Professional Documents

Culture Documents

Cheat Sheet BVPS: Lower Rate

Cheat Sheet BVPS: Lower Rate

Uploaded by

JaneCopyright:

Available Formats

You might also like

- Understanding Financial Statements (Review and Analysis of Straub's Book)From EverandUnderstanding Financial Statements (Review and Analysis of Straub's Book)Rating: 5 out of 5 stars5/5 (5)

- Earnings Per Share PDFDocument56 pagesEarnings Per Share PDFYuan ZhongNo ratings yet

- Cheat Sheet Earnings Per ShareDocument2 pagesCheat Sheet Earnings Per ShareJaneNo ratings yet

- Intermediate Accounting Volume 2 7th Edition Beechy Solutions ManualDocument10 pagesIntermediate Accounting Volume 2 7th Edition Beechy Solutions Manualconatusimploded.bi6q100% (24)

- Traditional Models of Financial Statements AnalysisDocument4 pagesTraditional Models of Financial Statements AnalysisMary LeeNo ratings yet

- 002 MAS FS Analysis Rev00 PDFDocument5 pages002 MAS FS Analysis Rev00 PDFCyvee Joy Hongayo OcheaNo ratings yet

- Lecture Notes - IAS 33 (Basic EPS)Document2 pagesLecture Notes - IAS 33 (Basic EPS)Mazhar AzizNo ratings yet

- Bvps and EpsDocument30 pagesBvps and EpsRenzo Melliza100% (1)

- Bhupendra Imrt B School Lucknow Difference Between Eps N DpsDocument15 pagesBhupendra Imrt B School Lucknow Difference Between Eps N Dpsbhupendra pt singhNo ratings yet

- Basic Earnings Per Share: Eps Net Income Preferred Dividends) End of Period Shares OutstandingDocument4 pagesBasic Earnings Per Share: Eps Net Income Preferred Dividends) End of Period Shares OutstandingSamsung AccountNo ratings yet

- Basic Earnings Per Share: Eps Net Income Preferred Dividends) End of Period Shares OutstandingDocument4 pagesBasic Earnings Per Share: Eps Net Income Preferred Dividends) End of Period Shares OutstandingLoudie Ann MarcosNo ratings yet

- Basic Earnings Per ShareDocument2 pagesBasic Earnings Per SharePaula De RuedaNo ratings yet

- PAS 33 - Earnings Per ShareDocument17 pagesPAS 33 - Earnings Per ShareKrizzia DizonNo ratings yet

- UGBA 120AB Chapter 19 PART 2 Spring 2020 Without SolutionsDocument53 pagesUGBA 120AB Chapter 19 PART 2 Spring 2020 Without Solutionsyadi lauNo ratings yet

- FAR-Book-value-and-Earnings-per-Share Lecture & MC FINALDocument8 pagesFAR-Book-value-and-Earnings-per-Share Lecture & MC FINALOlive Grace CaniedoNo ratings yet

- Ratio Formula'S Sheet For Financial Reporting Analysis ProjectDocument5 pagesRatio Formula'S Sheet For Financial Reporting Analysis ProjectHoney SheikhNo ratings yet

- Earnings Per ShareDocument5 pagesEarnings Per ShareAlexandra TagleNo ratings yet

- Pas 33Document2 pagesPas 33elle friasNo ratings yet

- Act06 Lfta222n001 Capistrano, JoanaDocument1 pageAct06 Lfta222n001 Capistrano, JoanaJoana loize CapistranoNo ratings yet

- Ratio Formalas PDFDocument4 pagesRatio Formalas PDFKinza AsimNo ratings yet

- LP Earnings Per Share For EnhancementDocument9 pagesLP Earnings Per Share For EnhancementJULIA CHRIS ROMERONo ratings yet

- Full Note On IND As 33Document7 pagesFull Note On IND As 33bachchanbarman389No ratings yet

- Basic Earnings Per ShareDocument18 pagesBasic Earnings Per ShareNatalie Irish VillanuevaNo ratings yet

- Pas 33Document3 pagesPas 33Ley Anne PaleNo ratings yet

- Earnings Per ShareDocument10 pagesEarnings Per ShareStacy SmithNo ratings yet

- Book Value Per Share and Earnings Per Share Book Value Per ShareDocument23 pagesBook Value Per Share and Earnings Per Share Book Value Per Share132345usdfghjNo ratings yet

- Book Value Per Share: Learning CompetenciesDocument24 pagesBook Value Per Share: Learning CompetenciesRaezel Carla Santos FontanillaNo ratings yet

- ACCT3103 ppt5Document73 pagesACCT3103 ppt5Nicholas LeeNo ratings yet

- PPT-5 Corporate Actions - Dividends, Bonus, Splits, Etc_ (1)Document16 pagesPPT-5 Corporate Actions - Dividends, Bonus, Splits, Etc_ (1)glacticematricsNo ratings yet

- Afar Ferrer PDFDocument48 pagesAfar Ferrer PDFJun Kenny PagaNo ratings yet

- Corporate Actions - Dividends, Bonus, Splits, Buyback EtcDocument37 pagesCorporate Actions - Dividends, Bonus, Splits, Buyback Etcagrawal.minNo ratings yet

- Pas 33 Earnings Per Share: I. NatureDocument3 pagesPas 33 Earnings Per Share: I. NatureR.A.No ratings yet

- IAS 33 Earnings Per ShareDocument5 pagesIAS 33 Earnings Per ShareCatalin BlesnocNo ratings yet

- Acc2 ReviewerDocument4 pagesAcc2 ReviewerJian AlberioNo ratings yet

- Financial Ratios - Basic Earnings Per Share: Bonds Fixed IncomeDocument1 pageFinancial Ratios - Basic Earnings Per Share: Bonds Fixed IncomeBhaskar MukherjeeNo ratings yet

- Rights Issue (Stock Right or Preemptive Right) : Right To Purchase Ordinary SharesDocument2 pagesRights Issue (Stock Right or Preemptive Right) : Right To Purchase Ordinary SharesVincent Jake NaputoNo ratings yet

- Book Value Per ShareDocument2 pagesBook Value Per SharePaula De RuedaNo ratings yet

- Statement of Comprehensive Income (CA5106)Document10 pagesStatement of Comprehensive Income (CA5106)rhbqztqbzyNo ratings yet

- Basic EPS Diluted EPS: Basic EPS Net Income Preferred Dividends Weighted Average of Ordinary SharesDocument3 pagesBasic EPS Diluted EPS: Basic EPS Net Income Preferred Dividends Weighted Average of Ordinary SharesRenz AlconeraNo ratings yet

- 04-01 - Financial Analysis (Dragged) 27Document3 pages04-01 - Financial Analysis (Dragged) 27Salsabila AufaNo ratings yet

- Earnings Per ShareDocument12 pagesEarnings Per ShareKim EllaNo ratings yet

- AAFR Notes IAS 33Document17 pagesAAFR Notes IAS 33WaqasNo ratings yet

- As-20 Earning Per ShareDocument17 pagesAs-20 Earning Per ShareRahul SinghNo ratings yet

- 06-Earnings-Per-Share Practice Problems Faisal & CODocument10 pages06-Earnings-Per-Share Practice Problems Faisal & COsyed asim shahNo ratings yet

- ACCA110-Financial Statement Analysis and RatioDocument7 pagesACCA110-Financial Statement Analysis and RatioJhovet Christian M. CariÑoNo ratings yet

- Module 9 Stocks Bonds Mutual FundsDocument7 pagesModule 9 Stocks Bonds Mutual FundsKristine MartinezNo ratings yet

- PPT-5 Corporate Action-Dividends, Bonus, Splits EtcDocument16 pagesPPT-5 Corporate Action-Dividends, Bonus, Splits EtcAmrita GhartiNo ratings yet

- IAS 33 - NotesDocument17 pagesIAS 33 - NotesJyNo ratings yet

- Book Value and Earnings Per ShareDocument6 pagesBook Value and Earnings Per ShareLui67% (3)

- IAS 33 Earnings Per Share: (Conceptual Framework and Standards)Document8 pagesIAS 33 Earnings Per Share: (Conceptual Framework and Standards)Joyce ManaloNo ratings yet

- Du Pont Chart: Multiplied byDocument9 pagesDu Pont Chart: Multiplied bymedhaNo ratings yet

- Corporation Transactions After FormationDocument14 pagesCorporation Transactions After FormationYanela YishaNo ratings yet

- Analysis For The Investor: Chapter # 10Document17 pagesAnalysis For The Investor: Chapter # 10fahad BataviaNo ratings yet

- Analysis For The Investor: Chapter # 10Document17 pagesAnalysis For The Investor: Chapter # 10Fahad BataviaNo ratings yet

- Chapter 20Document14 pagesChapter 20negalamadnNo ratings yet

- Ratio Analysis DuPont AnalysisDocument7 pagesRatio Analysis DuPont Analysisshiv0308No ratings yet

- AS 20 Earnings Per ShareDocument14 pagesAS 20 Earnings Per Sharefar_07No ratings yet

- MMW Module 9Document3 pagesMMW Module 9Kristine MartinezNo ratings yet

- Share Based Compensation Cheat SheetDocument2 pagesShare Based Compensation Cheat SheetJaneNo ratings yet

- Intermediate Accounting 3 Reflection Paper: "Going Concern"Document1 pageIntermediate Accounting 3 Reflection Paper: "Going Concern"JaneNo ratings yet

- Cheat Sheet Earnings Per ShareDocument2 pagesCheat Sheet Earnings Per ShareJaneNo ratings yet

- Intermediate Accounting 3 Reflection Paper: "Change"Document1 pageIntermediate Accounting 3 Reflection Paper: "Change"JaneNo ratings yet

- Intermediate Accounting 3 Reflection PaperDocument1 pageIntermediate Accounting 3 Reflection PaperJaneNo ratings yet

- Prior Period Error Effect in The Current Period AdjustmentDocument2 pagesPrior Period Error Effect in The Current Period AdjustmentJaneNo ratings yet

- Intermediate Accounting 3 Reflection Paper: "Matching and Recognition"Document1 pageIntermediate Accounting 3 Reflection Paper: "Matching and Recognition"JaneNo ratings yet

- Activity On Religion DiscussionDocument2 pagesActivity On Religion DiscussionJaneNo ratings yet

- Buddhism: Submitted byDocument3 pagesBuddhism: Submitted byJaneNo ratings yet

- PPSA SummaryDocument18 pagesPPSA SummaryJane100% (1)

Cheat Sheet BVPS: Lower Rate

Cheat Sheet BVPS: Lower Rate

Uploaded by

JaneOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Cheat Sheet BVPS: Lower Rate

Cheat Sheet BVPS: Lower Rate

Uploaded by

JaneCopyright:

Available Formats

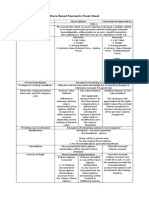

Cheat Sheet BVPS

BVPS EPS

Amount Used Total SHE Net Income

Formula Total SHE / Shares Outstanding (Net Income – PS Dividends)/

Average Outstanding Shares

Cumulative PS Deduct One Year unless Deduct 1 Year whether declared

Expressly Stated There is or not

Dividend in Arrears

(If silent current dividend is

included in arrears)

Non-Cumulative PS Deduct 1 Year Deduct only when declared

Outstanding Shares Not Averaged Averaged

1. Treat the Total SHE as if dividends available for distribution to shareholders

2. If there is Treasury Shares you can simply deduct the cost to the total SHE provided the Treasury

Shares is Ordinary Shares, if PS Treasury apply the retirement method and add the share

premium if there is any to the total SHE

3. In case there are two shares fully participating, give dividends to ordinary shares based on the

lower rate

4. Automatically deduct the (liquidation value x outstanding PS from Total SHE)

5. Share Premium to PS will be given to OS except if PS is Participating

6. Subscription Receivable are not Deducted from the Total SHE

You might also like

- Understanding Financial Statements (Review and Analysis of Straub's Book)From EverandUnderstanding Financial Statements (Review and Analysis of Straub's Book)Rating: 5 out of 5 stars5/5 (5)

- Earnings Per Share PDFDocument56 pagesEarnings Per Share PDFYuan ZhongNo ratings yet

- Cheat Sheet Earnings Per ShareDocument2 pagesCheat Sheet Earnings Per ShareJaneNo ratings yet

- Intermediate Accounting Volume 2 7th Edition Beechy Solutions ManualDocument10 pagesIntermediate Accounting Volume 2 7th Edition Beechy Solutions Manualconatusimploded.bi6q100% (24)

- Traditional Models of Financial Statements AnalysisDocument4 pagesTraditional Models of Financial Statements AnalysisMary LeeNo ratings yet

- 002 MAS FS Analysis Rev00 PDFDocument5 pages002 MAS FS Analysis Rev00 PDFCyvee Joy Hongayo OcheaNo ratings yet

- Lecture Notes - IAS 33 (Basic EPS)Document2 pagesLecture Notes - IAS 33 (Basic EPS)Mazhar AzizNo ratings yet

- Bvps and EpsDocument30 pagesBvps and EpsRenzo Melliza100% (1)

- Bhupendra Imrt B School Lucknow Difference Between Eps N DpsDocument15 pagesBhupendra Imrt B School Lucknow Difference Between Eps N Dpsbhupendra pt singhNo ratings yet

- Basic Earnings Per Share: Eps Net Income Preferred Dividends) End of Period Shares OutstandingDocument4 pagesBasic Earnings Per Share: Eps Net Income Preferred Dividends) End of Period Shares OutstandingSamsung AccountNo ratings yet

- Basic Earnings Per Share: Eps Net Income Preferred Dividends) End of Period Shares OutstandingDocument4 pagesBasic Earnings Per Share: Eps Net Income Preferred Dividends) End of Period Shares OutstandingLoudie Ann MarcosNo ratings yet

- Basic Earnings Per ShareDocument2 pagesBasic Earnings Per SharePaula De RuedaNo ratings yet

- PAS 33 - Earnings Per ShareDocument17 pagesPAS 33 - Earnings Per ShareKrizzia DizonNo ratings yet

- UGBA 120AB Chapter 19 PART 2 Spring 2020 Without SolutionsDocument53 pagesUGBA 120AB Chapter 19 PART 2 Spring 2020 Without Solutionsyadi lauNo ratings yet

- FAR-Book-value-and-Earnings-per-Share Lecture & MC FINALDocument8 pagesFAR-Book-value-and-Earnings-per-Share Lecture & MC FINALOlive Grace CaniedoNo ratings yet

- Ratio Formula'S Sheet For Financial Reporting Analysis ProjectDocument5 pagesRatio Formula'S Sheet For Financial Reporting Analysis ProjectHoney SheikhNo ratings yet

- Earnings Per ShareDocument5 pagesEarnings Per ShareAlexandra TagleNo ratings yet

- Pas 33Document2 pagesPas 33elle friasNo ratings yet

- Act06 Lfta222n001 Capistrano, JoanaDocument1 pageAct06 Lfta222n001 Capistrano, JoanaJoana loize CapistranoNo ratings yet

- Ratio Formalas PDFDocument4 pagesRatio Formalas PDFKinza AsimNo ratings yet

- LP Earnings Per Share For EnhancementDocument9 pagesLP Earnings Per Share For EnhancementJULIA CHRIS ROMERONo ratings yet

- Full Note On IND As 33Document7 pagesFull Note On IND As 33bachchanbarman389No ratings yet

- Basic Earnings Per ShareDocument18 pagesBasic Earnings Per ShareNatalie Irish VillanuevaNo ratings yet

- Pas 33Document3 pagesPas 33Ley Anne PaleNo ratings yet

- Earnings Per ShareDocument10 pagesEarnings Per ShareStacy SmithNo ratings yet

- Book Value Per Share and Earnings Per Share Book Value Per ShareDocument23 pagesBook Value Per Share and Earnings Per Share Book Value Per Share132345usdfghjNo ratings yet

- Book Value Per Share: Learning CompetenciesDocument24 pagesBook Value Per Share: Learning CompetenciesRaezel Carla Santos FontanillaNo ratings yet

- ACCT3103 ppt5Document73 pagesACCT3103 ppt5Nicholas LeeNo ratings yet

- PPT-5 Corporate Actions - Dividends, Bonus, Splits, Etc_ (1)Document16 pagesPPT-5 Corporate Actions - Dividends, Bonus, Splits, Etc_ (1)glacticematricsNo ratings yet

- Afar Ferrer PDFDocument48 pagesAfar Ferrer PDFJun Kenny PagaNo ratings yet

- Corporate Actions - Dividends, Bonus, Splits, Buyback EtcDocument37 pagesCorporate Actions - Dividends, Bonus, Splits, Buyback Etcagrawal.minNo ratings yet

- Pas 33 Earnings Per Share: I. NatureDocument3 pagesPas 33 Earnings Per Share: I. NatureR.A.No ratings yet

- IAS 33 Earnings Per ShareDocument5 pagesIAS 33 Earnings Per ShareCatalin BlesnocNo ratings yet

- Acc2 ReviewerDocument4 pagesAcc2 ReviewerJian AlberioNo ratings yet

- Financial Ratios - Basic Earnings Per Share: Bonds Fixed IncomeDocument1 pageFinancial Ratios - Basic Earnings Per Share: Bonds Fixed IncomeBhaskar MukherjeeNo ratings yet

- Rights Issue (Stock Right or Preemptive Right) : Right To Purchase Ordinary SharesDocument2 pagesRights Issue (Stock Right or Preemptive Right) : Right To Purchase Ordinary SharesVincent Jake NaputoNo ratings yet

- Book Value Per ShareDocument2 pagesBook Value Per SharePaula De RuedaNo ratings yet

- Statement of Comprehensive Income (CA5106)Document10 pagesStatement of Comprehensive Income (CA5106)rhbqztqbzyNo ratings yet

- Basic EPS Diluted EPS: Basic EPS Net Income Preferred Dividends Weighted Average of Ordinary SharesDocument3 pagesBasic EPS Diluted EPS: Basic EPS Net Income Preferred Dividends Weighted Average of Ordinary SharesRenz AlconeraNo ratings yet

- 04-01 - Financial Analysis (Dragged) 27Document3 pages04-01 - Financial Analysis (Dragged) 27Salsabila AufaNo ratings yet

- Earnings Per ShareDocument12 pagesEarnings Per ShareKim EllaNo ratings yet

- AAFR Notes IAS 33Document17 pagesAAFR Notes IAS 33WaqasNo ratings yet

- As-20 Earning Per ShareDocument17 pagesAs-20 Earning Per ShareRahul SinghNo ratings yet

- 06-Earnings-Per-Share Practice Problems Faisal & CODocument10 pages06-Earnings-Per-Share Practice Problems Faisal & COsyed asim shahNo ratings yet

- ACCA110-Financial Statement Analysis and RatioDocument7 pagesACCA110-Financial Statement Analysis and RatioJhovet Christian M. CariÑoNo ratings yet

- Module 9 Stocks Bonds Mutual FundsDocument7 pagesModule 9 Stocks Bonds Mutual FundsKristine MartinezNo ratings yet

- PPT-5 Corporate Action-Dividends, Bonus, Splits EtcDocument16 pagesPPT-5 Corporate Action-Dividends, Bonus, Splits EtcAmrita GhartiNo ratings yet

- IAS 33 - NotesDocument17 pagesIAS 33 - NotesJyNo ratings yet

- Book Value and Earnings Per ShareDocument6 pagesBook Value and Earnings Per ShareLui67% (3)

- IAS 33 Earnings Per Share: (Conceptual Framework and Standards)Document8 pagesIAS 33 Earnings Per Share: (Conceptual Framework and Standards)Joyce ManaloNo ratings yet

- Du Pont Chart: Multiplied byDocument9 pagesDu Pont Chart: Multiplied bymedhaNo ratings yet

- Corporation Transactions After FormationDocument14 pagesCorporation Transactions After FormationYanela YishaNo ratings yet

- Analysis For The Investor: Chapter # 10Document17 pagesAnalysis For The Investor: Chapter # 10fahad BataviaNo ratings yet

- Analysis For The Investor: Chapter # 10Document17 pagesAnalysis For The Investor: Chapter # 10Fahad BataviaNo ratings yet

- Chapter 20Document14 pagesChapter 20negalamadnNo ratings yet

- Ratio Analysis DuPont AnalysisDocument7 pagesRatio Analysis DuPont Analysisshiv0308No ratings yet

- AS 20 Earnings Per ShareDocument14 pagesAS 20 Earnings Per Sharefar_07No ratings yet

- MMW Module 9Document3 pagesMMW Module 9Kristine MartinezNo ratings yet

- Share Based Compensation Cheat SheetDocument2 pagesShare Based Compensation Cheat SheetJaneNo ratings yet

- Intermediate Accounting 3 Reflection Paper: "Going Concern"Document1 pageIntermediate Accounting 3 Reflection Paper: "Going Concern"JaneNo ratings yet

- Cheat Sheet Earnings Per ShareDocument2 pagesCheat Sheet Earnings Per ShareJaneNo ratings yet

- Intermediate Accounting 3 Reflection Paper: "Change"Document1 pageIntermediate Accounting 3 Reflection Paper: "Change"JaneNo ratings yet

- Intermediate Accounting 3 Reflection PaperDocument1 pageIntermediate Accounting 3 Reflection PaperJaneNo ratings yet

- Prior Period Error Effect in The Current Period AdjustmentDocument2 pagesPrior Period Error Effect in The Current Period AdjustmentJaneNo ratings yet

- Intermediate Accounting 3 Reflection Paper: "Matching and Recognition"Document1 pageIntermediate Accounting 3 Reflection Paper: "Matching and Recognition"JaneNo ratings yet

- Activity On Religion DiscussionDocument2 pagesActivity On Religion DiscussionJaneNo ratings yet

- Buddhism: Submitted byDocument3 pagesBuddhism: Submitted byJaneNo ratings yet

- PPSA SummaryDocument18 pagesPPSA SummaryJane100% (1)