagementDocument41 pagesPG Auditing Credit Risk ManagementErik100% (5)

- March 2008 CAIA Level II Sample Questions: Chartered Alternative Investment AnalystDocument35 pagesMarch 2008 CAIA Level II Sample Questions: Chartered Alternative Investment AnalystAnubhav Srivastava100% (1)

- Business Finance ComputationsDocument10 pagesBusiness Finance ComputationsacegutierrezNo ratings yet

- CBSE Class 12 Accountancy Accounting Ratios WorksheetDocument3 pagesCBSE Class 12 Accountancy Accounting Ratios WorksheetJenneil CarmichaelNo ratings yet

- MAS311 Financial Management Exercises Financial Statement AnalysisDocument4 pagesMAS311 Financial Management Exercises Financial Statement AnalysisLeanne QuintoNo ratings yet

- Tutorial 3 Ratio Analysis (A)Document9 pagesTutorial 3 Ratio Analysis (A)fooyy8No ratings yet

- PERMALINO - Learning Activity 19. Working Capital ManagementDocument3 pagesPERMALINO - Learning Activity 19. Working Capital ManagementAra Joyce PermalinoNo ratings yet

- ACC117 Project 2Document7 pagesACC117 Project 2Aliamaisara ZahiraNo ratings yet

- Financial Statement AnalysisDocument4 pagesFinancial Statement AnalysisJoy ConsigeneNo ratings yet

- Internal Controls in MicrofinanceDocument10 pagesInternal Controls in Microfinancemugenyi DixonNo ratings yet

- Solution: - A) Gross Profit Net Sales-Cost of Sales 3,000,000-2,000,000Document4 pagesSolution: - A) Gross Profit Net Sales-Cost of Sales 3,000,000-2,000,000Eyasu DestaNo ratings yet

- Advanced Accounting - 2015 (Chapter 17) Multiple Choice Solution (Part I)Document1 pageAdvanced Accounting - 2015 (Chapter 17) Multiple Choice Solution (Part I)John Carlos DoringoNo ratings yet

- Fundamentals of Corporate Finance 6th Edition Christensen Solutions ManualDocument6 pagesFundamentals of Corporate Finance 6th Edition Christensen Solutions ManualJamesOrtegapfcs100% (67)

- MA Assignment IVDocument16 pagesMA Assignment IVJaya BharneNo ratings yet

- ACC 221 - Intermediate Accounting 3 Exit Competency Exam: Additional InformationDocument2 pagesACC 221 - Intermediate Accounting 3 Exit Competency Exam: Additional InformationRyan PedroNo ratings yet

- Mefa ProblemsDocument39 pagesMefa Problemssravan kumarNo ratings yet

- Cost - Vi SemDocument18 pagesCost - Vi SemAR Ananth Rohith BhatNo ratings yet

- Ratio Analysis Numericals Including Reverse RatiosDocument6 pagesRatio Analysis Numericals Including Reverse RatiosFunny ManNo ratings yet

- Solution Maf503 - Jun 2018Document8 pagesSolution Maf503 - Jun 2018anis izzati100% (1)

- Financial Statements: Prepared By: Muhammad AkhtarDocument11 pagesFinancial Statements: Prepared By: Muhammad AkhtarMuhammad akhtarNo ratings yet

- Illustrative Questions: Classic TutorsDocument20 pagesIllustrative Questions: Classic TutorsTbabaNo ratings yet

- B326 MTA Fall 2017-2018 MGLDocument7 pagesB326 MTA Fall 2017-2018 MGLmjlNo ratings yet

- AccountsDocument4 pagesAccountsVencint LaranNo ratings yet

- Chapter 13 (Incomplete)Document22 pagesChapter 13 (Incomplete)Dan ChuaNo ratings yet

- Chapter 9 AssigmentDocument19 pagesChapter 9 AssigmentAriella Dee C. AbaoNo ratings yet

- Financial ManagementDocument18 pagesFinancial ManagementkatrinacruzvizcondeNo ratings yet

- Lecture 1Document12 pagesLecture 1ngyx-ab22No ratings yet

- FAR Activity Feb 19 With AnswersDocument16 pagesFAR Activity Feb 19 With AnswersCybill AiraNo ratings yet

- By Team: Wisdom Makers Submit To: Prof. Kirit ChauhanDocument19 pagesBy Team: Wisdom Makers Submit To: Prof. Kirit ChauhanTushar JethavaNo ratings yet

- Consolidation/Group Accounts: Example 18: Disposal of SubsidiaryDocument4 pagesConsolidation/Group Accounts: Example 18: Disposal of SubsidiaryMuhammad Sarfraz AsmatNo ratings yet

- Solving - Business Finance 1-6Document28 pagesSolving - Business Finance 1-6Samson, Ma. Louise Ren A.No ratings yet

- Income Statement 10.7 SolutionsDocument4 pagesIncome Statement 10.7 SolutionsHarry ChaoNo ratings yet

- Answer On AccountingDocument6 pagesAnswer On AccountingShahid MahmudNo ratings yet

- Mint Company SFP PDFDocument3 pagesMint Company SFP PDFRengeline LucasNo ratings yet

- Mba ZC415 Ec-3r First Sem 2022-2023Document4 pagesMba ZC415 Ec-3r First Sem 2022-2023Ravi KaviNo ratings yet

- Unit - II Module IIIDocument7 pagesUnit - II Module IIIpltNo ratings yet

- Role Play 20204 - Fin242Document2 pagesRole Play 20204 - Fin242Muhd Arreif Mohd AzzarainNo ratings yet

- Ratio Analysis ActivityDocument3 pagesRatio Analysis ActivityKarlla ManalastasNo ratings yet

- Bodie10ce SM CH19Document12 pagesBodie10ce SM CH19beadand1No ratings yet

- Graduate School: AnswerDocument3 pagesGraduate School: AnswerIan Mark Loreto RemanesNo ratings yet

- Alkaline Comp. Multi Step QuestionDocument2 pagesAlkaline Comp. Multi Step QuestionhotfujNo ratings yet

- Ice NineDocument4 pagesIce NinePolene GomezNo ratings yet

- Working Notes Profit and Loss Adjustment AccountDocument11 pagesWorking Notes Profit and Loss Adjustment Accountkvrajan6No ratings yet

- Statement of Comprehensive IncomeDocument4 pagesStatement of Comprehensive Incomebobo tangaNo ratings yet

- M4 Prac Exer. 2Document10 pagesM4 Prac Exer. 2Jasmine ActaNo ratings yet

- To Give The Shareholders / Investors The Return of Their Investments DividendsDocument8 pagesTo Give The Shareholders / Investors The Return of Their Investments DividendsDeryl GalveNo ratings yet

- Final Exam Solution Corporation AccountingDocument16 pagesFinal Exam Solution Corporation AccountingAbigail ConstantinoNo ratings yet

- Prelim Exam Part 2 SolutionsDocument4 pagesPrelim Exam Part 2 SolutionseaeNo ratings yet

- Ratio Analysis: Categories of RatiosDocument7 pagesRatio Analysis: Categories of RatiosAhmad vlogsNo ratings yet

- Receivable Management (Divya Jadi Booti)Document24 pagesReceivable Management (Divya Jadi Booti)Michael AdhikariNo ratings yet

- 04 Edu91 FM Practice Sheets FM Solution (Not To Print)Document154 pages04 Edu91 FM Practice Sheets FM Solution (Not To Print)Krutarth VyasNo ratings yet

- Trial Balance Adjustments Profit or Loss Financial Position Account Title Debit Credit Debit Credit Debit Credit Debit CreditDocument2 pagesTrial Balance Adjustments Profit or Loss Financial Position Account Title Debit Credit Debit Credit Debit Credit Debit CreditMichelle BabaNo ratings yet

- Ratio Analysis Solved ProblemsDocument34 pagesRatio Analysis Solved ProblemsHaroon KhanNo ratings yet

- Financial Analysis TestsDocument25 pagesFinancial Analysis Teststheodor_munteanuNo ratings yet

- Broker to Broker: Management Lessons From America's Most Successful Real Estate CompaniesFrom EverandBroker to Broker: Management Lessons From America's Most Successful Real Estate CompaniesNo ratings yet

- COVID19 - SOW - ADM501 - Mar-Jul 2020Document15 pagesCOVID19 - SOW - ADM501 - Mar-Jul 2020Liyana FarisyaNo ratings yet

- Types of Supporting DetailsDocument1 pageTypes of Supporting DetailsLiyana FarisyaNo ratings yet

- Objektif & Reference CTUDocument2 pagesObjektif & Reference CTULiyana FarisyaNo ratings yet

- Article Review Ent530Document49 pagesArticle Review Ent530Liyana FarisyaNo ratings yet

- Project 2 - Social Media Portfolio (FB)Document17 pagesProject 2 - Social Media Portfolio (FB)Liyana FarisyaNo ratings yet

- ARTICLE REVIEW ENT530 (Baru 2) PDFDocument11 pagesARTICLE REVIEW ENT530 (Baru 2) PDFLiyana FarisyaNo ratings yet

- Assignment (Stages of Financing)Document2 pagesAssignment (Stages of Financing)Liyana FarisyaNo ratings yet

- Written Article Analysis: Giving Lao'S Girls A Better FutureDocument3 pagesWritten Article Analysis: Giving Lao'S Girls A Better FutureLiyana FarisyaNo ratings yet

- Inductive and Deductive ReasoningDocument1 pageInductive and Deductive ReasoningLiyana FarisyaNo ratings yet

- Xii Mcqs CH - 9 Issue of SharesDocument7 pagesXii Mcqs CH - 9 Issue of SharesJoanna Garcia100% (1)

- Lecture 1 - Structured ProductDocument39 pagesLecture 1 - Structured ProductruoyuanquanNo ratings yet

- Banking & Insurance ManagementDocument2 pagesBanking & Insurance ManagementVishal Mandowara100% (1)

- HSBC Asian Local Bond Index (ALBI)Document17 pagesHSBC Asian Local Bond Index (ALBI)Areeys SyaheeraNo ratings yet

- 巴倫週刊 (Barrons) 2022 11 28Document78 pages巴倫週刊 (Barrons) 2022 11 28YuenNo ratings yet

- MCM Tutorial 2Document3 pagesMCM Tutorial 2SHU WAN TEHNo ratings yet

- Vivek Sir-SegriDocument4 pagesVivek Sir-Segrivivek sharmaNo ratings yet

- Accenture ProfileDocument2 pagesAccenture ProfiledianneNo ratings yet

- Portfolio Management and Security AnalysisDocument42 pagesPortfolio Management and Security AnalysisMarciano OmbeNo ratings yet

- Ratio Analysis of Heidelberg Cement BangladeshDocument15 pagesRatio Analysis of Heidelberg Cement BangladeshMehedi Hasan DurjoyNo ratings yet

- CH 11 - International Finance - NurhaiyyuDocument62 pagesCH 11 - International Finance - NurhaiyyukkNo ratings yet

- Hedge Fund Guru Suffers Wipeout: PreguntasDocument3 pagesHedge Fund Guru Suffers Wipeout: PreguntasClaudia Villanueva Peña100% (1)

- 1.mandakini Garg PDFDocument4 pages1.mandakini Garg PDFDeeplakhan BhanguNo ratings yet

- Stocks E Book PDFDocument38 pagesStocks E Book PDFdexter0% (1)

- Right IssueDocument14 pagesRight IssueayushiNo ratings yet

- EquityDocument126 pagesEquityChristopherNo ratings yet

- Money, Its Functions and Characteristics: Origin of The Word "MONEY"Document4 pagesMoney, Its Functions and Characteristics: Origin of The Word "MONEY"rosalyn mauricioNo ratings yet

- Chapter 7 B-EconDocument14 pagesChapter 7 B-EconCathy Tapinit43% (7)

- A Study On Portfolio Management at Angel Broking LTDDocument3 pagesA Study On Portfolio Management at Angel Broking LTDEditor IJTSRDNo ratings yet

- RMIB AssignmentDocument2 pagesRMIB AssignmentKhalid Mishczsuski LimuNo ratings yet

- Far 1 Notes Chapter 4Document66 pagesFar 1 Notes Chapter 4Nagaeshwary MuruganNo ratings yet

- Sapm SyllabusDocument5 pagesSapm Syllabusvandana_daki3941No ratings yet

The Weaknesses of The Companies

The Weaknesses of The Companies

Uploaded by

Liyana FarisyaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

The Weaknesses of The Companies

The Weaknesses of The Companies

Uploaded by

Liyana FarisyaCopyright:

Available Formats

The weaknesses of the companies:

i. Liquidity problem:

Yes Drink’s current assets are highly comprised of huge amount of inventories which

need some time to be converted into cash. Thus, company is facing liquidity problem

to settle the current obligation with the current assets because the company has

RM0.59 liquid assets to pay its RM1 short-term liabilities. This ratio also lowers as

compared to the other competitors in the same industry which have enough liquid

assets (RM2.00) to pay current obligation.

ii. Efficiency problem:

Yes Drink Bhd also is facing efficiency problem in handling the stock. This indicates

that the company replaced it stock 1.5 times per annum as compared to its

competitors who replaced their stocks 3 times per annum. This low inventory

turnover indicates that low demand for the goods or company was making poor

sales. This could be due to poor marketing strategy implemented by the company to

promote their products.

In addition, Yes Drink Bhd also is facing efficiency problem in collecting their debts

from customers. The company needs 36 days to collect money from customers

which is considered late as its competitors requires only 15 days to collect their

debts. This indicates that company does not properly monitor its debtor aging

schedule or the company has loose credit policy.

iii. Profitability problem:

Yes Drink Bhd also is facing profitability problem. The company gets RM0.07 net

profit for every RM1 sales made. This extremely lower as compared to other

competitors which managed to get 15% net profits for every RM1 sales made. This

could be due to operating expenses is too high .

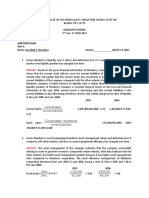

YES DRINK Industry

BHD average

i. Current ratio Current assets 393,500

Current liabilities 72,900

= 5.40:1.0 3.00 : 1.0

ii. Quick ratio CA – inventory – 393,500-350,200-

prepaid expenses 500

Current liabilities 72,900

= 0.59:1.0 2.00 : 1.0

iii. Inventory COGS 350,120

turnover Average stock [350,200

+120,000]/2

1.49 3 times

iv. Account A/C receivable 40,500

receivable collection Annual credit sales/360 400,280 X 360

period =36 days 15 days

v. Total assets Sales 500,350

turnover Total assets 451,900

1.11 2.00x

vi. Debt to equity Total debts 110,900

ratio Total equity x 100 230,000 x 100

48% 35%

vii. Time Interest EBIT 49,430

earned Interest expenses 2,450

= 20 times 10 times

viii. Net profit margin Net profit 35,235

Sales x 100 500,350 x 100

7% 15%

viii. Gross profit Gross Profit 150,230

margin Sales x 100 500,350 x 100

30% 30%

You might also like

- Managing ExpectationsDocument400 pagesManaging Expectationsswaroopr8100% (10)

- Fin Man Case Problems Financial Ratio AnalysisDocument5 pagesFin Man Case Problems Financial Ratio AnalysisCoreen Andrade50% (2)

- Sears Case AnalysisDocument2 pagesSears Case AnalysisAakash Shaw83% (6)

- Anti-Dilution Calculation (English Version)Document12 pagesAnti-Dilution Calculation (English Version)api-3764496100% (3)

- Problem - PROFORMA BALANCE SHEET WITH CHOICE OF FINANCINGDocument6 pagesProblem - PROFORMA BALANCE SHEET WITH CHOICE OF FINANCINGJohn Richard Bonilla100% (4)

- Market Profile GuideDocument24 pagesMarket Profile GuideMahesh Dulani100% (2)

- Bachelor of Business Management (Hons) Finance: Universiti Teknologi MARA, Melaka City CampusDocument34 pagesBachelor of Business Management (Hons) Finance: Universiti Teknologi MARA, Melaka City CampusPuteri Nina100% (1)

- ADM 3351-Final With SolutionsDocument14 pagesADM 3351-Final With SolutionsGraeme RalphNo ratings yet

- Liabilities With Answer For StudentsDocument29 pagesLiabilities With Answer For StudentsDivine CuasayNo ratings yet

- Finman ProblemDocument16 pagesFinman ProblemKatrizia FauniNo ratings yet

- Manual For Finance QuestionsDocument56 pagesManual For Finance QuestionssamiraZehra85% (13)

- Elc501 - Forum Portfolio (Odl)Document23 pagesElc501 - Forum Portfolio (Odl)Liyana Farisya95% (19)

- SHE ReviewMaterial3 PDFDocument23 pagesSHE ReviewMaterial3 PDFYou're WelcomeNo ratings yet

- PG Auditing Credit Risk ManagementDocument41 pagesPG Auditing Credit Risk ManagementErik100% (5)

- March 2008 CAIA Level II Sample Questions: Chartered Alternative Investment AnalystDocument35 pagesMarch 2008 CAIA Level II Sample Questions: Chartered Alternative Investment AnalystAnubhav Srivastava100% (1)

- Business Finance ComputationsDocument10 pagesBusiness Finance ComputationsacegutierrezNo ratings yet

- CBSE Class 12 Accountancy Accounting Ratios WorksheetDocument3 pagesCBSE Class 12 Accountancy Accounting Ratios WorksheetJenneil CarmichaelNo ratings yet

- MAS311 Financial Management Exercises Financial Statement AnalysisDocument4 pagesMAS311 Financial Management Exercises Financial Statement AnalysisLeanne QuintoNo ratings yet

- Tutorial 3 Ratio Analysis (A)Document9 pagesTutorial 3 Ratio Analysis (A)fooyy8No ratings yet

- PERMALINO - Learning Activity 19. Working Capital ManagementDocument3 pagesPERMALINO - Learning Activity 19. Working Capital ManagementAra Joyce PermalinoNo ratings yet

- ACC117 Project 2Document7 pagesACC117 Project 2Aliamaisara ZahiraNo ratings yet

- Financial Statement AnalysisDocument4 pagesFinancial Statement AnalysisJoy ConsigeneNo ratings yet

- Internal Controls in MicrofinanceDocument10 pagesInternal Controls in Microfinancemugenyi DixonNo ratings yet

- Solution: - A) Gross Profit Net Sales-Cost of Sales 3,000,000-2,000,000Document4 pagesSolution: - A) Gross Profit Net Sales-Cost of Sales 3,000,000-2,000,000Eyasu DestaNo ratings yet

- Advanced Accounting - 2015 (Chapter 17) Multiple Choice Solution (Part I)Document1 pageAdvanced Accounting - 2015 (Chapter 17) Multiple Choice Solution (Part I)John Carlos DoringoNo ratings yet

- Fundamentals of Corporate Finance 6th Edition Christensen Solutions ManualDocument6 pagesFundamentals of Corporate Finance 6th Edition Christensen Solutions ManualJamesOrtegapfcs100% (67)

- MA Assignment IVDocument16 pagesMA Assignment IVJaya BharneNo ratings yet

- ACC 221 - Intermediate Accounting 3 Exit Competency Exam: Additional InformationDocument2 pagesACC 221 - Intermediate Accounting 3 Exit Competency Exam: Additional InformationRyan PedroNo ratings yet

- Mefa ProblemsDocument39 pagesMefa Problemssravan kumarNo ratings yet

- Cost - Vi SemDocument18 pagesCost - Vi SemAR Ananth Rohith BhatNo ratings yet

- Ratio Analysis Numericals Including Reverse RatiosDocument6 pagesRatio Analysis Numericals Including Reverse RatiosFunny ManNo ratings yet

- Solution Maf503 - Jun 2018Document8 pagesSolution Maf503 - Jun 2018anis izzati100% (1)

- Financial Statements: Prepared By: Muhammad AkhtarDocument11 pagesFinancial Statements: Prepared By: Muhammad AkhtarMuhammad akhtarNo ratings yet

- Illustrative Questions: Classic TutorsDocument20 pagesIllustrative Questions: Classic TutorsTbabaNo ratings yet

- B326 MTA Fall 2017-2018 MGLDocument7 pagesB326 MTA Fall 2017-2018 MGLmjlNo ratings yet

- AccountsDocument4 pagesAccountsVencint LaranNo ratings yet

- Chapter 13 (Incomplete)Document22 pagesChapter 13 (Incomplete)Dan ChuaNo ratings yet

- Chapter 9 AssigmentDocument19 pagesChapter 9 AssigmentAriella Dee C. AbaoNo ratings yet

- Financial ManagementDocument18 pagesFinancial ManagementkatrinacruzvizcondeNo ratings yet

- Lecture 1Document12 pagesLecture 1ngyx-ab22No ratings yet

- FAR Activity Feb 19 With AnswersDocument16 pagesFAR Activity Feb 19 With AnswersCybill AiraNo ratings yet

- By Team: Wisdom Makers Submit To: Prof. Kirit ChauhanDocument19 pagesBy Team: Wisdom Makers Submit To: Prof. Kirit ChauhanTushar JethavaNo ratings yet

- Consolidation/Group Accounts: Example 18: Disposal of SubsidiaryDocument4 pagesConsolidation/Group Accounts: Example 18: Disposal of SubsidiaryMuhammad Sarfraz AsmatNo ratings yet

- Solving - Business Finance 1-6Document28 pagesSolving - Business Finance 1-6Samson, Ma. Louise Ren A.No ratings yet

- Income Statement 10.7 SolutionsDocument4 pagesIncome Statement 10.7 SolutionsHarry ChaoNo ratings yet

- Answer On AccountingDocument6 pagesAnswer On AccountingShahid MahmudNo ratings yet

- Mint Company SFP PDFDocument3 pagesMint Company SFP PDFRengeline LucasNo ratings yet

- Mba ZC415 Ec-3r First Sem 2022-2023Document4 pagesMba ZC415 Ec-3r First Sem 2022-2023Ravi KaviNo ratings yet

- Unit - II Module IIIDocument7 pagesUnit - II Module IIIpltNo ratings yet

- Role Play 20204 - Fin242Document2 pagesRole Play 20204 - Fin242Muhd Arreif Mohd AzzarainNo ratings yet

- Ratio Analysis ActivityDocument3 pagesRatio Analysis ActivityKarlla ManalastasNo ratings yet

- Bodie10ce SM CH19Document12 pagesBodie10ce SM CH19beadand1No ratings yet

- Graduate School: AnswerDocument3 pagesGraduate School: AnswerIan Mark Loreto RemanesNo ratings yet

- Alkaline Comp. Multi Step QuestionDocument2 pagesAlkaline Comp. Multi Step QuestionhotfujNo ratings yet

- Ice NineDocument4 pagesIce NinePolene GomezNo ratings yet

- Working Notes Profit and Loss Adjustment AccountDocument11 pagesWorking Notes Profit and Loss Adjustment Accountkvrajan6No ratings yet

- Statement of Comprehensive IncomeDocument4 pagesStatement of Comprehensive Incomebobo tangaNo ratings yet

- M4 Prac Exer. 2Document10 pagesM4 Prac Exer. 2Jasmine ActaNo ratings yet

- To Give The Shareholders / Investors The Return of Their Investments DividendsDocument8 pagesTo Give The Shareholders / Investors The Return of Their Investments DividendsDeryl GalveNo ratings yet

- Final Exam Solution Corporation AccountingDocument16 pagesFinal Exam Solution Corporation AccountingAbigail ConstantinoNo ratings yet

- Prelim Exam Part 2 SolutionsDocument4 pagesPrelim Exam Part 2 SolutionseaeNo ratings yet

- Ratio Analysis: Categories of RatiosDocument7 pagesRatio Analysis: Categories of RatiosAhmad vlogsNo ratings yet

- Receivable Management (Divya Jadi Booti)Document24 pagesReceivable Management (Divya Jadi Booti)Michael AdhikariNo ratings yet

- 04 Edu91 FM Practice Sheets FM Solution (Not To Print)Document154 pages04 Edu91 FM Practice Sheets FM Solution (Not To Print)Krutarth VyasNo ratings yet

- Trial Balance Adjustments Profit or Loss Financial Position Account Title Debit Credit Debit Credit Debit Credit Debit CreditDocument2 pagesTrial Balance Adjustments Profit or Loss Financial Position Account Title Debit Credit Debit Credit Debit Credit Debit CreditMichelle BabaNo ratings yet

- Ratio Analysis Solved ProblemsDocument34 pagesRatio Analysis Solved ProblemsHaroon KhanNo ratings yet

- Financial Analysis TestsDocument25 pagesFinancial Analysis Teststheodor_munteanuNo ratings yet

- Broker to Broker: Management Lessons From America's Most Successful Real Estate CompaniesFrom EverandBroker to Broker: Management Lessons From America's Most Successful Real Estate CompaniesNo ratings yet

- COVID19 - SOW - ADM501 - Mar-Jul 2020Document15 pagesCOVID19 - SOW - ADM501 - Mar-Jul 2020Liyana FarisyaNo ratings yet

- Types of Supporting DetailsDocument1 pageTypes of Supporting DetailsLiyana FarisyaNo ratings yet

- Objektif & Reference CTUDocument2 pagesObjektif & Reference CTULiyana FarisyaNo ratings yet

- Article Review Ent530Document49 pagesArticle Review Ent530Liyana FarisyaNo ratings yet

- Project 2 - Social Media Portfolio (FB)Document17 pagesProject 2 - Social Media Portfolio (FB)Liyana FarisyaNo ratings yet

- ARTICLE REVIEW ENT530 (Baru 2) PDFDocument11 pagesARTICLE REVIEW ENT530 (Baru 2) PDFLiyana FarisyaNo ratings yet

- Assignment (Stages of Financing)Document2 pagesAssignment (Stages of Financing)Liyana FarisyaNo ratings yet

- Written Article Analysis: Giving Lao'S Girls A Better FutureDocument3 pagesWritten Article Analysis: Giving Lao'S Girls A Better FutureLiyana FarisyaNo ratings yet

- Inductive and Deductive ReasoningDocument1 pageInductive and Deductive ReasoningLiyana FarisyaNo ratings yet

- Xii Mcqs CH - 9 Issue of SharesDocument7 pagesXii Mcqs CH - 9 Issue of SharesJoanna Garcia100% (1)

- Lecture 1 - Structured ProductDocument39 pagesLecture 1 - Structured ProductruoyuanquanNo ratings yet

- Banking & Insurance ManagementDocument2 pagesBanking & Insurance ManagementVishal Mandowara100% (1)

- HSBC Asian Local Bond Index (ALBI)Document17 pagesHSBC Asian Local Bond Index (ALBI)Areeys SyaheeraNo ratings yet

- 巴倫週刊 (Barrons) 2022 11 28Document78 pages巴倫週刊 (Barrons) 2022 11 28YuenNo ratings yet

- MCM Tutorial 2Document3 pagesMCM Tutorial 2SHU WAN TEHNo ratings yet

- Vivek Sir-SegriDocument4 pagesVivek Sir-Segrivivek sharmaNo ratings yet

- Accenture ProfileDocument2 pagesAccenture ProfiledianneNo ratings yet

- Portfolio Management and Security AnalysisDocument42 pagesPortfolio Management and Security AnalysisMarciano OmbeNo ratings yet

- Ratio Analysis of Heidelberg Cement BangladeshDocument15 pagesRatio Analysis of Heidelberg Cement BangladeshMehedi Hasan DurjoyNo ratings yet

- CH 11 - International Finance - NurhaiyyuDocument62 pagesCH 11 - International Finance - NurhaiyyukkNo ratings yet

- Hedge Fund Guru Suffers Wipeout: PreguntasDocument3 pagesHedge Fund Guru Suffers Wipeout: PreguntasClaudia Villanueva Peña100% (1)

- 1.mandakini Garg PDFDocument4 pages1.mandakini Garg PDFDeeplakhan BhanguNo ratings yet

- Stocks E Book PDFDocument38 pagesStocks E Book PDFdexter0% (1)

- Right IssueDocument14 pagesRight IssueayushiNo ratings yet

- EquityDocument126 pagesEquityChristopherNo ratings yet

- Money, Its Functions and Characteristics: Origin of The Word "MONEY"Document4 pagesMoney, Its Functions and Characteristics: Origin of The Word "MONEY"rosalyn mauricioNo ratings yet

- Chapter 7 B-EconDocument14 pagesChapter 7 B-EconCathy Tapinit43% (7)

- A Study On Portfolio Management at Angel Broking LTDDocument3 pagesA Study On Portfolio Management at Angel Broking LTDEditor IJTSRDNo ratings yet

- RMIB AssignmentDocument2 pagesRMIB AssignmentKhalid Mishczsuski LimuNo ratings yet

- Far 1 Notes Chapter 4Document66 pagesFar 1 Notes Chapter 4Nagaeshwary MuruganNo ratings yet

- Sapm SyllabusDocument5 pagesSapm Syllabusvandana_daki3941No ratings yet